Page 1 of 2

TLT cracks $90

Posted: Mon Sep 25, 2023 9:03 am

by amdda01

Thoughts?

Re: TLT cracks $90

Posted: Mon Sep 25, 2023 9:37 am

by Vil

Still have room for improvement. EUR 25+years bonds cracked 50% drawdown, TLT is still only -45% ...

Re: TLT cracks $90

Posted: Mon Sep 25, 2023 1:23 pm

by mathjak107

many people here were fearing equities falling 50% .

it turns out bonds were the riskiest bet of all.

but i have said that for a long time now , that rising rates were kryptonite to the pp.

equities can do well in rising rates if the economy stays healthy , but bond rates can’t hold up very long , even long term rates which tend to hold up better over the shorter term when short term rates rise.

this was just killer to anything with interest rate sensitivity like gold and bonds of all types

Re: TLT cracks $90

Posted: Mon Sep 25, 2023 1:58 pm

by Smith1776

I had to Google whether "cracks $90" meant on the upside or downside. Looks like some pretty violent losses.

Re: TLT cracks $90

Posted: Mon Sep 25, 2023 2:39 pm

by dualstow

Same. I didn’t know if it was going up or down because I haven’t looked in so long. I have some bonds due in 2050. I’ll try not to look until 2030 unless the news gets crazy.

Re: TLT cracks $90

Posted: Mon Sep 25, 2023 7:39 pm

by boglerdude

The Fed could increase the money supply (eg) 20% every year and buy all the treasuries to keep them at zero rate(?) Rates for other bonds would rise to over 20% (private lenders wont lend below inflation) but Fed could buy them too. Could they keep all rates near zero forever? (No I suppose new companies would spring up just to take out 0% loans...and maybe that happened)

Why do high inflation countries have high inflation and high rates, what does that accomplish vs low inflation and low rates. Are those high rates for loans the central banks cant influence, eg US inflation is 20% auto loans might be 25% because Fed doesnt buy them.

Trying to understand how high long rates could go

Re: TLT cracks $90

Posted: Tue Sep 26, 2023 2:22 pm

by Ugly_Bird

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

Re: TLT cracks $90

Posted: Tue Sep 26, 2023 3:30 pm

by D1984

Ugly_Bird wrote: ↑Tue Sep 26, 2023 2:22 pm

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

You have

no lots of long Treasuries--or LTT ETF/mutual fund shares--you can sell at a loss (not even a single one.....especially after the past two years)? What I mean is this:

Say one needed to buy, oh, $25,000 of TLT (or whatever your choice of LTT instrument is) in order to be at 25x4 again.

1. Sell enough of appreciated assets (hopefully from tax lots that have been held at least 1 year and a day in order to get LTCG treatment) such as VTI/VOO/VFIAX etc in order to get the money needed to rebalance into LTTs.

2. Then, sell an amount of TLT (from tax lots with a loss, obviously) such that the capital losses equal the $ amount of capital gain in step 1 above.

3. Now, immediately take the proceeds from step 1 and 2 and plow them into a

different LTT ETF (like VGLT, VUSTX, FNBGX, etc.....anything besides TLT itself); so long as the CUSIPs are different then it technically shouldn't create a wash sale by the letter of the tax law.

4. Voila! Taxable gains equal taxable losses so no additional income to increase your income and put you over the limit on the FAFSA...and you have done this while still avoiding a wash sale.

Failing this, just wait until 1/1 or 1/2 of 2024 to rebalance.....HB said annual rebalancing was fine anyway if one didn't want to do bands-based rebalancing.

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 4:36 am

by flyingpylon

Ugly_Bird wrote: ↑Tue Sep 26, 2023 2:22 pm

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

Regarding FAFSA, make sure your ordinary income qualifies you for financial aid before spending too much time strategizing about investments. If your income is above a certain level you won’t be getting any financial aid anyway, making much of this a waste of time (for that purpose at least).

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 6:50 am

by Ugly_Bird

flyingpylon wrote: ↑Wed Sep 27, 2023 4:36 am

Ugly_Bird wrote: ↑Tue Sep 26, 2023 2:22 pm

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

Regarding FAFSA, make sure your ordinary income qualifies you for financial aid before spending too much time strategizing about investments. If your income is above a certain level you won’t be getting any financial aid anyway, making much of this a waste of time (for that purpose at least).

Yeah, you are right, I think it might be pointless in my case anyway.

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 7:31 am

by Xan

Ugly_Bird wrote: ↑Wed Sep 27, 2023 6:50 am

flyingpylon wrote: ↑Wed Sep 27, 2023 4:36 am

Ugly_Bird wrote: ↑Tue Sep 26, 2023 2:22 pm

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

Regarding FAFSA, make sure your ordinary income qualifies you for financial aid before spending too much time strategizing about investments. If your income is above a certain level you won’t be getting any financial aid anyway, making much of this a waste of time (for that purpose at least).

Yeah, you are right, I think it might be pointless in my case anyway.

Here's the scenario:

You: how much money do you charge for your service?

Vendor: how much have you got?

In any situation other than education and healthcare the vendor would go to jail. For some reason this is par for the course in those two other areas. What a joke.

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 11:06 am

by seajay

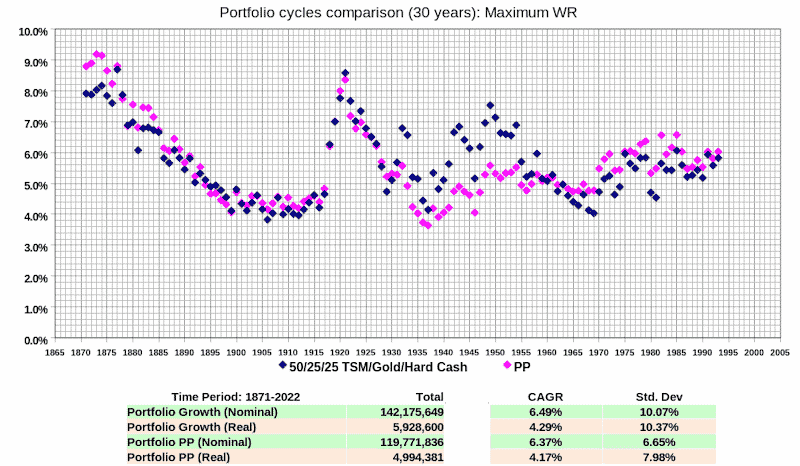

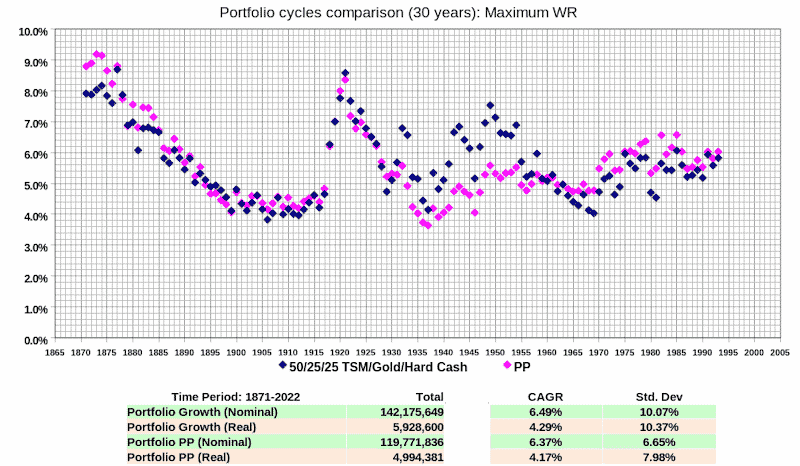

Increasingly leaning towards not lending ... no bonds nor cash deposits, the interest paid is often too low, more so after the taxman takes a slice. Swap the bond risk (25% in each of STT/LTT) over to the stock side (25/25 stock/hard-cash).

Comparing historic 50/25/25 stock/PM/hard-cash to that of the PP, 30 year maximum withdrawal rates ...

and that's with 50% of the total portfolio stuffed under your mattress (25% gold, 25% hard cash).

Maybe deposit (lend) the cash when interest rates are relatively high, but with it in mind that cash deposits into banks and that capital becomes the banks money, that may or may not be repaid depending upon how well or not the bank does in the casino (and where it in turn has it in mind that heads they win, tails and the taxpayers bail them out).

Increasingly, at least both in the UK and Australia, money you deposit into banks involves interrogation of where that money came from, and similarly withdrawals have to satisfy the bank where you're intending to spend that money, and with any suspicions they're supposed to flag you for investigation (without alerting you of that intent). With banks having their licence threatened if they fail to report suspicious activities the natural reaction by banks is to report all transactions - which is the underline real intent anyway, as that way the state gets to record all your financial transactions, along with your movements, internet searching activities ...etc. After all your wealth isn't really yours, its just a loan by the state, open to being partially or fully called in if/when the state so desires. Even less freedom in a unfree world. Half in-hand, half that can be liquidated in T+2 is about the limits of freedom nowadays

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 2:57 pm

by whatchamacallit

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

In short,

I am happy I moved to

GOVT instead of

TLT.

Other than that, I am trying to process what is causing higher interest rates. The only thing I can come up with is less liquidity to purchase the bonds but I don't know how or why. Somehow money is getting destroyed and lowering liquidity?

Re: TLT cracks $90

Posted: Wed Sep 27, 2023 6:40 pm

by boglerdude

On the short end, Fed's paying banks 5.4% on the billions they printed and handed them after GFC. How long can we afford that? On the long end, Fed's stopped buying

https://fred.stlouisfed.org/series/WALCL

Re: TLT cracks $90

Posted: Thu Sep 28, 2023 5:39 pm

by whatchamacallit

Luke Gromen getting into TLT and rising interest rates.

https://youtu.be/jJ3ajrsz-IY?feature=shared

I need to listen to it again to wrap my head around it some more.

I will just stick with 25% GOVT for now to be more cautious.

Re: TLT cracks $90

Posted: Mon Oct 02, 2023 4:27 pm

by t-bear52

Sure feels like we are sliding all the way down! So frustrating. Can’t sell as losses will be locked in. Newly retired and this s*cks!

Re: TLT cracks $90

Posted: Tue Oct 03, 2023 7:40 am

by Ugly_Bird

D1984 wrote: ↑Tue Sep 26, 2023 3:30 pm

Ugly_Bird wrote: ↑Tue Sep 26, 2023 2:22 pm

amdda01 wrote: ↑Mon Sep 25, 2023 9:03 amThoughts?

At 16.7% of my PP... Getting close to the 15% rebalance band. I hope it doesn't happen this year but will in 2024.

Will have to report my 2023 to FAFSA, so I do not want to sell anything from my brokerage accounts

You have

no lots of long Treasuries--or LTT ETF/mutual fund shares--you can sell at a loss (not even a single one.....especially after the past two years)? What I mean is this:

Say one needed to buy, oh, $25,000 of TLT (or whatever your choice of LTT instrument is) in order to be at 25x4 again.

1. Sell enough of appreciated assets (hopefully from tax lots that have been held at least 1 year and a day in order to get LTCG treatment) such as VTI/VOO/VFIAX etc in order to get the money needed to rebalance into LTTs.

2. Then, sell an amount of TLT (from tax lots with a loss, obviously) such that the capital losses equal the $ amount of capital gain in step 1 above.

3. Now, immediately take the proceeds from step 1 and 2 and plow them into a

different LTT ETF (like VGLT, VUSTX, FNBGX, etc.....anything besides TLT itself); so long as the CUSIPs are different then it technically shouldn't create a wash sale by the letter of the tax law.

4. Voila! Taxable gains equal taxable losses so no additional income to increase your income and put you over the limit on the FAFSA...and you have done this while still avoiding a wash sale.

Failing this, just wait until 1/1 or 1/2 of 2024 to rebalance.....HB said annual rebalancing was fine anyway if one didn't want to do bands-based rebalancing.

Great tip! But, I think it will not work in my case. All my LTTs are in the tax deferred accounts. No loss harvesting for me, I guess...

Re: TLT cracks $90

Posted: Tue Oct 03, 2023 7:54 am

by yankees60

Ugly_Bird wrote: ↑Tue Oct 03, 2023 7:40 am

Great tip! But, I think it will not work in my case. All my LTTs are in the tax deferred accounts. No loss harvesting for me, I guess...

Ugly_Bird

Your appearances here are so infrequent (this was your 7th in 2023) .... but each time you do I get amused by the picture of your bird! Love it!

Re: TLT cracks $90

Posted: Tue Oct 03, 2023 10:13 am

by Ugly_Bird

yankees60 wrote: ↑Tue Oct 03, 2023 7:54 am

Ugly_Bird wrote: ↑Tue Oct 03, 2023 7:40 am

Great tip! But, I think it will not work in my case. All my LTTs are in the tax deferred accounts. No loss harvesting for me, I guess...

Ugly_Bird

Your appearances here are so infrequent (this was your 7th in 2023) ....

That kinda jives with the PP concept. Things are slow and boring... Not much to appear here for. :-)

yankees60 wrote: ↑Tue Oct 03, 2023 7:54 am

but each time you do I get amused by the picture of your bird! Love it!

LOL

Re: TLT cracks $90

Posted: Thu Oct 05, 2023 8:41 pm

by boglerdude

Well I think she's pretty. Those lashes. Also, Matt's newsletter has been good over the last few days.

https://www.reddit.com/r/MoneyStuff/

Re: TLT cracks $90

Posted: Tue Oct 17, 2023 11:55 pm

by Hal French

I had the very great honor of meeting and corresponding with Harry Browne, and I've read "Fail-Safe Investing" multiple times. So I know Harry would chuckle at my feeble attempts to time the market but... at what point should I rebalance my TLT (now dipping below the 15% band) with the largesse from my IWV (over 30%)? I keep hearing contrarian investors are heading back into LTT, but it took yet another hit today, and it looks to be heading lower at least in the short run. What "tells" can I look for when the bloodletting has stopped? Board, help me out with your wisdom!

BONUS: more of a Cash question, but I'm seriously underwater on my STT (SHY + SCHO) as well. Lumping my I-Bonds in (as "Deep Cash") gets me over 30% on that segment, but I'd love to at least break even on these 2 ETFs before I bail on them for good. Plenty of talk on 10-year and LTTs, but what's the prognosis for STTs?

Re: TLT cracks $90

Posted: Wed Oct 18, 2023 8:35 am

by Ugly_Bird

Hal French wrote: ↑Tue Oct 17, 2023 11:55 pm

I had the very great honor of meeting and corresponding with Harry Browne, and I've read "Fail-Safe Investing" multiple times. So I know Harry would chuckle at my feeble attempts to time the market but... at what point should I rebalance my TLT (now dipping below the 15% band) with the largesse from my IWV (over 30%)? I keep hearing contrarian investors are heading back into LTT, but it took yet another hit today, and it looks to be heading lower at least in the short run. What "tells" can I look for when the bloodletting has stopped? Board, help me out with your wisdom!

BONUS: more of a Cash question, but I'm seriously underwater on my STT (SHY + SCHO) as well. Lumping my I-Bonds in (as "Deep Cash") gets me over 30% on that segment, but I'd love to at least break even on these 2 ETFs before I bail on them for good. Plenty of talk on 10-year and LTTs, but what's the prognosis for STTs?

If it is time to rebalance... just rebalance. It is simple.

Re: TLT cracks $90

Posted: Wed Oct 18, 2023 10:04 am

by yankees60

https://www.bloomberg.com/news/articles ... n-etf-loss

MarketsETFs & Mutual Funds

Dreams of Big Bond Gains Backfire With $10 Billion ETF Loss

Record sums of cash flowing to TLT despite an epic drawdown

Rare chance for double-digit returns at long end: McDonough

Re: TLT cracks $90

Posted: Thu Oct 19, 2023 12:41 am

by boglerdude

Are we going to be Argentina or Japan? Failing states get very high inflation and rates. Japan has a closed border and stable deflationary culture.

In any event, PP theory holds until long bonds are at 0.

Re: TLT cracks $90

Posted: Thu Oct 19, 2023 9:19 am

by yankees60

https://www.morningstar.com/markets/des ... tent=48882

MARKETS

Despite Big Losses, Investors Flock to Long-Term Bond ETFs

Locking in higher yields may be a draw for funds like the iShares 20+ Year Treasury ETF.

Katherine Lynch

Oct 11, 2023