PP/VP Strategy Sanity Check

Moderator: Global Moderator

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: PP/VP Strategy Sanity Check

I think we had a discussion about 'age in PP' which I like, because I kinda think of the PP like a bond. But personally, I try to keep around 10 years of spending in the PP, and I'm ok with the rest in other stuff. I think I did a back of the envelope on 10 years of expenses with a 4% real return, like the PP, and it would last a bit over 12 years or something like that, which is plenty of runway for you in case the rest of your investments went to shit too. If they didn't, then you could do whatever.

You there, Ephialtes. May you live forever.

Re: PP/VP Strategy Sanity Check

That is a great way to look at it. If I add a bond allocation to my retirement it would not to be try to maximize returns, it would be simply to add a tool to dampen the dips. So, I think that that would favor using treasuries. If I become super concerned about return, there are probably better ways to increase return on the equity side, like small or mid cap tilt. Though, given my propensity in the past to want to try to time the market, I think I'm better off not trying to tilt and just accepting the market returns. My life has certainly been less stressful and more enjoyable since I stopped trying to do that. If I ever did feel a strong conviction to tilt my portfolio in any direction, I think that would be something I would be better off separating into a true VP that is completely separate from both my PP and my long term retirement portfolio and fully in the realm of money that I'm totally ok to lose if worse comes to worse.Kbg wrote: ↑Fri Jan 25, 2019 12:46 pm Summing up total bonds versus treasuries. The former gets you a bit more return for a bit more risk but has higher correlation with the stock market due to the corporate bond element. Treasuries are almost always risk off assets so they zig when stocks zag which is a nice feature. IIRC a US total bond fund is about 65% government anyway...either choice will be just fine.

The above pretty much sums up the trade offs. It can be made more complex, but it really isn't.

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: PP/VP Strategy Sanity Check

Pmward, your thoughts are my thoughts but said more eloquently. Like others have said find the VP % you are comfortable with and the PP % in each asset you are comfortable holding while still maintaining the framework and philosophy AND stick to it for a while then reassess. We are tweakers at heart

I personally only invest in the PP in my taxable account (EF initially and keeps growing...) with a 70/30 tax-deferred retirement portfolio. Comes out to 55/35/10 or thereabouts when viewed holistically.

I personally only invest in the PP in my taxable account (EF initially and keeps growing...) with a 70/30 tax-deferred retirement portfolio. Comes out to 55/35/10 or thereabouts when viewed holistically.

Re: PP/VP Strategy Sanity Check

Well...I feel vindicated and destroyed in this thread by one article.

https://www.advisorperspectives.com/art ... roy-wealth

Head on down to the "Results" section for the bottom line.

Some excellent points in here...

https://www.advisorperspectives.com/art ... roy-wealth

Head on down to the "Results" section for the bottom line.

Some excellent points in here...

Re: PP/VP Strategy Sanity Check

Yes that was a good read. Of course a couple things to be careful of. They are testing one specific bucket approach that is specific to retirees. They are also testing said bucket approach specifically vs a 60/40 portfolio and nothing else. They also are not accounting for total assets, just assuming an SWR and that all funds withdrawn will be spent. In some cases, where someone barely has enough retirement to get by, the bucket approach may have them at a lower equity allocation than 60%. On the other hand, someone with say 2+ million in retirement may actually benefit by having more invested in equities with a bucket approach than 60/40.

For instance, let's use the person with 2 million. Let's assume that said person has $60,000 in yearly expenses as that's kind of considered the typical norm these days. If that person used a 60/40 they would have 1.2 million in equities. If, however, they used a bucket approach with 5 years of assets in the low risk bucket they would have 1.7 million in equities. If they had a conservative 10 years in the low risk bucket they would have 1.4 million in equities. Both above a 60/40 portfolio. If they also had their "low risk bucket" invested in PP as opposed to bonds, they would also likely get a bit more return out of it as well.

So it is a good article, and I think it has some good general advice, but there's definitely some holes that can be poked in it, and results will vary depending on the person and their total assets. There's also some strategy that can be employed. They mentioned the selling low phenomena in the bucket approach if done on a hard set date yearly schedule, but that can be avoided by having a hard rule that you don't rebalance from equities to the low risk bucket on years that the market is down. That allows you to live off of your low risk bucket while you wait for equities to recover and avoids the sell low. Of course, the tradeoff being that this requires a bit of management and can't just be automated. Like most things in life, it's not black or white but varying shades of grey.

For instance, let's use the person with 2 million. Let's assume that said person has $60,000 in yearly expenses as that's kind of considered the typical norm these days. If that person used a 60/40 they would have 1.2 million in equities. If, however, they used a bucket approach with 5 years of assets in the low risk bucket they would have 1.7 million in equities. If they had a conservative 10 years in the low risk bucket they would have 1.4 million in equities. Both above a 60/40 portfolio. If they also had their "low risk bucket" invested in PP as opposed to bonds, they would also likely get a bit more return out of it as well.

So it is a good article, and I think it has some good general advice, but there's definitely some holes that can be poked in it, and results will vary depending on the person and their total assets. There's also some strategy that can be employed. They mentioned the selling low phenomena in the bucket approach if done on a hard set date yearly schedule, but that can be avoided by having a hard rule that you don't rebalance from equities to the low risk bucket on years that the market is down. That allows you to live off of your low risk bucket while you wait for equities to recover and avoids the sell low. Of course, the tradeoff being that this requires a bit of management and can't just be automated. Like most things in life, it's not black or white but varying shades of grey.

Re: PP/VP Strategy Sanity Check

The only way to go is run a Monte Carlo, parameterize it a bit pessimistically, and examine the cumulative probability of your portfolio surviving to end of life. If it does to a 95% chance, what more can you do?

Portfoliovisualizer.com has Monte Carlo. Portfoliocharts.com has a historically based look at safe and perpetual withdrawal rates. Both are insightful.

Portfoliovisualizer.com has Monte Carlo. Portfoliocharts.com has a historically based look at safe and perpetual withdrawal rates. Both are insightful.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: PP/VP Strategy Sanity Check

Spend less!

Re: PP/VP Strategy Sanity Check

pmward, don't overthink this! And, especially pay attention to dualstow's warning: frequent strategy switching is really a form of active investing in disguise, and it also tends to chase high returns. Which means you're always buying into a new strategy just when it's about to revert to the mean i.e. go down. You can't know if you're buying into a new portfolio at the right time, but that would be when it's doing badly, not when it's doing well. So yes, simple is best. 100% stocks is certainly that!

I have different portfolio buckets, but it's mostly because I'm working with employer retirement accounts which limits investing options and ability to move $$ around. The problem with choosing to do this is that you really don't know what's going to happen over the next 15 years (that being the longest zero-return period for stocks historically). There are many people who saw their retirement accounts evaporate in 2008-2009, lost their jobs, had too little savings to pay their living expenses, and ended up having to raid their retirement accounts before the stock prices had a chance to recover.

I suggest picking a reasonable portion of retirement funds that you can put into 100% stocks if you like, and that you can "protect" by keeping a PP as the rest of your savings. Aim to grow both of them over time, and don't sweat it too much about exactly what proportion is what. When you're within ~10 years of retirement you may want to start moving out of that 100% stock position, but it will depend on lots of things like how much total savings you have, what your options are etc.

I have different portfolio buckets, but it's mostly because I'm working with employer retirement accounts which limits investing options and ability to move $$ around. The problem with choosing to do this is that you really don't know what's going to happen over the next 15 years (that being the longest zero-return period for stocks historically). There are many people who saw their retirement accounts evaporate in 2008-2009, lost their jobs, had too little savings to pay their living expenses, and ended up having to raid their retirement accounts before the stock prices had a chance to recover.

I suggest picking a reasonable portion of retirement funds that you can put into 100% stocks if you like, and that you can "protect" by keeping a PP as the rest of your savings. Aim to grow both of them over time, and don't sweat it too much about exactly what proportion is what. When you're within ~10 years of retirement you may want to start moving out of that 100% stock position, but it will depend on lots of things like how much total savings you have, what your options are etc.

Re: PP/VP Strategy Sanity Check

Thanks Sophie. Great advice. And yes this is exactly what I'm working on doing is locking in a strategy, writing it down on paper, and sticking to it so I'm not bouncing around strategies. I like you also have the 401k issue, which houses a great deal of my assets, but has limited options, so yes that's definitely part of why the "bucket" approach is so appealing. It kind of gives me a delineation so I don't have to worry about balancing across different accounts. It actually helps simplify things to a degree.

I do think that I am leaning towards what you're mentioning, building my PP for the defensive / capitol preservation side of my portfolio, and then starting off full on stocks for the long term capitol growth side of things. I am going to kick the can down the road as far as deciding whether or not to include bonds in my retirement accounts until next year, since building my PP will be building a larger defensive allocation than I'm used to having in and of itself. I think that just having the PP in and of itself will give me peace of mind, which will help me with the behavioral finance side of things, and allow me to stick to my long term strategies. Next year I'll have a better feel for the PP and I can then decide if I want to continue building that out exclusively for my defensive allocation, or if I want to let that grow organically and add some bonds into my retirement accounts. Either way, until now I've never had any defensive allocation, and it probably wasn't wise for me to have been taking all of that risk with no mind for preserving my capitol. Since I have such a high savings rate, I'm going to do just fine long term, so there's no need to be overly aggressive. I think that having somewhere in the ballpark of 20% of my total assets in defensives (through PP and possibly a future separate bond allocation) is a smart thing to help with the behavioral side of things. I have definitely learned a lot through doing all of this research lately. I also have one of HB's books on the way, and have been slowly making my way through the radio show. I also found last week that after committing to creating a PP, creating my PP account and transferring the cash and stock side of things over to that account already gave me a bit of peace of mind. I was able to get through the day at work without obsessively checking the market. I also didn't feel like I had to check my account balances every evening. That's a big step in the right direction.

I do think that I am leaning towards what you're mentioning, building my PP for the defensive / capitol preservation side of my portfolio, and then starting off full on stocks for the long term capitol growth side of things. I am going to kick the can down the road as far as deciding whether or not to include bonds in my retirement accounts until next year, since building my PP will be building a larger defensive allocation than I'm used to having in and of itself. I think that just having the PP in and of itself will give me peace of mind, which will help me with the behavioral finance side of things, and allow me to stick to my long term strategies. Next year I'll have a better feel for the PP and I can then decide if I want to continue building that out exclusively for my defensive allocation, or if I want to let that grow organically and add some bonds into my retirement accounts. Either way, until now I've never had any defensive allocation, and it probably wasn't wise for me to have been taking all of that risk with no mind for preserving my capitol. Since I have such a high savings rate, I'm going to do just fine long term, so there's no need to be overly aggressive. I think that having somewhere in the ballpark of 20% of my total assets in defensives (through PP and possibly a future separate bond allocation) is a smart thing to help with the behavioral side of things. I have definitely learned a lot through doing all of this research lately. I also have one of HB's books on the way, and have been slowly making my way through the radio show. I also found last week that after committing to creating a PP, creating my PP account and transferring the cash and stock side of things over to that account already gave me a bit of peace of mind. I was able to get through the day at work without obsessively checking the market. I also didn't feel like I had to check my account balances every evening. That's a big step in the right direction.

Re: PP/VP Strategy Sanity Check

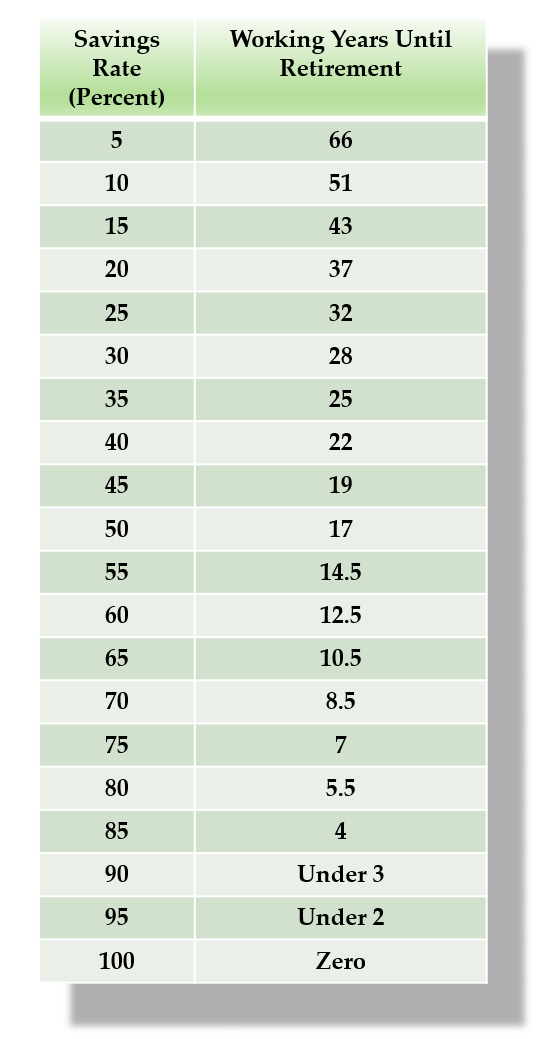

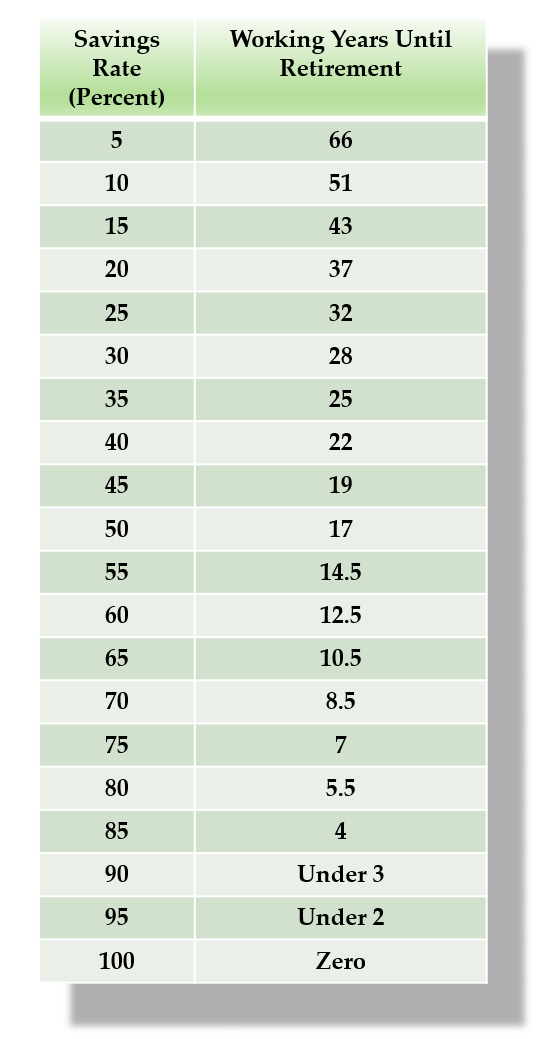

I've been doing a lot of modeling in portfolio visualizer the last few days. I'm really noticing some interesting things. The first being that in the accumulation phase, like I'm in, the actual division of the portfolio doesn't really matter much for the first ~8 years or so. At my current savings rate, when altering the start and end dates for all combinations of bull and bear timeframes (within the limited date ranges they provide) when making monthly contributions and annually rebalancing, there really is not that great of a difference in asset allocation styles. Whether I choose 100% stock, HBPP, 60/40, or a modified PP (70 stock/10/10/10 or 55 stock/15/15/15) I seem to always hit my FI number on an average of about ~11-12 years regardless of which years I start in (surprisingly even holds true if I start in 98 or 99 right before 2 large bear markets). This also assuming that I never get raises and keep only contributing at my current rate (odds are I will be contributing more each year). Now after that point my monthly contributions start becoming such a small drop in the bucket and things start to vary a bit more. This has been kind of an eye opening exercise, in that I was assuming that the difference of having a higher stock percentage in the early accumulation years would be more noticeable. Instead, I'm not really seeing that at all in the data. The difference is definitely noticeable when my account gets over a million, but at that point I probably would rather not have the roller coaster ride anyways. HBPP is definitely the smoothest ride from that point on. So since in the early years it doesn't matter that much what I do, maybe my current early game portfolio should look more like my desired end game portfolio? My FI target number is currently about 1.5 mil. Once I reach that I don't plan on retiring right away, so at that point I would most likely want to be in a 25/25/25/25 PP to keep standard deviation down and protect my capitol. Then anything I make and save from working is purely fun money.

It really does seem to me that the thing that matters the most where I am at is purely savings rate. So that tells me that while I might want to be a bit more aggressive until I reach my FI, that I probably should model my portfolio now so that it's easy to move to 25/25/25/25 long term (especially since a great deal of my savings will be in taxable accounts, where I will have to eat a lot of capitol gains if I have to do a huge rebalancing act). So I think what I'm leaning towards is probably going 55stock/15/15/15 from the get go. That had a max draw down of 25% in 2008, which is tolerable for me at this point in time (I mean I already just sat through a 20% draw down last month...). With access to stocks and short term treasuries in my 401k I should be able to make this work across all my accounts by keeping all the gold and LTT's in my IRA and taxable accounts. Then, as I approach my FI number I can slowly and easily move to 25/25/25/25 over time mostly through new contributions as opposed to selling and realizing capitol gains. Is there anything I'm overlooking here? Thoughts?

It really does seem to me that the thing that matters the most where I am at is purely savings rate. So that tells me that while I might want to be a bit more aggressive until I reach my FI, that I probably should model my portfolio now so that it's easy to move to 25/25/25/25 long term (especially since a great deal of my savings will be in taxable accounts, where I will have to eat a lot of capitol gains if I have to do a huge rebalancing act). So I think what I'm leaning towards is probably going 55stock/15/15/15 from the get go. That had a max draw down of 25% in 2008, which is tolerable for me at this point in time (I mean I already just sat through a 20% draw down last month...). With access to stocks and short term treasuries in my 401k I should be able to make this work across all my accounts by keeping all the gold and LTT's in my IRA and taxable accounts. Then, as I approach my FI number I can slowly and easily move to 25/25/25/25 over time mostly through new contributions as opposed to selling and realizing capitol gains. Is there anything I'm overlooking here? Thoughts?

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: PP/VP Strategy Sanity Check

Yup, the savings rate is the most important thing. ERE Jacob said he only utilized a savings account for the first 4 years while he figured out how to invest. If your savings rate is high enough (I'm talking 75% or so), you're going to get to 4% or 3% without much contribution from investment returns.

You there, Ephialtes. May you live forever.

Re: PP/VP Strategy Sanity Check

Yeah and all said and done, 75% savings rate might actually be realistic for me. I'm currently saving 52% of my net base salary. I've so far done all my calculations based just on this amount. I also get about another 50% of my base salary in company equity every year, which then vests at ~6% per quarter for 4 years. This is my first year at the company, so for the next 3 years it will kind of snowball where by the 4th year I'll be vesting for parts of 4 years worth of equity grants (2x my base salary at issue price). Now, I do not count this because I work for a mid cap growth tech company and the shares are pretty volatile, so what price I'm issued at and what price I can sell for are two different things. I could make out like a bandit or get severely disappointed depending on how the market goes, and whether or not growth tech names stay in favor. I'll probably also spend some of it on fun stuff and home renovations, but most of it will be plowing into my brokerage accounts. Either way, I should be able to hit FI in under 10 years bar any unforeseen circumstances.

It definitely was a shock to me though to see how 100% equities was actually not that far ahead (and not always ahead either) for my calculations. The traditional way of being super aggressive early, and moderating over time seems to work out better for people with longer time frames to let the gains compound. For someone that is saving as aggressive as I am, it doesn't seem to work out that way. It actually has me leaning a little more conservative than I was originally planning. I mean, in most cases 100% equities had me FI only 3-6 months earlier than a more conservative approach. So why assume all that extra risk just to reach my goal 3-6 months earlier? That really doesn't seem worth it to me, ya know? This has really been eye opening to say the least. For the first time I've begun to think about not just total absolute returns, but the cost and risk associated with those returns as well.

It definitely was a shock to me though to see how 100% equities was actually not that far ahead (and not always ahead either) for my calculations. The traditional way of being super aggressive early, and moderating over time seems to work out better for people with longer time frames to let the gains compound. For someone that is saving as aggressive as I am, it doesn't seem to work out that way. It actually has me leaning a little more conservative than I was originally planning. I mean, in most cases 100% equities had me FI only 3-6 months earlier than a more conservative approach. So why assume all that extra risk just to reach my goal 3-6 months earlier? That really doesn't seem worth it to me, ya know? This has really been eye opening to say the least. For the first time I've begun to think about not just total absolute returns, but the cost and risk associated with those returns as well.

-

Jeffreyalan

- Full Member

- Posts: 83

- Joined: Sat Sep 10, 2016 1:50 pm

Re: PP/VP Strategy Sanity Check

Just a thought but I have been using The Desert Portfolio for over a year and I am extremely pleased with the returns and low volitility. It has really helped me sleep at night and not be overly concerned with the daily market gyrations.

I am in ETFs:

IEF 60%

MGC 15%

SLY 15%

GLDM 10%

It may not be to your liking but I feel more confortable with the backtesting over the traditional PP.

I am in ETFs:

IEF 60%

MGC 15%

SLY 15%

GLDM 10%

It may not be to your liking but I feel more confortable with the backtesting over the traditional PP.

Re: PP/VP Strategy Sanity Check

55/15/15/15 seems like a very good portfolio to me.

Have you seen the website portfoliocharts.com yet? You may find that very interesting.

Have you seen the website portfoliocharts.com yet? You may find that very interesting.

Re: PP/VP Strategy Sanity Check

I had stumbled there a couple of times, but never did a deep dig through the site. Just went back on your recommendation and spent a few looking at the portfolios there, and also modeling the 55/15/15/15 that I'm contemplating. I must say, I do really like the way it models out. We also have not really had to deal with any high inflation years in a long time. I think most common portfolios don't really take inflation into account, and if they do it's either through REIT's which could be hit or miss (sure the value of the underlying real estate will go up, but at the same time the dividends will be less attractive compared to safer treasuries), or TIPS which thus far are untested in an era of high inflation (and likely to only be meh at most considering what inflation would do to the rest of the portfolio). At 37 years old, I have a very hard time believing that we will stay at these goldilocks inflation levels for the rest of my life. A period of high inflation would really make any PP style portfolio shine in comparison. I'm trying my damndest to poke holes in the 55/15/15/15 approach, but it's not proving to be an easy task. So we may have a winner. Golden butterfly also looks interesting, though I am not really a believer in growth or value factors these days as I think the market has become efficient to the point that both growth and value factors will even out in the end. If I were to overweight small caps at some point along the way I would probably just use the normal balanced S&P 600 and call it a day.

Re: PP/VP Strategy Sanity Check

If anyone is interested I’m running a leveraged Desert of 70 UST/20 TQQQ/10 VGSH and post performance from time to time in the VP PP inspired leveraged thread.

Re: PP/VP Strategy Sanity Check

55 stocks / 15 gold / 15 LTT / 15 STT

Re: PP/VP Strategy Sanity Check

Ok, so I officially wrote up my IPS. I'm going to sleep on it for a little over a week. If I'm still feeling in alignment with it on Monday the 11th then I will print it up, sign it, and rebalance all my accounts. So what I decided:

I was really leaning towards that 55/15/15/15. But when I sat down to try to figure out the logistics of how to balance between my 401k and all my Fidelity accounts (taxable, Roth IRA, rollover IRA, and HSA) it just became apparent that it was going to be a logistical nightmare. One of the things I need in a plan is simplicity, and building out complex spreadsheets to figure out how I can balance between my 401k (that only allows me to rebalance by percentages, not dollars), and my other accounts just seemed like a bit over the top. It was more trouble than it was worth.

So I'm going to lean on the bucket approach here just for my 401k and have that be a self contained 60/40 3 fund portfolio. It's not what I think is best, but it's not worth the additional headache otherwise. The only crappy thing is that my 401k has nothing available for an inflation hedge. And any bond funds other than the total bond index fund are active bond funds with .4 expense ratios. So I'm just going to do 40% total U.S., 20 % international, and 40% total bond. Really, the international is the only thing that might give me a tiny smidgen of protection if we have a bout of inflation . But, with limited options good enough really is going to have to be good enough in this case. I don't love a 60/40 portfolio, but it will work for this purpose and the important thing is that I will be able to sleep at night. Since I also have automated rebalancing my 401k is literally the very definition of set it and forget it. My 401k is also much smaller than my Fidelity accounts, and the 19k yearly contribution limit is less than I will be contributing to my Fidelity accounts each year. So, the overwhelming majority of my money will be protected.

For the rest of my accounts I'm going to do a modified golden butterfly. Since I have no gold or LTT's available in my 401k and since I'm going with a 60% stock allocation in my 401k I figured that a decrease to 40% in stock and a boost to 20% in the other assets was a fine tradeoff here. I also really like the way this portfolio models. The only modification I'm making is instead of doing 20% TSM and 20% SCV I'm just going to do a plain 40% TSM. Once again, this is mainly for ease of balancing across these accounts, and minimizing spreadsheet work I have to do every two weeks when I make new contributions. I can just do all TSM for the stock portion and not have to worry about balancing between TSM and SCV funds. Also, I believe that both small cap and value premiums have been mostly arbitraged away. They are too well known, too common, and in the days of ETF's and index factor funds too easy to implement (i.e. if it still existed it would be a free lunch, imo). I believe that there will be times both large caps and small caps have some time in the sun, and I believe that there will be times that both growth and value will have their time in the sun. By owning the haystack I at least know that I will be covered either way.

A couple things I will do from a logistics standpoint is I will prioritize LTT's in my IRA's for obvious tax reasons. I will prioritize stocks in my HSA, as my HSA is my most limited and most valuable retirement account so the more growth I can get here the better. I will prioritize cash, gold, and stocks in my taxable accounts (in that order). For cash I will hold 1 year of expenses as cash in an emergency fund money market. Everything above that I will invest in short term treasuries. I also decided that I'm not going to roll my rollover IRA into my 401k. This means I will not be able to do backdoor Roth contributions, which is a bummer. But the tradeoff is that those funds stay fully protected in this account, and I save the 60 bp bullshit "administration" fees my 401k charge. For Roth, I'm just going to have to do a conversion ladder later in life. Maybe at some point when I reach FI I'll take a year long sabbatical to travel and have fun, and the would be a good year to do a large conversion. We will see. I can cross this bridge when I come to it.

So that's it. I have it written down in an IPS contract to myself. Just going to sleep on it for a week and hopefully I'll still be on board and I can start making the changes. I think I will be able to sleep much better this way, and I will be able to place my day to day attention on things in my life that are more important than the stock market. I feel safe with this plan. I'm also currently halfway through Craig's book on the PP, and I have HB's "Why the best laid plans..." on the way. Hoping to be through both of those books by the 11th before I make any changes. Figured I would let you guys know where I ended up. You all have been very helpful, and I'm very glad I came here to get your take on things.

I was really leaning towards that 55/15/15/15. But when I sat down to try to figure out the logistics of how to balance between my 401k and all my Fidelity accounts (taxable, Roth IRA, rollover IRA, and HSA) it just became apparent that it was going to be a logistical nightmare. One of the things I need in a plan is simplicity, and building out complex spreadsheets to figure out how I can balance between my 401k (that only allows me to rebalance by percentages, not dollars), and my other accounts just seemed like a bit over the top. It was more trouble than it was worth.

So I'm going to lean on the bucket approach here just for my 401k and have that be a self contained 60/40 3 fund portfolio. It's not what I think is best, but it's not worth the additional headache otherwise. The only crappy thing is that my 401k has nothing available for an inflation hedge. And any bond funds other than the total bond index fund are active bond funds with .4 expense ratios. So I'm just going to do 40% total U.S., 20 % international, and 40% total bond. Really, the international is the only thing that might give me a tiny smidgen of protection if we have a bout of inflation . But, with limited options good enough really is going to have to be good enough in this case. I don't love a 60/40 portfolio, but it will work for this purpose and the important thing is that I will be able to sleep at night. Since I also have automated rebalancing my 401k is literally the very definition of set it and forget it. My 401k is also much smaller than my Fidelity accounts, and the 19k yearly contribution limit is less than I will be contributing to my Fidelity accounts each year. So, the overwhelming majority of my money will be protected.

For the rest of my accounts I'm going to do a modified golden butterfly. Since I have no gold or LTT's available in my 401k and since I'm going with a 60% stock allocation in my 401k I figured that a decrease to 40% in stock and a boost to 20% in the other assets was a fine tradeoff here. I also really like the way this portfolio models. The only modification I'm making is instead of doing 20% TSM and 20% SCV I'm just going to do a plain 40% TSM. Once again, this is mainly for ease of balancing across these accounts, and minimizing spreadsheet work I have to do every two weeks when I make new contributions. I can just do all TSM for the stock portion and not have to worry about balancing between TSM and SCV funds. Also, I believe that both small cap and value premiums have been mostly arbitraged away. They are too well known, too common, and in the days of ETF's and index factor funds too easy to implement (i.e. if it still existed it would be a free lunch, imo). I believe that there will be times both large caps and small caps have some time in the sun, and I believe that there will be times that both growth and value will have their time in the sun. By owning the haystack I at least know that I will be covered either way.

A couple things I will do from a logistics standpoint is I will prioritize LTT's in my IRA's for obvious tax reasons. I will prioritize stocks in my HSA, as my HSA is my most limited and most valuable retirement account so the more growth I can get here the better. I will prioritize cash, gold, and stocks in my taxable accounts (in that order). For cash I will hold 1 year of expenses as cash in an emergency fund money market. Everything above that I will invest in short term treasuries. I also decided that I'm not going to roll my rollover IRA into my 401k. This means I will not be able to do backdoor Roth contributions, which is a bummer. But the tradeoff is that those funds stay fully protected in this account, and I save the 60 bp bullshit "administration" fees my 401k charge. For Roth, I'm just going to have to do a conversion ladder later in life. Maybe at some point when I reach FI I'll take a year long sabbatical to travel and have fun, and the would be a good year to do a large conversion. We will see. I can cross this bridge when I come to it.

So that's it. I have it written down in an IPS contract to myself. Just going to sleep on it for a week and hopefully I'll still be on board and I can start making the changes. I think I will be able to sleep much better this way, and I will be able to place my day to day attention on things in my life that are more important than the stock market. I feel safe with this plan. I'm also currently halfway through Craig's book on the PP, and I have HB's "Why the best laid plans..." on the way. Hoping to be through both of those books by the 11th before I make any changes. Figured I would let you guys know where I ended up. You all have been very helpful, and I'm very glad I came here to get your take on things.

Re: PP/VP Strategy Sanity Check

Sounds like a fine plan. The contract is an interesting idea, if it helps keep you from tinkering. You might think about a spreadsheet tab with some auto checks for rebalancing - it will contain your chosen asset allocation right there to see, and that might help you stick with the plan also.

Are you scrapping SCV because the funds are hard to find? That's certainly true at Fidelity. Their SCV index fund has an eye-popping 0.91 ER. I'm using VBR, which is not commission-free but its ER of 0.09, compared to 0.25 for the commission-free IJS, ends up saving more than the commission for a reasonably sized investment held long term.

Are you scrapping SCV because the funds are hard to find? That's certainly true at Fidelity. Their SCV index fund has an eye-popping 0.91 ER. I'm using VBR, which is not commission-free but its ER of 0.09, compared to 0.25 for the commission-free IJS, ends up saving more than the commission for a reasonably sized investment held long term.

Re: PP/VP Strategy Sanity Check

Yeah I am an engineer, so I’m naturally a tinkerer. So the contract is to stop me from tinkering, haha. My biggest risk to my plan is me tinkering and changing things mid stream. My plan is long term, and anything less will produce suboptimal results. That's also why I'm trying to hash everything out now and look at things from all angles, so I know I've thought of everything and can get 100% full buy in on my plan.

My reason for not using SCV is mostly that I feel that the value premium has either been arbitraged away, or that it didn’t really exist to begin with and was just random for the timeframe with which we can back test. Value definitely performed well in the 70s and 80s, but since it's been rather meh. You can see here, at least over the last two decades there has been no real statistically significant value premium in the strategy, but there was a slight small cap premium:

https://www.portfoliovisualizer.com/bac ... 0&Gold3=20

I mainly was thinking that doing full on TSM would cover all bases and be easier to implement. However, now that you have me thinking, maybe doing S&P 600 and TSM at 20% each might not be so bad. S&P 600 performs great, and the ETF averages ~2% more per year than the Russell 2000 ETF historically because of the quality and liquidity filtering as well as more sensical rebalancing strategies. Each asset would just be 20% so I guess that really wouldn’t be much more complex than a straight 40% TSM. IJR also has only a .07% ER. I guess I didn’t look at that from all angles. I can see how having a small/large stock barbell would be complimentary to the short/long bond barbell. I would be much happier with S&P 600 core than with making a bet on a value tilt that I’m very skeptical will ever show back up in the future.

EDIT: See difference here between S&P 600 (IJR) and Russell 2000 (IWM). Now that is what I call a statistically significant difference in performance! Almost 2% more CAGR!

https://www.portfoliovisualizer.com/bac ... ion2_2=100

My reason for not using SCV is mostly that I feel that the value premium has either been arbitraged away, or that it didn’t really exist to begin with and was just random for the timeframe with which we can back test. Value definitely performed well in the 70s and 80s, but since it's been rather meh. You can see here, at least over the last two decades there has been no real statistically significant value premium in the strategy, but there was a slight small cap premium:

https://www.portfoliovisualizer.com/bac ... 0&Gold3=20

I mainly was thinking that doing full on TSM would cover all bases and be easier to implement. However, now that you have me thinking, maybe doing S&P 600 and TSM at 20% each might not be so bad. S&P 600 performs great, and the ETF averages ~2% more per year than the Russell 2000 ETF historically because of the quality and liquidity filtering as well as more sensical rebalancing strategies. Each asset would just be 20% so I guess that really wouldn’t be much more complex than a straight 40% TSM. IJR also has only a .07% ER. I guess I didn’t look at that from all angles. I can see how having a small/large stock barbell would be complimentary to the short/long bond barbell. I would be much happier with S&P 600 core than with making a bet on a value tilt that I’m very skeptical will ever show back up in the future.

EDIT: See difference here between S&P 600 (IJR) and Russell 2000 (IWM). Now that is what I call a statistically significant difference in performance! Almost 2% more CAGR!

https://www.portfoliovisualizer.com/bac ... ion2_2=100

Re: PP/VP Strategy Sanity Check

Also, before everything is set in stone next week, I would love to hear any counter arguments as to why small cap value would be a better pick than just the plain S&P 600. I'm just not seeing anything compelling in the data in the last 20 years to really make a case for SCV, it has basically performed inline with the S&P 600. Any difference has been so small in this timeframe that it's basically just noise. SCV also costs more, as I either have to pay commissions or a .25% ER vs .07% ER. But I could be missing something?

Re: PP/VP Strategy Sanity Check

Looks like I got some nice unintentional market timing. I decided to pull the trigger on my modified GB. I just sold stock over the last 2 days to reallocate into my gold, bond, and cash holdings. I also rebalanced my 401k 2 days ago from 100% equities into 60/40. Today the market is down 1.5% so far. Talk about great timing or what? And the nice thing is that with the market down like this, even though I'm still waiting to receive my bonds from the 30 year auction today, I don't have a worry in the world. I will be going to bed and sleeping just fine tonight regardless of what the market does

Re: PP/VP Strategy Sanity Check

You can thank me in any way you like :-) It's because I just bought stock after making a nice fat cash contribution.

Re: PP/VP Strategy Sanity Check

Haha, thanks Sophie!