Page 47 of 166

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 11:31 am

by Cortopassi

CullyB wrote:Is it possible that this is just a bad portfolio for the times we live in?

Do you have a different allocation in mind for these times? Just curious. I haven't found anything else. Not that I've been looking, but when I did, definitely worse for me.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 11:34 am

by barrett

Cortopassi wrote:Happy Thanksgiving to all!

Barrett, I am way past world domination stage. I just want to calmly finish my career and get my girls through college...

Yeah, me too (just one girl for us though). That 14% bump was the PP outperforming for a bit in my view. The thing is that if you try to time markets, you're likely to be on the sidelines when everything is hot, as happened back in June. Not saying anything new here but people who run a PP can benefit from getting a bit of support on here from time to time. When stocks get clobbered there's a whole world of investors ready to commiserate. We are just trying not to get clobbered. Would love to blather further but I have to go check the gold spot price!

Yes, Happy Thanksgiving everyone.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 11:41 am

by Tyler

CullyB wrote:Is it possible that this is just a bad portfolio for the times we live in?

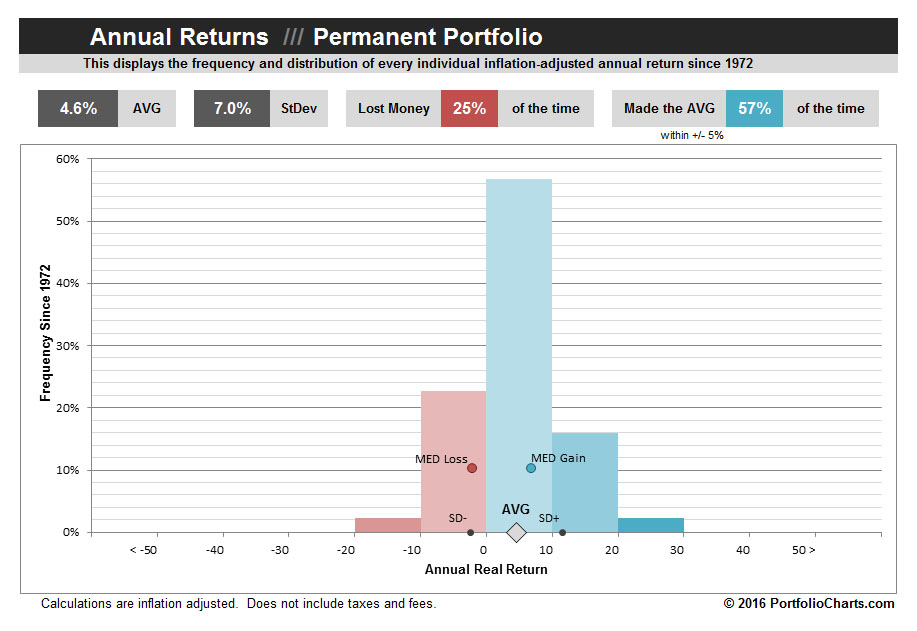

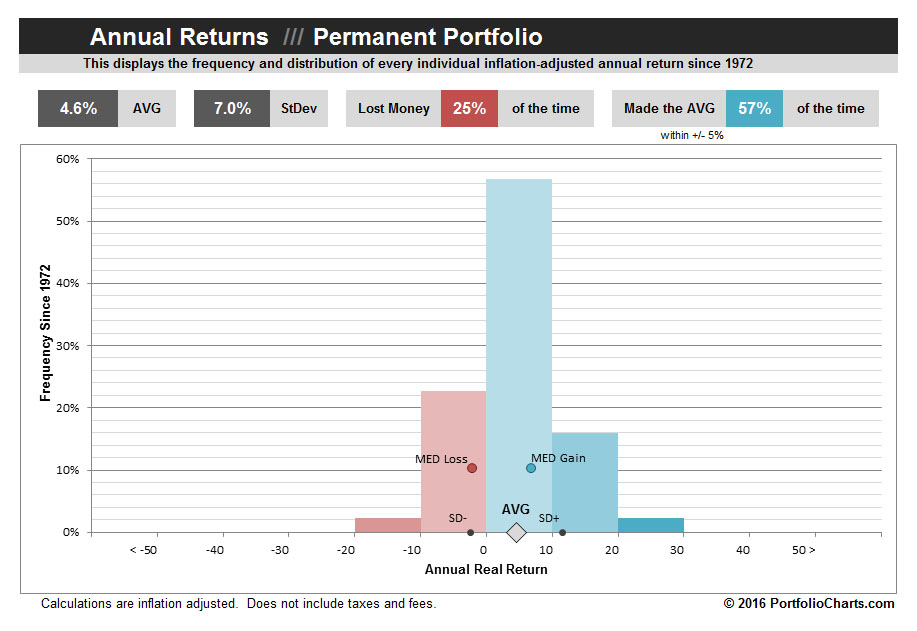

The returns this year are above average historically, so I see no indication that it's a bad time for the PP.

Natural market timers will never be happy with ANY portfolio that doesn't perpetually change with the times in an attempt to maximize returns. But for people who appreciate doing pretty well in all economic conditions with no effort required, there's a lot to like about the PP.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 3:23 pm

by buddtholomew

If you hadn't looked at the PP all year and you logged on to check balances, how would you feel? Don't fall into the trap of feeling you have lost money when you are actually UP YTD.

I personally sold SC and SCV to Bond index today, purchased more International and Gold.

Small caps have dominated after the election while international, fixed income and gold have declined.

It feels like shit to go counter-trend but it seems like the right thing to do.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 3:44 pm

by Cortopassi

True enough Budd, and good way to view things.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 4:09 pm

by buddtholomew

The further out your perspective the less the daily swings matter.

You have to mentally retrain yourself to accept declines.

Also, and this is a big one, my mind is preoccupied with work after my boss left a couple of months ago.

His departure brought me more job security (perceived or otherwise) and the ability to lead a team again.

I've swapped one dependency for another and hope that this time I don't switch back to perseverating about the PP.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 4:19 pm

by Libertarian666

I'm still up about 7% YTD as of this moment.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 4:44 pm

by buddtholomew

Libertarian666 wrote:I'm still up about 7% YTD as of this moment.

Yeah, but your portfolio is weird

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 5:13 pm

by Pointedstick

I haven't looked all year and up 6.3% is still fine by me. My Golden Butterfly portfolio is up almost 10% and I'm downright thrilled with that.

And all of this with zero intervention except for buying some gold every few months. Pretty great if you ask me.

Re: The GOLD scream room

Posted: Wed Nov 23, 2016 9:56 pm

by sophie

Pointedstick wrote:I haven't looked all year and up 6.3% is still fine by me. My Golden Butterfly portfolio is up almost 10% and I'm downright thrilled with that.

And all of this with zero intervention except for buying some gold every few months. Pretty great if you ask me.

Well, if you were a 100% stock investor you'd be up about the same amount and also with minimal intervention. But yes, the PP needs amazingly little attention for a portfolio that can be so complicated to dissect.

I got some gold Eagles (from Colorado Gold) just recently, so I'm back to wondering about storage. Right now the plan is to stick with the safe deposit box method, and add a personal articles policy to my homeowner's insurance. What are you doing about this, if I may ask?

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 4:17 am

by mathjak107

Tyler wrote:Libertarian666 wrote:

Corrections are great if you are in accumulation mode.

I'm not.

Per ETFreplay, the PP is up 7% YTD and is beating a global 60-40 portfolio with no gold by more than 3%. That's a correction I can get on board with.

This just another example of why 1) you shouldn't watch the markets, and 2) you need to look at the portfolio as a whole and not the individual components.

with such a strong dollar i see little need for investing in international funds . the american company's already have enough exposure in my opinion .

so just to bring you up to date on what a domestic portfolio would be doing now . the fidelity insight growth and income model i follow is up 7.14% that is a 65/35 model

the conservative income model 30/70 is up 5.50%

i use a mix of the two .

but remember how many prior years was the pp down recently ? so even if the 6.32% holds it is still pretty poor over the last few years and not comparable . .

so far my gold- long treasury bond predictions have not been wrong . things seem to be playing out just the way i thought they would , with gold and long term treasury bonds holding back whatever gains equity's can muster once the corner turned on bond rates which they did 3 months ago .

these increases in bond rates are only the beginning of the rise back towards more normal rates . for a low volatility portfolio the pp certainly has been seeing it's share of swings . half the double digit rise it had evaporated in a few months .

just my 2 cents for what it's worth here which is nothing . now back to my non posting status .

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 5:02 am

by mathjak107

sophie wrote:Pointedstick wrote:I haven't looked all year and up 6.3% is still fine by me. My Golden Butterfly portfolio is up almost 10% and I'm downright thrilled with that.

And all of this with zero intervention except for buying some gold every few months. Pretty great if you ask me.

Well, if you were a 100% stock investor you'd be up about the same amount and also with minimal intervention. But yes, the PP needs amazingly little attention for a portfolio that can be so complicated to dissect.

I got some gold Eagles (from Colorado Gold) just recently, so I'm back to wondering about storage. Right now the plan is to stick with the safe deposit box method, and add a personal articles policy to my homeowner's insurance. What are you doing about this, if I may ask?

up about the same ?

the s&p 500 is up almost 10% , the midcap index up 13% and the small cap index up 19%. that isn't close to being the same as the 6.32% of the pp especially when considering the pp losses the last few years .

if anything the gb has a far better balance than the pp in my opinion . while i am not thrilled with the long term bonds and gold at this point the small cap tilt and increased allocations to equity's is far more to my liking . i could see harry revising the pp today if he was alive to something along those lines .

if we sell off enough i can see the gb performing fine for new comers until the next round of rate increases next year . personally i feel it is a portfolio that i would use dynamically and be ready to make changes if rates were continuing upward .

as far as the gb design , it is easy to back in to data and construct the ideal solution to situations in the past so that they fair better then everything else .

it is a whole lot harder when the course going forward is pretty different from the road it was designed for if the path changes . 35 years of falling rates except for some speed bumps alters that road just enough to possibly make the design going forward not the best choice if rates continue up .

but with a lot of the froth out now the gb may be starting to look attractive as a dynamic portfolio where adjustments to allocations are made based on the big picture .

i don't intend to be a regular poster here again but i did want to throw out some comments .

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 9:46 am

by buddtholomew

What you fail to take into consideration is that many of us rebalanced following the ~13% increase.

I took the gain as an opportunity to rebuild cash position and am now reinvesting at lower gold and LTT prices.

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 9:49 am

by mathjak107

that just makes your returns worse . lol . if folks rebalanced they took what continued to go up and bought what fell further right up until yesterday .

you had to sell some stocks then and missed some of the equity run up if you converted to cash , yes ?

i doubt that made much of a difference either way . until bonds and gold rebound , if they do , it is basically a non event . .

. .

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 9:52 am

by buddtholomew

mathjak107 wrote:that just makes your returns worse . lol . if folks rebalanced they took what continued to go up and bought what fell further right up until yesterday .

you had to sell some stocks then and missed some of the equity run up if you converted to cash , yes ?

. .

No. Stocks were left untouched.

Sorry, try again.

Actually, I thought you were done posting.

Bye.

Re: The GOLD scream room

Posted: Thu Nov 24, 2016 9:53 am

by mathjak107

bye ........

Re: The GOLD scream room

Posted: Tue Dec 06, 2016 9:16 am

by dualstow

ochotona's strategy of just buying a single ounce regularly (if I remember that right) is starting to appeal to me.

The dollar cost averaging should make up for the extra ~$50 in markup.

Re: The GOLD scream room

Posted: Tue Dec 06, 2016 1:31 pm

by Cortopassi

Hey, mathjak!

I mentioned you not long ago thinking you'd probably be saying I told you so right around now. But I suppose I probably would have said the same to you in Feb of this year.

Hope all is well.

Re: The GOLD scream room

Posted: Tue Dec 06, 2016 8:59 pm

by ochotona

dualstow wrote:ochotona's strategy of just buying a single ounce regularly (if I remember that right) is starting to appeal to me.

The dollar cost averaging should make up for the extra ~$50 in markup.

I call it the "make small mistakes" strategy.

Articles like these keep me hoping for gold sub-$1000. If this happens, I'll make a bigger mistake.

http://investinghaven.com/screening/gol ... ving-1000/

http://investinghaven.com/reading-marke ... 1000-2017/

Re: The GOLD scream room

Posted: Thu Dec 08, 2016 11:02 am

by dualstow

24-hr sale at Apmex right now on random year 1oz coins. I'd order if I thought I'd be around to take delivery.

Re: The GOLD scream room

Posted: Thu Dec 08, 2016 1:20 pm

by dualstow

TennPaGa wrote:dualstow wrote:24-hr sale at Apmex right now on random year 1oz coins. I'd order if I thought I'd be around to take delivery.

Now

that is what I call amping up the doomsaying!

Xmas vacation only.

Re: The GOLD scream room

Posted: Wed Dec 14, 2016 3:03 pm

by ochotona

Wow, down 2% today

Re: The GOLD scream room

Posted: Wed Dec 14, 2016 3:06 pm

by buddtholomew

Everything down today.

Re: The GOLD scream room

Posted: Wed Dec 14, 2016 3:25 pm

by Cortopassi

Ocho, let's not fear monger! It was only down 1.3%...

Re: The GOLD scream room

Posted: Wed Dec 14, 2016 4:06 pm

by ochotona

Cortopassi wrote:Ocho, let's not fear monger! It was only down 1.3%...

I must've gotten an alert on an intraday price