No. Bitcoin is a figment of the technological imagination that is and has been easily manipulated by organized crime, has no intrinsic value, and is purely speculative in nature. It performs none of the functions expected of gold.

New Ray Dalio piece

Moderator: Global Moderator

- Ad Orientem

- Executive Member

- Posts: 3483

- Joined: Sun Aug 14, 2011 2:47 pm

- Location: Florida USA

- Contact:

Re: New Ray Dalio piece

No. Bitcoin is a figment of the technological imagination that is and has been easily manipulated by organized crime, has no intrinsic value, and is purely speculative in nature. It performs none of the functions expected of gold.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: New Ray Dalio piece

"Bitcoin is a figment of the technological imagination"Ad Orientem wrote: ↑Tue May 12, 2020 10:00 am No. Bitcoin is a figment of the technological imagination that is and has been easily manipulated by organized crime, has no intrinsic value, and is purely speculative in nature. It performs none of the functions expected of gold.

This has no meaning.

"easily manipulated by organized crime"

What sort of manipulation? Price? All actors in a market are "manipulating" the price when they buy and sell. Harry also objects to the idea of participants in the marketplace as manipulators (he talks of silver market example).

"has no intrinsic value"

There is no such thing as intrinsic value. All value is subjective and based on an individual's preferences and environment.

"purely speculative in nature"

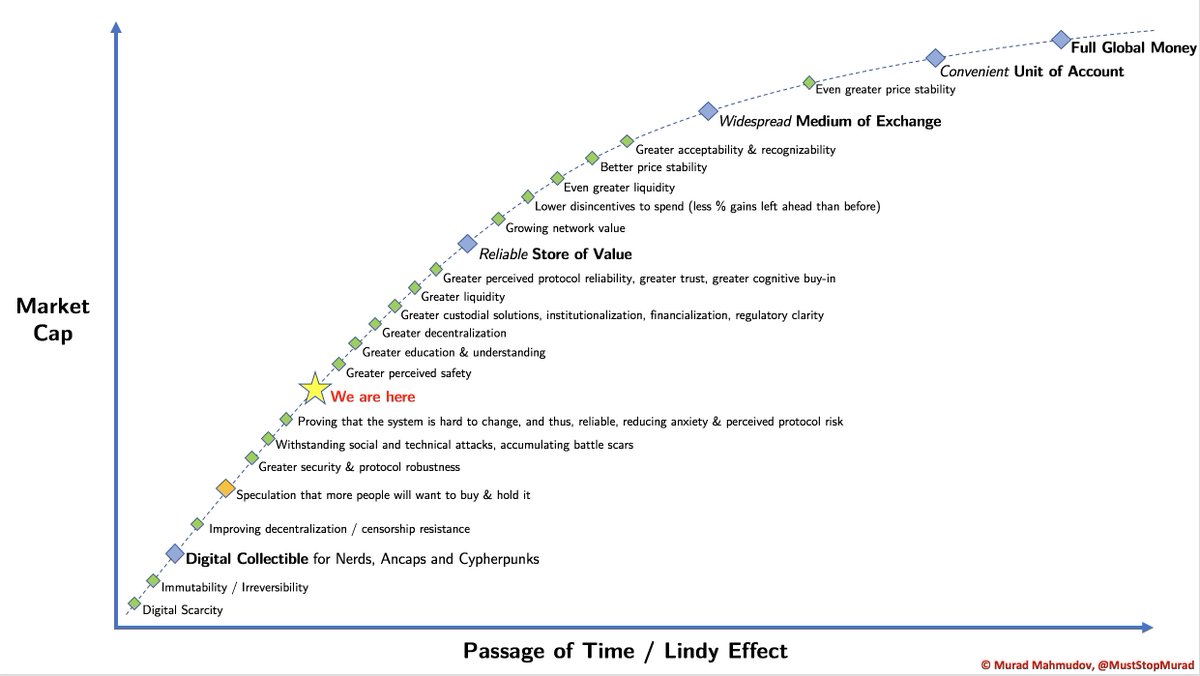

Many are using Bitcoin for practical purposes. As a savings vehicle in several high inflation countries for example. That said a lot of interest is speculation, I agree. But not all. And that speculation is about Bitcoin having strong monetary properties. See below:

"It performs none of the functions expected of gold."

I assume you mean gold's functions as money. Here are some valuable characteristics of money:

Durability: bitcoin and gold both strong here.

Portability: bitcoin is digital thus much more portable than gold.

Divisibility: A single bitcoin can be subdivided into 100,000 sub units. Gold much hard to pay with shavings.

Uniformity/Fungibility: gold strong here (verifiability of such uniformity later). I think bitcoin is a bit weaker currently due to transactions being public. Improvements hopefully to come there.

Limited supply: bitcoin has a mathematic max of 21m coins. Gold is scarce as well but more susceptible to increases in supply with price rises (stock to flow). I think the mining asteroids argument is far off.

Acceptability: bitcoin is bad here. Gold has history and global awareness. This will be the last domino to fall on bitcoin's monetization.

Censorship Resistance: gold pretty good. Bitcoin better due to digital nature.

Security: Much easier to store bitcoin (paper, brain) than bulky gold.

Verifiability: bitcoin can be verified with free software. Gold you need contraptions for coins which are cheap. But hard for bars (see recent scandals on fake gold)

Seizure resistance: bitcoin wins as there isnt anything in the physical world that you really need to own it. Plausible deniability. Gold can be searched and found

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: New Ray Dalio piece

When bitcoin has 5000 years of history I will look at it as I do gold

Re: New Ray Dalio piece

Mathjak touches upon one of my reservations about Bitcoin that I don't have about gold. Sure, gold and bitcoin have a lot of the same properties, but the difference is that gold (and silver) are proven as being timeless with thousands of years of history to back them up. That history is worth something. Bitcoin's supporters are espousing that the asset is something similarly timeless without the benefit of, well, time.

My second cause for hesitation is the fact that while the number of Bitcoins may be limited to a supply of 21 million, the supply of cryptocurrencies is not limited. Even worse, there are many cryptocurrencies that have vastly improved upon Bitcoin's 1.0-esque problems. Hashgraph looks particularly promising. None of the scaling problems, tremendous energy consumption, and slow transactions times like Bitcoin. Some like Libra also have commercial support, which is another conundrum.

In the end, I don't want to shun Bitcoin and just dismiss it. I think the fair statement to make is that the jury is still out.

My second cause for hesitation is the fact that while the number of Bitcoins may be limited to a supply of 21 million, the supply of cryptocurrencies is not limited. Even worse, there are many cryptocurrencies that have vastly improved upon Bitcoin's 1.0-esque problems. Hashgraph looks particularly promising. None of the scaling problems, tremendous energy consumption, and slow transactions times like Bitcoin. Some like Libra also have commercial support, which is another conundrum.

In the end, I don't want to shun Bitcoin and just dismiss it. I think the fair statement to make is that the jury is still out.

- bitcoininthevp

- Executive Member

- Posts: 465

- Joined: Fri Sep 25, 2015 8:30 pm

Re: New Ray Dalio piece

I think that hesitation is totally fair, personally. Those speculating on bitcoin becoming money, if they are correct, will be (some already are) insanely wealthy. But still a speculation in the meantime.Smith1776 wrote: ↑Fri Jul 03, 2020 5:50 pm Mathjak touches upon one of my reservations about Bitcoin that I don't have about gold. Sure, gold and bitcoin have a lot of the same properties, but the difference is that gold (and silver) are proven as being timeless with thousands of years of history to back them up. That history is worth something. Bitcoin's supporters are espousing that the asset is something similarly timeless without the benefit of, well, time.

I disagree. The equivalent would be someone discovering metals for the first time and saying the same about gold. Non gold metals do not have the same properties as gold, even if they might be shiny. Coins other than bitcoin do not have the same properties as bitcoin, even if they call themselves cryptocurrency.Smith1776 wrote: ↑Fri Jul 03, 2020 5:50 pm My second cause for hesitation is the fact that while the number of Bitcoins may be limited to a supply of 21 million, the supply of cryptocurrencies is not limited. Even worse, there are many cryptocurrencies that have vastly improved upon Bitcoin's 1.0-esque problems. Hashgraph looks particularly promising. None of the scaling problems, tremendous energy consumption, and slow transactions times like Bitcoin. Some like Libra also have commercial support, which is another conundrum.

Just one example: It costs $10+ million per day to sustain an attack on the Bitcoin network. The same attack on a "TOP 5" coin is $200k.

Libra or anything similar is centralized and susceptible to government control overnight.

Many of the promises of these alt coins ("faster!", "clean!") are just hand waving if not intentionally deceptive.

I know its just a figure of speech. But "some" of the jury is out and some is not.

Re: New Ray Dalio piece

The bank of international settlement made gold a tier one asset recently.