Adaptive gold allocation rule

Moderator: Global Moderator

Adaptive gold allocation rule

If gold went to $2500, I'd only keep a 5% gold weighting. If it went to $400, I'd have 35% gold weighting. In between those two extremes, if you draw a straight line, my gold allocation for today ($1240-ish) would be about 18%.

Applying a rule like this would mitigate the effects of twenty-year bear markets in gold, by making you sell more at the top, and buy more in the bottom, and in-between acting more "PP normally". With this linear function, at $750 for gold I'd be "all in"... standard 25% PP allocation.

It's not a hop-in, hop-out rule. You keep an allocation, but the allocation is adaptive. I'm thinking of re-evaluating gold allocations whenever gold moves more than 10%, or once a year, whichever comes first. I have used rules like this in the stock market when stocks are in a trading range. Works fine within the range, then it's a new world. Gold beyond $400-$2500 would be sort of unimaginable. Beyond those limits, the world could be very weird.

There are many ways to connect two points on a graph, a line is only one of them. There could be many other functions proposed, like logarithmic functions. But I'm just looking for something to suggest to me how to behave semi-rationally and consistently in the middle, not so much at the extremes.

GOLD 18%

CASH 25%

STOCKS 28.5%

BONDS 28.5%

Comments?

Applying a rule like this would mitigate the effects of twenty-year bear markets in gold, by making you sell more at the top, and buy more in the bottom, and in-between acting more "PP normally". With this linear function, at $750 for gold I'd be "all in"... standard 25% PP allocation.

It's not a hop-in, hop-out rule. You keep an allocation, but the allocation is adaptive. I'm thinking of re-evaluating gold allocations whenever gold moves more than 10%, or once a year, whichever comes first. I have used rules like this in the stock market when stocks are in a trading range. Works fine within the range, then it's a new world. Gold beyond $400-$2500 would be sort of unimaginable. Beyond those limits, the world could be very weird.

There are many ways to connect two points on a graph, a line is only one of them. There could be many other functions proposed, like logarithmic functions. But I'm just looking for something to suggest to me how to behave semi-rationally and consistently in the middle, not so much at the extremes.

GOLD 18%

CASH 25%

STOCKS 28.5%

BONDS 28.5%

Comments?

Last edited by ochotona on Thu Feb 12, 2015 1:01 pm, edited 1 time in total.

Re: Linear gold allocation rule

Why only for gold?

Because stocks are generally increasing over time, and dividends are paid. With government bonds, you get your principal back, and coupon interest.

No guarantees for gold! But we love the counter-cyclical volatility with the other components, right?

HB didn't think zero coupon bonds were any good for PP, right? Gold is like a zero coupon bond, but return of principal not guaranteed. I think it needs some kind of sanity test, some kind of circuit-breaker. Would we really want to buy gold at $2500 if it were to suddenly manifest? No!

Because stocks are generally increasing over time, and dividends are paid. With government bonds, you get your principal back, and coupon interest.

No guarantees for gold! But we love the counter-cyclical volatility with the other components, right?

HB didn't think zero coupon bonds were any good for PP, right? Gold is like a zero coupon bond, but return of principal not guaranteed. I think it needs some kind of sanity test, some kind of circuit-breaker. Would we really want to buy gold at $2500 if it were to suddenly manifest? No!

Last edited by ochotona on Thu Feb 12, 2015 9:35 am, edited 1 time in total.

Re: Linear gold allocation rule

I have been thinking about something along these lines (pun sort of intended) for LTTs. I don't like holding 25% of my assets in them when yields are really low because I think the downside risk is too great. Also deflation protection is not only offered by LTTs but also cash. At really low rates the PP seems overly protected against deflation. Of course, Harry Browne lived long enough to witness the Japan experience and I am sure he didn't overlook that.

In general what you are proposing is to just hold less of an asset when it has already run up considerably, correct? And if I am right on that point, would you now be 40%-50% in cash?

In general what you are proposing is to just hold less of an asset when it has already run up considerably, correct? And if I am right on that point, would you now be 40%-50% in cash?

Re: Linear gold allocation rule

No, I propose being selectively cruel to gold only; not bonds and stocks. Yes, I am prejudiced.

barrett wrote: In general what you are proposing is to just hold less of an asset when it has already run up considerably, correct? And if I am right on that point, would you now be 40%-50% in cash?

Re: Linear gold allocation rule

Damn! Can't you see I need help with my LTT issues???ochotona wrote: No, I propose being selectively cruel to gold only; not bonds and stocks. Yes, I am prejudiced.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Linear gold allocation rule

This could be a good solution to the lack of a duration problem.

But I bump MangoMan. Inquiring minds want to know!

But I bump MangoMan. Inquiring minds want to know!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Linear gold allocation rule

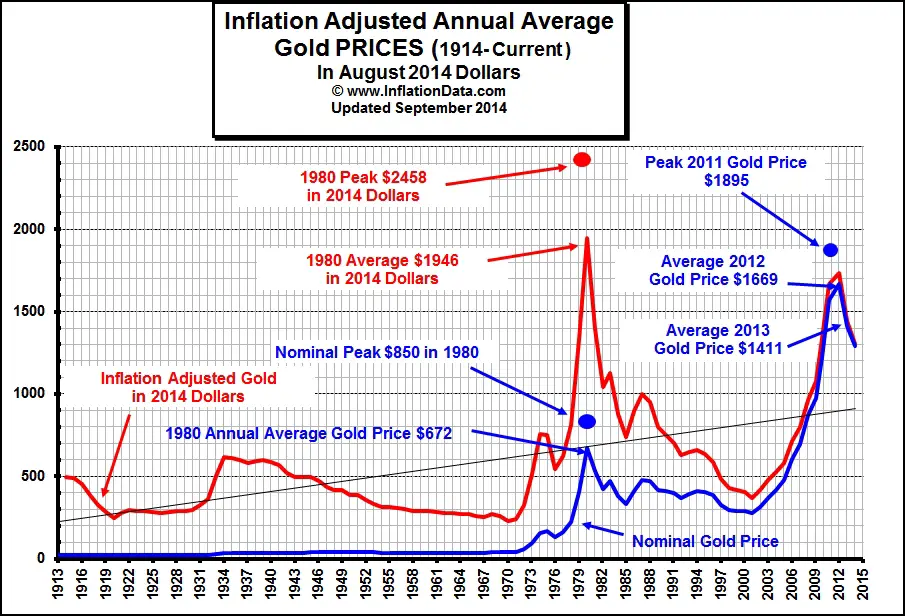

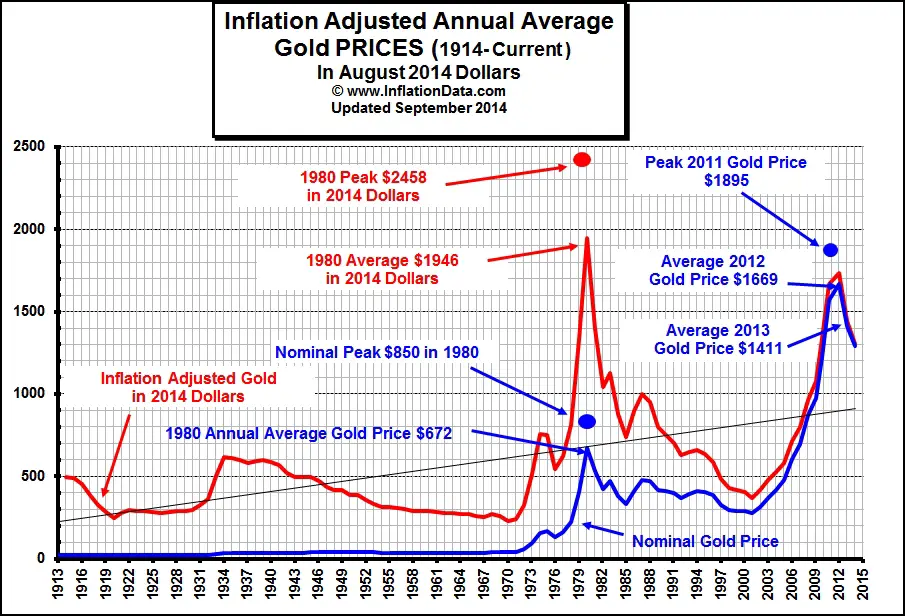

January 1980 peak was about $2500 adjusted for inflation to 2015 dollars. 2001 low was about $400 adjusted for inflation. Roughly. If you have precise US Dollars values for those dates, please let me know.

MangoMan wrote: ochotona,

How did you come up with the $400/$2500 figures as the lower and upper boundaries?

Last edited by ochotona on Thu Feb 12, 2015 10:57 am, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Linear gold allocation rule

Was the 2011 low the lowest low in real terms and not 1968 or 1998?ochotona wrote: How did you come up with the $400/$2500 figures as the lower and upper boundaries?

I track a similar allocation model for stocks based on the 1974 bear market low. It is currently 42.53% in cash. It dipped to around 5% cash in 1982 and 10% in late 2008 to early 2009. The core problem, however, is this is not scaled to the Great Depression so you could have bought 90% stocks in 2008/2009 and then went on to lose 66%, which is why Hussman didn't pull the trigger in late 2008. I can't think of any other portfolio but the PP where you could have survived intact buying at such an inopportune moment. Just wait for the day that Bogleheads puke up for their rabid fanboy devotion.

Last edited by MachineGhost on Thu Feb 12, 2015 11:13 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Linear gold allocation rule

Sorry, slipped a digit on my reply. I thought 2001 has been the lowest low recently, in real terms, and 1980 the highest high.

MachineGhost wrote: Was the 2011 low the lowest low in real terms and not 1968 or 1998?

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Linear gold allocation rule

Looks like 1970 is it...ochotona wrote: Sorry, slipped a digit on my reply. I thought 2001 has been the lowest low recently, in real terms, and 1980 the highest high.

Last edited by MachineGhost on Thu Feb 12, 2015 11:18 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Linear gold allocation rule

Nice graph.

Sold off 7% of my IAU, split proceeds and bought SCHB and TLO.

You know... if we get to the extremes again, it would be good to buy some of those 3x leverage gold or inverse gold ETFs. You could cover your entire PP for up or down movements in gold with only 1/3 of the money, effectively. If you dare.

Sold off 7% of my IAU, split proceeds and bought SCHB and TLO.

You know... if we get to the extremes again, it would be good to buy some of those 3x leverage gold or inverse gold ETFs. You could cover your entire PP for up or down movements in gold with only 1/3 of the money, effectively. If you dare.

Last edited by ochotona on Thu Feb 12, 2015 11:25 am, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Linear gold allocation rule

The 36-year bear market in gold is almost as bad as the 38-year bond bear market in length.ochotona wrote: Nice graph.

Last edited by MachineGhost on Thu Feb 12, 2015 11:30 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Linear gold allocation rule

No on the downside. The upside has no limit. I think a better approach is to focus on splitting the cash indicator equally among cash, bonds and gold once rescaled to GD data. Prosperity drives the PP.MangoMan wrote: MG, what about you?

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Linear gold allocation rule

I don't think gold has a well defined upside, really. I think above $2500 gets less likely, but I don't think anyone can be sure.

You can't compare market price fluctuations in LT bonds and market price fluctations in gold because... you get your principal back with bonds, and you get a coupon. When you include the coupon into the LT bond picture, it changes it a lot.

You can't compare market price fluctuations in LT bonds and market price fluctations in gold because... you get your principal back with bonds, and you get a coupon. When you include the coupon into the LT bond picture, it changes it a lot.

Re: Linear gold allocation rule

I've been thinking about this all day. I think my earlier proposal wasn't right. If gold goes to $500, on the way to $250, I don't think I'd really want to overweight to 35% gold; I am happy with 25%. The main issue is those big huge nosebleed mountains... 1980 and 2011. I don't ever want to get to the top of those, rebalance, then have multi-year losses in gold. How futile and avoidable.

Below $800, business as usual. Above $800, I think a taper has to be applied, to prevent harm if another volcano comes out of the sea.

$800 25%

$1200 18%

$1600 11%

$2000 4% no less than that

Interpolate as necessary - yep, I like this plan better

So if gold touches $800, rebalance to 25%. If it rises above that, don't rebalance until gold is at the 35% band, then rebalance at the new "nosebleed" allocation. And so on.

If gold stays below $800, PP rebalancing functions as originally designed.

Below $800, business as usual. Above $800, I think a taper has to be applied, to prevent harm if another volcano comes out of the sea.

$800 25%

$1200 18%

$1600 11%

$2000 4% no less than that

Interpolate as necessary - yep, I like this plan better

So if gold touches $800, rebalance to 25%. If it rises above that, don't rebalance until gold is at the 35% band, then rebalance at the new "nosebleed" allocation. And so on.

If gold stays below $800, PP rebalancing functions as originally designed.

MachineGhost wrote:Looks like 1970 is it...ochotona wrote: Sorry, slipped a digit on my reply. I thought 2001 has been the lowest low recently, in real terms, and 1980 the highest high.

Last edited by ochotona on Thu Feb 12, 2015 10:51 pm, edited 1 time in total.

Re: Adaptive gold allocation rule

Is it just me, or isn't it very easy to see after a parabolic gold melt-up and the price gets under the 300 day / 43 week simple moving average that it's going to be bad? Chart of GLD from Schwab.com YES it did the same in 2008... but it was still normally priced at that point. Falling off a stool and falling off a second story balcony are not the same thing. Why should anyone in this PP strategy voluntarily submit to buying gold during a melt-up just because "a book and my gold salesman told me to not worry and just following the simple PP rebalancing plan"? {crickets}

Last edited by ochotona on Fri Feb 13, 2015 9:23 am, edited 1 time in total.

Re: Adaptive gold allocation rule

It's very easy to see whatever you want to see in these graphs. The most critical thing that one wants to see, but actually does not, is the future.ochotona wrote: Is it just me, or isn't it very easy to see after a parabolic gold melt-up and the price gets under the 300 day / 43 week simple moving average that it's going to be bad?

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Adaptive gold allocation rule

A 50% decline has a 12.5% impact on the portfolio. Most of us are in the PP to avoid analyzing charts of this nature. Either you internalize the PP concept and avoid looking at GLD in isolation or perhaps this allocation is not for you.

I hate gold too, but without gold you have a convsetvative BH portfolio with limited inflation protection. All I see in the chart is a response to anticipated/high levels of inflation followed by average to low inflation expectations.

I hate gold too, but without gold you have a convsetvative BH portfolio with limited inflation protection. All I see in the chart is a response to anticipated/high levels of inflation followed by average to low inflation expectations.

"The first principle is that you must not fool yourself and you are the easiest person to fool" --Feynman.

Re: Adaptive gold allocation rule

But gold is a range limited oscillator in a band of $250 to $2500 in 2015 dollars. If you're at the bottom, you can see the future... the future is up! If you're at the top, you can see the future... it's down. In the middle... who knows.

Xan wrote: It's very easy to see whatever you want to see in these graphs. The most critical thing that one wants to see, but actually does not, is the future.

Re: Adaptive gold allocation rule

If we get to $2,500 gold, then who's to say it couldn't go to $5,000? If we do get to $2,500, we won't be buying gold anyway, we will be selling it to rebalance into other assets.ochotona wrote: But gold is a range limited oscillator in a band of $250 to $2500 in 2015 dollars. If you're at the bottom, you can see the future... the future is up! If you're at the top, you can see the future... it's down. In the middle... who knows.

Re: Adaptive gold allocation rule

I have gold, but not 25% at this price point. I totally get the utility of gold as a non-correlated asset in a multi-component portfolio, I don't want a conservative BH portfolio either, but I don't get this "I'm just going to shut my eyes and everything will be fine" attitude. It's not a religion. PP isn't optimum... it's a genius work, but humanity hasn't stopped innovating.

buddtholomew wrote: A 50% decline has a 12.5% impact on the portfolio. Most of us are in the PP to avoid analyzing charts of this nature. Either you internalize the PP concept and avoid looking at GLD in isolation or perhaps this allocation is not for you.

I hate gold too, but without gold you have a convsetvative BH portfolio with limited inflation protection. All I see in the chart is a response to anticipated/high levels of inflation followed by average to low inflation expectations.

Re: Adaptive gold allocation rule

I would never rule out $5000 gold. But based on hundreds of years of gold price, the 1980 and 2011 spikes stand alone. They abated at the $2000-ish level in 2015 dollars. They might be twin anomalies? The gold price really looks like a sawtooth sinusoid, if you ask me... with a period that lasts a generation!

It like the "oil is going to $200 a barrel" thing in 2008. And Peak Oil. I got caught up in that one. Really? Look where it is today.

It like the "oil is going to $200 a barrel" thing in 2008. And Peak Oil. I got caught up in that one. Really? Look where it is today.

stuper1 wrote: If we get to $2,500 gold, then who's to say it couldn't go to $5,000? If we do get to $2,500, we won't be buying gold anyway, we will be selling it to rebalance into other assets.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Adaptive gold allocation rule

Then find another market timing method than rebalancing bands. That's what I did. But I think the easier way to go is just risk normalize the PP so gold doesn't have such an outsized overinfluence to the PP. Because that's really what the problem is, not losing on any asset that three others cover.ochotona wrote: I have gold, but not 25% at this price point. I totally get the utility of gold as a non-correlated asset in a multi-component portfolio, I don't want a conservative BH portfolio either, but I don't get this "I'm just going to shut my eyes and everything will be fine" attitude. It's not a religion. PP isn't optimum... it's a genius work, but humanity hasn't stopped innovating.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Adaptive gold allocation rule

You can't compare now to history. In history, gold was money/cash which put on a upside limitation; now it is no longer money/cash so there is no upside limitation to gold when people lose confidence in a sovereign currency/debt and switch. What else do people trust when metaphysical toilet paper ceases to be?ochotona wrote: I would never rule out $5000 gold. But based on hundreds of years of gold price, the 1980 and 2011 spikes stand alone. They abated at the $2000-ish level in 2015 dollars. They might be twin anomalies? The gold price really looks like a sawtooth sinusoid, if you ask me... with a period that lasts a generation!

Have you ever looked at the Argentine gold coins issued shortly after the turn of the 20th century and calculated what it is worth today in real terms? It dwarfs any other investment in existence. Your eyes will bulge out of its sockets. $5000 is nothing.

Last edited by MachineGhost on Fri Feb 13, 2015 10:59 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Adaptive gold allocation rule

That is exactly the problem MG, finding a way to make any one of the assets not totally dominate the mix. Very hard since gold goes up and down by a factor of ten over the span of thirty years. That's why zero coupon bonds are not in the PP... too volatile, because of no coupon interest.

What, no "natural logarithm of the spot price of gold ETF"?

What, no "natural logarithm of the spot price of gold ETF"?

MachineGhost wrote: Then find another market timing method than rebalancing bands. That's what I did. But I think the easier way to go is just risk normalize the PP so gold doesn't have such an outsized overinfluence to the PP. Because that's really what the problem is, not losing on any asset that three others cover.