International Permanent Portfolio

Moderator: Global Moderator

International Permanent Portfolio

Deleted

Last edited by doodle on Mon Jan 11, 2021 4:34 pm, edited 2 times in total.

All of humanity's problems stem from man's inability to sit quietly in a room alone. - Blaise Pascal

Re: International Permanent Portfolio

Deleted

Last edited by doodle on Mon Jan 11, 2021 4:35 pm, edited 1 time in total.

All of humanity's problems stem from man's inability to sit quietly in a room alone. - Blaise Pascal

Re: International Permanent Portfolio

I am sympathetic to your concerns, but since I can't predict the future I'll stick with the traditional PP. But for my VP I invest mostly in non-US dollar assets, including foreign stocks, international bond funds, and silver. No one says you need to have everthing in the PP.

"Machines are gonna fail...and the system's gonna fail"

Re: International Permanent Portfolio

ISHG is a short-term (1-3 yr) int'l treasury fund. Not sure if that would work here or not.doodle wrote: Cash

12.5 SHY

12.5????????

-

LifestyleFreedom

- Senior Member

- Posts: 126

- Joined: Sun Aug 15, 2010 8:28 pm

Re: International Permanent Portfolio

If I understand Browne correctly, he recommended having wealth in more than one country to diversify sovereign risk.

So let's say I split my money onto four equal amounts and take the amounts to four countries, each located on a different continent (e.g., Asia, Europe, North America, and South America). Within each of these countries, I open local accounts and do the standard 4x25 allocation of stocks, bonds, gold, and cash. It's legal as far as I know for U.S. citizens to do this so long as everything is fully disclosed to the IRS. It will also likely cost a lot of money to administer in the sense local firms have to be hired to manage the assets and file the necessary paperwork.

If I want to remain in the U.S. and diversify somewhat, I need to find assets I can buy here that track prices in other locations. Instead of the S&P 500, for example, I might choose the EAFE index for tracking 21 developed international markets excluding the U.S. and Canada. Or I might go to WisdomTree and Everbank to find ETFs and other investment products that give me exposure to international prices (but they would be converted into U.S. dollars by the time I get the incomes and gains).

I have a portion of my portfolio invested in ADRs to get exposure in foreign equities, but dividends, gains, and losses get paid and reported to me in U.S. dollars. The S&P 500 itself is really a global index in that 40-50% of the business done by these large U.S.-based multinational companies is derived from economies outside the United States.

So let's say I split my money onto four equal amounts and take the amounts to four countries, each located on a different continent (e.g., Asia, Europe, North America, and South America). Within each of these countries, I open local accounts and do the standard 4x25 allocation of stocks, bonds, gold, and cash. It's legal as far as I know for U.S. citizens to do this so long as everything is fully disclosed to the IRS. It will also likely cost a lot of money to administer in the sense local firms have to be hired to manage the assets and file the necessary paperwork.

If I want to remain in the U.S. and diversify somewhat, I need to find assets I can buy here that track prices in other locations. Instead of the S&P 500, for example, I might choose the EAFE index for tracking 21 developed international markets excluding the U.S. and Canada. Or I might go to WisdomTree and Everbank to find ETFs and other investment products that give me exposure to international prices (but they would be converted into U.S. dollars by the time I get the incomes and gains).

I have a portion of my portfolio invested in ADRs to get exposure in foreign equities, but dividends, gains, and losses get paid and reported to me in U.S. dollars. The S&P 500 itself is really a global index in that 40-50% of the business done by these large U.S.-based multinational companies is derived from economies outside the United States.

Financial Freedom --> Time Freedom --> Lifestyle Freedom

Re: International Permanent Portfolio

Some diversification is good, but I don't think you want to make things too complicated.LifestyleFreedom wrote: So let's say I split my money onto four equal amounts and take the amounts to four countries, each located on a different continent (e.g., Asia, Europe, North America, and South America).

The S&P index (or a total market index) are probably all you really need as far as stocks go. ADR's will complicate things more than is needed (in my opinion). You may want to hold one or two different S&P index funds with a couple different brokerages, though.

I don't think there's really any substitute for long term US treasuries (I'm including TLT in that).

The cash portion you can diversify, by using the various short-term savings instruments available (T-bills, I-bonds, EE bonds), but you shouldn't try to diversify out of the dollar (at least, not if you're sticking to the HB PP).

I think a good way to diversify your gold holdings is to hold a mix of physical gold and a gold ETF (for rebalancing purposes). It's very difficult to hold gold in a Swiss bank account at present (which is what HB recommended), however, gold is the one asset that should have no counterparty risk, so holding it strictly within an ETF such as GLD is not going to give you the diversification you're looking for, in my opinion.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

If you want international equity exposure why not just substitute VT for VTI?

Re: International Permanent Portfolio

The central idea of the PP is that "the economy" will always be in one of four states, or transitioning between those states. For the portfolio to work "the economy" needs to mean the same thing for all four assets.

My personal definition of "the economy" is the US economy so all my funds are US based. I agree that US treasuries have their problems but I believe the market prices that in efficiently. Similarly the US stock market is dominated by multinationals that do something like half of their business overseas. The market has decided how much of an American concern's capital should be done overseas in non-dollar currencies, and I don't presume to know more than the market. I'm comfortable using the US TSM as my only stock fund, within the context of a PP.

If you believe the market is wrong about that and want to allocate more to foreign companies, by all means do, but that sounds more like a VP than a tweak to the PP.

All that being said, I think it would be fine for your personal definition of "the economy" to be the global economy. In that case your PP would be

stock: global stock index

bond: global long term treasuries

cash: global short term treasuries

gold: gold

Vanguard has a global stock index ETF, VT.

To my knowledge there are no global treasury funds. There are a very few ex-US treasury funds. As chrikenn suggested there is ISHG, so you could use a blend of ISHG and a US T-bill fund for cash.

I'm not aware of any ex-US long term treasury fund, so you'd have to create your own index of global treasuries. You might do something like spread the bonds among the top-5 countries in VT, which currently is USA, Japan, UK, France, Canada. I fear that the broker expenses and tax complications of individual foreign treasuries are dealbreakers, and so haven't researched this much further.

What I keep coming back to, though, is that it seems a global PP would have about the same risk/reward characteristics of a domestic PP, with greater complexity and expenses. So I stick with a domestic PP.

My personal definition of "the economy" is the US economy so all my funds are US based. I agree that US treasuries have their problems but I believe the market prices that in efficiently. Similarly the US stock market is dominated by multinationals that do something like half of their business overseas. The market has decided how much of an American concern's capital should be done overseas in non-dollar currencies, and I don't presume to know more than the market. I'm comfortable using the US TSM as my only stock fund, within the context of a PP.

If you believe the market is wrong about that and want to allocate more to foreign companies, by all means do, but that sounds more like a VP than a tweak to the PP.

All that being said, I think it would be fine for your personal definition of "the economy" to be the global economy. In that case your PP would be

stock: global stock index

bond: global long term treasuries

cash: global short term treasuries

gold: gold

Vanguard has a global stock index ETF, VT.

To my knowledge there are no global treasury funds. There are a very few ex-US treasury funds. As chrikenn suggested there is ISHG, so you could use a blend of ISHG and a US T-bill fund for cash.

I'm not aware of any ex-US long term treasury fund, so you'd have to create your own index of global treasuries. You might do something like spread the bonds among the top-5 countries in VT, which currently is USA, Japan, UK, France, Canada. I fear that the broker expenses and tax complications of individual foreign treasuries are dealbreakers, and so haven't researched this much further.

What I keep coming back to, though, is that it seems a global PP would have about the same risk/reward characteristics of a domestic PP, with greater complexity and expenses. So I stick with a domestic PP.

Re: International Permanent Portfolio

HB recommended the long term US treasury b/c the dollar is the most popular currency in the world. In a deflationary period, it's dollars that people want, not Euros, Swiss Francs, Yen, etc...when there is a crisis, this is where people go for safety.KevinW wrote: To my knowledge there are no global treasury funds.

This in and of itself is an advantage for those of us who live in the US, but you could argue that the PP works in other countries when you use their long term bonds as well.

However...the dollar is the currency of the country in which you live. If you use bonds in other currencies, then you are introducing currency risk to your portfolio. This, IMO, is the main reason to stick to US dollars/bonds.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

That makes sense. However, are we not vulnerable due to our economy's dependence on foreign products and foreign finance? My drift being that stability in the domestic market (and our ability to repay foreign debt) is so tied up in the dollar's relationship to other currencies.Adam1226 wrote:HB recommended the long term US treasury b/c the dollar is the most popular currency in the world. In a deflationary period, it's dollars that people want, not Euros, Swiss Francs, Yen, etc...when there is a crisis, this is where people go for safety.KevinW wrote: To my knowledge there are no global treasury funds.

This in and of itself is an advantage for those of us who live in the US, but you could argue that the PP works in other countries when you use their long term bonds as well.

However...the dollar is the currency of the country in which you live. If you use bonds in other currencies, then you are introducing currency risk to your portfolio. This, IMO, is the main reason to stick to US dollars/bonds.

Re: International Permanent Portfolio

Maybe, but then why is the interest rate so low? Keep in mind that the market for US Treasuries is probably one of the most efficient and transparent in the world. It's also huge. I know there's a lot of very logical chatter about weakness in the dollar and inflation, and the Fed being the only buyer, but do you really think that all of these people/entities are mis-pricing long term US treasury bonds? We're not the only ones who know about quantitative easing, and I somehow doubt that all of our creditors are as dumb in this regard as some of the US dollar bears like to think.TBV wrote:

That makes sense. However, are we not vulnerable due to our economy's dependence on foreign products and foreign finance? My drift being that stability in the domestic market (and our ability to repay foreign debt) is so tied up in the dollar's relationship to other currencies.

I know this probably isn't the linear/logical argument that will convince you that US treasuries are the place to be, but I think that any crystal clear argument is likely to be wrong or misleading (this is a frequent theme in investing, IMO). Their (bonds) future is really not knowable, but, that's why we have gold.

If US treasury bonds do take a big hit, gold will likely soar. Also, there would very likely come a time when treausry bonds became a sound investment again (unless you believe that the US government would cease to exist and therefore stop issuing them).

Bottom line, they may eventually take a hit (everything does), but the US will keep selling them, and eventually they will recover. Even if their value was cut in half, it's only a 12.5% drop in your portfolio, and, also, likely a great chance to rebalance.

My advice: don't tinker. You don't need to. No matter how much you dislike long term US treasury bonds, they're really the only show in town for purposes of the PP anyway. There's a saying (and I can't remember who said it), but it's something to the effect of "the best investments are made when you feel like you're going to puke." (You should never really feel that way with the PP, but, you get the idea).

Last edited by AdamA on Sun Mar 20, 2011 7:45 pm, edited 1 time in total.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

For those who think that interest rates on the long end of the curve are low right now, what do you base this conclusion on?

They are lower now than they have been in the last 40 years, but over the last 100 years or so, a 4.5% long term interest rate has been about the average.

They are lower now than they have been in the last 40 years, but over the last 100 years or so, a 4.5% long term interest rate has been about the average.

Last edited by MediumTex on Sun Mar 20, 2011 7:51 pm, edited 1 time in total.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: International Permanent Portfolio

Interesting... Subjectively, it seems low, especially given that the US dollar is no longer exchangable for gold (at a fixed rate).MediumTex wrote: For those who think that interest rates on the long end of the curve are low right now, what do you base this conclusion on?

They are lower now than they have been in the last 40 years, but over the last 100 years or so, a 4.5% long term interest rate has been about the average.

Nonetheless, it's a good point that only strengthens the anti-tinkering argument.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

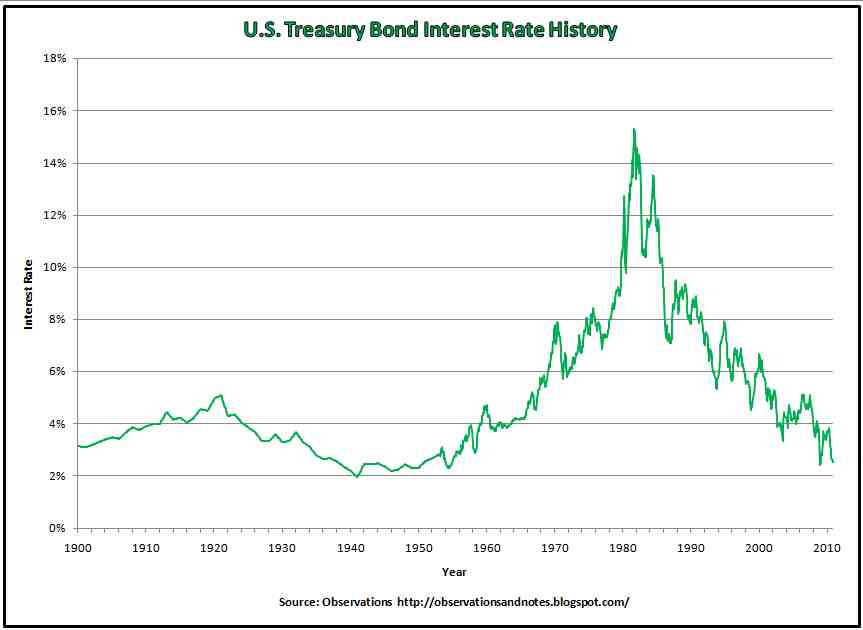

Between 1900 and about 1965, long term treasury rates never exceeded 5%.Adam1226 wrote:Interesting... Subjectively, it seems low, especially given that the US dollar is no longer exchangable for gold (at a fixed rate).MediumTex wrote: For those who think that interest rates on the long end of the curve are low right now, what do you base this conclusion on?

They are lower now than they have been in the last 40 years, but over the last 100 years or so, a 4.5% long term interest rate has been about the average.

Nonetheless, it's a good point that only strengthens the anti-tinkering argument.

That period included two world wars when government spending exploded and the government's balance sheet probably looked worse than it does today.

Here is a chart:

Last edited by MediumTex on Sun Mar 20, 2011 8:53 pm, edited 1 time in total.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: International Permanent Portfolio

That chart is a good example of why most people do so poorly when it comes to speculative investing (myself included). We all remember the 1980's when interest rates were very high, relatively speaking. 4.5% seems low, and I've even heard people say US bonds are in a bubble.

It's very easy to get stuck in this kind of recency trap, b/c we don't really recognize our tendency to over-rely on the things that have occured in recent decades, which is not really a very long time in the world of investing.

Having said that, I still think 4.5% is low for a 30 year annual return on an IOU for a fiat currency issued by a nation that is a net debtor (and a pretty big one)...

Having said that, US Treasury Bonds are my favorite PP asset right now.

That's the great thing about the PP...it kind of hedges an investor against his instincts.

It's very easy to get stuck in this kind of recency trap, b/c we don't really recognize our tendency to over-rely on the things that have occured in recent decades, which is not really a very long time in the world of investing.

Having said that, I still think 4.5% is low for a 30 year annual return on an IOU for a fiat currency issued by a nation that is a net debtor (and a pretty big one)...

Having said that, US Treasury Bonds are my favorite PP asset right now.

That's the great thing about the PP...it kind of hedges an investor against his instincts.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

Deleted

Last edited by doodle on Mon Jan 11, 2021 4:11 pm, edited 1 time in total.

All of humanity's problems stem from man's inability to sit quietly in a room alone. - Blaise Pascal

Re: International Permanent Portfolio

Any guess as to why exactly the opposite happened in Japan over the last 20 years?doodle wrote: My best guess given our abysmal balance sheet is that it will take much higher interest rates to attract capital.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: International Permanent Portfolio

MT,

I agree with your point that Japan is an extremely convenient example of what the U.S. is going through now. I'm not saying bet the farm on deflation and lower interest rates, but simply that the mere existence of Japan, when analyzed on an economic, monetary, and demographic level, should allow people to sleep MUCH better with LT treasuries in their portfolio. Fed policy doesn't exist within a vacuum. The massive deleveraging of retirees is a valid offset to fed-easing.

IF we have rising interest rates, it'll be interesting to see if the gold movements prove to be anything like they were in the 1970's (the only period of rising interest rates we have on record with a floating gold price). Gold, in that case, very well may NOT have the insane returns it had back then, but I wouldn't be so sure. I think if Americans start seeing interest rates rise, unemployment stay unfavorable, and inflation pick up (especially if their home prices aren't rising as fast), the rush into gold could be extremely fast, especially with all the conservative talk radio shows that have been planting the seeds of "inflation, default, end of the dollar's reign" for the last several years in their commercials and political speak..

Also, something I think people should take a look at is the returns associated with "the rise and fall of interest rates" (Craig's PP historical return chart is great) from the early 70's to the early 80's (rates rising), and the subsequent returns from 82-2000 (while rates were falling). Treasuries, do to increasing interest payments as rates rose, actually withstood inflation pretty well (considering that rising rates are their achilles heel), with their worst loss in the 70's being only -4% (nominal, of course). The subsequent falling of interest rates provided for some extremely lucrative years during the 80's and 90's that, in my opinion, far eclipse what you lost by holding them in the 70's. The cost/benefit of LT's is well worth the cost IMO, even if they do a lot of real value in a period of high interest rates. They really have proven to be a great hedge against some of the worst stock losses we've seen (as has gold).

I agree with your point that Japan is an extremely convenient example of what the U.S. is going through now. I'm not saying bet the farm on deflation and lower interest rates, but simply that the mere existence of Japan, when analyzed on an economic, monetary, and demographic level, should allow people to sleep MUCH better with LT treasuries in their portfolio. Fed policy doesn't exist within a vacuum. The massive deleveraging of retirees is a valid offset to fed-easing.

IF we have rising interest rates, it'll be interesting to see if the gold movements prove to be anything like they were in the 1970's (the only period of rising interest rates we have on record with a floating gold price). Gold, in that case, very well may NOT have the insane returns it had back then, but I wouldn't be so sure. I think if Americans start seeing interest rates rise, unemployment stay unfavorable, and inflation pick up (especially if their home prices aren't rising as fast), the rush into gold could be extremely fast, especially with all the conservative talk radio shows that have been planting the seeds of "inflation, default, end of the dollar's reign" for the last several years in their commercials and political speak..

Also, something I think people should take a look at is the returns associated with "the rise and fall of interest rates" (Craig's PP historical return chart is great) from the early 70's to the early 80's (rates rising), and the subsequent returns from 82-2000 (while rates were falling). Treasuries, do to increasing interest payments as rates rose, actually withstood inflation pretty well (considering that rising rates are their achilles heel), with their worst loss in the 70's being only -4% (nominal, of course). The subsequent falling of interest rates provided for some extremely lucrative years during the 80's and 90's that, in my opinion, far eclipse what you lost by holding them in the 70's. The cost/benefit of LT's is well worth the cost IMO, even if they do a lot of real value in a period of high interest rates. They really have proven to be a great hedge against some of the worst stock losses we've seen (as has gold).

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: International Permanent Portfolio

Deleted

Last edited by doodle on Mon Jan 11, 2021 4:10 pm, edited 2 times in total.

All of humanity's problems stem from man's inability to sit quietly in a room alone. - Blaise Pascal

Re: International Permanent Portfolio

Is it crazy to think that U.S. citizens could start buying treasury debt in large numbers in the future?doodle wrote: The primary difference that I can tell between US and Japan is that US debt is financed in large part by overseas investors and currently (the largest buyer) which is the Fed. Japan on the other hand has a high domestic savings rate which helps fund debt issuance.

That would easily provide enough demand to keep yields low.

I would say the fact that yields on U.S. debt are as low as they are without significant retail investor participation suggests that the prospect of these retail investors entering this market in the future could push yields on the long end much lower.

If the stock market rolls over again and the corporate debt market takes another dive, I can easily see people falling in love with long term treasurys.

This idea sounds crazy today, but we all know how perceptions can change over time.

In the 1940s, U.S. bonds were sold at the concession stands in movie theaters.

All I'm trying to do with these counterpoints is to try to loosen up this sense that many people have that yields can only go up. They could just as easily go down, as they have been doing for the last 30 years.

From a historical perspective, we are actually above the long term average on the long end of the yield curve.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: International Permanent Portfolio

People should also keep in mind that the actual yield doesn't matter a whole lot for purposes of the PP. A percentage or two down will produce a good chunk of capital gains, and probably allow most of us to rebalance into other assets.MediumTex wrote: From a historical perspective, we are actually above the long term average on the long end of the yield curve.

"All men's miseries derive from not being able to sit in a quiet room alone."

Pascal

Pascal

Re: International Permanent Portfolio

This is a really interesting question actually. Some of the math:MediumTex wrote:Is it crazy to think that U.S. citizens could start buying treasury debt in large numbers in the future?

- Yearly personal income in the US is around $13T, give or take a couple trillion

- Personal savings rate has varied from as low as 1.5% (~2005-2007) to almost 12% (early 1980s) of the above number. Currently they are near 4%

- Deficits are projected to be around $1T a year for a long time by most estimates

- $1T (yearly deficit) / $13T (yearly gross personal income)= ~7.7%.

This ignores details like treasury debt durations, people saving in banks vs. treasuries (and what the banks put their money in), etc.

Re: International Permanent Portfolio

Doodle,

I have the same concerns and investment interest as you. As a US-based investor my thought was to put 1/2 my PP in dollar-based investments and half in non-dollar investments. It's not the HB PP, but my objective is peace of mind rather than orthodoxy. I accept under performance or not fitting in with the crowd as the price of being relaxed about the fate of the dollar.

As per HB, 25% is gold, so that leaves another 25% to allocate out of dollars.

If you put 1/2 of your stock allocation into a low cost foreign index then you have taken care of another 12.5%. A number of posters on this forum admit that they make a similar foreign stock allocation. That leaves 12.5% to allocate into something foreign from either long bonds or cash.

Investing in foreign long bonds is not easy for a US citizen. My thought was German long bonds, but I could not find an inexpensive or convenient way to buy them.

The alternative I found was opening a foreign currency account at Everbank. They have a variety of currency choices. Some are interest bearing an some are not depending on the currency. They also have foreign currency CDs. So I put 12.5% of my cash into these type of investments spread around in different currencies that I perceive to be likely to be stable. The tax consequences of owning foreign currencies are complex. You should consult a professional before making this type of investment.

This is not what Harry Browne would have recommended when he was alive. It's my choice. I accept the consequences.

I have the same concerns and investment interest as you. As a US-based investor my thought was to put 1/2 my PP in dollar-based investments and half in non-dollar investments. It's not the HB PP, but my objective is peace of mind rather than orthodoxy. I accept under performance or not fitting in with the crowd as the price of being relaxed about the fate of the dollar.

As per HB, 25% is gold, so that leaves another 25% to allocate out of dollars.

If you put 1/2 of your stock allocation into a low cost foreign index then you have taken care of another 12.5%. A number of posters on this forum admit that they make a similar foreign stock allocation. That leaves 12.5% to allocate into something foreign from either long bonds or cash.

Investing in foreign long bonds is not easy for a US citizen. My thought was German long bonds, but I could not find an inexpensive or convenient way to buy them.

The alternative I found was opening a foreign currency account at Everbank. They have a variety of currency choices. Some are interest bearing an some are not depending on the currency. They also have foreign currency CDs. So I put 12.5% of my cash into these type of investments spread around in different currencies that I perceive to be likely to be stable. The tax consequences of owning foreign currencies are complex. You should consult a professional before making this type of investment.

This is not what Harry Browne would have recommended when he was alive. It's my choice. I accept the consequences.

Re: International Permanent Portfolio

Re: German Bonds

I'm actually surprised that there isn't a German Bund ETF at this point. I would be shocked of a product serving this sector doesn't come on line in the next couple of years. With the proliferation of ETF's, I can't imagine that there wouldn't be demand for this product.

There are a couple of alternatives, with BWX and IGOV, which invest in foreign government bonds, but they certainly would be more risky than a Bund-only type ETF.

I'm actually surprised that there isn't a German Bund ETF at this point. I would be shocked of a product serving this sector doesn't come on line in the next couple of years. With the proliferation of ETF's, I can't imagine that there wouldn't be demand for this product.

There are a couple of alternatives, with BWX and IGOV, which invest in foreign government bonds, but they certainly would be more risky than a Bund-only type ETF.

Re: International Permanent Portfolio

Maybe Mr Market expects the Feds to (as rumored) expropriate our 401Ks and force them into LT Treasuries at 3-4 per cent...?