printing money does not equal inflation

Moderator: Global Moderator

printing money does not equal inflation

Hi,

I **think** I read on this board that printing money does not necessarily lead to inflation. If I recall correctly, money printing precipitated by a credit crisis does not lead to inflation, according to the historical record.

Now I'm not 100% sure I got this right.

Could somebody set me straight?

I remember someone posting a list of examples. I can't find what I am looking for using the search utility, so that's why I'm asking.

I **think** I read on this board that printing money does not necessarily lead to inflation. If I recall correctly, money printing precipitated by a credit crisis does not lead to inflation, according to the historical record.

Now I'm not 100% sure I got this right.

Could somebody set me straight?

I remember someone posting a list of examples. I can't find what I am looking for using the search utility, so that's why I'm asking.

Re: printing money does not equal inflation

Sure...

You're referring to the Quantity Theory of Money. It was disproven by Keynes in the 1930s. In reality, predicting inflation is not that simple. If it was, we would have had very high inflation years ago, when government spending shot up in the 1990s.

Printing money can lead to inflation, but other things need to happen as well for it to take hold. Many people point to Weimar or Zimbabwe inflation as evidence that printing leads to inflation, but those individuals usually leave out the important exogenous factors that allowed money printing to cause inflation in those economies (such as war, or owing foreign-denominated debt).

Here's how Harry Browne explained it on his investment radio show (recorded on 12/12/04):

You're referring to the Quantity Theory of Money. It was disproven by Keynes in the 1930s. In reality, predicting inflation is not that simple. If it was, we would have had very high inflation years ago, when government spending shot up in the 1990s.

Printing money can lead to inflation, but other things need to happen as well for it to take hold. Many people point to Weimar or Zimbabwe inflation as evidence that printing leads to inflation, but those individuals usually leave out the important exogenous factors that allowed money printing to cause inflation in those economies (such as war, or owing foreign-denominated debt).

Here's how Harry Browne explained it on his investment radio show (recorded on 12/12/04):

See also...Harry Browne: Inflation results from the supply of money increasing faster than the demand for money. Now, mostly what we hear though is that inflation results from the increase supply of money. In other words, an increase in the supply of money is "A" and inflation is "B". When you get "A" then "B" follows. But what happens is periods like the past few years when the money supply has been increasing at a fairly rapid rate, and yet, we do not see any appreciable price inflation whatsoever. So, what we're seeing here is that the money supply has increased, but the consequence has not ensued. And that's because of two things. One of which is timing, and the other is that other factors can be introduced. So, what we do mean to say, really, is that an increase in the supply of money makes the inflation rate greater than it would be without that increase in the supply of money. We also take into account the demand for money — the desire of individuals to hold money in their pocket, to hang on to money, rather than spending, saving, or investing it. And if that is increasing as fast as the supply of money, then there is no increase in the inflation rate. So, all other things being equal, the increase in the supply of money leads to an increase in the price inflation rate. But, there are other things that have to be considered and that case, mostly the demand for money. These other factors always play a part, but we can't always see them.

Source: https://web.archive.org/web/20160324133 ... -12-12.mp3 (skip to 13:20)

melveyr wrote: Some interesting Japan graphs...

Note: This cannot be unseen and might lead to a different perspective, and possible brain re-wiring.

Notice how expansions in the money supply do not always result in inflation. There is always supply and demand at play. Schiff is focusing on supply while ignoring demand (among other more fundamental failings).

Last edited by Gumby on Tue Apr 03, 2012 11:07 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: printing money does not equal inflation

I think one also has to look at total debt levels. If people/companies/governments start defaulting on debt, then the total money supply will drastically decrease. A little money printing in such an environment will help to prevent a catastrophic deflation event.

I think this is why we aren't seeing too much inflation with all the money printing that has gone on since 2008. There still has been a lot of debt that has not and will not be repaid.

I think this is why we aren't seeing too much inflation with all the money printing that has gone on since 2008. There still has been a lot of debt that has not and will not be repaid.

Re: printing money does not equal inflation

"Printing money" tells you almost nothing about what kinds of inflation you might expect to see.

The U.S. government is constantly "printing money" just because paper bills only stay in circulation for a few years before needing to be replaced.

On the inflation topic generally, in an economy like the U.S. there are several factors that need to be in place for inflation to really gain traction. In an environment of high unemployment, few barriers to offshoring of jobs, contracting credit, overleveraged households, falling home prices, dramatically weakened labor unions compared to past decades, and very low tax rates compared to historical levels, it's hard to see a true inflationary spiral (i.e., rising prices met with rising prices in an upward spiral) developing here any time soon.

The U.S. government is constantly "printing money" just because paper bills only stay in circulation for a few years before needing to be replaced.

On the inflation topic generally, in an economy like the U.S. there are several factors that need to be in place for inflation to really gain traction. In an environment of high unemployment, few barriers to offshoring of jobs, contracting credit, overleveraged households, falling home prices, dramatically weakened labor unions compared to past decades, and very low tax rates compared to historical levels, it's hard to see a true inflationary spiral (i.e., rising prices met with rising prices in an upward spiral) developing here any time soon.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: printing money does not equal inflation

There's two general things that need to be said about "printing money."

1) When the fed "prints money," with few exceptions, it's simply trading it for a different kind of federally-issued fiat paper of a similar risk (T-bills). The exception being when the fed buys mortgage garbage at face value. This is significantly different, IMO, but as a general rule, printing money should be called trading money. These are almost always traded for short-term treasury bonds. T-Bills are about the closest thing to a US dollar you can get.

2) What this printing accomplishes is it stops rewarding people for holding their money in the form of interest, with the goal of increasing the velocity of that money, as people now play a bit more hot-potato with it and purchase stuff instead of hoarding money. Interestingly, in my view, in spite of what the M1 money charts show, the QUANTITY really hasn't changed in a way, since bonds are money too . This is my way of viewing it anyway, though economists worldwide would probably frown at me trying to change the definition of the "quantity of money." Anyway... when savers who were once holding treasury bills that paid 1% real return are now losing 1% to inflation, they are more apt to do one of the following:

. This is my way of viewing it anyway, though economists worldwide would probably frown at me trying to change the definition of the "quantity of money." Anyway... when savers who were once holding treasury bills that paid 1% real return are now losing 1% to inflation, they are more apt to do one of the following:

- Lend the money to businesses & households to get some real-return

- Spend the money on stuff like a car, new shingles or other long-lived assets

- Pile into gold, leather chaps, and guns as society collapses with the faith in the dollar (sarcasm... at least the way I see things)

Or some combination of those things, probably in about that order of likelihood, and other things I haven't mentioned... basically, it reduces peoples' motivation to hold US dollars as a form of savings.

However, in a country that is way too far in debt trying to pay it off, and with not enough savings, people are in a natural position to hoard those dollars even if hte don't have lucrative risk-free rates.

1) When the fed "prints money," with few exceptions, it's simply trading it for a different kind of federally-issued fiat paper of a similar risk (T-bills). The exception being when the fed buys mortgage garbage at face value. This is significantly different, IMO, but as a general rule, printing money should be called trading money. These are almost always traded for short-term treasury bonds. T-Bills are about the closest thing to a US dollar you can get.

2) What this printing accomplishes is it stops rewarding people for holding their money in the form of interest, with the goal of increasing the velocity of that money, as people now play a bit more hot-potato with it and purchase stuff instead of hoarding money. Interestingly, in my view, in spite of what the M1 money charts show, the QUANTITY really hasn't changed in a way, since bonds are money too

- Lend the money to businesses & households to get some real-return

- Spend the money on stuff like a car, new shingles or other long-lived assets

- Pile into gold, leather chaps, and guns as society collapses with the faith in the dollar (sarcasm... at least the way I see things)

Or some combination of those things, probably in about that order of likelihood, and other things I haven't mentioned... basically, it reduces peoples' motivation to hold US dollars as a form of savings.

However, in a country that is way too far in debt trying to pay it off, and with not enough savings, people are in a natural position to hoard those dollars even if hte don't have lucrative risk-free rates.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: printing money does not equal inflation

I probably can't add much here already, but I'll say this:

Just because banks have a lot of credit (money) available to them from the Fed does not mean it will make it into the economy. The Fed has made a lot of money available, but banks are not necessarily lending it to customers or those customers simply don't want to make use of it. So although the Fed can print Trillions of dollars in computer account credits, it doesn't mean it will make it into the economy and without those dollars in the economy they are never going to be inflationary.

Just because banks have a lot of credit (money) available to them from the Fed does not mean it will make it into the economy. The Fed has made a lot of money available, but banks are not necessarily lending it to customers or those customers simply don't want to make use of it. So although the Fed can print Trillions of dollars in computer account credits, it doesn't mean it will make it into the economy and without those dollars in the economy they are never going to be inflationary.

Re: printing money does not equal inflation

Something that hasn't been discussed yet is that an expansion of the money supply by about 2% annually has been required historically to keep prices around the 0% level. This is assuming a normal credit environment. If the money supply was constant, it would be deflationary. "Printing money" is a vague phrase because it could mean the normal expansion of money supply in a fully functioning economy (population growth + productivity).

The monetary inflation we see today is pretty large compared to previous periods, but is necessary to keep asset prices high in light of slow credit creation. For most people, the question shouldn't be "are we printing money?" It should be "what are savers getting paid?"

The monetary inflation we see today is pretty large compared to previous periods, but is necessary to keep asset prices high in light of slow credit creation. For most people, the question shouldn't be "are we printing money?" It should be "what are savers getting paid?"

Re: printing money does not equal inflation

We own a small, one product company that imports from China. The prices have been increasing the past 2 years. In our case, this has resulted in margin contraction rather than increased prices being passed on to retailers or consumers. I'm not sure how others, particularly larger companies have faired.Clive wrote: Given that India's inflation rate is nearly 9%, Brazil 6% and the growth of domestic wealth in Brazil, India and China potentially creating greater domestic demand in those countries that could push prices higher, coupled with the US running with a trade deficit (if you're anything like us in the UK almost all the common non perishables are made in China, India .. etc.) could that not be a driver of US inflation?

I know very little about economics, my simplistic view is that the amount of cheap stuff we seem to import from China could in concept start to rise in price and drive inflation higher despite there perhaps not being any domestic drivers of inflation such as higher wages?

Re: printing money does not equal inflation

Excellent point. That's one of the main criticisms of a credit-based monetary system. You typically need a growing money supply to pay off the private bank interest (except in rare situations where banks/creditors are paying debtors for goods and services):Wonk wrote: Something that hasn't been discussed yet is that an expansion of the money supply by about 2% annually has been required historically to keep prices around the 0% level. This is assuming a normal credit environment. If the money supply was constant, it would be deflationary. "Printing money" is a vague phrase because it could mean the normal expansion of money supply in a fully functioning economy (population growth + productivity).

The monetary inflation we see today is pretty large compared to previous periods, but is necessary to keep asset prices high in light of slow credit creation. For most people, the question shouldn't be "are we printing money?" It should be "what are savers getting paid?"

When coupled with fractional reserve banking, [a debt-based monetary system] becomes a credit-based monetary system, where both paper money and bank credit are supplied as interest bearing debt. Some economic and political commentators believe that debt-based paper money and fractional reserve banking together cause several economic problems such as, high government spending for debt servicing, economic recessions and depressions, and the consequent loss of property by borrowers during the downturn.

Source: http://en.wikipedia.org/wiki/Debt-based_monetary_system

Critics of fractional reserve banking claim that since money creation requires loans from the banking system, people are required to go into debt in order for any new money to be created. They assert that this can debase the means of exchange. Critics find it problematic that banks "create money out of nothing."

One criticism posits that since debt and the interest on the debt can only be paid in the same form of money, the total debt (principal plus interest) can never be paid in a debt-based monetary system unless more money is created through the same process. For example: if 100 credits are created and loaned into the economy at 10% per year, at the end of the year 110 credits will be needed to pay the loan and extinguish the debt. However, since the additional 10 credits does not yet exist, it too must be borrowed. This implies that debt must grow exponentially in order for the monetary system to remain solvent. This was the argument of the Social Credit movement of the 1930s, who proposed to remove the job of money creation from banks and give it to governments.

Source: http://en.wikipedia.org/wiki/Criticism_ ... ve_banking

Last edited by Gumby on Mon Apr 02, 2012 10:49 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: printing money does not equal inflation

Right, ok. By "printing money" I just mean "increasing the money supply".

Japan is one example of where the government has increased money supply and inflation hasn't happened. I suppose this is occurring because the *demand* for money is going up in tandem, thus zeroing out inflation? (I guess the 'demand for money' is occurring in Japan because people are paying off debt or are saving their money?)

Are there other examples?

Also, is the consumer price index an accurate reading of inflation? (They fudge the CPI in canada by leaving out the cost of energy and food, which have risen ~8% and ~4.5%, respectively, in the last 12 months. If you factor those in, the CPI would be at 4.6% instead of 2.6% that the governement is reporting. See http://www.statcan.gc.ca/daily-quotidie ... 3a-eng.htm .)

Japan is one example of where the government has increased money supply and inflation hasn't happened. I suppose this is occurring because the *demand* for money is going up in tandem, thus zeroing out inflation? (I guess the 'demand for money' is occurring in Japan because people are paying off debt or are saving their money?)

Are there other examples?

Also, is the consumer price index an accurate reading of inflation? (They fudge the CPI in canada by leaving out the cost of energy and food, which have risen ~8% and ~4.5%, respectively, in the last 12 months. If you factor those in, the CPI would be at 4.6% instead of 2.6% that the governement is reporting. See http://www.statcan.gc.ca/daily-quotidie ... 3a-eng.htm .)

Last edited by christina on Wed Apr 04, 2012 9:42 am, edited 1 time in total.

Re: printing money does not equal inflation

It is really difficult to construct a good inflation measuring index.christina wrote: Right, ok. By "printing money" I just mean "increasing the money supply".

Japan is one example of where the government has increased money supply and inflation hasn't happened. I suppose this is occurring because the *demand* for money is going up in tandem, thus zeroing out inflation? (I guess the 'demand for money' is occurring in Japan because people are paying off debt or are saving their money?)

Are there other examples?

Also, is the consumer price index an accurate reading of inflation? (They fudge the CPI in canada by leaving out the cost of energy and food, which have risen ~8% and ~4.5%, respectively, in the last 12 months. If you factor those in, the CPI would be at 4.6% instead of 2.6% that the governement is reporting. See http://www.statcan.gc.ca/daily-quotidie ... 3a-eng.htm .)

Most governments leave out food and energy (sometimes calling it the core CPI) because the CPI is a tool used to evaluate monetary policy. Food and energy have very volatile prices, irrespective of general inflation trends. Although the inclusion might better reflect our lives as consumers, the index would be so volatile that monetary policy would be back and forth between higher and lower rates.

Additionally, in a true inflation almost all prices would be rising. The exclusion of food and energy would not hide the problem. They are really just trying to cut out some of the noise.

Also, one big problem with a CPI is controlling for increasing quality as time goes on. A 2012 Toyota Camry has better features than a 1990 Camry. How are they supposed to control for that in the index? They use some formulas attempting to control for the value added, but it is a messy process.

To answer your question: Most government CPIs are okay. It is a messy process that is easy to criticize, but hard to improve upon.

everything comes from somewhere and everything goes somewhere

Re: printing money does not equal inflation

As Wonk mentioned, under a fixed supply of money, all goods would naturally fall in price over time. This is the natural benefit of living in an efficient, free market economy where goods become cheaper and cheaper to produce. (Such gentle deflation was generally the way of things from the founding of the United States through the very early 20th century.)

On top of this, we are experiencing about 3% inflation due to the increases in the money supply. Taken together, this represents a noticeable level of price inflation (and is certainly not deflation) but doesn't come anywhere close to matching the much more dramatic increase in money supply.

As with any other market, the "market" for dollars is governed strictly by supply and demand. If people (or banks or whoever) feel more comfortable holding on to money rather than spending it, that's an extremely important source of demand for money. (The idea behind ultra-low interest rates is to make money less attractive of a holding.)

There's another interesting source of dollar demand -- our trade deficit with China. As China sells far more goods to the United States than it buys from the United States, China winds up with a lot of dollars. The Chinese recipient of these dollars, however, need Chinese Yuan in order to pay their laborers and suppliers and to buy goods domestically.

These Chinese dollar holders need to trade this huge stash of dollars for Yuan. Normally, this demand for Yuan would cause a strengthening Yuan (in other words, its price in terms of dollars would increase.) However, China places a huge emphasis on their industrial base (and thus their exporters.) Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar. This allows us to export a great deal of price inflation to China as they struggle to keep the Yuan from strengthening against the dollar.

If China allowed its currency to appreciate or significantly diversified its dollar holdings into other currencies or commodities, this could change the equation. I could certainly see them doing this at some point but none of us really know how it'll all play out. With this many moving parts, it's best to stay... balanced and diversified.

On top of this, we are experiencing about 3% inflation due to the increases in the money supply. Taken together, this represents a noticeable level of price inflation (and is certainly not deflation) but doesn't come anywhere close to matching the much more dramatic increase in money supply.

As with any other market, the "market" for dollars is governed strictly by supply and demand. If people (or banks or whoever) feel more comfortable holding on to money rather than spending it, that's an extremely important source of demand for money. (The idea behind ultra-low interest rates is to make money less attractive of a holding.)

There's another interesting source of dollar demand -- our trade deficit with China. As China sells far more goods to the United States than it buys from the United States, China winds up with a lot of dollars. The Chinese recipient of these dollars, however, need Chinese Yuan in order to pay their laborers and suppliers and to buy goods domestically.

These Chinese dollar holders need to trade this huge stash of dollars for Yuan. Normally, this demand for Yuan would cause a strengthening Yuan (in other words, its price in terms of dollars would increase.) However, China places a huge emphasis on their industrial base (and thus their exporters.) Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar. This allows us to export a great deal of price inflation to China as they struggle to keep the Yuan from strengthening against the dollar.

If China allowed its currency to appreciate or significantly diversified its dollar holdings into other currencies or commodities, this could change the equation. I could certainly see them doing this at some point but none of us really know how it'll all play out. With this many moving parts, it's best to stay... balanced and diversified.

Re: printing money does not equal inflation

melveyr,

Am I misinterpreting your post? CPI DOES include food & fuel... this is what is published to the public and used to calculate SS benefits and the like. Core CPI is a fed tool to see whether inflation is taking hold.

Our CPI DOES NOT disclude food and fuel... in fact I think that's one myth that people need to know, as I've run into a lot of smart people that think CPI doesn't include those items. Best to not confuse them.

Am I misinterpreting your post? CPI DOES include food & fuel... this is what is published to the public and used to calculate SS benefits and the like. Core CPI is a fed tool to see whether inflation is taking hold.

Our CPI DOES NOT disclude food and fuel... in fact I think that's one myth that people need to know, as I've run into a lot of smart people that think CPI doesn't include those items. Best to not confuse them.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: printing money does not equal inflation

LW,

How do you see a moderate shift in China's priorities playing out? Seems to me that it would decrease our trade deficit, and increase demand for our business' products.

This seems to be the natural flow of it all to me. What scares me is the oft-described-by-Austrians shift not into traditional demand but hoarding (non-pejorative... in fact I don't like the word) of gold and other non-productive assets... as well as food/fuel, as they are necessities, rising while more discretionary business activity falls. The immediate rush could cause Americans to, rightly or wrongly, fear inflation as the main problem, and exacerbate the problem by continuing to skip over stocks and bonds to gold, commodities, stockpiling basements, etc.

Now by "what scares me" I mean "what I highly doubt will happen to a huge degree, but seems like a likely chink in the armor of my theory that Chinese rejection of the dollar will result in more demand for our labor and increased prosperity."

I mean.. the gov't can increase velocity by making dollars ugly to hold, but they can't force people to buy the consumer junk that corps are producing... if they are unsure about what they truly want in life, fear and "necessity inflation" could keep people disengaging in the consumer economy for a long time... in fact I see the discressionary nature of much of our spending to be one of our economy's greatest weaknesses. I think we could very quickly reevaluate our priorities and leave a good chunk of our economy obsolete or much too large. An economy where people are flippant about a good chunk of their spending is not as strong as it should be, IMO. People will abandon buying new cars every 3 years LONG before they give up something they truly feel expands their lifestyle in a positive way.

How do you see a moderate shift in China's priorities playing out? Seems to me that it would decrease our trade deficit, and increase demand for our business' products.

This seems to be the natural flow of it all to me. What scares me is the oft-described-by-Austrians shift not into traditional demand but hoarding (non-pejorative... in fact I don't like the word) of gold and other non-productive assets... as well as food/fuel, as they are necessities, rising while more discretionary business activity falls. The immediate rush could cause Americans to, rightly or wrongly, fear inflation as the main problem, and exacerbate the problem by continuing to skip over stocks and bonds to gold, commodities, stockpiling basements, etc.

Now by "what scares me" I mean "what I highly doubt will happen to a huge degree, but seems like a likely chink in the armor of my theory that Chinese rejection of the dollar will result in more demand for our labor and increased prosperity."

I mean.. the gov't can increase velocity by making dollars ugly to hold, but they can't force people to buy the consumer junk that corps are producing... if they are unsure about what they truly want in life, fear and "necessity inflation" could keep people disengaging in the consumer economy for a long time... in fact I see the discressionary nature of much of our spending to be one of our economy's greatest weaknesses. I think we could very quickly reevaluate our priorities and leave a good chunk of our economy obsolete or much too large. An economy where people are flippant about a good chunk of their spending is not as strong as it should be, IMO. People will abandon buying new cars every 3 years LONG before they give up something they truly feel expands their lifestyle in a positive way.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: printing money does not equal inflation

Good question. It's hard to say. If you look at it by itself, a strengthening Yuan should increase demand for US goods from Chinese buyers and decrease demand for Chinese goods from US buyers.moda0306 wrote: How do you see a moderate shift in China's priorities playing out? Seems to me that it would decrease our trade deficit, and increase demand for our business' products.

Beyond that, though, it's interesting to contemplate what China might diversify into. Whether they actively sell Treasuries or simply allow them to mature, the result is still a big pile of dollars. These must purchase some US-owned asset.

What would it be? Invest these dollars in other US markets? Perhaps commodities like gold, copper, and oil? Foreign currencies? It all sounds like it would tend to cause diminished purchasing power for US citizens along with potential positive results for US exporters. It should also create some upward pressure on interest rates.

Re: printing money does not equal inflation

If China diversified into foreign currencies, wouldn't that mean that foreigners are diversifying into dollars... and if they don't divest themselves of those dollars somehow, the result would be zero net affect on the US, correct?

To me, if you take the foreign sector as a whole, the only way for it to divest itself of dollars is to buy something from our domestic economy. That could be OUR copper, OUR factories, or OUR widgets, right?

Further, I'm not sure on the details around the laws around foreign ownership of domestic corps, but I think entire countries like China can't just purchase Wal Mart or something... it's probably important to look at those laws.

To me, if you take the foreign sector as a whole, the only way for it to divest itself of dollars is to buy something from our domestic economy. That could be OUR copper, OUR factories, or OUR widgets, right?

Further, I'm not sure on the details around the laws around foreign ownership of domestic corps, but I think entire countries like China can't just purchase Wal Mart or something... it's probably important to look at those laws.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: printing money does not equal inflation

Yes, printing money does not imply inflation. There are many definitions of inflation: CPI is only one of them. If you use the %change in the price index for the output of firms excluding the Govt., inflation is primarily dependent on the following:

- Unemployment rate (unless it is extremely low- which is unlikely for a while)

- wage rate

- cost of imports

- Unemployment rate (unless it is extremely low- which is unlikely for a while)

- wage rate

- cost of imports

Re: printing money does not equal inflation

Well, you're leaving out the fact that China prints more money (per GDP) than any other country on the planet, to help keep the Yuan from appreciating — essentially copying our dollars into freshly printed Yuan.Lone Wolf wrote:Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar.

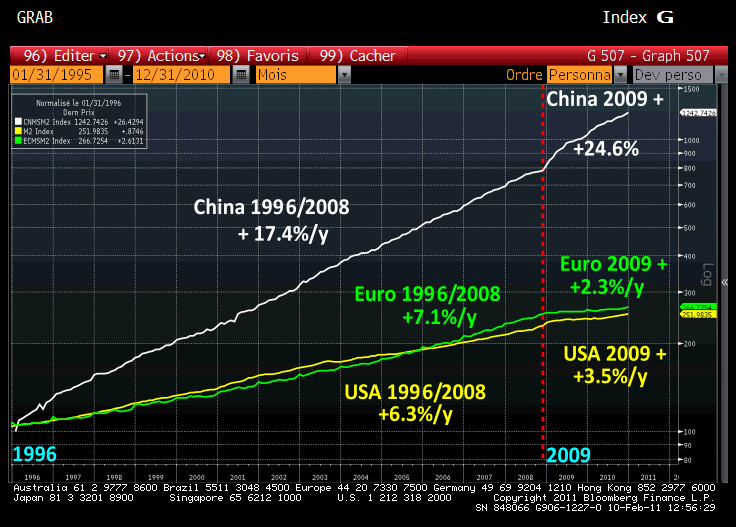

Here's a chart that compares the M2 money supply growth of China, the Euro Zone and the US...

[align=center]

[/align]

[/align]China's money supply growth has literally skyrocketed. Up until 2008, China's money supply was growing at an average of +17.4% each year. Compare that to +7.1% in the eurozone and +6.3% in the United States. Since the beginning of 2009, this divergence widened: Chinese M2 was growing up to 26.6% per annum (up until last year), versus +3.5% in the U.S. and +2.3% in the eurozone. China has reduced their M2 growth down to about 14% per annum, over the past few months.

The inflation rate in China was reported at 3.2 percent in February of 2012 (down from a three-year high of 6.5% in July). From 1994 until 2010, the average inflation rate in China was 4.25 percent reaching an historical high of 27.70 percent in October of 1994 and a record low of -2.20 percent in March of 1999.

China's 2012 inflation target is 4%.

Last edited by Gumby on Wed Apr 04, 2012 8:00 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: printing money does not equal inflation

Sure, they purchase dollar-denominated assets with printed Yuan. The rising inflation that they experienced in 2010 and early 2011 was in large part a result of them trying to keep up with our printing presses.Gumby wrote:Well, you're leaving out the fact that China prints more money (per GDP) than any other country on the planet, to help keep the Yuan from appreciating — essentially copying our dollars into freshly printed Yuan.Lone Wolf wrote:Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar.

I'm not sure that I see where we disagree.

Re: printing money does not equal inflation

We agree. I was just a bit confused by your phraseology. It sounded like you were saying that the Chinese government was purchasing (non-financial) dollar-denominated assets with Yuan — which doesn't make any sense, since you would need dollars to purchase dollar-denominated stuff. But, now I see you were just saying that the Chinese government is trading freshly printed Yuan for dollars given to Chinese corporations — which makes total sense.Lone Wolf wrote:Sure, they purchase dollar-denominated assets with printed Yuan. The rising inflation that they experienced in 2010 and early 2011 was in large part a result of them trying to keep up with our printing presses.Gumby wrote:Well, you're leaving out the fact that China prints more money (per GDP) than any other country on the planet, to help keep the Yuan from appreciating — essentially copying our dollars into freshly printed Yuan.Lone Wolf wrote:Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar.

I'm not sure that I see where we disagree.

In any case, I thought it was important to show just how much "printing" the Chinese government has to do to in order to keep the flow of capital moving.

Last edited by Gumby on Wed Apr 04, 2012 9:36 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: printing money does not equal inflation

It's important to realize that, other than coins, our entire money supply is debt-based. The government spends "base money" into existence, and simultaneously issues debt. When the government taxes, it's reclaiming that base money to reduce its debt — essentially destroying base money and its corresponding debt for all practical purposes.christina wrote:Japan is one example of where the government has increased money supply and inflation hasn't happened. I suppose this is occurring because the *demand* for money is going up in tandem, thus zeroing out inflation? (I guess the 'demand for money' is occurring in Japan because people are paying off debt or are saving their money?)

When base money exists in the private sector, the majority of it lives as reserves in your bank's reserve account at the Fed. The only time you get to touch base money is when you withdraw it from the bank — when it is literally sitting in your pocket. And banks create the overwhelming majority of the money supply (M2) by extending credit off of the actual reserves held at the Fed. These lines of credit are just numbers on a piece of paper and your statement — all the accounts in the bank are effectively sharing the same reserves.

So, to recap... The government spends debt-based base money into existence, and the private sector extends that base money with private credit.

So, when your employer pays you money, they are either paying you with the government's deficit dollars that were spent into existence (i.e. base money, held as reserves) or your employer — or whoever paid your employer — got a loan from their bank (which was private credit backed by deficit dollars) which enables their bank to transfer reserves to your bank. But, if your employer took out a loan to pay you — or whoever paid your employer took out a loan to pay them — then they need to repay those reserves, plus interest, when their loan is due. Either way, the money in your pocket comes from either a public or private debt.

The problem is that since such a large portion of the money supply is nothing more than bank credit (or agency debt, or commercial paper in the shadow banking system), the private sector can get in a lot of trouble if the economy slows down — since homeowners and businesses won't be able to pay back all of their loans, plus interest, before those payments are due. Normally they just get more private credit (or base money, as deficit dollars) to pay back those loans and interest. But when the economy slows, credit becomes scarce and only new deficit dollars can prevent the private sector from defaulting on itself. So, the population is using any cash they can get their hands on to save or pay down debt. People may default on their loans, which is deflationary. And the only way people can successfully pay back their private debts is to find new credit or base money. This is known as a balance sheet recession. Only the government can print up fresh defict-dollars to prevent the private sector from defaulting on itself when the economy is slow.

So, while the government is printing tons of base money, the private sector may not be loaning itself enough credit. The printing of enormous amounts of base money (as deficit dollars) is just making up for the shortfall in private credit. So, you really need to look at the total combination of base money and private credit to get an idea of how much money is really out there. And once you figure that out, then you need figure out what people are actually doing with that total money supply of base money and private credit. And then once you figure that out, then you need to figure out how much additional productive capacity, and supply, the economy has to absorb any additional demand for goods and services (by hiring more workers or outsourcing overseas, etc.) You need to figure out all those things before you can even begin to figure out if inflation is in the cards.

And then there are exogenous events that can override the all situations described above. If a country is attacked, or owes foreign-denominated debt, or has its currency pegged to another currency, everything can go right out the window and inflation can take hold as a currency is perceived to become more worthless — particularly if that country becomes unstable. So, it's all very complex. But, the overriding point is that printing does not always lead to inflation.

Last edited by Gumby on Thu Apr 05, 2012 8:57 am, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: printing money does not equal inflation

I agree 100%. Since the U.S. does not operate in a closed system, the current account is relevant. Price inflation in the U.S. is moderate because of China's insistence on pegging yuan and creating inflation domestically. There most definitely is inflation in the world and while it might not manifest itself in U.S. labor, one can look at commodity indexes (priced globally) for evidence that there's a lot more cash in the world than there used to be.Lone Wolf wrote:

There's another interesting source of dollar demand -- our trade deficit with China. As China sells far more goods to the United States than it buys from the United States, China winds up with a lot of dollars. The Chinese recipient of these dollars, however, need Chinese Yuan in order to pay their laborers and suppliers and to buy goods domestically.

These Chinese dollar holders need to trade this huge stash of dollars for Yuan. Normally, this demand for Yuan would cause a strengthening Yuan (in other words, its price in terms of dollars would increase.) However, China places a huge emphasis on their industrial base (and thus their exporters.) Rather than allow their citizens' purchasing power to appreciate, China's central bank has over time purchased a staggering quantity of US dollar-denominated assets to try to keep the Yuan cheap relative to the dollar. This allows us to export a great deal of price inflation to China as they struggle to keep the Yuan from strengthening against the dollar.

If China allowed its currency to appreciate or significantly diversified its dollar holdings into other currencies or commodities, this could change the equation. I could certainly see them doing this at some point but none of us really know how it'll all play out. With this many moving parts, it's best to stay... balanced and diversified.

Re: printing money does not equal inflation

The type of "printing" done by the Fed is to buy bonds. As long as interest rates remain positive, more money ultimately has to be paid back (by the bond issuers) on those bonds than the amount "printed". These interest payments eat into private and government revenue alike. This is deflationary.

With negative yields on short-term debt, this may finally change.

With negative yields on short-term debt, this may finally change.

Last edited by atrchi on Fri Apr 06, 2012 8:46 am, edited 1 time in total.