4.3% SWR for 30 years

Moderator: Global Moderator

4.3% SWR for 30 years

Excellent article by the well-known financial advisor Allan Roth on taking advantage of the current TIPS yields:

https://www.advisorperspectives.com/art ... 6692148692

There's a long discussion of this piece @ Bogleheads, with the likes of William Bernstein and Roth himself participating. Long story short, if you want or need to build a safe income floor and/or think that a regular equity + bond portfolio is unlikely to yield more than 4.3% real going forward this is indeed a rare opportunity.

I thought long and hard about it but in the end decided the complexity of managing such a portfolio (whether you go with a 30 year TIPS ladder or equivalent duration-matched TIPS funds) plus other limitations (e.g. needing to implement this largely if not exclusively in tax-deferred accounts) wasn't worth it in our case.

https://www.advisorperspectives.com/art ... 6692148692

There's a long discussion of this piece @ Bogleheads, with the likes of William Bernstein and Roth himself participating. Long story short, if you want or need to build a safe income floor and/or think that a regular equity + bond portfolio is unlikely to yield more than 4.3% real going forward this is indeed a rare opportunity.

I thought long and hard about it but in the end decided the complexity of managing such a portfolio (whether you go with a 30 year TIPS ladder or equivalent duration-matched TIPS funds) plus other limitations (e.g. needing to implement this largely if not exclusively in tax-deferred accounts) wasn't worth it in our case.

-

whatchamacallit

- Executive Member

- Posts: 751

- Joined: Mon Oct 01, 2012 7:32 pm

Re: 4.3% SWR for 30 years

I wondered if you could make it simpler with ETFs.

I don't know how to calculate your yield though.

You could split money 3 ways between these funds to spread out the duration. Then sell the fund that is up when you need to make a withdrawal.

https://www.pimco.com/en-us/investments ... raded-fund

https://www.pimco.com/en-us/investments ... raded-fund

https://www.pimco.com/en-us/investments ... raded-fund

I don't know how to calculate your yield though.

You could split money 3 ways between these funds to spread out the duration. Then sell the fund that is up when you need to make a withdrawal.

https://www.pimco.com/en-us/investments ... raded-fund

https://www.pimco.com/en-us/investments ... raded-fund

https://www.pimco.com/en-us/investments ... raded-fund

Re: 4.3% SWR for 30 years

How to do this with funds is discussed in detail by posters in the thread, along with the plusses and minuses of using funds vs. the ladder.

Essentially one needs to duration match for one’s spending and remember to rebalance and reduce the duration at least quarterly.

Some combination of VTIP, SCHP & LPTZ ought to do it.

Essentially one needs to duration match for one’s spending and remember to rebalance and reduce the duration at least quarterly.

Some combination of VTIP, SCHP & LPTZ ought to do it.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

His premise that a balanced portfolio can only support a draw rate in the 3% range is unfounded ….

Mathematically A failure of 4% needs to see less then a 2% real return the first 15 years of a 30 year retirement.

There is nothing since 1966 that has done that

Mathematically A failure of 4% needs to see less then a 2% real return the first 15 years of a 30 year retirement.

There is nothing since 1966 that has done that

Re: 4.3% SWR for 30 years

See Roth's more detailed article (he provided the link in the one I posted) here to understand why 3% is more realistic:mathjak107 wrote: ↑Tue Nov 08, 2022 4:24 am His premise that a balanced portfolio can only support a draw rate in the 3% range is unfounded ….

Mathematically A failure of 4% needs to see less then a 2% real return the first 15 years of a 30 year retirement.

There is nothing since 1966 that has done that

https://www.advisorperspectives.com/art ... eturn-risk

1966 is a pretty arbitrary and recent time frame to use. Heck, as Roth points out, we're currently in the middle of the worst bond market since 1842. Furthermore, we've never seen today's particular combination of high stock and bond valuations and raging inflation - in a broader context of massive debt and a Fed bent on quantitative tightening after 13 years of QE/money printing.

Looks like TIPS may end up being not just the best horse but the only good one at the glue factory.

Re: 4.3% SWR for 30 years

Overdue thenmathjak107 wrote: ↑Tue Nov 08, 2022 4:24 am His premise that a balanced portfolio can only support a draw rate in the 3% range is unfounded ….

Mathematically A failure of 4% needs to see less then a 2% real return the first 15 years of a 30 year retirement.

There is nothing since 1966 that has done that

10 years of 0% or lower total real are infrequent, once in every 50 years or so average events. If you hit a -2% real decade whilst also drawing 4%, to end up more than -60% down (real), then the 4% SWR relative to the ongoing 40% left = 10%+ SWR value relative to the ongoing portfolio value. Can still work out OK as a poor decade is often followed by a great decade, but close to the wire. For a average 30 year horizon that's a 60% chance of occurrence. 40% might get away without such a potentially critical hit during their drawdown time. Also helpful is that if you instead started a couple/few years either side of that date then prior gains or later less down's can also side step that risk. Maybe only actually hurting a relatively small percentage of retirees who just simply retired at the wrong point in time. But even then, their money might still last 25 years, instead of the 30 years that SWR is typically measured across, whilst a 65 year old may not get to be 90 let alone 95.

If you time diversify into retirement, start one SWR run a year before you actually retire, as though you were retired, but let the income build up in a cash account - with one third of the total. Then another run started the day you do retire with the another third - with the income from that supplemented with the cash you'd already accumulated from the first run. Then a third run, a year later with the last third. Averaging three sequential/overlapping 30 year SWR runs in such a manner will avoid having lumped all in at the worst point in time. Alleviate the likes of a 1969 (? 1966) bad start date. Three separate portfolios - but where if one does start straining another might have spare capacity, such that revising the poorer case to a lower 3% SWR value, increasing another to 5% (or other two to 4.5%) may see you through OK. Does leave you a little short on income in the first year of retirement, but that might be sorted by having built up a bit of additional cash to cover that before deciding that you'll retire 'next year'.

Was there ever a 30 year period where you didn't get the return of your inflation adjusted money, via 30 year 3.33% SWR with a PP? PV Monte Carlo suggests a very small probability of not doing so. Similar also for 50/50 TSM/10 year Treasury. Less so for 100% TSM (95% probability).

Re: 4.3% SWR for 30 years

A very interesting proposal in your second to the last paragraph. I find it amazing how often I get exposed to an idea that completely never occurred to me. A definite benefit of being exposed and open to many ideas.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

seajay wrote: ↑Tue Nov 08, 2022 10:01 amOverdue thenmathjak107 wrote: ↑Tue Nov 08, 2022 4:24 am His premise that a balanced portfolio can only support a draw rate in the 3% range is unfounded ….

Mathematically A failure of 4% needs to see less then a 2% real return the first 15 years of a 30 year retirement.

There is nothing since 1966 that has done that

10 years of 0% or lower total real are infrequent, once in every 50 years or so average events. If you hit a -2% real decade whilst also drawing 4%, to end up more than -60% down (real), then the 4% SWR relative to the ongoing 40% left = 10%+ SWR value relative to the ongoing portfolio value. Can still work out OK as a poor decade is often followed by a great decade, but close to the wire. For a average 30 year horizon that's a 60% chance of occurrence. 40% might get away without such a potentially critical hit during their drawdown time. Also helpful is that if you instead started a couple/few years either side of that date then prior gains or later less down's can also side step that risk. Maybe only actually hurting a relatively small percentage of retirees who just simply retired at the wrong point in time. But even then, their money might still last 25 years, instead of the 30 years that SWR is typically measured across, whilst a 65 year old may not get to be 90 let alone 95.

If you time diversify into retirement, start one SWR run a year before you actually retire, as though you were retired, but let the income build up in a cash account - with one third of the total. Then another run started the day you do retire with the another third - with the income from that supplemented with the cash you'd already accumulated from the first run. Then a third run, a year later with the last third. Averaging three sequential/overlapping 30 year SWR runs in such a manner will avoid having lumped all in at the worst point in time. Alleviate the likes of a 1969 (? 1966) bad start date. Three separate portfolios - but where if one does start straining another might have spare capacity, such that revising the poorer case to a lower 3% SWR value, increasing another to 5% (or other two to 4.5%) may see you through OK. Does leave you a little short on income in the first year of retirement, but that might be sorted by having built up a bit of additional cash to cover that before deciding that you'll retire 'next year'.

Was there ever a 30 year period where you didn't get the return of your inflation adjusted money, via 30 year 3.33% SWR with a PP? PV Monte Carlo suggests a very small probability of not doing so. Similar also for 50/50 TSM/10 year Treasury. Less so for 100% TSM (95% probability).

a 60/40 has had 5 failures where over the 30 years retirees failed to hold 4% if they started in these years.

1907, 1929,1937,1965.1966

FIRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $1,000,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles. The lowest and highest portfolio balance at the end of your retirement was $-272,474 to $4,564,899, with an average at the end of $1,434,120. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 5 cycles failed, for a success rate of 95.9%.

------------------------------------------------------------------------------------------

50/50 failed 6x so one more date failed but not sure off hand which one , I can’t read the graph on my iPad .

IRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $1,000,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles. The lowest and highest portfolio balance at the end of your retirement was $-223,952 to $4,145,063, with an average at the end of $1,159,395. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 6 cycles failed, for a success rate of 95.1%.

--------------------------------------------------------------------------------------------------

40/60 failed 8x

FIRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $1,000,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles. The lowest and highest portfolio balance at the end of your retirement was $-187,735 to $3,751,122, with an average at the end of $910,974. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 8 cycles failed, for a success rate of 93.4%

---------------------------------------------------------------------------------------------------------------

30/70 failed 15x and is considered unsafe at 4%

FIRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $1,000,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles. The lowest and highest portfolio balance at the end of your retirement was $-206,630 to $3,368,918, with an average at the end of $689,177. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 15 cycles failed, for a success rate of 87.7%.

Last edited by mathjak107 on Tue Nov 08, 2022 3:20 pm, edited 6 times in total.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

a 60/40 has ended 90% of the 122 rolling 30 year periods with more than one started with.

it has ended 67% of the time frames with more than 2X what you started with .

if we eliminated those 5 dates a withdrawal rate would be 6.50%..but without the worst of times it wouldn’t be considered a safe withdrawal rate , just a draw rate

it has ended 67% of the time frames with more than 2X what you started with .

if we eliminated those 5 dates a withdrawal rate would be 6.50%..but without the worst of times it wouldn’t be considered a safe withdrawal rate , just a draw rate

Re: 4.3% SWR for 30 years

IIRC Harry did like T-Bills for safety, and seemingly considered the 4x25 PP to be a alternative to that. As such perhaps it should only be expected to leave less of a residual amount at the end of a 30 year SWR period.

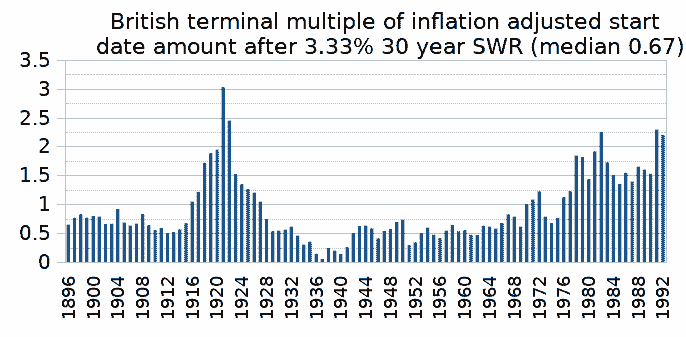

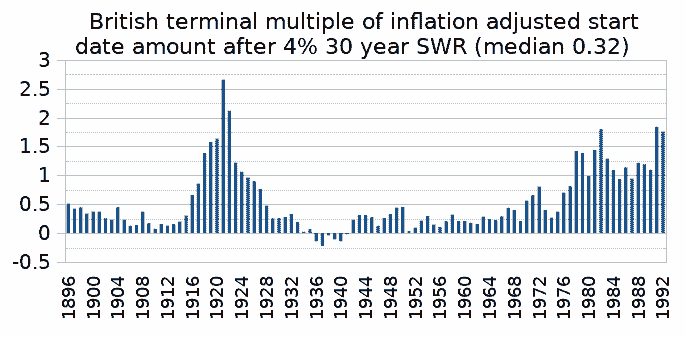

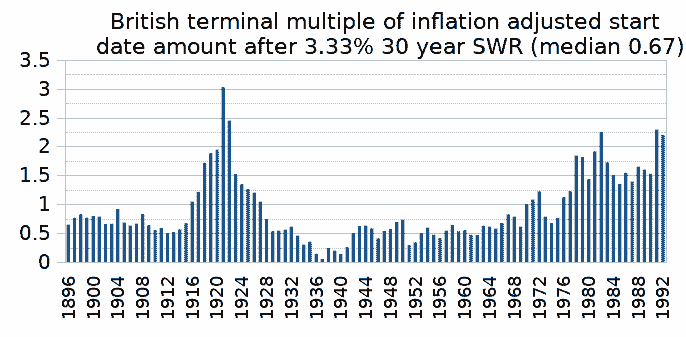

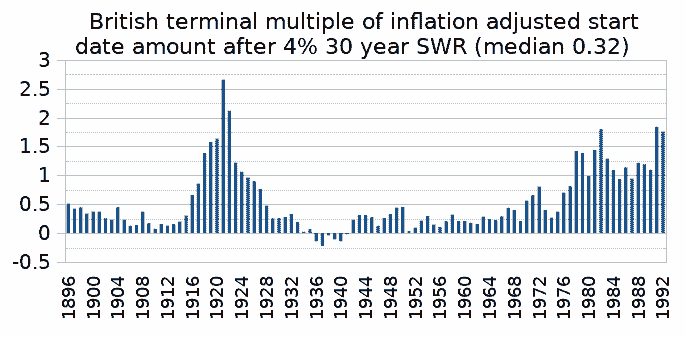

A British has been more of a inflation bond, tended to return your inflation adjusted money via 3.33% SWR (30 year instalments)

4% had failures

of which 1937 start year was the worst, lasted 25.5 years

Variable amounts of terminal amounts remaining after 30 years, as a multiple of the inflation adjusted start date amount. For 3.33% 30 year SWR the median case outcome had 67% of the inflation adjusted start date amount available at the end of the 30 years.

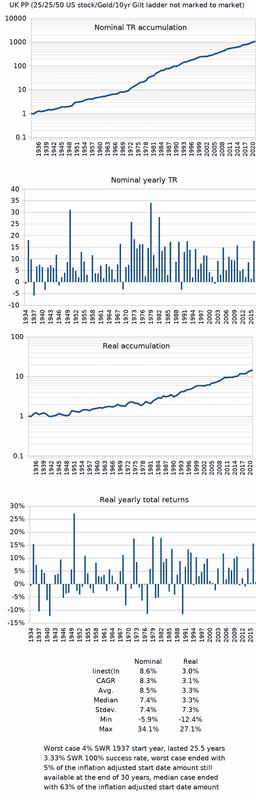

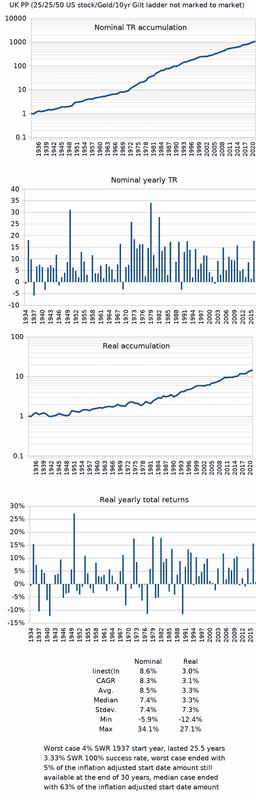

Data reflects British inflation/Pound adjusted for 25% US stock, 25% gold, 50% 10 year treasury ladder not marked to market.

within that you can see the relatively flat 1934 to late 1940's broad 0% real type progression such that SWR was eating the bottom line.

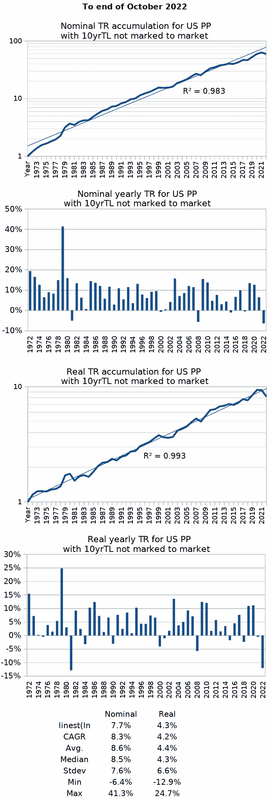

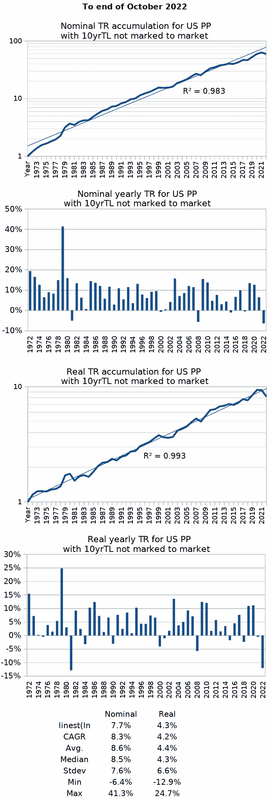

US version with 10 year ladder 50% (alongside 25% TSM, 25% gold)

Maybe more of a possible alternative for savers who otherwise might prefer cash deposit savings accounts. My parents were of that mindset, as were theirs, stocks and bonds being considered as being only for speculators.

For those more tolerant/inclined-to stocks/bonds then a PP risk is that of regret at reaching the end of 30 years with less residual wealth than alternative choices. One choice is to diversify, two separate portfolios, perhaps 50/50 PP with 60/40 TSM/TBM, there's a chance that the historic worst for one wont align with the worst for the other. And/or averaging into retirement along the lines I outlined earlier. Average up the worst cases = higher SWR.

Another factor is taxes. Bond interest 'back then' was more exposed to taxation, no tax-exempt hiding places. At least with stocks you could lower that risk via the likes of BRK/MKL that pay no dividends, nor does gold. Whichever is the more cost/tax efficient could make a significant difference to actual outcome.

A British has been more of a inflation bond, tended to return your inflation adjusted money via 3.33% SWR (30 year instalments)

4% had failures

of which 1937 start year was the worst, lasted 25.5 years

Variable amounts of terminal amounts remaining after 30 years, as a multiple of the inflation adjusted start date amount. For 3.33% 30 year SWR the median case outcome had 67% of the inflation adjusted start date amount available at the end of the 30 years.

Data reflects British inflation/Pound adjusted for 25% US stock, 25% gold, 50% 10 year treasury ladder not marked to market.

within that you can see the relatively flat 1934 to late 1940's broad 0% real type progression such that SWR was eating the bottom line.

US version with 10 year ladder 50% (alongside 25% TSM, 25% gold)

Maybe more of a possible alternative for savers who otherwise might prefer cash deposit savings accounts. My parents were of that mindset, as were theirs, stocks and bonds being considered as being only for speculators.

For those more tolerant/inclined-to stocks/bonds then a PP risk is that of regret at reaching the end of 30 years with less residual wealth than alternative choices. One choice is to diversify, two separate portfolios, perhaps 50/50 PP with 60/40 TSM/TBM, there's a chance that the historic worst for one wont align with the worst for the other. And/or averaging into retirement along the lines I outlined earlier. Average up the worst cases = higher SWR.

Another factor is taxes. Bond interest 'back then' was more exposed to taxation, no tax-exempt hiding places. At least with stocks you could lower that risk via the likes of BRK/MKL that pay no dividends, nor does gold. Whichever is the more cost/tax efficient could make a significant difference to actual outcome.

Re: 4.3% SWR for 30 years

Again from a British perspective and the terminal values after 3.33% 30 year SWR

in a small number of cases saw little difference whether you ran a PP or held 50/50 US stock/UK stock (all-stock). In other cases the difference was considerable, with all-stock in one case ending 30 years of 3.33% SWR with 8 times the inflation adjusted start date amount still available.

Given that the worst cases were no worse (approximately), then that's a free lottery ticket, that often pays out/wins. BUT a major risk is that of high volatility of stocks resulting in some painfully low ongoing valuations at times, that carried on to work, but that can/did scare some out of the market such that they ended up having bought high, capitulated low, and would have been better served by having just stuffed money under their mattress.

UK 1972 and inflation was near 10%, UK stocks dropped -28% total nominal return.

1974 inflation was up to 16% whilst stocks dropped another -50% total nominal return.

1975 and inflation hit 24% ... by which time many might have capitulated 'to save what little remained', but by year end 1975 UK stocks rebounded +150%. Still down, but those that managed to ride through those years, more so when not drawing a income but adding savings/accumulating, and things did work out OK in the end. But for some, perhaps many, the 'free lottery ticket' neither paid out and came at a very high cost after they were scared out of stocks, never to return.

in a small number of cases saw little difference whether you ran a PP or held 50/50 US stock/UK stock (all-stock). In other cases the difference was considerable, with all-stock in one case ending 30 years of 3.33% SWR with 8 times the inflation adjusted start date amount still available.

Given that the worst cases were no worse (approximately), then that's a free lottery ticket, that often pays out/wins. BUT a major risk is that of high volatility of stocks resulting in some painfully low ongoing valuations at times, that carried on to work, but that can/did scare some out of the market such that they ended up having bought high, capitulated low, and would have been better served by having just stuffed money under their mattress.

UK 1972 and inflation was near 10%, UK stocks dropped -28% total nominal return.

1974 inflation was up to 16% whilst stocks dropped another -50% total nominal return.

1975 and inflation hit 24% ... by which time many might have capitulated 'to save what little remained', but by year end 1975 UK stocks rebounded +150%. Still down, but those that managed to ride through those years, more so when not drawing a income but adding savings/accumulating, and things did work out OK in the end. But for some, perhaps many, the 'free lottery ticket' neither paid out and came at a very high cost after they were scared out of stocks, never to return.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

When all was said and done kitces crunched the failures and analyzed Them .

They all had a common denominator.

They all failed when the real return average the first 15 years fell below 2% ..

Even the best bull markets coming later couldn’t save the period .

Actually all the 30 year periods with the failures looked pretty average .

But it was sequence risk the first 15 years that did them in

They all had a common denominator.

They all failed when the real return average the first 15 years fell below 2% ..

Even the best bull markets coming later couldn’t save the period .

Actually all the 30 year periods with the failures looked pretty average .

But it was sequence risk the first 15 years that did them in

Re: 4.3% SWR for 30 years

Which can vary considerably between adjacent start years.mathjak107 wrote: ↑Tue Nov 08, 2022 4:52 pm When all was said and done kitces crunched the failures and analyzed Them .

They all had a common denominator.

They all failed when the real return average the first 15 years fell below 2% ..

Even the best bull markets coming later couldn’t save the period .

Actually all the 30 year periods with the failures looked pretty average .

But it was sequence risk the first 15 years that did them in

Of course if you're drawing 4% SWR and hit a first 15 years of say 0% real then your portfolio value is down more than -60% and the 40% remaining would be like starting with at least a 10% SWR target.

A good, perhaps better choice than the PP is to dump the bonds, just hold 50/50 stock/gold. Viewed from a betting odds perspective and the odds historically were good, create a Callan table of yearly total real gain/loss for each of stock and gold, years best at the top of each year, worst at the bottom and average those best row and worst row values for each decade and you'll see something like the best averaging maybe 12%, the worst averaging 0%, a combined average of +6%. That historically has held up relatively reliably for nearly all decades over the last two centuries. Only one decade with a marginally negative average, the 1910's (WW1) and even then just barely negative.

Run 3.33% 30 year SWR's and a 100% success rate, with a reasonably consistent 100% of your inflation adjusted start date portfolio value still available at the end.

When you have your inflation adjusted money returned via 3.33% yearly instalments for 30 years, and your money back again, in inflation adjusted terms at the end, then that's a 2x real gain factor. However as half of your money had been returned by SWR after 15 years, the average, then relative to capital at risk that's a 2 / 0.5 gain factor, and a 30 year 4x gain = 4.7% annualized gain on average capital at risk.

A barbell of fiat currency USD invested in stocks, and non-fiat commodity currency. With a tendency for multi-year inverse/low correlations. And that has tended to get you through otherwise bad times and be less inclined to capitulate.

If that's two thirds of your wealth, with the other third being in your home value (that might serve as the longer surviving partners cover for all-inclusive late life care-home costs), then that's along the lines of the ancient Talmud advice of thirds each in land (home), business/merchandize (stocks) and in-hand (gold).

If instead of a fixed 3.33% SWR where the value is conventionally uplifted by inflation, if instead you uplift the amount either by inflation or to 3.33% of the ongoing portfolio value each year, whichever is the higher, then whilst that will tend to leave less at the end of the 30 years, it will tend to see your income rise ahead of inflation over time, at perhaps hat 4.7% real rate, such that after a handful of years you might be drawing the equivalent of a 4.2% SWR rate, rising to 5.3% after ten years ...etc. that averages out at at something like a 6.5% over the total 30 year period, but with less at the start, more (in real terms) towards the end. Lumping half in at day zero, the other half a year later will also help reduce the risk of having lumped all-in at the worst possible date/time. As can lumping in after a year of both assets having declined in real terms, such as of recent.

Some years will see both stocks and gold down. In other years both will be up. But to different magnitudes. It's not as stable from year to year as the PP (in nominal terms, even the PP can be volatile in real terms from year to year). However quite often one or the other will be up, and be the asset that you draw income from.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

We are retired going on 8 years .

We use bob clyatts 95/5 method of withdrawal… it uses actual yearly balances .

It is a far better method then what is called the constant dollar method which is the traditional 4% swr ..

The traditional method will end up 90% of the time leaving you with to much money left un spent and not enjoyed without a system of raises other then inflation adjusting .

The 95/5 automatically accounts for inflation and raises ..there is nothing else to do so we like using it .

Firecalc actually has a tab in spending for 95/5.

95/5 gives you 4% of the actual balance each year , or in a down year you get THE HIGHER of 4% of the balance or 5% less then the previous year

The 5% is no problem since when you have good markets up to that point you are already at a higher draw then the constant dollar method would have you .

We use bob clyatts 95/5 method of withdrawal… it uses actual yearly balances .

It is a far better method then what is called the constant dollar method which is the traditional 4% swr ..

The traditional method will end up 90% of the time leaving you with to much money left un spent and not enjoyed without a system of raises other then inflation adjusting .

The 95/5 automatically accounts for inflation and raises ..there is nothing else to do so we like using it .

Firecalc actually has a tab in spending for 95/5.

95/5 gives you 4% of the actual balance each year , or in a down year you get THE HIGHER of 4% of the balance or 5% less then the previous year

The 5% is no problem since when you have good markets up to that point you are already at a higher draw then the constant dollar method would have you .

Re: 4.3% SWR for 30 years

If you don't mind me asking, what asset allocation do you apply that to?mathjak107 wrote: ↑Tue Nov 08, 2022 5:25 pm We are retired going on 8 years .

We use bob clyatts 95/5 method of withdrawal… it uses actual yearly balances .

It is a far better method then what is called the constant dollar method which is the traditional 4% swr ..

The traditional method will end up 90% of the time leaving you with to much money left un spent and not enjoyed without a system of raises other then inflation adjusting .

The 95/5 automatically accounts for inflation and raises ..there is nothing else to do so we like using it .

Firecalc actually has a tab in spending for 95/5.

95/5 gives you 4% of the actual balance each year , or in a down year you get THE HIGHER of 4% of the balance or 5% less then the previous year

The 5% is no problem since when you have good markets up to that point you are already at a higher draw then the constant dollar method would have you .

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

35-40% stock, the rest various bond funds and gold

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

So far it looks like next year will be our first cut in draw if we don’t bounce back .

So we will take 5% less then this ywar .

Which as I said is no big deal since our draw over the last 7 years is much higher then the traditional method .

I never found the constant dollar method much use as the system of taking raises in anything but worst outcomes can leave one scratching their heads as to how much to take extra and when without taking to much or to little .

One method kitces suggested is look every three years and if your balance is still more than 50% above your Starting point take another 10% plus the yearly inflation adjusting.

Repeat every three years . If still above 50% higher do it again ..

I much prefer the 95/5 method for its simplicity and rewards yearly.

A good spending budget should have a decent percentage of discretionary spending in the plan ..so slight adjustments are easily dealt with.

Flexibility is important when dealing with markets and rates and inflation

So we will take 5% less then this ywar .

Which as I said is no big deal since our draw over the last 7 years is much higher then the traditional method .

I never found the constant dollar method much use as the system of taking raises in anything but worst outcomes can leave one scratching their heads as to how much to take extra and when without taking to much or to little .

One method kitces suggested is look every three years and if your balance is still more than 50% above your Starting point take another 10% plus the yearly inflation adjusting.

Repeat every three years . If still above 50% higher do it again ..

I much prefer the 95/5 method for its simplicity and rewards yearly.

A good spending budget should have a decent percentage of discretionary spending in the plan ..so slight adjustments are easily dealt with.

Flexibility is important when dealing with markets and rates and inflation

Re: 4.3% SWR for 30 years

Thanks

Re: 4.3% SWR for 30 years

I'm going to use Bob Clyatt's 95% method. I'm retiring on my Medicare Day 1... During first half of 2026. I've run it recently and I get the strange feeling I'm going to have to work at spending the money I am allowed to spend

- vnatale

- Executive Member

- Posts: 9474

- Joined: Fri Apr 12, 2019 8:56 pm

- Location: Massachusetts

- Contact:

Re: 4.3% SWR for 30 years

It's not that unusual for those who have handled their money well in their lifetime.

I have considerably loosened my spending over the last year or so.

The last time I had spent any money on my house was 17 years ago when I had a new roof put on.

This year after 40 years of my driveway going I finally had it replaced. Just one of many other things I've had done to my house and will continue to do so into next year (mini-splits & heat pumps coming next week or next!).

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: 4.3% SWR for 30 years

Which is why I am quite interested in BelangP's approach....seajay wrote: ↑Tue Nov 08, 2022 5:22 pm A good, perhaps better choice than the PP is to dump the bonds, just hold 50/50 stock/gold. Viewed from a betting odds perspective and the odds historically were good, create a Callan table of yearly total real gain/loss for each of stock and gold, years best at the top of each year, worst at the bottom and average those best row and worst row values for each decade and you'll see something like the best averaging maybe 12%, the worst averaging 0%, a combined average of +6%. That historically has held up relatively reliably for nearly all decades over the last two centuries. Only one decade with a marginally negative average, the 1910's (WW1) and even then just barely negative.

<snip>

Some years will see both stocks and gold down. In other years both will be up. But to different magnitudes. It's not as stable from year to year as the PP (in nominal terms, even the PP can be volatile in real terms from year to year). However quite often one or the other will be up, and be the asset that you draw income from.

https://www.youtube.com/watch?v=E0GQ1Gx8YCw

Using 50% Int TSM, 28% Gold (~2:1 Ratio) and 22% Cash Buffer we get in AUD, SWR 4.4%

Fun fact: The Share/Cash ratio is approx 70% which is the inflection point on the 1Yr efficient frontier line. Relevant, maybe

https://www.idiosyncraticwhisk.com/2014 ... short.html

- Attachments

-

- Screen Shot 2022-12-18 at 7.15.11 pm.png (121.39 KiB) Viewed 2774 times

Aussie GoldSmithPP - 25% PMGOLD, 75% VDCO

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: 4.3% SWR for 30 years

this kitces video should be required viewing for entering retirement .

Very very informative for those who have an interest in safe withdrawal rates …one of the best videos I know of for learning

https://www.youtube.com/watch?v=7sUl_04g-CQ

Very very informative for those who have an interest in safe withdrawal rates …one of the best videos I know of for learning

https://www.youtube.com/watch?v=7sUl_04g-CQ

Re: 4.3% SWR for 30 years

Lowering SWR even a little can make a big difference to overall success/failure outcome.

I note that for British investors, a third in a world stock fund, nothing else, broadly offset inflation 1888 to recent. If the other two-thirds were split 50/50 between gold and US dollar (hard currency), then a 3% SWR had 100% success rate, where in 92% of cases you ended with at least a third of the inflation adjusted start date amount still available at the end of 30 years, a 77% chance that you ended with at least 50% remaining, median case you ended with 90%.

I note that for British investors, a third in a world stock fund, nothing else, broadly offset inflation 1888 to recent. If the other two-thirds were split 50/50 between gold and US dollar (hard currency), then a 3% SWR had 100% success rate, where in 92% of cases you ended with at least a third of the inflation adjusted start date amount still available at the end of 30 years, a 77% chance that you ended with at least 50% remaining, median case you ended with 90%.