Predictions For The Bottom In Gold

Moderator: Global Moderator

Re: Predictions For The Bottom In Gold

New 52 week low in platinum

- Cortopassi

- Executive Member

- Posts: 3338

- Joined: Mon Feb 24, 2014 2:28 pm

- Location: https://www.jwst.nasa.gov/content/webbL ... sWebb.html

Re: Predictions For The Bottom In Gold

I happened to catch Terry Savage on a radio interview two days ago and they were discussing gold. I found it interesting.

In the span of 2 minutes summed up she said she would be a buyer of gold, but only if it gets back to $800-850.

That is 27% below the current price.

Can you imagine any stock analyst getting interviewed and saying, yeah, I'd buy the DOW, but only if it drops to 13,000.

And it continues to act this morning in the fashion expected. A little rise and then drop. We have a way to go until this bloodbath is over I fear.

In the span of 2 minutes summed up she said she would be a buyer of gold, but only if it gets back to $800-850.

That is 27% below the current price.

Can you imagine any stock analyst getting interviewed and saying, yeah, I'd buy the DOW, but only if it drops to 13,000.

And it continues to act this morning in the fashion expected. A little rise and then drop. We have a way to go until this bloodbath is over I fear.

Test of the signature line

Re: Predictions For The Bottom In Gold

Tenn, You nailed it! Not sure why we didn't figure that out earlier. Perhaps you should move that over to the Cool PP Charts thread.TennPaGa wrote: [img width=500]http://i.imgur.com/7OrpwMO.png[/img]

Re: Predictions For The Bottom In Gold

I feel your pain. Been trained my whole life with a mouse in right hand but have a lot of trouble drawing with it. Left handed though I've got no problems. Stupid muscle memory.TennPaGa wrote:Hey, I'm a lefty using a mouse with my right hand! Gimme a break!Desert wrote: You do need to work on your handwriting though; it kinda sucks.

Background: Mechanical Engineering, Robotics, Control Systems, CAD Modeling, Machining, Wearable Exoskeletons, Applied Physiology, Drawing (Pencil/Charcoal), Drums, Guitar/Bass, Piano, Flute

"you are not disabled by your disabilities but rather, abled by your abilities." -Oscar Pistorius

"you are not disabled by your disabilities but rather, abled by your abilities." -Oscar Pistorius

- mathjak107

- Executive Member

- Posts: 4727

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Predictions For The Bottom In Gold

i am lefty and type with 1 finger since i have diabetic neuropathy in my finger tips and all but one are very sensitive to touch .TennPaGa wrote:Hey, I'm a lefty using a mouse with my right hand! Gimme a break!Desert wrote: You do need to work on your handwriting though; it kinda sucks.

i have gotten pretty quick with it but no cap keys .

- Cortopassi

- Executive Member

- Posts: 3338

- Joined: Mon Feb 24, 2014 2:28 pm

- Location: https://www.jwst.nasa.gov/content/webbL ... sWebb.html

Re: Predictions For The Bottom In Gold

Take this for what you will. I have met and talked with Mish a couple of times, and he is one of the more level headed economic bloggers out there.

Even today on the radio, another analyst was calling for $600 gold. He brought up the typical points, doesn't pay dividends, not a lot of industrial use, only held by hoarders, etc.

I am trying to recall if I have heard so much negative sentiment in the past 4 years. I do not think so. I certainly have not heard gold discussed on the radio this much, and exclusively in a negative light. Not a buying opportunity, always negative. Whatever the bottom might be, we are closer to it.

http://globaleconomicanalysis.blogspot. ... st-in.html

Even today on the radio, another analyst was calling for $600 gold. He brought up the typical points, doesn't pay dividends, not a lot of industrial use, only held by hoarders, etc.

I am trying to recall if I have heard so much negative sentiment in the past 4 years. I do not think so. I certainly have not heard gold discussed on the radio this much, and exclusively in a negative light. Not a buying opportunity, always negative. Whatever the bottom might be, we are closer to it.

http://globaleconomicanalysis.blogspot. ... st-in.html

Test of the signature line

- mathjak107

- Executive Member

- Posts: 4727

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Predictions For The Bottom In Gold

except this is a market that central banks can play with and do so you are not dealing with just the typical investor fear , greed and perception . in effect you are fighting the fed , by trying to fight the world central banks which never goes well in the end .

it wasn't joe the plumber dumping over a billion dollarsl last week in gold . that makes what you ,i or anyone else thinks likely a moot point .

it isn't the same as when all the women at my wife's beauty parlor were talking about their dot com stocks and you know it reached bubble level or in 2008 when the words buy stock made you want to vomit when we were down 6,000 points .

it wasn't joe the plumber dumping over a billion dollarsl last week in gold . that makes what you ,i or anyone else thinks likely a moot point .

it isn't the same as when all the women at my wife's beauty parlor were talking about their dot com stocks and you know it reached bubble level or in 2008 when the words buy stock made you want to vomit when we were down 6,000 points .

Last edited by mathjak107 on Sat Jul 25, 2015 3:52 am, edited 1 time in total.

-

AnotherSwede

- Senior Member

- Posts: 117

- Joined: Mon May 11, 2015 10:24 pm

Re: Predictions For The Bottom In Gold

Will gold still have low correlation?

Will gold still be volatile?

Will gold become worthless?

Keep stacking

Will gold still be volatile?

Will gold become worthless?

Keep stacking

-

Longstreet

- Junior Member

- Posts: 18

- Joined: Thu Sep 25, 2014 3:27 pm

Re: Predictions For The Bottom In Gold

Off topic, but please outline the "Desert Portfolio" once again. Thanks.

-

AnotherSwede

- Senior Member

- Posts: 117

- Joined: Mon May 11, 2015 10:24 pm

Re: Predictions For The Bottom In Gold

ochotona wrote: Desert is 30% equity, 60% 10-year Treasuries, 10% gold.

Re: Predictions For The Bottom In Gold

I like the current gold trajectory. I am ready to start a multi-month buy program. Not quite yet...

Re: Predictions For The Bottom In Gold

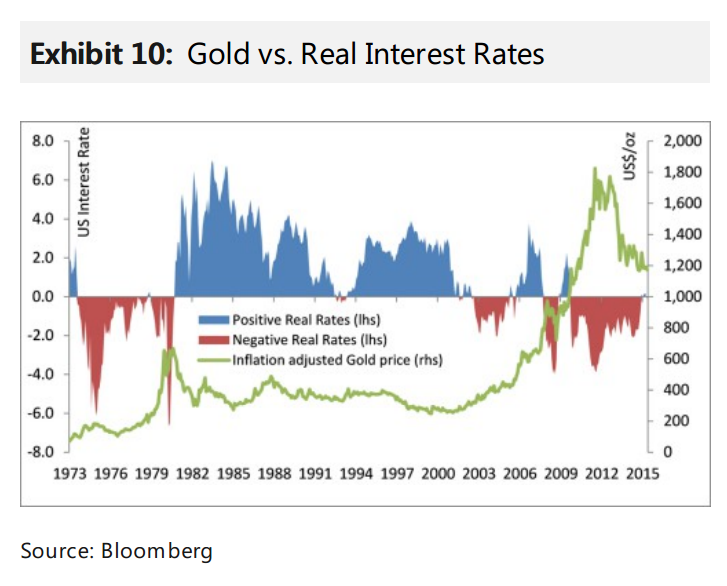

That's a great chart. Obviously it would be nice to have more data as we all know the shortcomings with the data from the 1970s (gold started at a price that was artificially low, etc.)Desert wrote: Here's an interesting gold chart, along with real interest rates:

http://thereformedbroker.com/2015/07/23 ... um=twitter

- Ad Orientem

- Executive Member

- Posts: 3483

- Joined: Sun Aug 14, 2011 2:47 pm

- Location: Florida USA

- Contact:

Re: Predictions For The Bottom In Gold

Forecasts, forecasts, everywhere

So the gold price drops, so the gold forecasts drop. Some recent calls in order of bearishness:

Deutsche Bank – fair value $785

Morgan Stanley – $800 under worst case scenario, $1,190 average for 2015

Claude Erb – fair value $825, will overshoot on downside to $350

Bloomberg Survey – $984 average estimate by 31 Dec 2015

Goldman Sachs – could fall below $1,000

ABN Amro – $1,000 by 31 Dec 2015 and $800 by 31 Dec 2016

OCBC – $1,050 by 31 Dec 2015

Capital Economics – $1,050 by 30 Sep 2015, $1,200 by 31 Dec 2015

UBS – $1,180 average price over second half of 2015.

From friend of the forum Bron Suchecki. See the rest of his post (with links) here...

http://goldchat.blogspot.com/2015/07/fo ... where.html

So the gold price drops, so the gold forecasts drop. Some recent calls in order of bearishness:

Deutsche Bank – fair value $785

Morgan Stanley – $800 under worst case scenario, $1,190 average for 2015

Claude Erb – fair value $825, will overshoot on downside to $350

Bloomberg Survey – $984 average estimate by 31 Dec 2015

Goldman Sachs – could fall below $1,000

ABN Amro – $1,000 by 31 Dec 2015 and $800 by 31 Dec 2016

OCBC – $1,050 by 31 Dec 2015

Capital Economics – $1,050 by 30 Sep 2015, $1,200 by 31 Dec 2015

UBS – $1,180 average price over second half of 2015.

From friend of the forum Bron Suchecki. See the rest of his post (with links) here...

http://goldchat.blogspot.com/2015/07/fo ... where.html

Trumpism is not a philosophy or a movement. It's a cult.

- Cortopassi

- Executive Member

- Posts: 3338

- Joined: Mon Feb 24, 2014 2:28 pm

- Location: https://www.jwst.nasa.gov/content/webbL ... sWebb.html

Re: Predictions For The Bottom In Gold

Seriously, I may be insane, but if it overshoots to $350, I will be out of the PP and 100% in gold for the rest of my life!

Virtually all analysts analyze all assets the same. If it's going up, it will keep going up. If it's going down it will keep going down.

Virtually all analysts analyze all assets the same. If it's going up, it will keep going up. If it's going down it will keep going down.

Test of the signature line

-

Libertarian666

- Executive Member

- Posts: 5994

- Joined: Wed Dec 31, 1969 6:00 pm

Re: Predictions For The Bottom In Gold

You mean that's not how one should analyze assets? Now you tell us!Cortopassi wrote: Seriously, I may be insane, but if it overshoots to $350, I will be out of the PP and 100% in gold for the rest of my life!

Virtually all analysts analyze all assets the same. If it's going up, it will keep going up. If it's going down it will keep going down.

Re: Predictions For The Bottom In Gold

i have recently been through a prediction saying that the prices may drop down to $450.

-

Libertarian666

- Executive Member

- Posts: 5994

- Joined: Wed Dec 31, 1969 6:00 pm

Re: Predictions For The Bottom In Gold

I'm pretty sure it won't go below $50/oz., because then the face value of $50 US gold eagles would be worth more than the gold content.

- Ad Orientem

- Executive Member

- Posts: 3483

- Joined: Sun Aug 14, 2011 2:47 pm

- Location: Florida USA

- Contact:

Re: Predictions For The Bottom In Gold

That seems well reasoned.Libertarian666 wrote: I'm pretty sure it won't go below $50/oz., because then the face value of $50 US gold eagles would be worth more than the gold content.

Trumpism is not a philosophy or a movement. It's a cult.

Re: Predictions For The Bottom In Gold

If gold is in oversupply right now, that is going to be a self limiting condition. I bet once production drops, prices will stabilize.

Meanwhile, enjoy the sale price! When gold purchase time comes around I'll be thrilled to stock up at these prices, even if they fall a bit farther. If stocks and bonds are truly overvalued and due for a correction, buying gold now is going to look like a lucky decision in the retrospectoscope. I'm a bit concerned that people talking about reducing gold allocations are going to miss out.

Meanwhile, enjoy the sale price! When gold purchase time comes around I'll be thrilled to stock up at these prices, even if they fall a bit farther. If stocks and bonds are truly overvalued and due for a correction, buying gold now is going to look like a lucky decision in the retrospectoscope. I'm a bit concerned that people talking about reducing gold allocations are going to miss out.

"Democracy is two wolves and a lamb voting on what to have for lunch." -- Benjamin Franklin

-

Libertarian666

- Executive Member

- Posts: 5994

- Joined: Wed Dec 31, 1969 6:00 pm

Re: Predictions For The Bottom In Gold

Most people are very bad at buying when investments are on sale. I figure that the more hysteria I see about gold going down to $350 or whatever, the closer the bottom is.sophie wrote: If gold is in oversupply right now, that is going to be a self limiting condition. I bet once production drops, prices will stabilize.

Meanwhile, enjoy the sale price! When gold purchase time comes around I'll be thrilled to stock up at these prices, even if they fall a bit farther. If stocks and bonds are truly overvalued and due for a correction, buying gold now is going to look like a lucky decision in the retrospectoscope. I'm a bit concerned that people talking about reducing gold allocations are going to miss out.

The Golden Constant: gold returns over next decade -3% to -11% per year

http://papers.ssrn.com/sol3/papers.cfm? ... id=2639284

Abstract:

In The Golden Dilemma, Erb and Harvey (2012) explored the possible relation between the real, inflation adjusted, price of gold and future real gold returns. This update suggests that the real return of gold over the next 10 years could be about -3% per year if the real price of gold mean reverts or -11% per year if the real price of gold overshoots and declines to previous low real price levels. This view reflects a “golden constant” hypothesis that inflation is the fundamental driver of the price of gold. Of course it is possible to entertain other hypotheses. A “golden constant” perspective suggests a fair value price for gold of $825 an ounce and a possible overshoot price of $350 an ounce.

Abstract:

In The Golden Dilemma, Erb and Harvey (2012) explored the possible relation between the real, inflation adjusted, price of gold and future real gold returns. This update suggests that the real return of gold over the next 10 years could be about -3% per year if the real price of gold mean reverts or -11% per year if the real price of gold overshoots and declines to previous low real price levels. This view reflects a “golden constant” hypothesis that inflation is the fundamental driver of the price of gold. Of course it is possible to entertain other hypotheses. A “golden constant” perspective suggests a fair value price for gold of $825 an ounce and a possible overshoot price of $350 an ounce.

- Stewardship

- Executive Member

- Posts: 219

- Joined: Mon Mar 10, 2014 6:31 am

Re: Predictions For The Bottom In Gold

Then Austrian gold Philharmonics would be worth 2x as much as gold eagles.Libertarian666 wrote: I'm pretty sure it won't go below $50/oz., because then the face value of $50 US gold eagles would be worth more than the gold content.

In a world of ever-increasing financial intangibility and government imposition, I tend to expect otherwise.