Ray Dalio on Bonds

Moderator: Global Moderator

-

AllWeatherPP

- Junior Member

- Posts: 8

- Joined: Mon Aug 10, 2020 5:27 am

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

this is why i said above we need to stop with the mental masturbation by reading what was or used to be , or how things may have back tested and concentrate on how things are reacting going forward .AllWeatherPP wrote: ↑Sun Oct 04, 2020 5:26 am Some more anti-bond sentiment:

https://investingsignal.com/2020/10/03/ ... t-plunges/

driving and looking in the rear view mirror may not be a great idea .

Re: Ray Dalio on Bonds

What do you guys think the worse case scenario is for the Long Term Treasury market?mathjak107 wrote: ↑Sun Oct 04, 2020 5:38 am

this is why i said above we need to stop with the mental masturbation by reading what was or used to be , or how things may have back tested and concentrate on how things are reacting going forward .

driving and looking in the rear view mirror may not be a great idea .

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

no idea .... i wouldn't attempt to guess .

Re: Ray Dalio on Bonds

Aren't you guessing by saying you don't want to hold them anymore?

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

yep , it is a weighted educated guess just based on risk vs reward and fed policy . but i have no idea how bad it can get for long term bonds

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

i am toying with a quick trade in TLT .. it is getting beat up today .

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

Took a shot with Tlt . 625 shares 159.63.

-

ahhrunforthehills

- Executive Member

- Posts: 326

- Joined: Tue Oct 19, 2010 3:35 pm

Re: Ray Dalio on Bonds

I think negative rates are unlikely. If you do get them, I can't imagine them being more than -.25% or -.5%. Anything more than that would be way too much stress on the financial sector and would force too many people towards alternative stores of wealth.AdamA wrote: ↑Mon Oct 05, 2020 12:56 pmWhat do you guys think the worse case scenario is for the Long Term Treasury market?mathjak107 wrote: ↑Sun Oct 04, 2020 5:38 am

this is why i said above we need to stop with the mental masturbation by reading what was or used to be , or how things may have back tested and concentrate on how things are reacting going forward .

driving and looking in the rear view mirror may not be a great idea .

Again, keep in mind that gold is effectively a 0% treasury with no counter-party risk. Not to mention the long-term inverse correlation between stocks/gold is stronger than stocks/bonds. The only real downside is the spread.

But also keep in mind that your Uncle Sam has other options as well. If he hits zero at the long-end of the yield curve, he could just as easily create a 50 year or 100 year treasury to squeeze more juice out of it (albeit with diminishing results).

You could be telling your great-grandkids "I remember when 1,000 year treasuries were yielding 0.35%... those were the days!"

Would that make the PP still viable with ultra-long duration bonds? It does in theory.

However, if you take a look at that latest report from the Congressional Budget Office for the next 30 years... I think it would be obvious to a 4 year old that based on current yields and future expenditures... holding Long-Term Treasuries over the long term is pretty crazy. Another industrial revolution wouldn't be enough to get America out of our hole. You are staring down the barrel of either default or hyperinflation.

I am only aware of one leader who was able to effectively bring his people out of a mountain of debt, made sure his people were well fed, provided lots of social programs, and boosting wages more than double that of other leading nations. His people loved him. The guy was a German named Adolf.

Even if this happened in america, I suspect rates will rise BEFORE we start brutally robbing people in other countries.

So obviously ultra-long duration bonds start really walking up that risk curve. How much risk is really dependent on how things play out over the rest of your life.

The PP has short-term volatility. I suspect it will be a dog performance-wise in the future. You can either go with the dog or extend the length of that short-term volatility. If you can stomach 4 or 5 years of volatility, being in a 2:1 or 3:1 stock/gold allocation would probably provide you with much better "safety" while maximizing yields in regards to risk over the long-term.

Obviously, if you are near retirement, you do not necessarily have that luxury of 4 to 5 years of volatility. At which point, you would want to look towards shorter duration bonds (like mathjak has done).

Re: Ray Dalio on Bonds

If you can stomach 4 or 5 years of volatility, being in a 2:1 or 3:1 stock/gold allocation would probably provide you with much better "safety" while maximizing yields in regards to risk over the long-term.ahhrunforthehills wrote: ↑Mon Oct 05, 2020 3:16 pmI think negative rates are unlikely. If you do get them, I can't imagine them being more than -.25% or -.5%. Anything more than that would be way too much stress on the financial sector and would force too many people towards alternative stores of wealth.AdamA wrote: ↑Mon Oct 05, 2020 12:56 pmWhat do you guys think the worse case scenario is for the Long Term Treasury market?mathjak107 wrote: ↑Sun Oct 04, 2020 5:38 am

this is why i said above we need to stop with the mental masturbation by reading what was or used to be , or how things may have back tested and concentrate on how things are reacting going forward .

driving and looking in the rear view mirror may not be a great idea .

Again, keep in mind that gold is effectively a 0% treasury with no counter-party risk. Not to mention the long-term inverse correlation between stocks/gold is stronger than stocks/bonds. The only real downside is the spread.

But also keep in mind that your Uncle Sam has other options as well. If he hits zero at the long-end of the yield curve, he could just as easily create a 50 year or 100 year treasury to squeeze more juice out of it (albeit with diminishing results).

You could be telling your great-grandkids "I remember when 1,000 year treasuries were yielding 0.35%... those were the days!"

Would that make the PP still viable with ultra-long duration bonds? It does in theory.

However, if you take a look at that latest report from the Congressional Budget Office for the next 30 years... I think it would be obvious to a 4 year old that based on current yields and future expenditures... holding Long-Term Treasuries over the long term is pretty crazy. Another industrial revolution wouldn't be enough to get America out of our hole. You are staring down the barrel of either default or hyperinflation.

I am only aware of one leader who was able to effectively bring his people out of a mountain of debt, made sure his people were well fed, provided lots of social programs, and boosting wages more than double that of other leading nations. His people loved him. The guy was a German named Adolf.

Even if this happened in america, I suspect rates will rise BEFORE we start brutally robbing people in other countries.

So obviously ultra-long duration bonds start really walking up that risk curve. How much risk is really dependent on how things play out over the rest of your life.

The PP has short-term volatility. I suspect it will be a dog performance-wise in the future. You can either go with the dog or extend the length of that short-term volatility. If you can stomach 4 or 5 years of volatility, being in a 2:1 or 3:1 stock/gold allocation would probably provide you with much better "safety" while maximizing yields in regards to risk over the long-term.

Obviously, if you are near retirement, you do not necessarily have that luxury of 4 to 5 years of volatility. At which point, you would want to look towards shorter duration bonds (like mathjak has done).

What is 2:1 allocation? 50% stock and 25% Gold? 25% cash or short duration bonds like SHY?

-

ahhrunforthehills

- Executive Member

- Posts: 326

- Joined: Tue Oct 19, 2010 3:35 pm

Re: Ray Dalio on Bonds

Sorry, I should have been more clear.... and I actually just realized I made a bad typo. I meant 1:2 or 2:3 allocation.modeljc wrote: ↑Mon Oct 05, 2020 4:06 pmIf you can stomach 4 or 5 years of volatility, being in a 2:1 or 3:1 stock/gold allocation would probably provide you with much better "safety" while maximizing yields in regards to risk over the long-term.ahhrunforthehills wrote: ↑Mon Oct 05, 2020 3:16 pmI think negative rates are unlikely. If you do get them, I can't imagine them being more than -.25% or -.5%. Anything more than that would be way too much stress on the financial sector and would force too many people towards alternative stores of wealth.AdamA wrote: ↑Mon Oct 05, 2020 12:56 pmWhat do you guys think the worse case scenario is for the Long Term Treasury market?mathjak107 wrote: ↑Sun Oct 04, 2020 5:38 am

this is why i said above we need to stop with the mental masturbation by reading what was or used to be , or how things may have back tested and concentrate on how things are reacting going forward .

driving and looking in the rear view mirror may not be a great idea .

Again, keep in mind that gold is effectively a 0% treasury with no counter-party risk. Not to mention the long-term inverse correlation between stocks/gold is stronger than stocks/bonds. The only real downside is the spread.

But also keep in mind that your Uncle Sam has other options as well. If he hits zero at the long-end of the yield curve, he could just as easily create a 50 year or 100 year treasury to squeeze more juice out of it (albeit with diminishing results).

You could be telling your great-grandkids "I remember when 1,000 year treasuries were yielding 0.35%... those were the days!"

Would that make the PP still viable with ultra-long duration bonds? It does in theory.

However, if you take a look at that latest report from the Congressional Budget Office for the next 30 years... I think it would be obvious to a 4 year old that based on current yields and future expenditures... holding Long-Term Treasuries over the long term is pretty crazy. Another industrial revolution wouldn't be enough to get America out of our hole. You are staring down the barrel of either default or hyperinflation.

I am only aware of one leader who was able to effectively bring his people out of a mountain of debt, made sure his people were well fed, provided lots of social programs, and boosting wages more than double that of other leading nations. His people loved him. The guy was a German named Adolf.

Even if this happened in america, I suspect rates will rise BEFORE we start brutally robbing people in other countries.

So obviously ultra-long duration bonds start really walking up that risk curve. How much risk is really dependent on how things play out over the rest of your life.

The PP has short-term volatility. I suspect it will be a dog performance-wise in the future. You can either go with the dog or extend the length of that short-term volatility. If you can stomach 4 or 5 years of volatility, being in a 2:1 or 3:1 stock/gold allocation would probably provide you with much better "safety" while maximizing yields in regards to risk over the long-term.

Obviously, if you are near retirement, you do not necessarily have that luxury of 4 to 5 years of volatility. At which point, you would want to look towards shorter duration bonds (like mathjak has done).

What is 2:1 allocation? 50% stock and 25% Gold? 25% cash or short duration bonds like SHY?

Cash isn't really that important if you can deal with 4 or 5 years of volatility. If you have income, you could be 40% gold and 60% stock for a 2:3 allocation. I would base the ratio based on historical data still. For example, you can adjust based on SWR and CAPE (and other factors) using this spreadsheet:

https://earlyretirementnow.com/2018/08/ ... s-part-28/

Belangp does some really good research on it as well: https://www.youtube.com/user/belangp/videos

Some of his views are backed up by research here: https://earlyretirementnow.com/2020/01/ ... s-part-34/

EarlyRetirementNow is a great resource because the guy is skeptical of gold... which is great because I don't want or need some gold-bug giving me data created to fill his narrative.

Belangp determined the best approach is to never rebalance (as it causes too much tax drag). You just draw from the highest performing asset.

Another variation could be 30% gold, 60% stock, 10% cash.

Last edited by ahhrunforthehills on Mon Oct 05, 2020 6:54 pm, edited 2 times in total.

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

Drawing from the highest asset is rebalancing for the most part

Re: Ray Dalio on Bonds

Replacing LTT with REIT in portfoliocharts, seems like an interesting move: ZUSAXAA20AI20AN20AO20GB20Z (shortcode).

Re: Ray Dalio on Bonds

Interesting discovery Senecaaa,

Whats your theory on why REITs perform so well?

Whats your theory on why REITs perform so well?

Re: Ray Dalio on Bonds

I was inspired by this tweet: https://twitter.com/alexisohanian/statu ... 7427155970. I interpreted "alternative" as "real estate"

Re: Ray Dalio on Bonds

Food for thought....senecaaa wrote: ↑Tue Oct 06, 2020 6:43 amI was inspired by this tweet: https://twitter.com/alexisohanian/statu ... 7427155970. I interpreted "alternative" as "real estate". No theory behind it.

Using the Pacific Peso, it works well.

Edit: Just remembered, this is similar to Marc Fabers portfolio https://mebfaber.com/wp-content/uploads ... Book-1.pdf

Had to sneak this in as well

- Attachments

-

- Screen Shot 2020-10-06 at 11.28.45 pm.png (448.91 KiB) Viewed 10216 times

-

- Pacific Peso.png (175.78 KiB) Viewed 10227 times

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

got stopped out already ...

-

ahhrunforthehills

- Executive Member

- Posts: 326

- Joined: Tue Oct 19, 2010 3:35 pm

Re: Ray Dalio on Bonds

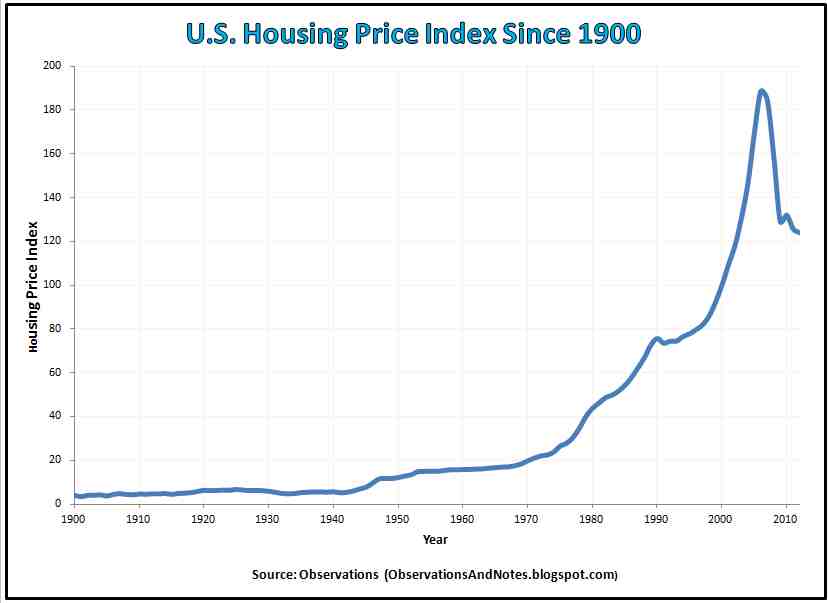

Hold the phone. Home loans get massively cheaper as yields drop, no? You simply get a lot more for your money.

18.45% Rate (Oct 1981) vs 3% (Now) on $300k 30 year fixed rate:

$4,632 vs $1,265 per month for the SAME EXACT HOUSE.

The average home has gotten much larger because people have more spending power to throw at houses (and because builders can now make your trim out of cardboard.

Here is the question:

Did real estate do just as well from 1941 to 1981 (rising rates) as it did from 1981 to 2021 (falling rates):

https://3.bp.blogspot.com/-ynrQyoAUzgM/ ... e+1900.jpg

Not even close.

It appears you are jumping from the Titanic into a lifeboat... but the lifeboat is welded to the deck of the titanic.

If (when) interest rates go up... the monthly price of an existing 5,000 sqft house goes up as well. Now you have fewer buyers. Since houses have gotten bigger (the bigger the house the more they cost to maintain) and they use less quality materials (increasing costs of repairs) the financial needs will be higher yet.

It reminds me of the best days of owning a boat.. the day you buy it and the day you sell it. When rates are falling everybody “has gotten a good deal on a new home”. But you are still talking about a pile of sticks sitting out in the rain. It doesn’t get better with age.

Also keep in mind other factors that have historically inflated real estate sales. Having a 20% down payment was the minimum many years ago. However, the time period you are backtesting is a period where people were able to put much much less down (which increases the risk like crazy).

Part of this is because banks have an incentive to push loans in a falling rate environment. If they need to repo your house, the falling rates help ensure they can resell the house easily.

Are there other factors at play outside of rates? Probably. But I am not seeing anything that makes me feel warm and fuzzy...

Today’s younger generation’s value system doesn’t seem to circle around nice houses like earlier generations. They would rather have expensive coffee and peletons.

Also, the largest population growth going forward is the hispanic population. They are much more likely as a group to have multiple families living in the same house.

You also have the downward pressure of the baby-boomers downsizing, selling, etc.

Housing is also arguably in a larger bubble than it was during the last collapse:

https://gordcollins.com/wp-content/uplo ... istory.png

Lastly, the chances of budget shortfalls in the future are enormous (again, refer to the CBO report). Higher property taxes seem inevitable.

The only plus I can think of is that you still get tax incentives through depreciation on the business side of it. However, if Trump ever has his tax returns exposed... those deductions could be a political unpopular issue going forward.

Last edited by ahhrunforthehills on Tue Oct 06, 2020 9:32 am, edited 2 times in total.

-

ahhrunforthehills

- Executive Member

- Posts: 326

- Joined: Tue Oct 19, 2010 3:35 pm

Re: Ray Dalio on Bonds

Sorry, one more... government has made it very clear lately that people don’t have to pay their rent if they lack emergency savings. Uncle Sam basically said real estate investors will be the first to be sacrificed during tough economic periods.

That definitely has to change the correlation dynamic between stocks and real-estate going forward.

That definitely has to change the correlation dynamic between stocks and real-estate going forward.

Re: Ray Dalio on Bonds

Seriously?? Can the landlord evict the tenant, or will the government pay the landlords bank loan if they have oneahhrunforthehills wrote: ↑Tue Oct 06, 2020 9:09 am Sorry, one more... government has made it very clear lately that people don’t have to pay their rent if they lack emergency savings. Uncle Sam basically said real estate investors will be the first to be sacrificed during tough economic periods.

That definitely has to change the correlation dynamic between stocks and real-estate going forward.

Are we living in "The Twilight Zone"?

Simonjester wrote: evictions are suspended, and outside what ever small business assistance is left over after big business sucked most of it up, is all they have. Property management is a whipping boy for the left, all rent is evil capitalism and slumlord-ism to them ..

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

even without covid , here in ny under the new laws a judge can give a delinquent tenant up to a year on your back under the new laws .

we are so glad we have nothing to do with real estate here anymore

we are so glad we have nothing to do with real estate here anymore

Re: Ray Dalio on Bonds

Speaking of real estate and bonds...I have mostly rolled to short and IT bonds but I still have a smidgeon of LTTs in my leveraged PP. However, I digress. I think I have sufficient cash and bond savings I overall, so I decided to back off accumulating more cash and bonds and throw the extra at my mortgage. I refinanced this year down to a 15 (alas I should have waited longer) and paid a bunch of points to buy down to a 2.25% irate.

Rationally, this is what the math dictates. If ST to IT bonds go above 2.25 and factoring in tax impacts I'll reverse.

Rationally, this is what the math dictates. If ST to IT bonds go above 2.25 and factoring in tax impacts I'll reverse.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Ray Dalio on Bonds

I think what you're talking about matters when discussing your own home's price, but not owning and operating real estate like a business like REITs do. REITs and other real estate investors can use low rates right now to secure the productive asset (the actual real estate), and can then respond to market conditions in whatever ways they need to. If inflation goes up and people start earning higher wages, they can raise the rent. If people don't want to live/work there, they can improve the property. If they can't get enough rent to be profitable, they can defer maintenance and let the property quality slide.ahhrunforthehills wrote: ↑Tue Oct 06, 2020 8:55 am Hold the phone. Home loans get massively cheaper as yields drop, no? You simply get a lot more for your money.

18.45% Rate (Oct 1981) vs 3% (Now) on $300k 30 year fixed rate:

$4,632 vs $1,265 per month for the SAME EXACT HOUSE.

The average home has gotten much larger because people have more spending power to throw at houses (and because builders can now make your trim out of cardboard.

Here is the question:

Did real estate do just as well from 1941 to 1981 (rising rates) as it did from 1981 to 2021 (falling rates):

Not even close.

It appears you are jumping from the Titanic into a lifeboat... but the lifeboat is welded to the deck of the titanic.

If (when) interest rates go up... the monthly price of an existing 5,000 sqft house goes up as well. Now you have fewer buyers. Since houses have gotten bigger (the bigger the house the more they cost to maintain) and they use less quality materials (increasing costs of repairs) the financial needs will be higher yet.

It reminds me of the best days of owning a boat.. the day you buy it and the day you sell it. When rates are falling everybody “has gotten a good deal on a new home”. But you are still talking about a pile of sticks sitting out in the rain. It doesn’t get better with age.

Also keep in mind other factors that have historically inflated real estate sales. Having a 20% down payment was the minimum many years ago. However, the time period you are backtesting is a period where people were able to put much much less down (which increases the risk like crazy).

Part of this is because banks have an incentive to push loans in a falling rate environment. If they need to repo your house, the falling rates help ensure they can resell the house easily.

Are there other factors at play outside of rates? Probably. But I am not seeing anything that makes me feel warm and fuzzy...

Today’s younger generation’s value system doesn’t seem to circle around nice houses like earlier generations. They would rather have expensive coffee and peletons.

Also, the largest population growth going forward is the hispanic population. They are much more likely as a group to have multiple families living in the same house.

You also have the downward pressure of the baby-boomers downsizing, selling, etc.

Housing is also arguably in a larger bubble than it was during the last collapse:

https://gordcollins.com/wp-content/uplo ... istory.png

Lastly, the chances of budget shortfalls in the future are enormous (again, refer to the CBO report). Higher property taxes seem inevitable.

The only plus I can think of is that you still get tax incentives through depreciation on the business side of it. However, if Trump ever has his tax returns exposed... those deductions could be a political unpopular issue going forward.

I guess what I'm getting at is that home buyers are more apt to use cheaper money to over-consume, but investors/business (maybe I should say good investors/business, since bad ones might operate more like an emotional homebuyer) would be looking at an investment rationally.

You there, Ephialtes. May you live forever.

- mathjak107

- Executive Member

- Posts: 4662

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Ray Dalio on Bonds

there is little link between home prices and mortgage rates until rates get way higher ...

my first mortgage in 1987 was 8-1/4% and real estate was booming .. i was happy to get 8-1/4 too . the boom leading up to the crash in 2007 was at 6%.

real estate is more local economy driven and quality of supply driven then anything else .

there can be 100 homes for sale . but if only one meets my wifes criteria he is getting top dollar .....the others might just as well not be for sale when it comes to " WIFE FACTOR "

my first mortgage in 1987 was 8-1/4% and real estate was booming .. i was happy to get 8-1/4 too . the boom leading up to the crash in 2007 was at 6%.

real estate is more local economy driven and quality of supply driven then anything else .

there can be 100 homes for sale . but if only one meets my wifes criteria he is getting top dollar .....the others might just as well not be for sale when it comes to " WIFE FACTOR "

Re: Ray Dalio on Bonds

I know Im a little late to the party here. But from a systematic perspective, wouldn't it make more sense to look at indicators that actually signal a bond reversal instead of just selling because rates are low and buying because they are high? What defines the subjective terms "low" and "high"? I mean selling into falling rates has been a widow maker trade for decades now. Why would that suddenly change today of all days? Why not look for indicators like rising inflation, growth, volatility, or yields as a means to sell, instead of selling because rates are falling and they are making you too much money? This is what I would look at if I were trying to create a systematic bond allocation. Those are the actual stats worth looking at for a leading indicator of what bonds will do going forward. Right now inflation and growth are non existent, bond volatility is super low, and rates are staying surprisingly stable considering the massive stock rally we have had over the last few months. It's kind of hard to argue for the death of the bond bull market and truly justify systematically selling bonds with all 4 of those stats saying the opposite.ahhrunforthehills wrote: ↑Thu Sep 24, 2020 12:10 pm

What I am getting at is have a documented mechanism in place to allocate out of LTT as yields decline, and back in as LTT yields go up... otherwise your emotions can easily get you lost at sea going forward.