Time to Return to the Gold Standard?

Moderator: Global Moderator

-

boglerdude

- Executive Member

- Posts: 1317

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Time to Return to the Gold Standard?

Goldbugs/libertarians dont do nuance. They are always good, and government's always bad.

But to steelman, I went to good schools and no one ever explained the inflation tax. Mostly the fault of my parents, but still

edit: Free market money might be ideal, if everyone were rational...

But to steelman, I went to good schools and no one ever explained the inflation tax. Mostly the fault of my parents, but still

edit: Free market money might be ideal, if everyone were rational...

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

Kbg wrote: ↑Thu May 09, 2019 12:10 pm

Tn,

How is it stolen and to whom do the benefits and costs go from inflation? ANSWER: Inflation steals from savers.....it discourages saving as the dollar becomes worth less over time....therefore encouraging spending, investing & debt....therefore "benefiting" the economy and punishing savers.

Am I stealing from the bank that decided to give me a 30 year fixed rate loan? ANSWER: not if you agreed to it. Am I benefiting from it now or still getting my clock cleaned?....ANSWER: Is your loan interest amortization denominated in an inflationary based currency (ex. US dollar) and economy? If yes, you and lender both win. Is your loan interest amortization denominated in an deflationary based currency (ex. BTC) in a inflationary based economy? If yes, this would be terrible to borrowers and great for lenders & savers.

But if you are going to assert inflation is always a detriment, pray tell why is a deflationary hard currency crisis a good thing and how am I benefitted by one more than low grade inflation. ANSWER: Inflation is not always bad....its great holding debt in an inflationary currency and economy. A deflationary currency encourages / rewards saving, discourages debt / borrowing....the perfect currency to hold if you live in an inflationary based economy.

Fact: In the modern world money is money because an internationally recognized government says it is. Correct-ish, however there are alternatives outside of government issued money......ultimately people give money / currency value.

Test question: What do we quote the value of gold in? Last time I checked I haven’t been able to find a quote for 17.5 lbs of green colored paper with dead US presidents on it per 1oz of gold metal. ANSWER: US dollar. as it is the most widely used currency by people....due to its perceived stable value amongst people.

Second test question: If you are running a gold bullion selling/ storage business, why in the world would you accept a list of 1s and 0s over the internet and send actual real gold to someone? It seems the height of foley to me. ANSWER: Ease of acceptance. If US dollar denominated and you reside in US.... taxes and paying vendors make it more desirable…..i.e. paying other people.

Bottom line.... Accept that we live in an inflationary currency based economy. (US dollar) This will not change anytime soon....therefore exploit it's weaknesses and utilize its attributes for your own benefit.

Re: Time to Return to the Gold Standard?

gaddyslapper007 wrote: ↑Mon May 13, 2019 3:28 pmKbg wrote: ↑Thu May 09, 2019 12:10 pm

Tn,

How is it stolen and to whom do the benefits and costs go from inflation? ANSWER: Inflation steals from savers.....it discourages saving as the dollar becomes worth less over time....therefore encouraging spending, investing & debt....therefore "benefiting" the economy and punishing savers.

Am I stealing from the bank that decided to give me a 30 year fixed rate loan? ANSWER: not if you agreed to it. Am I benefiting from it now or still getting my clock cleaned?....ANSWER: Is your loan interest amortization denominated in an inflationary based currency (ex. US dollar) and economy? If yes, you and lender both win. Is your loan interest amortization denominated in an deflationary based currency (ex. BTC) in a inflationary based economy? If yes, this would be terrible to borrowers and great for lenders & savers.

But if you are going to assert inflation is always a detriment, pray tell why is a deflationary hard currency crisis a good thing and how am I benefitted by one more than low grade inflation. ANSWER: Inflation is not always bad....its great holding debt in an inflationary currency and economy. A deflationary currency encourages / rewards saving, discourages debt / borrowing....the perfect currency to hold if you live in an inflationary based economy.

Fact: In the modern world money is money because an internationally recognized government says it is. Correct-ish, however there are alternatives outside of government issued money......ultimately people give money / currency value.

Test question: What do we quote the value of gold in? Last time I checked I haven’t been able to find a quote for 17.5 lbs of green colored paper with dead US presidents on it per 1oz of gold metal. ANSWER: US dollar. as it is the most widely used currency by people....due to its perceived stable value amongst people.

Second test question: If you are running a gold bullion selling/ storage business, why in the world would you accept a list of 1s and 0s over the internet and send actual real gold to someone? It seems the height of foley to me. ANSWER: Ease of acceptance. If US dollar denominated and you reside in US.... taxes and paying vendors make it more desirable…..i.e. paying other people.

Bottom line.... Accept that we live in an inflationary currency based economy. (US dollar) This will not change anytime soon....therefore exploit it's weaknesses and utilize its attributes for your own benefit.

1. Wrong. That's why we have "real" interest rates. Without real interest rates no one in their right mind would save anything. And this does not change in a fixed monetary system.

2. Why did you duck answering the hardest question I put to you? Read up on on the 1930s and provide the answer. The burden for his one is on you if you are going to assert it, defend it.

3. Wow, seriously? John Maynard Keynes...Paradox of Thrift. OK, I'm going to answer the question you failed to just above. The paradox of thrift is an actual documented and studied phenomena and when it gets started it drives people into becoming ever more impoverished with an economy that continues to contract as money gets hoarded. You probably hate the welfare state as well. Guess what, this is exactly why we have a welfare state in the US now. (Let that one sink in for a bit...it's 100% true.) Rational people will do nothing BUT save as anything else is irrational. And ta da...that's why no responsible central bank or country implements a fixed base currency. Even Bitcoin's inventors recognized this and that's why it's "mined" so that it can grow. Simply put, you have two devils to chose from. Fixed base or fiat monetary systems. The later is generally recognized in the mainstream as the greater devil. Oh by the way, there is a ton of historical examples of metal based monetary system devaluation. All the government has to do is say: Our new gold money piece is now 25% lead vs. 2%.

4. You got me there...there is a .005% fringe I could barter or do some other alternative monetary system with. However, my friend, you still fail the Walmart test. My credit card does not. For everyday life, I chose the 99.995% usability path.

5. Good to know we agree on something. :-)

6. Ditto #5

(Sorry I have no idea why this is all bold)

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

Kbg wrote: ↑Tue May 14, 2019 9:10 am

1. Wrong. That's why we have "real" interest rates. Without real interest rates no one in their right mind would save anything. And this does not change in a fixed monetary system.

2. Why did you duck answering the hardest question I put to you? Read up on on the 1930s and provide the answer. The burden for his one is on you if you are going to assert it, defend it.

3. Wow, seriously? John Maynard Keynes...Paradox of Thrift. OK, I'm going to answer the question you failed to just above. The paradox of thrift is an actual documented and studied phenomena and when it gets started it drives people into becoming ever more impoverished with an economy that continues to contract as money gets hoarded. You probably hate the welfare state as well. Guess what, this is exactly why we have a welfare state in the US now. (Let that one sink in for a bit...it's 100% true.) Rational people will do nothing BUT save as anything else is irrational. And ta da...that's why no responsible central bank or country implements a fixed base currency. Even Bitcoin's inventors recognized this and that's why it's "mined" so that it can grow. Simply put, you have two devils to chose from. Fixed base or fiat monetary systems. The later is generally recognized in the mainstream as the greater devil. Oh by the way, there is a ton of historical examples of metal based monetary system devaluation. All the government has to do is say: Our new gold money piece is now 25% lead vs. 2%.

4. You got me there...there is a .005% fringe I could barter or do some other alternative monetary system with. However, my friend, you still fail the Walmart test. My credit card does not. For everyday life, I chose the 99.995% usability path.

5. Good to know we agree on something. :-)

6. Ditto #5

(Sorry I have no idea why this is all bold)

1. Sorry I do not understand your answer...please provide your answer to your question if you would please.....trying to understand your point. Are you saying real interest rates negate my answer? (or are the solution)?

2. no defense here.....(FYI....I hate gold (physical / non divisible properties)....but hold it like you) My simplistic answer /understanding is it was not one (1) thing....but a culmination of several stacked irresponsible behaviors / practices of lenders / banks and government mingling.

3. We wont agree here...thats fine. I lean toward Austrian Economics. To me it seems VERY unreasonable, delusional to believe that a person or group of people (government) can "control" an economy within target boundaries based upon millions of individuals.... Yes Bitcoin is inflationary (for now) until the year ~2140.....at which point all coins will be mined. Its inflation schedule halves every 4 years until then. Once again.....bad actors were the causes of many currency collapses….that's the point! Corruption will find its way into anything if given human influence / control.

4. you don't get to dictate where I spend my money....you force me to go to Walmart? Why cant I shop at pawn shops / jewelers with gold (I wont by the way), or Whole Foods, starbucks, whoever else with BTC? FYI.....I choose ease of use as well....the point is....we are moving toward a muti-currency world whether you like it or not. The dollar has been losing its world reserve status well over a decade.

Re: Time to Return to the Gold Standard?

1. I'm saying inflation does not of itself discourage savers unless a positive real rate of return is not achievable. No doubt negative real rates do happen from time to time and that does tend to discourage saving (or so we thought...but now we have negative yielding sovereign bonds.)

2. "Responsible" central banking in today's world generally means low inflation with jobs. Not too hot, not too cold.

3. Explain to me why gold fixes human corruption? I'm guessing about the same time humans figured out this invention called money another set were figuring out how to manipulate it.

4. I'm not dictating what you do in any way shape or form. I'm just pointing out physical gold is not usable at Walmart to purchase what is on their shelves because they won't take it. This is a metaphor that means physical gold is not legal tender in the U.S. and other than pawn shops and gold dealers you can't do anything with it as compared to what actually is money. For people living in the United States it is almost irrelevant that we are going to a multi-currency world. We've been living in one for several hundred years. If you live in the US you A) better have some US coins/bills or B) an electronic account that is in US dollars or will convert to them on your demand to US accepted 1s and 0s.

But I think you are missing my main point which is: Money in the modern world is what a government decides is money for the piece of turf on this earth they control. What gold fans refuse to recognize is that in reality it has always been this way and that gold can be debased by a government almost as easily as can paper money. Pretty much the only times this is not the case is when the government has lost control of its populace.

If it has lost control well who knows what will be "money" and gold/silver is probably a good first guess to posture for if you are so inclined.

2. "Responsible" central banking in today's world generally means low inflation with jobs. Not too hot, not too cold.

3. Explain to me why gold fixes human corruption? I'm guessing about the same time humans figured out this invention called money another set were figuring out how to manipulate it.

4. I'm not dictating what you do in any way shape or form. I'm just pointing out physical gold is not usable at Walmart to purchase what is on their shelves because they won't take it. This is a metaphor that means physical gold is not legal tender in the U.S. and other than pawn shops and gold dealers you can't do anything with it as compared to what actually is money. For people living in the United States it is almost irrelevant that we are going to a multi-currency world. We've been living in one for several hundred years. If you live in the US you A) better have some US coins/bills or B) an electronic account that is in US dollars or will convert to them on your demand to US accepted 1s and 0s.

But I think you are missing my main point which is: Money in the modern world is what a government decides is money for the piece of turf on this earth they control. What gold fans refuse to recognize is that in reality it has always been this way and that gold can be debased by a government almost as easily as can paper money. Pretty much the only times this is not the case is when the government has lost control of its populace.

If it has lost control well who knows what will be "money" and gold/silver is probably a good first guess to posture for if you are so inclined.

-

boglerdude

- Executive Member

- Posts: 1317

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Time to Return to the Gold Standard?

It might be simpler to forget gold/bitcoin, and first wonder what would happen if the Fed disabled their (digital) printing press

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

Good idea... thought experiment!.....Rulesboglerdude wrote: ↑Tue May 14, 2019 8:49 pm It might be simpler to forget gold/bitcoin, and first wonder what would happen if the Fed disabled their (digital) printing press

1. so gold / bitcoin never existed before as currency nor will they.

2. US government made mandatory tax payments be collected in US dollars or else people (government employees) with guns come to take your freedom. <-- this greatly encourages people to adopt a government currency as their freedom is at stake....so it therefore has a perceived value!

3. Once US dollar has established adoption / acceptance ~100years?? or so the Fed shuts down.

4. Now we have fixed money supply. What does the economy do going forward? Short term (1-10 years) 2. Mid term: (10-50 years) 3. Long Term (50+ years)

My thoughts....Short term economy S**t's itself as dollars are now harder to get and our economy is addicted to debt. The contraction of "money" supply lost would be unfathomable. (as most money in circulation is lent into existence) - Mid term - day-to day life has settled...prices have reset to accommodate current economy / market conditions. Long term - Removing any other human / government interference the free market goes through its natural cycles. good or bad. <-- this is where ethical / humane values /beliefs difference in opinions come into play...not an easy subject / solution....

Re: Time to Return to the Gold Standard?

Indeed. I've mentioned this elsewhere but I think it would be interesting to fast forward 50-100 years to see what becomes standard monetary theory. The former theory is not fitting reality very well post GFC and I think will eventually be overturnedboglerdude wrote: ↑Tue May 14, 2019 8:49 pm It might be simpler to forget gold/bitcoin, and first wonder what would happen if the Fed disabled their (digital) printing press

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

Kbg wrote: ↑Tue May 14, 2019 4:31 pm 1. I'm saying inflation does not of itself discourage savers unless a positive real rate of return is not achievable. No doubt negative real rates do happen from time to time and that does tend to discourage saving (or so we thought...but now we have negative yielding sovereign bonds.)

2. "Responsible" central banking in today's world generally means low inflation with jobs. Not too hot, not too cold.

3. Explain to me why gold fixes human corruption? I'm guessing about the same time humans figured out this invention called money another set were figuring out how to manipulate it.

4. I'm not dictating what you do in any way shape or form. I'm just pointing out physical gold is not usable at Walmart to purchase what is on their shelves because they won't take it. This is a metaphor that means physical gold is not legal tender in the U.S. and other than pawn shops and gold dealers you can't do anything with it as compared to what actually is money. For people living in the United States it is almost irrelevant that we are going to a multi-currency world. We've been living in one for several hundred years. If you live in the US you A) better have some US coins/bills or B) an electronic account that is in US dollars or will convert to them on your demand to US accepted 1s and 0s.

But I think you are missing my main point which is: Money in the modern world is what a government decides is money for the piece of turf on this earth they control. What gold fans refuse to recognize is that in reality it has always been this way and that gold can be debased by a government almost as easily as can paper money. Pretty much the only times this is not the case is when the government has lost control of its populace.

If it has lost control well who knows what will be "money" and gold/silver is probably a good first guess to posture for if you are so inclined.

1. Gotcha!...understand what your saying now.

2. Agree....this assumes "Responsible" is a constant (which history has shown to not be the case due to bad actors at some point). But agree.

3. It does not...and I won't try to say it will. The only thing Gold has is scarcity and hard to replicate (counterfeit)...that's about it.

4. I understand your point / agree.....I would rather personally rather have currency that is unmanipulatlable. I'm a PP'r…..I love diversity! I will hold Dollars, Gold and BTC. I can go anywhere in the world and someone will accept one these.

5. Agree...Per my above post. Government prints paper, government demands taxes be paid in said paper, threatens people to pay taxes or go to prison, <-- Voila! Paper now has value amongst the people! My point.....like it or not, BTC has been existence for 10 years and gets stronger more adopted by the day...."people" have a desire /want a money outside of government oversight, control and manipulation...it that's easy. Whether or not BTC ultimately delivers that is the questions.....time will tell. And straight up....I will move to another country if the US outlaws BTC. That would be pure infringement upon freedom of speech, property, etc.....(<--note, has nothing do with money...principles of no longer being a free(ish) country.)

Re: Time to Return to the Gold Standard?

No manipulation for personal/organizational gain going on here...I'm sure.gaddyslapper007 wrote: ↑Wed May 15, 2019 8:55 am 5. Agree...Per my above post. Government prints paper, government demands taxes be paid in said paper, threatens people to pay taxes or go to prison, <-- Voila! Paper now has value amongst the people! My point.....like it or not, BTC has been existence for 10 years and gets stronger more adopted by the day...."people" have a desire /want a money outside of government oversight, control and manipulation...it that's easy. Whether or not BTC ultimately delivers that is the questions.....time will tell. And straight up....I will move to another country if the US outlaws BTC. That would be pure infringement upon freedom of speech, property, etc.....(<--note, has nothing do with money...principles of no longer being a free(ish) country.)

https://en.wikipedia.org/wiki/List_of_bitcoin_forks

I'm really, really not trying to be mean...but I'm going to keep on popping hallucinogenic bubbles.

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

Its not manipulation….the bitcoin ledger is still what it always has been! (individuals did not lose in the BTC & BCash fork event....they got more "free" money (BCash).) Yes, the individuals who forked their own blockchain (Bcash) may have tried for personal gain.....but it did not affect BTC. Being a free market it comes with the territory....im ok / encourage that. Bcash "could" be an improvement to BTC (its not)....it wouldn't matter either way because if you held BTC at the time of the fork you received the equivalent in Bcash. That "manipulation" made every BTC holder more wealthy....the opposite is case with any other "manipulated" currency". (individuals get screwed ..government / market makers makes win)Kbg wrote: ↑Wed May 15, 2019 11:00 amNo manipulation for personal/organizational gain going on here...I'm sure.gaddyslapper007 wrote: ↑Wed May 15, 2019 8:55 am 5. Agree...Per my above post. Government prints paper, government demands taxes be paid in said paper, threatens people to pay taxes or go to prison, <-- Voila! Paper now has value amongst the people! My point.....like it or not, BTC has been existence for 10 years and gets stronger more adopted by the day...."people" have a desire /want a money outside of government oversight, control and manipulation...it that's easy. Whether or not BTC ultimately delivers that is the questions.....time will tell. And straight up....I will move to another country if the US outlaws BTC. That would be pure infringement upon freedom of speech, property, etc.....(<--note, has nothing do with money...principles of no longer being a free(ish) country.)

https://en.wikipedia.org/wiki/List_of_bitcoin_forks

I'm really, really not trying to be mean...but I'm going to keep on popping hallucinogenic bubbles.

I don't think you are being mean at all....its a called a discussion. But don't pat yourself on the back so quickly when you think you "know" about BTC. You've proven to me twice in this thread to not have deep understanding of it. <-- not intended as insult...but an observation.

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

FYI.....thanks for all thoughts and inputs throughout this chat forum! You are one of my top respected peeps I have on here to learn from....and you have shaped my mind /portfolio over the years. Please do not think I engage in this discussion for malicious purpose ...other than to getting inside your mind for your thoughts! thanks again for all your contributions!Kbg wrote: ↑Wed May 15, 2019 11:00 amNo manipulation for personal/organizational gain going on here...I'm sure.gaddyslapper007 wrote: ↑Wed May 15, 2019 8:55 am 5. Agree...Per my above post. Government prints paper, government demands taxes be paid in said paper, threatens people to pay taxes or go to prison, <-- Voila! Paper now has value amongst the people! My point.....like it or not, BTC has been existence for 10 years and gets stronger more adopted by the day...."people" have a desire /want a money outside of government oversight, control and manipulation...it that's easy. Whether or not BTC ultimately delivers that is the questions.....time will tell. And straight up....I will move to another country if the US outlaws BTC. That would be pure infringement upon freedom of speech, property, etc.....(<--note, has nothing do with money...principles of no longer being a free(ish) country.)

https://en.wikipedia.org/wiki/List_of_bitcoin_forks

I'm really, really not trying to be mean...but I'm going to keep on popping hallucinogenic bubbles.

Re: Time to Return to the Gold Standard?

Thank you for the kind words. I enjoy collegial debate & banter back and forth.

-

boglerdude

- Executive Member

- Posts: 1317

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Time to Return to the Gold Standard?

> if the US outlaws BTC

The US gov is big business. Do Gates, Buffet, and Bezos want Bitcoin as the currency?

The US gov is big business. Do Gates, Buffet, and Bezos want Bitcoin as the currency?

-

gaddyslapper007

- Full Member

- Posts: 65

- Joined: Fri Dec 16, 2016 9:06 am

Re: Time to Return to the Gold Standard?

From my understanding......Gates originally liked the idea of BTC, then later shunned it......not sure of his stance now. Seems like recall reading something recently that Microsoft is building on the network....but could be wrong there.boglerdude wrote: ↑Wed May 15, 2019 8:30 pm > if the US outlaws BTC

The US gov is big business. Do Gates, Buffet, and Bezos want Bitcoin as the currency?

Buffet calls it “rat poison”......so no! (He hates gold as well.)

Bezos - I honestly don’t know.....couldn’t find anything with google search.

I don’t think BTC is going to de-thrown the USD anytime soon. I do think we will see it overtake gold (market cap) within the next 10 years.

The fundamental fact of money!....it goes where it is treated best. (I.e. less taxation / government oversight).

What form of money that will be?.....I don’t know.

Re: Time to Return to the Gold Standard?

Most of my reading on Bitcoin indicates there isn't a ton of interest in it for monetary purposes. Think about it...banks transfer gobs of money securely every day. Of course theft happens physically and electronically but we've all read about multiple bitcoin bank heists so personally I also don't see the advantage. However, there is a TON of interest in using the associated technology for things like unique verifiable tagging, electronic identities, and several more. The technology is here to stay, no doubt about that, whether it becomes a serious form of money I think the jury is still out.

Having knocked the monetary property side of things, it is also fact that Bitcoin futures are proving to be a resilient product and they are trading fairly robustly for a newish product.

Having knocked the monetary property side of things, it is also fact that Bitcoin futures are proving to be a resilient product and they are trading fairly robustly for a newish product.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: Time to Return to the Gold Standard?

Bitcoin* is not focused on being a payment network. As you mention there are plenty of those. My Visa card works perfectly almost all the time.Kbg wrote: ↑Thu May 16, 2019 9:08 am Most of my reading on Bitcoin indicates there isn't a ton of interest in it for monetary purposes. Think about it...banks transfer gobs of money securely every day. Of course theft happens physically and electronically but we've all read about multiple bitcoin bank heists so personally I also don't see the advantage. However, there is a TON of interest in using the associated technology for things like unique verifiable tagging, electronic identities, and several more. The technology is here to stay, no doubt about that, whether it becomes a serious form of money I think the jury is still out.

Having knocked the monetary property side of things, it is also fact that Bitcoin futures are proving to be a resilient product and they are trading fairly robustly for a newish product.

Bitcoin* is focused on being the hardest money. With a (currently weak) payment network as part of its capabilities.

When I say hard money I mean resistance to changes in its supply curve (other than its known inflation/distribution-of-coins schedule).

> multiple bitcoin bank heists

Is the dollar weak if someone robs a bank? Or is that a weakness of the bank? "not your keys, not your coins"

> don't see the advantage

Bitcoin is a censorship resistant digital bearer instrument. Here are some related use cases for Bitcoin:

> a TON of interest in using the associated technology

Which of these use cases require censorship resistance? Would they perform better than centralized alternatives? What are the incentive mechanisms for securing such networks? Which do you use? Which have any traction? Im very skeptical here as you can tell. This stuff has been talked about for years and is getting no usage.

* Obviously Bitcoin is software and does not have intentions. But its software parameters, the developers, and community around it is what I am referencing here.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: Time to Return to the Gold Standard?

Linking to a list of Bitcoin Forks without any context and somehow implying it as "a burn" doesn’t add value to the conversation. Anyone remotely familiar with Bitcoin is aware of such forks. The question for you is, why are forks "bad"? How are Bitcoins technical or economical operations negatively impacted?Kbg wrote: ↑Wed May 15, 2019 11:00 am https://en.wikipedia.org/wiki/List_of_bitcoin_forks

I'm really, really not trying to be mean...but I'm going to keep on popping hallucinogenic bubbles.

Re: Time to Return to the Gold Standard?

Pretty sure I didn't claim it was "bad." I said, like government issued money, Bitcoin is driven by people and is manipulated for various ends. I am not a Bitcoin expert, but I'm pretty sure I understand enough about the forking that is occurring to understand it isn't altruistically driven. (And you know that too.)bitcoininthevp wrote: ↑Mon May 20, 2019 10:29 am Linking to a list of Bitcoin Forks without any context and somehow implying it as "a burn" doesn’t add value to the conversation. Anyone remotely familiar with Bitcoin is aware of such forks. The question for you is, why are forks "bad"? How are Bitcoins technical or economical operations negatively impacted?

I assume you are Bitcoin expert, so of all the forks how many are instantly exchangeable between each of the other forks and into the foreign currency of one's choice?

However, I will repeat something I am highly confident in. For legal transactions, Bitcoin technology as a form of money is entirely beholden to government approval or as a minimum non-interference. True believers are deluded if they actually think that isn't the case. Of course let's say Bitcoin gets some large powerful constituent behind it and wants it to be widely recognized by government(s), this could happen. Alternatively the reverse could happen and it would happen something like this: Congress or Fed to Banks/Other Large Financial Institutions: Thou shalt not accept nor transact using Bitcoin if you want to continue doing business in the United States. And unlike Iranian oil which is a tangible thing, what's the point of even trying to buck such an edict?

In terms of financial instruments I am rarely pro or con anything. I just try to understand them and their behavior. The fact Bitcoin has futures on the CME says to me it is getting a measure of recognition. While maybe not outright endorsement, United States government acceptance at some level is implicit in their approval to trade.

Like physical gold, I throw down the Walmart and McDonald's test to Bitcoin. When you can successfully pass it, I will fully recognize Bitcoin as a legit, serious form of money. Until then, in my humble view, it is a minor sideshow composed of true believers, speculators and outright fraud.

(Note: I am not saying all Bitcoin variations are frauds, but there are many that are. I also understand/believe a competitive environment where creators hope their version will catch on is a major reason for multiple variants. This is not fraud, just entrepreneurship at its best and only "X" of them will survive over time.)

And for the readers of this thread...a "money" reality check

Hey this could be a legit form of money (2014) https://viewfinder.expedia.com/expedia- ... s-bitcoin/

Or maybe not...(2018) https://cointelegraph.com/news/confirme ... ent-option

I'm sure bitcoininthevp can probably google up an exact opposite example...however, my USD Visa has worked without a hitch the entire time.

Speaking of speculation...Bitcoin has been an outstanding speculative instrument if you can call it correctly. (Wish I could!)

Last edited by Kbg on Mon May 20, 2019 9:27 pm, edited 1 time in total.

Re: Time to Return to the Gold Standard?

I forgot to address any of your other issues, yes I did. I'll concede every one of them.

However, this is a thread about what is "good money" not what we wish was good money and the most important feature of any form of money is that it is widely accepted for just about every form of commercial or private transaction.

Gold no, Bitcoin no.

However, this is a thread about what is "good money" not what we wish was good money and the most important feature of any form of money is that it is widely accepted for just about every form of commercial or private transaction.

Gold no, Bitcoin no.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: Time to Return to the Gold Standard?

You implied negativity with your "fork+pop your bubble" comments. To claim otherwise is being intellectually dishonest.> Pretty sure I didn't claim it was "bad."

They are probably 99% scams IMHO.> I understand enough about the forking that is occurring to understand it isn't altruistically driven.

Im not sure the validity of that test. But Id say only a minority of forks are listed on exchanges. With very low volume. I personally dont use any. When a fork happens and I receive the "free" coins, I just sell them for BTC.> so of all the forks how many are instantly exchangeable between each of the other forks and into the foreign currency of one's choice?

Which government?> For legal transactions, Bitcoin technology as a form of money is entirely beholden to government approval or as a minimum non-interference.

This is in progress. Keep in mind, Bitcoin is new and growing. No one is claiming the Bitcoin ecosystem is complete. Fidelity is adopting. ICE is launching a Bitcoin company (w/ Microsoft and Starbucks)> let's say Bitcoin gets some large powerful constituent behind it

USG also has SOLD Bitcoins they seized from drug markets. If that isnt a nod of approval (so far), I dont know what is. They dont sell cocaine from drug busts.> United States government acceptance at some level is implicit in their approval to trade

Probably all variants are. But if something somehow shows as a better future sound money candidate than Bitcoin, Id jump there.> I am not saying all Bitcoin variations are frauds, but there are many that are.

I agree with this 100%.> Until then, in my humble view, it is a minor sideshow composed of true believers, speculators and outright fraud.

I said as much in my previous comment. But you seem to be focused on Bitcoin exclusively as a payment rail. There are plenty of payment rails out there (credit cards, paypal, apple pay, bank transfers, cash app and the like, etc). In fact, I think it is ridiculous to spend Bitcoin unless there is some discount or other reason to do so. If you believe it will be money in the future, its worth, per coin, in order to have liquidity to support any small % of the economy will have to go up something like ~100x.> my USD Visa has worked without a hitch the entire time.

Bitcoin wasn’t created to compete with any of these payment mechanism. Bitcoin is out to compete with other *monies* and central banks.

There will probably be layer 2 technologies on TOP of Bitcoin, using bitcoin's "money-ness" for fast *payments*. Look into Lightning Network. But that stuff is still being proven out.

I think you should consider a perspective of "Is this Bitcoin thing on track to be a future money?" instead of "Its not perfect and used everywhere today".

I think its really hard to argue Bitcoin isnt moving in the direction of money. See here for one idea of path to Bitcoin becoming money: https://medium.com/@vijayboyapati/the-b ... ecc8bdecc1

Sure its volatile and not widely spread. But that is part of what you would expect to see with a new non sovereign asset working towards being money. Sure doesn’t mean its inevitable. "They laughed at Columbus, they laughed at Fulton, they laughed at the Wright Brothers. But they also laughed at Bozo the Clown. " and all that. I get it.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: Time to Return to the Gold Standard?

Try telling that to the people of Venezuela or other countries which have hyper-inflated in the last few years.

To reiterate my stance on it, I think unit of account will be the last money-ness domino to fall. Decades. Payment network is probably somewhere between here in there.

Re: Time to Return to the Gold Standard?

bit,

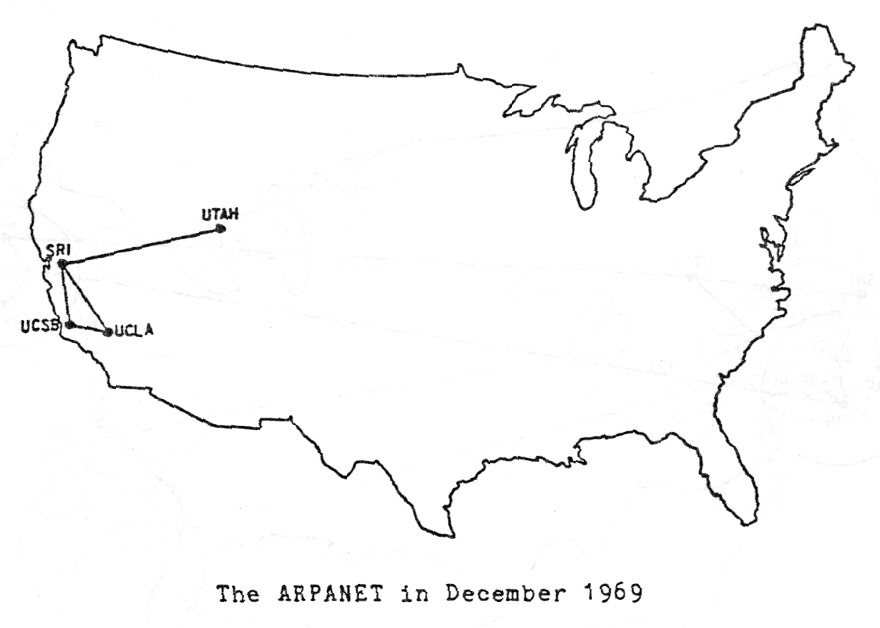

Based on your answers, overall, I believe our thoughts are pretty similar on the technical points. As mentioned earlier, I'm not a Bitcoin hater it just is not widely accepted and therefore is not a good form of money right now. While the ARPANet map is interesting, it also makes my point. The "internet" didn't became a "thing" until it became widely deployed/employed.

If bitcoin becomes better than my digitally enabled Visa card, I'll adopt it.

If one understands the associated technology and can make good bets for investing purposes or is good at speculating in bitcoin good for them.

And sorry, you served up a big ole softball so I'm going to take a big swing...how's the Petro working out?

Here's an interesting BBC article on Bitcoin in Venezuela and it does seem to be helping the people there (but probably only those who are well to do) https://www.bbc.com/news/business-47553048

Not a hater, just a pragmatist.

Based on your answers, overall, I believe our thoughts are pretty similar on the technical points. As mentioned earlier, I'm not a Bitcoin hater it just is not widely accepted and therefore is not a good form of money right now. While the ARPANet map is interesting, it also makes my point. The "internet" didn't became a "thing" until it became widely deployed/employed.

If bitcoin becomes better than my digitally enabled Visa card, I'll adopt it.

If one understands the associated technology and can make good bets for investing purposes or is good at speculating in bitcoin good for them.

And sorry, you served up a big ole softball so I'm going to take a big swing...how's the Petro working out?

Here's an interesting BBC article on Bitcoin in Venezuela and it does seem to be helping the people there (but probably only those who are well to do) https://www.bbc.com/news/business-47553048

Not a hater, just a pragmatist.

-

boglerdude

- Executive Member

- Posts: 1317

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Time to Return to the Gold Standard?

Bitcoin could make things worse by increasing tax evasion and as a payment method for crime. Transparency is good for society

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: Time to Return to the Gold Standard?

Agreed in general. Only additional comment here is that a buy and hold on Bitcoin's future is a way to make money on "crypto's" success in a way that wasn’t possible with the Internet build out. With the Internet you needed to pick companies that would win. With Bitcoin, if you buy the hypothesis that money is winner take all (or winner take most), you can invest in Bitcoin as an asymmetric bet. I realize this is getting into Bitcoin evangelism shilling weirdness. So Ill leave it at that.Kbg wrote: ↑Tue May 21, 2019 9:37 pm The "internet" didn't became a "thing" until it became widely deployed/employed.

If bitcoin becomes better than my digitally enabled Visa card, I'll adopt it.

If one understands the associated technology and can make good bets for investing purposes or is good at speculating in bitcoin good for them.

Petro is centralized garbage. I hope no one confuses a centralized "crypto" with a decentralized Bitcoin. To paraphrase Tommy Boy: "If you want me to take a dump in a box, and mark it a cryptocurrency I will. I've got spare time.". Remember the point of all of this is decentralization to facilitate censorship resistance (so transactions cannot be stopped, supply cannot be inflated, etc). Petro has nothing to do with that.

We cant all be early adopters of all technologies. Esp ones requiring a financial investment.

Im curious. Is there an objective metric that you would consider bitcoin to "have been adopted to your satisfaction"? For example there have been debit cards tied to bitcoin balances allowing you to "spend bitcoin" wherever Visa is accepted. I assume that is insufficient for you. Even though that is the same payment rail used by the USD. So what would be a more accurate version of your subjective Bitcoin-is-adopted-sufficiently?