For the financially independent among us

Moderator: Global Moderator

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

For the financially independent among us

Question for the forum's financially independent folks: did you become that way primarily through ownership of a business, or as a salaried employee who saved a lot? See the poll.

. . .

This topic, and the discussion I'm hoping to kindle, are sort of a continuation of the "is the successful salaried retail investor a myth?" thread, inspired by a post of TennPaGa's recently. He posted a quote from an article indicating that even Warren Buffett--probably the world's best known investor--actually made most of his initial wealth as more of a business owner than an investor: http://gyroscopicinvesting.com/forum/st ... #msg100171

It seems like the traditional route to a great deal of wealth has always been ownership of a business. Basically, you make your money in business, then you invest it to protect or grow it. The route "little guys" like us are taking, of trying to invest our savings while we're still earning money, is actually very risky because we don't yet have the money cushion of the truly rich that would enable us to weather a 20 or 40% decline that truly lucrative investments (like stocks) may deliver, even if the individual declines are relatively infrequent.

What we consider today to be "safe" and "traditional" approaches to retirement such as working for 30 years and saving money in our 401ks are actually being totally new, untried, and seem to be largely unsuccessful for most of the people who are attempting it. The ERE philosophy and the PP seem to be two "hacks" that basically make it work by 1) rapidly increasing cash wealth to provide you with more of a money cushion, and 2) reducing the volatility of the investments that destroy most small investors' returns through panic sale and low total returns throughout an investing career that may be punctuated by intermittent withdrawals.

. . .

This topic, and the discussion I'm hoping to kindle, are sort of a continuation of the "is the successful salaried retail investor a myth?" thread, inspired by a post of TennPaGa's recently. He posted a quote from an article indicating that even Warren Buffett--probably the world's best known investor--actually made most of his initial wealth as more of a business owner than an investor: http://gyroscopicinvesting.com/forum/st ... #msg100171

It seems like the traditional route to a great deal of wealth has always been ownership of a business. Basically, you make your money in business, then you invest it to protect or grow it. The route "little guys" like us are taking, of trying to invest our savings while we're still earning money, is actually very risky because we don't yet have the money cushion of the truly rich that would enable us to weather a 20 or 40% decline that truly lucrative investments (like stocks) may deliver, even if the individual declines are relatively infrequent.

What we consider today to be "safe" and "traditional" approaches to retirement such as working for 30 years and saving money in our 401ks are actually being totally new, untried, and seem to be largely unsuccessful for most of the people who are attempting it. The ERE philosophy and the PP seem to be two "hacks" that basically make it work by 1) rapidly increasing cash wealth to provide you with more of a money cushion, and 2) reducing the volatility of the investments that destroy most small investors' returns through panic sale and low total returns throughout an investing career that may be punctuated by intermittent withdrawals.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: For the financially independent among us

Put me down for the salaried route. And allow me to put on my FI enthusiasm hat for a few minutes. I love this topic.

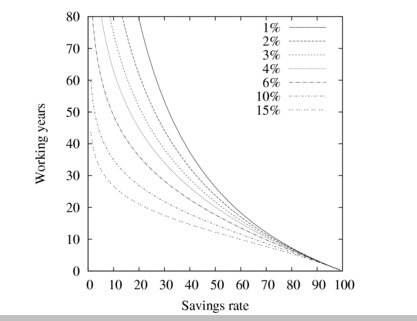

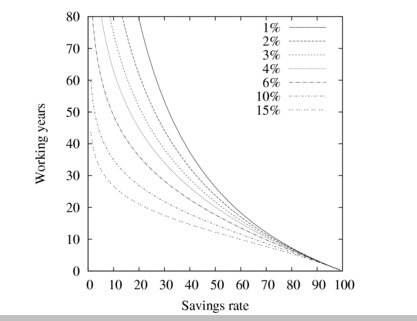

Achieving financial independence is fundamentally a simple matter of savings rate, not absolute income. From the ERE book:

Look at the 6% returns curve. The typical advice of saving 10% of your income (living on the other 90%) will require you to work almost 50 years in order to be financially independent. People working until they're 70 sounds about right these days. And those are the "responsible" ones who actually save anything at all. For these people, even starting a successful business and making millions will not get them any closer to retirement if they scale their spending accordingly and blow 90% of their income on yachts and vacation homes. But this consumerist mentality is, in fact, the norm today.

Now look to the right end of the chart. If you save 70% of your income, you will be FI in a mere 10 years! For the average person, saving that much sounds ridiculous and something like owning a business would be necessary to pull this off while maintaining their "earned" standard of living. But the subset of people who earn decent salaries and consciously live simple lives are in a particularly strong position if they understand the math here.

My wife and I are DINKS so we had a good amount of income to work with. And we happen to be low-maintenance people who have generally avoided lifestyle inflation over the years. All was well and good, but once we got on the ERE bandwagon about three years ago we got serious and made some big changes (like moving out of the Bay Area, minimizing recurring bills, etc) to really go for it. As a result, our savings rate has peaked out over 80% the last few years while our general life satisfaction has (somewhat counter-intuitively based on popular consumerist culture) greatly improved. We're on track to hit our big FI "number" within the next few weeks. In our late 30s.

For anyone who has been keeping up with my posts lately, it should come as no surprise that I'm a huge fan of the PP as a retirement portfolio. But I really like it as an accumulation portfolio as well, especially for someone who saves as aggressively as I do. The thing about potentially retiring before 40 is that you don't have the typical decades to wait out the periodic big stock market dive for your solid long-term returns to average out. If I was this close to FI in 2008 in 100% stocks, I'd be seriously depressed watching my savings crater and knowing I'd be working for years to recover. Instead, my savings just keep on growing. It's a great feeling, and makes financial planning a lot easier.

The HBPP & ERE have been some of the most positive and meaningful philosophies in my life to date. Two great things that go great together.

Achieving financial independence is fundamentally a simple matter of savings rate, not absolute income. From the ERE book:

Look at the 6% returns curve. The typical advice of saving 10% of your income (living on the other 90%) will require you to work almost 50 years in order to be financially independent. People working until they're 70 sounds about right these days. And those are the "responsible" ones who actually save anything at all. For these people, even starting a successful business and making millions will not get them any closer to retirement if they scale their spending accordingly and blow 90% of their income on yachts and vacation homes. But this consumerist mentality is, in fact, the norm today.

Now look to the right end of the chart. If you save 70% of your income, you will be FI in a mere 10 years! For the average person, saving that much sounds ridiculous and something like owning a business would be necessary to pull this off while maintaining their "earned" standard of living. But the subset of people who earn decent salaries and consciously live simple lives are in a particularly strong position if they understand the math here.

My wife and I are DINKS so we had a good amount of income to work with. And we happen to be low-maintenance people who have generally avoided lifestyle inflation over the years. All was well and good, but once we got on the ERE bandwagon about three years ago we got serious and made some big changes (like moving out of the Bay Area, minimizing recurring bills, etc) to really go for it. As a result, our savings rate has peaked out over 80% the last few years while our general life satisfaction has (somewhat counter-intuitively based on popular consumerist culture) greatly improved. We're on track to hit our big FI "number" within the next few weeks. In our late 30s.

For anyone who has been keeping up with my posts lately, it should come as no surprise that I'm a huge fan of the PP as a retirement portfolio. But I really like it as an accumulation portfolio as well, especially for someone who saves as aggressively as I do. The thing about potentially retiring before 40 is that you don't have the typical decades to wait out the periodic big stock market dive for your solid long-term returns to average out. If I was this close to FI in 2008 in 100% stocks, I'd be seriously depressed watching my savings crater and knowing I'd be working for years to recover. Instead, my savings just keep on growing. It's a great feeling, and makes financial planning a lot easier.

The HBPP & ERE have been some of the most positive and meaningful philosophies in my life to date. Two great things that go great together.

Last edited by Tyler on Thu Jul 24, 2014 12:16 am, edited 1 time in total.

Re: For the financially independent among us

This is true. When left to their own devices, most people don't save enough and the ones that do are often terrible investors. And sadly, the assumption that one can stay fully employed for 30+ years is quickly eroding as well.Pointedstick wrote: What we consider today to be "safe" and "traditional" approaches to retirement such as working for 30 years and saving money in our 401ks are actually being totally new, untried, and seem to be largely unsuccessful for most of the people who are attempting it.

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: For the financially independent among us

Congratulations, Tyler! That's impressive. I think you've illustrated the point I was trying to make: ERE and the PP are hacks to make the traditional new model of wage slavery salaried corporate employment actually work when it comes to providing for a secure financial future.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: For the financially independent among us

Agreed. I also find them quite complementary philosophically, especially when you start thinking about antifragile systems. For me, a big part of financial independence is building a resilient life, and both the PP and ERE share that mindset.Pointedstick wrote: ERE and the PP are hacks to make the traditional new model of wage slavery salaried corporate employment actually work when it comes to providing for a secure financial future.

And FWIW, I could see myself trying to start a small business once my salary man days are over. Having a solid financial backstop has a way of making me feel more entrepreneurial.

Last edited by Tyler on Thu Jul 24, 2014 7:30 pm, edited 1 time in total.

Re: For the financially independent among us

Bit of both, needed to have a voting slider

Salary got me to being almost debt free with a fair buffer, random business related luck and some extra lifestyle adjustments did the rest.

However probably the biggest factor was the desire born from the experience of the dot com bomb years just as I was starting out with mortgage and family.

Anyone that's been in that circumstance doesn't need the FI / PP hacks explaining, but you can talk yourself blue to many that haven't.

If you can see the need for FI there's probably a way, I felt the boot on my neck before I saw the need.

Salary got me to being almost debt free with a fair buffer, random business related luck and some extra lifestyle adjustments did the rest.

However probably the biggest factor was the desire born from the experience of the dot com bomb years just as I was starting out with mortgage and family.

Anyone that's been in that circumstance doesn't need the FI / PP hacks explaining, but you can talk yourself blue to many that haven't.

If you can see the need for FI there's probably a way, I felt the boot on my neck before I saw the need.

Re: For the financially independent among us

I went the business route, but I've met a lot of extreme savers who went the salaried employee route.

Here's a presentation that I did comparing four different ways to quit the rat race (including the two options in the OP): https://www.youtube.com/watch?v=Zz-dxV8VfPE

Here's a presentation that I did comparing four different ways to quit the rat race (including the two options in the OP): https://www.youtube.com/watch?v=Zz-dxV8VfPE

- WildAboutHarry

- Executive Member

- Posts: 1090

- Joined: Wed May 04, 2011 9:35 am

Re: For the financially independent among us

[quote=MangoMan]This was touched on briefly in another thread, but it really worries me and think it needs discussion. More from the perspective of how to protect yourself if it happens, rather than whether or not it will. WWHBD? [What would Harry Browne do?][/quote]

Harry would have some money overseas to protect against confiscatory programs at home. Oops, can't do that anymore.

I would, in no particular order:

1) Diversify investments among different tax treatments (taxable, Roth, IRA, etc.)

2) Hold physical precious metals, in your possession.

3) Own real estate (mortgage free if possible).

4) Get out of and stay out of debt.

5) Keep a cash reserve (mattress, safe deposit box).

6) Live a lifestyle that appears well below your actual means.

7) Stay informed and be ready to adjust to changing circumstances.

Harry would have some money overseas to protect against confiscatory programs at home. Oops, can't do that anymore.

I would, in no particular order:

1) Diversify investments among different tax treatments (taxable, Roth, IRA, etc.)

2) Hold physical precious metals, in your possession.

3) Own real estate (mortgage free if possible).

4) Get out of and stay out of debt.

5) Keep a cash reserve (mattress, safe deposit box).

6) Live a lifestyle that appears well below your actual means.

7) Stay informed and be ready to adjust to changing circumstances.

It is the settled policy of America, that as peace is better than war, war is better than tribute. The United States, while they wish for war with no nation, will buy peace with none" James Madison

Re: For the financially independent among us

The main thing I can think of is to decouple your life, to the best of your ability, from cash flow. Taxes and redistribution in the United States almost always hit cash flow rather than savings.MangoMan wrote: This was touched on briefly in another thread, but it really worries me and think it needs discussion. More from the perspective of how to protect yourself if it happens, rather than whether or not it will. WWHBD? [What would Harry Browne do?]

1) If you're not working, you have no regular income for the IRS to tax

2) Avoid income portfolios, and stick with capital gains that you have the power to optimize for tax efficiency (the PP is quite good in this regard)

3) Don't spend a lot of money. As a corollary, learn to do things yourself (fix you own car, grow your own food, etc) rather than pay someone else to do it for you.

4) Don't depend on government handouts or subsidies that can be taken away

If you follow 1-3, one can live quite comfortably while appearing to the IRS to be living near the poverty line from an income perspective. As a result, it's feasible to pay zero federal taxes today even on a million-dollar portfolio. You'll probably receive various subsidies and tax credits, in fact. And if you follow 4, you won't care if they bother to means-check the handouts.

Last edited by Tyler on Fri Jul 25, 2014 9:55 am, edited 1 time in total.

Re: For the financially independent among us

My advice keeps the IRS hands off of your retirement income, and may actually make you a beneficiary from popular redistribution. There will always be opportunities for smart and flexible people to use the existing system to their advantage.MangoMan wrote: Same comment as above. Good advice that unfortunately doesn't really ease my pain.

If your fear is direct confiscation of savings accounts, I don't know what to say other than be prepared to leave with your gold or get another job. But stealing property has always been a very difficult political sell compared to taxing new money, and honestly so few people save for retirement any more that there probably won't be much there as a whole to confiscate. It's a lot easier to tax the income of the young to fund the lifestyles of the old -- that's what they do today and what I imagine will continue for quite a while.

In any case, what's the alternative? Join the crowd spending every dollar they make and depending on the government or perpetual uninterrupted salaried employment to sustain them? Pass. I'd much rather be in the position of being financially independent and keeping an eye out for ways to preserve my savings than to be dependent on others to survive. Whatever the risk of someone taking my money in 20 years, it's still much less than the risk associated with depending on bureaucrats and corporations for my needs. I just make the best decisions I can based on current information in front of me, and will adjust as I need to. I'm confident in my abilities to adapt.

Last edited by Tyler on Fri Jul 25, 2014 11:49 am, edited 1 time in total.

- Early Cuyler

- Full Member

- Posts: 81

- Joined: Sun Mar 11, 2012 12:24 am

Re: For the financially independent among us

+1. Great post, Tyler!MangoMan wrote:Now that's soothingTyler wrote:My advice keeps the IRS hands off of your retirement income, and may actually make you a beneficiary from popular redistribution. There will always be opportunities for smart and flexible people to use the existing system to their advantage.MangoMan wrote: Same comment as above. Good advice that unfortunately doesn't really ease my pain.

If your fear is direct confiscation of savings accounts, I don't know what to say other than be prepared to leave with your gold or get another job. But stealing property has always been a very difficult political sell compared to taxing new money, and honestly so few people save for retirement any more that there probably won't be much there as a whole to confiscate. It's a lot easier to tax the income of the young to fund the lifestyles of the old -- that's what they do today and what I imagine will continue for quite a while.

In any case, what's the alternative? Join the crowd spending every dollar they make and depending on the government or perpetual uninterrupted salaried employment to sustain them? Pass. I'd much rather be in the position of being financially independent and keeping an eye out for ways to preserve my savings than to be dependent on others to survive. Whatever the risk of someone taking my money in 20 years, it's still much less than the risk associated with depending on bureaucrats and corporations for my needs. I just make the best decisions I can based on current information in front of me, and will adjust as I need to. I'm confident in my abilities to adapt.

Thanks!

I am by no means rich, but all of my savings are a result of a combination of decent pay and extremely low expenses. Having no children also helps of course.

You know how I feel about handouts...cash is much more flexible, hell, cash is king!

Re: For the financially independent among us

great discussion

I had to look up some acronyms to try to follow though and have some questions

FI - apparently there is a number/level reached for this, which is what calculation/where?

ERE - do I need to read the book mentioned to grasp this?

thanks

I had to look up some acronyms to try to follow though and have some questions

FI - apparently there is a number/level reached for this, which is what calculation/where?

ERE - do I need to read the book mentioned to grasp this?

thanks

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: For the financially independent among us

It's when you've accumulated investments equal to 25-33x your annual expenses.workingatit wrote: great discussion

I had to look up some acronyms to try to follow though and have some questions

FI - apparently there is a number/level reached for this, which is what calculation/where?

TL;DR version: achieve FI before 40. Or maybe even before 30 for RERE (ridiculously early retirement extreme)!workingatit wrote: ERE - do I need to read the book mentioned to grasp this?

thanks

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: For the financially independent among us

Anyone have anything to add or quibble with on WildAboutHarry's list?

Again, he suggests ("in no particular order"):

1) Diversify investments among different tax treatments (taxable, Roth, IRA, etc.)

2) Hold physical precious metals, in your possession.

3) Own real estate (mortgage free if possible).

4) Get out of and stay out of debt.

5) Keep a cash reserve (mattress, safe deposit box).

6) Live a lifestyle that appears well below your actual means.

7) Stay informed and be ready to adjust to changing circumstances.

They all look like good steps to me mostly because they are steps that I have already taken (confirmation bias alert!). One point that I don't see discussed much is #5. In the US I hear so many folks say things like "I haven't used cash in such and such amount of time." I continue to use it a lot as it makes the pain of paying for something tangible. But I also think it might be a good idea to keep a decent amount on hand just in case there is a shortage.

And, just to tie in with the theme that PS started the thread with, I am not yet FI but whatever steps I have taken in that direction are through running my own business. Never actually had a salary.

Again, he suggests ("in no particular order"):

1) Diversify investments among different tax treatments (taxable, Roth, IRA, etc.)

2) Hold physical precious metals, in your possession.

3) Own real estate (mortgage free if possible).

4) Get out of and stay out of debt.

5) Keep a cash reserve (mattress, safe deposit box).

6) Live a lifestyle that appears well below your actual means.

7) Stay informed and be ready to adjust to changing circumstances.

They all look like good steps to me mostly because they are steps that I have already taken (confirmation bias alert!). One point that I don't see discussed much is #5. In the US I hear so many folks say things like "I haven't used cash in such and such amount of time." I continue to use it a lot as it makes the pain of paying for something tangible. But I also think it might be a good idea to keep a decent amount on hand just in case there is a shortage.

And, just to tie in with the theme that PS started the thread with, I am not yet FI but whatever steps I have taken in that direction are through running my own business. Never actually had a salary.

- WildAboutHarry

- Executive Member

- Posts: 1090

- Joined: Wed May 04, 2011 9:35 am

Re: For the financially independent among us

I agree with barrett and would add (or modify #5) spending cash whenever possible, rather than using credit or debit cards.

Call me paranoid, but I want to minimize my financial trail as much as possible ("You are paranoid", says you). Also minimizes chances for fraud, etc.

Call me paranoid, but I want to minimize my financial trail as much as possible ("You are paranoid", says you). Also minimizes chances for fraud, etc.

It is the settled policy of America, that as peace is better than war, war is better than tribute. The United States, while they wish for war with no nation, will buy peace with none" James Madison

Re: For the financially independent among us

I personally have no issue with credit cards as long as they are always paid off monthly. The ones with cash back are actually quite nice for people who never pay interest.

I do have about $1k in cash in the house mostly as a (rarely used) Craigslist fund. But it's also nice to have around for the occasional ice storm or blackout where communication lines are not guaranteed to be functioning at the grocery store for a time.

I do have about $1k in cash in the house mostly as a (rarely used) Craigslist fund. But it's also nice to have around for the occasional ice storm or blackout where communication lines are not guaranteed to be functioning at the grocery store for a time.

Re: For the financially independent among us

Desert,

I am a self-employed freelance entertainer. To say I "run" a business is even a bit of a stretch.

I am a self-employed freelance entertainer. To say I "run" a business is even a bit of a stretch.

Re: For the financially independent among us

I would add that becoming a government employee , in my case a federal employee, is a great way to become financially independent. The pay and benefits are excellent, in many cases better than the private sector, and they still offer old fashioned pensions. I know teachers in New York who are guaranteed a rate of return on their investments of 7%! Where can you get that kind of stuff in the real world?

-

flyingpylon

- Executive Member

- Posts: 1102

- Joined: Fri Jan 06, 2012 9:04 am

Re: For the financially independent among us

And related to that, a US military career if especially if you do well and you go the full 30 years. Though of course there are more than the usual risks involved in that plan.Reub wrote: I would add that becoming a government employee , in my case a federal employee, is a great way to become financially independent.

Re: For the financially independent among us

With "irresponsible people who did stupid things" you mean mostly the banks I suppose? That's where most of the bailout money went.MangoMan wrote:What I witnessed during the housing bust was a bunch of irresponsible people who did stupid things and were bailed out by the responsible people who did the smart thing.

"Well, if you're gonna sin you might as well be original" -- Mike "The Cool-Person"

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

Re: For the financially independent among us

Do you think your acquaintances set out to benefit at your expense when they were shopping for a house and a mortgage?MangoMan wrote:I had serious feelings of unfairness, however, when acquaintances would tell me that they had part of their mortgage forgiven...

The bank bailouts were "at your expense" too, and probably slightly more expensive. And they were certainly out to benefit. Seems unfair too.

"Well, if you're gonna sin you might as well be original" -- Mike "The Cool-Person"

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

- Mountaineer

- Executive Member

- Posts: 4960

- Joined: Tue Feb 07, 2012 10:54 am

Re: For the financially independent among us

I'd suggest if those acquaintances are like most, they are out to extract from everyone else the the maximum possible to benefit themselves. In my opinion, there are very few altruistic people on this side of heaven.Jan Van wrote:Do you think your acquaintances set out to benefit at your expense when they were shopping for a house and a mortgage?MangoMan wrote:I had serious feelings of unfairness, however, when acquaintances would tell me that they had part of their mortgage forgiven...

The bank bailouts were "at your expense" too, and probably slightly more expensive. And they were certainly out to benefit. Seems unfair too.

... Mountaineer

DNA has its own language (code), and language requires intelligence. There is no known mechanism by which matter can give birth to information, let alone language. It is unreasonable to believe the world could have happened by chance.

Re: For the financially independent among us

Which then also would explain why the banks did what they did. But wouldn't that spell trouble for the future acceptance rate for heaven? Guess that's another thread though!Mountaineer wrote: I'd suggest if those acquaintances are like most, they are out to extract from everyone else the the maximum possible to benefit themselves. In my opinion, there are very few altruistic people on this side of heaven.

"Well, if you're gonna sin you might as well be original" -- Mike "The Cool-Person"

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

"Yeah, well, that’s just, like, your opinion, man" -- The Dude

- Mountaineer

- Executive Member

- Posts: 4960

- Joined: Tue Feb 07, 2012 10:54 am

Re: For the financially independent among us

You get to heaven not on what you do but on what you believe. (As you can probably tell, I do not subscribe to a works-righteous interpretation of Scripture - I am a "justification by grace through faith" guy.)Jan Van wrote:Which then also would explain why the banks did what they did. But wouldn't that spell trouble for the future acceptance rate for heaven? Guess that's another thread though!Mountaineer wrote: I'd suggest if those acquaintances are like most, they are out to extract from everyone else the the maximum possible to benefit themselves. In my opinion, there are very few altruistic people on this side of heaven.

... Mountaineer

DNA has its own language (code), and language requires intelligence. There is no known mechanism by which matter can give birth to information, let alone language. It is unreasonable to believe the world could have happened by chance.