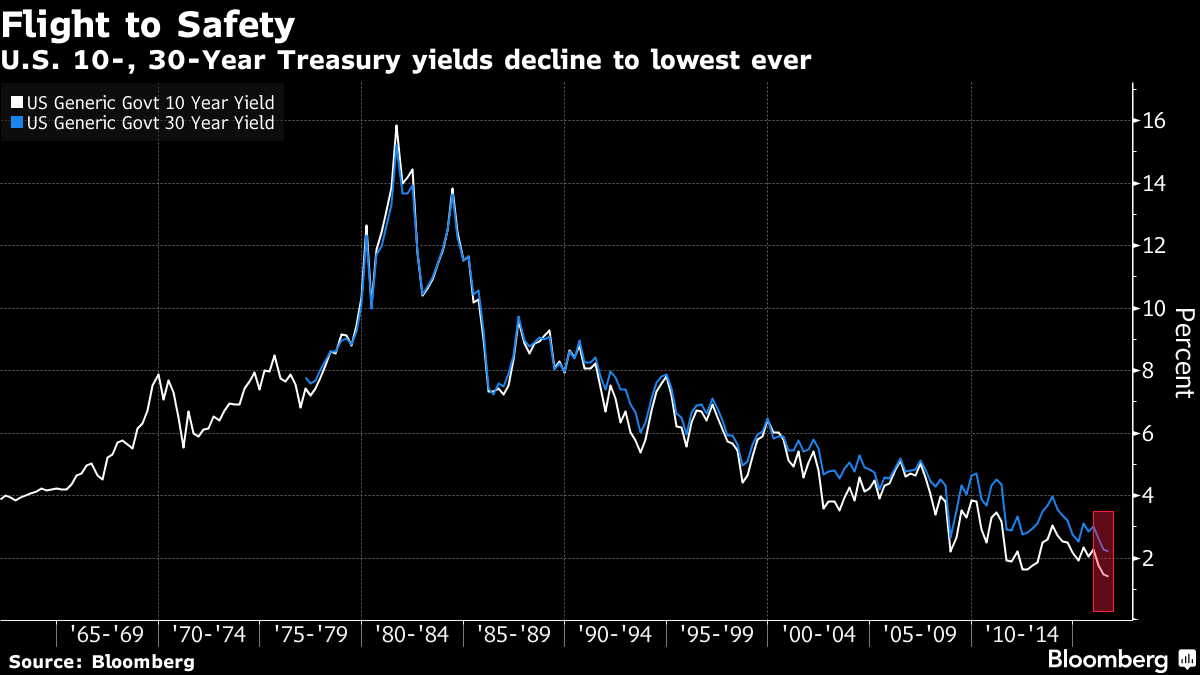

3 Decades of yields

Moderator: Global Moderator

3 Decades of yields

Even though I did live through it, hard to imagine hitting near 16%, seems like an alternate universe!

Re: 3 Decades of yields

The first year I had a few bucks to invest was 1981 and a friend told me to park it in a money market fund which was returning 16-17%. Indeed, it was a very different time.jswinner wrote:Even though I did live through it, hard to imagine hitting near 16%, seems like an alternate universe!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: 3 Decades of yields

And the only reason you could do that at the time and not lose was because inflation was on the way down due to 20% Federal Funds Rates.barrett wrote:The first year I had a few bucks to invest was 1981 and a friend told me to park it in a money market fund which was returning 16-17%. Indeed, it was a very different time.jswinner wrote:Even though I did live through it, hard to imagine hitting near 16%, seems like an alternate universe!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: 3 Decades of yields

That chart doesn't take into account differences in the inflation and also something called the "term premium". Take a look at the second chart here:

http://macromarketmusings.blogspot.co.i ... ation.html

http://macromarketmusings.blogspot.co.i ... ation.html

Re: 3 Decades of yields

I've typed this three times and not posted it for fear of insulting someone but I will pull the trigger this time. At the end of the day asset classes are highly rational over the long term and will return their underlying fundamentals based on the inflation rate. People often forget money is nothing but a cross rate with something else whether another currency or a gallon of gas/milk. Assuming some inflation over the long term:

1. Cash decreases at the rate of inflation

2. Bonds maintain pace with inflation

3. Gold maintains pace with inflation

4. Stocks return inflation + GDP.

Expectations for future inflation and GDP drive excursions from the mean for items 2-4. Expectations are entirely a human creation. With regards to cash and bonds, this is nothing more than a carry trade. Thus, if you want to know what to do about bonds or where they are going the thing you should actually be paying attention to is what is going on with cash. These are very long term looks for sure, but there really is no mystery to it. Personally the main curiosity for me is the relationship between gold and negative interest rates. The current situation is a bit of a novelty:

1. Cash decreases at the rate of inflation

2. Bonds maintain pace with inflation

3. Gold maintains pace with inflation

4. Stocks return inflation + GDP.

Expectations for future inflation and GDP drive excursions from the mean for items 2-4. Expectations are entirely a human creation. With regards to cash and bonds, this is nothing more than a carry trade. Thus, if you want to know what to do about bonds or where they are going the thing you should actually be paying attention to is what is going on with cash. These are very long term looks for sure, but there really is no mystery to it. Personally the main curiosity for me is the relationship between gold and negative interest rates. The current situation is a bit of a novelty: