"Full Faith & Credit" when the inmates take over the asylum

Moderator: Global Moderator

Re: "Full Faith & Credit" when the inmates take over the asylum

I agree with the statement above. But it contradicts your assertions that cash and bonds are equivalent.

"The willingness of the consumers in the economy to use these notes is largely dependent....<snip>"

He also contradicts himself elsewhere where he states that government debt is the private sector's asset because he omits the part that the "notes" change in value as in the statement I just quoted

"The willingness of the consumers in the economy to use these notes is largely dependent....<snip>"

He also contradicts himself elsewhere where he states that government debt is the private sector's asset because he omits the part that the "notes" change in value as in the statement I just quoted

Re: "Full Faith & Credit" when the inmates take over the asylum

Yes, but we have to decide HOW government "distorts" the economy. We have countries like South Korea which consist of massive metropolis after massive metropolis, a fiat currency, centralized healthcare and education, etc.Kshartle wrote:And all those things you mention harm the economy. The distort it by encouraging unproductive economic activity. When they stop distorting the bubble bursts and the recession starts. Printing again and repeating the mistakes only does more harm. The government can't help by creating additional credit or money to offset the recession.Simonjester wrote:this is close to the point where MR and I split company, MR says we cant cause inflation with the numbers used in the book keeping since the system is fully fiat (fake) i think its probably true...... but in the world of fake money the new measure of inflation "trouble brewing" is the size and rate of government expansion, the size of the mis-allocation in gov spending, the percentage of corruption and cronyism, the weight of bureaucratic regulation choking small business, the size of the military and prison industrial complex, the militarization of the police force, loss of liberty, etc etc because those things are what that "faith" in fiat now rest on. and since ever expanding spending = ever expanding government it seems we are getting more of all of these almost continually...Kshartle wrote:

The government's liability is someone else's asset and income man. It doesn't matter that the debt was racked up on welfare payments and missles. If the government didn't borrow to buy votes we'd run out of money and the economy would grind to a halt for lack of paper. Government borrowing money and spending it helps the economy, especially when non-government credit is shrinking because people want to save and pay down debt.

It just seems to me that automatically assuming that government is doing something that is horribly unnatural and unwanted within the economy is a bit much. Now maybe "the private sector can do it better," and that's another argument, but eventually we have to decide whether the government is building a completely disgustingly distorted machine, or simply providing products and services that the private sector could do better, but the government does "good enough" to be serviceable by the rest of a massive, productive, hopefully peaceful, growing economy.

I mean I never really like the USPS, but I certanly think it's serviceable enough. I don't think our roads are perfect, but they pretty effectively get me where I need together. Maybe the private sector COULD do these things better (I think this is laughable in some areas, but that's not the point), but at the end of the day how much harm do we really think an imperfect traffic system doing to us?

An economy is just some people wanting things and other people producing things. It can only be so "artificial." I actually want what I want, and I actually people usually actually WANT what I produce. Human desire and ability are tough things to manipulate too far from normal.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

I don't follow your logic. There is no contradiction, because the "notes" are our medium of exchange. The "bonds" are a promise to pay notes and they are easily tradable for "notes". In both cases, the willingness of consumers to use either bonds or cash depends on productivity. What's the problem?Mdraf wrote: I agree with the statement above. But it contradicts your assertions that cash and bonds are equivalent.

"The willingness of the consumers in the economy to use these notes is largely dependent....<snip>"

I still don't understand your logic. Why does it matter if the private sector's asset changes value? If you explain how this relates to inflation, I'm all ears.Mdraf wrote:He also contradicts himself elsewhere where he states that government debt is the private sector's asset because he omits the part that the "notes" change in value as in the statement I just quoted

When a bank swaps assets with the Fed, on any given day, it's balance sheet doesn't change in value on that day. You're describing a non-issue so far as I can tell.

Last edited by Gumby on Tue Oct 01, 2013 12:31 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

Well "monetizing the debt" has some quite limited effect... a lot less when rates are being driven to zero naturally by pathetically low demand for loanable funds and a depressed economy. What does have a meaningful effect is deficit spending, but only given other conditions like expansion or contraction of private credit, and trade deficits (absorbtion of our currency by foreign productivity).Mdraf wrote: I agree with the statement above. But it contradicts your assertions that cash and bonds are equivalent.

"The willingness of the consumers in the economy to use these notes is largely dependent....<snip>"

He also contradicts himself elsewhere where he states that government debt is the private sector's asset because he omits the part that the "notes" change in value as in the statement I just quoted

Just because something has the ability to change value doen't mean it's somehow contradictory to the idea that it's the private sector's asset and government's liability. If my $10,000 bond falls to $9,500, the government has a $9,500 liability (they could buy the bond from me (or someone else) for $9,500), and I have an asset of $9,500.

So I really don't see how this fundamentally changes anything. We USE these nominal fiat assets to "grease the wheels" of ecnomic transactions. If I woke up tomorrow with $1 Million in extra t-bills in my TD Ameritrade account, I would feel just as rich as if I woke up and found $1 Million in cash. However, the economy didn't produce diddly in additional productive capacity while I was sleeping, so this has inflationary potential (moreso in an economy at or near productive capacity).

And this affect of price changes is really more prevalent in longer-term bonds. Short term bonds make up the majority of the debt, and are remarkably similar to behaving like cash (especially considering the fed pays interest on reserves).

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

Agreed. Broad liquidity (which is what all economists actually use to lump Treasury Bills and "money" together as a measure of our purchasing power) technically only includes the shorter term treasuries. But since the overwhelming majority of our debt is short term, broad liquidity includes the overwhelming majority of US debt.moda0306 wrote:And this affect of price changes is really more prevalent in longer-term bonds. Short term bonds make up the majority of the debt, and are remarkably similar to behaving like cash (especially considering the fed pays interest on reserves).

Mdraf, it's like you are looking for infinitesimally small minutia to disagree with when you clearly agree with 99.99% of what MR says.

Last edited by Gumby on Tue Oct 01, 2013 12:39 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

How are they being poor stewards of the currency? You've admitted yourself that you don't think they'll be inflation in the short-term, and with low demand for loanable funds, why SHOULD rates by high?Simonjester wrote:MR says inflation is a constraint, but since we do x, y, z, we are not experiencing runaway inflation, or wont in the near future, i am saying its probably true because the understanding of bookkeeping and the effects of x,y,z, are pretty clearly understood.moda0306 wrote:

Simon,

I've never heard MR'ists assert that these numbers can't cause inflation. Am I misinterpreting your post?

Also, I think they're quite clear that giving the government powers can cause all sorts of problems and misallocations of resources (this is when they start getting out of MR a little and into opinionizing).

the effects of runamuck mis-allocation are either not understood or dismissed in favor of much easier topics like correcting a pre-fiat understandings of monetary mechanics.

the relevant point in bold, the government isn't a very good steward and the bond is heading for breakage... we are in the process of crashing the car... it may be a very slow motion crash that takes decades (its beyond my ability to predict when, but the direction we are going in seems apparent...)Quote from: Cullen Roche

The willingness of the consumers in the economy to use these notes is largely dependent on the underlying value of the output and/or productivity, the government's ability to be a good steward of the currency, the banking system’s distribution of money and the ability to regulate its usage. I like to think of this as an interconnected bond between these various forces. If any link in the bond is broken the nation's monetary system is at risk of collapse.

Source: http://papers.ssrn.com/sol3/papers.cfm? ... id=1905625

This is where I just don't get where people are coming from.... there is nothing I've seen of merit from Austrians that indicates to me why rates should naturally be very high at all in this economic environment.

Simonjester wrote: this is exactly where it gets tricky the numbers/bookkeeping say no inflation as long as we "......," but the other variable, unlimited (ever expanding) or poorly limited government. has a negative effect on the economy, kind of like walking out on a tight rope that gets narrower the further out you get.. will the crash be inflationary? i am not sure. How does loss of faith, bring down a fiat reserve dollar? has it even happened before? i can't think of any precedences of the top of my head.. which is why i put the word inflation under a strike out and replaced it with "trouble brewing"..

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

Rates are the price people pay to use someone else's savings. Demand for loans is only one side of the equation. Savings is the supply. People are broke. They racked up debt in a cosumption binge when they thought they were rich from the housing bubble. They thought that had good jobs and a long career. It was a bubble created by the artificially low interest rate policies of the FED. When higher interest rates exposed that the paper value of their assets was false, all they were left with was the debt.moda0306 wrote: with low demand for loanable funds, why SHOULD rates by high?

People don't want to be in debt. They want to save. QE, taxes, regulations prevent that. Due to all of these things the entire nation is swamped with debt and very little savings.

Low supply means a higher price. The meager real savings people make available means the price should be higher. The government cannot bear higher rates so it is deliberatly pushing them down and printing to make up for it's deficit. The fact that they are lower reduces the incentive to save and to loan, except to loan to the government since you should at least get the principle back. The government needs the low rates to finance it's schemes. But it is wrecking the economy pursuing these schemes with no end in sight that isn't either a deflationary crash or inflationary one.

Higher rates are going to expose the government's inability to pay by any means other than printing. The printing should cause rates to move higher as it picks up in pace and rates push further negative. It will feed itself. Until they stop. If they stop printing and borrowing this little shutdown distruption will look like the goldilocks economy.

Re: "Full Faith & Credit" when the inmates take over the asylum

Again, that has nothing to do with MR. You could say the same thing about any economic framework. That would be like complaining about a car manual because it ignores what happens when a bad driver gets behind the wheel.Simonjester wrote:but the other variable, unlimited (ever expanding) or poorly limited government. has a negative effect on the economy, kind of like walking out on a tight rope that gets narrower the further out you get..

WARNING: ANY ECONOMIC FRAMEWORK CAN FAIL WHEN A GOVERNMENT MAKES BAD DECISIONS.

Last edited by Gumby on Tue Oct 01, 2013 1:10 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

Well all dollars inside the banking system form the "supply" times whatever the reserve ratio is at that time (if we want to pretend for a sec that the reserve ratio is worth using), so the "supply" of loanable funds is massive.Kshartle wrote:Rates are the price people pay to use someone else's savings. Demand for loans is only one side of the equation. Savings is the supply. People are broke. They racked up debt in a cosumption binge when they thought they were rich from the housing bubble. They thought that had good jobs and a long career. It was a bubble created by the artificially low interest rate policies of the FED. When higher interest rates exposed that the paper value of their assets was false, all they were left with was the debt.moda0306 wrote: with low demand for loanable funds, why SHOULD rates by high?

People don't want to be in debt. They want to save. QE, taxes, regulations prevent that. Due to all of these things the entire nation is swamped with debt and very little savings.

Low supply means a higher price. The meager real savings people make available means the price should be higher. The government cannot bear higher rates so it is deliberatly pushing them down and printing to make up for it's deficit. The fact that they are lower reduces the incentive to save and to loan, except to loan to the government since you should at least get the principle back. The government needs the low rates to finance it's schemes. But it is wrecking the economy pursuing these schemes with no end in sight that isn't either a deflationary crash or inflationary one.

Higher rates are going to expose the government's inability to pay by any means other than printing. The printing should cause rates to move higher as it picks up in pace and rates push further negative. It will feed itself. Until they stop. If they stop printing and borrowing this little shutdown distruption will look like the goldilocks economy.

Maybe we've found an actual point we can build on here.

How on earth do you get the idea that our supply of loanable funds is small? When I see it, and its potential, it's absolutely massive.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

When we discuss the bad decisions and impacts of the government and the risks in asset classes and possible bad outcomes, MR is trotted out as some refutation. Every, single, time.Gumby wrote:Again, that has nothing to do with MR. You could say the same thing about any economic framework. That would be like complaining about a car manual because it ignores what happens when a bad driver gets behind the wheel.Simonjester wrote:but the other variable, unlimited (ever expanding) or poorly limited government. has a negative effect on the economy, kind of like walking out on a tight rope that gets narrower the further out you get..

WARNING: ANY ECONOMIC FRAMEWORK CAN FAIL WHEN A GOVERNMENT MAKES BAD DECISIONS.

Re: "Full Faith & Credit" when the inmates take over the asylum

It's because you are confusing bad decisions with a harmless asset swap. If the asset swaps were harmful, I'd hope you'd be able to find evidence from the previous times QE was implemented over the last 100 years. It doesn't help us to make assertions that you can't back up with evidence.Kshartle wrote:When we discuss the bad decisions and impacts of the government and the risks in asset classes and possible bad outcomes, MR is trotted out as some refutation. Every, single, time.Gumby wrote:Again, that has nothing to do with MR. You could say the same thing about any economic framework. That would be like complaining about a car manual because it ignores what happens when a bad driver gets behind the wheel.Simonjester wrote:but the other variable, unlimited (ever expanding) or poorly limited government. has a negative effect on the economy, kind of like walking out on a tight rope that gets narrower the further out you get..

WARNING: ANY ECONOMIC FRAMEWORK CAN FAIL WHEN A GOVERNMENT MAKES BAD DECISIONS.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

It's technically infinite right now. The reserve requirement has been zero since December 27, 1990. Banks aren't reserve constrained.moda0306 wrote:How on earth do you get the idea that our supply of loanable funds is small? When I see it, and its potential, it's absolutely massive.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

This is only when you're discussing general monetary and fiscal policy. If you want to talk about the moral and functional aspects of universal healthcare, the USPS, our military, etc, I promise we won't mention MR as a solution.Kshartle wrote:When we discuss the bad decisions and impacts of the government and the risks in asset classes and possible bad outcomes, MR is trotted out as some refutation. Every, single, time.Gumby wrote:Again, that has nothing to do with MR. You could say the same thing about any economic framework. That would be like complaining about a car manual because it ignores what happens when a bad driver gets behind the wheel.Simonjester wrote:but the other variable, unlimited (ever expanding) or poorly limited government. has a negative effect on the economy, kind of like walking out on a tight rope that gets narrower the further out you get..

WARNING: ANY ECONOMIC FRAMEWORK CAN FAIL WHEN A GOVERNMENT MAKES BAD DECISIONS.

And if you want to talk about mass confiscation or war with aliens, we might even mention hyperinflation as a possible scenario.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

You just have understand what is happening. Take a look at it. The government prints to pay for invasions and occupations. It prints to pay people to not work. It prints to hire police to round up people and put them in cages for victimless crimes against the state. It prints to hire economic police to make sure people don't trade property and labor in voluntary agreements.Gumby wrote: I'd hope you'd be able to find evidence from the previous times QE was implemented over the last 100 years. It doesn't help us to make assertions that you can't back up with evidence.

This is not a indicment against government, it's an observation of what they do to the economy with their printed money. They create new money, devaluing other money in existance, redistributing purchasing power away from the people who earned it through theft. It's used for political purposes and distorts the marketplace, destroying capital and wealth and decreasing the standard of living.

If they didn't print they would have to tax or borrow. People would resist the taxes since the theft would be ovbious. The borrowing without printing would cause upward pressure on rates because demand would be rising with no equal rise in supply. They can't afford the market interest rate so they must print.

These things are obvious. Do you need evidence to know you can't beat someone up into loving you? It is obvious.

That is reality. If MR ignores reality then so be it. I don't care about it.

Last edited by Kshartle on Tue Oct 01, 2013 1:37 pm, edited 1 time in total.

Re: "Full Faith & Credit" when the inmates take over the asylum

Governments did lots of horribly intrusive things well before fiat currencies were invented. Fiat currencies might help a government grow, but this might just be the government building more roads and infrastructure to meet the needs of a growing economy. It doesn't have to be a communist state.Simonjester wrote:but it has everything to do with the realities of true fiat monetary systems. its not my fault MR doesn't want to describe the relationship between true fiat and bad government but the fact remains that one grows the other,Gumby wrote:

Again, that has nothing to do with MR. You could say the same thing about any economic framework. That would be like complaining about a car manual because it ignores what happens when a bad driver gets behind the wheel.

WARNING: ANY ECONOMIC FRAMEWORK CAN FAIL WHEN A GOVERNMENT MAKES BAD DECISIONS.

any economic frame work can fail when government makes bad decisions, is not the same as when this economic framework (fiat) encourages or inevitably leads them to make bad decisions.. as long as we ignore this we blindly walk further out on the tight rope towards trouble... fiat is the system we got, so if you wasn't to keep fiat you must address the reality's and find ways to relive or negate the problem

MR is not complaining about the owners manual failing to mentioning the dangers of having rocket boosters on the car roof and push me signs all over the dash board around the countless and unavoidable fire buttons....

And lastly, MR DOES have the rocket booster warning. They do state that you have to be careful with these tools no different than our military or safety net systems.

Simonjester wrote: yes they did and do lots of horribly intrusive things that is why we have checks and balances, but i disagree with "might help a government grow" and would say "forces or almost always forces a government to grow" and yes it "might be building more roads and infrastructure to meet the needs of a growing economy" but it more often it isn't or it is doing things that slow or stall the economy" it doesn't have to be a communist state today or tomorrow, when it gets there depends on how well those checks and balances are working or how much they are failing to work, but now we are finally at the meat and potatoes of it all, we need enough people to understand both MR and the dangers of fiat to have an intelligent national discussion about the direction fiat is pushing us in... and how to check it, or what the alternatives are....

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

FIAT gives governments the legal mechanisim to confiscate all the property. Who gives a rat's /-\55 about the details if you don't understand the consequences and their effects on standards of living?

Re: "Full Faith & Credit" when the inmates take over the asylum

How could any government ever come close to acquiring all the wealth in the country just via money printing.Kshartle wrote: FIAT gives governments the legal mechanisim to confiscate all the property. Who gives a rat's /-\55 about the details if you don't understand the consequences and their effects on standards of living?

If there's any actions that would result in a hyperinflation within a couple days, this would be it.

Remember, we're free to use money and other assets as we see fit, and price them accordingly (for the most part). This sounds like Zimbabwe all over again. Do you really think the government will try to give all our farmland to disenfranchised blacks? That would be the modern-day equivalent.

Further, though, the government has the right to confiscate all wealth via its right to tax. If the tax law has no real limits, the government could have a one-time 100% wealth tax introduced. A fiat currency would be a dumb way to try to do it.

Isn't this a bit ridiculous, though? Our government has a military that could destroy the world 5 times over. Would we ever give an entity that kind of power if we thought they'd try to use our fiat currency to acquire all our wealth from us?

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

Those are political disagreements with fiscal spending. We are talking about monetary policy. Big difference. Surely you understand the difference?Kshartle wrote:You just have [to] understand what is happening. Take a look at it. The government prints to pay for invasions and occupations. It prints to pay people to not work. It prints to hire police to round up people and put them in cages for victimless crimes against the state. It prints to hire economic police to make sure people don't trade property and labor in voluntary agreements.

Sounds the same to me. Except that you are confusing a monetary operation with a fiscal operation. Big difference.Kshartle wrote:This is not a indicment against government, it's an observation of what they do to the economy with their printed money.

And you might have a valid point if that was what was happening with QE — but it isn't. The money from QE isn't used to pay for soldiers or weapons — the money just becomes reserves that nobody outside of a bank gets to touch. As far as government spending goes, it really does pale in comparison to the amount of money that banks create out of thin air. That should be obvious by now.Kshartle wrote:They create new money, devaluing other money in existance, redistributing purchasing power away from the people who earned it through theft. It's used for political purposes and distorts the marketplace, destroying capital and wealth and decreasing the standard of living.

Can't afford it? There is no reserve constraint, so the government can obviously afford any interest rate they feel like. When interest rates rise, it implies a strong economy and/or overheated bubble and the government would be wise to cut spending (and/or raise taxes) anyway. Only a dummy would overspend into an overheated economy. Nobody in their right mind does that. You are describing a theoretical problem that doesn't have to play out the way you think it will.Kshartle wrote:They can't afford the market interest rate so they must print.

No... that is your prediction. You have no evidence to support your theories from previous QE policies over the past 100 years. None. Zip. Nada. If you can't find evidence to support your wild theories, them you're just talk and no show.Kshartle wrote:That is reality.

Last edited by Gumby on Tue Oct 01, 2013 2:44 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

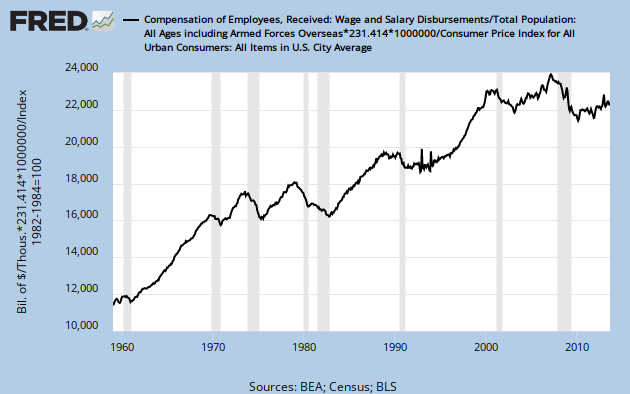

Trust me, you don't want to argue the "living standards" card. Living standards have risen considerably over the past century despite all your complaints. Again, you blurt out statements without any evidence.Kshartle wrote: FIAT gives governments the legal mechanisim to confiscate all the property. Who gives a rat's /-\55 about the details if you don't understand the consequences and their effects on standards of living?

[align=center]Real Wage and Salary Disbursements Per Capita[/align]

[align=center]

[/align]

[/align]

Last edited by Gumby on Tue Oct 01, 2013 2:45 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

Yes.Gumby wrote:Trust me, you don't want to argue the "living standards" card. Living standards have risen considerably over the past century despite all your complaints. Again, you throw out statements without any evidence.Kshartle wrote: FIAT gives governments the legal mechanisim to confiscate all the property. Who gives a rat's /-\55 about the details if you don't understand the consequences and their effects on standards of living?

At some point we have to quit hypothesizing about what the government "could do," or what the affects of its utter tyranny, death and destruction have been, and just take. a. look. around.

It seems to me, the most productive, robust, "happy" (if you had to take a poll) societies have found a balance between "submitting to the iron fist of the tyrannical government apparatus of death" and private activity.

The two other extremes tend to fail pretty miserably.

Though I think Libertarian666 gave some examples, and I don't mean to undermine my lack of education, it seems to me there is no perfectly free society out there. This shows me that these societies either are extremely fragile, or they eventually "lose their libertarianism" and like governent... That there's an actual demand, not necessarily for "controlling others," but for settling into an environment that you tend to agree with the implied contract of control vs the benefits that it provides.

I mean that's really what we're talking about here. I don't continue to live in the U.S. because I want to "control others." I simply am ok with the implied contract of settling where I'm at... a relatively liberal state in a relatively conservative country, near my family and friends, and with TONS of opportunities to bring economic value to others around me for a pretty good ROI, and the ability to enjoy life in ways that people in decades and centuries past would be dumbfounded by.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: "Full Faith & Credit" when the inmates take over the asylum

These MR threads go so fast one has to stay connected to the forum 24/7 to keep up!

Anyway Gumby, by "notes" I took it to mean a note as in promissory note, ie. bonds. Not banknotes.

Anyway Gumby, by "notes" I took it to mean a note as in promissory note, ie. bonds. Not banknotes.

Re: "Full Faith & Credit" when the inmates take over the asylum

Well, I am comforted by the fact that we seem to agree about 99% of the discussion. I guess it comes down to QE.Mdraf wrote: These MR threads go so fast one has to stay connected to the forum 24/7 to keep up!

Anyway Gumby, by "notes" I took it to mean a note as in promissory note, ie. bonds. Not banknotes.

Can you at least explain why you think an asset swap should result in high inflation if one of the assets is changing in value? The way I see it, the swap itself does not change the balance sheet of a bank on the day of the swap. I don't see how it could result in much inflation (beyond enabling the bank to bid up financial assets in the process).

If you could explain how that results in inflation, I'd love to hear your thoughts!

Last edited by Gumby on Tue Oct 01, 2013 3:03 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: "Full Faith & Credit" when the inmates take over the asylum

I leave the inflation discussion to Kshartle since I would be cutting and pasting what he already said. My beef is the other side of the "swap". I don't believe those bonds are equivalent to the cash which was printed to buy them, and that they will eventually lose value as interest rates rise and the US debt/gdp ratio gets into further iffy territory.Gumby wrote:Well, I am comforted by the fact that we seem to agree about 99% of the discussion. I guess it comes down to QE.Mdraf wrote: These MR threads go so fast one has to stay connected to the forum 24/7 to keep up!

Anyway Gumby, by "notes" I took it to mean a note as in promissory note, ie. bonds. Not banknotes.

Can you at least explain why you think an asset swap should result in high inflation if one of the assets is changing in value? The way I see it, the swap itself does not change the balance sheet of a bank on the day of the swap. I don't see how it could result in much inflation (beyond enabling the bank to bid up financial assets in the process).

If you could explain how that results in inflation, I'd love to hear your thoughts!

Re: "Full Faith & Credit" when the inmates take over the asylum

Nobody gave the USG a military. They built it by issuing the currency to pay soldiers and contractors.moda0306 wrote:Isn't this a bit ridiculous, though? Our government has a military that could destroy the world 5 times over. Would we ever give an entity that kind of power if we thought they'd try to use our fiat currency to acquire all our wealth from us?

There aren't any historical examples for total freedom. There has always been a chief, king, or state. So there isn't any evidence for one extreme, to claim it fails. There is just evidence that chiefs et al fail eventually.moda0306 wrote:It seems to me, the most productive, robust, "happy" (if you had to take a poll) societies have found a balance between "submitting to the iron fist of the tyrannical government apparatus of death" and private activity.

The two other extremes tend to fail pretty miserably.

Of course saying they fail isn't saying much, since kings generally got what they wanted in life, as do Senators, gov't contractors, etc.

The main argument against the state has always been a moral one. Living in the West it is easy for me to see my standard of living is high. Whatever the unseen costs of bureaucracy, they are made up for by American hegemony. All it takes to reverse that, though, is for me to change places with an Iraqi. The dead don't have a standard of living.

Re: "Full Faith & Credit" when the inmates take over the asylum

Well, he didn't say anything all that convincing — and he didn't back up anything he said with any evidence — so maybe we'll just leave it alone then.Mdraf wrote:I leave the inflation discussion to Kshartle since I would be cutting and pasting what he already said.

So, let me see if I follow what you're saying... Let's say Bank of America has a $100 billion dollars of T-bonds on its balance sheet. And let's say that in December, the value of their T-bonds goes down to $90 billion. The Fed purchases $10 billion of their bonds that month and gives them $10 billion in cash for those bonds that lost value. What problem am I missing? BOA's balance sheet is no different after each swap.Mdraf wrote:My beef is the other side of the "swap". I don't believe those bonds are equivalent to the cash which was printed to buy them, and that they will eventually lose value as interest rates rise and the US debt/gdp ratio gets into further iffy territory.

What problem am I supposed to be noticing here? I guess I still just don't see what your point is.

Last edited by Gumby on Tue Oct 01, 2013 4:29 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.