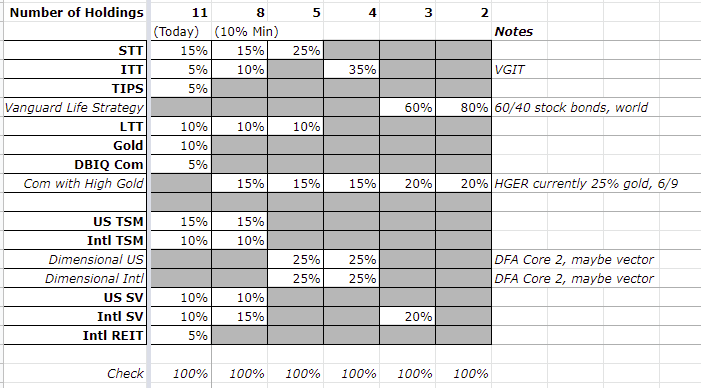

One week later - I absolutely failed at avoiding spreadsheets, but given the minimal amount of change after all the gyrations over the past weekend, I think I'm settling into a good spot with my portfolio. Two minor tweaks - I dropped the extra EM fund - if I'm so risk averse to avoid credit risk with my bonds, why overweight the political risks with EM? And I decided to go international-only with the REITs which brings my international stocks even with US (I dig the symmetry of all these 50/50 splits).

Conventional, Non Equities . . | . . Conventional, Stocks

Short and Int Treasuries . . . . | . . World

-------------------------------------|--------------------------------

Tilt, Non equities . . . . . . . . .| . . Tilt, Stocks

LTT, Gold, iBonds, TIPS . . . . .| . . Us-SV, Intl-SV, intl REITs

Yesterday, I pulled out an old investor policy statement in 2009. Turns out that my inclinations 13 years ago have stayed consistent (the only major change is going heavy on SV tilt to compensate for a higher bond percentage).

Our mistake in the intervening decade has been the quixotic quest to buy a house all cash as home price inflation outpaced our savings rate. (Less judgementally you could say we never exercised our option for a real estate investment with the opportunity cost being missing out on the decade of stock market gains).

So the big decisions are in alignment between past and current me. Now we just need to execute over the next few months. After that, hopefully this will be a practice of occasional maintenance (I'd like this to settle into an annual event, around tax time).