Stock scream room

Moderator: Global Moderator

- dualstow

- Executive Member

- Posts: 15307

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Stock scream room

I like to think of him as one of the FBI agents in the original Twin Peaks. The one played by Miguel Ferrer, not Kyle Maclachlan.

Budd’s path is a difficult one.

Budd’s path is a difficult one.

RIP LALO SCHIFRIN

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Stock scream room

I was ridiculed for years because I didn’t ascribe to the philosophy that one or more assets would buoy the portfolio in times of economic distress. We are now witnessing this distress first-hand and the PP has proven it does not have the ability to overcome an inflationary environment with rising interest rates. Moreover, the one asset that differentiates the portfolio from other conservative allocations and was selected for this very economic climate (Gold) is wavering in the wind with inflation at 40 year highs. If this does not give you pause then I don’t know what to tell you. The portfolio just isn’t what others have made it out to be. Period.

YTD Returns:

SPY -21.84

IAU +.58

TLT -23.86

YTD Returns:

SPY -21.84

IAU +.58

TLT -23.86

- mathjak107

- Executive Member

- Posts: 4652

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Stock scream room

But had you had 60/40 or all stocks your balance over the years would have been way higher too.

So being down more maybe only part of the story

So being down more maybe only part of the story

Re: Stock scream room

I took a look on Portfolio Visualizer comparing the PP, GB, and a 60/40 (with World-TSM and ITT as bond). Starting 2010 (after the last crash) with $100k, and monthly 1k contributions. All of them were creamed by the Classic Jack Bogle Vanguard 60/40 portfolio (the green benchmark line).

America kicked serious ass over the past decade.

America kicked serious ass over the past decade.

- Attachments

-

- Screenshot 2022-06-14 160513.png (153.87 KiB) Viewed 32103 times

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

Re: Stock scream room

Joypog, something doesn't look right. There's no way the PP would be returning a CAGR of 12.59% for that time period. It should be closer to 6% or a little less.

Re: Stock scream room

Hmm I reran the test and here are the settings and results.

I'm a n00b with PV, so I may well be wrong. Is there a setting that's off?

- Attachments

-

- Screenshot 2022-06-14 171125.png (15.36 KiB) Viewed 31971 times

-

- Screenshot 2022-06-14 171047.png (59.67 KiB) Viewed 31971 times

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

Re: Stock scream room

I don't think anything was wrong with what you did....IIRC PortfolioVisualizer counts contributions when calculating CAGR; even if you had a hypothetical asset with an exact 0% return that you were kicking in, say, $1K a month to (in order to buy $1,000 of this zero-return asset each and every month of the year) PV would still show a positive CAGR for this portfolio because the contributions would increase the total amount of assets above what it was when the portfolio started.

EDITED TO ADD:

PP in PV while starting with $100K on 1-1-2010 and adding an inflation-adjusted $1K each month:

https://www.portfoliovisualizer.com/bac ... tion4_1=25

PP in PV simply starting with $100K on 1-1-2010 and never adding anything else:

https://www.portfoliovisualizer.com/bac ... tion4_1=25

Notice the wildly different CAGRs?

Re: Stock scream room

Thank you for clarifying that. On the one hand I get it, they're giving you the total portfolio growth whether that came from investment returns or contributions. On the other hand, if you start with a $10,000 portfolio and contribute $1000/month, it will give you a CAGR of over 29% in the summary box Joypog shared. If you scroll down to Trailing returns, it gives you a performance number that would be more appropriate for the conversation here.

Re: Stock scream room

OK thanks! I'm still got another 10-20 years of accumulation phase so I always throw in some contributions into the calcs cause it's closer to my circumstances. But yeah I could see that getting really messy. Sorry for the confusion.

Ultimately I think the main point is that the US 60/40 was just destroying everything out there for this most recent period. The PP is naturally going to bad against that. My big surprise was how the World TSM portfolio was much closer to the PP than the Jack Bogle special.

I totally get tracking error regret, but in light of that, it seems unfair to kick oneself too hard by comparing oneself to the ideal portfolio of the past decade.

Ultimately I think the main point is that the US 60/40 was just destroying everything out there for this most recent period. The PP is naturally going to bad against that. My big surprise was how the World TSM portfolio was much closer to the PP than the Jack Bogle special.

I totally get tracking error regret, but in light of that, it seems unfair to kick oneself too hard by comparing oneself to the ideal portfolio of the past decade.

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

-

Jack Jones

- Executive Member

- Posts: 681

- Joined: Mon Aug 24, 2015 3:12 pm

Re: Stock scream room

Also, don't forget, these comparisons can't show the additional tail-risk benefits you get from holding gold:joypog wrote: ↑Tue Jun 14, 2022 7:38 pm Ultimately I think the main point is that the US 60/40 was just destroying everything out there for this most recent period. The PP is naturally going to bad against that. My big surprise was how the World TSM portfolio was much closer to the PP than the Jack Bogle special.

I totally get tracking error regret, but in light of that, it seems unfair to kick oneself too hard by comparing oneself to the ideal portfolio of the past decade.

- survival of $USD devaluation

- war at home

- confiscation of on-the-book assets

- estate tax

- FAFSA calculation

Re: Stock scream room

No, people gave you a hard time for railing on (investing in?) something you didn't believe in and thoroughly disliked. Your gold rants were/are epic.buddtholomew wrote: ↑Tue Jun 14, 2022 10:22 am I was ridiculed for years because I didn’t ascribe to the philosophy that one or more assets would buoy the portfolio in times of economic distress.

For example, it's ok not to like gold. But rather than blowing one's top on a down day, much better to say something like..."I don't think gold is a great holding and here's my evidence/thoughts on why." Or...here's how I invest/my allocation and these are the reasons why.

In short, bringing value added is, well, bringing value added vs. a text explosion that does you no actual good and annoys others when it is done repeatedly.

Peace brother...gold is not Satan. It's a metal that is shiny and yellowish and goes up and down in the price people are willing to pay for it. Some think there is money to be made investing in it, others believe it provides no productive value or intrinsic return and is therefore not worth buying. These views can coexist peacefully in our universe.

-

boglerdude

- Executive Member

- Posts: 1492

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Stock scream room

What's been happening with the leveraged ETFs?

https://www.bogleheads.org/forum/viewtopic.php?t=288192

https://www.bogleheads.org/forum/viewtopic.php?t=288192

Re: Stock scream room

It's ugly...first hand experience. :-)

-

whatchamacallit

- Executive Member

- Posts: 759

- Joined: Mon Oct 01, 2012 7:32 pm

Re: Stock scream room

Nasdaq up over 17% ytd? That is some pain.

- dualstow

- Executive Member

- Posts: 15307

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Stock scream room

Rough day for the market, eh?

Going to have to peek at B’heads today.

Going to have to peek at B’heads today.

RIP LALO SCHIFRIN

Re: Stock scream room

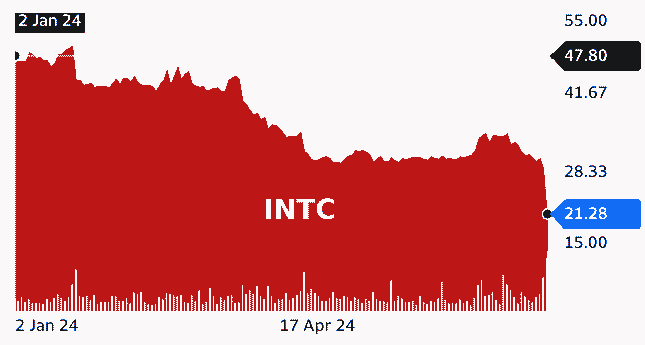

Intel down over 50% year to date, and looking to halve its workforce. Seems to have been a AI sell off today, most such techs down, excepting Apple.

Start of a AI bubble burst?

Isn't it November when US elections coincide with the BRICS introduction of a alternative to the US SWIFT (international trade settlements). A kick back to the Russia sanctions. 75% of the worlds population migrating over to that along with increased barriers of access to US markets (here in the UK buying US based mutuals/ETF's is pretty much a no-go nowadays). The US could transition to being just a <5% of global population isolationist block, with up-starts preferring to list elsewhere (Asia) for the greater market size that yields. Trump when president pretty much P'd off the EU, Biden's done the same with the UK, Australia are more focused upon closer proximity trading partners (China) ... the 'West' could transition to just being US/Canada.

Many B’heads swear by America first ... no need for international as that only relatively lags. World/Global stock reduces geopolitical concentration risk. If the US does relatively lag and reduce down from recent 60%+ of global market cap, then others rise. Along with gold (global non-fiat commodity currency).

No need for bonds, lending to someone who has a money printing press so has no real need to borrow.

- dualstow

- Executive Member

- Posts: 15307

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Stock scream room

They scrapped their dividend as well, for the time being.

Yeah, but doesn’t it seem like much more? Genuine concerns about the economy this week.

Start of a AI bubble burst?

…

Then again, August tends to suck.

I sold all of my tech fund yesterday. Holding on to Vanguard Total Stock Market come what may.

RIP LALO SCHIFRIN

-

boglerdude

- Executive Member

- Posts: 1492

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Stock scream room

> here in the UK buying US based mutuals/ETF's is pretty much a no-go

why. Wasnt Brexit supposed to fix things like that

why. Wasnt Brexit supposed to fix things like that

Re: Stock scream room

Dividends and capital gains are both taxed as income. To avoid that requires a KIDD/reporting as per the EU rules (that were rolled into UK law and haven't been changed due to parliament not really respecting the democratic (referendum) decision, looking more to re-merge the UK back under EU binding). Parliament for instance opted to establish a UK internal border rather than having a UK/EU external border (Northern Ireland/Great Britain internal UK single market sea-border rather than a Northern Ireland/Southern Ireland UK/EU land border).boglerdude wrote: ↑Sat Aug 03, 2024 1:57 am > here in the UK buying US based mutuals/ETF's is pretty much a no-go

why. Wasnt Brexit supposed to fix things like that

All just part of a general global distancing from the US/Dollar. BRICS to initiate a SWIFT alternative come November. US expression of dislike of the EU (under Trump) and UK (Biden). Barriers instated, such as the above. Wont be too long before Australia align more with the BRICS, and the EU also inclined to do likewise, followed by UK, to leave the 'West' being just the US and Canada. The decline of the US being able to export inflation will perhaps see significant declines in US standards of living, and a greater inclination for up starts to list elsewhere than NYSE.

If say Trump wins the presidency and instates yet more tariffs/barriers so they'll be reciprocated + more. Drive the acceleration of others not wanting to trade in/with or hold USD/US debt. 5% of global population (US/Canada) isolationism. A transition to why list in NYSE when listing elsewhere opens up 90% global population exposure/market.

Re: Stock scream room

Has anyone else been following "intel guy" on WSB?seajay wrote: ↑Fri Aug 02, 2024 10:59 amIntel down over 50% year to date, and looking to halve its workforce. Seems to have been a AI sell off today, most such techs down, excepting Apple.

Start of a AI bubble burst?

Isn't it November when US elections coincide with the BRICS introduction of a alternative to the US SWIFT (international trade settlements). A kick back to the Russia sanctions. 75% of the worlds population migrating over to that along with increased barriers of access to US markets (here in the UK buying US based mutuals/ETF's is pretty much a no-go nowadays). The US could transition to being just a <5% of global population isolationist block, with up-starts preferring to list elsewhere (Asia) for the greater market size that yields. Trump when president pretty much P'd off the EU, Biden's done the same with the UK, Australia are more focused upon closer proximity trading partners (China) ... the 'West' could transition to just being US/Canada.

Many B’heads swear by America first ... no need for international as that only relatively lags. World/Global stock reduces geopolitical concentration risk. If the US does relatively lag and reduce down from recent 60%+ of global market cap, then others rise. Along with gold (global non-fiat commodity currency).

No need for bonds, lending to someone who has a money printing press so has no real need to borrow.

He bought 700k worth of shares the day before the 30% drop. Pure WSB legend.

www.allterrainportfolio.com

Re: Stock scream room

I want to buy a share of intel just so i can say that i joined in on the fun.. at least a little bit.

www.allterrainportfolio.com

Re: Stock scream room

I did that for those congressional insider trading etfs, NANC and KRUZ. I put $500 in each the other day just get in on the action that our members of congress are enjoying.

Re: Stock scream room

I went and did it. One share. Big speculator today.

www.allterrainportfolio.com

Re: Stock scream room

I just can't help but think that stocks (and real estate) are going to have a "moment".

I remember on this board pre-2022 we discussed when TLT was going to have it's moment... and indeed, it came. Similarly with gold, when was it going to have its (good) moment... and it came, and still it's moving.

The post-election surge just seems over the top to me, given the valuation metrics. AllocateSmartly has a freemium offer for a real-time (updates overnight) US stock market valuation and 10-year forecasting tool... if you create an account, you get access to it, then of course you will get marketing emails, so choose your junk email account I suppose.

The forecasting tool isn't just doomer porn, it weights models that forecast +9% CAGR over the next decade to -11% CAGR. The weighted average return is now... 1.8% CAGR. The 60/40 is 2.8%. The long term average fit of the forecast to the 10-year lagged real result is... fairly good, in my view. What worries me is that the black line is surging upwards and diverging from the orange line even more since the blog post on 8/14/2023... at some point, someday, it's going to move sharply downward and "catch down "and re-connect with the forecast, and that catching-down is going to a bear market and/or just a sideways choppy market for a long time.

I think the straws that will break the camel's back is still going to be 10-year US Treasury yields and continuing inflation. The Treasury issuance required in the future is immense, and 10-year rates are now reflecting that. If they get above 5%, investors are really going to take a harder look at stocks vs bonds. Buy the bond dip, sell the stock rip. I know many of you voted for the guy who is proposing more tariffs, but I cannot how see those won't be inflationary, and if trading partners throw up retaliatory tariffs then we're in a 1930s style trade war which can't end well. Also sending home migrants, either the asylees or the straight-out undocumented ones, will have a complex effect on inflation - I'm not sure if directionally up or down, but this is what I see - an effect on real estate.

As you know, construction crews are really heavily Latino. Send some of them home, and the cost of construction and renovation goes up. Mortgages follow the 10-year Treasury, not the short end of the yield curve, so mortgages are going up... not to 3%. I think residential real estate, like stocks, is going to have a "moment" too (commercial RE has been having a terrible time since lockdowns). Oh yes, send migrants home, residential RE demands in incrementally lower, rents come down. But think about residential RE investors:

Constuction / renovation costs up... cost of money up... demand down (migrants go home, and continuing general inflation and associated suck). Investors are going to look at their RE portfolios, and they are going to look a 5%+ risk-free on the US 10-year if they hold to maturity, that takes $500,000 to $638,141 (nominal) and they're going to say, "you know what? I'm done". Their illusion about what they think their property is worth is going to continue to get messed up. These things take years. RE peaked mid-2022. Could be a few more years. These things take 5-6 years to correct.

I don't see any levers that ameliorate inflation and high 10-year rates, other than an old-fashioned recession and temporary disinflation. I think we're goingto see the Everything Bubble start to deflate. I have no idea about timing. I have no prediction talent. I just think about directionality.

Disclosure - I'm a paying member of AllocateSmartly for Tactical Asset Allocation, other than that, I have no connection to them, though the guy who runs it, Walter, is very helpful and I like him.

I remember on this board pre-2022 we discussed when TLT was going to have it's moment... and indeed, it came. Similarly with gold, when was it going to have its (good) moment... and it came, and still it's moving.

The post-election surge just seems over the top to me, given the valuation metrics. AllocateSmartly has a freemium offer for a real-time (updates overnight) US stock market valuation and 10-year forecasting tool... if you create an account, you get access to it, then of course you will get marketing emails, so choose your junk email account I suppose.

The forecasting tool isn't just doomer porn, it weights models that forecast +9% CAGR over the next decade to -11% CAGR. The weighted average return is now... 1.8% CAGR. The 60/40 is 2.8%. The long term average fit of the forecast to the 10-year lagged real result is... fairly good, in my view. What worries me is that the black line is surging upwards and diverging from the orange line even more since the blog post on 8/14/2023... at some point, someday, it's going to move sharply downward and "catch down "and re-connect with the forecast, and that catching-down is going to a bear market and/or just a sideways choppy market for a long time.

I think the straws that will break the camel's back is still going to be 10-year US Treasury yields and continuing inflation. The Treasury issuance required in the future is immense, and 10-year rates are now reflecting that. If they get above 5%, investors are really going to take a harder look at stocks vs bonds. Buy the bond dip, sell the stock rip. I know many of you voted for the guy who is proposing more tariffs, but I cannot how see those won't be inflationary, and if trading partners throw up retaliatory tariffs then we're in a 1930s style trade war which can't end well. Also sending home migrants, either the asylees or the straight-out undocumented ones, will have a complex effect on inflation - I'm not sure if directionally up or down, but this is what I see - an effect on real estate.

As you know, construction crews are really heavily Latino. Send some of them home, and the cost of construction and renovation goes up. Mortgages follow the 10-year Treasury, not the short end of the yield curve, so mortgages are going up... not to 3%. I think residential real estate, like stocks, is going to have a "moment" too (commercial RE has been having a terrible time since lockdowns). Oh yes, send migrants home, residential RE demands in incrementally lower, rents come down. But think about residential RE investors:

Constuction / renovation costs up... cost of money up... demand down (migrants go home, and continuing general inflation and associated suck). Investors are going to look at their RE portfolios, and they are going to look a 5%+ risk-free on the US 10-year if they hold to maturity, that takes $500,000 to $638,141 (nominal) and they're going to say, "you know what? I'm done". Their illusion about what they think their property is worth is going to continue to get messed up. These things take years. RE peaked mid-2022. Could be a few more years. These things take 5-6 years to correct.

I don't see any levers that ameliorate inflation and high 10-year rates, other than an old-fashioned recession and temporary disinflation. I think we're goingto see the Everything Bubble start to deflate. I have no idea about timing. I have no prediction talent. I just think about directionality.

Disclosure - I'm a paying member of AllocateSmartly for Tactical Asset Allocation, other than that, I have no connection to them, though the guy who runs it, Walter, is very helpful and I like him.