I've no problems. I was just on it a few days ago for the statements and just now. Do a traceroute?sophie wrote:I'd look into the stats to see if there really has been a jump but...

It's been 3 days now. Wonder if they use Arvixe.

P2P Lending

Moderator: Global Moderator

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

It's been up and down. Down right now but was up briefly last night.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

I think you'll get a kick out of this...sophie wrote:It's been up and down. Down right now but was up briefly last night.

http://seekingalpha.com/article/3981272 ... t-72448249

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

Despite the glowing jobs report that came out today, I've seen an enormous jump in Lending Club delinquencies recently. Could be chance but I have enough notes that I doubt this. Also, the delinquent notes are all ones funded in the past 2 years.

I'm used to seeing a chargeoff rate of ~7% per year, which would be right about in line with predictions. Right now this is what I have:

Grace Period: 3.2%

Late 16-30 days: 2.7%

Late 31-120 days: 2.0%

And this is after chargeoffs year to date of 4.9%. Almost all the above notes look like they are headed for chargeoff. Many of them are declaring bankruptcy or gave Lending Club a cease and desist order.

It looks to me like Lending Club loosened its borrower requirements quite significantly about 2 years ago while reducing interest rates, presumably to attract more borrowers so they can inflate their portfolios and collect more fees. And it works - despite the recent bad press, their loan issuance is still going up. Quite a conflict of interest. It was fun for a while but I think there are better places for VP money.

I'm used to seeing a chargeoff rate of ~7% per year, which would be right about in line with predictions. Right now this is what I have:

Grace Period: 3.2%

Late 16-30 days: 2.7%

Late 31-120 days: 2.0%

And this is after chargeoffs year to date of 4.9%. Almost all the above notes look like they are headed for chargeoff. Many of them are declaring bankruptcy or gave Lending Club a cease and desist order.

It looks to me like Lending Club loosened its borrower requirements quite significantly about 2 years ago while reducing interest rates, presumably to attract more borrowers so they can inflate their portfolios and collect more fees. And it works - despite the recent bad press, their loan issuance is still going up. Quite a conflict of interest. It was fun for a while but I think there are better places for VP money.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

Not so fast! Before you give up, what you need is superior credit intelligence than what LC just provides out of the box. I just logged in to see my stats since Jan 2015:sophie wrote:It looks to me like Lending Club loosened its borrower requirements quite significantly about 2 years ago while reducing interest rates, presumably to attract more borrowers so they can inflate their portfolios and collect more fees. And it works - despite the recent bad press, their loan issuance is still going up. Quite a conflict of interest. It was fun for a while but I think there are better places for VP money.

Grace Period: 0%

Late 16-30 days: 0.59%

Late 31-20 days: 0.59%

Charged Off: 1.18%

For a 11.59% adjusted net annualized return, 14.17% weighted average rate. I too have noticed a teeth gritting slight uptick recently, more obvious in my other account.

So head over to http://lendingalpha.com/ I asked them a lot of hard hitting questions initially and I am satisfied they really know what they're doing (as I would do things myself) and can weather and adapt to anything that comes. Worst case is breakeven in another 2008 crisis. But to make this work safely, you've got plan to DCA in over 5 years since the term composition is about 50%/50% split between three and five. I do deposits literally every week to smooth it out.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

Thanks for the pointer.

It comes down to whether you believe Lending Club's charge-off rate prediction - which LendingAlpha apparently does. It looks to me like LC is underestimating it by at least a factor of two.

Shame, because I really liked the model. Interestingly, a friend of mine invented something like this on a small scale years ago - he called it "the FOO Bank", established a 5% interest rate, and had a program running to calculate the daily interest with compounding and calculate/track payments. It was among friends of course. I had some money in it for a while.

It comes down to whether you believe Lending Club's charge-off rate prediction - which LendingAlpha apparently does. It looks to me like LC is underestimating it by at least a factor of two.

Shame, because I really liked the model. Interestingly, a friend of mine invented something like this on a small scale years ago - he called it "the FOO Bank", established a 5% interest rate, and had a program running to calculate the daily interest with compounding and calculate/track payments. It was among friends of course. I had some money in it for a while.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

My two charged off were D and E and were for debt consolidation purposes; they paid 26% and 36% of the balance before giving up the ghost. Of the graces, both are rated C (!); one is 31-120 days late for credit card refinancing, the other is 16-30 days late and is another debt consolidation. One paid 36% of the balance and the other 51% of the balance. I guess its true that if a note makes it well past 50%, you're unlikely to have a default?

Since you said you were focusing on F and G, I'm gonna speculate there's not enough loans in those grades to derive an accurate risk forecast. It's definitely early days, yet! Total volume might be impressive based on $ but it isn't for quantity:

subgrade: 1, loan count: 2826

subgrade: 2, loan count: 3166

subgrade: 3, loan count: 3529

subgrade: 4, loan count: 5871

subgrade: 5, loan count: 5102

subgrade: 6, loan count: 4055

subgrade: 7, loan count: 4796

subgrade: 8, loan count: 7085

subgrade: 9, loan count: 5344

subgrade: 10, loan count: 5189

subgrade: 11, loan count: 4663

subgrade: 12, loan count: 4303

subgrade: 13, loan count: 2612

subgrade: 14, loan count: 2504

subgrade: 15, loan count: 2162

subgrade: 16, loan count: 2676

subgrade: 17, loan count: 2299

subgrade: 18, loan count: 1696

subgrade: 19, loan count: 1368

subgrade: 20, loan count: 898

subgrade: 21, loan count: 661

subgrade: 22, loan count: 519

subgrade: 23, loan count: 388

subgrade: 24, loan count: 294

subgrade: 25, loan count: 234

subgrade: 26, loan count: 153

subgrade: 27, loan count: 134

subgrade: 28, loan count: 88

subgrade: 29, loan count: 79

subgrade: 30, loan count: 62

subgrade: 31, loan count: 50

subgrade: 32, loan count: 44

subgrade: 33, loan count: 31

subgrade: 34, loan count: 52

subgrade: 35, loan count: 67

I fail to understand how a lender can have a high FICO score to get in, yet somehow manage to grade E, F or G. And since defaults are banned, it's a diminishing supply of potential lenders over time. How did this lender even get their foot in their door?!!

Since you said you were focusing on F and G, I'm gonna speculate there's not enough loans in those grades to derive an accurate risk forecast. It's definitely early days, yet! Total volume might be impressive based on $ but it isn't for quantity:

subgrade: 1, loan count: 2826

subgrade: 2, loan count: 3166

subgrade: 3, loan count: 3529

subgrade: 4, loan count: 5871

subgrade: 5, loan count: 5102

subgrade: 6, loan count: 4055

subgrade: 7, loan count: 4796

subgrade: 8, loan count: 7085

subgrade: 9, loan count: 5344

subgrade: 10, loan count: 5189

subgrade: 11, loan count: 4663

subgrade: 12, loan count: 4303

subgrade: 13, loan count: 2612

subgrade: 14, loan count: 2504

subgrade: 15, loan count: 2162

subgrade: 16, loan count: 2676

subgrade: 17, loan count: 2299

subgrade: 18, loan count: 1696

subgrade: 19, loan count: 1368

subgrade: 20, loan count: 898

subgrade: 21, loan count: 661

subgrade: 22, loan count: 519

subgrade: 23, loan count: 388

subgrade: 24, loan count: 294

subgrade: 25, loan count: 234

subgrade: 26, loan count: 153

subgrade: 27, loan count: 134

subgrade: 28, loan count: 88

subgrade: 29, loan count: 79

subgrade: 30, loan count: 62

subgrade: 31, loan count: 50

subgrade: 32, loan count: 44

subgrade: 33, loan count: 31

subgrade: 34, loan count: 52

subgrade: 35, loan count: 67

I fail to understand how a lender can have a high FICO score to get in, yet somehow manage to grade E, F or G. And since defaults are banned, it's a diminishing supply of potential lenders over time. How did this lender even get their foot in their door?!!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

I have 29 chargeoffs to date and 16 more clearly headed in that direction, so I have a somewhat larger sample size. I've seen chargeoffs follow a couple of separate patterns.

There's the group that charges off in the first year, often in the first few months. Most of those cases have to be fraud/criminal behavior. The borrower knows they're going to default on their credit card debt, and they have nothing to lose by snagging an extra $35K from a P2P lender beforehand. I'm disappointed that Lending Club hasn't done more to clamp down on this behavior. For example, they could set a rule that any cash disbursed has to be used first to pay off existing unsecured, non-student loan debt, like a balance transfer deal, and they transfer the money themselves rather than trusting the borrower to do it. In other words, act more like the banks do. They make it hard for people to get cash advances, and there is good reason for this.

The second group is the steady-state incidence of people losing their jobs, getting sick or even dying, etc. Remember these are the people with no savings, who couldn't fund an unexpected $1,000 expense. This is the 2% per year rate that banks experience. I've had loans charge off with just a few months remaining to pay off.

I suppose there may be another group that just gets tired of paying the loan after a year or two, and decides there's no real penalty if they stop paying - vs the very real "penalty" of not being able to buy the newest iPad or Xbox. The chargeoff rate definitely decreases about halfway through the loan.

Also: I'm focusing on E & F grades. No G.

There's the group that charges off in the first year, often in the first few months. Most of those cases have to be fraud/criminal behavior. The borrower knows they're going to default on their credit card debt, and they have nothing to lose by snagging an extra $35K from a P2P lender beforehand. I'm disappointed that Lending Club hasn't done more to clamp down on this behavior. For example, they could set a rule that any cash disbursed has to be used first to pay off existing unsecured, non-student loan debt, like a balance transfer deal, and they transfer the money themselves rather than trusting the borrower to do it. In other words, act more like the banks do. They make it hard for people to get cash advances, and there is good reason for this.

The second group is the steady-state incidence of people losing their jobs, getting sick or even dying, etc. Remember these are the people with no savings, who couldn't fund an unexpected $1,000 expense. This is the 2% per year rate that banks experience. I've had loans charge off with just a few months remaining to pay off.

I suppose there may be another group that just gets tired of paying the loan after a year or two, and decides there's no real penalty if they stop paying - vs the very real "penalty" of not being able to buy the newest iPad or Xbox. The chargeoff rate definitely decreases about halfway through the loan.

Also: I'm focusing on E & F grades. No G.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

LA relies on its own models, not anything from LC. But, I didn't know back in the beginning both P and LC were truly P2P and "free market" as far as lenders setting rates went and a social networking thing. Because lenders had no clue what interest rate to charge, etc.. It was disaster prompting "intervention" where P and LC had to step in and start providing credit scores, rates, etc. all the usual jazz to lenders. So they're doing that service as an after thought not a primary reason for being. And that was a also disaster during the initial years as well which I'm much more familiar with. So I say don't even expect them to be competent at it. The self-interest just isn't there.

I've read LC's page on their collection practices and I'm left wanting more. Having lived through the hell of 12 creditors coming after me all all at once before charging off (and then getting handed off to a perpetual revolving door of collection agencies for at least 7 years afterwards), it's just not enough to do things the traditional old way. So your best defense is going to be as best an offense as possible from the very outset. Ruthlessly weed out as many potential deadbeats as you can. N\o mercy.

And I'm pretty disappointed LC allows in as low as a 640 FICO score as far back as 2012 (and it's probably worse now). Their high loan deny rate has to be over much more stupid and insignificant things than what really matters. I'm seeing stories of high FICO, high income, responsible people getting denied.

I've read LC's page on their collection practices and I'm left wanting more. Having lived through the hell of 12 creditors coming after me all all at once before charging off (and then getting handed off to a perpetual revolving door of collection agencies for at least 7 years afterwards), it's just not enough to do things the traditional old way. So your best defense is going to be as best an offense as possible from the very outset. Ruthlessly weed out as many potential deadbeats as you can. N\o mercy.

And I'm pretty disappointed LC allows in as low as a 640 FICO score as far back as 2012 (and it's probably worse now). Their high loan deny rate has to be over much more stupid and insignificant things than what really matters. I'm seeing stories of high FICO, high income, responsible people getting denied.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

You went through a charge-off? Sounds like there is a story there worth telling.

If it were more difficult to get out of paying a debt, then Lending Club might not exist in the first place. The investor profits depend entirely on most people feeling obliged to repay debts.

Definitely I'm talking myself out of this investment. I thought Lending Club's self-interest would be enough to protect investors from the worst excesses of the borrowers, but now I'm not so sure of that.

If it were more difficult to get out of paying a debt, then Lending Club might not exist in the first place. The investor profits depend entirely on most people feeling obliged to repay debts.

Definitely I'm talking myself out of this investment. I thought Lending Club's self-interest would be enough to protect investors from the worst excesses of the borrowers, but now I'm not so sure of that.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

11 credit cards and 1 personal loan. I really hate to say this (especially in this topic), but just go directly to Chapter 11 (well, in the old days). Do not put your head in the sand like an ostrich and wait it out (in my defense, I was young and naive and interacting with the government was a scary proposition at the time on top of the already very scary situation). However, I wasn't gaming the system like certain P2P borrowers appear to be doing (its really hard to tell with no personal contact with the borrowers, which I also find rather aggravating... not that I want to bust their kneecaps or anything like that!sophie wrote:You went through a charge-off? Sounds like there is a story there worth telling.

So now that I think about it, I guess I approve of the tougher bankruptcy rules passed a few years ago that force people first into debt counseling and then Chapter 13 rather just instantly wiping the slate clean via Chapter 11. I did indeed do debt counseling (voluntarily) which is just a mechanism to centralize all disbursements to creditors via just one payment and also substantially lower the monthly required payments, but it only goes so far if you don't have the income even for that.

Which reminds me, aren't we still the creditors on the charged off loans? The debt doesn't disappear just because its charged off and written off our taxes unless it is cleared in a slate wipe Chapter 11 or the statute of limitations runs out to collect. Statute of limitations vary by state but any third party debt collector without a legal nexus buying charged off debts from the original creditors for pennies on the dollar can try to collect and if you're stupid enough to engage with them in any way shape or form, it gives default legal presumption the debt is valid resets the clock. It seems like LC dropped the ball on that one also. Grrrr! I really don't have much confidence in their collection practices at all. I should start up "MachineGhost's Knee Cap Busting Collection Agency". Just the name alone should scare people into paying.

Did you see that hilarious video in the YouTube junky thread where John Oliver starts a collection agency? "Fuck you, Opera!"

Last edited by MachineGhost on Sat Jul 09, 2016 8:19 pm, edited 3 times in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

Me too, but I think you should giva LA a chance before giving up. It costs you nothing which is a rare opportunity. And they're far superior to LendingRobot which is just run o' the mill and does cost you. There may be others, but I'm not interested. I know a good thing when I see one.sophie wrote:Definitely I'm talking myself out of this investment. I thought Lending Club's self-interest would be enough to protect investors from the worst excesses of the borrowers, but now I'm not so sure of that.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

Wow, I'm glad you were able to dig yourself out of that mess. Scary situation indeed. BTW yes, we are the creditors for the charged off loans. I've been seeing recoveries of ~15% on the principle, after the hefty collection fees. Typically recoveries show up around 6 months after chargeoff. I've never seen additional or later recoveries, so I guess either the collection agency gets to keep anything additional, or the rate of additional recoveries is vanishingly low.

Anytime there is a system, people will game it. I don't really blame the borrowers, because it's Lending Club's job to do something about people who get loans with no intention of paying them back. If you're the person who pays off debts and saves money instead, you're the sucker - not the person who goes into bankruptcy. Lending Club was attractive in part because it felt like a chance to turn the tables.

Will look more into LA!

Anytime there is a system, people will game it. I don't really blame the borrowers, because it's Lending Club's job to do something about people who get loans with no intention of paying them back. If you're the person who pays off debts and saves money instead, you're the sucker - not the person who goes into bankruptcy. Lending Club was attractive in part because it felt like a chance to turn the tables.

Will look more into LA!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

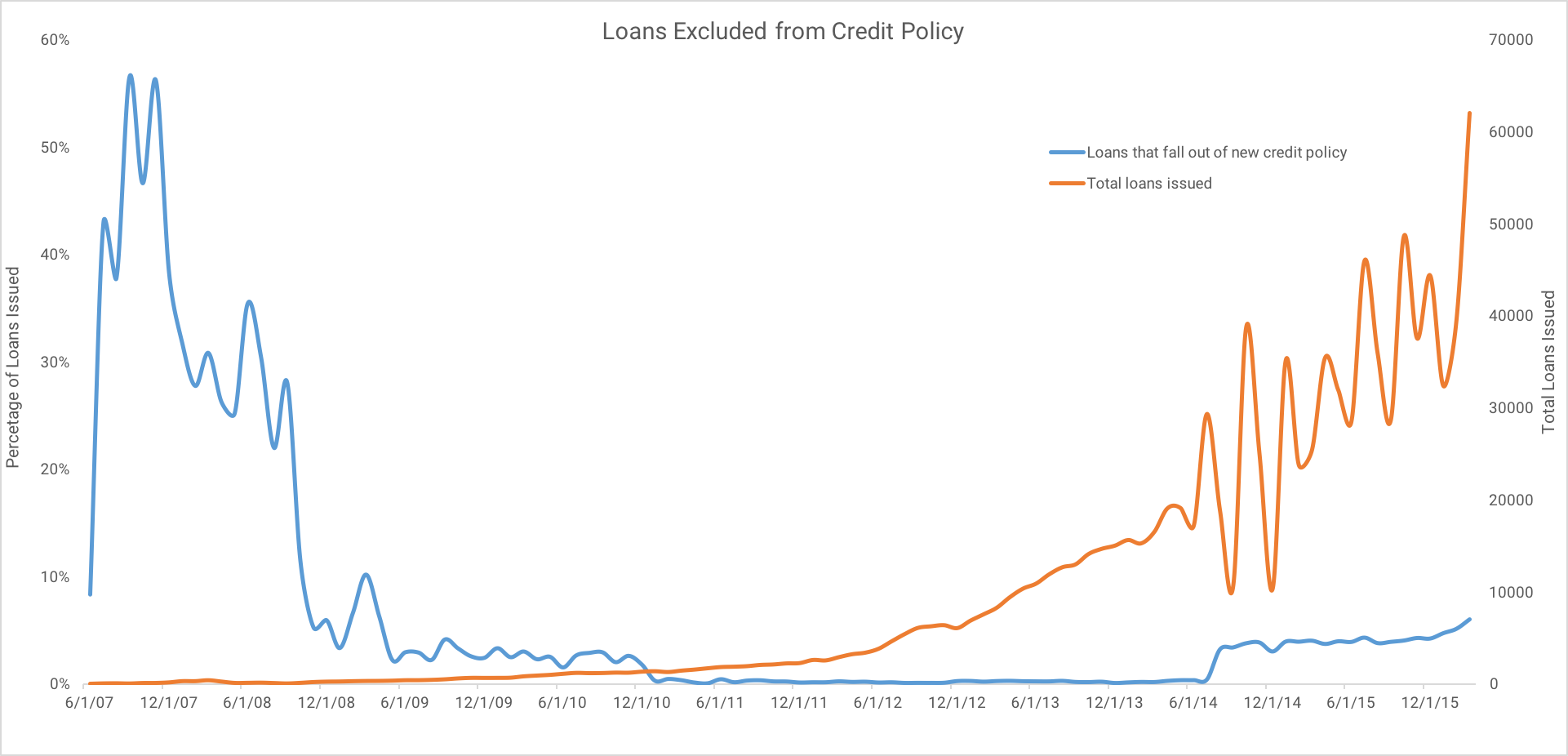

This chart seems to indicate that LC's existing underwriting policy has been maintained despite short term growth pressures (which is a conflict of interest). It's hard to see but the growth of new loans is above the growth of defaults so far. LC is now an orphan stock under $5 so no need to worry about Wall Street quarterly earnings pressures! I expect this honeymoon can't last forever.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

You can earn 5% APR by buying Veteran Business Bonds to lend money to veteran-owned small businesses at https://streetshares.com/

It's kind of lame in that there's only a $5K limit unless you qualify as accredited and/or sophisticated. To get around it, you have to skip the retail portal and sign up for the professional.

It's kind of lame in that there's only a $5K limit unless you qualify as accredited and/or sophisticated. To get around it, you have to skip the retail portal and sign up for the professional.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

Hmm! It cost about 18%, but I'm not going to complain!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

As far as real estate P2P possibilities went, I decided on FundRise. They offer eREIT's regulated by the SEC but are not traded on an exchange so you avoid all the dumb money malarky.

https://fundrise.com/

I wanted in on the income fund but it hasn't reopened whereas the growth fund has several times. They both make distributions, but obviously the latter is more of a upgrader thing to raise rents compared to just cash flow.

https://fundrise.com/

I wanted in on the income fund but it hasn't reopened whereas the growth fund has several times. They both make distributions, but obviously the latter is more of a upgrader thing to raise rents compared to just cash flow.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

You can expect to recover an average of 10% on charged off loans, after fees.

The greatly increased rate of deadbeat loans continues, and it's mostly loans about 6 months old. I'm curious about the reasons. It may be some fundamental weaknesses in the economy, like the job count glossing over the realities of low paying, part time jobs. I suspect, though, that there just isn't much of an incentive to repay an unsecured loan, and there are probably a lot of people who have figured out that if you're already going to default on a credit card loan, you might as well pick up an extra $35K from a P2P lender on the way. This is outright fraud, but that's hard to prove and near impossible if the person has made 6 payments.

Not sure any unsecured loan scheme is going to be any better. I'm still getting a decent return (~12%) from LC, but it relies entirely on Lending Club somehow limiting the number of fraudulent borrowers, and they have no real incentive to do so.

The greatly increased rate of deadbeat loans continues, and it's mostly loans about 6 months old. I'm curious about the reasons. It may be some fundamental weaknesses in the economy, like the job count glossing over the realities of low paying, part time jobs. I suspect, though, that there just isn't much of an incentive to repay an unsecured loan, and there are probably a lot of people who have figured out that if you're already going to default on a credit card loan, you might as well pick up an extra $35K from a P2P lender on the way. This is outright fraud, but that's hard to prove and near impossible if the person has made 6 payments.

Not sure any unsecured loan scheme is going to be any better. I'm still getting a decent return (~12%) from LC, but it relies entirely on Lending Club somehow limiting the number of fraudulent borrowers, and they have no real incentive to do so.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

I think I found the reason!sophie wrote:You can expect to recover an average of 10% on charged off loans, after fees.

The greatly increased rate of deadbeat loans continues, and it's mostly loans about 6 months old. I'm curious about the reasons. It may be some fundamental weaknesses in the economy, like the job count glossing over the realities of low paying, part time jobs. I suspect, though, that there just isn't much of an incentive to repay an unsecured loan, and there are probably a lot of people who have figured out that if you're already going to default on a credit card loan, you might as well pick up an extra $35K from a P2P lender on the way. This is outright fraud, but that's hard to prove and near impossible if the person has made 6 payments.

Not sure any unsecured loan scheme is going to be any better. I'm still getting a decent return (~12%) from LC, but it relies entirely on Lending Club somehow limiting the number of fraudulent borrowers, and they have no real incentive to do so.

I wonder if this will turn into a race to the bottom as economic malaise trickles up? I really can't emphasize enough that you've got to diversify like you've never diversified before in your life and not just in quantity but over time too. Fortunately, the latest stats from LR show that the 98% confidence level for earning a positive return happens with just 150-200 notes which is nothing. This is not a get rich quick scheme, but 10 years down the line, the yearly cash flow is ginormous! Where else can you actually diversify into positivity other than dividend growth stocks? Very cool.In September 2014 the company loosened its credit policy and raised the acceptable level of a borrower's DTI from 35% to 40%. Borrowers who fell inside this new category represented an immediate increase of 3.2% of originations in August 2014, which has nearly doubled to 6% as of March 2016. Most of these new borrowers fell into grades D-E, which corresponds with higher risk.

In early 2016 Lending Club announced that it had discovered 'pockets of loans that were underperforming expectations'. According to SEC filings, Lending Club tightened credit requirements effective June 7th, 2016, returning DTI limits to 2014 levels. Their reasoning was explained in a 8k filing:

In some higher risk grades in early 2016, we identified some underperforming pockets of loans and made modifications to pricing and credit policies accordingly. The population eliminated from the credit policy represents slightly less than 5% of loan volume (annualized based on Q4 2015), and was mainly characterized by high indebtedness, an increased propensity to accumulate debt and lower credit scores.

Lending Club did not release statistics on how these underperforming segments were affecting investor return. The two questions are therefore,

How poorly were these loans performing?

How will this move affect company revenue?

(Source: Compiled Lending Club data)

Although not directly comparable due to improvements in the company's overall underwriting algorithms, we have some reference to how these borrowers have done as a population as credit was extended to this category from the company's founding until late 2010. All of these notes have now reached maturity, which gives us the opportunity to calculate a definitive ROI. The results are stark: while the platform average return during this period was 7.7%, notes with similar characteristics to the underperforming segment returned -33%.

LendingRobot estimates that the elimination of these poorly performing segments will raise the platform average return by 0.6% to 1%. For those investing in higher-risk borrowers (grades D-G), returns may increase 2% to 3.5%.

http://seekingalpha.com/article/3995758 ... gs-preview

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: P2P Lending

U.S. Consumers Are Increasingly Defaulting on Loans Made Online

http://www.bloomberg.com/news/articles/ ... ne-lenders

http://www.bloomberg.com/news/articles/ ... ne-lenders

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: P2P Lending

In case anyone is into Lending Club....

Get out now.

I put a tiny slice of VP money into it as an experiment, just enough to diversify sufficiently. Return's been good (~9%) but in the past several months I've seen a constant stream of loans going bad. The company's claimed charge-off rate is absurdly low. At the current pace, I expect that at least 1/3 - 1/2 of my loans will ultimately charge off. And, the recoveries have shrunk to less than 1% of charged-off amounts, as opposed to the 10% I was getting previously.

Either the economy is not nearly as healthy as advertised, or LC has decided to dump investors overboard and aren't going after deadbeat borrowers. Not good news either way. I guess P2P lending has run its course, but I wonder about all the big pension funds that bought into it.

Get out now.

I put a tiny slice of VP money into it as an experiment, just enough to diversify sufficiently. Return's been good (~9%) but in the past several months I've seen a constant stream of loans going bad. The company's claimed charge-off rate is absurdly low. At the current pace, I expect that at least 1/3 - 1/2 of my loans will ultimately charge off. And, the recoveries have shrunk to less than 1% of charged-off amounts, as opposed to the 10% I was getting previously.

Either the economy is not nearly as healthy as advertised, or LC has decided to dump investors overboard and aren't going after deadbeat borrowers. Not good news either way. I guess P2P lending has run its course, but I wonder about all the big pension funds that bought into it.

-

Libertarian666

- Executive Member

- Posts: 5994

- Joined: Wed Dec 31, 1969 6:00 pm

Re: P2P Lending

I can't imagine why anyone would do this. It's not like running up debt on credit cards is hard for anyone who is likely to pay it back, so why would they need to borrow from other individuals, unless they are really bad risks?sophie wrote:In case anyone is into Lending Club....

Get out now.

I put a tiny slice of VP money into it as an experiment, just enough to diversify sufficiently. Return's been good (~9%) but in the past several months I've seen a constant stream of loans going bad. The company's claimed charge-off rate is absurdly low. At the current pace, I expect that at least 1/3 - 1/2 of my loans will ultimately charge off. And, the recoveries have shrunk to less than 1% of charged-off amounts, as opposed to the 10% I was getting previously.

Either the economy is not nearly as healthy as advertised, or LC has decided to dump investors overboard and aren't going after deadbeat borrowers. Not good news either way. I guess P2P lending has run its course, but I wonder about all the big pension funds that bought into it.

The big pension funds are going to go broke from this and all the other tricks that they have been using to try to meet their return expectations. I blame the Fed for their interest-rate suppression... although actually it's the fault of the government for spending so far beyond their means.

- blue_ruin17

- Executive Member

- Posts: 153

- Joined: Sat Aug 13, 2016 11:16 pm

- Location: New Brunswick, Canada

Re: P2P Lending

For any Canadians out there looking to get into P2P lending, checkout LENDING LOOP

So far I've put $25 into every loan they've posted since January (about 50) and I've yet to have a single late payment or charge-off.

I'm fascinated by the technology of P2P lending, in the same way that I'm intrigued by how Uber and AirBNB are killing the legacy taxi and hotel models. I like the idea of being able to compete directly with the biggest banks in the country for small-business loans. Where will P2P lending be in a decade? Is it just a fad? Or is there a private debt distribution/investment revolution in the near-future that we can't even envision yet, in the same way that we couldn't envision a social media world in 2003?

I don't know. And that's why I just put play money into Lending Loop so far.

Here is one of the company profiles for a 'D' rated, 20%+ interest listing:

So far I've put $25 into every loan they've posted since January (about 50) and I've yet to have a single late payment or charge-off.

I'm fascinated by the technology of P2P lending, in the same way that I'm intrigued by how Uber and AirBNB are killing the legacy taxi and hotel models. I like the idea of being able to compete directly with the biggest banks in the country for small-business loans. Where will P2P lending be in a decade? Is it just a fad? Or is there a private debt distribution/investment revolution in the near-future that we can't even envision yet, in the same way that we couldn't envision a social media world in 2003?

I don't know. And that's why I just put play money into Lending Loop so far.

Here is one of the company profiles for a 'D' rated, 20%+ interest listing:

...Clearly the P2P lending model is still in the "wild west" stage. But I'll be watching closely, and throwing all the Eram Transport Ltd's out there a few bones...and sticking with the HBPP for my serious capital.What Does Eram Transportation Ltd. Do?

We're a trucking company that transports a variety of goods.

Financial Situation

My business is profitable and growing.

What is the loan for?

We intend to buy new equipment to improve a truck.

Why are we safe to lend to?

I'm a hard worker.

STAT PERPETUS PORTFOLIO DUM VOLVITUR ORBIS

Amazon: Investing Equanimity: The Logic & Wisdom of the Permanent Portfolio

Amazon: Investing Equanimity: The Logic & Wisdom of the Permanent Portfolio

Re: P2P Lending

Wild west is right.

I thought borrowers would legitimately be people looking for lower interest rates than you can get from banks, but I think a lot of them are scammers. Think of it this way: the only penalty for not repaying a loan is a 7 year, 100-200 point hit on your credit rating. That's surely worth the $30K+ you can score by taking out the max size loan, making 6 payments to protect against fraud charges, and sending a cease-and-desist letter. This is a pattern I've been seeing often, and it doesn't help that I think Lending Club has reduced its effort to go after the deadbeats. Failed loans cost them nothing after all, but collection efforts do.

I expect to get all my money back from Lending Club with a fairly decent profit (maybe 7% annual cagr), but it's truly not worth the effort. It was fun to try though. Don't do it with an amount you'd be uncomfortable losing - I invested only a very small amount and would not have dreamed of doing what some people do and putting in 10% or more of their retirement savings. That would be sheer insanity.

I thought borrowers would legitimately be people looking for lower interest rates than you can get from banks, but I think a lot of them are scammers. Think of it this way: the only penalty for not repaying a loan is a 7 year, 100-200 point hit on your credit rating. That's surely worth the $30K+ you can score by taking out the max size loan, making 6 payments to protect against fraud charges, and sending a cease-and-desist letter. This is a pattern I've been seeing often, and it doesn't help that I think Lending Club has reduced its effort to go after the deadbeats. Failed loans cost them nothing after all, but collection efforts do.

I expect to get all my money back from Lending Club with a fairly decent profit (maybe 7% annual cagr), but it's truly not worth the effort. It was fun to try though. Don't do it with an amount you'd be uncomfortable losing - I invested only a very small amount and would not have dreamed of doing what some people do and putting in 10% or more of their retirement savings. That would be sheer insanity.

- blue_ruin17

- Executive Member

- Posts: 153

- Joined: Sat Aug 13, 2016 11:16 pm

- Location: New Brunswick, Canada

Re: P2P Lending

What do you think about the future of P2P lending? Will it prove to be a fad, remain fringe, or is there potential for it to grow to rival the big banks, should the issues you experienced be somehow addressed?sophie wrote:Wild west is right.

I thought borrowers would legitimately be people looking for lower interest rates than you can get from banks, but I think a lot of them are scammers. Think of it this way: the only penalty for not repaying a loan is a 7 year, 100-200 point hit on your credit rating. That's surely worth the $30K+ you can score by taking out the max size loan, making 6 payments to protect against fraud charges, and sending a cease-and-desist letter. This is a pattern I've been seeing often, and it doesn't help that I think Lending Club has reduced its effort to go after the deadbeats. Failed loans cost them nothing after all, but collection efforts do.

I expect to get all my money back from Lending Club with a fairly decent profit (maybe 7% annual cagr), but it's truly not worth the effort. It was fun to try though. Don't do it with an amount you'd be uncomfortable losing - I invested only a very small amount and would not have dreamed of doing what some people do and putting in 10% or more of their retirement savings. That would be sheer insanity.

STAT PERPETUS PORTFOLIO DUM VOLVITUR ORBIS

Amazon: Investing Equanimity: The Logic & Wisdom of the Permanent Portfolio

Amazon: Investing Equanimity: The Logic & Wisdom of the Permanent Portfolio