Cracks emerging in money markets?

Moderator: Global Moderator

Re: Cracks emerging in money markets?

77% repos? That's gone up since I last checked (was about 60%). Crazy.

I only wish FDLXX could be used as a sweep account. It's not that hard to keep shifting cash into it though. With the smartphone app I can do it while walking to work, or while stuck in boring meetings. I also have 3 sets of T bills on autoroll, and it looks like you can add to those positions anytime with the "buy" button. Pugchief have you tried that?

I only wish FDLXX could be used as a sweep account. It's not that hard to keep shifting cash into it though. With the smartphone app I can do it while walking to work, or while stuck in boring meetings. I also have 3 sets of T bills on autoroll, and it looks like you can add to those positions anytime with the "buy" button. Pugchief have you tried that?

- mathjak107

- Executive Member

- Posts: 4652

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Cracks emerging in money markets?

i use fzfxx as a sweep account

Re: Cracks emerging in money markets?

That's what I do now, except I have the FDLXX fund in a separate brokerage account and use the cash account only for ATM withdrawals. I put all the credit card auto-debits on the brokerage after an episode this past April where Fidelity's auto-transfer software failed, and a bunch of people got stuck with late fees from their credit cards. I went with the separate brokerage because you can't set up auto transfers into a money market fund in the cash account, and its sweep pays essentially no interest.MangoMan wrote: ↑Sun Sep 22, 2019 8:48 amTried T-bills/autoroll? Yes, but I prefer the liquidity of a MM fund.sophie wrote: ↑Sun Sep 22, 2019 8:42 am 77% repos? That's gone up since I last checked (was about 60%). Crazy.

I only wish FDLXX could be used as a sweep account. It's not that hard to keep shifting cash into it though. With the smartphone app I can do it while walking to work, or while stuck in boring meetings. I also have 3 sets of T bills on autoroll, and it looks like you can add to those positions anytime with the "buy" button. Pugchief have you tried that?

I didn't know about this whole repo thing until this thread, but I have held cash in other MM funds at Fidelity, and they do automatically pull funds if necessary to cover debits that can't be paid from the sweep fund, so I will be keeping most of my cash there in FDLXX going forward.

- mathjak107

- Executive Member

- Posts: 4652

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Cracks emerging in money markets?

Nope..not concerned at all..repurchase agreements are standard fed action whether a fund takes part or not

Re: Cracks emerging in money markets?

I think a lot of investors would have described buying and selling in the large secondary market in collaterized mortgage obligations-- the sort held by Bear Stearns prior to 2008 -- as a standard action for all the TBTF investment banks on Wall Street.mathjak107 wrote: ↑Sun Sep 22, 2019 2:24 pm Nope..not concerned at all..repurchase agreements are standard fed action whether a fund takes part or not

“Groucho Marx wrote:

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

Re: Cracks emerging in money markets?

Exactly. All the articles I've read state that the Fed's current intervention in the repo market is not typical and hasn't happened since 2008. That seems like cause for at least a little bit of concern and scrutiny.

Re: Cracks emerging in money markets?

https://www.pragcap.com/three-things-i- ... o-madness/

Good article.

PS: if you have a brokerage that you can see futures quotes with and monitor stocks, T-bonds, currencies, gold and large industrial commodities it’s pretty easy to see if something is up. I haven’t seen anything to suggest a problem.

Good article.

PS: if you have a brokerage that you can see futures quotes with and monitor stocks, T-bonds, currencies, gold and large industrial commodities it’s pretty easy to see if something is up. I haven’t seen anything to suggest a problem.

Re: Cracks emerging in money markets?

I still don’t quite understand. Has the Fed been injecting billions of dollars into the repo market each day (e.g., giving it to the banks like “free money”), or has it simply been lending that money to the banks at below-market interest rates?

If the repo lending rates spiked this past week because the banks lack sufficient reserves, then doesn’t that mean the reserve requirements are doing their job, i.e., maybe the banks should dial back their lending a bit to correspond to the reserves they actually have?

If the repo lending rates spiked this past week because the banks lack sufficient reserves, then doesn’t that mean the reserve requirements are doing their job, i.e., maybe the banks should dial back their lending a bit to correspond to the reserves they actually have?

Re: Cracks emerging in money markets?

Its way complex...but the bottom line is it isn’t the liquidity being injected but the spread that matters. Wide spread basically means trust is breaking down.

-

boglerdude

- Executive Member

- Posts: 1492

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Cracks emerging in money markets?

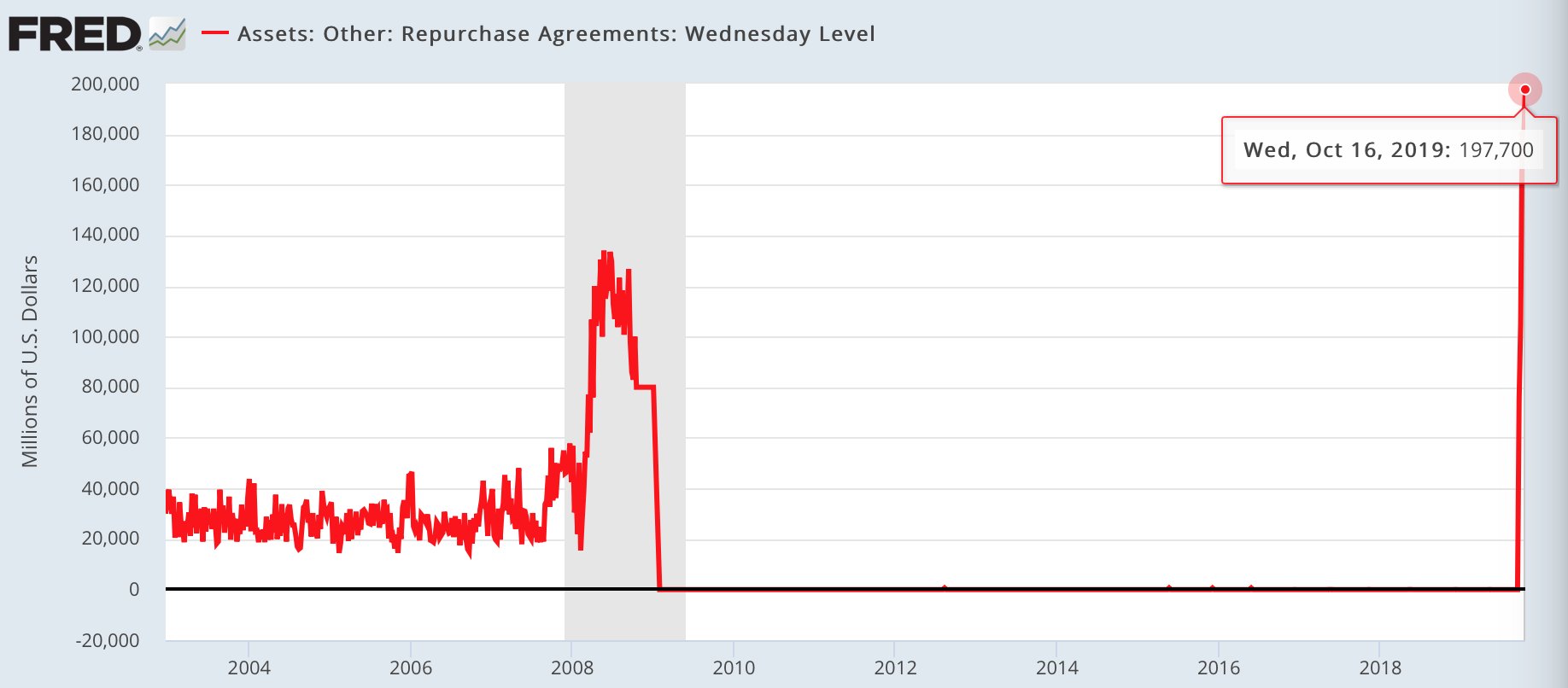

https://fred.stlouisfed.org/graph/?g=mc6A

Looks like a lot of e-cash sitting around compared to before 08. Thats still not enough liquidity?

Looks like a lot of e-cash sitting around compared to before 08. Thats still not enough liquidity?

Re: Cracks emerging in money markets?

Exactly Kbgboglerdude wrote: ↑Tue Sep 24, 2019 1:43 am https://fred.stlouisfed.org/graph/?g=mc6A

Looks like a lot of e-cash sitting around compared to before 08. Thats still not enough liquidity?

"Wide spread basically means trust is breaking down."

"The increased role of non-bank institutions in providing credit means that an increasing proportion of international finance comes from unregulated sources. Effectively, this means that these institutions, including money market funds, investments banks, etc., have unwittingly assumed even bigger risks in their lending practices than commercial banks. This also means that when the downturn comes, the share of non-performing and/or defaulted loans will grow higher than before."

I can hear them asking ..What's in your Wallet I mean Portfolio/Collateral?

¯\_(ツ)_/¯

Re: Cracks emerging in money markets?

+1

For even more detail and analysis, see "Securitized Banking and the Run on the Repo," by Gary Borton and Andrew Metrick, a National Bureau of Economic Research working paper available on-line:

https://www.nber.org/papers/w15223

For me, the bottom line is that Uncle Harry's wisdom still prevails. Own each asset in the purest form possible, with the fewest pieces of paper between you and your money. Avoid the repo market. Buy Treasurys.

“Groucho Marx wrote:

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

Re: Cracks emerging in money markets?

The Fed said they will inject liquidity until October 10-ish. So what happens after then???

- Attachments

-

- Liz Ann Sonders

- Screenshot 2019-09-24 at 9.01.14 PM.png (148.74 KiB) Viewed 24372 times

-

- woman screaming at cat meme

- Screenshot 2019-09-24 at 8.58.18 PM.png (734.96 KiB) Viewed 24373 times

Re: Cracks emerging in money markets?

Fuhget about it, it don’t mean nuthin.

- dualstow

- Executive Member

- Posts: 15308

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Cracks emerging in money markets?

I hope Pug won’t mind if I add a WSJ link. Actually, the link in the OP is from the WSJ.

Fed Adds $63.5 Billion to Financial System in Repo Transaction

https://www.wsj.com/articles/fed-adds-6 ... 1569846438

Fed Adds $63.5 Billion to Financial System in Repo Transaction

https://www.wsj.com/articles/fed-adds-6 ... 1569846438

RIP LALO SCHIFRIN

- dualstow

- Executive Member

- Posts: 15308

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Cracks emerging in money markets?

I thought you always asked for a non-paywalled alternative. I’m probably thinking of someone else, then.MangoMan wrote: ↑Mon Sep 30, 2019 8:31 pmWhy would I mind?dualstow wrote: ↑Mon Sep 30, 2019 10:33 am I hope Pug won’t mind if I add a WSJ link. Actually, the link in the OP is from the WSJ.

Fed Adds $63.5 Billion to Financial System in Repo Transaction

https://www.wsj.com/articles/fed-adds-6 ... 1569846438

RIP LALO SCHIFRIN

Re: Cracks emerging in money markets?

¯\_(ツ)_/¯

Re: Cracks emerging in money markets?

Through Q2 2020. I wonder if they can really stop at that point.shekels wrote: ↑Tue Oct 15, 2019 10:59 am When is QE not QE?

The new-new-new plan.

https://wolfstreet.com/2019/10/11/10-ye ... ury-bills/

Re: Cracks emerging in money markets?

Sounds like a de facto standing repo facility, which the Fed proposed earlier this year.

If so, maybe at some point they'll just "make it official" and replace their current ad hoc repo market interventions with a standing repo facility.

If so, maybe at some point they'll just "make it official" and replace their current ad hoc repo market interventions with a standing repo facility.

Re: Cracks emerging in money markets?

Oh of course. That would be because I just bought long bonds!

-

Libertarian666

- Executive Member

- Posts: 5994

- Joined: Wed Dec 31, 1969 6:00 pm

Re: Cracks emerging in money markets?

Thanks for this info, everyone.sophie wrote: ↑Sun Sep 22, 2019 8:42 am 77% repos? That's gone up since I last checked (was about 60%). Crazy.

I only wish FDLXX could be used as a sweep account. It's not that hard to keep shifting cash into it though. With the smartphone app I can do it while walking to work, or while stuck in boring meetings. I also have 3 sets of T bills on autoroll, and it looks like you can add to those positions anytime with the "buy" button. Pugchief have you tried that?

Most of my Fidelity assets are in two sets of T-bills with autoroll.

I have just entered an order to move most of my "cash" (about 25% of my Fidelity account) from SPAXX to FDLXX, which should be executed on Monday.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Cracks emerging in money markets?

You there, Ephialtes. May you live forever.

Re: Cracks emerging in money markets?

Repo Market Simplified, or maybe not.

Printing is always an option until it is not.

Jeff Snider has his opinion explained.

https://www.youtube.com/watch?v=w5AR-KBVgJ0&t

Printing is always an option until it is not.

Jeff Snider has his opinion explained.

https://www.youtube.com/watch?v=w5AR-KBVgJ0&t

¯\_(ツ)_/¯

-

welderwannabe

- Senior Member

- Posts: 144

- Joined: Sat Jul 20, 2019 12:53 pm

Re: Cracks emerging in money markets?

Im not sure there are cracks emerging in money markets. There are many theories on why this is happening. One is the concern about counterparty risk which really came to the forefront with the MBS crisis.

My theory is that is is more likely because the Fed started paying interest on reserves, both required and excess. The fed pays 1.6% right now on any reserves held with it. If a bank can just deposit with the fed and earn a guaranteed 1.6%, why bother with the repo market and take whatever limited repo risk?

They started paying interest on reserves to make it more palatable for banks to have higher reserves....making them stronger. However, this is a form of money tightening IMHO.

Therefore the Fed is stepping in.

Its definitely broken, but im not sure I would read in that there is a lot of risk in money markets now.

My theory is that is is more likely because the Fed started paying interest on reserves, both required and excess. The fed pays 1.6% right now on any reserves held with it. If a bank can just deposit with the fed and earn a guaranteed 1.6%, why bother with the repo market and take whatever limited repo risk?

They started paying interest on reserves to make it more palatable for banks to have higher reserves....making them stronger. However, this is a form of money tightening IMHO.

Therefore the Fed is stepping in.

Its definitely broken, but im not sure I would read in that there is a lot of risk in money markets now.