I think of cash as a way of "delevering" the portfolio.

Are you familiar with how margin trading works? It essentially allows you to buy more risky assets than you could otherwise by allowing you to "short" cash. You pay your broker the return that cash is getting plus a little extra to compensate them for the risk / effort.

So what would be the opposite of going on margin be? Holding cash. I have the belief that the amount of leverage (including negative leverage) is up to the discretion of the investor. So I wouldn't object to someone having 70% cash, 10% stocks, 10% gold, and 10% bonds nor would I object to 33% in stocks, bonds, and gold. It depends how much risk you are comfortable taking.

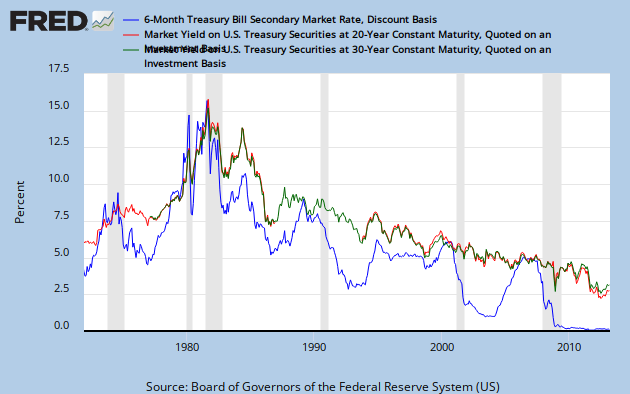

The one caveat is that occasionally the Fed punishes leveraged players (by hiking short term rates very aggressively) and other times it spoils them by holding them very low for extended periods (like what is happening right now).

However, with all of that said, it is somewhat concerning that you would see 30 year treasuries as being a substitute for cash. You should really study the PP and the returns of the assets before you implement this strategy. Long term treasuries that are perpetually rolled over (what the pp does) are extremely risky in isolation and are not very cash like. I think you have a lot of reading to do and ironically a 100% cash portfolio might be best for you until you hit the books!