Re: Rethinking the Permanent Portfolio

Posted: Fri Jun 28, 2019 2:09 am

I think I found it. Definitely looks like a good read, but I too couldn't find a non-paywall version.

Permanent Portfolio Forum

https://www.gyroscopicinvesting.com/forum/

https://www.gyroscopicinvesting.com/forum/viewtopic.php?t=9960

I think I found it. Definitely looks like a good read, but I too couldn't find a non-paywall version.

Code: Select all

!googleCode: Select all

!google “The Worthy Idea Behind Facebook’s Libra”You’re right. I’ve been wasting my time!InsuranceGuy wrote: ↑Fri Jun 28, 2019 10:17 amDoing this completely bypasses any privacy of DDG. Because your search is actually taking place on that other site, you are subject to that site’s policies, including its data collection practices.dualstow wrote: ↑Fri Jun 28, 2019 8:16 am In other words, at duckduckgo, searchCode: Select all

!google “The Worthy Idea Behind Facebook’s Libra”

You might as well go to google.com, bend over, and search “The Worthy Idea Behind Facebook’s Libra” as that is what is happening through DDG.

That's why I prefer Beanie Babies for my portfolio! At least you have a plush toy.Ad Orientem wrote: ↑Sat Jun 29, 2019 12:02 pm Late to this discussion and I haven't read all the comments so apologies if my comment has already been made.

Cryptos are a new and largely untested type of asset with no real history to them. In this sense I don't think they have a place in any PP much less the HBPP. They are at best a speculative investment. It's hard to see them gaining acceptance of the kind we accord to stocks, cash, bonds and gold anytime in what remains of my life. Looking at them on a solely speculative basis, I am not impressed. They strike me as incredibly high risk with all kinds of variables, including potential government regulation, or worse, the continued near complete absence of regulation. And lastly it strikes me as something perilously close to a scam. A sort of tech fantasy turned racket. In the 1970's someone made a fortune marketing "pet rocks." But the big difference was that if you sent in your order with a check, you actually did get a rock mailed back to you. What am I getting here that is real or tangible?

Libra is simply a peg to a basket of currencies. You could do that now without any counterparty risk with the whole custody thing.Smith1776 wrote: ↑Thu Jun 20, 2019 3:36 pm The question I think is: what should be in that 12.5% cryptocurrency allocation? All Libra? All Bitcoin? An index of ALL cryptocurrencies? Maybe half in Libra and half in Bitcoin? What about the issue of increased complexity vs. a desire for simplicity in the portfolio?

I don't have answers to any of those questions, but I have been thinking on this matter a lot. Either way, I am convinced that this issue is worth considering, because the status of gold as the de facto alt cash in society may not be as strong as it once was in the coming decades.

My personal feeling is that a Libra dominated allocation to cryptocurrencies, with some exposure to others like bitcoin may be prudent in the coming years. Heck, if someone could create a basket or vehicle to hold all of them in one security, that might be the balance one needs to between the increased complexity and the desire to maintain simplicity.

Mind everyone, I am not proposing that we should all just suddenly make a major shift in the PP theory today. I'd like to simply explore what this all means, and not potentially get stuck in the past by stubbornly espousing an investing theory founded by a man who never lived to see this era. No one can know what Browne would have thought.

Is that what Adam Smith meant when he was talking about economies of scale?bitcoininthevp wrote: ↑Wed Jul 03, 2019 12:59 pm Gold (and not silver, copper, etc) was selected by Harry because it had the highest % of its value derived from monetary value (vs industrial value). You would want to apply the same logic to holding crypto. Hold the "best money" crypto. Not some blockchain token that lets you track organic salmon* or some nonsense.

The ease in which crypto is "manipulated" is due to its current small size.

Absolutely governments will get involved. The question is, which? And in what ways.

My personal take is that I'd really like to own both. Gold, which has ultimate resistance against any kind of digital attacks or electronic infrastructure failure. And Bitcoin, which has ultimate resistance against physical confiscation.bitcoininthevp wrote: ↑Wed Jul 03, 2019 1:26 pmThe ease in which crypto is "manipulated" is due to its current small size.

Harry notes that such "manipulation" is really just market participants acting and I tent to agree with his approach.

Sure there are some crypto exchanges that commit fraud and if you want to call that manipulation, Id largely agree.

However, if Bitcoin continues to grow, it will be much easier for a digital bearer asset to resist "manipulation" than it would a physical asset. Gold's downfall was its physical nature. This allows it to be confiscated, led to centralization on vaults (and not individual ownership), etc.

bitcoininthevp, would you be willing to write up a short post (sticky?) as a guide on how best the rest of us can test the waters in integrating bitcoin/cyrptocurrencies into our portfolios? I mean, guides like that exist, but I mean your ideas within the context of the pp/vp. What to avoid, how best to pursue it practically, how much to integrate, and all that pragmatic stuff.bitcoininthevp wrote: ↑Wed Jul 03, 2019 1:32 pmAbsolutely governments will get involved. The question is, which? And in what ways.

There is a lot of incentive to see the US dollar dethroned. Perhaps the US, money #1 is threatened by Bitcoin, but that is just incentive for other governments to adopt and secure Bitcoin.

Bitcoin's digital nature actually allows its security (mining) to be contributed to completely in secret without the countries supporting Bitcoin to overtly admit that they are doing so.

A lot of fodder for fiction writers. ^

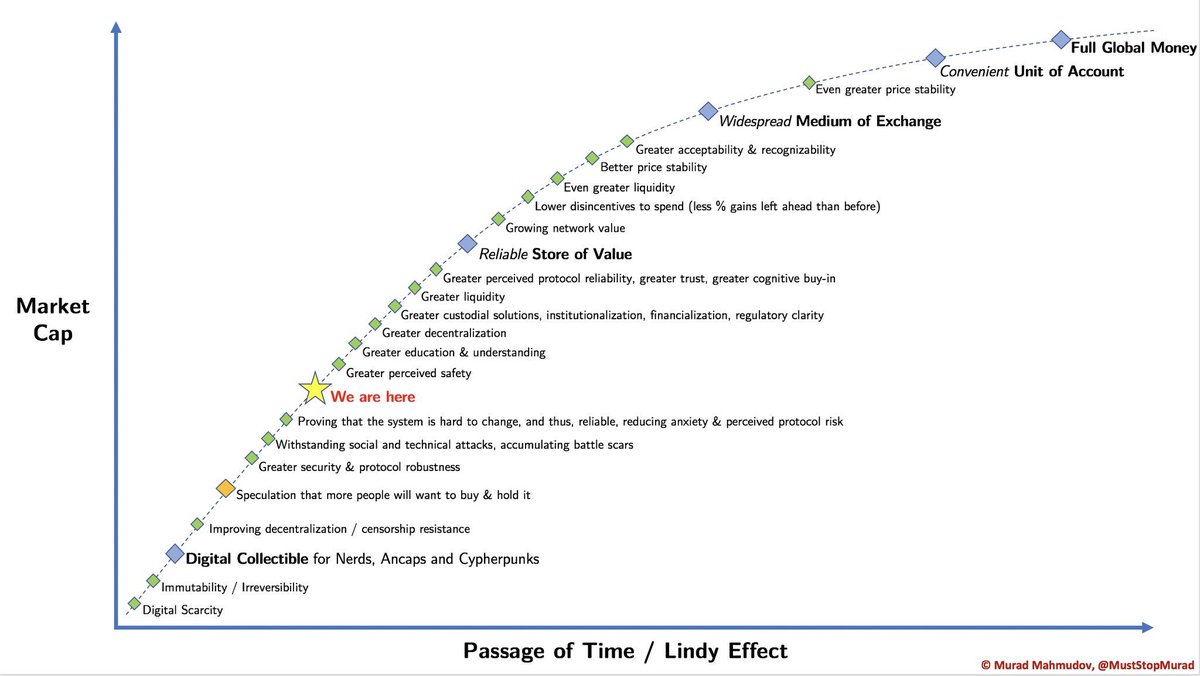

One thing that I would add here is that Bitcoin is in the process* of monetization. Gold has already monetized. A reason to not spend your Bitcoin (in addition to the ones you outlined and I agree with above), is that in order for Bitcoin to continue monetizing, it will have to appreciate in value due to its limited supply. Most people holding Bitcoin believe this is happening long term. Thus the speculation component results in a strong holding and not spending culture.Smith1776 wrote: ↑Fri Jun 28, 2019 11:40 pm What's funny about Bitcoin is that as an asset its economic substance is becoming more and more like gold. Even more so than the community even suspected I think.

We PPers think of gold as an alt cash. However, it's really a reserve asset, in that we don't use gold to buy a cup of coffee. It's just too cumbersome. We use our domestic fiat currencies to do that.

Bitcoin, it seems, is inheriting this quality.

Bitcoin's onerous transaction confirmation times, transaction costs, limited block size, and volatility make it unsuitable as real cash. Many of these limitations are due to legacy baggage that can't be changed. As such, even the Bitcoin diehards are resorting to using the cryptocurrency purely for large transactions, or as a long term store for their wealth. Not the proverbial cup of coffee. That isn't unlike gold.

Why is blockchain fascinating? What use case does the blockchain enable beyond money?

When you "own" 1BTC (Bitcoin), there is an entry on a ledger shared by thousands of computers which enables you and you alone (via cryptography) to direct where it goes next.

Since IMHO Bitcoin would be in the VP, there are not many guidances that would be PP specific. Since I think the VP is "anything goes" pretty much. But maybe Im missing something there. Feel free to add some follow up questions. Im happy to include some ideas on monetization, risks, applicable articles that might appeal to PPers.Smith1776 wrote: ↑Wed Jul 03, 2019 1:39 pm bitcoininthevp, would you be willing to write up a short post (sticky?) as a guide on how best the rest of us can test the waters in integrating bitcoin/cyrptocurrencies into our portfolios? I mean, guides like that exist, but I mean your ideas within the context of the pp/vp. What to avoid, how best to pursue it practically, how much to integrate, and all that pragmatic stuff.

when moon, sir ?bitcoininthevp wrote: ↑Wed Jul 03, 2019 2:00 pm I am also happy to answer any direct messages for people who have specific questions.

Exactly. I feel like I’ve given this answer before but:bitcoininthevp wrote: ↑Wed Jul 03, 2019 1:44 pmWhy is blockchain fascinating? What use case does the blockchain enable beyond money?

Blockchains are for resisting censorship.

...

Agreed that bitcoin and cryptocurrencies in general are most appropriate for the VP. And certainly the VP is where anything goes.bitcoininthevp wrote: ↑Wed Jul 03, 2019 2:00 pmSince IMHO Bitcoin would be in the VP, there are not many guidances that would be PP specific. Since I think the VP is "anything goes" pretty much. But maybe Im missing something there. Feel free to add some follow up questions. Im happy to include some ideas on monetization, risks, applicable articles that might appeal to PPers.Smith1776 wrote: ↑Wed Jul 03, 2019 1:39 pm bitcoininthevp, would you be willing to write up a short post (sticky?) as a guide on how best the rest of us can test the waters in integrating bitcoin/cyrptocurrencies into our portfolios? I mean, guides like that exist, but I mean your ideas within the context of the pp/vp. What to avoid, how best to pursue it practically, how much to integrate, and all that pragmatic stuff.

I can recommend a way to acquire a small amount of Bitcoin that I think is most safe. And a way to store Bitcoin securely. Ill let others post any additional questions here before I draft it to make sure everything is included.

I am also happy to answer any direct messages for people who have specific questions.