I’m just frustrated that the PP has performed so poorly it’s almost embarrassing. I used to think it was such a novel idea and bulletproof but its pie in the sky hopium.yankees60 wrote: ↑Thu Sep 15, 2022 10:32 amYes, same question.jason wrote: ↑Thu Sep 15, 2022 10:23 amIf no gold or LTTs, what do you hold? Only stocks? What else?buddtholomew wrote: ↑Thu Sep 15, 2022 10:11 amNo Gold or LTT’s.whatchamacallit wrote: ↑Thu Sep 15, 2022 10:04 amGave me a laugh at least.

What is your recommended portfolio allocation?

I can’t think of a worse portfolio to hold than this one for the last decade plus. All a bunch of garbage. It has proven its worthlessness time after time.

Also, do you share my "security seeking personality" where there is seemingly never enough?

Gold will rise when Fed stops raising interest rates?

Moderator: Global Moderator

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Gold will rise when Fed stops raising interest rates?

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Gold will rise when Fed stops raising interest rates?

You can clearly see that Gold and LTT’s have underperformed cash. STOP thinking the PP will save you during a recession caused by rising interest rates.jason wrote: ↑Thu Sep 15, 2022 10:41 amGold has been disappointing so far this year. But is holding only stocks and cash the solution? We could be on the verge of a major recession with a huge stock market crash. Stocks and cash doesn't seem very diversified.buddtholomew wrote: ↑Thu Sep 15, 2022 10:33 amStocks and Cash.jason wrote: ↑Thu Sep 15, 2022 10:23 amIf no gold or LTTs, what do you hold? Only stocks? What else?buddtholomew wrote: ↑Thu Sep 15, 2022 10:11 amNo Gold or LTT’s.whatchamacallit wrote: ↑Thu Sep 15, 2022 10:04 amGave me a laugh at least.

What is your recommended portfolio allocation?

I can’t think of a worse portfolio to hold than this one for the last decade plus. All a bunch of garbage. It has proven its worthlessness time after time.

Gold doesn’t respond to unexpected inflation - what a surprise so why bother holding it at all?

All passive portfolios use fixed income so the PP is not unique in that regard.

The main differentiator for the PP was the allocation to gold and obviously its relationship to inflation is weak so why bother holding it at all? The whole story around different economic climates and selecting assets for each is flawed. Now we have the data to show how pathetic it truly is.

SPY YTD: -18%

TLT YTD: -26%

GLD YTD: -8%

Honestly, pathetic!!

Re: Gold will rise when Fed stops raising interest rates?

How much of the "gold market", so to speak, really care about the type of inflation we're currently seeing? The dollar is very strong, and inflation is being driven mostly by stuff that institutional gold holders don't care much about (used cars, homes, and gasoline). I don't see this as a case of overall currency devaluation type of inflation as much as it is isolated pockets of bubbly assets and supply chain disruptions. Perhaps the behavior of gold, Bitcoin, etc is drastically different than expected in this paradigm. Little consolation for us peons that need money to pay for actual things, but also possibly an indicator that this inflation is temporary and might whipsaw into deflation quickly. Who knows, just some random thoughts.

Re: Gold will rise when Fed stops raising interest rates?

Understood. Why do you think that holding only stocks and cash right now is a good path forward?buddtholomew wrote: ↑Thu Sep 15, 2022 10:54 amYou can clearly see that Gold and LTT’s have underperformed cash. STOP thinking the PP will save you during a recession caused by rising interest rates.jason wrote: ↑Thu Sep 15, 2022 10:41 amGold has been disappointing so far this year. But is holding only stocks and cash the solution? We could be on the verge of a major recession with a huge stock market crash. Stocks and cash doesn't seem very diversified.buddtholomew wrote: ↑Thu Sep 15, 2022 10:33 amStocks and Cash.jason wrote: ↑Thu Sep 15, 2022 10:23 amIf no gold or LTTs, what do you hold? Only stocks? What else?buddtholomew wrote: ↑Thu Sep 15, 2022 10:11 amNo Gold or LTT’s.whatchamacallit wrote: ↑Thu Sep 15, 2022 10:04 amGave me a laugh at least.

What is your recommended portfolio allocation?

I can’t think of a worse portfolio to hold than this one for the last decade plus. All a bunch of garbage. It has proven its worthlessness time after time.

Gold doesn’t respond to unexpected inflation - what a surprise so why bother holding it at all?

All passive portfolios use fixed income so the PP is not unique in that regard.

The main differentiator for the PP was the allocation to gold and obviously its relationship to inflation is weak so why bother holding it at all? The whole story around different economic climates and selecting assets for each is flawed. Now we have the data to show how pathetic it truly is.

SPY YTD: -18%

TLT YTD: -26%

GLD YTD: -8%

Honestly, pathetic!!

Re: Gold will rise when Fed stops raising interest rates?

Data wise, and academically there is zero proof gold provides anything more than the equivalent allocation in bonds...sometimes more, most of the time less. The only thing you can say is gold always is more volatile than bonds.

Whether one includes or excludes the 1970s for US-based gold returns is a judgement call; however, there is no doubt the decade was a one off due to gold becoming free floating/market based vs. fixed.

Whether one includes or excludes the 1970s for US-based gold returns is a judgement call; however, there is no doubt the decade was a one off due to gold becoming free floating/market based vs. fixed.

Re: Gold will rise when Fed stops raising interest rates?

I don't think it was a one-off. Look at the performance of gold after the crash of 2008 and all the money-printing that ensued. Gold more than doubled. So gold does react.Kbg wrote: ↑Thu Sep 15, 2022 11:09 am Data wise, and academically there is zero proof gold provides anything more than the equivalent allocation in bonds...sometimes more, most of the time less. The only thing you can say is gold always is more volatile than bonds.

Whether one includes or excludes the 1970s for US-based gold returns is a judgement call; however, there is no doubt the decade was a one off due to gold becoming free floating/market based vs. fixed.

-

whatchamacallit

- Executive Member

- Posts: 759

- Joined: Mon Oct 01, 2012 7:32 pm

Re: Gold will rise when Fed stops raising interest rates?

I can sympathize with a 50/50 stock and cash portfolio as a chicken little investor. I have contemplated that exact holding in the past.

I did give up on long term treasuries when I realized yields we're not worth the risk. Maybe someday they will look worth it again.

I also hate gold but history is on it's side as a great diversifier. I haven't found anything to replace it yet.

I did give up on long term treasuries when I realized yields we're not worth the risk. Maybe someday they will look worth it again.

I also hate gold but history is on it's side as a great diversifier. I haven't found anything to replace it yet.

Re: Gold will rise when Fed stops raising interest rates?

But did it react for different reasons in each scenario, and is either scenario relevant to today?jason wrote: ↑Thu Sep 15, 2022 11:12 amI don't think it was a one-off. Look at the performance of gold after the crash of 2008 and all the money-printing that ensued. Gold more than doubled. So gold does react.Kbg wrote: ↑Thu Sep 15, 2022 11:09 am Data wise, and academically there is zero proof gold provides anything more than the equivalent allocation in bonds...sometimes more, most of the time less. The only thing you can say is gold always is more volatile than bonds.

Whether one includes or excludes the 1970s for US-based gold returns is a judgement call; however, there is no doubt the decade was a one off due to gold becoming free floating/market based vs. fixed.

I don't know the answer, but I've concluded gold is a speculative asset that will simply do its own thing, and not necessarily consistently.

For this reason I've lost trust in it as a reliable component of a strategy like the PP. But then I don't have a better alternative to suggest if the goal is a defensive "bulletproof" portfolio.

Re: Gold will rise when Fed stops raising interest rates?

My counterpoint is 2000-2001 where gold did nothing for two years and finally kicked in during the third year of the bear. Meanwhile, treasuries did quite well the entire time...and of course gold has done nothing for us this year either but decline.jason wrote: ↑Thu Sep 15, 2022 11:12 amI don't think it was a one-off. Look at the performance of gold after the crash of 2008 and all the money-printing that ensued. Gold more than doubled. So gold does react.Kbg wrote: ↑Thu Sep 15, 2022 11:09 am Data wise, and academically there is zero proof gold provides anything more than the equivalent allocation in bonds...sometimes more, most of the time less. The only thing you can say is gold always is more volatile than bonds.

Whether one includes or excludes the 1970s for US-based gold returns is a judgement call; however, there is no doubt the decade was a one off due to gold becoming free floating/market based vs. fixed.

Gold's hard. People who don't sell or promote gold for a living understand it's a difficult asset to characterize and don't make a lot of predictions about it. For every "gold does this", I can guarantee you there is a "well, it didn't do it here, or here" response.

I speak out of both sides of my mouth...I have around a 20% allocation to gold which ends up about 10% proportionally in the leveraged portfolios I run. I don't expect anything from it based on anything. I am completely going by the historical track record that indicates every once in a while it goes on a pretty good run and, most importantly, has low correlation to the other stuff I invest in.

-

Lorddoskias123

- Junior Member

- Posts: 13

- Joined: Mon Apr 26, 2021 9:01 pm

Re: Gold will rise when Fed stops raising interest rates?

Exactly.

Thus far it seems obvious that the prevailing economic environment is " tight money" and all the PP assets appear to be performing as HB suggested they would in such an environment... poorly.

His suggestion that the "tight money" environment is self limiting and usually shifts to a different environment within 18 months seems reasonably likely to play out this time as well. Time will tell.

Re: Gold will rise when Fed stops raising interest rates?

Yup same here. I'm aiming for 16% cause we're at "coast-FI" so why not. Seems prudent to have a third non-correlated leg to portfolio-stool....and unlike crypto, gold ain't going nowhere. Maybe not up as fast as stocks, but the worst case scenario is stagnation (aside from outright fraud in a paper gold ETF).Kbg wrote: ↑Thu Sep 15, 2022 12:43 pm I speak out of both sides of my mouth...I have around a 20% allocation to gold which ends up about 10% proportionally in the leveraged portfolios I run. I don't expect anything from it based on anything. I am completely going by the historical track record that indicates every once in a while it goes on a pretty good run and, most importantly, has low correlation to the other stuff I invest in.

I don't believe in it strongly enough to proselytize it. Heck I might even change to a 8% Gold , 8% Managed Futures split...but I really like having something "not-stocks and not-bonds" in the portfolio that moves independently to smooth out the ride with a little random action.

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

Re: Gold will rise when Fed stops raising interest rates?

You may find this link interesting. (5 part article). It suggests a stock/cash allocation is optimal, however gold was not considered.whatchamacallit wrote: ↑Thu Sep 15, 2022 11:33 am I can sympathize with a 50/50 stock and cash portfolio as a chicken little investor. I have contemplated that exact holding in the past.

I did give up on long term treasuries when I realized yields we're not worth the risk. Maybe someday they will look worth it again.

I also hate gold but history is on it's side as a great diversifier. I haven't found anything to replace it yet.

https://www.idiosyncraticwhisk.com/2014 ... ation.html

- I Shrugged

- Executive Member

- Posts: 2156

- Joined: Tue Dec 18, 2012 6:35 pm

Re: Gold will rise when Fed stops raising interest rates?

I guess I am trying to say that if we could count on gold to behave on cue, then that is already baked into the price. But you can't. It's something of value that occasionally goes up nicely. I think the saying about gold is that it takes the escalator down, but the elevator up.

Re: Gold will rise when Fed stops raising interest rates?

^- this is exactly how I view current situation - prevailing economic environment is "tight money", more so than inflation. Strong dollar with stocks, bonds, gold performing poorly as expected. While not keeping up with inflation, at least Tbill MMF finally yielding over 2%. Moving some cash to 1-year Tbills now yielding 4%. New funds to stocks and LTT given both down so much this year.Lorddoskias123 wrote: ↑Thu Sep 15, 2022 1:37 pm Thus far it seems obvious that the prevailing economic environment is " tight money" and all the PP assets appear to be performing as HB suggested they would in such an environment... poorly.

His suggestion that the "tight money" environment is self limiting and usually shifts to a different environment within 18 months seems reasonably likely to play out this time as well. Time will tell.

Re: Gold will rise when Fed stops raising interest rates?

So how do you think things are going to play out? Do you expect the tight money situation to end and for the PP to perform as normal/well again?coasting wrote: ↑Thu Sep 15, 2022 11:47 pm^- this is exactly how I view current situation - prevailing economic environment is "tight money", more so than inflation. Strong dollar with stocks, bonds, gold performing poorly as expected. While not keeping up with inflation, at least Tbill MMF finally yielding over 2%. Moving some cash to 1-year Tbills now yielding 4%. New funds to stocks and LTT given both down so much this year.Lorddoskias123 wrote: ↑Thu Sep 15, 2022 1:37 pm Thus far it seems obvious that the prevailing economic environment is " tight money" and all the PP assets appear to be performing as HB suggested they would in such an environment... poorly.

His suggestion that the "tight money" environment is self limiting and usually shifts to a different environment within 18 months seems reasonably likely to play out this time as well. Time will tell.

Re: Gold will rise when Fed stops raising interest rates?

Gold is up today! (20220916)

I predict it won’t go down for at least two day

Maybe more, but hard to project out that far

I predict it won’t go down for at least two day

Maybe more, but hard to project out that far

Re: Gold will rise when Fed stops raising interest rates?

Yes, that's my expectation. I recall HB's comments regarding tight money recession same as Lorddoskias123 described it: self-limiting and of relatively short duration, up to 18 months or so. HB could not find an asset to respond well during economic contraction, so the cash/Tbill allocation is there to just ride it out. Then transition to a new economic environment that suits one of the other assets. Not a prediction, just what I expect according to PP theory.jason wrote: ↑Fri Sep 16, 2022 2:11 pmSo how do you think things are going to play out? Do you expect the tight money situation to end and for the PP to perform as normal/well again?coasting wrote: ↑Thu Sep 15, 2022 11:47 pm^- this is exactly how I view current situation - prevailing economic environment is "tight money", more so than inflation. Strong dollar with stocks, bonds, gold performing poorly as expected. While not keeping up with inflation, at least Tbill MMF finally yielding over 2%. Moving some cash to 1-year Tbills now yielding 4%. New funds to stocks and LTT given both down so much this year.Lorddoskias123 wrote: ↑Thu Sep 15, 2022 1:37 pm Thus far it seems obvious that the prevailing economic environment is " tight money" and all the PP assets appear to be performing as HB suggested they would in such an environment... poorly.

His suggestion that the "tight money" environment is self limiting and usually shifts to a different environment within 18 months seems reasonably likely to play out this time as well. Time will tell.

Re: Gold will rise when Fed stops raising interest rates?

Energy tends to be a good asset to hold in times like these. I've done some backtesting with TLT and energy related assets. There may be some promise here but I don't have anything solid yet due to lack of time to properly analyze it fully.

- mathjak107

- Executive Member

- Posts: 4654

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Gold will rise when Fed stops raising interest rates?

There have been many dr Frankenstein versions of the pp tried over the decades .

Oil , commodities,etc , all have been tried but all didn’t work out as as well as 4x4 .of course a 40 year bull market in bonds likely skewed results

Oil , commodities,etc , all have been tried but all didn’t work out as as well as 4x4 .of course a 40 year bull market in bonds likely skewed results

Re: Gold will rise when Fed stops raising interest rates?

Are you predicting a 40 year run in gold? At least bonds had/have that going for them.

There are extremely good financial and economic reasons not to invest in gold…we here are in a minority and perhaps a delusional one at that. All we got is hope and history, financially and economically we got zero.

There are extremely good financial and economic reasons not to invest in gold…we here are in a minority and perhaps a delusional one at that. All we got is hope and history, financially and economically we got zero.

- mathjak107

- Executive Member

- Posts: 4654

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Gold will rise when Fed stops raising interest rates?

I cant predict a thing

Re: Gold will rise when Fed stops raising interest rates?

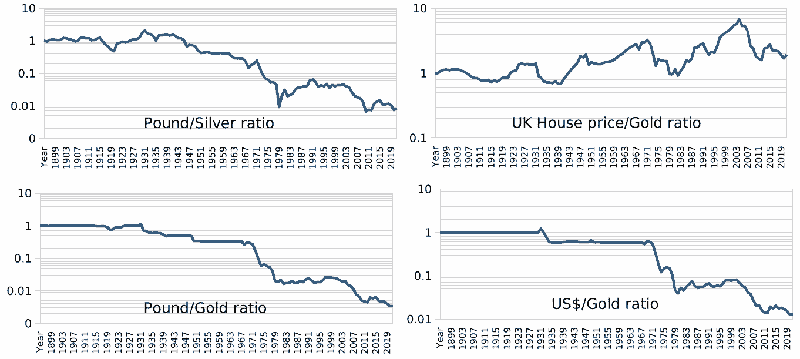

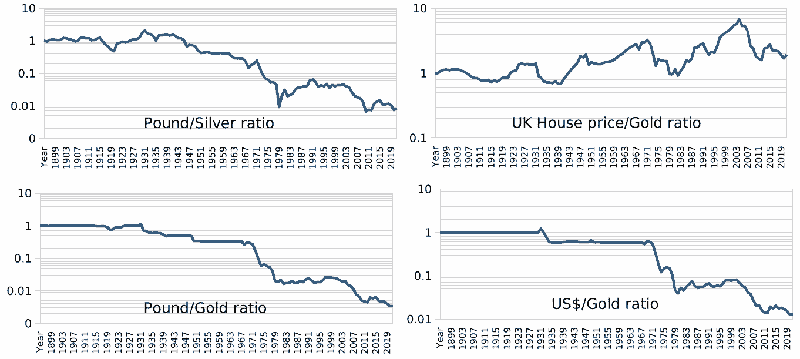

When on a gold standard partial/total defaults are blatantly obvious. Broadly there's 0% inflation, with periodic clusters of high volatility.

With Fiat the state can target progressive/less perceptible defaults, such as 2%/year inflation.

Gold will do well when fears of more significant Fiat weakness/default-risk arise. Between such times the price of gold tends to decline, becomes increasingly better value/cheap.

From the Nixon Shock (late 1960's unable to pay for the cost of the Vietnam war), Dow/Gold declined from 25 down to 1.0 levels (1980). From there the ratio progressively rose again, up to 40 levels at the 1999 stock peaks. The 2008/9 financial crisis saw it back down into single digit, but where subsequently its risen back to near 20 levels.

I also like just the stock/cash liquid asset choice, at least alongside owning a home and having pensions income (that some consider to be bond-like), and where for 'cash' hard gold (non-fiat commodity currency) is preferred. I don't spend/exchange gold coins as cash however, legal tender $50 Eagle one ounce gold coin currency value is dwarfed by the $1600 gold commodity value. Liquidating 'paper' gold into $$$'s currency involves just T+3 time. If gold is down in price - spend some stock shares instead, more often one or the other tends to be up each year, but not always, in which case just spend whichever is down the least. Equally selling shares involves T+3 time for exchanging into paper currency.

That over the shorter term the price of gold is unbound to any hard set of valuation rules is great. Gold generates dividends via its price volatility and the higher that volatility/faster the cycles the better. More typically however the cycles are long, similar to shares where if you're not intending to invest for at least 10, 20 years or more, its considered better to hold bonds instead of either stock or gold.

I imagine that 2% target inflation (currency devaluation) rates will continue into the future, and so see the US$ broadly decline relative to gold, its nice to have a asset that doesn't pay interest/dividends as a potential compensatory offset against that decline. And simple rebalancing, such as 50/50 stock/gold has you following a automatic trading plan that tends to have you add-low/reduce-high in a manner that broadly captures trading gains. PV data since 1972 suggests that 50/50 stock/gold yearly rebalanced has, to recent, yielded the same total return reward as all-stock, and did so in a more smoother progressive motion/manner, a more consistently stable choice of whether to spend some stock shares or gold when it comes to actual spending.

Day trading/watching, trying to predict - fuggedaboutit. Just accept the collective wisdom of the entire market/world to level daily/ongoing valuations to 50/50 levels of prices rising/falling.

With Fiat the state can target progressive/less perceptible defaults, such as 2%/year inflation.

Gold will do well when fears of more significant Fiat weakness/default-risk arise. Between such times the price of gold tends to decline, becomes increasingly better value/cheap.

From the Nixon Shock (late 1960's unable to pay for the cost of the Vietnam war), Dow/Gold declined from 25 down to 1.0 levels (1980). From there the ratio progressively rose again, up to 40 levels at the 1999 stock peaks. The 2008/9 financial crisis saw it back down into single digit, but where subsequently its risen back to near 20 levels.

I also like just the stock/cash liquid asset choice, at least alongside owning a home and having pensions income (that some consider to be bond-like), and where for 'cash' hard gold (non-fiat commodity currency) is preferred. I don't spend/exchange gold coins as cash however, legal tender $50 Eagle one ounce gold coin currency value is dwarfed by the $1600 gold commodity value. Liquidating 'paper' gold into $$$'s currency involves just T+3 time. If gold is down in price - spend some stock shares instead, more often one or the other tends to be up each year, but not always, in which case just spend whichever is down the least. Equally selling shares involves T+3 time for exchanging into paper currency.

That over the shorter term the price of gold is unbound to any hard set of valuation rules is great. Gold generates dividends via its price volatility and the higher that volatility/faster the cycles the better. More typically however the cycles are long, similar to shares where if you're not intending to invest for at least 10, 20 years or more, its considered better to hold bonds instead of either stock or gold.

I imagine that 2% target inflation (currency devaluation) rates will continue into the future, and so see the US$ broadly decline relative to gold, its nice to have a asset that doesn't pay interest/dividends as a potential compensatory offset against that decline. And simple rebalancing, such as 50/50 stock/gold has you following a automatic trading plan that tends to have you add-low/reduce-high in a manner that broadly captures trading gains. PV data since 1972 suggests that 50/50 stock/gold yearly rebalanced has, to recent, yielded the same total return reward as all-stock, and did so in a more smoother progressive motion/manner, a more consistently stable choice of whether to spend some stock shares or gold when it comes to actual spending.

Day trading/watching, trying to predict - fuggedaboutit. Just accept the collective wisdom of the entire market/world to level daily/ongoing valuations to 50/50 levels of prices rising/falling.

-

Jack Jones

- Executive Member

- Posts: 681

- Joined: Mon Aug 24, 2015 3:12 pm

Re: Gold will rise when Fed stops raising interest rates?

Great post!Lorddoskias123 wrote: ↑Thu Sep 15, 2022 1:37 pmExactly.

Thus far it seems obvious that the prevailing economic environment is " tight money" and all the PP assets appear to be performing as HB suggested they would in such an environment... poorly.

His suggestion that the "tight money" environment is self limiting and usually shifts to a different environment within 18 months seems reasonably likely to play out this time as well. Time will tell.

Also, stop worrying about gold rising and appreciate that you have some of your wealth outside the financial system. That's the true value of gold, IMO. What's the return on 25% of your estate not being subject to the estate tax?

Re: Gold will rise when Fed stops raising interest rates?

Looks like someone still likes gold!

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: Gold will rise when Fed stops raising interest rates?

Gold is a lifestyle choice, with its own risks and risks-reduction factors.

Consider two, each with $1M wealth where one opts for 50/50 House/TSM and the other opts for thirds each House/TSM/Gold.

Neither has to find/pay rent, they have the imputed rent benefit, where the 50/50'er has a larger/more expensive home ($500K versus $333K). The 50/50'er draws 4% SWR from their $500K stock allocation, $20K/year disposable income. The thirds'er draws 3.33% SWR from their $666K stock/gold allocation, $20K/year disposable income. Both have the same disposable income.

PV (and others such as the Trinity Study) indicates that 4% SWR applied to $500K TSM (all stock)

PV

Safe Withdrawal Rate 4.03%

Perpetual Withdrawal Rate 2.40%

90.16% survived all withdrawals

Their withdrawal rate is a SWR, in a bad case ended 30 years with the portfolio value all having been spent.

The thirds'er draws 3.33% SWR from their $666K combined TSM/Gold 50/50 which PV indicates

PV

Safe Withdrawal Rate 4.89%

Perpetual Withdrawal Rate 3.38%

99.50% survived all withdrawals

Hmm! Their 3.33% SWR is a PWR, conceptually at least sustains forever (covers longevity).

Consider also if your son marries and you gift him a $1M value wedding gift either in the form of 50/50 house/TSM or thirds house/TSM/gold. A year later they have a child, and a few years after that they separate/divorce where the Court awards the entire home and child to the mother and half the stock portfolio value along with it, he's left with 25% ($250K). Contrasted with the thirds'er losing the entire home value, half of the stock value, but keeps all of the gold that you've secured for him in your own safe/storage ... he's still left with 50% ($500K). Of the two gift options many might prefer the thirds'er choice than the 50/50'er choice.

The PP of course dilutes down both the stock and gold allocations I used in the above. Opts instead for a equal split between 50/50 TSM/bonds and 50/50 gold/bonds. if anything I'd be more inclined to say that there are sound reasons not to invest in bonds.