Page 2 of 2

Re: Highest I bond rate ever: 7.12%

Posted: Fri Nov 05, 2021 3:10 pm

by jhogue

Xan,

Are you sure about that?

Hillsdale College appears on the Dept. of Education's Database of Accredited Postsecondary Institutions and Programs. So far as I know, that qualifies students at Hillsdale to use US savings bonds to pay for qualified higher education expenses.

See:

https://ope.ed.gov/dapip/#/search-results

Re: Highest I bond rate ever: 7.12%

Posted: Fri Nov 05, 2021 3:51 pm

by Cortopassi

jhogue wrote: ↑Fri Nov 05, 2021 1:29 pm

Corto,

TIPS have two principal issues, which I think makes them unsuitable for PP investors:

1. Interest rate risk.

Unlike I-bonds, where the interest rate is known and guaranteed at the time of purchase, TIPS can turn negative, wiping out your gains from interest or capital gains (or both). I take my risk in equities, not cash.

2. Tax treatment.

I-bonds are tax-deferred for an incredible 30 year span. Interest and capital gains from TIPS are taxable every year. Plus, if you put TIPS in your IRA you are taking up space better used to shield the three volatile assets.

If you have a lot of spare cash beyond annual I-bonds, a better alternative strategy is to ladder your own 1-5 year T-bills in a taxable or tax-deferred account. A 5-year T-bill is currently 1.06%; more than twice the yield of your Ally savings account. You can buy T-bills on the secondary market free at Fidelity; not sure about Vanguard.

Argh. Why can't I just have a nice 5% money market account like before! :-)

Re: Highest I bond rate ever: 7.12%

Posted: Fri Nov 05, 2021 4:01 pm

by pp4me

Cortopassi wrote: ↑Fri Nov 05, 2021 3:51 pm

jhogue wrote: ↑Fri Nov 05, 2021 1:29 pm

Corto,

TIPS have two principal issues, which I think makes them unsuitable for PP investors:

1. Interest rate risk.

Unlike I-bonds, where the interest rate is known and guaranteed at the time of purchase, TIPS can turn negative, wiping out your gains from interest or capital gains (or both). I take my risk in equities, not cash.

2. Tax treatment.

I-bonds are tax-deferred for an incredible 30 year span. Interest and capital gains from TIPS are taxable every year. Plus, if you put TIPS in your IRA you are taking up space better used to shield the three volatile assets.

If you have a lot of spare cash beyond annual I-bonds, a better alternative strategy is to ladder your own 1-5 year T-bills in a taxable or tax-deferred account. A 5-year T-bill is currently 1.06%; more than twice the yield of your Ally savings account. You can buy T-bills on the secondary market free at Fidelity; not sure about Vanguard.

Argh. Why can't I just have a nice 5% money market account like before! :-)

I'm already partially giving up on my TIPS experiment even though I had intended to wait until the end of the year. Still down .08% in my taxable account but slightly up in tax deferred (bought both batches at the same time but this has been exactly how it's working - down in taxable and slightly up in tax-deferred but not enough to make up for the loss in taxable).

If TIPS can't do well with inflation at an all time high then what is the point?

Re: Highest I bond rate ever: 7.12%

Posted: Fri Nov 05, 2021 4:21 pm

by Xan

jhogue wrote: ↑Fri Nov 05, 2021 3:10 pm

Xan,

Are you sure about that?

Hillsdale College appears on the Dept. of Education's Database of Accredited Postsecondary Institutions and Programs. So far as I know, that qualifies students at Hillsdale to use US savings bonds to pay for qualified higher education expenses.

See:

https://ope.ed.gov/dapip/#/search-results

Well played! So that's even better than I had thought.

Re: Highest I bond rate ever: 7.12%

Posted: Wed Dec 15, 2021 10:34 am

by Kriegsspiel

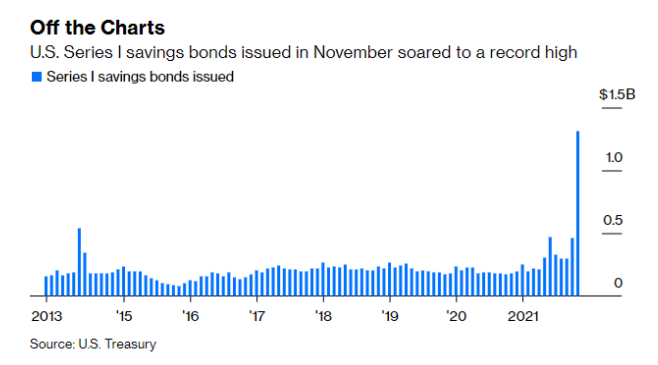

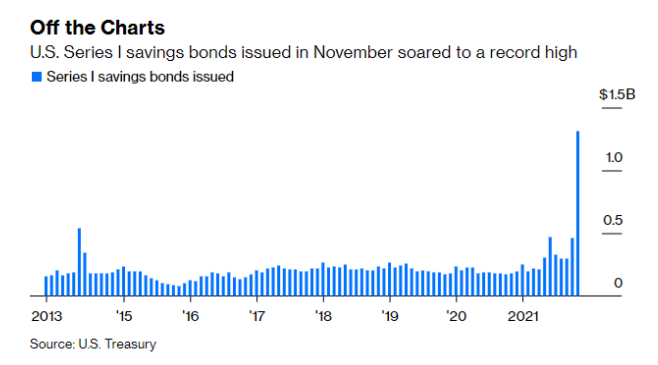

People like the I-Bonds.

Re: Highest I bond rate ever: 7.12%

Posted: Wed Dec 15, 2021 12:11 pm

by jhogue

Kriegs,

Nice chart. Where did you find it?

( I am curious why it leaves out everything before 2013).

Re: Highest I bond rate ever: 7.12%

Posted: Wed Dec 15, 2021 12:17 pm

by Kriegsspiel

Bloomberg, via

A Wealth Of Common Sense.

"The Treasury disclosed that it issued $1.312 billion of Series I bonds in November, according to data released late Monday. That’s by far the most on record since the department began breaking out monthly totals eight years ago."

Re: Highest I bond rate ever: 7.12%

Posted: Thu Dec 16, 2021 8:46 am

by jhogue

Thanks.

I guess a record high yield is the best sales campaign for I bonds .

Re: Highest I bond rate ever: 7.12%

Posted: Tue Jan 04, 2022 3:08 pm

by Cortopassi

Moved another 20k pp cash into iBonds yesterday for me and my wife.

Re: Highest I bond rate ever: 7.12%

Posted: Tue Jan 04, 2022 6:10 pm

by ppnewbie

Loaded up again in 2022.

Re: Highest I bond rate ever: 7.12%

Posted: Wed Jan 05, 2022 9:10 am

by jhogue

A couple of recent posts by forum members remind us that you can boost your I bond holdings significantly by treating this side of the New Year as another buying opportunity. This is a good way to deal with Treasury’s I bond purchase limitation of $10,000 per SSN per year (a common complaint among investors).

Note also that even if you buy at the end of January 2022, you will be paid interest for the entire month. In addition if you buy before 1 April 2022 you will get the guaranteed rate of 7.12% for the next six months. If the subsequent rate should fall to 0.00% (and I doubt that it will), you will still gain, at the very least, an annualized rate of 3.56%. In comparison, a 1 year Treasury bill has a current yield of 0.42% and a 5 year bank CD is about 1.30%.

I think that I get best value from I bonds as part of a long-term strategy. Right now, it looks like new I-bonds held for a minimum of one year are also the most competitive place to park short term Cash.