Repubs party platform: comittee to eval return to gold std and audit fed

Moderator: Global Moderator

Re: Repubs party platform: comittee to eval return to gold std and audit fed

TBV:

•I may be missing something, but the usual social credit money shortage scenario seems no different than saying that, in the aggregate, all products offered by businessmen who borrow X amount of money and then sell products for a total price of X+1 (to make a profit) can't be bought since no one has been afforded enough money to meet their price. How is the return claimed by the entrepreneur any different really than that claimed by the banker?

Am I right in thinking that so long as profits get spent back into the economy, then things can still continue to be sold at a profit? The other way that things can be sold at a profit is by increasing indebtedness. I guess that if bankers' spend all the debt interest they receive back into the economy then similarly things can roll along. I think the problem arises when money is lent to bid up asset prices and so bank ballance sheets increase in size in parallel with the asset prices. That provides the unsustainable sink of net saving as far as I can see. So the road to crisis is to have profits coming not from spending of pre-existing profits but rather from increasing the size of bank ballance sheets by lending to bid up asset prices.

I totally agree with your points about state mediated credit. I think an asset tax and citizens' dividend would avoid the pitfalls of having the state decide what are sensible uses of resources (especially peoples time). I think individual people are best placed to know what they can provide and want to aquire. So long as financial power is somewhat dispersed, then capitalism allows a match between what each of us can provide and want.

•I may be missing something, but the usual social credit money shortage scenario seems no different than saying that, in the aggregate, all products offered by businessmen who borrow X amount of money and then sell products for a total price of X+1 (to make a profit) can't be bought since no one has been afforded enough money to meet their price. How is the return claimed by the entrepreneur any different really than that claimed by the banker?

Am I right in thinking that so long as profits get spent back into the economy, then things can still continue to be sold at a profit? The other way that things can be sold at a profit is by increasing indebtedness. I guess that if bankers' spend all the debt interest they receive back into the economy then similarly things can roll along. I think the problem arises when money is lent to bid up asset prices and so bank ballance sheets increase in size in parallel with the asset prices. That provides the unsustainable sink of net saving as far as I can see. So the road to crisis is to have profits coming not from spending of pre-existing profits but rather from increasing the size of bank ballance sheets by lending to bid up asset prices.

I totally agree with your points about state mediated credit. I think an asset tax and citizens' dividend would avoid the pitfalls of having the state decide what are sensible uses of resources (especially peoples time). I think individual people are best placed to know what they can provide and want to aquire. So long as financial power is somewhat dispersed, then capitalism allows a match between what each of us can provide and want.

"Good judgment comes from experience. Experience comes from bad judgment." - Mulla Nasrudin

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Xan, sales taxes such as the "Fair Tax" screw the economy up IMO. Imagine a scenario where one person grows rice and the other person catches fish. Without sales tax, the rice could be sold to the fish guy and the money could then be used to buy fish and then the fish guy could use that money to buy rice and so on for ever. Imagine then that the "Fair Tax" is imposed. The farmer has $10 worth of rice to sell and the fisherman has $10. The fisherman gets $8 of rice, $2 goes to "Fair tax" and 20% of the rice rots. The fisherman has $10 worth of fish and the farmer now has $8. Farmer gets $6.40c of fish, $1.60c goes to "Fair Tax" and $3.60c worth of fish rot and so on. The farmer and the fisherman may try and cope by laying off staff, dropping prices etc but it will be a deflationary death spiral.

Of course we do have something much like the "Fair Tax" in europe. In the UK we have VAT at 20%. The deflationary force of VAT is countered by massive government deficit spending and increasing bank balance sheets. Basically sales taxes are a way to allow massive injections of credit without getting wage inflation. They are an instrument of class war as far as I can see- transfering power to the banks and government .

.

Of course we do have something much like the "Fair Tax" in europe. In the UK we have VAT at 20%. The deflationary force of VAT is countered by massive government deficit spending and increasing bank balance sheets. Basically sales taxes are a way to allow massive injections of credit without getting wage inflation. They are an instrument of class war as far as I can see- transfering power to the banks and government

"Good judgment comes from experience. Experience comes from bad judgment." - Mulla Nasrudin

Re: Repubs party platform: comittee to eval return to gold std and audit fed

You're right, in a sense that miners found "debt-free" gold, and then brought that gold to the Treasury and received a gold certificate that was "money". And that money could be exchanged for labor producing something. No doubt. As stone pointed out in his fable, if there is enough liquidity, the system works. But, historically, the liquidity wasn't always there when a large portion of the population needed it.craigr wrote:I thought people exchanged their labor producing something. Gold just made the exchange more liquid between parties. If someone produced fruit for gold then their only "debt" was the time it took them to grow the crop. Etc. We should not mix up fundamental issues here and ignore that ultimately it's human productive capacity underneath it all that makes value.Gumby wrote:But, just so we are clear. Gold wouldn't be debt free if the population had to go into debt in order to purchase it or borrow it. If the government just handed out some gold to everyone — with no strings attached — that would be debt-free money, and very fair.

In L. Frank Baum's The Wonderful Wizard of Oz, there are lots of symbolism for desperately needed liquidity (the rusty tin man who needs oil; the water that kills the wicked witch and represents the liquidity that ended the Great Depression). Gold would be fine if the liquidity always existed, but Gold wasn't liquid enough at times. These times of illiquidity required many non gold holders to go into debt (or essentially starve).

I know that there's more to the story than that (i.e. too much liquidity at times), but my point is that allowing society to become so heavily reliant on debt, even during good times, just leads to more and more instability and inequality over time.

Last edited by Gumby on Fri Aug 31, 2012 7:04 am, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

The fact is that the average person is heavily in debt. Entrepreneurs like Donald Trump have the smarts to turn a mountain of debt into a fortune. Donald Trump had about $900 million in personal debt at one point. He now has $3 billion in wealth. Hardly an example of the average American.TBV wrote:Doesn't sound like any entrepreneur I ever heard of. In fact, guys like Donald Trump are as famous for being in debt as they are for being wealthy.

The answer, of course, is that the State also provides money to the population, by going into debt. The State's debt is really just borrowing money from savers and handing those savers a piece of paper (a Treasury Bond) that allows them to store their wealth and receive interest payments. In effect, the interest payments on savings concentrates more wealth with the rich and savers that aren't in debt. Without the constant recycling of savings back into the private sector, there would be major liquidity problems.TBV wrote:

- If debt-based money leads to an absence of buying power which condemns us all to deflationary spirals, then why is the history of the last 100 years been one of fairly steady, if sometimes mild, inflation?

You mean... no casual link, except for the Great Depression.TBV wrote:

- If deflation is so fatal to prosperity, why has no causal link been found between deflation and depressions?http://minneapolisfed.org/research/sr/sr331.pdf

The researchers are essentially pointing out that depressions are also caused by exogenous circumstances (war, currency crises, loss of confidence, etc.) — which makes perfect sense."Our main finding is that the only episode in which we find evidence of a link between deflation and depression is the Great Depression."

Source: http://minneapolisfed.org/research/sr/sr331.pdf

Last edited by Gumby on Fri Aug 31, 2012 8:30 am, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Stone,stone wrote:Imagine then that the "Fair Tax" is imposed. The farmer has $10 worth of rice to sell and the fisherman has $10. The fisherman gets $8 of rice, $2 goes to "Fair tax" and 20% of the rice rots. The fisherman has $10 worth of fish and the farmer now has $8. Farmer gets $6.40c of fish, $1.60c goes to "Fair Tax" and $3.60c worth of fish rot and so on. The farmer and the fisherman may try and cope by laying off staff, dropping prices etc but it will be a deflationary death spiral.

I'm not sure how that's different from any other kind of tax. Certainly the exact same scenario plays out with an income tax, if each producer must pay a portion of his gain for each transaction. I suppose the decay is slower with an asset tax, but still there to some extent.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

That's not how the money is distributed. That's a mischaracterization. Money could be handed out to regional public banks who hand out money to non-profits who might determine who gets investment money. There are an infinite number of ways to determine who gets a citizens dividend.TBV wrote:

- If working capital is made available to enterprises by technocrats on the basis of which enterprises are profitable, how does one keep from funding solvent but plodding dinosaurs instead of shaky but promising start-ups?

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

That is not what the research pointed out. They concluded: "There are 65 episodes of deflation without depression and 21 of depression without deflation. Thus,65 of 73 deflation episodes had no depression, and 8 of 29 depression episodes had no deflation.What is striking is that nearly 90% of the episodes with deflation did not have depression. In a broad historical context, beyond the Great Depression, the notion that deflation and depression are linked virtually disappears.......Note that most of the episodes in the data set that have deflation and no depression occurred under a gold standard.Gumby wrote:

You mean... no casual link, except for the Great Depression.TBV wrote:

- If deflation is so fatal to prosperity, why has no causal link been found between deflation and depressions?http://minneapolisfed.org/research/sr/sr331.pdf

The researchers are essentially pointing out that depressions are also caused by exogenous circumstances (war, currency crises, loss of confidence, etc.) — which makes perfect sense."Our main finding is that the only episode in which we find evidence of a link between deflation and depression is the Great Depression."

Source: http://minneapolisfed.org/research/sr/sr331.pdf

The data suggest that deflation is not closely related to depression. A broad historical look finds

many more periods of deflation with reasonable growth than with depression and many more periods

of depression with inflation than with deflation. Overall, the data show virtually no link between

deflation and depression......The bar has thus been raised for those who claim that deflation and depression are closely linked."

This is one of the reasons I find the Austrian analysis of the business cycle more compelling.

Last edited by TBV on Fri Aug 31, 2012 10:11 am, edited 1 time in total.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

So, deflation doesn't always cause a depression. Big deal. Nobody disputes that.

The questions I have for you TBV, are...

Why you think that individuals — without money — should be forced to take on interest-bearing debt in order to educate themselves, or start a business? There are currently $1 Trillion in interest-bearing student debt. Do you think that makes sense for a society? Why not provide debt-free loans in a society to those people who are trying to invest in themselves in order to improve society for the better?

And if deflation is so wonderful, why on Earth would anyone want to take out an interest-bearing loan when the individual would clearly be underwater when the principal and interest are due? And if interest rates were to turn negative, why would anyone want to lend out money to someone?

My apologies if this is offensive (I do not intend it to be) but I'm guessing that you would not be so kind to gold and Austrian economics if you were a poor individual who was unable to become successful. It often seems that those who are the largest supporters of gold also tend to be those that have some gold and aren't stuck under increasing levels of personal debt. I don't think that's a coincidence.

As Thomas Edison said, in the New York Times, in 1921...

The questions I have for you TBV, are...

Why you think that individuals — without money — should be forced to take on interest-bearing debt in order to educate themselves, or start a business? There are currently $1 Trillion in interest-bearing student debt. Do you think that makes sense for a society? Why not provide debt-free loans in a society to those people who are trying to invest in themselves in order to improve society for the better?

And if deflation is so wonderful, why on Earth would anyone want to take out an interest-bearing loan when the individual would clearly be underwater when the principal and interest are due? And if interest rates were to turn negative, why would anyone want to lend out money to someone?

My apologies if this is offensive (I do not intend it to be) but I'm guessing that you would not be so kind to gold and Austrian economics if you were a poor individual who was unable to become successful. It often seems that those who are the largest supporters of gold also tend to be those that have some gold and aren't stuck under increasing levels of personal debt. I don't think that's a coincidence.

As Thomas Edison said, in the New York Times, in 1921...

"Make it perfectly clear that I'm not advocating any changes in banks and banking. Banks are a might good thing. They are essential to the commerve of the country. It is the money broker, the money profiteer, the private banker, that I oppose. They gain their power through a fictitous and false value given to gold.

"Gold is a relic of Julius Caesar and interest is an invention of Satan. Gold is intrinsical of less utility than most metals. The probable reason why it is retained as the basis of money is that it is easy to control. And it is the control money that is the root of all evil.

...

"Money ought to be plentiful and gold is not plentiful. It would be plentiful if it were mined in as large quantities as it could be, but an artificial scarcity is maintained by those who use gold to monopolize money."

...

"...Under the old way any time we wish to add to the national wealth we are compelled to add to the national debt. Now, that is what Henry Ford wants to prevent. He thinks it is stupid, and so do I, that for the loan of $30,000,000 of their own money the people of the United States should be compelled to pay $66,000,000 — that is what it amounts to, with interest. People who will not turn a shovelful of dirt nor contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. That is the terrible thing about interest. In all our great bond issues the interest is always greater than the principal. All of the great public works cost more than twice the actual cost, on that account. Under the present system of doing business we simply add 120 to 150 per cent to the stated cost.

"But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good, also. The difference between the bond and the bill is that the bond lets the money brokers collect twice the amount of the bond and an additional 20 percent, whereas the currency pays nobody but those who directly contribute...in some meaningful way.

...

"It is absurd to say that our country can issue $30,000,000 in currency in bonds and not $30,000,000 in currency. Both are promises to pay; but one promise fattens the usurer, and the other helps the people. If the currency issued by the Government were no good, then the bonds issued would be no good either. It is a terrible situation when the Government, to increase the national wealth, must go into debt and submit to ruinous interest charges at the hands of men who control the fictitious values of gold.

"Look at it another way. If the Government issues bonds, the brokers will sell them. The bonds will be negotiable; they will be considered as gilt-edged paper. Why? Because the Government is behind them, but who is behind the Government? The people. Therefore it is the government who constitute the basis of Government credit. Why then cannot the people have the benefit of their own gilt-edged credit by receiving non-interest bearing currency...instead of the bankers receiving the benefit of the people's credit in interest-bearing bonds?"

"The people must pay any way; why should they be compelled to pay twice, as the bond system compells them to pay? The people of the United States always accept their Government's currency. If the United States Government will adopt this policy if increasing its national wealth without contributing to the interest collector — for the whole national debt is made up of interest charges — then you will see an era of progress and prosperity in this country such as could never have come otherwise."

...

"I am just expressing my opionion as a citizen. Ford's idea is flawless. They won't like it. They will fight it, but the people of this country ought to take it up and think about it. I believe it points the way to many reforms and achievements which cannot come under the old system."

— Thomas Edison, quoted in NY Times, Dec. 6, 1921

Last edited by Gumby on Fri Aug 31, 2012 11:44 am, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Xan, with an asset tax, the tax is payable irrespective of whether the fisherman sells his fish or the farmer sells his rice. It doesn't impinge on trade in the real economy. I think to describe the whole system it is necessary to bring in the spending the government does with the money it takes in tax. Clearly if the government spent all of the money straight back to the fisherman and the farmer then that would make up for the tax drain. Inevitably though, some of the money government spends, end up being skimmed off and used to bid up asset prices rather than it all going straight back to people who need to buy stuff. An asset tax however only recycles money back into the system from asset prices and so everything keeps flowing. A sales tax ignores asset prices but hits consumer sales so asset prices bubble up whilst consumer sales shut down.Xan wrote:Stone,stone wrote:Imagine then that the "Fair Tax" is imposed. The farmer has $10 worth of rice to sell and the fisherman has $10. The fisherman gets $8 of rice, $2 goes to "Fair tax" and 20% of the rice rots. The fisherman has $10 worth of fish and the farmer now has $8. Farmer gets $6.40c of fish, $1.60c goes to "Fair Tax" and $3.60c worth of fish rot and so on. The farmer and the fisherman may try and cope by laying off staff, dropping prices etc but it will be a deflationary death spiral.

I'm not sure how that's different from any other kind of tax. Certainly the exact same scenario plays out with an income tax, if each producer must pay a portion of his gain for each transaction. I suppose the decay is slower with an asset tax, but still there to some extent.

"Good judgment comes from experience. Experience comes from bad judgment." - Mulla Nasrudin

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Gumby:

You ask why anyone should have to pay interest and then a few lines later ask why anyone would want to lend unless the interest rate were sufficiently attractive. Everyone has a time preference with respect to money. Either one wants to compensate folks for any delay in getting to spend their money on what they want (which encourages them to save/lend) or not (which doesn't.) It's gotta be one or the other.

You ask why anyone would borrow money if the money they pay it back with is more valuable than the money they borrowed. Well, having to pay back more than we borrow (in real terms) is the situation we usually face, even when there is no deflation. Going one step further, I might reply with the question "Why would anyone lend money when the inflation-debased dollars they are repaid with would be worth less than what was lent?" Clearly folks face both risks from time to time and yet money still gets borrowed and lent. Why? Because the participants make it worth their while: the lender by asking for sufficient interest to cover his risk and the borrower by choosing a rate/term that does not exceed the gain he anticipates from having access to the money.

As for why anyone would want to lend money out when interest rates are zero, let's acknowledge that it's usually a condition which does not persist very long (exceptions like Japan being the result of government/central bank distortions of market forces.) When the supply of available money contracts, it becomes more valuable. Those wishing to borrow bid up the price, so interest rates will rise until it's more advantageous for lenders to lend than not to. The interest needn't be much since, even at zero, repayment in deflated dollars represents a real gain to the lender.

I don't know what the profile is of the typical supporter of gold money. But in my judgment they seem more averse than others to the accumulation of debt, by them or anyone else. I wish the same could be said for advocates of easy money. There is no shortage of critics of fractional reserve banking among gold advocates, so it's a false characterization to suggest that they are oblivious to, much less support, the ill effects of excessive bank credit expansion.

Having said what I wanted to say, I'm now going to spend my Labor Day weekend (and beyond) on other things.

You ask why anyone should have to pay interest and then a few lines later ask why anyone would want to lend unless the interest rate were sufficiently attractive. Everyone has a time preference with respect to money. Either one wants to compensate folks for any delay in getting to spend their money on what they want (which encourages them to save/lend) or not (which doesn't.) It's gotta be one or the other.

You ask why anyone would borrow money if the money they pay it back with is more valuable than the money they borrowed. Well, having to pay back more than we borrow (in real terms) is the situation we usually face, even when there is no deflation. Going one step further, I might reply with the question "Why would anyone lend money when the inflation-debased dollars they are repaid with would be worth less than what was lent?" Clearly folks face both risks from time to time and yet money still gets borrowed and lent. Why? Because the participants make it worth their while: the lender by asking for sufficient interest to cover his risk and the borrower by choosing a rate/term that does not exceed the gain he anticipates from having access to the money.

As for why anyone would want to lend money out when interest rates are zero, let's acknowledge that it's usually a condition which does not persist very long (exceptions like Japan being the result of government/central bank distortions of market forces.) When the supply of available money contracts, it becomes more valuable. Those wishing to borrow bid up the price, so interest rates will rise until it's more advantageous for lenders to lend than not to. The interest needn't be much since, even at zero, repayment in deflated dollars represents a real gain to the lender.

I don't know what the profile is of the typical supporter of gold money. But in my judgment they seem more averse than others to the accumulation of debt, by them or anyone else. I wish the same could be said for advocates of easy money. There is no shortage of critics of fractional reserve banking among gold advocates, so it's a false characterization to suggest that they are oblivious to, much less support, the ill effects of excessive bank credit expansion.

Having said what I wanted to say, I'm now going to spend my Labor Day weekend (and beyond) on other things.

Last edited by TBV on Sat Sep 01, 2012 5:17 am, edited 1 time in total.

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Repubs party platform: comittee to eval return to gold std and audit fed

I'm not offended, but just to provide a data point, I discovered Austrian economics when I had no assets and was $77,000 in debt at between 6.8 and 8% interest. Did that make me poor? Or is "poor" a mindset and culture? I now recognize that Austrian economics is a bit dated in places, (especially when you try to use it to explain what's happening monetarily in a debt-based monetary system), but at the time, it wasn't the part about gold or deflation that appealed most to me. It was the focus on real production, the power of the individual, the role of the entrepreneur in society, the incisive critiques of central planning, oppressive regulation, and the corrupting nature of democratic elections.Gumby wrote: My apologies if this is offensive (I do not intend it to be) but I'm guessing that you would not be so kind to gold and Austrian economics if you were a poor individual who was unable to become successful. It often seems that those who are the largest supporters of gold also tend to be those that have some gold and aren't stuck under increasing levels of personal debt. I don't think that's a coincidence.

I think you have a tendency to conflate the aggregate with the individual. Increasing debt for society doesn't require increasing debt for any given individual. Nobody forced me to take out those loans. And once I really kicked my butt into gear to start paying them off, I was no longer "stuck under increasing levels of personal debt". In fact, my debt dropped rapidly and was eliminated entirely last month (YAAAAY!)

Nobody forces anyone to get into debt. Debt is just a single option among others. The reason why so many people (myself formerly included) choose the quick and easy debt-ridden path instead of the slow and hard path of working, earning, and saving has, IMHO, more to do with their (our, my) desire for instant gratification than the monetary system. Even with a non-debt-backed currency, debt would still exist and people could use it if they chose to. And now that I'm out of debt, I never intend to be back in it again, regardless of how easy it would be for me to get a mortgage or charge a bunch of useless junk to a credit card.

Last edited by Pointedstick on Fri Aug 31, 2012 12:06 pm, edited 1 time in total.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: Repubs party platform: comittee to eval return to gold std and audit fed

I don't think we should derive our worldview of economics from a fiction tale. What you are saying is all well and good. But then again there are countless stories that could be told of money being made worthless, dictators rising to power to fix things, and even more misery and suffering coming about as a result.Gumby wrote:In L. Frank Baum's The Wonderful Wizard of Oz, there are lots of symbolism for desperately needed liquidity (the rusty tin man who needs oil; the water that kills the wicked witch and represents the liquidity that ended the Great Depression). Gold would be fine if the liquidity always existed, but Gold wasn't liquid enough at times. These times of illiquidity required many non gold holders to go into debt (or essentially starve).

So taking my chances with gold or paper money that could be printed on a whim and massive debt created with it? I'll take my chances with gold acknowledging the weaknesses. The markets can work around these issues. But how do you work around bad inflation that could happen without suffering? You don't. You suffer along with everyone else.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

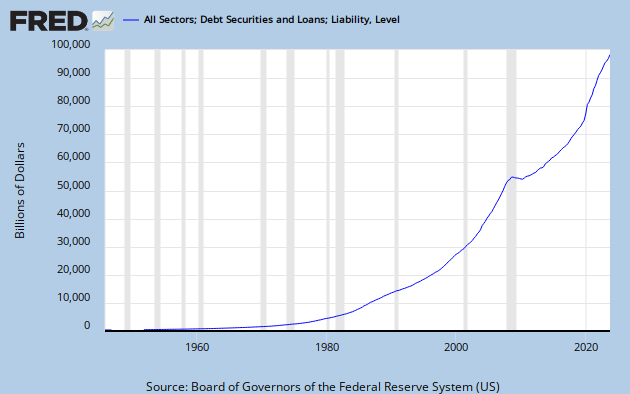

And yet, you don't seem to realize that in order for you to climb out of debt, others needed to go into debt collectively — since all money comes from debt, mostly as private credit, in a debt-based society.Pointedstick wrote:And once I really kicked my butt into gear to start paying them off, I was no longer "stuck under increasing levels of personal debt". In fact, my debt dropped rapidly and was eliminated entirely last month (YAAAAY!)

[align=center]

[/align]

[/align]

Last edited by Gumby on Fri Aug 31, 2012 12:13 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Repubs party platform: comittee to eval return to gold std and audit fed

…except base money is debt held by the government where we agree it doesn't actually matter, and coins are created debt-free. Theoretically, couldn't the money I spent to extinguish my debts have originated entirely in the form of federal spending, which only contributed to the meaningless national debt? What if I paid it all off in quarters and dimes? What makes you so sure that the dollars I used were bank-created money that became debts for the private sector rather than fed-created money that became debts (that don't really matter) for the public sector?Gumby wrote:And yet, you don't seem to realize that in order for you to climb out of debt, others needed to go into debt collectively — since all money comes from debt, mostly as private credit, in a debt-based society.Pointedstick wrote:And once I really kicked my butt into gear to start paying them off, I was no longer "stuck under increasing levels of personal debt". In fact, my debt dropped rapidly and was eliminated entirely last month (YAAAAY!)

Again, I think you're conflating the aggregate with the individual here. It's not like I had to to convince my neighbors to go take out car loans or buy furniture and groceries on credit so I could get the cash necessary to pay off my debts.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Because the overwhelming majority of our money supply comes from private credit. (Roughly ~$55 Trillion to date). Coins and public debt are actually quite small in relation to private credit — not to mention that the middle class are encouraged to pay taxes in order to "lower the national debt".Pointedstick wrote:What makes you so sure that the dollars I used were bank-created money that became debts for the private sector rather than fed-created money that became debts (that don't really matter) for the public sector?

Anyway, the discussion at hand is really about a debt-based fictitious gold-based/fixed-currency society where most people don't have access to gold. I've spent the last few pages of this discussion asking why citizens can't be given debt-free loans (for tuition or startup costs), and nobody has provided a good answer so far.

Again, our own society has $1 Trillion in interest-bearing student loan debt. That's not a good thing, and it will only further inequality and instability. What are your thoughts about that?

You only believe that because you keep looking at the situation from a micro level. You need to look at the macro level to see what I'm talking about.Pointedstick wrote:Again, I think you're conflating the aggregate with the individual here. It's not like I had to to convince my neighbors to go take out car loans or buy furniture and groceries on credit so I could get the cash necessary to pay off my debts.

Last edited by Gumby on Fri Aug 31, 2012 12:59 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Pointed Stick,

Keep in mind that it's not the "debt" or "credit" that's a problem in a debt/credit-based society. For instance, debt-free Tally Sticks would be just fine. The problem is the interest payments that causes the poor to go deeper into debt on a macro level. The interest payment concentrates wealth with the wealthy (again, on a macro level) and causes the poor to take on more debt (on a macro level) just to pay the collective interest to the wealthy.

Even Treasury Bonds enable the savers (i.e. the banks, the wealthy and those without any personal debt) to receive interest payments from the government — making them richer and richer over time — thus concentrating wealth.

Keep in mind that it's not the "debt" or "credit" that's a problem in a debt/credit-based society. For instance, debt-free Tally Sticks would be just fine. The problem is the interest payments that causes the poor to go deeper into debt on a macro level. The interest payment concentrates wealth with the wealthy (again, on a macro level) and causes the poor to take on more debt (on a macro level) just to pay the collective interest to the wealthy.

Even Treasury Bonds enable the savers (i.e. the banks, the wealthy and those without any personal debt) to receive interest payments from the government — making them richer and richer over time — thus concentrating wealth.

"It is true democratic feeling, that all the measures of the government are directed to the purpose of making the rich richer and the poor poorer"

— William Henry Harrison, the ninth President of the U.S. (1841), in an October 1, 1840 speech

Last edited by Gumby on Fri Aug 31, 2012 1:22 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Why would "massive debt" be necessary for 'debt-free' money? By definition, there would be no debt with debt-free money.craigr wrote:So taking my chances with gold or paper money that could be printed on a whim and massive debt created with it? I'll take my chances with gold acknowledging the weaknesses.

Speaking of which, Gold is notorious for causing massive debt-loads, since it's always been so scarce. Governments, individuals and businesses have always had to borrow gold from gold holders to make payments. My point about L. Frank Baum is that he correctly pointed out that gold was too scarce for the nation when many regions desperately needed more liquidity. Thomas Edison echoed this point as well when he pointed out that gold is not plentiful enough for everyone to use freely.

Last edited by Gumby on Fri Aug 31, 2012 1:16 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Repubs party platform: comittee to eval return to gold std and audit fed

I think the real issue is dispersal or concentration of financial power rather than what mechanism of finance is used. Gold supply can be manipulated to grab financial power in a gold as money system. Debt can be deployed to grab financial power both in pure fiat or in gold based systems. Debt free money could also be used to dish out financial power to cronies. IMO for an economy to reflect what everyone wants, everyone needs to have skin in the game with each of the key three elements of the economy: labour, capital and government. If those three aspects work in concert to mutual benefit, then all works well. If those three aspects have different interest groups and fight it out; then waste and strife are the only result. If everyone is both a worker and an owner and can influence government then things can be worked out whatever type of money we use so long as we understand how whatever type we use works and so we are not bamboozled into getting our pockets picked and ending up economically excluded like the people in that "gold island" fable I put in earlier.

"Good judgment comes from experience. Experience comes from bad judgment." - Mulla Nasrudin

Re: Repubs party platform: comittee to eval return to gold std and audit fed

That's a great point. It really doesn't matter what backs a currency. What really matters is who controls its issuance.stone wrote:Debt free money could also be used to dish out financial power to cronies.

Last edited by Gumby on Fri Aug 31, 2012 1:46 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Repubs party platform: comittee to eval return to gold std and audit fed

We already have asset taxes in the USA. Its called a direct tax, as opposed to income taxes which are indirect (measured by the source of the income, wherever derived). Direct taxes have to be apportioned among the states to be fair and just. It's politically unpopular because a direct tax is seen as a tax on the right to exist, just as your asset tax is.stone wrote: I'm definitely suggesting an asset tax as an alternative to the current taxes not as an addition. I think transaction taxes tend to shut down the real economy. Shifting to an asset tax and away from transaction taxes might be what we need to get the economy up and running again IMO.

So screw that.

Last edited by MachineGhost on Fri Aug 31, 2012 6:10 pm, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Repubs party platform: comittee to eval return to gold std and audit fed

The APT is king of the hill, but it just seems to get no respect. Why do alterantie taxing schemes with more controversial elements and weaknesses attract more attention and support? Pity.Xan wrote: Great points, PointedStick. Another horror of an asset tax in your Antiques Roadshow scenario is if the government tries to go after you for BACK asset taxes for all the years that end table sat in your attic!

These seem to be reasons why the FairTax is better than an asset tax, while still retaining the benefits.

The Automated Payment Transaction (APT) tax is a proposal to replace all United States taxes with a single tax (using a very low rate) on each and every transaction in the economy. The system was developed by University of Wisconsin–Madison Professor of Economics Dr. Edgar L. Feige.

The foundations of the APT tax proposal—a small, uniform tax on all economic transactions—involve simplification, base broadening, reductions in marginal tax rates, the elimination of tax and information returns and the automatic collection of tax revenues at the payment source. The APT approach would extend the tax base from income, consumption and wealth to all transactions. As such, it should be regarded as a revenue neutral transactions tax, whose tax base is primarily made up of financial transactions. The APT tax extends the tax reform ideas of John Maynard Keynes,[1] James Tobin[2] and Lawrence Summers,[3] to their logical conclusion, namely to tax the broadest possible tax base at the lowest possible tax rate. The result is to significantly improve economic efficiency, enhance stability in financial markets, while reducing to a minimum the costs of tax administration (assessment, collection,and compliance costs). Supporters argue that a uniform tax might not, on its face, look progressive, but would be since the volume of taxed transactions rise disproportionately with personal income. Daniel Akst, writing in the New York Times[4], wrote "the Automated Payment Transaction tax offers fairness, simplicity, and efficiency. It may not be a free lunch. But it sure smells better than the one we eat now." On April 28,2005, the APT proposal was presented to the President's Advisory Panel on Federal Tax Reform in Washington, DC.[5]

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Repubs party platform: comittee to eval return to gold std and audit fed

+1Pointedstick wrote: Gumby, after reading over that page and the quotations you've pasted here, this all sounds like it will require massive government intervention in the economy in the form of a central planing apparatus to direct the socialized funds that would, like all such institutions, be vulnerable to corruption and capture by the moneyed class whose wealth it's meant to redistribute. In addition, it would obviously suffer from all the other standard problems of economic central planning.

Screw that.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Repubs party platform: comittee to eval return to gold std and audit fed

That sounds like what a naive left-winger would say. Lets pretend for a moment that we don't increasingly have a crony capitalist system at present and that its at least 50-years ago. By that standard, capitalism is about the freedom to have the opportunity and the choice to improve your lot in life through ownership of the means of production, whether directly your own or indirectly that of others. Once business competition becomes restricted by regulatory capture or a plutocracy via the "government" hallucinotion, it ceases to be capitalism. Back in the present day, it seems like capitalism really only exists in burgeoning new ideas and new industries that don't have vested interests against it, though we certainly can still invest in existing monopolies (i.e. stock market).Gumby wrote: Capitalism is great if you're lucky enough to succeed. But, it's not so great for the bottom of the barrel. Most post capitalistic frameworks are about giving everyone a fair shot. Capitalism tends to favor the top of the heap.

This is all a fancy way of saying that the legal system matters. Without a legal system based on common law rights, sanctity of contract, protection of private property and possibly anti-trust law, you do not have democratic capitalism.

Last edited by MachineGhost on Fri Aug 31, 2012 6:12 pm, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Repubs party platform: comittee to eval return to gold std and audit fed

MachineGhost wrote:That sounds like what a naive left-winger would say. Lets pretend for a moment that we don't increasingly have a crony capitalist system at present and that its at least 50-years ago. By that standard, capitalism is about the freedom to have the opportunity and the choice to improve your lot in life through by ownership of the means of production, whether directly your own or indirectly that of others. Once business competition becomes restricted by regulatory capture or a plutocracy ala the "government" hallucinotion, it ceases to be capitalism. Back in the present day, it seems like capitalism really only exists in burgeoning new ideas and new industries that don't have vested interests against it, though we certainly can still invest in existing monopolies (i.e. stock market).Gumby wrote: Capitalism is great if you're lucky enough to succeed. But, it's not so great for the bottom of the barrel. Most post capitalistic frameworks are about giving everyone a fair shot. Capitalism tends to favor the top of the heap.

This is all a fancy way of saying that the legal system matters. Without a legal system based on common law rights, sanctity of contract, protection of private property and possibly anti-trust law, you do not have democratic capitalism.

http://www.mind-trek.com/treatise/ecr-pem/intro.htm

Because man has not mastered the problem of achieving prosperity, he has turned to government for its solution. Thus he has complicated his problem, for government offers no solution to the problem of prosperity, while its intervention in this primary problem brings the additional problem of how to govern government. When government undertakes to solve man's problem for him it undertakes the mastery of society and it cannot be both master and servant. Thus it has failed in both spheres. By intertwining the prosperity problem with the political problem man has snarled the threads and no solution of either is possible without separation.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Repubs party platform: comittee to eval return to gold std and audit fed

Taking on debt to enrich others is an optional choice. I would also point out that debt-as-assets on the lending side can be written off and even deducted against taxes. It is not real wealth, but a paper fiction. You'd have a stronger case based on real asset scarcity. Debt-as-money simply monetizes labor and productivity. What the recipient does with it is up to them.Gumby wrote: Yes, everyone has the opportunity and only a few are able to climb out of debt by convincing others to go into debt. In a debt-based society, there can be no other way.

I get the impression you like to continually conflate state capitalism with debt-based money. One may not be able to exist without the other, but coercion is NOT the essence of capitalism.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!