Page 4 of 6

Re: The PP, marginal utility, and investment "faith"

Posted: Tue Jan 11, 2022 7:26 pm

by Hal

FWIW: If investing as a resident of a country with a very small economy (eg NZ, Australia, Fiji) I think it would be easiest and most efficient to just set up a 3x33% portfolio consisting of International Bonds, International Shares and Gold.

Why not 25% of your local currency? Well, if the Fiji dollar experienced a "tight money recession" or "inflation", none of the other asset classes listed above would react as it would in a standard US PP. The local economy would be too small to take a chance with a 100% of your allocation. Granted it would be worthwhile to hold some local currency, but not 25% if you are investing a large amount.

Just a random thought....

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 7:55 am

by perfect_simulation

I Shrugged wrote: ↑Tue Jan 11, 2022 6:27 pm

HB liked growth stocks specifically, because of how they are bid up during bull markets.

Additionally, HB said that interest rates are low during times of Prosperity. And growth stocks benefit the most in that environment.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 10:12 am

by barrett

Smith1776 wrote: ↑Mon Jan 10, 2022 10:33 pm

That's a good point. Since it's Canadian and since the stock portion is globally diversified, it's not technically a GB. What shall I call it then?

The All Winter portfolio?

Well, you are in the Lower mainland of BC so maybe the All Rainy Weather Portfolio? At least this time of the year. Perhaps the asset allocation never changes but the name does so seasonally. Just planting comedic seeds here in case dualstow is reading!

The BC Wild Firewalls Portfolio?

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 10:27 am

by Smith1776

barrett wrote: ↑Wed Jan 12, 2022 10:12 am

Smith1776 wrote: ↑Mon Jan 10, 2022 10:33 pm

That's a good point. Since it's Canadian and since the stock portion is globally diversified, it's not technically a GB. What shall I call it then?

The All Winter portfolio?

Well, you are in the Lower mainland of BC so maybe the All Rainy Weather Portfolio? At least this time of the year. Perhaps the asset allocation never changes but the name does so seasonally. Just planting comedic seeds here in case dualstow is reading!

The BC Wild Firewalls Portfolio?

lol!!! Yes, very fitting!

When asking a girl out on a date in Vancouver I always say "Water you doing tonight?"

I'll see myself out now.

Well, investment portfolios are what we put our savings into right? And our savings are for a rainy day. How about the Rainy Day Portfolio? It keeps the Vancouver motif and it's accurate, too.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 10:35 am

by Smith1776

vincent_c wrote: ↑Wed Jan 12, 2022 10:25 am

Smith1776 wrote: ↑Tue Jan 11, 2022 7:03 pm

Step 1 - Identify as many independent and investible sources of risk and return that you possibly can

This is interesting, because I've only ever been able to think of 2 independent sources of risk which have positive expected return which is credit and duration.

No? I suppose I'd point out: equity premium, value premium, liquidity premium, reinsurance risk, momentum premium, and the variance risk premium to name a few.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 11:33 am

by Smith1776

vincent_c wrote: ↑Wed Jan 12, 2022 11:29 am

Smith1776 wrote: ↑Wed Jan 12, 2022 10:35 am

No? I suppose I'd point out: equity premium, value premium, liquidity premium, reinsurance risk, momentum premium, and the variance risk premium to name a few.

Equity, value, momentum, variance premiums are subsets of credit risk that if you were fully diversified then you would just be getting pure credit risk.

I'm not sure about liquidity risk. I think you mean that investors want to be compensated more for buying something that has poor liquidity, but it would seem to me that poor liquidity is either because of idiosyncratic risk or is also due to credit risk.

Reinsurance is interesting, but the nature of insurance is that if it were fair then it's more like a business with a profit margin than a true risk with long term expected returns based on the underlying risks.

This is one of those topics that I'd love to be proven wrong though because we all want more truly uncorrelated assets to work with.

We will have to agree to disagree then. No problem with that.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 1:46 pm

by I Shrugged

Smith1776 wrote: ↑Tue Jan 11, 2022 6:46 pm

I Shrugged wrote: ↑Tue Jan 11, 2022 6:27 pm

HB liked growth stocks specifically, because of how they are bid up during bull markets.

How would you define growth stocks?

I think he meant the typical definition, the higher P/E types, not value stocks that one might feel are poised to grow.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 1:47 pm

by Smith1776

I Shrugged wrote: ↑Wed Jan 12, 2022 1:46 pm

Smith1776 wrote: ↑Tue Jan 11, 2022 6:46 pm

I Shrugged wrote: ↑Tue Jan 11, 2022 6:27 pm

HB liked growth stocks specifically, because of how they are bid up during bull markets.

How would you define growth stocks?

I think he meant the typical definition, the higher P/E types, not value stocks that one might feel are poised to grow.

Cool beans.

Re: The PP, marginal utility, and investment "faith"

Posted: Wed Jan 12, 2022 3:40 pm

by Smith1776

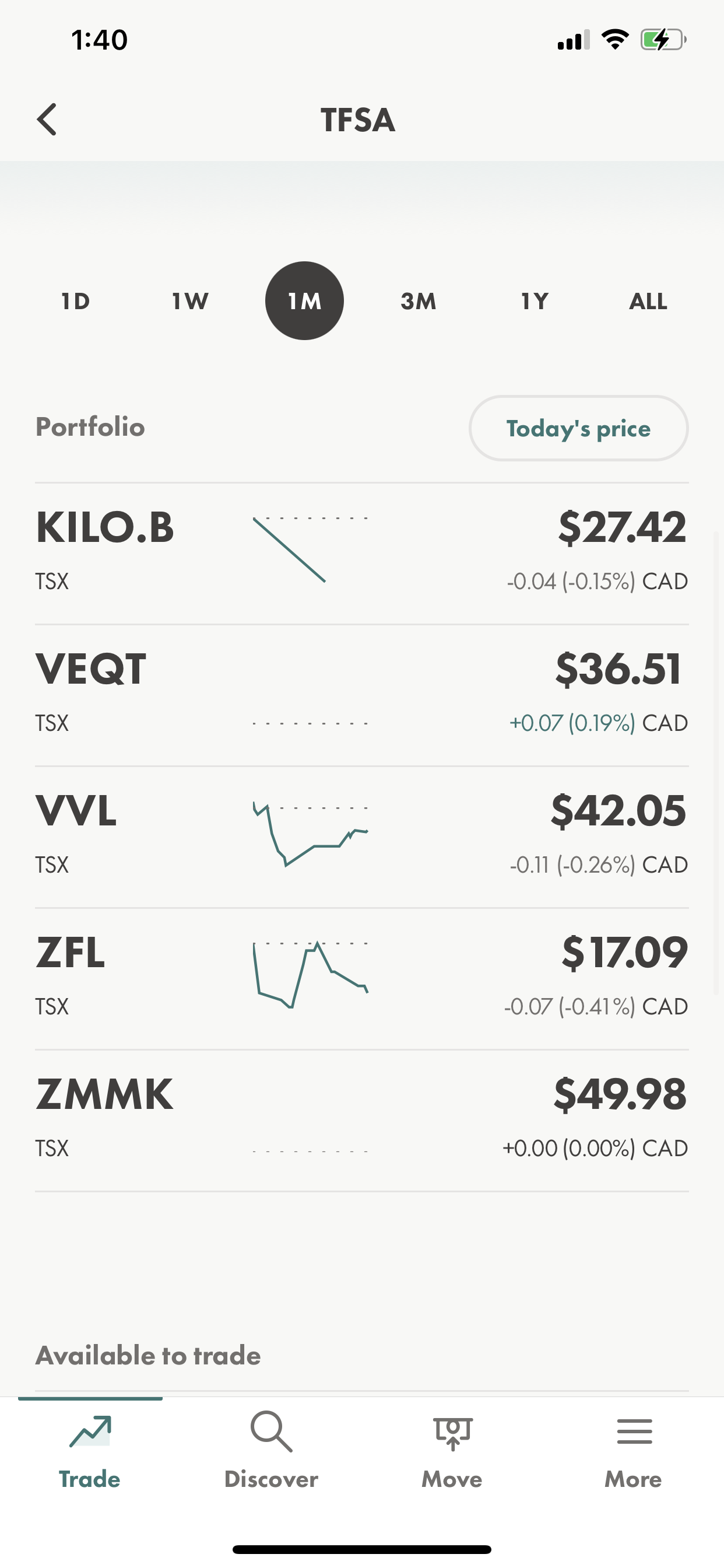

- 2CC458DE-A1E8-4662-B83A-B0BECE6E5618.png (429.1 KiB) Viewed 8721 times

Re: The PP, marginal utility, and investment "faith"

Posted: Thu Jan 13, 2022 11:50 am

by Smith1776

I'm just viewing this thread on desktop for the first time since my last post and seeing how big that screenshot was lol. Sorry!

Re: The PP, marginal utility, and investment "faith"

Posted: Thu Jan 13, 2022 2:51 pm

by barrett

Smith1776 wrote: ↑Thu Jan 13, 2022 11:50 am

I'm just viewing this thread on desktop for the first time since my last post and seeing how big that screenshot was lol. Sorry!

I thought you were just using a large font to help out us older folks.

Does this mean that the Rainy Day Portfolio has been implemented? Do we have liftoff?

Re: The PP, marginal utility, and investment "faith"

Posted: Thu Jan 13, 2022 5:49 pm

by Smith1776

barrett wrote: ↑Thu Jan 13, 2022 2:51 pm

Smith1776 wrote: ↑Thu Jan 13, 2022 11:50 am

I'm just viewing this thread on desktop for the first time since my last post and seeing how big that screenshot was lol. Sorry!

I thought you were just using a large font to help out us older folks.

Does this mean that the Rainy Day Portfolio has been implemented? Do we have liftoff?

The Rainy Day Portfolio is a go!

Re: The PP, marginal utility, and investment "faith"

Posted: Thu Jan 13, 2022 6:51 pm

by dualstow

How about some notes on those tickers?

Re: The PP, marginal utility, and investment "faith"

Posted: Thu Jan 13, 2022 9:20 pm

by Smith1776

Yup yup!

Cash - ZMMK - BMO money market fund - 14bps

Long bond - ZFL - BMO Federal long term bond - 20bps

Gold - KILO.B - Purpose gold etf - 20bps

Stocks - VEQT - vanguard global equity - 22bps

Value stocks - VVL - vanguard value fund - 35bps

Re: The PP, marginal utility, and investment "faith"

Posted: Fri Jan 21, 2022 11:11 am

by Smith1776

Turns out my dad’s portfolio was almost all dividend paying stocks.

Re: The PP, marginal utility, and investment "faith"

Posted: Fri Jan 21, 2022 5:59 pm

by dualstow

Smith1776 wrote: ↑Fri Jan 21, 2022 11:11 am

Turns out my dad’s portfolio was almost all dividend paying stocks.

Could be worse! Start a thread on it, because I’m curious about it, man.

Oh, I guess it’s this thread.

Can’t tell from the title.

I wanted to ask: does Canada have a tax basis step-up, or whatever it’s called? That is, does the cost basis get friendlier for heirs of the deceased in Canada? In the States you can have a huge amount of unrealized gains that are reset when you pass on and the stocks go to your heir(s). Some of Congress is trying to eliminate that if they haven’t already. I don’t follow it closely.

Re: The PP, marginal utility, and investment "faith"

Posted: Sat Jan 22, 2022 1:11 am

by ppnewbie

Smith1776 wrote: ↑Fri Jan 21, 2022 11:11 am

Turns out my dad’s portfolio was almost all dividend paying stocks.

Hopefully that is going to be a perpetual money machine for you.

Re: The PP, marginal utility, and investment "faith"

Posted: Sun Feb 06, 2022 4:39 pm

by yankees60

Smith1776 wrote: ↑Tue Jan 11, 2022 2:48 pm

Charts. I love charts. Here is one from ray dalio’s new book.

It really speaks for itself.

Hard money portfolios. Hell yeah.

3F358F6D-A1A3-4A89-9CEA-79BC7FBA9C1D.jpeg

Just started reading this Dalio books within the last half hour.

Who else as read the book aside from Smith1776?

What is your general opinion of Dalio?

Re: The PP, marginal utility, and investment "faith"

Posted: Sun Feb 06, 2022 7:14 pm

by ppnewbie

yankees60 wrote: ↑Sun Feb 06, 2022 4:39 pm

Smith1776 wrote: ↑Tue Jan 11, 2022 2:48 pm

Charts. I love charts. Here is one from ray dalio’s new book.

It really speaks for itself.

Hard money portfolios. Hell yeah.

3F358F6D-A1A3-4A89-9CEA-79BC7FBA9C1D.jpeg

Just started reading this Dalio books within the last half hour.

Who else as read the book aside from Smith1776?

What is your general opinion of Dalio?

Been watching several interviews with Dalio. What he is saying seems reasonable and probable. Its inline with what I am thinking and maybe what many people on this forum think. Can you repost that chart. It did not upload correctly.

Re: The PP, marginal utility, and investment "faith"

Posted: Sun Feb 06, 2022 7:32 pm

by yankees60

ppnewbie wrote: ↑Sun Feb 06, 2022 7:14 pm

yankees60 wrote: ↑Sun Feb 06, 2022 4:39 pm

Smith1776 wrote: ↑Tue Jan 11, 2022 2:48 pm

Charts. I love charts. Here is one from ray dalio’s new book.

It really speaks for itself.

Hard money portfolios. Hell yeah.

3F358F6D-A1A3-4A89-9CEA-79BC7FBA9C1D.jpeg

Just started reading this Dalio books within the last half hour.

Who else as read the book aside from Smith1776?

What is your general opinion of Dalio?

Been watching several interviews with Dalio. What he is saying seems reasonable and probable. Its inline with what I am thinking and maybe what many people on this forum think. Can you repost that chart. It did not upload correctly.

The chart is still there under the Smith1775 post to which I responded. Page 3 in this topic.

His book is brilliant!

Re: The PP, marginal utility, and investment "faith"

Posted: Sun Feb 06, 2022 7:53 pm

by ppnewbie

Great chart.

I learned a valuable way to look at alpha from an interview I watched with Dalio the other day. He said beta is what the market is returning and Alpha is what you take directly from another party. Never thought about it that way. He also said that there are very few people that are good enough to get alpha, so you most likely wont be able to get access to them.

https://www.youtube.com/watch?v=_hf5tCnJye0

https://www.youtube.com/watch?v=wP2fnqhzJk0

Re: The PP, marginal utility, and investment "faith"

Posted: Mon Feb 07, 2022 3:24 pm

by Smith1776

yankees60 wrote: ↑Sun Feb 06, 2022 4:39 pm

Smith1776 wrote: ↑Tue Jan 11, 2022 2:48 pm

Charts. I love charts. Here is one from ray dalio’s new book.

It really speaks for itself.

Hard money portfolios. Hell yeah.

3F358F6D-A1A3-4A89-9CEA-79BC7FBA9C1D.jpeg

Just started reading this Dalio books within the last half hour.

Who else as read the book aside from Smith1776?

What is your general opinion of Dalio?

He's not perfect, but I generally am amenable to his views. I think of him as a modern day Harry Browne.

For everyday investors he preaches one thing above all else: truly balanced and diversified portfolios. That's where I diverge from people like Warren Buffett. Buffett is all about being all-in on America. I'd rather have a maximally diversified portfolio!

Re: The PP, marginal utility, and investment "faith"

Posted: Mon Feb 07, 2022 3:43 pm

by boglerdude

Dalio started as a golf caddy getting inside info. Bridgewater is run like a cult, good for insider trading. His core idea was "cycles" but Australia went 30 years without a cycle/recession and is only imploding now because of a real event, China burst. And he wont condemn China on human rights.

Just saying he's not smarter than any of you. And hes fun to listen to.

Re: The PP, marginal utility, and investment "faith"

Posted: Mon Feb 07, 2022 4:27 pm

by ppnewbie

boglerdude wrote: ↑Mon Feb 07, 2022 3:43 pm

Dalio started as a golf caddy getting inside info. Bridgewater is run like a cult, good for insider trading. His core idea was "cycles" but Australia went 30 years without a cycle/recession and is only imploding now because of a real event, China burst. And he wont condemn China on human rights.

Just saying he's not smarter than any of you. And hes fun to listen to.

From what I hear, Australia's housing bubble is much bigger than the US before the great financial crisis. I've the economy is Holes (mining) and homes.

Also, I get the human rights issue in China, but the US should probably not throw stones. It's pretty bad. Deaths of despair, opoids, food insecurity, have a minor accident go to the hospital and go bankrupt, homeless people literally coming out every corner, average American baby boomer having 40k saved heading into retirement, average american not being to withstand a 400 unexpected expense, civil asset forteiture (WTF!). Companies (FB, etc, etc...) from the US actively attempting to tear this nation and other nations apart for a profit.

Again, I am not excusing the stuff going on there but personally, I choose to focus on my own country.

Re: The PP, marginal utility, and investment "faith"

Posted: Mon Feb 07, 2022 9:27 pm

by yankees60

boglerdude wrote: ↑Mon Feb 07, 2022 3:43 pm

Dalio started as a golf caddy getting inside info. Bridgewater is run like a cult, good for insider trading. His core idea was "cycles" but Australia went 30 years without a cycle/recession and is only imploding now because of a real event, China burst. And he wont condemn China on human rights.

Just saying he's not smarter than any of you. And hes fun to listen to.

Quite the sentence I just read in his book!

"There are no investors I know and no senior economic policy makers I know - and I know many and I know the best - who have any excellent understandings of what happened in the past and why."