I am not having fun reading your responses. I feel quite irritated actually. For now I'm not going to respond anymore to your posts, I'm sorry.Gumby wrote:Yeah, but you don't go around making videos about how wrong the EU is about reported inflation. I suspect if you did go around making such claims you'd know who publishes the reports.MediumTex wrote: Marc is not in the U.S. so not knowing about the BLS is forgivable. I have no idea who tracks inflation in the EU.

I was also just having some fun. I'm sure Marc is very knowledgable.

Chances of losing (and winning!) are close to zero.

Moderator: Global Moderator

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

Markets can be wrong for a decade and can reflect the truth about the previous decade only in the next decade.AdamA wrote: But what do you make of the fact that the bond market hasn't responded to any of this? It seems unlikely to me that the the yields could remain so low for 12 years if inflation was truly 5.5%.

And when it comes to the bond market, interest rates are highly manipulated. Most of the printed money goes directly to keeping up financial institutions, keeping financial bond interest rates artificially low, keeping mortgage and saving accounts interest rates artificially low, and the other half of the printed money goes to buying government bonds directly keeping those also at artificially high valuations & artificially low interest rates.

How high do you think interest rates for governement bonds, mortgages and saving accounts would be if no money was printed, most of the banks would have defaulted and the FED doesn't buy half of the new issued government bonds?

Last edited by Marc De Mesel on Fri Nov 16, 2012 11:27 am, edited 1 time in total.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

Ok, I'm willing to lower my estimate for transaction costs and taxes from my initial 1.2% per year to your 0.16%. In my calculation this raises the return from the US PP since 2000 from 7.5% - 5.5% - 0.16% = 1.84% - 0.8% for your own time you spend on it, you have a profit of 1% per year now instead of zero. For me 1% is still negligible. But maybe I made more estimation errors?Pointedstick wrote:It's not really that hard. Here's an example of the expenses for a pure HBPP:Marc De Mesel wrote:Congratulations on keeping your expenses and taxes so low. I think though that such low expenses and taxes are not representable to the average investor as I think it requires a serious amount of time, comparable to what professionals invest in it, to get to such an optimized low expense situation.Pointedstick wrote: the yearly fees and expenses on my PP are 0.16%, and nearly all of it is tax-sheltered and therefore incurs no tax costs.

What would you take as an estimate for average expenses and taxes for a US PP for the average investor?

Stocks: VTI 0.06% ER

Bonds: 30-year Treasuries 0% ER

Gold: Bullion in a safe in your house 0% ER

Cash: T-bills or 1 year T-bonds 0% ER

That's a 0.015% ER for your whole portfolio. It's barely any worse with all ETFs:

Stocks: VTI 0.06% ER

Bonds: EDV 0.13% ER

Gold: IAU 0.25% ER

Cash: SCHO 0.08% ER

That's 0.13% total.

I'm curious to know what your estimate of true inflation in the US is since 2000 if you'd like to share.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Chances of losing (and winning!) are close to zero.

I don't think I would subtract 0.8% for the time I spend on it. Opportunity cost doesn't seem appropriate to factor into your investments, especially with auch a low-maintenance portfolio like a PP. You can go for months without looking at it! I'm also not sure I agree with you in inflation. It really depends on what you spend. As MT said, if your budget consists of health care, concert tickets, and college tuition, you'd be in trouble, and your personal inflation rate would be maybe 10 or 15%.Marc De Mesel wrote: Ok, I'm willing to lower my estimate for transaction costs and taxes from my initial 1.2% per year to your 0.16%. In my calculation this raises the return from the US PP since 2000 from 7.5% - 5.5% - 0.16% = 1.84% - 0.8% for your own time you spend on it, you have a profit of 1% per year now instead of zero. For me 1% is still negligible. But maybe I made more estimation errors?

I'm curious to know what your estimate of true inflation in the US is since 2000 if you'd like to share.

Personally, my biggest expenditures are rent, food, bills & utilities, and car stuff. Here is how I would estimate my personal inflation in these areas:

Rent: 4%

food: 2%

Bills: -1%

Car stuff -12% (dramatic decline in the price of car insurance)

Everything else: -1 to 2%

If I was a homeowner, it's not hard to imagine that my costs would have fallen substantially in that area. Anyone who buys a lot of consumer electronics (as I used to) is also used to pretty heavy and consistent price deflation, too. I also think that the official CPI is pretty accurate in the light of all the independent work done to verify it. The work at http://bpp.mit.edu/usa is outstanding.

So here's how I would personally calculate US performance from 2000 - 2007: 7.5% - 2.5% - 0.16 = 4.84% real gains. I'm a fairly new PP'er, but I'd be pretty darn happy with that.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

I agree with you that wages have only gone up with the same amount as official inflation, ie: 2.5% since 2000 in the US and this indeed is one indicator that official inflation is correct.MediumTex wrote: To me, the strongest indicator that there hasn't been significant overall inflation in the U.S. is the fact that there hasn't been significant inflation in the single most important price of all: WAGES. Without wage inflation, there can't be significant across the board inflation in other prices because people simply won't have the money to pay the higher prices.

The same is true in Europe, however, almost no one experiences that wages are going up with the same amount as true inflation. Most people complain that wages shrink in purchasing power, for 3 decades now. And indeed, 3 decades back one wage was sufficient to support an average household. Today you need two wages to support an average household. I assume the same is true in the US. Proving the wages are lacking true inflation.

If in one category you recognize serious inflation, of I assume 7.5% (prices have doubled in 10 years) and another category you notice tame inflation, of I assume 2.5%, then the average is still 5%. Do I interpret you correctly that you mean 7.5% and 2.5% inflation for these categories?If all you spent money on was health care, concert tickets and college tuition you would have experienced very serious inflation, but if you also buy houses, computers and flat screen TVs what you have seen, on balance, is pretty tame inflation.

The price of cars is also a pretty good barometer of inflation because so many different types of materials, products and services go into building a car. The price of an average car hasn't gone up much at all in recent years, and in some cases has even gone down. When you consider that you can finance many cars today at 0% interest, the actual cost of purchasing a car for most people has probably declined.

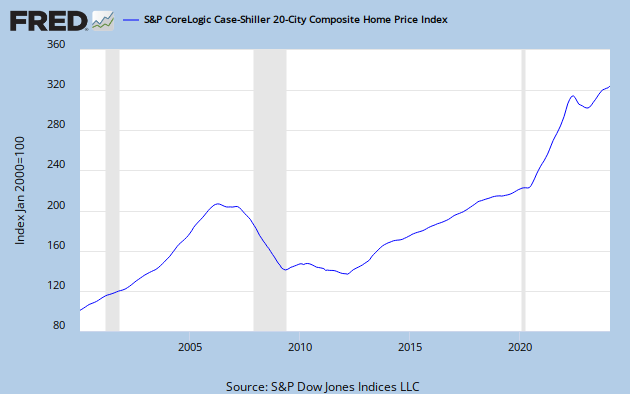

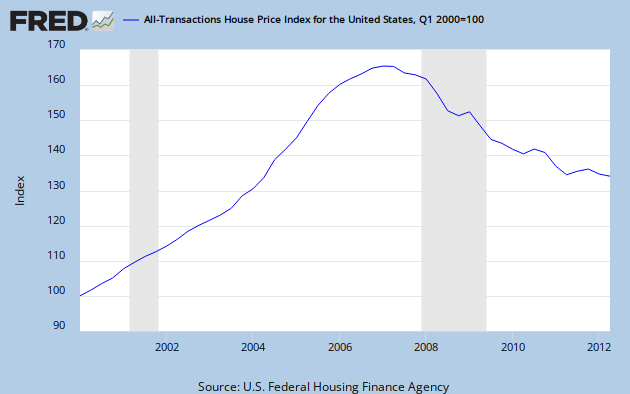

I don't think your house represents the average situation in the US. From the indexes I see average housing prices in the US have still gone up by 5% per year since 2000, even after the correction since 2006. Would you agree or disagree?I bought my house 11 years ago in a pretty typical suburban neighborhood in a pretty typical part of the country and it is basically worth today exactly what I paid for it in 2001. However, I refinanced several times during that period, so my actual cost of purchasing the house has declined over this 11 year period by several hundred dollars a month. That's just my own experience, but there is nothing unusual about it.

Last edited by Marc De Mesel on Fri Nov 16, 2012 2:49 pm, edited 1 time in total.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

Re: Chances of losing (and winning!) are close to zero.

Marc,

If you believe U.S. inflation is that high, how do you explain the fact that wages have definitely NOT risen by anything near 5.5% per year?

Inflation without rising wages is always transitory and usually concentrated in particular sectors (as opposed to across the whole economy, as the U.S. experienced in the 1970s).

If you believe U.S. inflation is that high, how do you explain the fact that wages have definitely NOT risen by anything near 5.5% per year?

Inflation without rising wages is always transitory and usually concentrated in particular sectors (as opposed to across the whole economy, as the U.S. experienced in the 1970s).

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Chances of losing (and winning!) are close to zero.

[align=center]Marc De Mesel wrote:I don't think your house represents the average situation in the US. From the indexes I see average housing prices in the US have still gone up by 5% since 2000, even after the correction since 2006. Would you agree or disagree?

[/align]

[/align][align=center]

[/align]

[/align]

Last edited by Gumby on Fri Nov 16, 2012 12:50 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Chances of losing (and winning!) are close to zero.

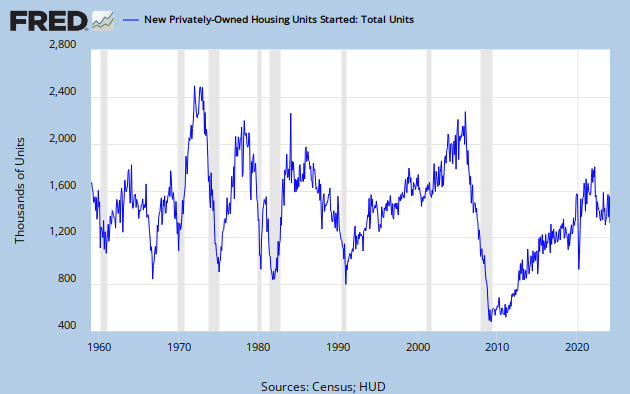

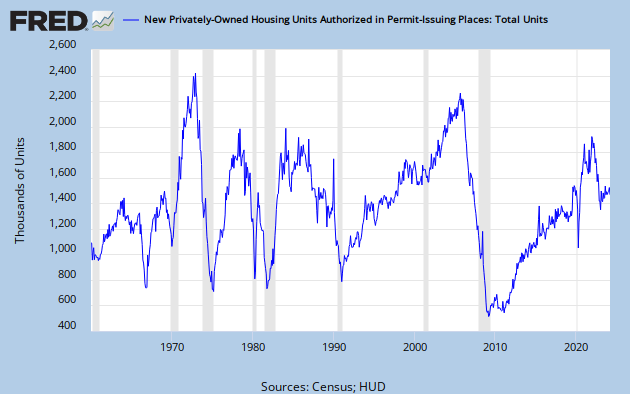

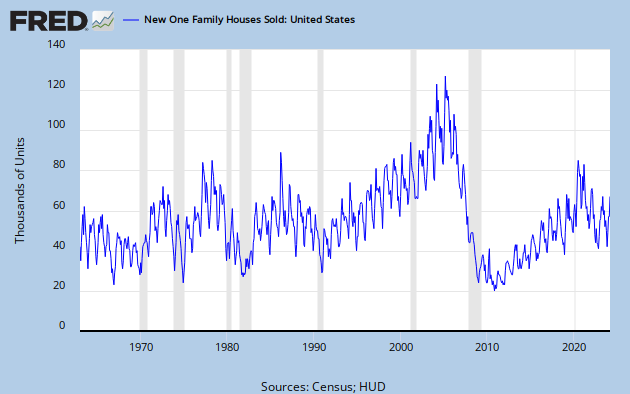

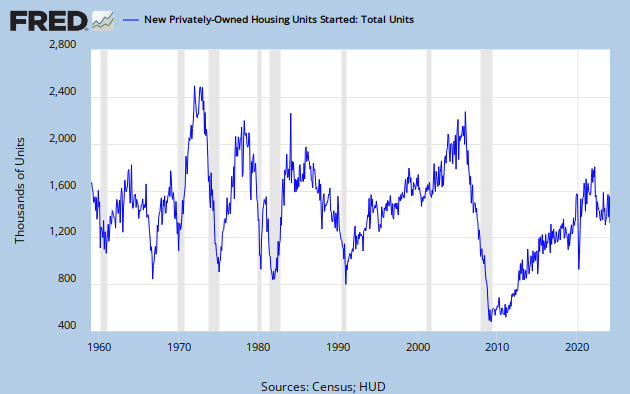

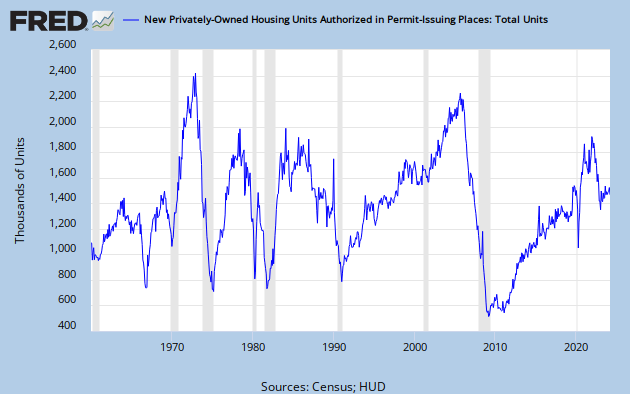

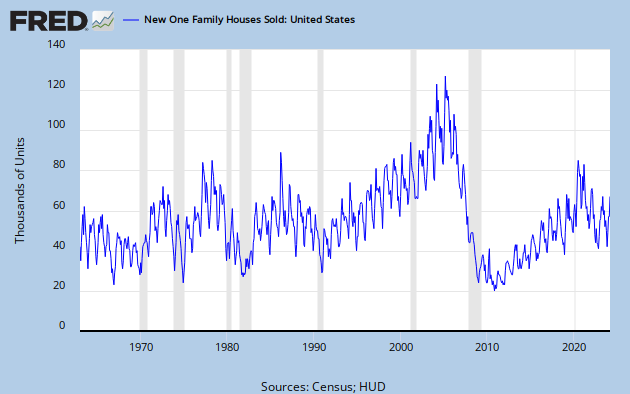

Also, home prices aren't everything. There are far less new homes being built and sold now.

Housing Starts...

[align=center] [/align]

[/align]

Building Permits...

[align=center] [/align]

[/align]

New Home Sales...

[align=center] [/align]

[/align]

Housing Starts...

[align=center]

[/align]

[/align]Building Permits...

[align=center]

[/align]

[/align]New Home Sales...

[align=center]

[/align]

[/align]Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Chances of losing (and winning!) are close to zero.

Since I'm a wannabe elitist, this is my inflation metric: http://www.forbes.com/sites/scottdecarl ... ire-style/Gumby wrote: Whether or not you believe the government figures, calculating true inflation is extremely difficult. BLS numbers (right or wrong) are simply the best data we have. There are some websites that claim to calculate true inflation, for a fee, (ShadowStats for instance) but I tend to not believe those websites since even they haven't increased their subscription prices over the past six years through all this supposed inflation we are experiencing. In "real" terms, their subscription prices are experiencing deflation!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

That some items have lower price rises then others is mostly explained in the same way: supply vs demand.MediumTex wrote:

If you believe U.S. inflation is that high, how do you explain the fact that wages have definitely NOT risen by anything near 5.5% per year?

Depending on the cycle some things have higher supply then demand and vice versa.

Wage earners since the last 3-4 decades have undergone an enormous expansion in supply as women started to work, communism fell in the east, and liberalism has opened up international trade in the 80's and 90's, adding an enormous supply of wage earners to the market. Companies however have not kept up with creating new jobs, creating an oversupply in wage earners and an undersupply in jobs, pressuring down wage prices.

That would be my explanation. In contrast to central bank propaganda I don't believe wages have more value as an indicator of true inflation then all the other items. It is just one of them.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

Re: Chances of losing (and winning!) are close to zero.

If the amount of money in consumers' pockets isn't increasing and the debt they are taking on isn't increasing, then I don't know how you can say that the aggregate price level is increasing.Marc De Mesel wrote: In contrast to central bank propaganda I don't believe wages have more value as an indicator of true inflation then all the other items. It is just one of them.

Wages are not just another price level--without wages you don't have prices of anything else because no one has any money to spend.

The amount of spending will always be a function of wages, and inflation without rising wages is not inflation with any staying power. Inflation without rising wages is a precursor to a recession. That's what we saw in 2007-2008.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

Interesting articleMachineGhost wrote:Since I'm a wannabe elitist, this is my inflation metric: http://www.forbes.com/sites/scottdecarl ... ire-style/Gumby wrote: Whether or not you believe the government figures, calculating true inflation is extremely difficult. BLS numbers (right or wrong) are simply the best data we have. There are some websites that claim to calculate true inflation, for a fee, (ShadowStats for instance) but I tend to not believe those websites since even they haven't increased their subscription prices over the past six years through all this supposed inflation we are experiencing. In "real" terms, their subscription prices are experiencing deflation!

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

I'm getting the impression that you do not respond to my counterarguments but instead ignore them and go on with giving new and other arguments in favor of your position. I'm feeling less attracted to continue giving more counterarguments to your future positions if you ignore my previous counterarguments. I might be wrong in my observation of the dynamic here but I'm willing to support my observation that you ignore my counterarguments with examples if you prefer.MediumTex wrote:If the amount of money in consumers' pockets isn't increasing and the debt they are taking on isn't increasing, then I don't know how you can say that the aggregate price level is increasing.Marc De Mesel wrote: In contrast to central bank propaganda I don't believe wages have more value as an indicator of true inflation then all the other items. It is just one of them.

Wages are not just another price level--without wages you don't have prices of anything else because no one has any money to spend.

The amount of spending will always be a function of wages, and inflation without rising wages is not inflation with any staying power. Inflation without rising wages is a precursor to a recession. That's what we saw in 2007-2008.

Last edited by Marc De Mesel on Fri Nov 16, 2012 2:19 pm, edited 1 time in total.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

Re: Chances of losing (and winning!) are close to zero.

Marc,

I'm trying to follow your argument, but here is what I am hearing you say:

1. The BLS inflation numbers are under-reporting inflation;

2. The MIT Billion Prices Project data is wrong;

3. The whole Treasury market is wrong; and

4. The fact that wages aren't rising isn't relevant to the question of whether significant and under-reported inflation is present.

I feel like you are describing a ghost and when I say I can't see it you say that this just confirms that it's a ghost.

Isn't there sort of an Occam's Razor element to this at some point--i.e., maybe it's simply true that inflation has actually been pretty low for the last few years, and that over the last 40 years it has been about 5% or so a year, which would provide real PP returns in the 4.5% range, which is what we are all expecting over time.

What you seem to be suggesting is that over the last 40 years inflation has actually averaged 7-8% per year, but if that were the case virtually everything we buy would be enormously more expensive than it actually is.

To cite the automobile industry as an example because it is in so many ways a good proxy for inflation because of all of the inputs that go into building a car, in 2007 I bought a Toyota Camry for about $19,700. Today I could buy this year's version of that car for about $21,000. If the price of this car had been going up at the rate of inflation you are suggesting, it would cost over $27,000 today.

I could cite similar examples in the areas of appliances, repair services, skilled trades, you name it--it's easy to see 2-3% annual inflation in many industries, but the 7-8% you are suggesting is very rare. Once you get away from health care, concert tickets and college tuition, it's hard to find the price of ANYTHING going up 7-8% a year right now.

I'll bet that if you suggested to most business owners that they could raise their prices by 7-8% a year they would say you were crazy, but you seem to be suggesting that this is actually what business owners are doing.

I'm trying to follow your argument, but here is what I am hearing you say:

1. The BLS inflation numbers are under-reporting inflation;

2. The MIT Billion Prices Project data is wrong;

3. The whole Treasury market is wrong; and

4. The fact that wages aren't rising isn't relevant to the question of whether significant and under-reported inflation is present.

I feel like you are describing a ghost and when I say I can't see it you say that this just confirms that it's a ghost.

Isn't there sort of an Occam's Razor element to this at some point--i.e., maybe it's simply true that inflation has actually been pretty low for the last few years, and that over the last 40 years it has been about 5% or so a year, which would provide real PP returns in the 4.5% range, which is what we are all expecting over time.

What you seem to be suggesting is that over the last 40 years inflation has actually averaged 7-8% per year, but if that were the case virtually everything we buy would be enormously more expensive than it actually is.

To cite the automobile industry as an example because it is in so many ways a good proxy for inflation because of all of the inputs that go into building a car, in 2007 I bought a Toyota Camry for about $19,700. Today I could buy this year's version of that car for about $21,000. If the price of this car had been going up at the rate of inflation you are suggesting, it would cost over $27,000 today.

I could cite similar examples in the areas of appliances, repair services, skilled trades, you name it--it's easy to see 2-3% annual inflation in many industries, but the 7-8% you are suggesting is very rare. Once you get away from health care, concert tickets and college tuition, it's hard to find the price of ANYTHING going up 7-8% a year right now.

I'll bet that if you suggested to most business owners that they could raise their prices by 7-8% a year they would say you were crazy, but you seem to be suggesting that this is actually what business owners are doing.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Chances of losing (and winning!) are close to zero.

It's great to have you here, Marc! I remember reading about your European Permanent Portfolio waaaay back in the day on the Bogleheads thread.

Imagine that money comes gushing into the economy due to interest rates being held at 0%. Let's say that we live in a world of negative real interest rates where commodities and "real stuff" gain favor as savings/investment vehicles. It seems to me that you then have "stuff" growing expensive more quickly than wages might rise.

Of course, wages will still rise (as they are, slowly, today.) But they may not rise as quickly as crucial items like food and energy. I think that this is the pain that Marc is referring to. Don't you see a lot of this lately? Wages never quite seeming to keep up with rising costs? An additional cruelty of the artificially low rates is that a combination of ZIRP and inflation chew away at your savings while all of this is going on. I don't know about your experience, but this seems to be a common "man on the street" complaint lately.

I agree that without some external force, the relative stagnancy of wages should halt this. But so long as the money spigot is turned on, I don't see why this "negative real wage increase" couldn't continue indefinitely. Plausible?

While 5.5% is high, I wonder though -- would wages have to necessarily rise as fast as other prices?MediumTex wrote: If you believe U.S. inflation is that high, how do you explain the fact that wages have definitely NOT risen by anything near 5.5% per year?

Imagine that money comes gushing into the economy due to interest rates being held at 0%. Let's say that we live in a world of negative real interest rates where commodities and "real stuff" gain favor as savings/investment vehicles. It seems to me that you then have "stuff" growing expensive more quickly than wages might rise.

Of course, wages will still rise (as they are, slowly, today.) But they may not rise as quickly as crucial items like food and energy. I think that this is the pain that Marc is referring to. Don't you see a lot of this lately? Wages never quite seeming to keep up with rising costs? An additional cruelty of the artificially low rates is that a combination of ZIRP and inflation chew away at your savings while all of this is going on. I don't know about your experience, but this seems to be a common "man on the street" complaint lately.

I agree that without some external force, the relative stagnancy of wages should halt this. But so long as the money spigot is turned on, I don't see why this "negative real wage increase" couldn't continue indefinitely. Plausible?

Re: Chances of losing (and winning!) are close to zero.

Can you restate your counterargument?Marc De Mesel wrote:I'm getting the impression that you do not respond to my counterarguments but instead ignore them and go on with giving new and other arguments in favor of your position. I'm feeling less attracted to continue giving more counterarguments to your future positions if you ignore my previous counterarguments.MediumTex wrote:If the amount of money in consumers' pockets isn't increasing and the debt they are taking on isn't increasing, then I don't know how you can say that the aggregate price level is increasing.Marc De Mesel wrote: In contrast to central bank propaganda I don't believe wages have more value as an indicator of true inflation then all the other items. It is just one of them.

Wages are not just another price level--without wages you don't have prices of anything else because no one has any money to spend.

The amount of spending will always be a function of wages, and inflation without rising wages is not inflation with any staying power. Inflation without rising wages is a precursor to a recession. That's what we saw in 2007-2008.

My understanding of your argument so far is that all official reports of inflation are incorrect, even though the MIT Billion Prices Project and my own personal inflation experience matches those official figures pretty closely.

One additional macroeconomic point I would make is that most consumers in recent years have experienced a deflationary double whammy: their wages have not risen AND the amount of debt they are willing to take on has declined, which means for most consumers that they have experienced a net loss of purchasing power (even if prices hadn't risen at all), which is certainly not inflationary.

We are in the middle of a long-term deflationary trend, which is what one would expect on the other side of a credit-fueled asset bubble. Periods like these make it very hard for inflation to get much traction because people respond to many price increases by simply reducing consumption, which tends to push the economy into recession, which tends to push prices back down (see 2007-2008 for a great example of this process).

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Chances of losing (and winning!) are close to zero.

What I'm saying is that for lots of people they haven't seen their wages rise AT ALL in recent years, in part because there is no tightness in most labor markets to push up wages.Lone Wolf wrote: It's great to have you here, Marc! I remember reading about your European Permanent Portfolio waaaay back in the day on the Bogleheads thread.

While 5.5% is high, I wonder though -- would wages have to necessarily rise as fast as other prices?MediumTex wrote: If you believe U.S. inflation is that high, how do you explain the fact that wages have definitely NOT risen by anything near 5.5% per year?

But is money gushing into the economy? If it is I don't see it. I see speculative assets rising here and there, but I don't see an across the board increase in the money available to spend. In fact, since people seem less willing to take on new debt, it seems like there is actually less money to be spent because consumers are much more cautious about taking on new debt.Imagine that money comes gushing into the economy due to interest rates being held at 0%. Let's say that we live in a world of negative real interest rates where commodities and "real stuff" gain favor as savings/investment vehicles. It seems to me that you then have "stuff" growing expensive more quickly than wages might rise.

I agree that even low rates of inflation in a ZIRP world make it hard to protect your savings, but as I note above I think that many people have seen no wage increases whatsoever in recent years, and many of them have actually seen wage declines (ask employees of American Airlines about this).Of course, wages will still rise (as they are, slowly, today.) But they may not rise as quickly as crucial items like food and energy. I think that this is the pain that Marc is referring to. Don't you see a lot of this lately? Wages never quite seeming to keep up with rising costs? An additional cruelty of the artificially low rates is that a combination of ZIRP and inflation chew away at your savings while all of this is going on. I don't know about your experience, but this seems to be a common "man on the street" complaint lately.

Well, I would argue that until the government is mailing $10,000 checks to every household, the "money spigot" hasn't really been turned on.I agree that without some external force, the relative stagnancy of wages should halt this. But so long as the money spigot is turned on, I don't see why this "negative real wage increase" couldn't continue indefinitely. Plausible?

To me, all I really need to know about inflation can be easily observed by taking a look at household balance sheets and aggregate wage levels. If people aren't earning more money and aren't taking on more debt, inflation can't be much of a problem for very long. 2007-2008 taught us this, even though everyone was certain all the way through about July of 2008 that the long awaited inflationary spiral was well underway. They weren't just wrong about this--they were TOTALLY wrong, since the spiral we were on the cusp of was a deflationary spiral, not an inflationary spiral.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Chances of losing (and winning!) are close to zero.

I was going to address Medium Tex, but you did the job for me!Lone Wolf wrote:

Of course, wages will still rise (as they are, slowly, today.) But they may not rise as quickly as crucial items like food and energy. I think that this is the pain that Marc is referring to. Don't you see a lot of this lately? Wages never quite seeming to keep up with rising costs? An additional cruelty of the artificially low rates is that a combination of ZIRP and inflation chew away at your savings while all of this is going on. I don't know about your experience, but this seems to be a common "man on the street" complaint lately.

But just to state it in my own words, I see prices on almost everything higher than they were since before the financial crisis. It's like the financial crisis never happened, and prices just went up from the 2007 baseline. I'm talking about necessities...rent, food, common drug items, healthcare, gasoline. Luxuries like high-tech gadgets have gone down, but the stuff we need has gone up. Whatever the experts call it, I call it inflation and a reduction in standard of living. ZIRP is killing many of us and gold and stocks, the traditional inflation hedges, aren't keeping pace. Neither are short-term Treasuries, another inflation hedge mentioned in another thread. That's why those of us suffering from inflation, stagnant incomes and/or retirement under ZIRP, are opting to protect ourselves using income-heavy portfolios.

Re: Chances of losing (and winning!) are close to zero.

From what I can tell, Marc rejects the official inflation numbers because they partake in hedonic adjustments. Yet, economists fully support hedonic adjustments because the quality of things improve dramatically in our lives. Our standard of living tends to improve over time.

For instance, when you buy a house today, you don't buy a house with all the furnishings of the 1970s or the 1980s. No. You buy a house with air-conditioning, stainless steel appliances, electrical upgrades, garage-door openers, security system, granite countertops, etc. So, you can't really compare the price of a 1980s house with the price of a 2012 house without using hedonic adjustments.

Hedonic adjustments play a real role in economics and those who reject them are usually interested in conspiracy theories.

For instance, when you buy a house today, you don't buy a house with all the furnishings of the 1970s or the 1980s. No. You buy a house with air-conditioning, stainless steel appliances, electrical upgrades, garage-door openers, security system, granite countertops, etc. So, you can't really compare the price of a 1980s house with the price of a 2012 house without using hedonic adjustments.

Hedonic adjustments play a real role in economics and those who reject them are usually interested in conspiracy theories.

Wikipedia.org wrote:Some commentators, including Austrian economists, have criticized the US government's use of hedonic regression in computing its CPI, fearing it can be used to mask the "true" inflation rate and thus lower the interest it must pay on Treasury Inflation-Protected Securities (TIPS) and Social Security cost of living adjustments.

However, the same use of hedonic models when analyzing consumer prices in other countries has shown that non-hedonic methods may misstate inflation over time by failing to take quality changes into account.

Source: http://en.wikipedia.org/wiki/Hedonic_re ... #Criticism

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Chances of losing (and winning!) are close to zero.

I agree that modern conveniences come with new homes, but quality of workmanship and durability are another issue. It seems that many things these days are throwaways. They are not built to last. Instead of buying one item that lasts for 20 years, you end up buying 5. That is another form of inflation, just like smaller packages are a form of inflation. I would factor the declines in durability as a negative to counter some of the positives that come from hedonic adjustments.Gumby wrote: From what I can tell, Marc rejects the official inflation numbers because they partake in hedonic adjustments. Yet, economists fully support hedonic adjustments because the quality of things improve dramatically in our lives. Our standard of living tends to improve over time.

For instance, when you buy a house today, you don't buy a house with all the furnishings of the 1970s or the 1980s. No. You buy a house with air-conditioning, stainless steel appliances, electrical upgrades, granite countertops, etc. So, you can't really compare the price of a 1980s house with the price of a 2012 house without using hedonic adjustments.

Hedonic adjustments play a real role in economics and those who reject them are usually interested in conspiracy theories.

And though getting off the topic a bit, pesticides in our foods, mercury in our oceans, etc., which may result in lower food costs through "efficiency" in production, probably produce higher healthcare bills in the long-run, which is another form of stealth inflation.

Re: Chances of losing (and winning!) are close to zero.

It's worth mentioning that ShadowStats excludes hedonic adjustments. So, from that standpoint an iPad 2 costs the same as a first-generation iPad. A TV from the 1980s is the same as a TV from 2012. There is no accounting for product improvement and it makes zero sense whatsoever.

By the way... here is a good explanation of why ShadowStats is wrong:

http://traderscrucible.com/2011/04/13/s ... ery-wrong/

By the way... here is a good explanation of why ShadowStats is wrong:

http://traderscrucible.com/2011/04/13/s ... ery-wrong/

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

I will link to my counterarguments if that is ok.MediumTex wrote:Can you restate your counterargument?Marc De Mesel wrote:

I'm getting the impression that you do not respond to my counterarguments but instead ignore them and go on with giving new and other arguments in favor of your position. I'm feeling less attracted to continue giving more counterarguments to your future positions if you ignore my previous counterarguments.

My understanding of your argument so far is that all official reports of inflation are incorrect, even though the MIT Billion Prices Project and my own personal inflation experience matches those official figures pretty closely.

My counterargument to the argument that 'MIT Billion Prices' confirms official inflation numbers is here.

My counterargument to your personal experience matching official inflation numbers when it comes to housing is here (last paragraph).

My counterargument to the argument that 'the whole treasury market is wrong' or 'why are interest rates so low if inflation is so high' is here.

My counterargument to your argument that wages are only rising at 2.5% and confirm the official low inflation is here and here.

I also asked several questions in my counterarguments. I am not saying that you have to respond to my counterarguments, or you have to answer my questions to you. You are free to do not ofcourse. I am just saying that I don't enjoy this way of debating when someone does not recognize my counterarguments and comes up with other new arguments, or worse, just repeats the arguments that I have debunked already.

Note that my estimate is not that since 2000 until 2011 there has been 7-8% inflation in the US, my estimate is that it has been around 5% (sorry to make it bold, not meant to scream but to imprint in the eyeball

Last edited by Marc De Mesel on Fri Nov 16, 2012 3:29 pm, edited 1 time in total.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2

Re: Chances of losing (and winning!) are close to zero.

The price of gold has gone up 500% in the last decade.Gary wrote: ZIRP is killing many of us and gold and stocks, the traditional inflation hedges, aren't keeping pace.

I would say that gold has more than kept pace with inflation.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Chances of losing (and winning!) are close to zero.

According to his interview, Marc is also convinced that he can determine inflation from the amount of money being printed. That line of thinking is known as "Monetarism," and it has it's founding in the Quantity Theory of Money. Economists really don't believe in QToM these days — particularly over the short term.

Short term QToM was disproven as far back as the 1930s and Monetarism died when it couldn't explain how all the money printing during the 1990s resulted in very little inflation.

If you print money and then bury it in a hole that nobody can get to, it doesn't cause inflation.

Short term QToM was disproven as far back as the 1930s and Monetarism died when it couldn't explain how all the money printing during the 1990s resulted in very little inflation.

If you print money and then bury it in a hole that nobody can get to, it doesn't cause inflation.

Last edited by Gumby on Fri Nov 16, 2012 3:29 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

- Marc De Mesel

- Executive Member

- Posts: 184

- Joined: Wed Feb 16, 2011 5:33 am

- Location: Europe

Re: Chances of losing (and winning!) are close to zero.

That is also my personal experience in Europe, Belgium. Except for 2008 when everything fell to the floor, since 2009 we have had serious inflation again. As you can see in my tables here are my estimated true inflation numbers since 2008:Gary wrote: I see prices on almost everything higher than they were since before the financial crisis. It's like the financial crisis never happened, and prices just went up from the 2007 baseline. I'm talking about necessities...rent, food, common drug items, healthcare, gasoline. Luxuries like high-tech gadgets have gone down, but the stuff we need has gone up. Whatever the experts call it, I call it inflation and a reduction in standard of living. ....

2008: -5%

2009: +11%

2010: +11%

2011: +3%

Average: +4.9%

For the USA my estimated inflation numbers are:

2008: -1%

2009: +5%

2010: +11%

2011: +9%

Average: 6.0%

Again I could estimate it too high as many think here but until now I have missed the argument that convinces me of lowering my estimatations.

"We think, the more people on earth, the less we each have. But it's exactly the opposite, the more people, the more resources we all have!" - Julian Simon, The Ultimate Resource 2