Page 15 of 21

Re: BTC in the PP

Posted: Thu Dec 05, 2024 8:46 pm

by yankees60

Smith1776 wrote: ↑Thu Dec 05, 2024 4:04 pm

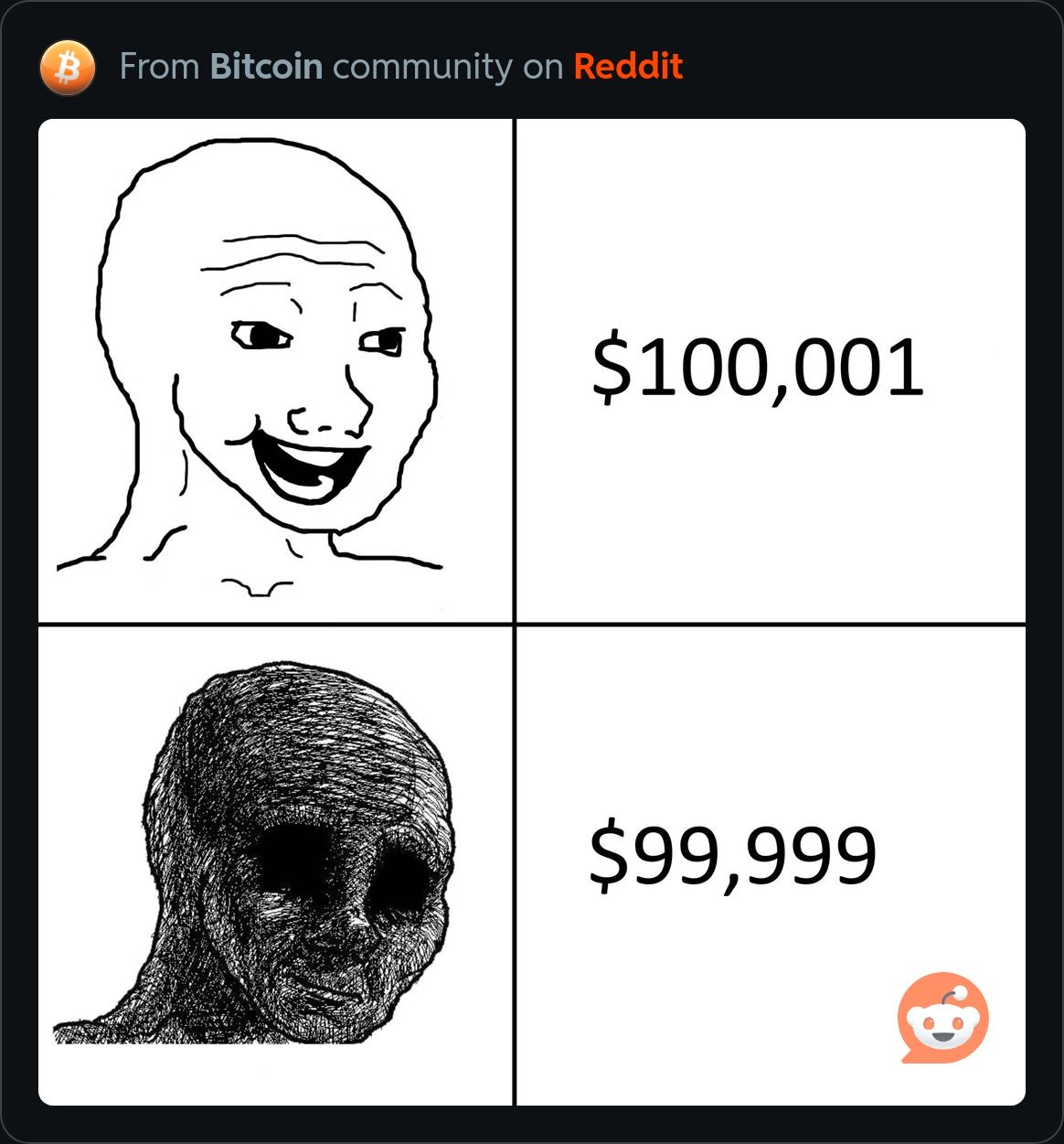

Back to 99k. Party’s over!

One word:

GameStop!!!!!

Re: BTC in the PP

Posted: Thu Dec 05, 2024 10:31 pm

by Smith1776

yankees60 wrote: ↑Thu Dec 05, 2024 8:46 pm

Smith1776 wrote: ↑Thu Dec 05, 2024 4:04 pm

Back to 99k. Party’s over!

One word:

GameStop!!!!!

I still have about $1,000 tied up in the ol' tried and true diversified way of doing things. Just as an homage to my investing past.

Re: BTC in the PP

Posted: Fri Dec 06, 2024 1:31 am

by boglerdude

Re: BTC in the PP

Posted: Fri Dec 06, 2024 4:40 am

by dualstow

Smith1776 wrote: ↑Thu Dec 05, 2024 10:31 pm

I still have about $1,000 tied up in the ol' tried and true diversified way of doing things. Just as an homage to my investing past.

This makes me sad.

Re: BTC in the PP

Posted: Fri Dec 06, 2024 12:00 pm

by yankees60

https://money.com/bitcoin-price-100k-mi ... aily_money

Bitcoin Just Hit $100K. Is a Crypto Sell-Off Coming Next?

By: Jordan Chussler

Editor: Julia Glum

Published: Dec 05, 20246 min read

Re: BTC in the PP

Posted: Fri Dec 06, 2024 1:06 pm

by Jack Jones

Benjamin Graham wrote:There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are:

- speculating when you think you are investing

- speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it

- risking more money in speculation than you can afford to lose

What's the difference?

Benjamin Graham wrote:An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

Re: BTC in the PP

Posted: Fri Dec 06, 2024 2:30 pm

by yankees60

Jack Jones wrote: ↑Fri Dec 06, 2024 1:06 pm

Benjamin Graham wrote:There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are:

- speculating when you think you are investing

- speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it

- risking more money in speculation than you can afford to lose

What's the difference?

Benjamin Graham wrote:An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

Based upon the expert witness, i.e, Graham, that Jack Jones has presented ... the court rules in Jack Jones's favor!

Re: BTC in the PP

Posted: Fri Dec 06, 2024 3:31 pm

by Smith1776

dualstow wrote: ↑Fri Dec 06, 2024 4:40 am

Smith1776 wrote: ↑Thu Dec 05, 2024 10:31 pm

I still have about $1,000 tied up in the ol' tried and true diversified way of doing things. Just as an homage to my investing past.

This makes me sad.

I’ll be back to risk parity when I switch to the withdrawal phase!

Re: BTC in the PP

Posted: Fri Dec 06, 2024 11:09 pm

by Smith1776

The mayor of my hometown, Ken Sim, is embracing the idea of a strategic bitcoin reserve. Slowly but surely, this thing is percolating through both markets and governments.

https://www.bloomberg.com/news/articles ... y-finances

Re: BTC in the PP

Posted: Sat Dec 07, 2024 11:48 am

by Smith1776

Re: BTC in the PP

Posted: Sat Dec 07, 2024 9:14 pm

by Smith1776

- IMG_7405.jpeg (201.94 KiB) Viewed 53511 times

Re: BTC in the PP

Posted: Wed Dec 18, 2024 5:23 am

by Smith1776

In less than a year, Bitcoin ETF AUM has surpassed gold despite the latter being around for 20 years.

https://www.cointribune.com/en/gold-det ... ry-of-etf/

https://www.cointribune.com/en/gold-det ... ry-of-etf/

Re: BTC in the PP

Posted: Wed Dec 18, 2024 7:29 am

by dualstow

Younger generations aren’t really interested in gold or silver, are they?

They were in the early 2010s.

Re: BTC in the PP

Posted: Wed Dec 18, 2024 8:34 am

by Xan

We should put Yukon Cornelius on TV more often.

- uln5joo4bk421.jpg (21.83 KiB) Viewed 52316 times

Re: BTC in the PP

Posted: Wed Dec 18, 2024 9:33 am

by dualstow

_ _ _ _ _

I asked chatGPT about the progress of computing and if it would affect Bitcoin mining. Here is its response:

“

The advent of new, more powerful computers—especially quantum computers like Google’s **Willow chip**—could indeed influence Bitcoin, but not necessarily in the way of accelerating mining or directly increasing the speed at which the remaining Bitcoin is mined. Here's why:

### 1. **Bitcoin's Mining Process**

- Bitcoin mining is regulated by its difficulty adjustment mechanism, which recalibrates roughly every two weeks to ensure blocks are mined approximately every 10 minutes. Even if quantum computers vastly outperform traditional miners, the difficulty would simply adjust upward to maintain the 10-minute block time. Quantum computers wouldn’t necessarily "speed up" mining, though they might outcompete traditional miners.

### 2. **Quantum Computers and Bitcoin Security**

- Bitcoin relies heavily on cryptographic algorithms, particularly **SHA-256** for mining and **ECDSA** for private key security. Quantum computers like Willow could theoretically crack these cryptographic systems more efficiently than classical computers. This could pose risks:

- **Mining Monopoly**: A quantum computer could solve mining puzzles much faster than conventional miners, leading to centralization and undermining the decentralized nature of Bitcoin.

- **Private Key Vulnerability**: Quantum computers might be able to derive private keys from public keys, threatening wallets that have reused public keys or left them exposed.

### 3. **Mitigations in the Bitcoin Network**

- The Bitcoin community is already aware of quantum computing risks. If quantum computers become a credible threat, the protocol could transition to **quantum-resistant cryptography** (such as lattice-based cryptography). This would require a significant update to the Bitcoin network, but it's technically feasible.

### 4. **Impact of Willow and Other Chips**

- While Willow is a powerful step in quantum computing, practical quantum systems that could compromise Bitcoin are likely years, if not decades, away. Current quantum computers still face scalability and error-correction challenges that limit their real-world application to cryptographic problems.

In summary, while quantum computers like Willow could have a profound impact on Bitcoin’s security in the future, their effect on mining itself would likely be mitigated by the built-in difficulty adjustment mechanism. The more immediate concern would be ensuring Bitcoin remains secure against quantum cryptography threats.

“

Re: BTC in the PP

Posted: Thu Jan 02, 2025 11:53 pm

by Smith1776

Michael Saylor and Eric Trump. This SBR thing might just happen after all.

- IMG_7571.jpeg (948.37 KiB) Viewed 51489 times

Re: BTC in the PP

Posted: Fri Jan 03, 2025 12:15 pm

by yankees60

That picture struck me with how tall Eric Trump ..... which then sent me to here:

Here's How Tall All Five Of Donald Trump's Kids Are

https://www.msn.com/en-us/news/politics ... r-BB1hcMz7

Trump produced children well out of the norm for average height.

From 5'8" to 6'7"

However, I do not know how height correlates to interest in Bitcoin.

Re: BTC in the PP

Posted: Thu Jan 09, 2025 3:55 pm

by frugal

Jack Jones wrote: ↑Sun Nov 24, 2024 4:20 pm

frugal wrote: ↑Sun Nov 24, 2024 3:54 pm

Hello

So what are the PP users and HB followers doing ?

Bitcoin on VP only ?

Or 5% on HBPP is correct

?

Kindest regards!

Frugal, I'm glad you're still out there. Would you please give us one random fact about you?

Despite being the OP of this thread, I now believe it's only appropriate for the VP.

Hi

Now we can see that 5-10% of our savings n bitcoin would be a good idea

with low risk level …

What do you think

?

Regards

Re: BTC in the PP

Posted: Thu Jan 09, 2025 3:59 pm

by frugal

dualstow wrote: ↑Mon Nov 25, 2024 7:37 am

Jack Jones wrote: ↑Sun Nov 24, 2024 4:20 pm

frugal wrote: ↑Sun Nov 24, 2024 3:54 pm

Hello

So what are the PP users and HB followers doing ?

Bitcoin on VP only ?

Or 5% on HBPP is correct

?

Kindest regards!

Frugal, I'm glad you're still out there. Would you please give us one random fact about you?

Despite being the OP of this thread, I now believe it's only appropriate for the VP.

Seconded, and we already know you’re from Portugal (I think?), Frugal, so that detail doesn’t count.

As you know, Harry has passed, so there’s no bitcoin in the

HBPP. But, if bitcoin continues to take hold I wouldn’t be surprised if guest portfolios with the stuff start showing up at Tyler’s Portfolio Charts.

Nice blast from the past seeing you!

Hello

fellow American

What PPeers here in the forum do related to bitcoin?

Marc spreaded some coins

many years ago

Regards

Re: BTC in the PP

Posted: Thu Jan 09, 2025 5:55 pm

by coasting

frugal wrote: ↑Thu Jan 09, 2025 3:59 pm

What PPeers here in the forum do related to bitcoin?

I don't know which economic regime that bitcoin can be expected to do well in: prosperity, recession, inflation, deflation? How can I place it in the PP if I cannot definitively answer that question? I sometimes hear bitcoin referred to as a form of "digital" gold. Other times I hear bitcoin referred to as a "risk on" asset. I pay for things in units of US dollars, and the price of bitcoin has been rather volatile in dollar terms, so I do not consider it like cash. If bitcoin interests you enough to hold some, I would say consider it part of your variable portfolio.

Bogleheads on Investing Podcast Episode 71 features Rick Ferri interviewing Matt Hougan, the CIO of a cryptocurrency index ETF. I found this amusing as cryptocurrency/bitcoin is a "forbidden" topic on the bogleheads.org forum! Anyway, I recall Matt Hougan sees the value in bitcoin by viewing it as a service. A service that offers two key attributes:

1) no central authority (e.g. government, company, institution, etc.)

2) the ability to be quickly transferred to anywhere in the world

I can see both points. For attribute 1, gold already serves that role for me. For attribute 2, I acknowledge how that could be important to a lot of people. But I also consider a potential downside to this attribute: is bitcoin

too easy to move around. I think there is something to be said for the friction involved in moving physical gold from one place to another. The vast majority of the time, I want my gold to just sit there and remain in specific secure vaults. If it moves, it better be because of my instructions, and I accept that some time and planning are required to accomplish this. For that matter, my stocks/bonds/cash also better stay with whatever custodian/broker/bank I've selected. And if I choose to change institutions, this process should take some time with various checks and balances to ward off fraudulent activity.

Re: BTC in the PP

Posted: Sat Jan 25, 2025 3:53 pm

by yankees60

Smith1776 wrote: ↑Thu Jan 02, 2025 11:53 pm

Michael Saylor and Eric Trump. This SBR thing might just happen after all.

IMG_7571.jpeg

Does this affect anything?

https://apnews.com/article/trump-crypto ... 9f03470be3

Trump promotes new meme coin before taking office on pro-crypto agenda

Re: BTC in the PP

Posted: Mon Jan 27, 2025 8:36 am

by frugal

coasting wrote: ↑Thu Jan 09, 2025 5:55 pm

frugal wrote: ↑Thu Jan 09, 2025 3:59 pm

What PPeers here in the forum do related to bitcoin?

I don't know which economic regime that bitcoin can be expected to do well in: prosperity, recession, inflation, deflation? How can I place it in the PP if I cannot definitively answer that question? I sometimes hear bitcoin referred to as a form of "digital" gold. Other times I hear bitcoin referred to as a "risk on" asset. I pay for things in units of US dollars, and the price of bitcoin has been rather volatile in dollar terms, so I do not consider it like cash. If bitcoin interests you enough to hold some, I would say consider it part of your variable portfolio.

Bogleheads on Investing Podcast Episode 71 features Rick Ferri interviewing Matt Hougan, the CIO of a cryptocurrency index ETF. I found this amusing as cryptocurrency/bitcoin is a "forbidden" topic on the bogleheads.org forum! Anyway, I recall Matt Hougan sees the value in bitcoin by viewing it as a service. A service that offers two key attributes:

1) no central authority (e.g. government, company, institution, etc.)

2) the ability to be quickly transferred to anywhere in the world

I can see both points. For attribute 1, gold already serves that role for me. For attribute 2, I acknowledge how that could be important to a lot of people. But I also consider a potential downside to this attribute: is bitcoin

too easy to move around. I think there is something to be said for the friction involved in moving physical gold from one place to another. The vast majority of the time, I want my gold to just sit there and remain in specific secure vaults. If it moves, it better be because of my instructions, and I accept that some time and planning are required to accomplish this. For that matter, my stocks/bonds/cash also better stay with whatever custodian/broker/bank I've selected. And if I choose to change institutions, this process should take some time with various checks and balances to ward off fraudulent activity.

Nice

answer!

My question

is:

What is the right % of variable portfolio of our total savings?

I mean what should be the % of HB PP ?

80 - 90 % PP and 10 - 20 % VP ?

With my best regards.

Re: BTC in the PP

Posted: Mon Jan 27, 2025 10:32 am

by Jack Jones

You have to figure that out yourself. VP is for money you can afford to lose. Everything else goes in the PP, according to HB.

Re: BTC in the PP

Posted: Tue Jan 28, 2025 4:24 pm

by frugal

Jack Jones wrote: ↑Mon Jan 27, 2025 10:32 am

You have to figure that out yourself. VP is for money you can afford to lose. Everything else goes in the PP, according to HB.

Maybe 5% is correct

What is yours ?

Regards

Re: BTC in the PP

Posted: Thu Jan 30, 2025 4:28 pm

by Smith1776

I just sold $10,000 of my MicroStrategy position to pay for grad school tuition. Ouch!