https://sowhat.ist/the-4-rule-financial ... af746c64d8

or

http://www.investopedia.com/terms/f/fou ... t-rule.asp

Do the member of this forum believe in the 4% rule? or is it more like 3%, 2%? Or is the thinking flawed?

4% Rule: Do PPers Believe in it?

Moderator: Global Moderator

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

- Mountaineer

- Executive Member

- Posts: 4960

- Joined: Tue Feb 07, 2012 10:54 am

Re: 4% Rule: Do PPers Believe in it?

2.76767659842987%

On a more serious note, I retired several years before "typical retirement age". I planned for more of a 2 to 3% rule due to a higher probablity of success; the consequences of missing with a 4% rule were rather severe if I were to live longer than "average". I viewed the numbers as a guide only, not a hard and fast rule, as there are many other considerations when planning for retirement.

On a more serious note, I retired several years before "typical retirement age". I planned for more of a 2 to 3% rule due to a higher probablity of success; the consequences of missing with a 4% rule were rather severe if I were to live longer than "average". I viewed the numbers as a guide only, not a hard and fast rule, as there are many other considerations when planning for retirement.

DNA has its own language (code), and language requires intelligence. There is no known mechanism by which matter can give birth to information, let alone language. It is unreasonable to believe the world could have happened by chance.

Re: 4% Rule: Do PPers Believe in it?

The 4% rule is fine conceptually, but the studies that established it started with some very important assumptions that too many people ignore:

1) The only two investment options are an S&P500 index fund and an intermediate bond index fund.

2) You live and invest exclusively in the US and experience US inflation with no currency conversions required.

3) You plan to live off of your investments exactly 30 years and go broke the day you die (in the worst historical scenario).

4) The worst historical retirement date was not less than 30 years ago.

5) You plan to maintain a constant standard of living that merely paces inflation every year. You never increase or reduce your expenses and never earn another dollar in your life.

6) You stuck with the same plan for 30 years and never got spooked out of the market by a steep market drop.

Break any of those assumptions, and the 4% rule no longer applies to you. Most people break at least one, so IMHO the 4% rule is mostly a security blanket for a retirement conversation launching point with very little foundation in the everyday world. But luckily, you can apply the same math to identify portfolios (like the PP) that may work really well for you and even have withdrawal rates north of 4%.

For lots more info, read each of these articles in order: https://portfoliocharts.com/portfolio/r ... nt-income/

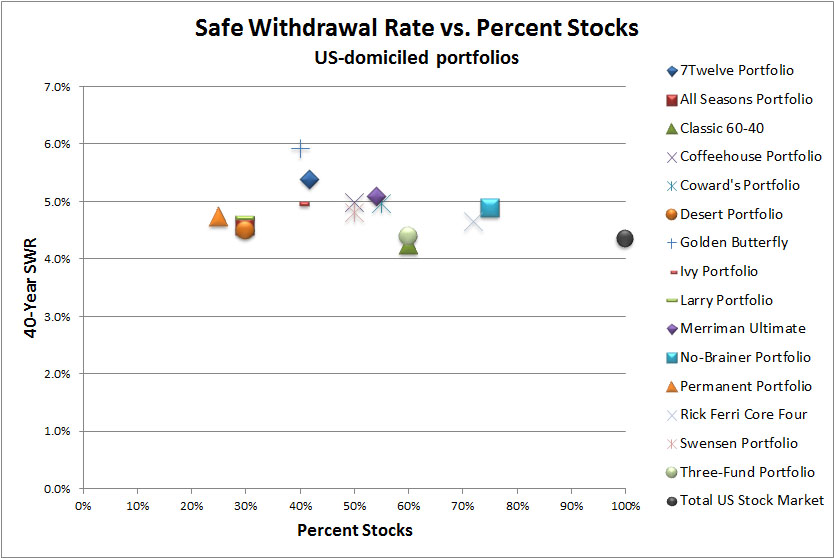

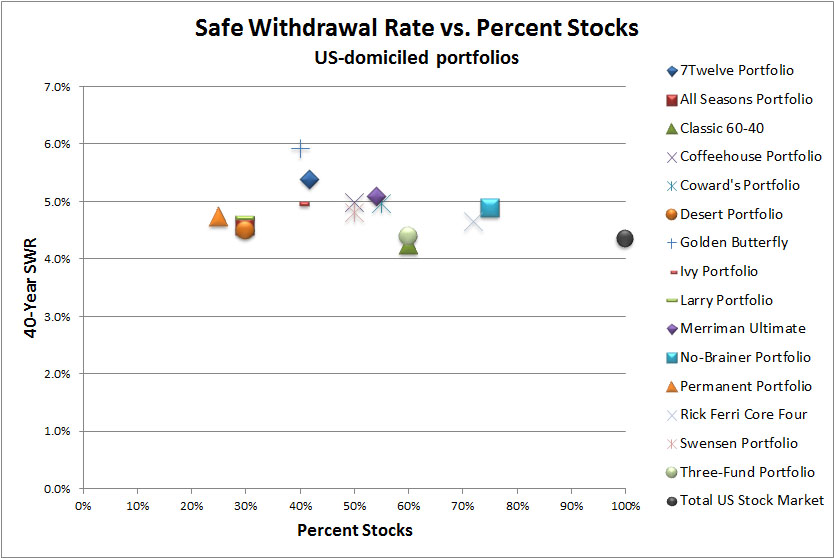

Just looking at item #1, withdrawal rates for different asset allocations are WAY more interesting than the typical literature implies. Loading up on stocks is not all it's cracked up to be, and that conclusion is drawn simply because most studies arbitrarily limit themselves to only one other option!

1) The only two investment options are an S&P500 index fund and an intermediate bond index fund.

2) You live and invest exclusively in the US and experience US inflation with no currency conversions required.

3) You plan to live off of your investments exactly 30 years and go broke the day you die (in the worst historical scenario).

4) The worst historical retirement date was not less than 30 years ago.

5) You plan to maintain a constant standard of living that merely paces inflation every year. You never increase or reduce your expenses and never earn another dollar in your life.

6) You stuck with the same plan for 30 years and never got spooked out of the market by a steep market drop.

Break any of those assumptions, and the 4% rule no longer applies to you. Most people break at least one, so IMHO the 4% rule is mostly a security blanket for a retirement conversation launching point with very little foundation in the everyday world. But luckily, you can apply the same math to identify portfolios (like the PP) that may work really well for you and even have withdrawal rates north of 4%.

For lots more info, read each of these articles in order: https://portfoliocharts.com/portfolio/r ... nt-income/

Just looking at item #1, withdrawal rates for different asset allocations are WAY more interesting than the typical literature implies. Loading up on stocks is not all it's cracked up to be, and that conclusion is drawn simply because most studies arbitrarily limit themselves to only one other option!

Re: 4% Rule: Do PPers Believe in it?

I think of the 4% rule as a guideline. In practice, the PP and its variants are exceptionally strong in retirement because of factors that are not accounted for in the Trinity study, nor in most SWR calculations: the cash allocation, band-triggered rebalancing, and low volatility. Tyler, I believe you did use the spreadsheet simulation to calculate SWRs for the PP?

It would be great to survey real life retirement experiences though, to assess prospectively the role of a person-controlled portfolio in retirement, and how it actually survives over the years. I expect few people rely solely on the portfolio, or even portfolio + Social Security. Even with all the dire statistics out there on how little retirement savings people have, we don't hear much about starving octogenarians who have spent down all their savings. I do however know of quite a few instances where family have stepped in to help, or people who have nominally retired have to go get jobs.

It would be great to survey real life retirement experiences though, to assess prospectively the role of a person-controlled portfolio in retirement, and how it actually survives over the years. I expect few people rely solely on the portfolio, or even portfolio + Social Security. Even with all the dire statistics out there on how little retirement savings people have, we don't hear much about starving octogenarians who have spent down all their savings. I do however know of quite a few instances where family have stepped in to help, or people who have nominally retired have to go get jobs.

Re: 4% Rule: Do PPers Believe in it?

Yep! https://portfoliocharts.com/portfolio/p ... portfolio/WiseOne wrote:Tyler, I believe you did use the spreadsheet simulation to calculate SWRs for the PP?

Compare the PP charts to other portfolio options, and it really drives home just how consistently the PP performs.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: 4% Rule: Do PPers Believe in it?

I didnt know you had so many articles on that site! And the withdrawal rate calculator is great. Thank you.Tyler wrote: For lots more info, read each of these articles in order: https://portfoliocharts.com/portfolio/r ... nt-income/