Indeed! That's also why we like the PP. The time before you started was marked by high inflation and poor markets. The PP did fine. The last 15 years have been market by poor markets and a huge gold run-up. The PP did fine. Right now, the markets are great, and gold is suffering. I won't say the PP is still doing fine, but it's surviving. None of us are losing our shirts. Although I will admit many are struck by returns envy!mathjak107 wrote: the problem was , for most americans the time leading up to that time frame was one of the worst. it was near impossible to save a dime with the high inflation and poor markets . don't forget 401k's didn't even exist. it was all well and good the party was here but few had money.

but isn't that typical of life ha ha ha

meeting your retirement goals with the pp

Moderator: Global Moderator

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: meeting your retirement goals with the pp

From Mathjak's Kitkes article, the average SWR for stocks/bonds over the years is 6.5%. But the entire point of doing retirement studies is to point out the great risk that comes with volatility and uncertainty. Especially when you account for the stock market boom years, averages are extremely deceptive. A 50% success rate is decent odds in Vegas but is a terrible retirement plan.Pointedstick wrote: What am I missing, Mathjak? If I go to http://www.firecalc.com and plug in a 6.5% withdrawal rate on a 50/50 or 60/40 portfolio, I get success rates under 50% for all time periods since 1871. At 4%, the success rate goes up to 80-95%.

Last edited by Tyler on Tue Jul 07, 2015 2:05 pm, edited 1 time in total.

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

firecalc is including those worst scenarios. you could never pull 6.50% including those time frames . that was my point about the pp.

without including the 4 worst time frames looking at the time frames they extended into like the 1966 group ran through the 1970's you are not actually comparing a safe withdrawal rate by just starting the pp off in the 1970's..

without including the 4 worst time frames looking at the time frames they extended into like the 1966 group ran through the 1970's you are not actually comparing a safe withdrawal rate by just starting the pp off in the 1970's..

Re: meeting your retirement goals with the pp

But the PP has handled the worst the markets have thrown at it since 1972 much better than the 60-40 portfolio over the same timeframe. I believe that's a strong indicator that it would similarly perform better in earlier economic conditions. You cannot accept that without direct proof. We just have different perspectives. At some point we all have to make a decision that will help us sleep at night and roll with it -- to each his own. I do believe there's more than one good path to retirement finances.mathjak107 wrote: without including the 4 worst time frames looking at the time frames they extended into like the 1966 group ran through the 1970's you are not actually comparing a safe withdrawal rate by just starting the pp off in the 1970's..

In any case, I agree with you that flexibility with expenses is far more important than putting all your faith in SWRs. All of these studies have so many assumptions baked in that they rarely resemble real life.

Last edited by Tyler on Tue Jul 07, 2015 2:27 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: meeting your retirement goals with the pp

Yes, that's my worry too and thanks to mathjak for bringing it up. I figure you can either increase the equity and scale the other three assets down or just do a better job with the 25%. One thing mathjak likes to overlook is the behavioral effect of increased maximum drawdowns with heavier equity portfolios. He also seems to discount the possibility of another 50% correction over the next couple of years. How can anyone in retirement stand up to that along with ultra low interest rates? I can't see where the recovery will come from. We've never had a dual overvalued equity and bond market before which makes it risky to any portfolio.Pointedstick wrote: I have zero worries about the PP being able to survive those kinds of crises. My worry is your other one: that the PP will miss out on a lot of growth during good times. But you can't have it both ways. The PP isn't going to grow more slowly than a stock-heavy portfolio during prosperity and then fell on its face when the markets crash or inflation picks up or interest rates rise.

So must we reduce our duration on the PP as well as enhancing the equity? Its really annoying to have to do that, but I guess that's life. Nothing works forever.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

one of the reason retirement planning is so vague now is because we have zero scenario's ever like now to simulate. low rates and high valuations never happened before and they may be just as deadly spending down from the pp as a conventional mix.

which goes back to what I said earlier about insurance products playing A much bigger role along with our own investing . I have been looking in to this a lot lately and I am quite intrigued by some of the usages .

I am using a dynamic method of withdrawing based on each years actual balance and I left plenty of slack in the budget.

to be honest ,with 3 weeks to go I am nervous as heck.

which goes back to what I said earlier about insurance products playing A much bigger role along with our own investing . I have been looking in to this a lot lately and I am quite intrigued by some of the usages .

I am using a dynamic method of withdrawing based on each years actual balance and I left plenty of slack in the budget.

to be honest ,with 3 weeks to go I am nervous as heck.

Last edited by mathjak107 on Tue Jul 07, 2015 2:51 pm, edited 1 time in total.

Re: meeting your retirement goals with the pp

My way of making this a little less worrisome is to just not re-balance so frequently. When I first started out with the PP I stuck religiously to the 25% allocations but for the past couple of years I just check it in February and only re-balance if I exceed the bands. I was pretty close last year but let it ride for another year, so I'm probably over now but not bothering to check. I figure if it wants to get stock heavy during a time of prosperity, why fight it, as long as it doesn't exceed a reasonable degree of risk.MachineGhost wrote:Yes, that's my worry too and thanks to mathjak for bringing it up.Pointedstick wrote: I have zero worries about the PP being able to survive those kinds of crises. My worry is your other one: that the PP will miss out on a lot of growth during good times. But you can't have it both ways. The PP isn't going to grow more slowly than a stock-heavy portfolio during prosperity and then fell on its face when the markets crash or inflation picks up or interest rates rise.

Last edited by screwtape on Tue Jul 07, 2015 4:59 pm, edited 1 time in total.

Formerly known as madbean

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

Tyler wrote:But the PP has handled the worst the markets have thrown at it since 1972 much better than the 60-40 portfolio over the same timeframe. I believe that's a strong indicator that it would similarly perform better in earlier economic conditions. You cannot accept that without direct proof. We just have different perspectives. At some point we all have to make a decision that will help us sleep at night and roll with it -- to each his own. I do believe there's more than one good path to retirement finances.mathjak107 wrote: without including the 4 worst time frames looking at the time frames they extended into like the 1966 group ran through the 1970's you are not actually comparing a safe withdrawal rate by just starting the pp off in the 1970's..

In any case, I agree with you that flexibility with expenses is far more important than putting all your faith in SWRs. All of these studies have so many assumptions baked in that they rarely resemble real life.

over all rolling 30 year periods you are saying the pp did better than 60/40 since 1972 ? i would have to see that to believe it . i would be very skeptical of that claim. .

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

Tyler wrote:If one establishes their needed portfolio size based on expenses, then the issue is not how large the portfolio is at retirement but how long it takes to reach your "number".ochotona wrote: OK, but... if someone had used the PP as their accumulation phase portfolio, their portfolio size is likely smaller at retirement. So the PP has a higher SWR on a smaller amount. But if we forgot about the SW RATE and go after the SW absolute amount, based on a $10,000 investment made four decades before retirement, probably the 60/40 does not fail more than the PP.

Starting from zero and saving $2k/month, a 60-40 portfolio would get you to $1mm (in today's dollars) in 16-24 years. That's an 8-year window, and market dives right before retirement can push it out 8 years. Under the same conditions, the PP hits $1mm in 21-24 years. A 3-year window. So it's true that a 60-40 portfolio could get you there faster than the PP. But they both pretty much guarantee retirement the same year.

So IMHO it may come down to where you are in life. I would have absolutely no problem with a younger investor preferring a 60-40 portfolio for the long haul. It's a perfectly fine way to invest and has a chance for excellent returns. I discovered the PP several years before retirement, and found the lower volatility a godsend for making my own plans. While others stressed about whether markets may dive in their final few years of accumulation, I could predict my exit date pretty accurately within a few months.

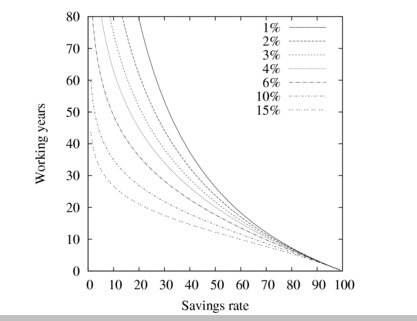

Again, note the color distribution.

As an aside, the higher your savings percentage relative to your income, the more irrelevant investment returns are to how fast you reach your goal. My secret to retiring very early honestly had nothing to do with investments. When I saw this chart, I cut the wasteful spending that wasn't making me happy anyway and upped my savings rate to 80%. Even the worst markets couldn't hold me back at that point.

the argument i would have is the accumulation stages run 25-40 years not 10 or 15. most folks do not use 40% bonds either through their accumulation stage.

i am on the 401k committee at work and the median is 80-100% equity's under the age of 50 with most in target date funds . they wouldn't see 40% bonds until pretty much retirement.

i don't think you can find many 30 year time frames where the spread between the pp and the typical target date fund or similar allocation wouldn't be very sizable .

Re: meeting your retirement goals with the pp

That's true. If one has the fortitude to ride a single total stock market fund for 30 years and never look at their accounts, they'll very likely make more money than they would with the PP.mathjak107 wrote: i don't think you can find many 30 year time frames where the spread between the pp and the typical target date fund or similar allocation wouldn't be very sizable .

But most people don't ride out their entire career in a single fund without touching it. The median duration in any single fund is historically only five years. Some people try something new and give up after only a few weeks.

I do agree that the typical accumulation phase is closer to 40 years. I personally find that to be shame and an artifact of corporate brainwashing rather than an assumption we should just accept. There's so much more to life than working 5 days a week for 40 years at a job you probably don't even care for before calling it quits and not even remembering how to feel fulfilled without a boss giving you daily direction. It doesn't have to be that way. But that's a topic for another discussion.

Last edited by Tyler on Tue Jul 07, 2015 6:02 pm, edited 1 time in total.

Re: meeting your retirement goals with the pp

Amen to that, but probably belongs over in other discussions.Tyler wrote: I do agree that the typical accumulation phase is closer to 40 years. I personally find that to be shame and an artifact of corporate brainwashing rather than an assumption we should just accept. There's so much more to life than working 5 days a week for 40 years at a job you probably don't even care for before calling it quits and not even remembering how to feel fulfilled without a boss giving you daily direction. It doesn't have to be that way. But that's a topic for another discussion.

Maybe we could get Bob Dylan to write a song about it.... 40 years of working and they put you in the drawdown phase. But not to worry, you still have "end of life issues" to plan for. Don't forget about those.

Last edited by screwtape on Tue Jul 07, 2015 5:49 pm, edited 1 time in total.

Formerly known as madbean

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

Tyler wrote:That's true. If one has the fortitude to ride a single TSM fund for 30 years and never look at their accounts, they'll very likely make more money than they would with the PP.mathjak107 wrote: i don't think you can find many 30 year time frames where the spread between the pp and the typical target date fund or similar allocation wouldn't be very sizable .

But most people don't ride out their entire career in a single TSM fund without touching it. The median duration in any single fund is historically only five years. Some people try something new and give up after only a few weeks.People constantly move things around where the action is hot, sell in a panic when things are dire, and inevitably lose money. Studies have shown that the average investor only barely beats inflation in the longrun. That's where backtests that ignore investor psychology (including PS's point that most people carry way more cash than they assume when looking at portfolio returns) miss the boat.

I do agree that the typical accumulation phase is closer to 40 years. I personally find that to be shame and an artifact of corporate brainwashing rather than an assumption we should just accept. There's so much more to life than working 5 days a week for 40 years at a job you probably don't even care for before calling it quits and not even remembering how to feel fulfilled without a boss giving you daily direction. It doesn't have to be that way. But that's a topic for another discussion.

you can't measure human emotion or investors acting badly in to the equation because it is a variable you can't measure.

but i can tell you we have so many participants in our plan that do not fiddle. they leave things alone and just don't pay attention.

the bottom line is that if you want to compare you have to compare apples to apples.

i think the inflation adjusted return for the s&p 500 cagr from 1980 to 2014 was 8.35% . most growth models run about 80-90% equity for decades before falling off . no matter how you slice it the potential was there for a considerable difference if someone wanted the volatility of a growth model.

to compare the pp to a growth model for the accumulation stage is just silly . it would be no contest.

now i am not saying that a growth model is foer everyone .. many do not want that level of swing . but to do comparisons of a typical accumulation stage model and use a 60/40 mix isn't being fair either in the comparison .

the pp is for those who do not really want to have the volatility that goes with that superior growth and that is a fine idea.. i am just against showing short 10 or 15 year time frames and 60/40 mixes and showing how superior the pp would be in the accumulation stage. not a very accurate picture of that stage and its potential. historically with more suitable allocations for that stage..

we can only talk about up to this moment since we can't predict what is a head. . .

Last edited by mathjak107 on Tue Jul 07, 2015 6:13 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: meeting your retirement goals with the pp

From 1987 starting with $10K:mathjak107 wrote: it really depends on the actual portfolio and the time frame .

as I posted above in my 27 year time frame 10k in the pp was 67k. 10k in the very conservative wellesley income I think was 167k . my own portfolio 10k was 203k . you really can't compare in general terms nor imply amounts.

For 60/40 I get 150K.

For Wellesley I get 113K.

For Vanilla PP I get $72K.

For Vanilla PP with 5-year CD ladder I get $74K.

For Vanilla PP with EW MC equity I get $86K.

For Vanilla PP with MoMo equity I get $136K.

For Vanilla PP with Quality Value equity I get $224K.

Squeezing blood from a rock here! Literally.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

https://www.portfoliovisualizer.com/bac ... sisResults shows that the nominal CAGR of a 100% stock portfolio during that time was 11%, while the PP was 7.85%.mathjak107 wrote: i think the inflation adjusted return for the s&p 500 cagr from 1980 to 2014 was 8.35% . most growth models run about 80-90% equity for decades before falling off . no matter how you slice it the potential was there for a considerable difference if someone wanted the volatility of a growth model.

to compare the pp to a growth model for the accumulation stage is just silly . it would be no contest.

But what if your accumulation phase was only 5-10 years because your goal was super-early retirement? If your 5-10 accumulation years had been anytime during 1982-1998, you'd feel like the king of the world. But what if you happened to start working in 1998? Uh-oh. Looks like your accumulation phase is going to be more like 15 years...

The point of the PP for this type of application is to reduce the yearly volatility so you can stick to your plan. If your goal is to make the maximum amount of money over 2-3 decades without looking at it or touching it or caring about volatility, then sure, I bet you could get everyone here to agree with you that a more stock-heavy portfolio would on average yield more. But that's not what most of us here are doing. This forum is heavily self-selected from among the ERE crowd precisely because it's such a good short accumulation early retirement portfolio. If there are any members of this forum in their 20s who anticipate working 3 more decades, please raise your hands! I haven't seen many. That's because the PP is an obviously inferior choice for the person who wants to maximize their potential upside over the course of decades.

Last edited by Pointedstick on Tue Jul 07, 2015 6:21 pm, edited 1 time in total.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: meeting your retirement goals with the pp

I've gathered that you jumped into the PP and then got out. Would you care to summarize for us succinctly what led to your decision in both directions? Complicated ideas with charts and figures and such don't work well with me because I'm a financial dumb-ass.mathjak107 wrote: the pp is for those who do not really want to have the volatility that goes with that superior growth and that is a fine idea.. i am just against showing short 10 or 15 year time frames and 60/40 mixes and showing how superior the pp would be in the accumulation stage. not a very accurate picture of that stage and its potential. historically with more suitable allocations for that stage..

Last edited by screwtape on Tue Jul 07, 2015 6:21 pm, edited 1 time in total.

Formerly known as madbean

Re: meeting your retirement goals with the pp

Just because it's difficult to measure doesn't mean it isn't real.mathjak107 wrote: you can't measure human emotion or investors acting badly in to the equation because it is a variable you can't measure.

[img width=500]http://www.investmentu.com/assets/image ... -chart.jpg[/img]

But yes, I will happily concede that there are better portfolios out there purely for long-term growth than the PP. I don't at all believe that there's one single portfolio that is best for every investor or situation. The trick is picking the right one ahead of time and sticking with the plan. The PP works very well for me personally because of the reasonable returns, low volatility, and neutral economic outlook. But every person is different and will have different priorities.

BTW, the real CAGR for the total stock market since 1972 is 6.0% For the PP it is 5.0%. Let's not demand more years of history for SWRs but pick shorter periods for average returns.

Last edited by Tyler on Tue Jul 07, 2015 6:31 pm, edited 1 time in total.

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

oooh we know it is real . small investors stink . i assume you see that the investor return vs the fund return is given on most funds in morningstar.

they track the money in and out and small investors do the wrong thing at the wrong time. but that still does not mean the difference in potential for someone staying the course isn't going to be pretty big most likely.

they track the money in and out and small investors do the wrong thing at the wrong time. but that still does not mean the difference in potential for someone staying the course isn't going to be pretty big most likely.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: meeting your retirement goals with the pp

mathjak107 wrote: over all rolling 30 year periods you are saying the pp did better than 60/40 since 1972 ? i would have to see that to believe it . i would be very skeptical of that claim. .

Code: Select all

60/40 PP

1928 1957 6.03% 2.86%

1929 1958 5.85% 2.72%

1930 1959 6.17% 2.96%

1931 1960 6.46% 3.23%

1932 1961 7.54% 3.64%

1933 1962 7.18% 3.54%

1934 1963 6.48% 2.68%

1935 1964 6.79% 2.62%

1936 1965 6.00% 2.26%

1937 1966 5.03% 2.01%

1938 1967 6.09% 2.99%

1939 1968 5.44% 2.78%

1940 1969 4.95% 2.49%

1941 1970 5.22% 2.66%

1942 1971 6.08% 3.35%

1943 1972 6.33% 3.78%

1944 1973 5.22% 3.82%

1945 1974 3.97% 3.72%

1946 1975 3.79% 2.91%

1947 1976 5.11% 3.59%

1948 1977 4.98% 3.93%

1949 1978 4.76% 4.09%

1950 1979 4.14% 4.65%

1951 1980 3.88% 4.51%

1952 1981 3.24% 3.97%

1953 1982 3.75% 4.47%

1954 1983 4.08% 4.44%

1955 1984 3.11% 3.87%

1956 1985 3.45% 4.11%

1957 1986 0.76% 1.88%

1958 1987 0.88% 2.11%

1959 1988 0.40% 1.77%

1960 1989 0.99% 2.04%

1961 1990 0.70% 1.82%

1962 1991 0.91% 1.76%

1963 1992 1.21% 1.69%

1964 1993 1.20% 1.81%

1965 1994 0.63% 1.47%

1966 1995 1.57% 1.97%

1967 1996 2.17% 2.18%

1968 1997 2.69% 1.81%

1969 1998 3.36% 2.04%

1970 1999 3.96% 2.47%

1971 2000 3.88% 2.37%

1972 2001 3.35% 2.06%

1973 2002 2.58% 1.54%

1974 2003 3.82% 1.76%

1975 2004 4.95% 1.85%

1976 2005 4.45% 2.02%

1977 2006 4.15% 2.12%

1978 2007 4.61% 2.47%

1979 2008 4.61% 2.47%

1980 2009 4.75% 1.71%

1981 2010 4.97% 2.09%

1982 2011 5.75% 2.85%

1983 2012 5.18% 2.39%

1984 2013 5.27% 2.27%

1985 2014 5.70% 2.63%

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

Pointedstick wrote:https://www.portfoliovisualizer.com/bac ... sisResults shows that the nominal CAGR of a 100% stock portfolio during that time was 11%, while the PP was 7.85%.mathjak107 wrote: i think the inflation adjusted return for the s&p 500 cagr from 1980 to 2014 was 8.35% . most growth models run about 80-90% equity for decades before falling off . no matter how you slice it the potential was there for a considerable difference if someone wanted the volatility of a growth model.

to compare the pp to a growth model for the accumulation stage is just silly . it would be no contest.

But what if your accumulation phase was only 5-10 years because your goal was super-early retirement? If your 5-10 accumulation years had been anytime during 1982-1998, you'd feel like the king of the world. But what if you happened to start working in 1998? Uh-oh. Looks like your accumulation phase is going to be more like 15 years...

The point of the PP for this type of application is to reduce the yearly volatility so you can stick to your plan. If your goal is to make the maximum amount of money over 2-3 decades without looking at it or touching it or caring about volatility, then sure, I bet you could get everyone here to agree with you that a more stock-heavy portfolio would on average yield more. But that's not what most of us here are doing. This forum is heavily self-selected from among the ERE crowd precisely because it's such a good short accumulation early retirement portfolio. If there are any members of this forum in their 20s who anticipate working 3 more decades, please raise your hands! I haven't seen many. That's because the PP is an obviously inferior choice for the person who wants to maximize their potential upside over the course of decades.

as i stated over and over the pp is perfect for protecting the money once your goal is reached. if you have 10 years until retirement that is perfect since you better have most of your funds already in place if you are retiring early,

Re: meeting your retirement goals with the pp

BINGO!screwtape wrote:My way of making this a little less worrisome is to just not re-balance so frequently. When I first started out with the PP I stuck religiously to the 25% allocations but for the past couple of years I just check it in February and only re-balance if I exceed the bands. I was pretty close last year but let it ride for another year, so I'm probably over now but not bothering to check. I figure if it wants to get stock heavy during a time of prosperity, why fight it, as long as it doesn't exceed a reasonable degree of risk.MachineGhost wrote:Yes, that's my worry too and thanks to mathjak for bringing it up.Pointedstick wrote: I have zero worries about the PP being able to survive those kinds of crises. My worry is your other one: that the PP will miss out on a lot of growth during good times. But you can't have it both ways. The PP isn't going to grow more slowly than a stock-heavy portfolio during prosperity and then fell on its face when the markets crash or inflation picks up or interest rates rise.

If your mind isn't loose and relaxed when you think about your investments, you're missing out on one of the biggest benefits the PP has to offer an investor.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: meeting your retirement goals with the pp

Have you examined the effect of wider rebalancing bands at peak2through?screwtape wrote: My way of making this a little less worrisome is to just not re-balance so frequently. When I first started out with the PP I stuck religiously to the 25% allocations but for the past couple of years I just check it in February and only re-balance if I exceed the bands. I was pretty close last year but let it ride for another year, so I'm probably over now but not bothering to check. I figure if it wants to get stock heavy during a time of prosperity, why fight it, as long as it doesn't exceed a reasonable degree of risk.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

MachineGhost wrote:mathjak107 wrote: over all rolling 30 year periods you are saying the pp did better than 60/40 since 1972 ? i would have to see that to believe it . i would be very skeptical of that claim. .Code: Select all

60/40 PP 1928 1957 6.03% 2.86% 1929 1958 5.85% 2.72% 1930 1959 6.17% 2.96% 1931 1960 6.46% 3.23% 1932 1961 7.54% 3.64% 1933 1962 7.18% 3.54% 1934 1963 6.48% 2.68% 1935 1964 6.79% 2.62% 1936 1965 6.00% 2.26% 1937 1966 5.03% 2.01% 1938 1967 6.09% 2.99% 1939 1968 5.44% 2.78% 1940 1969 4.95% 2.49% 1941 1970 5.22% 2.66% 1942 1971 6.08% 3.35% 1943 1972 6.33% 3.78% 1944 1973 5.22% 3.82% 1945 1974 3.97% 3.72% 1946 1975 3.79% 2.91% 1947 1976 5.11% 3.59% 1948 1977 4.98% 3.93% 1949 1978 4.76% 4.09% 1950 1979 4.14% 4.65% 1951 1980 3.88% 4.51% 1952 1981 3.24% 3.97% 1953 1982 3.75% 4.47% 1954 1983 4.08% 4.44% 1955 1984 3.11% 3.87% 1956 1985 3.45% 4.11% 1957 1986 0.76% 1.88% 1958 1987 0.88% 2.11% 1959 1988 0.40% 1.77% 1960 1989 0.99% 2.04% 1961 1990 0.70% 1.82% 1962 1991 0.91% 1.76% 1963 1992 1.21% 1.69% 1964 1993 1.20% 1.81% 1965 1994 0.63% 1.47% 1966 1995 1.57% 1.97% 1967 1996 2.17% 2.18% 1968 1997 2.69% 1.81% 1969 1998 3.36% 2.04% 1970 1999 3.96% 2.47% 1971 2000 3.88% 2.37% 1972 2001 3.35% 2.06% 1973 2002 2.58% 1.54% 1974 2003 3.82% 1.76% 1975 2004 4.95% 1.85% 1976 2005 4.45% 2.02% 1977 2006 4.15% 2.12% 1978 2007 4.61% 2.47% 1979 2008 4.61% 2.47% 1980 2009 4.75% 1.71% 1981 2010 4.97% 2.09% 1982 2011 5.75% 2.85% 1983 2012 5.18% 2.39% 1984 2013 5.27% 2.27% 1985 2014 5.70% 2.63%

nice work . it looks like no contest for the pp in comparison to even the 60/40 . i wouldn't have thought there would be that big a difference using 60/40 but if your numbers are correct the pp has a lot less growth over a typical long term accumulation stage with very few exceptions..

Last edited by mathjak107 on Tue Jul 07, 2015 6:37 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: meeting your retirement goals with the pp

Okay then! Please come up with a formula for how much to increase the PP equity to per a given age so that it decreases down to 25% at retirement age. I betcha that will work.Pointedstick wrote: The point of the PP for this type of application is to reduce the yearly volatility so you can stick to your plan. If your goal is to make the maximum amount of money over 2-3 decades without looking at it or touching it or caring about volatility, then sure, I bet you could get everyone here to agree with you that a more stock-heavy portfolio would on average yield more. But that's not what most of us here are doing. This forum is heavily self-selected from among the ERE crowd precisely because it's such a good short accumulation early retirement portfolio. If there are any members of this forum in their 20s who anticipate working 3 more decades, please raise your hands! I haven't seen many. That's because the PP is an obviously inferior choice for the person who wants to maximize their potential upside over the course of decades.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: meeting your retirement goals with the pp

Remember there is a lot of survivorship bias built into those figures.mathjak107 wrote:nice work . it looks like no ontest for the pp in comparison to even the 60/40 .MachineGhost wrote:mathjak107 wrote: over all rolling 30 year periods you are saying the pp did better than 60/40 since 1972 ? i would have to see that to believe it . i would be very skeptical of that claim. .Code: Select all

60/40 PP 1928 1957 6.03% 2.86% 1929 1958 5.85% 2.72% 1930 1959 6.17% 2.96% 1931 1960 6.46% 3.23% 1932 1961 7.54% 3.64% 1933 1962 7.18% 3.54% 1934 1963 6.48% 2.68% 1935 1964 6.79% 2.62% 1936 1965 6.00% 2.26% 1937 1966 5.03% 2.01% 1938 1967 6.09% 2.99% 1939 1968 5.44% 2.78% 1940 1969 4.95% 2.49% 1941 1970 5.22% 2.66% 1942 1971 6.08% 3.35% 1943 1972 6.33% 3.78% 1944 1973 5.22% 3.82% 1945 1974 3.97% 3.72% 1946 1975 3.79% 2.91% 1947 1976 5.11% 3.59% 1948 1977 4.98% 3.93% 1949 1978 4.76% 4.09% 1950 1979 4.14% 4.65% 1951 1980 3.88% 4.51% 1952 1981 3.24% 3.97% 1953 1982 3.75% 4.47% 1954 1983 4.08% 4.44% 1955 1984 3.11% 3.87% 1956 1985 3.45% 4.11% 1957 1986 0.76% 1.88% 1958 1987 0.88% 2.11% 1959 1988 0.40% 1.77% 1960 1989 0.99% 2.04% 1961 1990 0.70% 1.82% 1962 1991 0.91% 1.76% 1963 1992 1.21% 1.69% 1964 1993 1.20% 1.81% 1965 1994 0.63% 1.47% 1966 1995 1.57% 1.97% 1967 1996 2.17% 2.18% 1968 1997 2.69% 1.81% 1969 1998 3.36% 2.04% 1970 1999 3.96% 2.47% 1971 2000 3.88% 2.37% 1972 2001 3.35% 2.06% 1973 2002 2.58% 1.54% 1974 2003 3.82% 1.76% 1975 2004 4.95% 1.85% 1976 2005 4.45% 2.02% 1977 2006 4.15% 2.12% 1978 2007 4.61% 2.47% 1979 2008 4.61% 2.47% 1980 2009 4.75% 1.71% 1981 2010 4.97% 2.09% 1982 2011 5.75% 2.85% 1983 2012 5.18% 2.39% 1984 2013 5.27% 2.27% 1985 2014 5.70% 2.63%

I suspect that a German, French, Italian, Greek, Russian, Mexican, Cuban, Lebanese, Japanese, Chinese or British PP wouldn't have fared nearly so well during many of those periods above.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: meeting your retirement goals with the pp

I don't think that risk tolerance is as much a function of age as many people think.MachineGhost wrote:Okay then! Please come up with a formula for how much to increase the PP equity to per a given age so that it decreases down to 25% at retirement age. I betcha that will work.Pointedstick wrote: The point of the PP for this type of application is to reduce the yearly volatility so you can stick to your plan. If your goal is to make the maximum amount of money over 2-3 decades without looking at it or touching it or caring about volatility, then sure, I bet you could get everyone here to agree with you that a more stock-heavy portfolio would on average yield more. But that's not what most of us here are doing. This forum is heavily self-selected from among the ERE crowd precisely because it's such a good short accumulation early retirement portfolio. If there are any members of this forum in their 20s who anticipate working 3 more decades, please raise your hands! I haven't seen many. That's because the PP is an obviously inferior choice for the person who wants to maximize their potential upside over the course of decades.

I believe that a person's risk tolerance is more a function of his psychological makeup than his age.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”