This is a good approach.I Shrugged wrote: ↑Wed Oct 20, 2021 3:41 pm I love everything about it except the speculative nature/ price movement. Of course I say that with only a vague understanding of how it works.

Anyway, when and if the price ever settles into a range that inspires long term confidence, then I'd be willing to get in. And if that price is 200K, that's fine. I don't need to get rich in Bitcoin. If it's not going away, then I can wait for it to be what I want it to be. And if it's going away, then I will be glad I waited. That's not exactly conventional thinking about it, but it's my take.

A worthwhile read for all PP'ers

Moderator: Global Moderator

-

Jack Jones

- Executive Member

- Posts: 527

- Joined: Mon Aug 24, 2015 3:12 pm

Re: A worthwhile read for all PP'ers

Re: A worthwhile read for all PP'ers

My take away from the blog post with which I started this thread is that crypto is very likely usurping gold's role to a considerable extent. This doesn't mean that will always be the case and certainly gold's thousands of years as a proven store of value and as currency deserves respect. But not necessarily 25%-of-your-total-portfolio respect.vincent_c wrote: ↑Wed Oct 27, 2021 1:13 pmI'm not sure if this is a good approach, but I would like to explore it further.

The question I would ask is, does bitcoin take value away from gold?

If and when bitcoin settles into a range that inspires long term confidence, and if it has taken value away from gold would you agree that it was just as risky if not more risky to have only held gold as your store of value during the time it took for bitcoin to settle into this range?

I have taken the approach that the least risky position is to weight bitcoin and gold according to the probability that they will make up the future basket of assets that is the proxy for a long term store of value.

I struggle with this, because on the one hand I believe that a piece of art can have store of value properties, but on the other hand I believe that there is a fixed amount of value that is divided among all forms of stores of value so that it is a zero sum game between them. In other words if value goes into being stored in bitcoin then it is being taken from something else (whether it is art or gold, etc.).

I've posted this link in another context but it may be of interest to some. The author, Steven Evanson, is principal at Evanson Asset Management, a well-known financial advisor in the DFA/Modern Portfolio Theory world. Evanson is no gold bug but also no Boglehead and often has clients include 7-15% gold in their portfolios. He tends to be very defensive and bearish in his outlook and is at least as cynical about Wall Street and politicians as most who frequent these forums.

https://www.evansonasset.com/alternativ ... ses-64.htm

Then there's the well-known early retirement blogger ERN, who is a bona fide gold hater (or at least strong disliker) who nonetheless says that 15% in gold is a good way to hedge against sequence-of-returns risk in an otherwise equity-heavy portfolio:

https://earlyretirementnow.com/2020/01/ ... s-part-34/

Re: A worthwhile read for all PP'ers

I don't know what level of maturity or market cap Bitcoin will eventually reach.vincent_c wrote: ↑Wed Oct 27, 2021 3:05 pm Thanks for think links.

I actually don't think that this is a generational issue but just a matter of what the fundamental nature of gold and bitcoin are.

I fully expect bitcoin and gold to exist almost with an even split market cap once everything stabilizes because there's really no significant difference in either one that would cause much of a value difference between them at that point.

What would you say about the risks of not owning bitcoin or owning only once it matures. Do you think it actually makes the HBPP more risky because it has no exposure to bitcoin when it should? Or do you think that gold is and will always be the barometer for store of value and that bitcoin will just catch up and then match gold's performance once it does and so in a sense it was never a store of value until that exact moment where bitcoin and gold trade in tandem.

As of the launch of the bitcoin futures ETF in the US, I believe it represents an endorsement that bitcoin will not later on be made illegal. I'm pretty much convinced that the scenario I mentioned above is going to play out so it seems like we should be trading gold for bitcoin to the extent that we accept the volatility impact to our portfolios.

There are various ways to achieve this.

1) Bite the bullet and just go 50/50 gold/bitcoin right away.

2) Weight it according to current market cap.

3) Dollar cost average selling gold into bitcoin.

Also, for those who do not agree this scenario will play out, other than bitcoin being made illegal, can you share why you might think bitcoin will not reach this level of maturity?

The only criteria (to me) for including it in the PP (or any other portfolio) are these:

1. Does it have a (at least nominal) positive expected return over the long run?

2. Does it have an uncorrelated return profile with most/all the other assets in the portfolio?

In other words, would anyone be recommending adding BTC to the HBPP if it had a horrible return over the past few years or past decade rather than the sky-high returns it has had?

I would also add that I don't forsee BTC becoming a true "currency" (in the sense of something people hold everyday spending money in and use it to purchase goods/services on a regular basis) any more than gold is today. There's a reason we don't price and pay for things in gold (hint: it's too volatile). Doesn't mean it can't/won't increase in value from here but if someone's case for a (for example) $500K or $1M BTC valuation is that someday everyone will be using it as a currency just like dollars are used today....well, no. Not unless it becomes no more volatile than maybe T-Bills or short-Treasuries are today.

Finally, I still have yet to see a true "killer app" use case for Bitcoin despite Bitcoin being around since late 2009. What app/service/purchasing method/transaction system will one day make Bitcoin the currency of choice? How many transactions are today priced in BTC (not counting the ones that are designed to do illegal/shady stuff from the get-go like collecting ransomware payments, buying black-market goods or services, evading taxation/evading creditors, etc) vs in Dollars/Yen/Euros/Yuan/etc?

Re: A worthwhile read for all PP'ers

1. Is likely quite true; over the long-term it will probably go up (albeit just like gold, stocks or bonds it will do so at times where it violently outperforms--in the short to medium term--its true trend line vs GDP or monetary inflation or CPI inflation and plenty of other times when it underperforms it in the short to medium term)vincent_c wrote: ↑Wed Oct 27, 2021 4:04 pm1. Yes, because it has deflationary economics.

2. This is a good point, because currently we have inflationary economics in the dollar system such that the price of stocks are detached from traditional valuations and this has made the speculative component of stock returns historically high. Bitcoin's price volatility is relatively high and the speculative component has historically fluctuated frequently from over and undervaluing bitcoin. It may be reasonable to suspect that it displays the same "risk-on" speculative premium that is more correlated to stocks than to gold in the short term.

It is possible that this is sufficient to reduce the risk adjusted performance of a permanent portfolio with bitcoin integrated. However, it may also be that bitcoin has itself such asymmetrical risk to reward characteristics that it will improve the risk adjusted return of any combination of assets it is added to.

As for your other points, I think it is important to only focus on bitcoin as a long term store of value rather than a currency. The reason is not because it is impossible but just that it is unnecessary to consider that scenario for the purpose of deciding whether to integrate bitcoin into the PP.

The killer use case for bitcoin has always been the innovation of digital property rights which prior to bitcoin's innovation was impossible. There are actually many more use cases of bitcoin that may or may not be described as "killer apps" depending on your viewpoints but again I do not think it is relevant to the current issue.

2A. Regarding focusing on BTC as a long-term store of value vs as a currency - fair enough...but the issue here is many/most of all the die-hard BTC fanboys is that someday, somehow, BTC will become used as another currency just like the USD or Euro and that is what justifies a several hundred thousand (or several million) dollar valuation on it. If OTOH it won't ever become commonly used as a currency then that valuation case just went "<poof>" and vanished into thin air.

2B. "Digital property rights" is not a "killer use case" for BTC or any other crypto. It seems to me like you are falling into the mental trap of describing how BTC (and for that matter most other cryptos) are technologically clever and technically elegant and novel (which they are) but that is not what I am asking. What I am asking is this...what is going to make people one day en-masse decide to start spending/earning in BTC or another crypto instead of, say, US Dollars? Assuming I am not hiding assets, aren't doing anything malicious or illegal, and aren't trying to evade taxes....what use to does BTC have to someone like me that either paper dollars or electronic dollars (or credit cards, debit cards, pay by cell phone, etc) do not? Why would an average American want to stop using dollars for everyday purchases and start using BTC? What can/could incent them to do that? That's what I meant by "killer app".

Re: A worthwhile read for all PP'ers

Fair enough, but in that case what major advantages does BTC have over gold? Gold if nothing else has the fact that it exists in physical form and you can make useful and/or beautiful stuff out of it (and also the fact that if it got cheap enough increased demand--say from things like builders who might start wiring homes with gold wire if it ever got as cheap as copper--would eventually tend to raise the price again somewhat). Gold--at least physical gold--also is impervious to catastrophic events like EMPs or massive solar storms...BTC...not so much.

I'm not saying BTC's price can't rise further; it may or may not and if it does rise it may be (or for that matter may not be) more due to speculative froth than to any actual use case for Bitcoin. But unless one is trying to hide wealth, say, or sneak large amounts of it across borders without disclosing it, or ransomware a Fortune 500 company, then what advantage does BTC have over gold that outweigh its considerable disadvantages?

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

All the data Ive heard is that younger generations own almost no gold and own almost all the crypto. And that older generations own almost no crypto and almost all the gold.

Assuming this is trend is true and persists, and assuming that old people die at a higher rate than young people, there seems to be a tailwind for crypto and headwind for gold.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

I cant tell where you are coming from on this. Bitcoin is a trillion dollar network and has been growing exponentially since its inception. How could you possibly be asking this question?

Here are some use cases I listed previously. The last one, "Programmable money", could probably be spun out to its own list of sub use cases. Maybe Ill take a crack at that some day.D1984 wrote: ↑Wed Oct 27, 2021 4:29 pmAssuming I am not hiding assets, aren't doing anything malicious or illegal, and aren't trying to evade taxes....what use to does BTC have to someone like me that either paper dollars or electronic dollars (or credit cards, debit cards, pay by cell phone, etc) do not? Why would an average American want to stop using dollars for everyday purchases and start using BTC? What can/could incent them to do that? That's what I meant by "killer app".

bitcoininthevp wrote: ↑Mon Jan 07, 2019 9:49 am I cant know your situation and how Bitcoin might benefit you, but here are some examples of what people are using Bitcoin for. I am not claiming Bitcoin is a perfect solution for each of these uses cases, but that this is what people can and are using it for.

Censorship resistance. This includes individuals whose payments are typically censored, like wikileaks or online drug markets. This also includes groups or individuals who getting "deplatformed" (block by paypal or other fundraising platforms) because they have views that those platforms (or their governments) do not like.

Store of value. This includes people in countries whose currencies are inflating at a rate that makes Bitcoin's current volatility seem appealing. It also includes people in countries with lacking or no banking services available to them.

Speculation. This includes short term traders trying to trade on trends. But this also includes people that hold long term who believe Bitcoin can become money and in order to do so will appreciate drastically in value.

International payments. This includes people remitting money from overseas to their family. Also people paying for goods and services overseas can save money by using Bitcoin to transact. There are also countries where it is hard or impossible to exchange with online which would be serviced by Bitcoin.

Private payments. While Bitcoin is not completely anonymous, it can be transacted in a "more private" way. This includes individuals who value their financial privacy.

Micropayments. It is possible to transact in bitcoin using fractions of pennies. Especially using tools ontop of bitcoin (lightning network). This is applicable for pay-per-use services like an online newspaper paywall, paying realtime per minute used on a cell plan, etc. Even new use cases are opened up here like machine to machine micro transaction payments.

Tax evasion. This is for individuals who do not wish to pay the government the recommended taxes: income tax or otherwise.

Anti confiscation. This includes people that want to have value stored in something that cannot easily be stolen. Individuals crossing borders, feeling countries, etc. Asset forfeiture is applicable here. It also includes anyone fearful that their government might become a bit more invasive.

Anti inflation hedge. This includes individuals wanting to hold money that isnt inflating. As this use case becomes more appealing (bitcoin's volatility decreasing), Bitcoin will be a threat to central banks and the governments that attain part of their non-taxation funding from inflating the money supply. By eliminating the ability for governments to print money to benefit themselves, governments will have to shrink or get their funding from increasing taxes, which is harder than inflating.

Cheaper payments. Fees on Bitcoin transactions can be very low. So there is some advantage for people transacting in Bitcoin, even in the same country, where fees might be high. This might be the case when making medium/large purchase online and avoiding the ~3% credit card fee for example.

Programmable money. I give my son bitcoin that cannot be spent before the year 2050 for example. My 3 business partners and I can fund a bitcoin address such that 2 our of the 3 of us has to approve the transaction in order for it to go through. Google "smart contracts" for other examples of this.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

See a list I made here:

bitcoininthevp wrote: ↑Fri Jul 03, 2020 2:05 pm "It performs none of the functions expected of gold."

I assume you mean gold's functions as money. Here are some valuable characteristics of money:

Durability: bitcoin and gold both strong here.

Portability: bitcoin is digital thus much more portable than gold.

Divisibility: A single bitcoin can be subdivided into 100,000 sub units. Gold much hard to pay with shavings.

Uniformity/Fungibility: gold strong here (verifiability of such uniformity later). I think bitcoin is a bit weaker currently due to transactions being public. Improvements hopefully to come there.

Limited supply: bitcoin has a mathematic max of 21m coins. Gold is scarce as well but more susceptible to increases in supply with price rises (stock to flow). I think the mining asteroids argument is far off.

Acceptability: bitcoin is bad here. Gold has history and global awareness. This will be the last domino to fall on bitcoin's monetization.

Censorship Resistance: gold pretty good. Bitcoin better due to digital nature.

Security: Much easier to store bitcoin (paper, brain) than bulky gold.

Verifiability: bitcoin can be verified with free software. Gold you need contraptions for coins which are cheap. But hard for bars (see recent scandals on fake gold)

Seizure resistance: bitcoin wins as there isnt anything in the physical world that you really need to own it. Plausible deniability. Gold can be searched and found

Gold's physical properties are a NEGATIVE for it, per above.D1984 wrote: ↑Wed Oct 27, 2021 4:39 pm Gold if nothing else has the fact that it exists in physical form and you can make useful and/or beautiful stuff out of it (and also the fact that if it got cheap enough increased demand--say from things like builders who might start wiring homes with gold wire if it ever got as cheap as copper--would eventually tend to raise the price again somewhat). Gold--at least physical gold--also is impervious to catastrophic events like EMPs or massive solar storms...BTC...not so much.

Also, saying gold has non-monetary uses is also a negative, not a positive, for gold. When considering monetary goods, you want the good with the HIGHEST monetary premium, and the least non-monetary premium. This is (one reason) why Harry didn’t like silver and other metals as much as gold. Gold had/has the highest monetary premium of other metals and thus made the best monetary good.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

Im not sure of the non monetary uses that you mention. Lightning is a payment network for BTCs so BTC is still being used as money there. Liquid is similar, you peg in BTC to Liquid network and can do monetary things with the BTCs on that network. Im not too familiar with RSK or Stacks.

Perhaps you can give me a canonical non-monetary use for bitcoin (the currency) that you are thinking about?

Or are you concerned about people using Bitcoin (the network) is some non-monetary way?

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

I think BTC being used to pay for things is good. That is what money is for right?

The reason I think ETH is a bad investment isnt because you use ETH to pay for things on the Ethereum network. In fact IMHO that is the only reason ETH has any value, as a utility token for doing things on the Ethereum network. Just like chuckecheese tokens have value solely for their value for playing games at chuckecheese. But when Im done playing skeeball, I want anything left to be stored IN MONEY. It just so happens that ETH makes bad money (for reasons Ive outlined before: its not trying to be money, its monetary policy is not credible, it keeps changing things like proof of work/supply/cap, its been known to censor transactions, etc) so I dont want to leave value there for longer than the skeeball game lasts.

NOW, I think there could be a danger if the Bitcoin NETWORK is used to issue tokens/stocks/etc because its possible that the value of say all stocks issued on the Bitcoin network could be 100x larger than the value of BTCs on the bitcoin network. That could cause issues with Bitcoin's incentive structure as there would be incentive from stockholders to reorganize the Bitcoin chain to favor their stock trades for example.

Re: A worthwhile read for all PP'ers

How could I possibly be asking this question? Easy.bitcoininthevp wrote: ↑Thu Oct 28, 2021 10:00 amI cant tell where you are coming from on this. Bitcoin is a trillion dollar network and has been growing exponentially since its inception. How could you possibly be asking this question?

Here are some use cases I listed previously. The last one, "Programmable money", could probably be spun out to its own list of sub use cases. Maybe Ill take a crack at that some day.D1984 wrote: ↑Wed Oct 27, 2021 4:29 pmAssuming I am not hiding assets, aren't doing anything malicious or illegal, and aren't trying to evade taxes....what use to does BTC have to someone like me that either paper dollars or electronic dollars (or credit cards, debit cards, pay by cell phone, etc) do not? Why would an average American want to stop using dollars for everyday purchases and start using BTC? What can/could incent them to do that? That's what I meant by "killer app".

bitcoininthevp wrote: ↑Mon Jan 07, 2019 9:49 am I cant know your situation and how Bitcoin might benefit you, but here are some examples of what people are using Bitcoin for. I am not claiming Bitcoin is a perfect solution for each of these uses cases, but that this is what people can and are using it for.

Censorship resistance. This includes individuals whose payments are typically censored, like wikileaks or online drug markets. This also includes groups or individuals who getting "deplatformed" (block by paypal or other fundraising platforms) because they have views that those platforms (or their governments) do not like.

Store of value. This includes people in countries whose currencies are inflating at a rate that makes Bitcoin's current volatility seem appealing. It also includes people in countries with lacking or no banking services available to them.

Speculation. This includes short term traders trying to trade on trends. But this also includes people that hold long term who believe Bitcoin can become money and in order to do so will appreciate drastically in value.

International payments. This includes people remitting money from overseas to their family. Also people paying for goods and services overseas can save money by using Bitcoin to transact. There are also countries where it is hard or impossible to exchange with online which would be serviced by Bitcoin.

Private payments. While Bitcoin is not completely anonymous, it can be transacted in a "more private" way. This includes individuals who value their financial privacy.

Micropayments. It is possible to transact in bitcoin using fractions of pennies. Especially using tools ontop of bitcoin (lightning network). This is applicable for pay-per-use services like an online newspaper paywall, paying realtime per minute used on a cell plan, etc. Even new use cases are opened up here like machine to machine micro transaction payments.

Tax evasion. This is for individuals who do not wish to pay the government the recommended taxes: income tax or otherwise.

Anti confiscation. This includes people that want to have value stored in something that cannot easily be stolen. Individuals crossing borders, feeling countries, etc. Asset forfeiture is applicable here. It also includes anyone fearful that their government might become a bit more invasive.

Anti inflation hedge. This includes individuals wanting to hold money that isnt inflating. As this use case becomes more appealing (bitcoin's volatility decreasing), Bitcoin will be a threat to central banks and the governments that attain part of their non-taxation funding from inflating the money supply. By eliminating the ability for governments to print money to benefit themselves, governments will have to shrink or get their funding from increasing taxes, which is harder than inflating.

Cheaper payments. Fees on Bitcoin transactions can be very low. So there is some advantage for people transacting in Bitcoin, even in the same country, where fees might be high. This might be the case when making medium/large purchase online and avoiding the ~3% credit card fee for example.

Programmable money. I give my son bitcoin that cannot be spent before the year 2050 for example. My 3 business partners and I can fund a bitcoin address such that 2 our of the 3 of us has to approve the transaction in order for it to go through. Google "smart contracts" for other examples of this.

One, how many of the transactions in Bitcoin so far are for actual goods or services and not just speculative buying and selling of Bitcoin for short-term investment/speculation purposes? How, does this compare to the amount of goods and services bought in, say, USD each day?

Two, how is Bitcoin cheaper, easier, or more frictionless to use than dollars? I can pay with a contactless credit card, with my phone, with a regular debit or credit card, via Venmo or via another P2P or P2Seller type app, or with cash itself; cash is accepted pretty much everywhere and Vias/MC/Amex/Discover are accepted maybe 95% to 99% of places.....BTC not so much. If I am not trying to hide anything, am not interested in evading taxes, and I am not one of these paranoid inflation hawks who somehow thinks 4 or 5% inflation is going to lead us to become Weimar Germany, then why should I want to use Bitcoin as a way to make purchases?

If the issue is credit card fees, then the simple solution to that is to have the government legislate to regulate the fees such that they are less than they are now (Visa and Amex--nor the actual banks issuing the cards themselves--do NOT need 2 or 3% on each transaction to make money; maybe they did back when credit cards first started back in the 1960s, but not with today's technology).

If the issue is worries about inflation, I can just buy I-Bonds (and set up either a trust or an Arizona or Wyoming LLC if I want to buy more than $15K a year of them)....besides, I don't know about you but I'd kinda prefer my "stable store of value" not to be something that can either almost lose half its value in a few short months nor nearly double in a few months....both of which BTC has already done in 2021 alone). If OTOH I am actually looking at a truly long-term store of value (for retirement savings, say) then I'd be likely putting the money into equities or property of some kind (i.e. something that over the long term wouldn't be expected to just keep up with inflation but far surpass it) rather than either cash or Bitcoin.

Maybe I'm just being shortsighted but when I think of ANY new technology that succeeded in the marketplace, there were two common factors involved:

1. The use case was pretty obvious, and

2. It did something better (sometimes MUCH better), more effectively, and/or cheaper than a currently existing technology.

It doesn't matter what the technology in question was was; you name it--fire, the wheel, written languages with alphabets, paved roads, the steam engine, the automobile, the electric motor, the machine gun, the incandescent light bulb, surgical anesthesia, the airplane, antibiotics, radar, gas heating and lighting, the telegraph, the telephone, the microwave oven, radio, TV, digital computer, etc; any technology that caught on and came into widespread use met both of the above criteria.

Things may change in the future, but from my point of view BTC as it currently stands fails to at least some degree on both counts. Had we never invented cash (in either paper or electronic form or in the form of cash substitutes like checks and money orders) and were still using barter or gold then yes, Bitcoin would (more or less) meet both conditions above. With that said, since we DO in fact have currency/cash that we can use to buy and sell things with, then Bitcoin is (at least as things stand now) a solution in search of a problem.

Last edited by D1984 on Thu Oct 28, 2021 12:14 pm, edited 1 time in total.

Re: A worthwhile read for all PP'ers

1. How much remittances are in BTC vs in USD? From what I can tell BTC is still a bit player in this space.vincent_c wrote: ↑Thu Oct 28, 2021 12:17 pmA lot of transactions are financial in nature. Either for remittances or like I have been mentioning, in defi which is a nascent but fast growing thing in bitcoin.D1984 wrote: ↑Thu Oct 28, 2021 11:58 am How could I possibly be asking this question? Easy.

One, how many of the transactions in Bitcoin so far are for actual goods or services and not just speculative buying and selling of Bitcoin for short-term investment/speculation purposes? How, does this compare to the amount of goods and services bought in, say, USD each day?

It is faster when it comes to finality and settlement.D1984 wrote: ↑Thu Oct 28, 2021 11:58 am Two, how is Bitcoin cheaper, easier, or more frictionless to use than dollars? I can pay with a contactless credit card, with my phone, with a regular debit or credit card, via Venmo or via another P2P or P2Seller type app, or with cash itself; cash is accepted pretty much everywhere and Vias/MC/Amex/Discover are accepted maybe 95% to 99% of places.....BTC not so much. If I am not trying to hide anything, am not interested in evading taxes, and I am not one of these paranoid inflation hawks who somehow thinks 4 or 5% inflation is going to lead us to become Weimar Germany, then why should I want to use Bitcoin as a way to make purchases?

Bitcoin meets both these criteria because it is actually a 10x improvement on cash.D1984 wrote: ↑Thu Oct 28, 2021 11:58 am

Maybe I'm just being shortsighted but when I think of ANY new technology that succeeded in the marketplace, there were two common factors involved:

1. The use case was pretty obvious, and

2. It did something better (sometimes MUCH better), more effectively, and/or cheaper than a currently existing technology.

2. Faster when it comes to finality and settlement?: ACH transfers taking three days to clear (or CC transactions taking 1-2 days to fully clear...albeit the actual purchase transaction clears in a few seconds from the user's point of view) are all simply relics of the way things were set up; if everyone in the US had accounts at the Fed transactions could clear virtually instantaneously. Doesn't Bitcoin still take around 10 minutes just to clear one transaction?

3. How is Bitcoin a 10X improvement on cash? Assuming I not a diehard anarcho-capitalist or Randroid who thinks fiat money is the root of all evil, and assuming that I am not trying to hide money from the IRS or from creditors, then what appeal should BTC have to me? What use does it have it that regular dollars can't fulfill?

I'm not saying it may not be a good investment or an intelligent speculation at some points in time...but as a good currency I still don't see it. The purpose of a currency is not to make its HOLDERS richer, it is to make its USERS (i.e. the economy as a whole) richer by making transactions easier, smoother, and more fluid to conduct. Compared to cash (or electronic forms of it) Bitcoin doesn't seem like much of an improvement in this regard.

- vnatale

- Executive Member

- Posts: 9490

- Joined: Fri Apr 12, 2019 8:56 pm

- Location: Massachusetts

- Contact:

Re: A worthwhile read for all PP'ers

MangoMan wrote: ↑Thu Oct 28, 2021 7:56 pm

D1984 wrote: ↑Thu Oct 28, 2021 11:58 am

If the issue is credit card fees, then the simple solution to that is to have the government legislate to regulate the fees such that they are less than they are now (Visa and Amex--nor the actual banks issuing the cards themselves--do NOT need 2 or 3% on each transaction to make money; maybe they did back when credit cards first started back in the 1960s, but not with today's technology).

I agree with the premise that 2-3% fees are excessive for profit. If it a 'simple solution' for the government to regulate fees, why has it not already been done? Ohhh, lobbyists. Yeah, not gonna happen.

Does anyone know the answer to this one?

I have that well advertised Citibank cashback card wherein I earn 1% when I use it and than another 1% when I pay the bill...so a total of 2% every time I use it.

Therefore if Citibank is charging 2% to 3% for it's use...it is only netting 0% or 1%. Unless it is charging more than the 2% to 3%.

I've looked at a lot of merchant credit card bills and I see charges with all different rates applied to them, leading me to believe that the higher the reward the higher the merchant was charged for its customers using these higher reward cards. But, if so, why would not a card issuer offer a 5% rebate to us since it just gets passed on to the merchant?

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- vnatale

- Executive Member

- Posts: 9490

- Joined: Fri Apr 12, 2019 8:56 pm

- Location: Massachusetts

- Contact:

Re: A worthwhile read for all PP'ers

In what ways? Where in the process? When signing up with a bank that accepts credit card payments? Or, when a customer is going to use a certain credit card to pay the merchant's bill?

A few weeks ago I was at a restaurant and when the person I was with pulled out his American Express card to pay the bill he was informed that the restaurant did not accept American Express cards.

I've seen that...that only certain type cards will not be accepted. But I've never seen the case wherein a certain Visa or MasterCard is not accepted because it carries too high of a reward to the customer (with the corresponding cost being passed on to the merchant).

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- dualstow

- Executive Member

- Posts: 14308

- Joined: Wed Oct 27, 2010 10:18 am

- Location: synagogue of Satan

- Contact:

Re: A worthwhile read for all PP'ers

It’s not just merchant fees but the late fees of irresponsible customers (or customers who lose their income) that add up to cash back rewards.

A restaurant owner once told me that American Express sends a giant binder of rules every year and she just didn’t want to deal with it anymore.

A restaurant owner once told me that American Express sends a giant binder of rules every year and she just didn’t want to deal with it anymore.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

I think Bitcoin is trying to be money. I think others are utility tokens that people think will have value but since they are just utility (chuckecheese) tokens they wont keep value other than people transacting with them. This is essentially the An (Institutional) Investor’s Take on Cryptoassets thesis.

Lets say that someone issues $100 trillion worth of real stock on the bitcoin blockchain. (note: everyone does these sort of token issuance thing on ethereum or other networks but it IS possible and was done many years via things like colored coins or counterparty) on bitcoin. Lets say the "market cap" (all value of bitcoins) is only $1 billion. Well, its likely that the incentives Bitcoin currently has of miners acting in their self interest to "secure the network" and get the block rewards each 10 minutes breaks down because miners could be bribed by someone who owns a lot of stock to "undo" 10 hrs of bitcoin transactions (which include stock transactions that could be advantageous for them to undo for some reason) for example. This would not be good for the reliability of the Bitcoin network, thus the bitcoin BTC currency would suffer, Id think.

Dominate is strong. I think people are underestimating gold currently. But I think the long term direction, per my demographics comments (old people gold, young people bitcoin, old people die) will trend toward bitcoin attaining gold market cap parity.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

I think a useful mental framework for Bitcoin is that it is a digital store of value (a digital gold, if you will) with a clunky payments mechanism attached.D1984 wrote: ↑Thu Oct 28, 2021 11:58 am One, how many of the transactions in Bitcoin so far are for actual goods or services and not just speculative buying and selling of Bitcoin for short-term investment/speculation purposes? How, does this compare to the amount of goods and services bought in, say, USD each day?

Two, how is Bitcoin cheaper, easier, or more frictionless to use than dollars? I can pay with a contactless credit card, with my phone, with a regular debit or credit card, via Venmo or via another P2P or P2Seller type app, or with cash itself; cash is accepted pretty much everywhere and Vias/MC/Amex/Discover are accepted maybe 95% to 99% of places.....BTC not so much. If I am not trying to hide anything, am not interested in evading taxes, and I am not one of these paranoid inflation hawks who somehow thinks 4 or 5% inflation is going to lead us to become Weimar Germany, then why should I want to use Bitcoin as a way to make purchases?

If the issue is credit card fees, then the simple solution to that is to have the government legislate to regulate the fees such that they are less than they are now (Visa and Amex--nor the actual banks issuing the cards themselves--do NOT need 2 or 3% on each transaction to make money; maybe they did back when credit cards first started back in the 1960s, but not with today's technology).

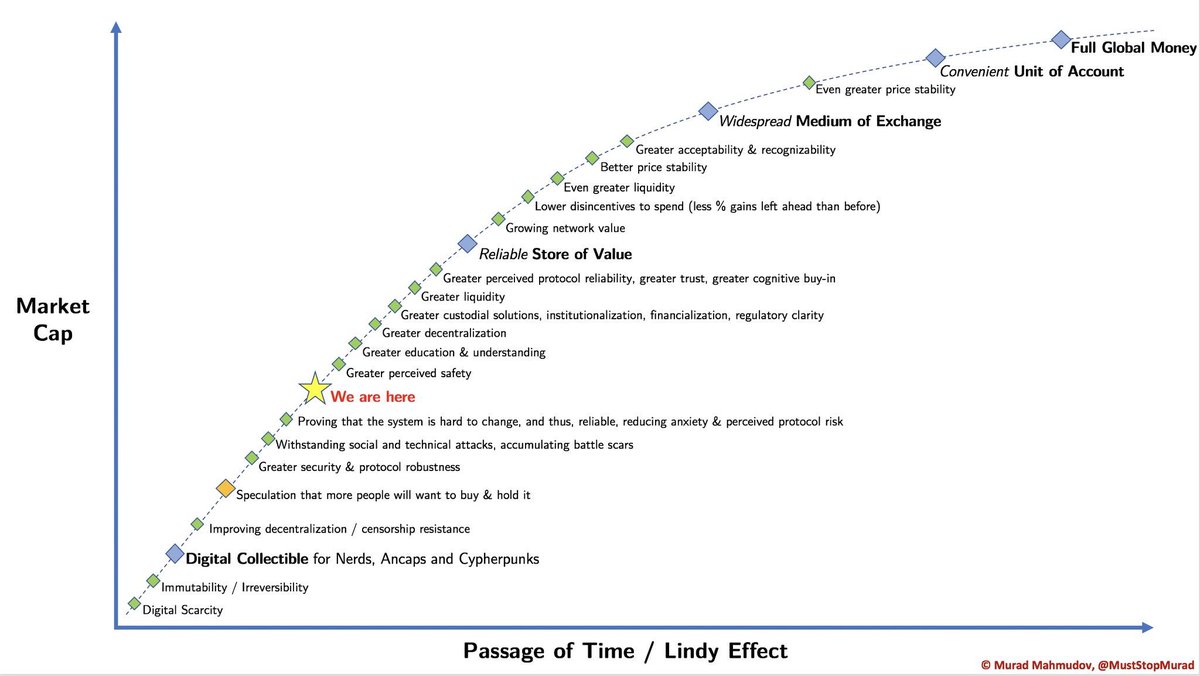

Few people are wanting to buy bitcoins just to be able to transact with them immediately. Some are, for remittances or whatnot, sure, but bitcoin isnt a cheap/fast payment network first, which is how you are approaching it. This is a useful chart of how I see Bitcoin progressing:

Part of the speculation on Bitcoin is speculating that it will continue to progress along this curve (the process of becoming money).

You asked how Bitcoin is better than gold and I provided a starter list of how. Did you have objections there?D1984 wrote: ↑Thu Oct 28, 2021 11:58 am If the issue is worries about inflation, I can just buy I-Bonds (and set up either a trust or an Arizona or Wyoming LLC if I want to buy more than $15K a year of them)....besides, I don't know about you but I'd kinda prefer my "stable store of value" not to be something that can either almost lose half its value in a few short months nor nearly double in a few months....both of which BTC has already done in 2021 alone). If OTOH I am actually looking at a truly long-term store of value (for retirement savings, say) then I'd be likely putting the money into equities or property of some kind (i.e. something that over the long term wouldn't be expected to just keep up with inflation but far surpass it) rather than either cash or Bitcoin.

Sure Bitcoin is volatile. Did you really think a magic Internet money was going to go from $0.0000000 to $1,000,000 in a straight line??

But if you look at data the volatility of bitcoin is decreasing over time. And as I show in the chart above, no one is claiming bitcoin to be a unit of account TODAY.

Close your eyes and imagine a magic Internet money eventually becoming a unit of account and stable store of value. Isnt the first 11 years of bitcoin exactly how it would go?

1. I provided a list of use cases where bitcoin excelsD1984 wrote: ↑Thu Oct 28, 2021 11:58 am Maybe I'm just being shortsighted but when I think of ANY new technology that succeeded in the marketplace, there were two common factors involved:

1. The use case was pretty obvious, and

2. It did something better (sometimes MUCH better), more effectively, and/or cheaper than a currently existing technology.

2. I provided a list of how bitcoin is better in many ways to gold (the existing technology)

You didn’t seem to have objections to either, but then post the exact same "concerns" again.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

That’s just it, you can issue tokens on the bitcoin network that are NOT BTC tokens. And, in theory, the value of those issued tokens could be much larger than the native BTC tokens on the network.

Re: A worthwhile read for all PP'ers

My objection is that Bitcoin as a stable store of value (at least as it stands today and in the near future) kind of...well...sucks.bitcoininthevp wrote: ↑Fri Oct 29, 2021 10:05 amI think a useful mental framework for Bitcoin is that it is a digital store of value (a digital gold, if you will) with a clunky payments mechanism attached.D1984 wrote: ↑Thu Oct 28, 2021 11:58 am One, how many of the transactions in Bitcoin so far are for actual goods or services and not just speculative buying and selling of Bitcoin for short-term investment/speculation purposes? How, does this compare to the amount of goods and services bought in, say, USD each day?

Two, how is Bitcoin cheaper, easier, or more frictionless to use than dollars? I can pay with a contactless credit card, with my phone, with a regular debit or credit card, via Venmo or via another P2P or P2Seller type app, or with cash itself; cash is accepted pretty much everywhere and Vias/MC/Amex/Discover are accepted maybe 95% to 99% of places.....BTC not so much. If I am not trying to hide anything, am not interested in evading taxes, and I am not one of these paranoid inflation hawks who somehow thinks 4 or 5% inflation is going to lead us to become Weimar Germany, then why should I want to use Bitcoin as a way to make purchases?

If the issue is credit card fees, then the simple solution to that is to have the government legislate to regulate the fees such that they are less than they are now (Visa and Amex--nor the actual banks issuing the cards themselves--do NOT need 2 or 3% on each transaction to make money; maybe they did back when credit cards first started back in the 1960s, but not with today's technology).

Few people are wanting to buy bitcoins just to be able to transact with them immediately. Some are, for remittances or whatnot, sure, but bitcoin isnt a cheap/fast payment network first, which is how you are approaching it. This is a useful chart of how I see Bitcoin progressing:

Part of the speculation on Bitcoin is speculating that it will continue to progress along this curve (the process of becoming money).

You asked how Bitcoin is better than gold and I provided a starter list of how. Did you have objections there?D1984 wrote: ↑Thu Oct 28, 2021 11:58 am If the issue is worries about inflation, I can just buy I-Bonds (and set up either a trust or an Arizona or Wyoming LLC if I want to buy more than $15K a year of them)....besides, I don't know about you but I'd kinda prefer my "stable store of value" not to be something that can either almost lose half its value in a few short months nor nearly double in a few months....both of which BTC has already done in 2021 alone). If OTOH I am actually looking at a truly long-term store of value (for retirement savings, say) then I'd be likely putting the money into equities or property of some kind (i.e. something that over the long term wouldn't be expected to just keep up with inflation but far surpass it) rather than either cash or Bitcoin.

Sure Bitcoin is volatile. Did you really think a magic Internet money was going to go from $0.0000000 to $1,000,000 in a straight line??

But if you look at data the volatility of bitcoin is decreasing over time. And as I show in the chart above, no one is claiming bitcoin to be a unit of account TODAY.

Close your eyes and imagine a magic Internet money eventually becoming a unit of account and stable store of value. Isnt the first 11 years of bitcoin exactly how it would go?

1. I provided a list of use cases where bitcoin excelsD1984 wrote: ↑Thu Oct 28, 2021 11:58 am Maybe I'm just being shortsighted but when I think of ANY new technology that succeeded in the marketplace, there were two common factors involved:

1. The use case was pretty obvious, and

2. It did something better (sometimes MUCH better), more effectively, and/or cheaper than a currently existing technology.

2. I provided a list of how bitcoin is better in many ways to gold (the existing technology)

You didn’t seem to have objections to either, but then post the exact same "concerns" again.

If I want to hold a "stable" store of value, then it needs to actually hold value and not shift around by more than, say, a few percent over a short period of time.

Let's say I wanted to put aside some money from my paycheck to pay for the following:

1. My groceries next week

2. A vacation six months from now

3. For a down payment on a home that I will be buying maybe two years from now.

I would never want to save for any of those in Bitcoin because I don't want a store of value that could conceivably lose half (or more) of its value right when (or shortly before) I need to liquidate and spend it. For much the same reason, I wouldn't save for any of the above, in, say, a triple leveraged ETF, or in oil futures, or even in relatively (compared to the leveraged ETF or the futures) "tame" stuff like an ordinary S&P 500 ETF, or gold, or long-term Treasury zeroes. Yes, with any of those I could potentially profit handsomely (as indeed I could with Bitcoin) but it's not worth the risk of a severe and sharp drawdown in the value of my savings thanks to my having chosen a too volatile and too potentially risky store of value for said savings. How does BTC beat (in terms of stability and guarantee of the return of my principal) a checking account for #1 above, a savings account/MMA/reward checking account for #2 above, and either one of the same options as #2 and/or I-Bonds for # 3 above? It doesn't.

Also, how is BTC as easy to spend as dollars? How many places accept it vs accept cash (or even accept it vs accept Visa/MC if you think "places that accept cash" isn't a fair comparison since cash is legal tender by fiat in the US while neither BTC nor Visa/MC are)? How easy is it to get a refund for goods paid for in BTC if the merchant disagrees with me and refuses to give me the refund? What recourse do I have if I pay for a good or service in BTC and the seller simply never holds up his end of the deal and never provides the good/service agreed upon? Will the US government accept BTC directly in payment of taxes?

Most of your "use cases" you mentioned were fringe (and/or illegal) things that don't apply to roughly 97-98% or more of financial transactions. I don't plan on doing things that some people have used BTC for....stuff like: paying over the Dark Web to have someone murdered, or buying stolen documents from Wikileaks, or purchasing illegal drugs or trafficked human beings, or ransomingwareing a large company and demanding payment in BTC, or evading taxes I legally owe, etc...and I'm not exactly worried about the US dollar turning into a Weimar or Zimbabwe style "100 trillion dollar bills that are only good as toilet paper" hyperinflationary clusterfuck in the next few years either.

How exactly does BTC offer "cheaper payments" than, say, cash, or ACHs, or POPMoney/P2P transfers, or bank wires (much less what would happen if everyone simply had a bank account at the Fed and could transfer money instantly to anyone else at zero cost)? Average BTC transaction fees (while as of right now at around $3 or $3.50 or so) reached above $45 or $50 earlier this year (late March though much April of 2021); furthermore, if I am reading this right--and I hope I'm not--the more people using the Bitcoin network at any given time, the higher typical average transaction fees will go (which seems to me to be exactly the wrong direction to go in; you want economies of scale to benefit a currency transaction system, not go against it). The Lightning Network may help some of this but again, if we can all have instant zero fee money transfers simply by giving everyone a current account at the Fed, then why do we need BTC (or Lightning) for transactions? How does it make them quicker or cheaper and/or more liquid than doing what I just suggested?

The one major reason I can see to hold BTC that makes sense is speculation; if BTC does ever approach (for example) gold's market cap then that implies a roughly 9.5 or 10-fold increase from its current value. This reason at least makes sense to me....but again, the whole "potential 10-bagger" thesis for investing in BTC could apply to any speculative investment (and like any other speculative investment, BTC could also lose 99 or 100% of its value rather than shoot up to a million dollars).

If your investment case for Bitcoin is that "as more people hold it, then the value will fluctuate less and less, which will drive yet more people to see it as safe and thus even more people will want to hold it, which will drive further reductions in volatility, etc, and so ad infinitum, and as such it makes sense now to get in on the ground floor while Bitcoin is still (relatively speaking) cheap" then yes, that makes sense (although to be anything close to a replacement for Dollars/Yen/Euros/etc it will end up having to fluctuate even less than, say, gold or stocks; most people don't hold their everyday spending cash or their short-term or medium-term savings in instruments like that for the very reason that they are too volatile and thus too risky)...I'm not saying that I agree with it or that it will come to pass, but at least from a rational first principles explanatory standpoint it makes sense.

Other than that...I'm sorry, I still don't see a reason to hold or to use Bitcoin when ordinary US dollars still spend just fine, thank you.

PS - Long-term deflationary currencies are a bad idea for an economy as a whole even though they may be good for any particular individual holder of said currency/currencies. A long-term stable currency (i.e. neither inflationary nor deflationary) might well be a different story but--given that BTC will only ever have 21 million coins and never more (and if I understand it correctly it's even worse than that since if someone loses a physical or digital "wallet" then those BTC are gone forever and essentially don't exist anymore)--it stands to be a long-term deflationary currency which is not something a growing economy needs.

Last edited by D1984 on Fri Oct 29, 2021 1:35 pm, edited 1 time in total.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

I dont think anyone is claiming bitcoin is currently a stable store of value. In fact, to the contrary, I sent a chart that had "reliable store of value" as something that would have to come in the future.

Ive not argued that BTC is currently more widely adopted than USD or that its easier to make most merchant/vendor/etc payments in BTC.

Im not saying Bitcoin should replace 100% of daily transactions (today, anyway!), you’re again rebutting a claim I have not made. You are still very focused on Bitcoins payment capabilities as if it were trying to compete with Visa, that’s not what Bitcoin is for. Bitcoin is not (currently?) for day to day transacting, that’s not the point. Maybe Lightning will augment some of those payment features and it could be better for payments down the road.

I noted that Bitcoin payments can be cheaper than credit card payments for certain sized payments and that it is particularly cheaper in overseas/remittance payments. I didn’t claim its always cheaper than every payment method, please stop misrepresenting my points.D1984 wrote: ↑Fri Oct 29, 2021 1:26 pm How exactly does BTC offer "cheaper payments" than, say, cash, or ACHs, or POPMoney/P2P transfers, or bank wires (much less what would happen if everyone simply had a bank account at the Fed and could transfer money instantly to anyone else at zero cost)? Average BTC transaction fees (while as of right now at around $3 or $3.50 or so) reached above $45 or $50 earlier this year (late March though much April of 2021); furthermore, if I am reading this right--and I hope I'm not--the more people using the Bitcoin network at any given time, the higher typical average transaction fees will go (which seems to me to be exactly the wrong direction to go in; you want economies of scale to benefit a currency transaction system, not go against it).

I think the speculation that Bitcoin will be the best money is the investment thesis and part of the (long term) speculation case for it. I think dampening volatility is part of that.D1984 wrote: ↑Fri Oct 29, 2021 1:26 pm If your investment case for Bitcoin is that "as more people hold it, then the value will fluctuate less and less, which will drive yet more people to see it as safe and thus even more people will want to hold it, which will drive further reductions in volatility, etc, and so ad infinitum, and as such it makes sense now to get in on the ground floor while Bitcoin is still (relatively speaking) cheap" then yes, that makes sense (although to be anything close to a replacement for Dollars/Yen/Euros/etc it will end up having to fluctuate even less than, say, gold or stocks; most people don't hold their everyday spending cash or their short-term or medium-term savings in instruments like that for the very reason that they are too volatile and thus too risky)...I'm not saying that I agree with it or that it will come to pass, but at least from a rational first principles explanatory standpoint it makes sense.

Still with the day to day coffee payments.

Re: A worthwhile read for all PP'ers

Have you at least considered the possibility that you have succumbed to tulip-mania? I'm not saying you have, but you do need to deeply consider that possibility. The easiest person to fool is ourselves.vincent_c wrote: ↑Fri Oct 29, 2021 2:29 pm People on this forum are obviously above average when it comes to intelligence.

The fact that we still don't have full consensus on this tells you why the opportunity is there. It's not priced correctly precisely because there is a discrepancy between what it is, and what many people think it is.

It's not hard to understand, but it is easy to misunderstand.

For example: if all these intelligent people DID have full consensus, you would be saying "I'm right". Now you're taking the lack of full consensus as proving you're right. Confirmation bias is a real thing.

I'm not saying you're wrong because I really have no idea. But do consider that you're blinding yourself by your 100% certain attitude and cheerleading. A lot of people have lost a lot of money doing those things.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: A worthwhile read for all PP'ers

I bought some crypto at the end of August with some VP play money (up 24%). If I can Matthew Effect this motherfucker, then great. But even if it goes bust, it's a pretty interesting phenomenon to get into.

You there, Ephialtes. May you live forever.

Re: A worthwhile read for all PP'ers

Bitcoin is largely unregulated, some such as Elton for instance are pumping/dumping to his advantage. Banks are accommodating it for their clients that do wish to do secret transactions but regulation will be inclined to prevent them from using that themselves. With time it is inclined to become more regulated and see greater price stability, with that will be greater inclination to short what amounts the limited supply of nothing. Presently shorts are shy due to the unlimited downside risks (short at $5,000 and if the price rose to $50,000 as it has breached).

I'd put the upside at a potential double and double again price level, $5Tn total across 21M coins. From there regulation and shorters of the limited supply of nothing 'asset' would be inclined to see it being shorted to near or actually out of existence as other 'currencies' backed by tangible assets became more favored.

A tulip bulb style speculative bubble, wide open to popping at any time, appropriate only for a small percentage of total asset allocation (trading/speculation), with a mid to longer term value potentially considerably lower than present prices, maybe $0.

I'd put the upside at a potential double and double again price level, $5Tn total across 21M coins. From there regulation and shorters of the limited supply of nothing 'asset' would be inclined to see it being shorted to near or actually out of existence as other 'currencies' backed by tangible assets became more favored.

A tulip bulb style speculative bubble, wide open to popping at any time, appropriate only for a small percentage of total asset allocation (trading/speculation), with a mid to longer term value potentially considerably lower than present prices, maybe $0.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

To the tulip guys, do you distinguish between Bitcoin being in a (series of) bubble vs Bitcoin being a bubble?

For example here are a bunch of bubble pops that have happened in Bitcoin:

$30->$1

$260->$40

$1200->$200

$19k->$3k

$65k->$28k

I think even us die hard Bitcoiners think there will be another blow off top coming. Just like the ones above. And prices crash from $150k down to say $40k and bears light up with glee vindicated that it was a bubble. Only to be proven wrong that instead of Bitcoin BEING a bubble it was IN a bubble. And we repeat again, as has been the pattern.

Imagine thinking a novel digital money would increase in value in a straight linear pattern.

I dont think anything is 100% and its possible that the 6th. 7th. 8th Bitcoin bubble is the last, but it seems increasingly unlikely that is the case.

I just read Devil Take the Hindmost and its good to keep an informed perspective for sure. But I already believe Bitcoin to be in a blowing up bubble phase so its really more a curious thing to watch than anything. One could use these cycles from a trading perspective, with all of the associated risk of course.

For example here are a bunch of bubble pops that have happened in Bitcoin:

$30->$1

$260->$40

$1200->$200

$19k->$3k

$65k->$28k

I think even us die hard Bitcoiners think there will be another blow off top coming. Just like the ones above. And prices crash from $150k down to say $40k and bears light up with glee vindicated that it was a bubble. Only to be proven wrong that instead of Bitcoin BEING a bubble it was IN a bubble. And we repeat again, as has been the pattern.

Imagine thinking a novel digital money would increase in value in a straight linear pattern.

I dont think anything is 100% and its possible that the 6th. 7th. 8th Bitcoin bubble is the last, but it seems increasingly unlikely that is the case.

I just read Devil Take the Hindmost and its good to keep an informed perspective for sure. But I already believe Bitcoin to be in a blowing up bubble phase so its really more a curious thing to watch than anything. One could use these cycles from a trading perspective, with all of the associated risk of course.