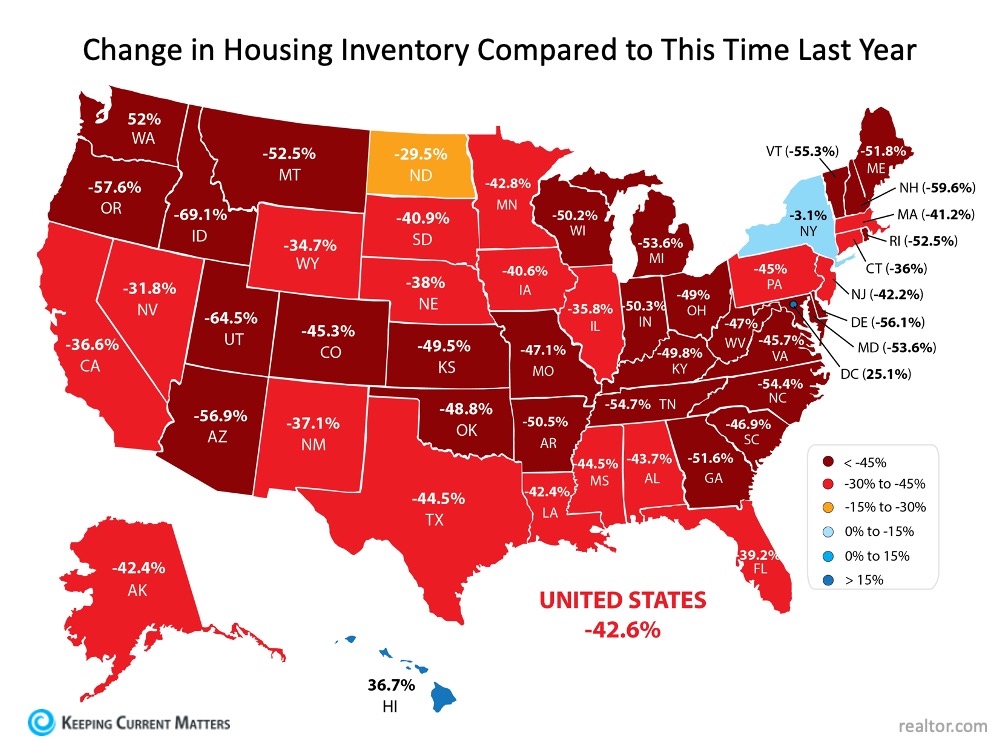

One of my coworkers is having a fit about this right now. But it goes back to what I said about the desirable locations. They're only looking to buy in the highest-demand areas, where there are bidding wars for low inventory which is already at the upper end of his price range. Pretty much every other area around here is easily affordable, but his wife won't consider any of them. He blames rich, "stupid" people who are paying too much for low-quality housesflyingpylon wrote: ↑Wed Mar 31, 2021 10:23 am Housing inventory is at record lows. You can find stories from all different parts of the country about sellers receiving multiple offers well above asking from buyers that haven't even seen the house.

Housing prices

Moderator: Global Moderator

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

You there, Ephialtes. May you live forever.

Re: Housing prices

Yes, but there is also an aesthetic and conventions that have overtaken the housing industry that are further reinforced by the 24/7 HGTV propaganda machine that tell us how our yards, and houses and kitchens and bathrooms should look. In that regard few think outside the box because the consumers minds are already so boxed in to a certain idea of what a house looks like. For example...average kitchen over 10k out of box store....I can build a very cool and nice kitchen for a few thousand...80% less than what most people pay. Of course, it will look a bit different...but equally functional.

As far as the land prices, I agree that highly desirable areas will carry a higher price tag but again a lot of this is also due to NIMBYism that won't allow higher density projects to be built or ADUs to be constructed etc etc. Highly desirable areas should naturally trend toward higher density construction as any scarce and valuable resource is maximized for greatest efficiency.

In my last city I purchased a 6000 square foot downtown lot in a district that contained single family homes but had recently been rezoned to multifamily. The city has a major affordable housing issue and my idea was to have a local modular builder (not trailers...these were indistinguishable from site built) drop four 700 square foot units that I would sell for around 175k each...well under half the median house price in the area....perfect for singles or a couple. Each unit had a small yard and parking pad and fit within building setbacks etc. Well, building department flatly denied me...so I sold to a developer who wanted to build a 450k 2500 square foot home. And all the while the gov keeps crying that they need developers to build affordable housing stock. Whatever!

As far as the land prices, I agree that highly desirable areas will carry a higher price tag but again a lot of this is also due to NIMBYism that won't allow higher density projects to be built or ADUs to be constructed etc etc. Highly desirable areas should naturally trend toward higher density construction as any scarce and valuable resource is maximized for greatest efficiency.

In my last city I purchased a 6000 square foot downtown lot in a district that contained single family homes but had recently been rezoned to multifamily. The city has a major affordable housing issue and my idea was to have a local modular builder (not trailers...these were indistinguishable from site built) drop four 700 square foot units that I would sell for around 175k each...well under half the median house price in the area....perfect for singles or a couple. Each unit had a small yard and parking pad and fit within building setbacks etc. Well, building department flatly denied me...so I sold to a developer who wanted to build a 450k 2500 square foot home. And all the while the gov keeps crying that they need developers to build affordable housing stock. Whatever!

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

Ok? I think we're all familiar with the current paradigm, the re-imagined one is more interesting.doodle wrote: ↑Wed Mar 31, 2021 10:40 am Yes, but there is also an aesthetic and conventions that have overtaken the housing industry that are further reinforced by the 24/7 HGTV propaganda machine that tell us how our yards, and houses and kitchens and bathrooms should look. In that regard few think outside the box because the consumers minds are already so boxed in to a certain idea of what a house looks like. For example...average kitchen over 10k out of box store....I can build a very cool and nice kitchen for a few thousand...80% less than what most people pay. Of course, it will look a bit different...but equally functional.

Hah, that's an idea I've been kicking around too. I'd assume most modular home companies have their version of the detached studio apartment/cabin. I was going to do the same thing, but rent them out instead of selling. This has been so adequately covered on Granola Shotgun I feel there's really nothing left to say about it.As far as the land prices, I agree that highly desirable areas will carry a higher price tag but again a lot of this is also due to NIMBYism that won't allow higher density projects to be built or ADUs to be constructed etc etc. Highly desirable areas should naturally trend toward higher density construction as any scarce and valuable resource is maximized for greatest efficiency.

In my last city I purchased a 6000 square foot downtown lot in a district that contained single family homes but had recently been rezoned to multifamily. The city has a major affordable housing issue and my idea was to have a local modular builder (not trailers...these were indistinguishable from site built) drop four 700 square foot units that I would sell for around 175k each...well under half the median house price in the area....perfect for singles or a couple. Each unit had a small yard and parking pad and fit within building setbacks etc. Well, building department flatly denied me...so I sold to a developer who wanted to build a 450k 2500 square foot home. And all the while the gov keeps crying that they need developers to build affordable housing stock. Whatever!

You there, Ephialtes. May you live forever.

-

flyingpylon

- Executive Member

- Posts: 1166

- Joined: Fri Jan 06, 2012 9:04 am

Re: Housing prices

+1 on Granola Shotgun, great blog.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

He's mad that other people have more money (or have access to more money than him), so they can buy fixer uppers and fix them up there and he can't. Pretty simple. He's aware there's nothing he can do about this but he still enjoys being mad about it.

*shrug*

*shrug*

You there, Ephialtes. May you live forever.

-

flyingpylon

- Executive Member

- Posts: 1166

- Joined: Fri Jan 06, 2012 9:04 am

Re: Housing prices

76 all-cash offers on one home. The housing madness shows no signs of slowing

Now obviously suburban Washington DC is not "Anywhere USA" but it's still happening in many parts of the country.

https://www.cnn.com/2021/03/29/success/ ... index.htmlEllen Coleman had never received so many offers on a house in her 15 years of selling real estate. She listed a fixer-upper in suburban Washington, DC for $275,000 on a Thursday. By Sunday evening, she had 88 offers. "The offers just kept coming," she said. "I felt like Lucy with the chocolates. I'm thinking, 'This is just out of control.'"

Of those 88 offers, 76 were all-cash, said Coleman, who works for RE/MAX Realty Centre. There wasn't even enough time for all of the bidders to visit the property. She said 15 offers were sight unseen.

The four-bedroom, 1,800 square-foot home sold for $460,000, nearly a 70% increase from the asking price. She said the winning bid was not the highest offer, but it was all-cash with no contingencies and it had paperwork in place. The buyer, she said, is an investor who is likely to renovate and resell at an even higher price.

Now obviously suburban Washington DC is not "Anywhere USA" but it's still happening in many parts of the country.

Re: Housing prices

Scott Adams said on his podcast the other day that a house in his neighborhood sold for $500k over the asking price, which was originally around $2.2 million.

He lives somewhere outside of San Francisco from whence are coming all the buyers looking to get away from the city. After selling their homes in the city at an enormous profit they can easily afford the extra $500k above the asking price.

He lives somewhere outside of San Francisco from whence are coming all the buyers looking to get away from the city. After selling their homes in the city at an enormous profit they can easily afford the extra $500k above the asking price.

Re: Housing prices

Wow.

There's been a spate of spam calls to my mom's old home phone (which I monitor on Google Voice) expressing interest in her house. I can guess why.

On the other hand - my aunt's home in a nearby suburban town was sold last summer for a pretty soft price (about what it would have sold for pre-COVID) with just one offer on the table. The town is one of those high quality schools, high quality public services, and sky high property taxes of ~$20K/year, so that maybe had something to do with it.

But, I tend to think it's because my sister & cousin, as my aunt's POAs, picked a lazy idiot for a real estate broker. I learned from the sale of my last apartment in 2015 that everything that goes into a sale (staging, pricing, open house scheduling etc) has a very big impact if it's done right.

There's been a spate of spam calls to my mom's old home phone (which I monitor on Google Voice) expressing interest in her house. I can guess why.

On the other hand - my aunt's home in a nearby suburban town was sold last summer for a pretty soft price (about what it would have sold for pre-COVID) with just one offer on the table. The town is one of those high quality schools, high quality public services, and sky high property taxes of ~$20K/year, so that maybe had something to do with it.

But, I tend to think it's because my sister & cousin, as my aunt's POAs, picked a lazy idiot for a real estate broker. I learned from the sale of my last apartment in 2015 that everything that goes into a sale (staging, pricing, open house scheduling etc) has a very big impact if it's done right.

Re: Housing prices

How do you find a good one?WiseOne wrote: ↑Thu Apr 01, 2021 12:25 pm Wow.

There's been a spate of spam calls to my mom's old home phone (which I monitor on Google Voice) expressing interest in her house. I can guess why.

On the other hand - my aunt's home in a nearby suburban town was sold last summer for a pretty soft price (about what it would have sold for pre-COVID) with just one offer on the table. The town is one of those high quality schools, high quality public services, and sky high property taxes of ~$20K/year, so that maybe had something to do with it.

But, I tend to think it's because my sister & cousin, as my aunt's POAs, picked a lazy idiot for a real estate broker. I learned from the sale of my last apartment in 2015 that everything that goes into a sale (staging, pricing, open house scheduling etc) has a very big impact if it's done right.

- I Shrugged

- Executive Member

- Posts: 2203

- Joined: Tue Dec 18, 2012 6:35 pm

Re: Housing prices

Start by finding ones who have a lot of sales.Xan wrote: ↑Thu Apr 01, 2021 12:52 pmHow do you find a good one?WiseOne wrote: ↑Thu Apr 01, 2021 12:25 pm Wow.

There's been a spate of spam calls to my mom's old home phone (which I monitor on Google Voice) expressing interest in her house. I can guess why.

On the other hand - my aunt's home in a nearby suburban town was sold last summer for a pretty soft price (about what it would have sold for pre-COVID) with just one offer on the table. The town is one of those high quality schools, high quality public services, and sky high property taxes of ~$20K/year, so that maybe had something to do with it.

But, I tend to think it's because my sister & cousin, as my aunt's POAs, picked a lazy idiot for a real estate broker. I learned from the sale of my last apartment in 2015 that everything that goes into a sale (staging, pricing, open house scheduling etc) has a very big impact if it's done right.

Re: Housing prices

Results not guaranteed, but here goes. First, find someone by word of mouth. Ask people who have bought places recently in your area. Then, interview the person. Zoom works but video is important if you can swing it. I have a pretty good ability to size people up on an interview, after quite a bit of experience with hiring staff (and making my share of mistakes). If the person passes your sniff test, you then ask for references. 3 is good. You then read those references carefully for hints that the person might just be trying to be polite.Xan wrote: ↑Thu Apr 01, 2021 12:52 pmHow do you find a good one?WiseOne wrote: ↑Thu Apr 01, 2021 12:25 pm Wow.

There's been a spate of spam calls to my mom's old home phone (which I monitor on Google Voice) expressing interest in her house. I can guess why.

On the other hand - my aunt's home in a nearby suburban town was sold last summer for a pretty soft price (about what it would have sold for pre-COVID) with just one offer on the table. The town is one of those high quality schools, high quality public services, and sky high property taxes of ~$20K/year, so that maybe had something to do with it.

But, I tend to think it's because my sister & cousin, as my aunt's POAs, picked a lazy idiot for a real estate broker. I learned from the sale of my last apartment in 2015 that everything that goes into a sale (staging, pricing, open house scheduling etc) has a very big impact if it's done right.

I also grade based on general professional demeanor during email or phone interactions and promptness of replies/responsiveness.

In the case of the above idiot broker, I talked to him myself after my sister recommended him as a broker option for my mother's business. It took me probably less than a minute to figure out that I would not ever have chosen to do business with him. (I already knew at that time that my sister's judgment on such things is, let us say, not the best.)

-

whatchamacallit

- Executive Member

- Posts: 763

- Joined: Mon Oct 01, 2012 7:32 pm

Re: Housing prices

I am of same mindset as rich dad. Your home is really a liability.

Live as cheap as you can for as long as you can and buy house when you could afford to buy in cash as a luxury purchase.

Live as cheap as you can for as long as you can and buy house when you could afford to buy in cash as a luxury purchase.

Re: Housing prices

I agree with this, even though it flies in the face of how most people think. When viewed in purely financial terms, a house is a non-income producing asset that you are purchasing on a perpetual installment plan, even if you buy it for cash.whatchamacallit wrote: ↑Thu Apr 01, 2021 9:29 pm I am of same mindset as rich dad. Your home is really a liability.

Live as cheap as you can for as long as you can and buy house when you could afford to buy in cash as a luxury purchase.

Re: Housing prices

My experience with house purchasing completely contradicts that point. It can be much cheaper to buy than rent over time. I owned an apartment for 7 years and then sold it (to buy another). My carrying costs for the apartment, counting everything including lost investment opportunity, turned out to be about 1/3 of what I'd have paid for an equivalent rental over the same period.

There are two important caveats. First, you don't want to buy in an environment (like now) when housing prices far outstrip rental rates. There's a rule of thumb for the ratio between these (forget exactly what it is).

Second, once you buy a house you need to keep it for a good long time. Minimum 7 years. If you think you might move earlier than that, you shouldn't buy.

If those two ducks line up for you, it makes total sense to buy. No need to pay in cash.

There are two important caveats. First, you don't want to buy in an environment (like now) when housing prices far outstrip rental rates. There's a rule of thumb for the ratio between these (forget exactly what it is).

Second, once you buy a house you need to keep it for a good long time. Minimum 7 years. If you think you might move earlier than that, you shouldn't buy.

If those two ducks line up for you, it makes total sense to buy. No need to pay in cash.

-

flyingpylon

- Executive Member

- Posts: 1166

- Joined: Fri Jan 06, 2012 9:04 am

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

Well, I figure DC would make sense having a lot of turnover after a Presidential election year with all the administration people and lobbyists changing out.

You there, Ephialtes. May you live forever.

-

whatchamacallit

- Executive Member

- Posts: 763

- Joined: Mon Oct 01, 2012 7:32 pm

Re: Housing prices

I was looking at current mortgage rates out of curiosity and was surprised to see they are almost still at all time lows.

The only thing that makes sense to me is that these mortgages are just being arbitraged to the federal reserve since they know they are buying them.

When i put in $350k house with 20% down to lenderfi.com I saw you could get 30 year at 2.75% with $1000 cash back.

I would never buy that debt instrument unless I knew I could just turn around and sell it to the federal reserve for a quick profit.

It is basically a 30 year callable bond with ever increasing service fees and collateral risk.

If I had to hold that thing for 30 years I can't image wanting less than 8%.

The only thing that makes sense to me is that these mortgages are just being arbitraged to the federal reserve since they know they are buying them.

When i put in $350k house with 20% down to lenderfi.com I saw you could get 30 year at 2.75% with $1000 cash back.

I would never buy that debt instrument unless I knew I could just turn around and sell it to the federal reserve for a quick profit.

It is basically a 30 year callable bond with ever increasing service fees and collateral risk.

If I had to hold that thing for 30 years I can't image wanting less than 8%.

- I Shrugged

- Executive Member

- Posts: 2203

- Joined: Tue Dec 18, 2012 6:35 pm

Re: Housing prices

Anyone know what the housing market is doing in other developed countries? I know it’s just as hot in Canada.

Re: Housing prices

Even better than a mortgage: intrafamily loans.

No fees, no application process, and way better interest rates for both borrower and lender. You just need to draw up a document spelling out loan terms, as per IRS rules, and you can regard them as mortgages for income tax purposes.

The IRS prescribes minimum interest rates. I have no idea what they're based on. From April to May of this year, the required 30 year rate jumped from 1.96% to 2.14%. If 30 year mortgages haven't gone up, this is inexplicable. I assume the intrafamily rate will always beat the pants off a bank mortgage though.

Still - I wish I knew about this years ago! It's a great tool to have in your war chest for times like these. And, loan terms can be arranged to suit - for example, for my mom's apartment purchase we could make payments interest only for the first year, to allow time to sell the house. And of course allow prepayments and early payoff.

No fees, no application process, and way better interest rates for both borrower and lender. You just need to draw up a document spelling out loan terms, as per IRS rules, and you can regard them as mortgages for income tax purposes.

The IRS prescribes minimum interest rates. I have no idea what they're based on. From April to May of this year, the required 30 year rate jumped from 1.96% to 2.14%. If 30 year mortgages haven't gone up, this is inexplicable. I assume the intrafamily rate will always beat the pants off a bank mortgage though.

Still - I wish I knew about this years ago! It's a great tool to have in your war chest for times like these. And, loan terms can be arranged to suit - for example, for my mom's apartment purchase we could make payments interest only for the first year, to allow time to sell the house. And of course allow prepayments and early payoff.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

Some quick Google-Fu leads me to believe that people are bullish on real estate across the Western world.

BTW whatchamacallit, you forgot to mention that in the US, we mostly utilize fixed-rate mortgages, whereas in most other countries (IIRC) they use adjustable-rate mortgages. I doubt that would continue without federal participation in the housing/finance markets.

BTW whatchamacallit, you forgot to mention that in the US, we mostly utilize fixed-rate mortgages, whereas in most other countries (IIRC) they use adjustable-rate mortgages. I doubt that would continue without federal participation in the housing/finance markets.

You there, Ephialtes. May you live forever.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Housing prices

Very interesting! I'll have to dig into these, my parents and I might find an opportunity to utilize an intrafamily loan at some point. Good looking out WiseOne!WiseOne wrote: ↑Sat Apr 24, 2021 9:24 am Even better than a mortgage: intrafamily loans.

No fees, no application process, and way better interest rates for both borrower and lender. You just need to draw up a document spelling out loan terms, as per IRS rules, and you can regard them as mortgages for income tax purposes.

The IRS prescribes minimum interest rates. I have no idea what they're based on. From April to May of this year, the required 30 year rate jumped from 1.96% to 2.14%. If 30 year mortgages haven't gone up, this is inexplicable. I assume the intrafamily rate will always beat the pants off a bank mortgage though.

Still - I wish I knew about this years ago! It's a great tool to have in your war chest for times like these. And, loan terms can be arranged to suit - for example, for my mom's apartment purchase we could make payments interest only for the first year, to allow time to sell the house. And of course allow prepayments and early payoff.

You there, Ephialtes. May you live forever.