Page 57 of 62

Re: Stock scream room

Posted: Mon May 02, 2022 5:16 pm

by dockinGA

murphy_p_t wrote: ↑Mon May 02, 2022 5:00 pm

dualstow wrote: ↑Mon May 02, 2022 4:50 pm

murphy_p_t wrote: ↑Mon May 02, 2022 3:46 pm

Agreed. Another reason why the pp is no longer for me.

I don’t follow. A bear market in stocks makes you want to leave the pp? To pile into stocks while they’re low?

or something else - more gold?

I think there's a strong likelihood there's something much bigger than your normal bear market in the coming year or two... Something on the order of 1929 onwards...

I hope I can time it as well as you suggest!

(Yeah, I'm overweight mining stocks)

I'm not going to disagree with you, because I think this is definitely a possibility (as well as the massive deflation that came with that crash, as strange as that sounds given the current high levels of inflation). But I would caution that I've (personally) been expecting another Great Depression for about 10 years, and yet here we are....

Re: Stock scream room

Posted: Mon May 02, 2022 5:28 pm

by murphy_p_t

Thank you.

In my view, it just means we're 10 years closer.

In case I'm wrong, I still have some domestic ETFs for different market segments, following guidance from a financial newsletter. (Xle, xlv, xlv, short sp500 fund, etc)

Re: Stock scream room

Posted: Mon Jun 13, 2022 8:01 am

by dualstow

Re: Stock scream room

Posted: Mon Jun 13, 2022 8:51 am

by Vil

dualstow wrote: ↑Mon Jun 13, 2022 8:01 am

let 2022 be the year of GOLD

If 2022 is not the year of GOLD, it would be definitely the year of pain.

Re: Stock scream room

Posted: Mon Jun 13, 2022 9:13 am

by buddtholomew

Take the PP and shove it [ edited ]

Re: Stock scream room

Posted: Mon Jun 13, 2022 10:40 am

by Xan

Folks, let's let this be a Budd-free summer here, and Budd, you can have a forum-free summer. I think it'll be nicer for everyone!

Re: Stock scream room

Posted: Mon Jun 13, 2022 11:26 am

by buddtholomew

it’s ok, everyone knows what they’re dealing with now.

Re: Stock scream room

Posted: Mon Jun 13, 2022 12:18 pm

by Kbg

Too funny...why does someone care who's not in the portfolio?

Re: Stock scream room

Posted: Mon Jun 13, 2022 12:46 pm

by Jack Jones

I think when Budd is mad at the PP, an inanimate object, he needs to release the pressure somewhere so takes it out on us. Personally, I’m okay with it.

Re: Stock scream room

Posted: Mon Jun 13, 2022 1:04 pm

by dualstow

I like to think of him as one of the FBI agents in the original Twin Peaks. The one played by Miguel Ferrer, not Kyle Maclachlan.

Budd’s path is a difficult one.

Re: Stock scream room

Posted: Tue Jun 14, 2022 10:22 am

by buddtholomew

I was ridiculed for years because I didn’t ascribe to the philosophy that one or more assets would buoy the portfolio in times of economic distress. We are now witnessing this distress first-hand and the PP has proven it does not have the ability to overcome an inflationary environment with rising interest rates. Moreover, the one asset that differentiates the portfolio from other conservative allocations and was selected for this very economic climate (Gold) is wavering in the wind with inflation at 40 year highs. If this does not give you pause then I don’t know what to tell you. The portfolio just isn’t what others have made it out to be. Period.

YTD Returns:

SPY -21.84

IAU +.58

TLT -23.86

Re: Stock scream room

Posted: Tue Jun 14, 2022 4:59 pm

by mathjak107

But had you had 60/40 or all stocks your balance over the years would have been way higher too.

So being down more maybe only part of the story

Re: Stock scream room

Posted: Tue Jun 14, 2022 6:09 pm

by joypog

I took a look on Portfolio Visualizer comparing the PP, GB, and a 60/40 (with World-TSM and ITT as bond). Starting 2010 (after the last crash) with $100k, and monthly 1k contributions. All of them were creamed by the Classic Jack Bogle Vanguard 60/40 portfolio (the green benchmark line).

America kicked serious ass over the past decade.

Re: Stock scream room

Posted: Tue Jun 14, 2022 6:49 pm

by glennds

Joypog, something doesn't look right. There's no way the PP would be returning a CAGR of 12.59% for that time period. It should be closer to 6% or a little less.

Re: Stock scream room

Posted: Tue Jun 14, 2022 7:12 pm

by joypog

glennds wrote: ↑Tue Jun 14, 2022 6:49 pm

Joypog, something doesn't look right. There's no way the PP would be returning a CAGR of 12.59% for that time period. It should be closer to 6% or a little less.

Hmm I reran the test and here are the settings and results.

I'm a n00b with PV, so I may well be wrong. Is there a setting that's off?

Re: Stock scream room

Posted: Tue Jun 14, 2022 7:15 pm

by D1984

joypog wrote: ↑Tue Jun 14, 2022 7:12 pm

glennds wrote: ↑Tue Jun 14, 2022 6:49 pm

Joypog, something doesn't look right. There's no way the PP would be returning a CAGR of 12.59% for that time period. It should be closer to 6% or a little less.

Hmm I reran the test and here are the settings and results.

I'm a n00b with PV, so I may well be wrong. Is there a setting that's off?

I don't think anything was wrong with what you did....IIRC PortfolioVisualizer counts contributions when calculating CAGR; even if you had a hypothetical asset with an exact 0% return that you were kicking in, say, $1K a month to (in order to buy $1,000 of this zero-return asset each and every month of the year) PV would still show a positive CAGR for this portfolio because the contributions would increase the total amount of assets above what it was when the portfolio started.

EDITED TO ADD:

PP in PV while starting with $100K on 1-1-2010 and adding an inflation-adjusted $1K each month:

https://www.portfoliovisualizer.com/bac ... tion4_1=25

PP in PV simply starting with $100K on 1-1-2010 and never adding anything else:

https://www.portfoliovisualizer.com/bac ... tion4_1=25

Notice the wildly different CAGRs?

Re: Stock scream room

Posted: Tue Jun 14, 2022 7:36 pm

by glennds

D1984 wrote: ↑Tue Jun 14, 2022 7:15 pm

Thank you for clarifying that. On the one hand I get it, they're giving you the total portfolio growth whether that came from investment returns or contributions. On the other hand, if you start with a $10,000 portfolio and contribute $1000/month, it will give you a CAGR of over 29% in the summary box Joypog shared. If you scroll down to Trailing returns, it gives you a performance number that would be more appropriate for the conversation here.

Re: Stock scream room

Posted: Tue Jun 14, 2022 7:38 pm

by joypog

OK thanks! I'm still got another 10-20 years of accumulation phase so I always throw in some contributions into the calcs cause it's closer to my circumstances. But yeah I could see that getting really messy. Sorry for the confusion.

Ultimately I think the main point is that the US 60/40 was just destroying everything out there for this most recent period. The PP is naturally going to bad against that. My big surprise was how the World TSM portfolio was much closer to the PP than the Jack Bogle special.

I totally get tracking error regret, but in light of that, it seems unfair to kick oneself too hard by comparing oneself to the ideal portfolio of the past decade.

Re: Stock scream room

Posted: Wed Jun 15, 2022 7:19 am

by Jack Jones

joypog wrote: ↑Tue Jun 14, 2022 7:38 pm

Ultimately I think the main point is that the US 60/40 was just destroying everything out there for this most recent period. The PP is naturally going to bad against that. My big surprise was how the World TSM portfolio was much closer to the PP than the Jack Bogle special.

I totally get tracking error regret, but in light of that, it seems unfair to kick oneself too hard by comparing oneself to

the ideal portfolio of the past decade.

Also, don't forget, these comparisons can't show the additional tail-risk benefits you get from holding gold:

- survival of $USD devaluation

- war at home

- confiscation of on-the-book assets

- estate tax

- FAFSA calculation

Re: Stock scream room

Posted: Wed Jun 15, 2022 8:51 am

by Kbg

buddtholomew wrote: ↑Tue Jun 14, 2022 10:22 am

I was ridiculed for years because I didn’t ascribe to the philosophy that one or more assets would buoy the portfolio in times of economic distress.

No, people gave you a hard time for railing on (investing in?) something you didn't believe in and thoroughly disliked. Your gold rants were/are epic.

For example, it's ok not to like gold. But rather than blowing one's top on a down day, much better to say something like..."I don't think gold is a great holding and here's my evidence/thoughts on why." Or...here's how I invest/my allocation and these are the reasons why.

In short, bringing value added is, well, bringing value added vs. a text explosion that does you no actual good and annoys others when it is done repeatedly.

Peace brother...gold is not Satan. It's a metal that is shiny and yellowish and goes up and down in the price people are willing to pay for it. Some think there is money to be made investing in it, others believe it provides no productive value or intrinsic return and is therefore not worth buying. These views can coexist peacefully in our universe.

Re: Stock scream room

Posted: Sat Oct 01, 2022 3:54 am

by boglerdude

Re: Stock scream room

Posted: Mon Oct 03, 2022 5:29 pm

by Kbg

It's ugly...first hand experience. :-)

Re: Stock scream room

Posted: Thu Feb 02, 2023 11:59 am

by whatchamacallit

Nasdaq up over 17% ytd? That is some pain.

Re: Stock scream room

Posted: Thu Aug 01, 2024 2:29 pm

by dualstow

Rough day for the market, eh?

Going to have to peek at B’heads today.

Re: Stock scream room

Posted: Fri Aug 02, 2024 10:59 am

by seajay

dualstow wrote: ↑Thu Aug 01, 2024 2:29 pm

Rough day for the market, eh?

Going to have to peek at B’heads today.

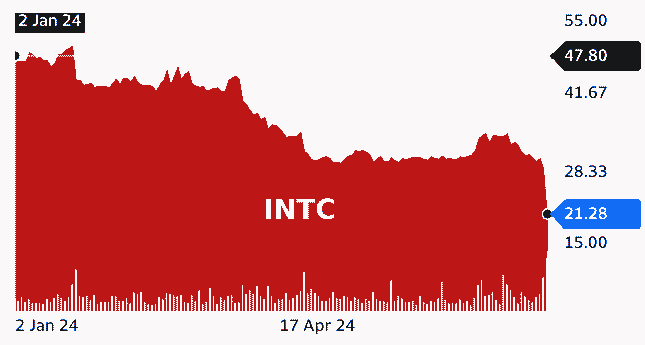

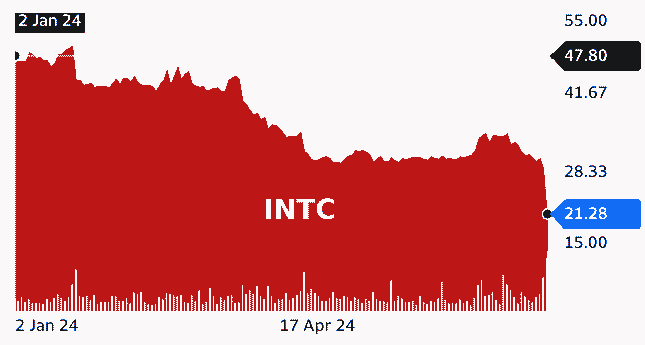

Intel down over 50% year to date, and looking to halve its workforce. Seems to have been a AI sell off today, most such techs down, excepting Apple.

Start of a AI bubble burst?

Isn't it November when US elections coincide with the BRICS introduction of a alternative to the US SWIFT (international trade settlements). A kick back to the Russia sanctions. 75% of the worlds population migrating over to that along with increased barriers of access to US markets (here in the UK buying US based mutuals/ETF's is pretty much a no-go nowadays). The US could transition to being just a <5% of global population isolationist block, with up-starts preferring to list elsewhere (Asia) for the greater market size that yields. Trump when president pretty much P'd off the EU, Biden's done the same with the UK, Australia are more focused upon closer proximity trading partners (China) ... the 'West' could transition to just being US/Canada.

Many B’heads swear by America first ... no need for international as that only relatively lags. World/Global stock reduces geopolitical concentration risk. If the US does relatively lag and reduce down from recent 60%+ of global market cap, then others rise. Along with gold (global non-fiat commodity currency).

No need for bonds, lending to someone who has a money printing press so has no real need to borrow.