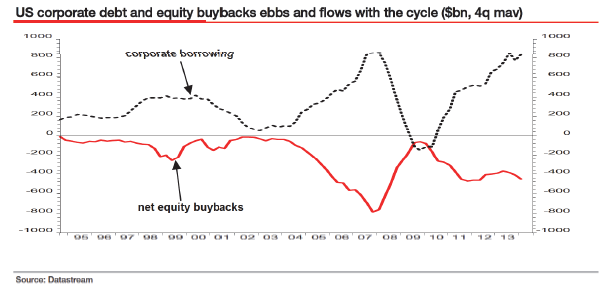

Not highlighted in the below story is how companies are borrowing billions in debt just to buy back their shares. How will this not end badly and any different than the leveraged banks/insurance companies imploding after the subprime bubble?

[quote=http://www.bloomberg.com/news/articles/ ... u-s-market]Not everyone is convinced buybacks are good. They’re used to boost per-share earnings in a way that enhances the pay of chief executives, according to William Lazonick, a professor of economics at the University of Massachusetts Lowell.

“Companies use a phony ideology saying if you maximize your shareholder value you somehow increase the efficiency of the economy,”? Lazonick said in a phone interview. “But the only justification for doing it that holds water is that executives get a lot of their income from buybacks.”? [/quote]

The Buyback Bubble

Moderator: Global Moderator

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

The Buyback Bubble

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: The Buyback Bubble

http://fofoa.blogspot.de/2015/03/the-big-picture.html

This guy wrote a great article about the buybacks.

This guy wrote a great article about the buybacks.

Re: The Buyback Bubble

What is the debt equity ratio for these companies? I'm guessing they have very little debt to begin with

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: The Buyback Bubble

[align=center]dragoncar wrote: What is the debt equity ratio for these companies? I'm guessing they have very little debt to begin with

[/align]

[/align]"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: The Buyback Bubble

Gwarsh, I wonder why...

It's just disgusting.http://www.reuters.com/article/2015/03/25/us-companies-pay-ceo-insight-idUSKBN0ML0AX20150325 wrote:In the five years after the financial crisis, CEOs at large U.S. companies collectively realized at least $6B more in compensation than initially estimated in annual disclosures, a Reuters analysis shows. The reason for the windfall: the soaring value of their stock awards. The S&P 500's total return (including dividends) of 166% - from the end of 2008 through Monday - has some investors re-evaluating how they judge compensation plans. In some cases, they say CEOs may be benefiting from the bull market even when their performance might be weak.

For example, Michael Cuggino, president and portfolio manager of the $5.3 billion Permanent Portfolio Family of Funds in San Francisco, supported the pay of Gilead CEO Martin. His funds own Gilead shares and Cuggino said Martin deserves credit fo managing the company in a risky industry, where failed drug trials are common and can wreck a company’s share price.

Last edited by MachineGhost on Wed Mar 25, 2015 9:55 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!