ETF Fraud - Documents to proove

Moderator: Global Moderator

ETF Fraud - Documents to proove

ETF Fraud - Documents to proove

Hi,

what kind of documents shall we ask to the broker to be sure that they invested our money in the ETF's ?

I'm afraid to use a broker that can do something wrong.

Regards

what kind of documents shall we ask to the broker to be sure that they invested our money in the ETF's ?

I'm afraid to use a broker that can do something wrong.

Regards

Last edited by frugal on Mon Dec 17, 2012 4:28 am, edited 1 time in total.

Live healthy, live actively and live life!

Re: ETFs Fraudes - Documents to proove

How can we avoid this?smurff wrote: losing all your paper assets in a fraud scheme not insured by the fdic or sipc

Thank you

Live healthy, live actively and live life!

Re: ETF Fraud - Documents to proove

It is insured in France, but that's theory. You might want to check Portugal's situation, but I think all EU works the same in this regard.

Frugal, you can't avoid this. Every person between you and your money is an added layer of risk. That's why I think one should only have the stock portion based on an ETF, and ideally have 2 or 3 ETFs to mitigate the risk. I especially don't trust gold ETFs at all and find bonds ETF antinomic (you want govt bonds because that's the safest asset in a deflation where everyone fails but you ask someone else to keep those bonds for you ?)

Frugal, you can't avoid this. Every person between you and your money is an added layer of risk. That's why I think one should only have the stock portion based on an ETF, and ideally have 2 or 3 ETFs to mitigate the risk. I especially don't trust gold ETFs at all and find bonds ETF antinomic (you want govt bonds because that's the safest asset in a deflation where everyone fails but you ask someone else to keep those bonds for you ?)

Re: ETF Fraud - Documents to proove

frugal, in the other topic I was discussing an insurance benefit of real gold. So to insure against the possibility of loss through fraud where government insurance agencies don't cover it-- like the fdic and sipc in the USA-- keep some of your assets in gold, in the yellow metal, physical form. And don't rely on only one brokerage company, use two or three, and be sure they are not both owned by the same big financial firm. If you use etfs for stocks and bonds, realize that there are usually several companies competing with the same product. For example there are several companies that offer S&P 500 index etfs, and when you include no- load S&P 500 index mutual funds, there are dozens of such funds. Make use of funds from more than one company.frugal wrote:How can we avoid this?smurff wrote: losing all your paper assets in a fraud scheme not insured by the fdic or sipc

Thank you

In the USA there have been many instances recently where the fdic and sipc did not cover financial frauds when the public believed they would. With last year's MSGlobal, we learned that sipc did not cover most futures accounts. We learned the same lesson again with PFGBest when that fraud was exposed early this year. This was a shock, since most people think of futures as securities and investments, and have not read the fine print on sipc about what they do and do not cover.

With Madoff Investments, there was a long term fraud in a situation where customers thought their funds were invested in legitimate stocks, but they were not. Faked paperwork showed capital gains and reinvested dividends. Although sipc covered losses up to the statutory maximum of $500K and the trustee sold Madoff assets to cover the rest, they set the total amount covered at the ORIGINAL IINVESTMENT, not at what that investment would be after, for example, 20 years. So someone who originally invested $100K with Madoff in 1990 would reasonably expect their investment to be worth more than $4 million after 20 years of capital gains and dividend reinvestments. But the sipc probably refunded only $100K to them. If they originally invested $700K, expecting it to be worth nearly $30 million after 20 years, sipc refunded $500K, and the trustee likely allowed only another $200K. Nothing close to the millions these defrauded investors had expected for their lifetime of investing. (Since people paid real taxes on some of those faked capital gains and dividends, the IRS allowed them to file amended tax returns to reclaim some of that money, but I don't recall how far back they were allowed to go With their amendments.)

These decisions shocked investors as much as the original fraud shocked them.

Keeping a percentage of your pp assets in real physical yellow gold coins will not only protect you from a Madoff, it will also protect you from the consequences of having government and industry- sponsored insurance agencies determining that your losses in a fraud will not be compensated.

Having said all of that, after making your investments, I would relax. It is a good idea to keep track of what's happening in the investing world and make changes if you observe something that makes you uncomfortable. But to worry about it all the time will take a mental toll on you that can defeat the purpose of making precautions.

Re: ETF Fraud - Documents to proove

frugal, please research to find out if there is a government agency (Portugal or EU) or an agency sponsored by the financial industry in Portugal or the EU, that insures investors from losses due to fraud at banks and brokerage/investment firms. All countries are different in this, with some having minimal or no coverage, and others having high limits of coverage. The EU May have its own insurance schemes, I don't know, but since you are in Europe you have a better idea than I do, Since I am in the USA.frugal wrote: Hi,

what kind of documents shall we ask to the broker to be sure that they invested our money in the ETF's ?

I'm afraid to use a broker that can do something wrong.

Regards

Next, be certain that all financial companies you use are covered by those insuring agencies. Pay close attention to disclosures from companies that do business across legal borders, for example doing business both the USA and Portugal. The insurance available in one country may not be available in the other. Some such insurance may be limited to their own residents (this became an issue with Icesave, where customers from the UK and the Netherlands had savings accounts from an Icelandic bank that collapsed during the 2008 crisis) and others will cover international clients only under certain circumstances (like, for example the account is opened in person in the country where you want the coverage from).

Finally, such agencies will have an upper limit on what they will insure, so don't keep more than that maximum limit in the account.

If there is no such automatic insurance for accounts, sometimes private insurance companies, like Lloyds, provide it. But that is only useful if you have a very high net worth-- in which case you are better off looking outside your own borders for a good bank. If you do not have a high net worth and live in an area where there is no such insurance, you have to do even more due diligence to make sure the firm is reputable, legitimate, and honest. This is where physical gold takes on a real importance for its insurance qualities.

I hope this helps.

Re: ETF Fraud - Documents to proove

Hello,

Good answers.

My problems are?

- the high price of Gold doesnt allow me to easly buy gold physic

- putting money on a foreign broker like IB interative brokers, i feel insecure, money is far in another country and if something happens, it is more difficult to resolve

Please comment.

Regards.

Good answers.

My problems are?

- the high price of Gold doesnt allow me to easly buy gold physic

- putting money on a foreign broker like IB interative brokers, i feel insecure, money is far in another country and if something happens, it is more difficult to resolve

Please comment.

Regards.

Live healthy, live actively and live life!

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: ETF Fraud - Documents to proove

Unless you have an extremely small portfolio, why would it be easier to buy if the price was lower? Sounds like you need to just bite the bullet and buy the bullion.frugal wrote: - the high price of Gold doesnt allow me to easly buy gold physic

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: ETF Fraud - Documents to proove

"Bite Bullet, Buy Bullion", Blabs BBS Boffin

Re: ETF Fraud - Documents to proove

A gold sovereign, which is very liquid all over Europe, only costs about 320 €, shipment included (online, with very serious dealers that ship in Portugal). A 20 francs coin, which is probably as liquid in Portugal, is only about 275 €. If you invest through an ETF, you will not be able to invest significantly less than that without paying huge fees to your broker, so I really don't see the point. Sure, a gram of physical gold is a little more expensive than a gram in an ETF, but that's an issue that has nothing to do with the size of your portfolio. More expensive, but with a stronger insurance (you pay 3% more for a security against fraud or failure of your vendor or confiscation from your government).

Furthermore, you seem to have an issue with the fact that your assets are stored in another country, but that will happen with a gold ETF anyway, even if your broker is Portugese (unless you find a Portugese gold ETF with reasonable fees, which would surprise me).

Furthermore, you seem to have an issue with the fact that your assets are stored in another country, but that will happen with a gold ETF anyway, even if your broker is Portugese (unless you find a Portugese gold ETF with reasonable fees, which would surprise me).

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: ETF Fraud - Documents to proove

…Being Badly Bitten By Bilbo Baggins.Xan wrote: "Bite Bullet, Buy Bullion", Blabs BBS Boffin

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: ETF Fraud - Documents to proove

pointedstick promoting purchasing "precious" per permanent portfolio paradigm

Last edited by l82start on Mon Dec 17, 2012 8:25 pm, edited 1 time in total.

-Government 2020+ - a BANANA REPUBLIC - if you can keep it

-Belief is the death of intelligence. As soon as one believes a doctrine of any sort, or assumes certitude, one stops thinking about that aspect of existence

-Belief is the death of intelligence. As soon as one believes a doctrine of any sort, or assumes certitude, one stops thinking about that aspect of existence

Re: ETF Fraud - Documents to proove

PS,Pointedstick wrote:Unless you have an extremely small portfolio, why would it be easier to buy if the price was lower? Sounds like you need to just bite the bullet and buy the bullion.frugal wrote: - the high price of Gold doesnt allow me to easly buy gold physic

It depends on the portfolio size?

How?

20-25% in physical gold is a QUARTERk9 wrote: A gold sovereign, which is very liquid all over Europe, only costs about 320 €, shipment included (online, with very serious dealers that ship in Portugal). A 20 francs coin, which is probably as liquid in Portugal, is only about 275 €. If you invest through an ETF, you will not be able to invest significantly less than that without paying huge fees to your broker, so I really don't see the point. Sure, a gram of physical gold is a little more expensive than a gram in an ETF, but that's an issue that has nothing to do with the size of your portfolio. More expensive, but with a stronger insurance (you pay 3% more for a security against fraud or failure of your vendor or confiscation from your government).

Furthermore, you seem to have an issue with the fact that your assets are stored in another country, but that will happen with a gold ETF anyway, even if your broker is Portugese (unless you find a Portugese gold ETF with reasonable fees, which would surprise me).

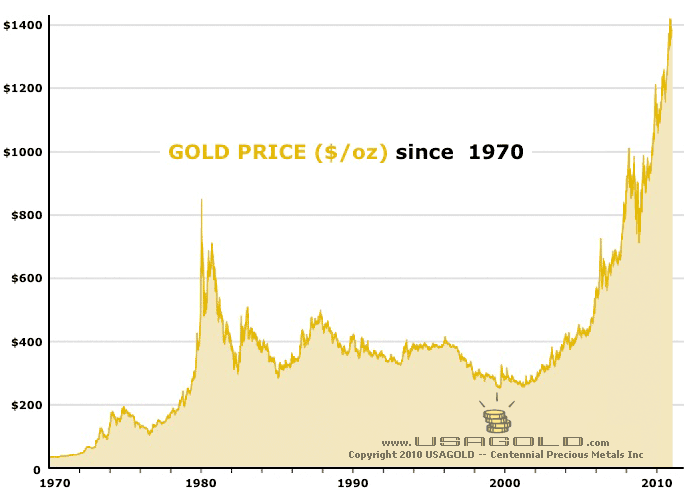

it is not easy to spend when GOLD is at the TOP

Live healthy, live actively and live life!

Re: ETF Fraud - Documents to proove

Gold is more expensive than it was four years ago, but there is no way to know that you're at the top.

Re: ETF Fraud - Documents to proove

it as a "real" calculated price?smurff wrote: Gold is more expensive than it was four years ago, but there is no way to know that you're at the top.

Live healthy, live actively and live life!

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: ETF Fraud - Documents to proove

Huh?frugal wrote:it as a "real" calculated price?smurff wrote: Gold is more expensive than it was four years ago, but there is no way to know that you're at the top.

Gold has risen a lot recently, but there's no way to tell if we're near the top. You could easily avoid gold now for fear of buying near the top only to see it rocket up to $5,000/oz. I'm sure there were U.S. stock investors who said similar things in 1992 when the stock market was at record highs--but would keep on rising for another 8 years. They probably felt pretty silly for sitting out that huge bull market because of a bad market timing decision.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: ETF Fraud - Documents to proove

4 years ago, it was already at the top and people were wondering if they should buy some or not. I remembered wondering "this is so expensive this is getting silly ; if the 20 francs goes north 180€, I'll think about selling everything". We're now at 250€ and I haven't sold everything. Oh, and people said it was too expensive when I started investing at about 800$/oz. But we might be at the top, and many technical analysts are not confident on the short run. The point is : we don't know.

We don't know and that could be true of any other asset in the PP. Bonds are very expensive, everybody thinks they're on a bubble too, and they said so for the 4 last years too. So what's left ? Stocks ? Are you really sure you want to go 100% stocks in the current economic situation ? Stocks are not as cheap as they were in 2008 and the situation is not really better, so there is room for a fall.

You can also invest small step after small step if it feels better to you.

We don't know and that could be true of any other asset in the PP. Bonds are very expensive, everybody thinks they're on a bubble too, and they said so for the 4 last years too. So what's left ? Stocks ? Are you really sure you want to go 100% stocks in the current economic situation ? Stocks are not as cheap as they were in 2008 and the situation is not really better, so there is room for a fall.

You can also invest small step after small step if it feels better to you.

Re: ETF Fraud - Documents to proove

Dear friends

your brokers have a omnibus account with all their assets in their name or on your name?

I would like to understand this point and what to do to be safe.

Regards!

your brokers have a omnibus account with all their assets in their name or on your name?

I would like to understand this point and what to do to be safe.

Regards!

Live healthy, live actively and live life!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: ETF Fraud - Documents to proove

It's all omnibus by default. Everything is held and registered in the broker's street name unless you specify otherwise. And that will involve a fee to do so and to send you the paper.frugal wrote: I would like to understand this point and what to do to be safe.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: ETF Fraud - Documents to proove

Hey I'vre just learned a little more about this topic. Here in Europe (so this is for you, Frugal), all assets are stored at a central provider (Clearstream, Euroclear to name a few if you want to learn more about them). Assets are stored under your name but managed, in fine, by these providers.

It doesn't prevent you from a fraud of your broker : what if your broker says you sold an asset (to lend securities, for instance) but does not say you so ?

"Yes, Mr. Clearstream, Frugal just sold all of his stocks"

"Yes, Mr. Frugal, everything is OK, business as usual, of course you still have all your stocks"

"Yes, Mr. third party investor, you can short sell these securities, I just found an investor that is okay to lend you his".

Your broker is not allowed to do this, and if he does, most of the time, everything will be okay. If things turn bad, you're almost screwed but, lucky you, you are protected by the European equivalent of FDIC for at most the equivalent of 100 000 € of your securities.

Such bad things happened in the US, remember MF Global.

So, remember, having only one broker is (almost) the same as investing only in your company's micro-cap stock. To be as safe as possible, have more than one broker. Three is a reasonable maximum, I guess.

It doesn't prevent you from a fraud of your broker : what if your broker says you sold an asset (to lend securities, for instance) but does not say you so ?

"Yes, Mr. Clearstream, Frugal just sold all of his stocks"

"Yes, Mr. Frugal, everything is OK, business as usual, of course you still have all your stocks"

"Yes, Mr. third party investor, you can short sell these securities, I just found an investor that is okay to lend you his".

Your broker is not allowed to do this, and if he does, most of the time, everything will be okay. If things turn bad, you're almost screwed but, lucky you, you are protected by the European equivalent of FDIC for at most the equivalent of 100 000 € of your securities.

Such bad things happened in the US, remember MF Global.

So, remember, having only one broker is (almost) the same as investing only in your company's micro-cap stock. To be as safe as possible, have more than one broker. Three is a reasonable maximum, I guess.