MachineGhost's Research Resort

Moderator: Global Moderator

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

I have modified the above modified Wealth Pyramid levels to be in the below order and weights to take into account both time-in-market and intrinsic risk:MachineGhost wrote:For all those who wondered, below is my Prosperity allocation. It is a diversified mix of strategies, holding period lengths, risks and returns.

Startup Investing (3-10 years) 1.25%

Sector-Focused Investments (2-10 years) 2.5%

Blue Chip Outperformers (1-5 years) 2.50%

Diversified Core Portfolio (Forever) 3.75%

Short Term Trading (0-9 months) 5%

Conservative Income (1-3 years) 10%

I was tempted to put a PP within a PP into Diversified Core Portfolio but I think that would be rather silly but fun nonsense.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

Blue is growth. Black is value.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

Excellent! And very timely too!

Here's a short rundown of how RAFI Commodity works... they equal weight Metal, Energy and Hard/Softs sectors. Then for the individual commodities within each sector they use the 5-year average volume to determine the base weights. Then they combine implied roll yield and momentum to adjust those base weights to deal with the normal conundrum of negative momentum with backwardation (positive roll yield) and positve momentum with contango (negative roll yield). And lastly, they use various criteria to decide where on the futures contract curve to actually purchase so they're not gamed/arbitraged by front-runners. It is also long-only so there is actually a correlation with inflation. Basically, the index fixes all of the flaws that have plaqued the first generation of managed future funds to date.The Elkhorn Fundamental Commodity Strategy ETF is an actively-managed ETF that seeks to provide investment returns that are highly correlated to the Dow Jones RAFI® Commodity Index by investing in exchange-traded commodity futures contracts and other commodity-linked instruments. The Dow Jones RAFI® Commodity Index offers an alternative beta strategy that uses price momentum and roll yield to outperform the broad market. The ETF is designed to be a fundamental factor-weighted, broad-market commodity strategy with a modified dynamic roll. The fund's assets will also be invested in a short duration portfolio of highly liquid, high quality bonds to collateralize exposure and target a total return which exceeds that of the Dow Jones RAFI® Commodity Index.

http://www.marketwired.com/press-releas ... 160317.htm

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

That is cheap for a managed futures strategy. The first gen ones were around upper 1% to lower 2%. Managed futures are great because they're like gold in that they have a persistent negative correlation to stocks and bonds. Without knowing about the PP, wise investors would use stock, bonds and managed futures via CTA's. Now you don't need the CTA and their expensive 2%/20% fees.MangoMan wrote:Sounds like an interesting model, but the ETF has a really high ER at 0.75%.

Once I have enough data to calcualte risk stats, I'll give it some $ from Real. Diversification never killed anybody. Speaking of which, I wonder how the "rebalancing bonus" would work on inttra-asset diversification -- never looked into it. Keeping costs down seems a challenge when rebalancing.

I consider .75% to be the max to pay for any kind of fund though. For that much it damn well better do something than just weight stocks differently like virtually all of the "smart beta" junx. Like offer downside protection.

Next peg to hammer... quantitative duration for Treasuries. Screw the Gross's and Grundlach's of the world.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

The last sentence is operative:

And here's another take on gold:

And here's another take on gold:

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

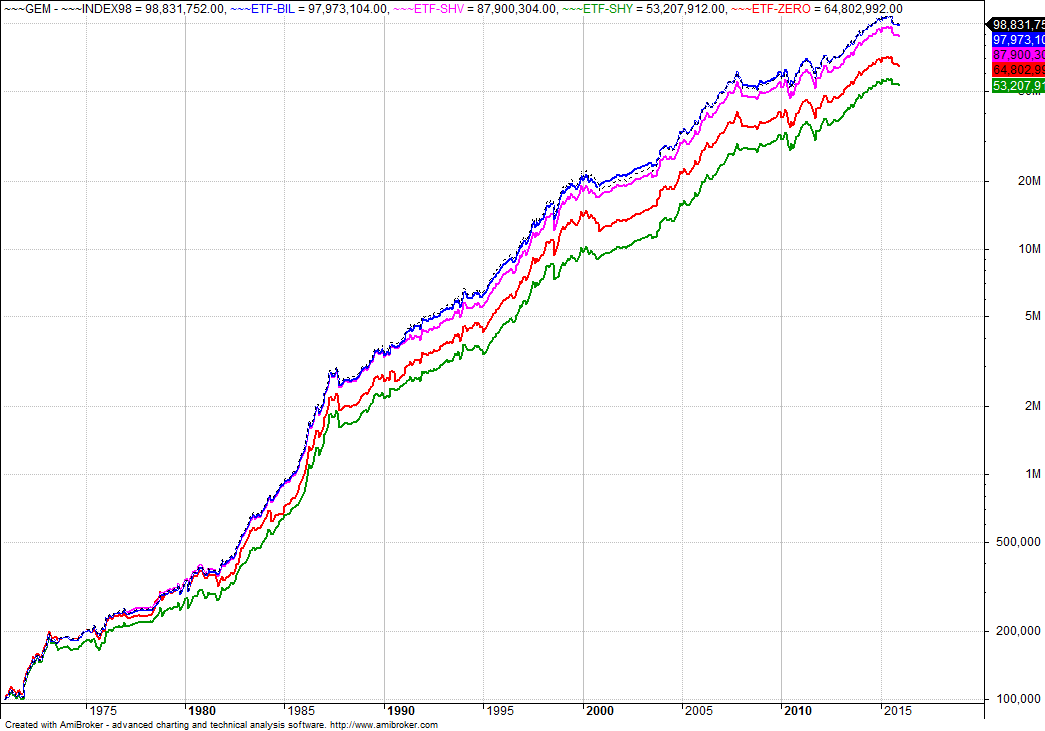

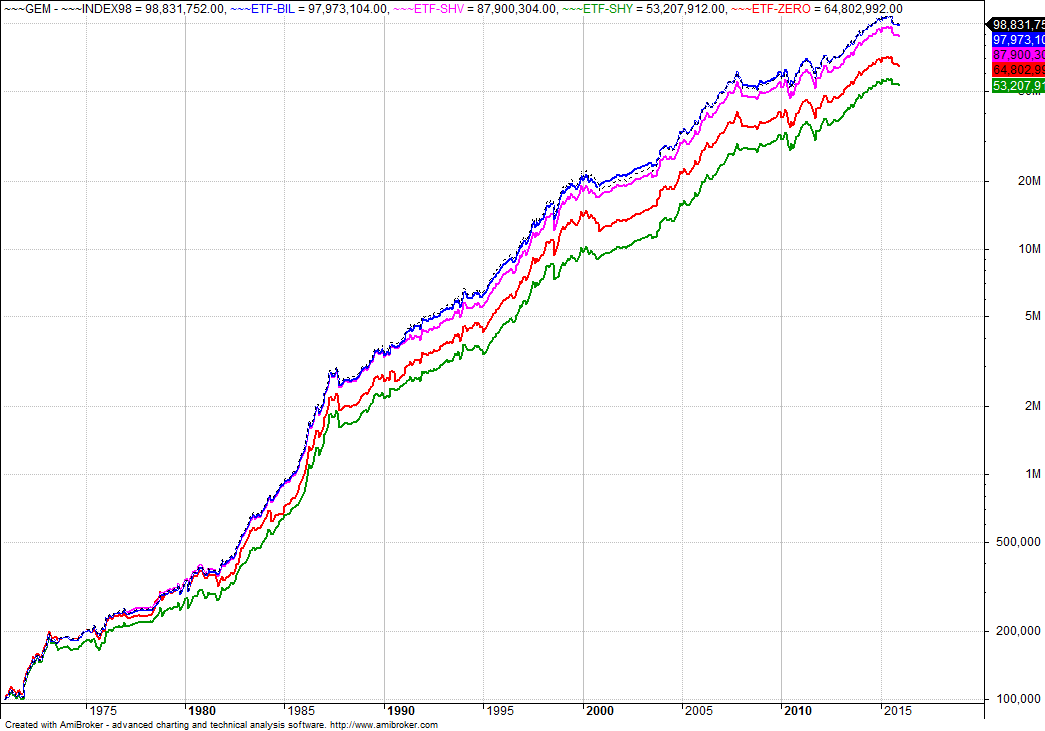

This shows the effect of using diferent types of "cash" for calculating absolute momentum in Antonacci's GEM:

The good news is that using extended ETFs back to the 1970's tracks virtually the uninvestable indexes of GEM (although I don't believe the data source was different between the two). It doesn't prove that GEM isn't curve fit based on the specific symbol universe used but at least it holds up using real-world funds.

The good news is that using extended ETFs back to the 1970's tracks virtually the uninvestable indexes of GEM (although I don't believe the data source was different between the two). It doesn't prove that GEM isn't curve fit based on the specific symbol universe used but at least it holds up using real-world funds.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: MachineGhost's Research Resort

It looks like the portfolio with SHV in the absolute momentum signal missed one timely reentry in 1991 but was otherwise effectively identical to the one checking BIL.

Here's the original post, which also charts the extended ETF to index comparison MG referenced: http://indexswingtrader.blogspot.com/20 ... h-gem.html

Here's the original post, which also charts the extended ETF to index comparison MG referenced: http://indexswingtrader.blogspot.com/20 ... h-gem.html

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

Here's the rebalancing bands optimal for each asset rather than all as a single group:

Stocks 12.02%

Bonds 16.54%

Gold 14.15%

Cash 4.37%

This adds 1.31% CAGR with about a 1.17% decrease in MaxDD over vanilla since 1969. Checked on a yearly basis.

The cash band seems a little odd but as that is 1-year T-Bills, I imagine they rarely move much.

Stocks 12.02%

Bonds 16.54%

Gold 14.15%

Cash 4.37%

This adds 1.31% CAGR with about a 1.17% decrease in MaxDD over vanilla since 1969. Checked on a yearly basis.

The cash band seems a little odd but as that is 1-year T-Bills, I imagine they rarely move much.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: MachineGhost's Research Resort

Hmmm...a 2x PP is looking totally awesome to me. GTAA AGG is the only one close to a 2x's performance. Oh yeah, and zero timing required.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

But the "zero timing" price comes with stupendous drawdowns. How brassy are your balls for surviving a -50% MaxDD?Kbg wrote:Hmmm...a 2x PP is looking totally awesome to me. GTAA AGG is the only one close to a 2x's performance. Oh yeah, and zero timing required.

Put simply, current market conditions are associated with small potential returns and enormous latent risks across nearly every asset class. The combination of extreme valuations, weak prospective returns, and emerging risk-aversion suggests that market losses could unfold abruptly, creating an interconnected Rube Goldberg chain of consequences because of the steep leverage that investors and corporations have taken on in recent years. The image that comes to mind is that of speculators scrounging around on their hands and knees to pull a few pennies from the catch of a mousetrap whose hammer is tied to the lid of a box of angry bees and a switch that drops an anvil. Even if there are rewards in the short-run, the situation isn’t likely to end well.

http://hussmanfunds.com/wmc/wmc161010.htm

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: MachineGhost's Research Resort

Hussman's been saying this for seven years now. And why did he have to mention Rube Goldberg anyway??MachineGhost wrote:But the "zero timing" price comes with stupendous drawdowns. How brassy are your balls for surviving a -50% MaxDD?Kbg wrote:Hmmm...a 2x PP is looking totally awesome to me. GTAA AGG is the only one close to a 2x's performance. Oh yeah, and zero timing required.

Put simply, current market conditions are associated with small potential returns and enormous latent risks across nearly every asset class. The combination of extreme valuations, weak prospective returns, and emerging risk-aversion suggests that market losses could unfold abruptly, creating an interconnected Rube Goldberg chain of consequences because of the steep leverage that investors and corporations have taken on in recent years. The image that comes to mind is that of speculators scrounging around on their hands and knees to pull a few pennies from the catch of a mousetrap whose hammer is tied to the lid of a box of angry bees and a switch that drops an anvil. Even if there are rewards in the short-run, the situation isn’t likely to end well.

http://hussmanfunds.com/wmc/wmc161010.htm

- InsuranceGuy

- Executive Member

- Posts: 425

- Joined: Sun Mar 29, 2015 1:44 pm

Re: MachineGhost's Research Resort

[deleted]

Last edited by InsuranceGuy on Mon Mar 08, 2021 9:18 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

QEternity made a fool of everyone, that's for sure.Reub wrote:Hussman's been saying this for seven years now. And why did he have to mention Rube Goldberg anyway??

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: MachineGhost's Research Resort

How many times do we have to replay this...care to post the max DD not including the one after the 400% increase in gold?

No, I thought not. It ruins the narrative.

And besides...I'm simply using YOUR posted data for the assessment for the time frame of the observations. So on a pure apples to apples basis, there is no doubt a 2x PP hits the top 2 of your list.

No, I thought not. It ruins the narrative.

And besides...I'm simply using YOUR posted data for the assessment for the time frame of the observations. So on a pure apples to apples basis, there is no doubt a 2x PP hits the top 2 of your list.

- InsuranceGuy

- Executive Member

- Posts: 425

- Joined: Sun Mar 29, 2015 1:44 pm

Re: MachineGhost's Research Resort

[deleted]

Last edited by InsuranceGuy on Mon Mar 08, 2021 9:18 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

No, I'm not going to cherry pick or selectively show a MaxDD that doesn't include the worst case to support your cognitive bias and your narrative. If that's how you're fauxly brassing up your balls, good luck with the delusion.Kbg wrote:How many times do we have to replay this...care to post the max DD not including the one after the 400% increase in gold?

No, I thought not. It ruins the narrative.

And besides...I'm simply using YOUR posted data for the assessment for the time frame of the observations. So on a pure apples to apples basis, there is no doubt a 2x PP hits the top 2 of your list.

P.S. That MaxDD event had nothing to do with gold and everything to do with the Fed.

P.P.S. So how about we exclude the forthcoming MaxDD event after the nearly 3,000% increase in T-Bonds? And so on and so on.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

Okay, buddy, since 1969 a 2x PP would have returned 17.66% CAGR and -38.04% MaxDD. This assumes exactly 2x returns is possible and 10% rebalancing bands are used and checked on a yearly basis in January so you're avoiding the worst of the MaxDD event.

So not quite a doubling since MaxDD growth isn't typically linear. Are your balls still brassy?

P.S. The above may not be entirely accurate as you can't double the 1yr T-Bill returns AFAIK. Without the cash, 15.56% CAGR and -39.22% MaxDD.

So not quite a doubling since MaxDD growth isn't typically linear. Are your balls still brassy?

P.S. The above may not be entirely accurate as you can't double the 1yr T-Bill returns AFAIK. Without the cash, 15.56% CAGR and -39.22% MaxDD.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: MachineGhost's Research Resort

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: MachineGhost's Research Resort

For a CTA, those figures would be world class for such a long period of time...not to mention it completely clocked 100% equities. Look, this is definitely not grandma's retirement portfolio. Never claimed it was.MachineGhost wrote:Okay, buddy, since 1969 a 2x PP would have returned 17.66% CAGR and -38.04% MaxDD. This assumes exactly 2x returns is possible and 10% rebalancing bands are used and checked on a yearly basis in January so you're avoiding the worst of the MaxDD event.

So not quite a doubling since MaxDD growth isn't typically linear. Are your balls still brassy?

P.S. The above may not be entirely accurate as you can't double the 1yr T-Bill returns AFAIK. Without the cash, 15.56% CAGR and -39.22% MaxDD.