Re: When will indexing blow up?

Posted: Fri Jun 02, 2023 4:57 pm

seajay wrote: ↑Thu May 25, 2023 11:33 am

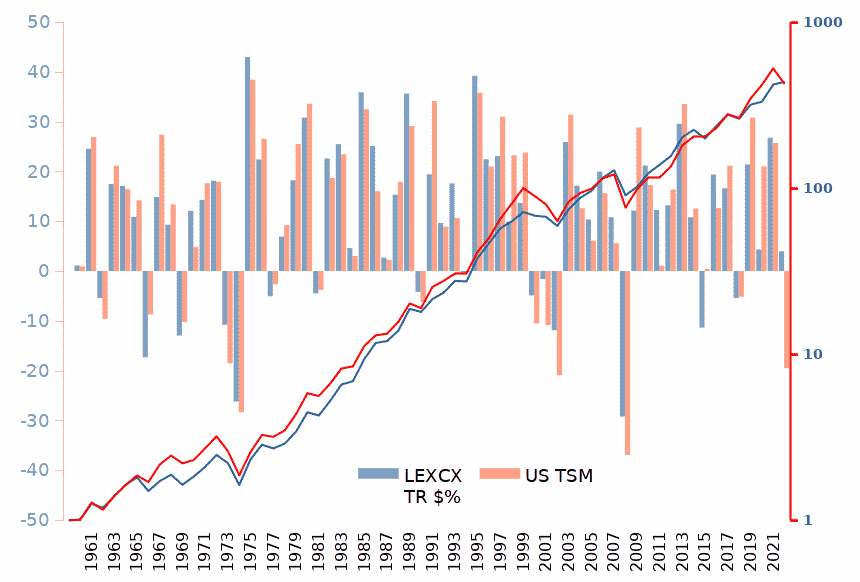

LEXCX holds a sizeable proportion in Union Pacific, and some Berkshire Hathaway stock. Initial equal weight not rebalanced will tend to end up like that, more average weighting in the stock(s) that did well. Rebalancing has a tendency to reduce the concentration risk, whilst still tending to achieve the same overall total returns.

At the offset equal weightings is reasonable, as you've no idea which will end up as having been the best. Cap weighting in effect adds more capital to the stock(s) that HAD performed the best up to that point in time, and injecting more capital into those, less into others is in effect a prediction that past momentum will persist, often it doesn't.

On a risk adjusted reward basis, rebalanced tends to yield the higher/better result, same reward with less volatility. As a marketing product I guess Vanguard just prefer a one size fits all rather than having to manage thousands of accounts each with different weightings.

The Golden Butterfly/PP run along similar lines. Stock price only, cash and bonds with interest accumulated, gold ... might each reasonably be expected to negate inflation, but individually with some pretty wild volatility. Equal weightings is inclined to smooth down that volatility, same inflation pacing reward, with less portfolio volatility. Over any one time period you might expect to see the sorted worst to best order (left to right) having a bad case left tail, but where the best case right tail compensates and more that worst case. That's just a natural fractal pattern that applies at both the short and long time scale, and across multiples assets (for instance if you divided the Dow 30 into 5 sets of 6 stocks ranked by total returns worst to best, you'd be inclined to see a similar left tail set compensated and more by the right tail set).

Buying the market, cap weighted index, can accommodate all, however many choose to invest. Equal initial weighting with large amounts thrown at it will disproportionately modify the index, add more to smaller caps. Most investors would be better served by initial weightings, but are left to do that for themselves, such as via the PP, GB ...etc.

Bogle figures his static-50 fund would cost 0.15% of assets to run. Alas, his successor as chief executive of the nonprofit Vanguard Group, John Brennan, doesn't plan to offer the product. Creating new portfolios annually (because newcomers would not be allowed into an existing portfolio) would be an administrative headache with each distinct one lacking sufficient economies of scale, Vanguard believes.

https://www.forbes.com/forbes/1999/0614 ... f358a76874

LEXCX discussed here:

https://www.mymoneyblog.com/buy-hold-do ... tg=9627344

The Power (and Limitations) of Buy & Hold “Do Nothing” Portfolios

JUNE 1, 2023 BY JONATHAN PING 2 COMMENTS

"He added a real-world example of “buy and hold forever” in the Voya Corporate Leaders Trust (LEXCX), which is a very quirky mutual fund that essentially bought equal amounts of stock from 30 of the largest US companies back in 1935 and then sat on its hands. Voya Corporate Leaders Trust also did quite well over the same 1993-2023 period:"