Page 7 of 8

Re: The System Is Rigged

Posted: Fri Feb 03, 2012 10:13 am

by Gumby

stone wrote:

Gumby, I suppose you have faith that our entirely novel and revolutionary expanding fiat money system will be able to successfully continue. What I don't sense though is that you acknowledge just how much our current system ensures that the monetary set up in ten years time will have been transformed because of the expansion and that ten years later it will have been transformed again and so on and that each of those transformations will take things further out away from conventional capitalism of the sort that has occurred previously in history.

People have been predicting the demise of our system for far longer than you and I have been alive. The future is unpredictable, Stone. We don't know what's going to happen. We could have inflation, deflation, prosperity or recession.... or total annihilation. Most politicians are so confused about the deficit that they will probably steer us into an austerity-driven depression just to avoid the super-deficits anyhow. No sense in trying to conjure up a mythical economic democracy to escape whatever our inevitable future is.

I'm glad you enjoyed that link. A lot of it makes sense, but it also seems like something that could only be implemented in a perfect world — which we do not have. Anyway, it's been fun, but I'm a bit exhausted with this discussion. And I don't have any interest in forming an Economic Democracy society right now. I've got to get back to being a productive member of the working class!

Re: The System Is Rigged

Posted: Fri Feb 03, 2012 10:52 am

by stone

Gumby, thanks again for that link. You are right, it really does encompass pretty much all of what I have been wittering on about. Martin Luther King was part of it! I never knew about any of that.

Clearly a lot of people have heard about it and it hasn't been what anyone has wanted to implement (other than isolated cranks

).

Re: The System Is Rigged

Posted: Fri Feb 03, 2012 10:58 am

by Gumby

stone wrote:Martin Luther King was part of it! I never knew about any of that.

Me neither. Pretty cool.

Re: The System Is Rigged

Posted: Fri Feb 03, 2012 11:03 am

by MediumTex

I want to return to the OP, and ask a related question:

Is a casino "rigged"?

I think that the answer depends upon what your goals are when you enter the casino. If your goal is to have an entertaining gambling experience, then the system is probably not rigged at all. If, however, you want to leave the casino with more money than you entered with, it is clearly rigged to prevent this outcome.

Similarly, I think that the larger economic/monetary/political system is geared to much the same outcome. The idea, I think, is for people to basically spend all of the money they make as soon as possible after they make it. If a person lives his life in this way, the system probably won't seem rigged, and might even seemed rigged in his favor as the government helps to subsidize his expenses when his cash flow runs low.

If, however, a person desires upward economic mobility and seeks to accumulate wealth that will help to facilitate this upward mobility, then the system probably does feel very rigged, just like the casino would to someone hoping to take out more money than he brought in.

The answer to this problem in practice seems to have been for certain interests in society to stop complaining about the odds at the gaming tables, and instead find a way to open up their own casinos. This seems to be what many corporate interests have done by purchasing enough access and influence that they have been able to essentially create their own "house advantage" in their corner of the market.

Re: The System Is Rigged

Posted: Sat Feb 04, 2012 4:54 pm

by systemskeptic

TripleB wrote:

My thesis is that the system is rigged against the middle class and there is essentially no way to win except to fall down to the lower class (and get to suck on government tits) or to rise into the upper 1% and screw over the middle class that you were once a part of.

There is at least one other option:

http://www.forbes.com/sites/kenrapoza/2 ... president/

You also forgot in your post that the government also mainly exists to protect the wealth of those that have it -- from those that do not.

Re: The System Is Rigged

Posted: Sun Feb 05, 2012 2:20 am

by stone

systemskeptic, In the UK our labour unions started off persecuted and powerless with many members being murdered, deported to Australia etc etc. They then grew to be ludicrously powerfull by the 1970s. SOGAT was the ultimate union. They insited that companies did not pay or recruit or manage staff. Instead the company had to pay SOGAT and SOGAT would then pay the staff as SOGAT chose. SOGAT would not reveal to the company how many staff were working or what they were doing. SOGAT paid strike pay that was exactly the same as regular working pay. Strikes could last over a year. Basically unions can entirely loot and destroy the economy just as badly as banks etc are now.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 7:46 am

by MachineGhost

Gumby wrote:

MachineGhost wrote:

Gumby wrote:

I think you'll have a hard time arguing that there isn't a correlation between the disposable income rate and the inflation rate.

I think you'll have a hard time arguing that there isn't a correlation between the rate of government spending and the inflation rate. ;)

MG

Um, Really? Have you been awake the past twenty years? Government spending has soared and inflation is very low.

Perhaps you didn't get the memo, but Monetarism died in the 1990s when it couldn't explain the fact that inflation stayed low as government spending increased.

I think the sarcasm was lost on you. You've been making the spurious claim that inflation comes from consumer demand, but I've been trying to point out that consumer demand is a symptom and inflation as a cause comes from unproductive government spending, which under MMR, provides all source money for an economy. That doesn't seem contestable, but you seem not to have gotten to memo either on the discredited Philips Curve relationship between employment and inflation. It sounds very intuitive, but like most everything in economics, it falls apart when examined with cold, hard [post-gold standard] data.

The quantity theory of money (which is not the same thing as Monetarism) is part of mainstream economics. It is held to be true in the long run, just as the Philips Curve doesn't hold true in the long run. If you're going to claim it's been discredited and no longer paid any respect, what is it replaced with under the heterodox MMR?

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 7:57 am

by MachineGhost

Gumby wrote:

Yes, velocity is the speed at which people spend money once they get it. All spending is an exchange.

Having disposable income implies that people may start demanding more goods than they would ordinarily be purchasing — which should drive up the cost of those goods.

But velocity is part of the quantity theory of money that you claim is discredited?

Anyway, having more disposable income requires providing value in some capacity which results in higher productive output. Thus it is a net wash for inflation. The only way to have more employment than there is an increase in productive output is for the government to use its money creating ability to employ people in unproductive jobs (or under a gold-standard). This is what is generally meant by unproductive government spending causes inflation. It is all stated in the inflation equation. This is true under MMR, otherwise inflation would not exist.

But I now think you're definitely talking about supply/demand imbalances, i.e. the new definitions that got folder into "inflation" post-gold standard. But that has nothing to do with money as the

original source of inflation in the economy. Are you claiming that MMR only believes inflation comes from supply/demand imbalances and not government excess?

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:03 am

by moda0306

MG,

Unlike Keynesians, MMR's/MMT's, I believe, think that "inflation expectation" monetary policy is flawed. Very simply, in the medium-to-long run, you need more and more base currency to service a growing economy. It's not about causing inflation to scare people into productive activity, but simply not keeping people so starved of base money that their balance sheet leaves them in a position where they don't want to spend, leaving us all in a big Mexican standoff, where we have skills and capacity but nobody pulls the trigger.

I tend to agree with your equation in the long term, but unlike Austrians, I feel that it's people sitting on their butts doing nothing is much worse than that INFLATION end of the equation coming out to 1-3% every year.

To your other points, if the government simply spends more money into the economy via fiscal stimulus, the spending of that money would very well simply result in an increase in productive output, thereby leaving inflation untouched (or barely touched).

That's why the productive capacity considerations and balance sheet considerations of users of the currency are so important.

Plus, where does foreign demand for our currency (trade deficit) come into play? Is that part of velocity? That should be factored in somewhere.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:08 am

by MachineGhost

moda0306 wrote:

Gumby & MG,

I still think you guys are agreeing and you don't know it....

Gumby,

The last 10 years we've had deficits, but also had production grow... therefore, low-to-moderate inflation. This fits with MG's calculation

...but here's where I think MG's wrong, though I have to do a little reaserch...

MG,

I think the velocity of money has to be measured somehow... aka, how quickly it's exchanged for hard assets, goods, and services after it's received... but then again that signifies production, so maybe either my thinking or your equation needs a tune-up.

EDIT:

Nevermind... the velocity increases, increasing inflation potential, and production increases all the same, decreasing potential... still sounds solid.

Remember, it is the CHANGE in velocity, because everything, including people's reactions to expected inflation, maintains an equilibirum of price levels in the economy at any given level of velocity. The only way to have a CHANGE in velocity upwards is to have an excess supply come from somewhere (and under the equation that has to be unproductivity). Gumby believes its demand (horse), I say its too much supply (cart). The delineating difference here is the demand is for one thing (good/service), the supply is another (money), rather than the more typical symmetrical suppy/demand imbalance of just one particular good/service.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:16 am

by Gumby

MachineGhost wrote:I've been trying to point out that consumer demand is a symptom and inflation as a cause comes from unproductive government spending, which under MMR, provides all source money for an economy. That doesn't seem contestable

Nobody advocates "unproductive" government spending. And since ALL MONEY (except coins) either comes public debt or private debt, there needs to be debt in order to have a money supply.

MachineGhost wrote:but you seem not to have gotten to memo either on the discredited Philips Curve relationship between employment and inflation. It sounds very intuitive, but like most everything in economics, it falls apart when examined with cold, hard [post-gold standard] data.

MMR doesn't prescribe a job guarantee, it just explains how the monetary system works. If the Philips Curve is false, then MMT (which does prescribe a job guarantee) will fail. MMT is just a theory — and it will probably never be tested. MMR is just a description of how the country remains solvent. You're certainly entitled to your own opinion on inflation.

MachineGhost wrote:The quantity theory of money (which is not the same thing as Monetarism) is part of mainstream economics. It is held to be true in the long run, just as the Philips Curve doesn't hold true in the long run. If you're going to claim it's been discredited and no longer paid any respect, what is it replaced with under the heterodox MMR?

I'm not aware of any mainstream economists who are using QMoT. Perhaps you are? Why would they be when velocity is unstable?

Monetarism is deeply rooted in QMoT. Monetarism is dead.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:22 am

by MachineGhost

moda0306 wrote:

His equation isn't really quantity theory though, because it contains a velocity element.

That means it takes into consideratin the supply/demand for money that Quantity Theory didn't.

Looking at deficit spending, and not M0, also helps identify that it's the net financial assets, not monetary base, that we should pay attention to, even if QToM is incomplete.

Saying that any one of the elements can generate inflation is correct, but he points out what I believe to be a technicality in that since the government spends the money into existence, it's the base "cause" of inflation.

Of course, that's incomplete if not irrelevent, because even in a fixed money system, production and velocity will still drive inflation/deflation as much as "new money" does.

So I think we're circling the drain of frustrated agreement here... you just think he's talking QToM and he's not, and he thinks gov't drives inflation and that's incomplete.

I still like his equation for now, because it appears to contain the base elements of inflation... using my definition of velocity which may or may not be right... basically, consumer demand & investment (investment being the buying/building of new machinery or a new factory).

Gumby's just stuck on the Philips Curve. It's one of those intuitive and logical fallacy theories and I use to believe in it too, if it's any consolation.

Again, I was merely arguing that consumer demand is a SYMPTOM and not a CAUSE of MONETARY, i.e. general price increase, inflation. It's too simplistic to say that MONETARY inflation alone is responsible for all price increases, which is why the quantity theory of money doesn't work in the short term and Monetarism (a school of thought) is silly. Even though I wasn't taling about the QUANTITY of money per se, it is still part of mainstream economics so I find it strange that it has been "discredited". Everyone knows that inflation drives up prices in the long term!

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:32 am

by moda0306

MG,

I tend to think of money like a freeway... not valuable in and of itself, but much more efficiently gets you to where you want to go, and therefore allows people to be much more productive and happy.

Yes, building too much freeway in the wrong place can cause distortions in where people go and how they get there, but for the most part, it's MUCH more dangerous to have too little freeway with bottlenecks all over the place than having too much freeway with a few market distortions here and there.

So while I can see how you could say the gov't is responsible for all inflation, maybe inflation isn't that big of a problem at 1-3%. Maybe, instead, not enough currency existing on our balance sheets causes much bigger problems.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:33 am

by Gumby

MachineGhost wrote:Gumby's just stuck on the Philips Curve. It's one of those intuitive and logical fallacy theories and I use to believe in it too, if it's any consolation.

I have no allegiance to the Philips Curve or MMT. I only follow MMR. But, as far as I know, MMT uses the

New Keynesian Phillips curve (NKPC). It's not perfect, but it has yet to be disproved. MG, if you know otherwise, please share with us.

On the other hand, Monetarism is dead and mainstream economists do not use QoMT. If you can find mainstream economists who believe in QMoT, please share with us. Though, telling us about what holds true over the long term is pretty much moot since barely anyone can predict what's going to happen over the short term, let alone the long term.

MachineGhost wrote:Again, I was merely arguing that consumer demand is a SYMPTOM and not a CAUSE of MONETARY, i.e. general price increase, inflation. It's too simplistic to say that MONETARY inflation alone is responsible for all price increases, which is why the quantity theory of money doesn't work in the short term and Monetarism (a school of thought) is silly. Even though I wasn't taling about the QUANTITY of money per se, it is still part of mainstream economics so I find it strange that it has been "discredited". Everyone knows that inflation drives up prices in the long term!

Honestly, who cares, MG? The dollar has lost something like 90% of its value over the past century, the quantity of money has skyrocketed since then, and the standard of living has risen dramatically. What exactly is the problem? Where is all the horrible inflation you speak of?

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:39 am

by MachineGhost

stone wrote:

Gumby, I want to understand your point about how a wealth tax would be in danger of causing more government intrusion. Currently all bank accounts and accounts with stock brokers etc have to be reported don't they if they involve any taxable transactions? If you buy or sell a piece of art or gold bullion or whatever that has to be reported? When you die your entire estate needs to be reported. I just don't see where the current privacy exists that potentially could be lost? I was presuming that it would work by largely having self reporting and having the rule that if the tax wasn't up to date on anything then it wasn't legally yours. It would then be confiscated and you could buy it back if you so wished on the open market or whatever. Perhaps I'm being naive but on the face of it it all seems a lot more transparent and straightforward than the current set up

There's currently no reporting of offshore gross proceeds and generally only gross proceeds of transactions are reported domestically. Some gross proceeds aren't reported at all, like option transactions. So there's a moderate level of privacy which is soon to be ending as everything offshore will have to be reported starting next year or 30% withholding will be applied to all U.S. source money. This applies to all foreign-owned institutions and the predictable result is they are dropping/refusing U.S. customers rather than register and comply with the IRS. It is de facto capital controls. It seems at odds with the hegemony of the petrodollar.

The only way a wealth tax can work is if the government knows literally everything about what you own and where. But unfortunately, that seems to be the plan.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 8:49 am

by MachineGhost

Gumby wrote:

What kind of economics system do you think your policies would fall under? They don't sound like run-of-the-mill capitalism to me. Definitely some kind of Post-Capitalism. Perhaps you're advocating Economic democracy?

http://en.wikipedia.org/wiki/Economic_democracy

That sounds like Conscious Capitalism -- at least as far as the stakeholder model goes -- which is the direction we're going, albeit very slowly.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:22 am

by MachineGhost

moda0306 wrote:

Unlike Keynesians, MMR's/MMT's, I believe, think that "inflation expectation" monetary policy is flawed. Very simply, in the medium-to-long run, you need more and more base currency to service a growing economy. It's not about causing inflation to scare people into productive activity, but simply not keeping people so starved of base money that their balance sheet leaves them in a position where they don't want to spend, leaving us all in a big Mexican standoff, where we have skills and capacity but nobody pulls the trigger.

I think "inflation expectations" could be reflected in the

level of velocity and that "unexpected inflation" could be reflected in the

change in velocity. But this is just my personal intuition and understanding, it could be wrong.

I tend to agree with your equation in the long term, but unlike Austrians, I feel that it's people sitting on their butts doing nothing is much worse than that INFLATION end of the equation coming out to 1-3% every year.

It seems obvious to me that the government: a) pays too high prices for good/services it consumes from private sector ($1500 toilet seats) 2) transfers payments to members of society that cannot increase productive output, 3) transfers payments to prop up capitalist losers and protect bond/equity holders. That we only have 1-3% inflation isn't a bad price to pay if 2 compensates the losers of society. It is 1 and 3 that will eventually cause double digit inflation down the road because once the money is issues, it can't really be taken back short of confiscatory taxation. It won't require increased consumer demand or increased employment for the

change in velocity to increase, merely less willingless to hold off lower paying "off the run" money vs newer paying "on the run" money. I'm talking about supply/demand of money to itself here, i.e. a tautology.

To your other points, if the government simply spends more money into the economy via fiscal stimulus, the spending of that money would very well simply result in an increase in productive output, thereby leaving inflation untouched (or barely touched).

That's very true. That's why the inflation equation subtracts out productive output. Both government spending and the

change in velocity will result in increased productivity through increased employment and increased supply of goods/services, i.e. a net wash. It is any financing of unproductive activity that equals inflation, i.e. more money chasing fewer goods/services.

Plus, where does foreign demand for our currency (trade deficit) come into play? Is that part of velocity? That should be factored in somewhere.

That net is just part of the Current Account, i.e. "net financial savings" owned by foreigners. Remember, money (short of currency in circulation) actually leaves our shores, it stays parked in the system. But we get hard goods/services in return. China is the ultimate bagholder if we were to repudiate on our debts or nationalize foreign-owned assets. Sucks to be them.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:37 am

by MachineGhost

Gumby wrote:

MachineGhost wrote:I've been trying to point out that consumer demand is a symptom and inflation as a cause comes from unproductive government spending, which under MMR, provides all source money for an economy. That doesn't seem contestable

Nobody advocates "unproductive" government spending. And since ALL MONEY (except coins) either comes public debt or private debt, there needs to be debt in order to have a money supply.

MachineGhost wrote:but you seem not to have gotten to memo either on the discredited Philips Curve relationship between employment and inflation. It sounds very intuitive, but like most everything in economics, it falls apart when examined with cold, hard [post-gold standard] data.

MMR doesn't prescribe a job guarantee, it just explains how the monetary system works. If the Philips Curve is false, then MMT (which does prescribe a job guarantee) will fail. MMT is just a theory — and it will probably never be tested. MMR is just a description of how the country remains solvent. You're certainly entitled to your own opinion on inflation.

MachineGhost wrote:The quantity theory of money (which is not the same thing as Monetarism) is part of mainstream economics. It is held to be true in the long run, just as the Philips Curve doesn't hold true in the long run. If you're going to claim it's been discredited and no longer paid any respect, what is it replaced with under the heterodox MMR?

I'm not aware of any mainstream economists who are using QMoT. Perhaps you are? Why would they be when velocity is unstable?

Monetarism is deeply rooted in QMoT. Monetarism is dead.

We have unproductive government spending otherwise we wouldn't have any inflation! It is that simple. If this is "opinion" to you so be it, but you can easily verify it through the same kind of rate of change charting you did with consumer spending, with the appropriate lag. Again, I state you are conflating cause and effect.

I think MMT (as opposed to MMR) is full of hot air in general, especially if they base their Post-Keynesianism prescriptions on the Philips Curve. To wit:

In economics, the Phillips curve is a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy. Stated simply, the lower the unemployment in an economy, the higher the rate of inflation. While it has been observed that there is a stable short run tradeoff between unemployment and inflation, this has not been observed in the long run.

I didn't bring up MMT originally; you did with your "consumer demand causes inflation" statement. Does that exist in MMR? I didn't think so. Does government spending exist in MMR? Yes!

Here is your proof that the quantity theory of money it is still part of mainstream economics:

The theory was challenged by Keynesian economics,[1] but updated and reinvigorated by the monetarist school of economics. While mainstream economists agree that the quantity theory holds true in the long run, there is still disagreement about its applicability in the short run. Critics of the theory argue that money velocity is not stable and, in the short-run, prices are sticky, so the direct relationship between money supply and price level does not hold.

I don't know what good a short-run Philips Curve is good for when it doesn't hold up in the long term, but monetary inflation does. If you choose not to correct your error in thinking, so be it. I'm tired of discussing it.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:40 am

by moda0306

MG & Gumby,

I'm currently trying to figure the difference between trade deficit & capital account deficit and I'm wondering if the former is not a better measure of whether we've truly lost currency to overseas.

If an investor uses dollars to invest overseas, he owns a financial asset denominated in dollars that just happens to be resulting in overseas commerce.

If a consumer buys something from overseas, he owns a widget and a Chinese company owns a dollar.

To me, in terms of looking at whether we have enough base currency on our balance sheets in the U.S., it is maybe more appropriate to look at trade balance, not capital/current account balance.

What do you think?

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:52 am

by MachineGhost

Gumby wrote:

I have no allegiance to the Philips Curve or MMT. I only follow MMR. But, as far as I know, MMT uses the New Keynesian Phillips curve[/i (NKPC). It's not perfect, but it has yet to be disproved. MG, if you know otherwise, please share with us.

Broke my vow already. I'll readily admit I've never heard of the New Keynesianism Phillips Curve. Is that where the "consumer demand" allegedly causes inflation tenant comes from?

Honestly, who cares, MG? The dollar has lost something like 90% of its value over the past century, the quantity of money has skyrocketed since then, and the standard of living has risen dramatically. What exactly is the problem? Where is all the horrible inflation you speak of?

Well, I think it matters because if you confuse the true source of inflation, the "fix" will be wrong as well, so there is need for competitive debate. And this isn't exactly non-theoretical. The huge increase of the Fed's balance sheet through both legal and illegal purchases of bonds guarantees us double digit inflation down the road under the equilibrium theory. It is all but done and sprung, only current low velocity is preventing its manifestation in the economy. I don't think anyone can understand that from a "consumer demand" causes inflation framework as that's blaming the wrong actors. Sure we can be cocky as PPers that it won't effect us all that much, if at all, but to society it will be disastrous. Look at the experience of the 70's... the lower class with no assets lost 28% of their purchasing power, the middle class got decimated (on top of massive pension fund losses in 1973-1974) and the rich suffered the least, if not got better off.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:53 am

by Gumby

MachineGhost wrote:I think MMT (as opposed to MMR) is full of hot air in general, especially if they base their Post-Keynesianism prescriptions on the Philips Curve.

Lucky for MMTers they don't. MMTers base their Post-Keynesianism prescriptions on the

New Keynesian Phillips curve (NKPC).

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:57 am

by Gumby

MachineGhost wrote:

Gumby wrote:

I have no allegiance to the Philips Curve or MMT. I only follow MMR. But, as far as I know, MMT uses the New Keynesian Phillips curve[/i (NKPC). It's not perfect, but it has yet to be disproved. MG, if you know otherwise, please share with us.

Broke my vow already. I'll readily admit I've never heard of the New Keynesianism Phillips Curve. Is that where the "consumer demand" allegedly causes inflation tenant comes from?

Sorry, I'm not an MMTer MG. You'd have to ask an MMTer.

MachineGhost wrote:

Honestly, who cares, MG? The dollar has lost something like 90% of its value over the past century, the quantity of money has skyrocketed since then, and the standard of living has risen dramatically. What exactly is the problem? Where is all the horrible inflation you speak of?

Well, I think it matters because if you confuse the true source of inflation, the "fix" will be wrong as well, so there is need for competitive debate. And this isn't exactly non-theoretical. The huge increase of the Fed's balance sheet through both legal and illegal purchases of bonds guarantees us double digit inflation down the road under the equilibrium theory.

Ah yes... the equilibrium "theory" "guarantees us double digit inflation." That makes perfect sense. I guess you believe that a simple equation can predict the future. Never mind all of the other factors. Sounds like Monetarism to me. Look how that turned out.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 9:59 am

by Gumby

I've got to say MG.. You're entire argument seems to be that the government causes inflation because it creates a base money supply. That's like saying that you can't have inflation without base money. Well, yeah. But, the base money supply doesn't cause inflation. There are other factors. If you didn't have a base money supply, you wouldn't have a money supply to begin with, let alone inflation.

Besides, the government has the power to tax and stop spending, to reduce inflation and destroy the private sector's money supply, if need be.

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 2:19 pm

by MachineGhost

Gumby wrote:

Sorry, I'm not an MMTer MG. You'd have to ask an MMTer.

You're copping out. You made the original assertation that "consumer demand causes inflation", posted a chart and made statements about employment and inflation being linked (which is a claim of the Philips Curve), so at least back it up, even if you've got to go get a revised version from a MMTer. How else do you have any basis for your claim?

Here's some quick proof for mine:

From Inflation and the Size of Government:

http://research.stlouisfed.org/publicat ... t2/Han.pdf

"It is commonly supposed in public and academic discourse that inflation and big government are related. The authors show that economic theory delivers such a prediction only in special cases. As an empirical matter, inflation is significantly positively related to the size of government mainly when periods of war and peace are compared. The authors find a weak positive peacetime time-series correlation between inflation and the size of government and a negative cross-country correlation of inflation with non-defense spending."

From the web:

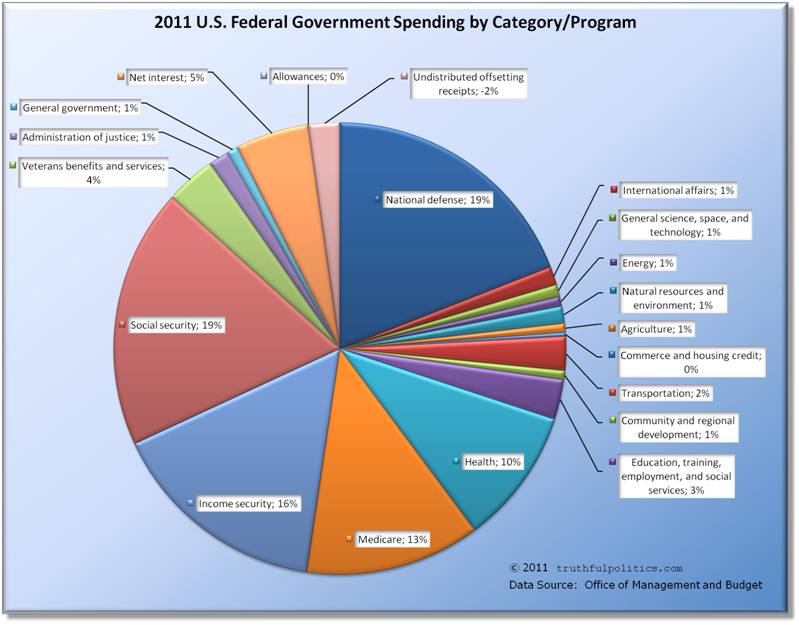

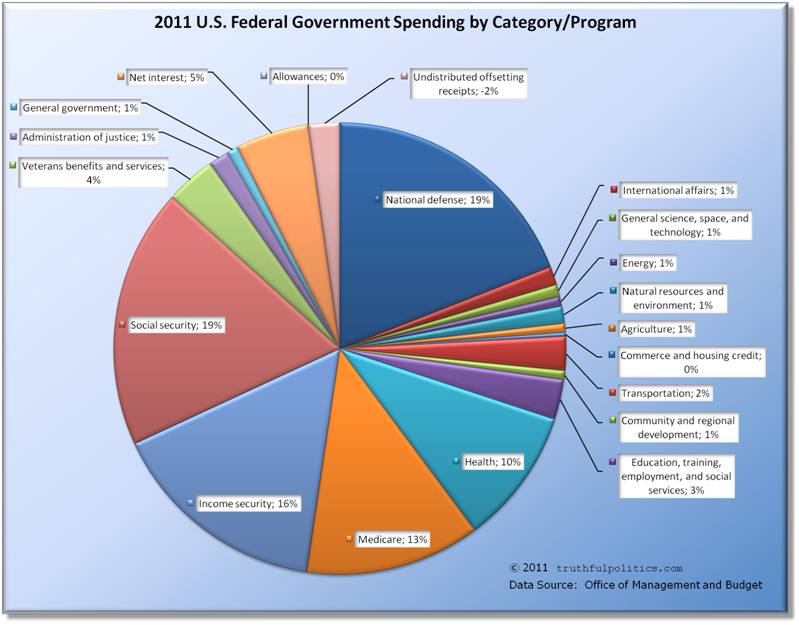

How much of this spending is unproductive???

How much of this spending is unproductive???

Again:

INFLATION = ( GOVERNMENT SPENDING + CHANGE IN VELOCITY ) - PRODUCTIVITY

Take note that I've said over and over it is

UNPRODUCTIVE government spending, not spending per se, that causes inflation. War -- an extreme version of the Broken Windows Fallacy -- is an example. Look at Iran's hyperinflation right now: holding government spending constant, it has an increasing change in velocity as people dump their money along with declining productivity as imports and costs rise by the hour, hence inflation of

the existing supply of money previously spent into existence by the government. This is all in accord with MMR (and probably some parts of MMT?). So my point has nothing to do with the QUANTITY of money nor am I alleging Monetarism.

Ah yes... the equilibrium "theory" "guarantees us double digit inflation." That makes perfect sense. I guess you believe that a simple equation can predict the future. Never mind all of the other factors. Sounds like Monetarism to me. Look how that turned out.

Has the equilibrium theory been discredited or disputed in some way? Then point it out. It may be simple, but it is descriptive of how people actually behave in reality. It essentially says that people will nominalize out the effects of inflation on goods and services as all assets have their prices readjusted to deal with the new reality. Example: When the government appropriates goods/services away from the private sector, there is a reduction in supply along with a concommital increase in money (because it first creates the money to spend). The money will have to be adjusted downward in price/upwards in yield while the value of the remaining goods/services increases.

Here's a question: Do you deny that competitive supply and demand forces have any effect on money itself? Because I think that gets to the crux of the argument.

MG

Re: The System Is Rigged

Posted: Wed Feb 08, 2012 2:24 pm

by moda0306

MG,

If we agree that simply giving people dollars can be fully or mostly cancelled out by the productivity they buy that's undercapacity, I wonder if even unproductive activity is truly "unproductive."

For instance... $1,000 check to person for doing nothing... he buys widgets, and widget manufacturer who's under capacity simply has his staff work longer.

- or -

Gov't pays soldier to learn how to kill people.... $1,000 check to person... he buys widgets, and widget manufacturer who's under capcity simply has his staff work longer.

I am not saying that the "kill-training" was productive, but would it really reverse the productivity that was bought by the soldier purchasing widgets?