Page 1 of 1

Variable Portfolio?

Posted: Fri Nov 29, 2019 8:45 pm

by vnatale

Who here is only strictly 100% Permanent Portfolio (with no variations).

Who here has both a strictly 100% Permanent Portfolio (with no variations) paired with a Variable Portfolio?

Vinny

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 12:38 am

by europeanwizard

Not strictly PP, I've got 25% global stocks instead of the recommended 25% national stocks. Also, I've got a small VP with crypto and P2P lending, sized to about 4% of my PP.

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 8:09 am

by dualstow

Vinny there's a whole section called Variable Portfolio Discussion which you might like to check out ⇢

viewforum.php?f=10

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 10:22 am

by Kbg

Och and I probably post the most about mechanical VPs and there are a couple of threads in this section that might be worth your time. I spent quite a bit of time posting about the use of leveraged ETFs in PP inspired portfolios. I don’t have much to add to what I’ve already written and now I mainly post performance updates on a couple of different mixes I like (and put real money toward).

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 12:32 pm

by foglifter

If I guessed right, you refer to the classic 4x25 HBPP when you say "100% PP". I use GB as my PP and also have a small VP. As others suggested, this section has some good threads on VP.

I think most people here have some kind of VP. Harry Browne was smart to mention VP in his book. It's better to let the kids play in a small isolated playground than let them gamble with all the money they can't afford to lose.

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 5:27 pm

by vnatale

foglifter wrote: ↑Sat Nov 30, 2019 12:32 pm

If I guessed right, you refer to the classic 4x25 HBPP when you say "100% PP". I use GB as my PP and also have a small VP. As others suggested, this section has some good threads on VP.

I think most people here have some kind of VP. Harry Browne was smart to mention VP in his book. It's better to let the kids play in a small isolated playground than let them gamble with all the money they can't afford to lose.

Yes, you guessed correctly. And, "GB" = ?

At this point of my life once I fully convert to the classic Permanent Portfolio (newest goal: no later than December 31, 2019), I don't have a desire to also have a Variable Portfolio. I was just curious as to how many are in the position I intend to be versus how many are doing "classic" plus a Variable Portfolio.

Vinny

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 5:43 pm

by mathjak107

As I explained in another thread , my variable portfolio is the pp....I use a growth and income model as my more fixed portfolio.

I have found for years the volatility in gold and long term treasuries lends itself well to quick hits and then rebuying 1 or 2% later ...I find if I don’t I have nice run ups of a few thousand bucks and then poof right back down again .

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 7:16 pm

by foglifter

vnatale wrote: ↑Sat Nov 30, 2019 5:27 pm

foglifter wrote: ↑Sat Nov 30, 2019 12:32 pm

If I guessed right, you refer to the classic 4x25 HBPP when you say "100% PP". I use GB as my PP and also have a small VP. As others suggested, this section has some good threads on VP.

I think most people here have some kind of VP. Harry Browne was smart to mention VP in his book. It's better to let the kids play in a small isolated playground than let them gamble with all the money they can't afford to lose.

Yes, you guessed correctly. And, "GB" = ?

At this point of my life once I fully convert to the classic Permanent Portfolio (newest goal: no later than December 31, 2019), I don't have a desire to also have a Variable Portfolio. I was just curious as to how many are in the position I intend to be versus how many are doing "classic" plus a Variable Portfolio.

Vinny

GB = Golden Butterfly. In a nutshell, this is a PP with an enlarged small-value-tilted equity bucket. This portfolio has been discussed here several times and a number of folks do use it. Sorry I don't have the specific thread URLs handy, you can do a search here and you'll surely find a lot, including threads where GB is compared to HBPP and some other portfolios.

https://portfoliocharts.com/2015/09/22/ ... butterfly/

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 8:10 pm

by ochotona

If you use trendfollowing on the stocks in the Permanent Portfolio, you will be able to make the equity slice bigger, which will grew the portfolio more aggressively. But it is more work and it doesn't necessarily work in the short term, and "short" can be years. But it will pay over the complete economic cycle.

Re: Variable Portfolio?

Posted: Sat Nov 30, 2019 8:29 pm

by vnatale

foglifter wrote: ↑Sat Nov 30, 2019 7:16 pm

vnatale wrote: ↑Sat Nov 30, 2019 5:27 pm

foglifter wrote: ↑Sat Nov 30, 2019 12:32 pm

If I guessed right, you refer to the classic 4x25 HBPP when you say "100% PP". I use GB as my PP and also have a small VP. As others suggested, this section has some good threads on VP.

I think most people here have some kind of VP. Harry Browne was smart to mention VP in his book. It's better to let the kids play in a small isolated playground than let them gamble with all the money they can't afford to lose.

Yes, you guessed correctly. And, "GB" = ?

At this point of my life once I fully convert to the classic Permanent Portfolio (newest goal: no later than December 31, 2019), I don't have a desire to also have a Variable Portfolio. I was just curious as to how many are in the position I intend to be versus how many are doing "classic" plus a Variable Portfolio.

Vinny

GB = Golden Butterfly. In a nutshell, this is a PP with an enlarged small-value-tilted equity bucket. This portfolio has been discussed here several times and a number of folks do use it. Sorry I don't have the specific thread URLs handy, you can do a search here and you'll surely find a lot, including threads where GB is compared to HBPP and some other portfolios.

https://portfoliocharts.com/2015/09/22/ ... butterfly/

Regarding that small-value title.

Just before I read what you wrote above, I was looking in Quicken at my portfolio values.

My investment with the largest absolute $$$ value is Vanguard's Small-Cap Value Index. However, I then compared its average annual return % for the last five years to that of Vanguard's Total Stock Market Index.

Small-Cap Value - 7.2%

Total Stock Market - 10.6%

My last investment decisions were implemented in January 2003 and have been unchanged since then. This will be, of course, changed when I FINALLY implement Permanent Portfolio.

Those January 2003 investment allocations were heavily influenced by William Bernstein's Four Pillars of Investing book. Therefore, I had a heavy value tilt, both with small- and large-cap.

I have most recently subsequently read that much of that small-cap value superiority exhibited in the past via back testing is illusionary. That one could have never bought at the prices used in the back testing as assumed prices. That those types of investments did not even exist until the fairly recent past. And, that, there really is not small-cap value alpha after one adjusts for risk.

Vinny

Re: Variable Portfolio?

Posted: Tue Dec 03, 2019 12:39 am

by foglifter

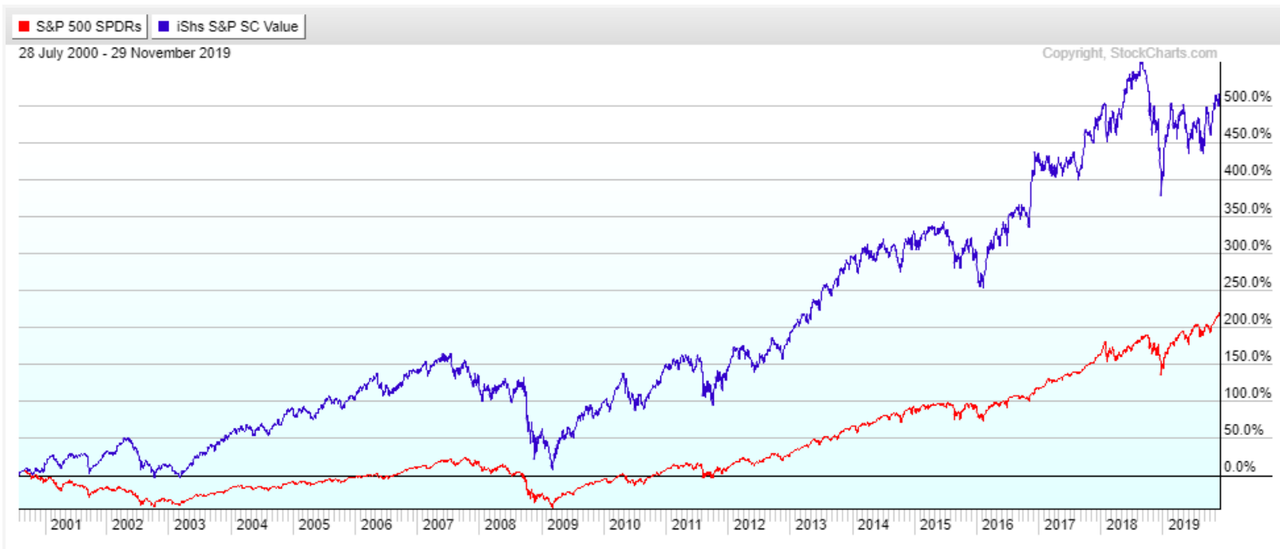

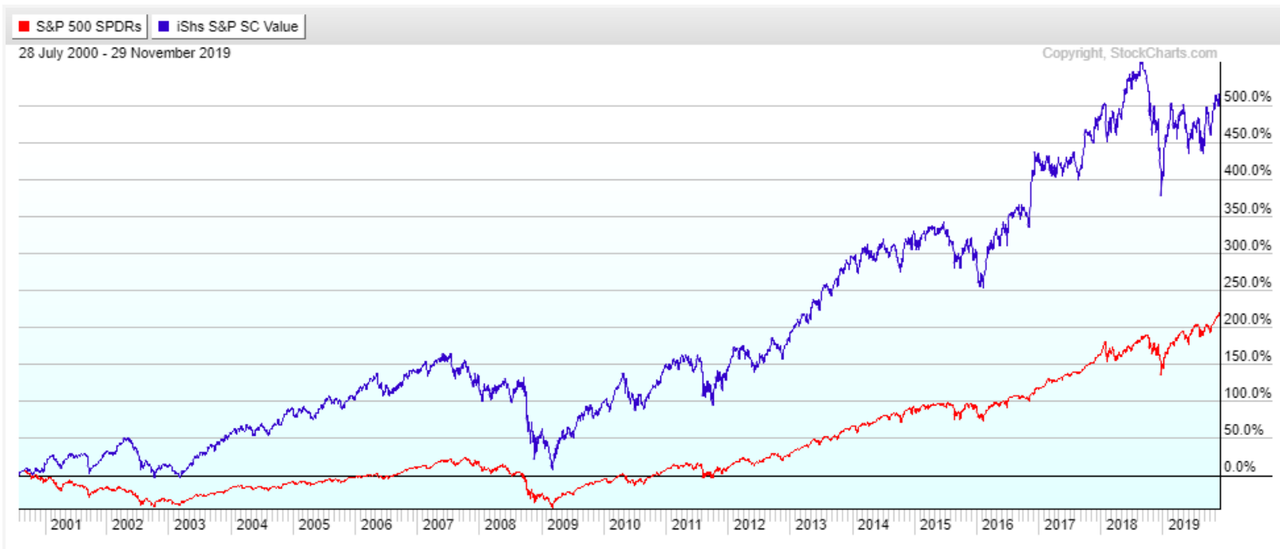

I wouldn't come to conclusions regarding any investment's long-term performance based on such a short period of time (5 years). Looking at a longer period we can see how SCV outperformed after the dot-com bust and the Great Recession.

Value and size factors have been discussed at length here as well as at BH (Bogleheads) forum and I don't intend to start another discussion. Of course no factor will outperform all the time: as you correctly mentioned, large caps outperformed small caps over the last decade or so.

I forgot to mention something about my GB: unlike the classic GB I have roughly 25% in TSM (total stock market) and 10% in SCV. I'm not saying this allocation is superior to the classic GB, it's just something I'm comfortable with.

There's one point about small caps many investors overlook:

it's important to choose the right index. It's beyond me why most small cap mutual funds are based on Russell 2000 and Russel 2000 Value indexes, which have fundamental flaws in construction. In my portfolios I only use ETFs based on S&P indexes for SC and SCV (IJR, IJS, SLYV).

Here's a good article explaining this issue.

Re: Variable Portfolio?

Posted: Tue Dec 03, 2019 11:34 am

by Kbg

Of (significant) note,

IJR (S&P600) has outperformed IJS (S6 value) over the past 18 years by .3% CAGR and both have outperformed SPY by 2.5%ish CAGR. IJT (S6 growth) has outperformed IJS.

That's a good chunk of time...beware historical stats before a particular segment of the market was easily invested in. Once it is we are in a new environment.

I think we can safely conclude small cap outperforms large cap (at least in the last two decades). I don't think we can conclude small cap value outperforms small cap.

Re: Variable Portfolio?

Posted: Tue Dec 03, 2019 2:15 pm

by foglifter

Kbg wrote: ↑Tue Dec 03, 2019 11:34 am

...

I think we can safely conclude small cap outperforms large cap (at least in the last two decades). I don't think we can conclude small cap value outperforms small cap.

Agreed! SCB includes both growth and value and essentially can be considered as a size play with no focus on value or growth. Also, IJR has a smaller ER than IJS.