Why The PP Will Eventually Fail

Moderator: Global Moderator

Why The PP Will Eventually Fail

The PP will eventually fail. I don't know when, but we're heading on a path that it must fail. Unfortunately there is no better alternative so sticking the course is prudent.

Eventually stocks will fail to produce returns during prosperity. Government regulation is going to grow and grow until no business can be profitable. Everything will essentially become like a public-private utility with government-set profit margins. There will not be any prosperity for which to capture gains during.

Unfortunately, gold, cash, and LTTs won't do well in this environment either, relative to inflation.

I've recently read Harry Browne's Why Government Doesn't Work and Harry Hazlitt's Economics In One Lesson and I see the course that government is taking and it's one towards stricter and stricter regulation.

The irony is reading my Liberal Friends' postings on social media sites. After Obama was re-elected, several large businesses made big cuts in employees and reduced hours to part-time to avoid paying healthcare benefits. My Liberal Friends posted about how horrible and atrocious these evil businesses are acting with no regard for their employees. They fail to see the obvious truth. And they will support future leaders that make more regulations to "fix" the problem of businesses going out of the way to avoid the Accountable Care Act.

Perhaps the government will require that all businesses are not allowed to hire employees for less than 40 hours per week if the employee is willing to work all 40 hours and does not yet have another full time job. And this will lead to businesses laying off more people and causing other "unforeseen" consequences that are detrimental to the economy.

Look at banking regulations put into place in the last few years to "protect" us from EVIL CAPITALISTS because the banking crisis was "a failure of free enterprise, yet again" and we need the government to fix it.

Airliners are heavily regulated because it's safety and required for a strong national infrastructure.

Car manufacturers are now outright owned by the federal government.

Utilities have been run by the government for decades.

Telecoms have consolidated down to a handful of companies and all are beholded to government regulation of FCC spectrums.

Energy companies fall under the Clean Air Act and Obama hates coal and will put a stop to that soon.

Consumer Discretionary are NOT heavily regulated and will likely never be heavily regulated, relative to other industries, however if consumers have no discretionary funds, because of a reduction in spending power due to inflation and regulatory costs of their necessary purchases, then this sector will fail.

I'm hard pressed to see a prosperous future in America, Europe, or any country that basically will be eventually become the Soviet Union.

What's the point of this post if there's no good alternative? Partially to bitch and complain. Partially to spread information. Partially to promote Variable Portfolios.

I feel that in a VP one can potentially hedge against the future by looking at the intermediate future and speculating on sectors that may be strong. For example, government will eventually take over all of healthcare by necessity. There will be no more private R&D in drugs. 99% of drugs will be generic due to cost cutting measures by the government. Thus, instead of investing in the Mercks and Pfizers, consider investing in the Mylans and Tevas and Dr. Reddy's that produce generic drugs. Their margins are small but their volumes will increase with greater government spending.

Look at Defense Contractors. It's plain to see that the US is bankrupt and has no manufacturing capability. Our dollars are being devalued by QE 1, 2, Infinity, and eventually the rest of the world will stop accepting our dollars for their commodities, which would be disastrous because we can't make anything domestically anymore. The solution will be more war. We went into Iraq to grab Saddam because he threatened to take Euros as payment for oil. One of the major reasons the USD is actually worth anything on the global market, in spite of it not really being worth anything, is because OPEC only takes USD, which artificially drives up the demand for dollars and thus the value.

Fortunately for the USD, the Euro is going to fail within 10 to 20 years and there really won't be any other currency. Perhaps Gold demand will soar, but perhaps not.

It's inevitable that the US will go back into war. The broken glass fallacy that war is good for the economy will cause politicians to drive us into war to get us out of a future recession. Invest your VP into defense contractors for the intermediate term.

Make your own judgements about the VP but I urge you to be forward looking. Don't bet on Apple or other short term things. Bet on things that may cause the PP to fail such as the situation described above.

Eventually stocks will fail to produce returns during prosperity. Government regulation is going to grow and grow until no business can be profitable. Everything will essentially become like a public-private utility with government-set profit margins. There will not be any prosperity for which to capture gains during.

Unfortunately, gold, cash, and LTTs won't do well in this environment either, relative to inflation.

I've recently read Harry Browne's Why Government Doesn't Work and Harry Hazlitt's Economics In One Lesson and I see the course that government is taking and it's one towards stricter and stricter regulation.

The irony is reading my Liberal Friends' postings on social media sites. After Obama was re-elected, several large businesses made big cuts in employees and reduced hours to part-time to avoid paying healthcare benefits. My Liberal Friends posted about how horrible and atrocious these evil businesses are acting with no regard for their employees. They fail to see the obvious truth. And they will support future leaders that make more regulations to "fix" the problem of businesses going out of the way to avoid the Accountable Care Act.

Perhaps the government will require that all businesses are not allowed to hire employees for less than 40 hours per week if the employee is willing to work all 40 hours and does not yet have another full time job. And this will lead to businesses laying off more people and causing other "unforeseen" consequences that are detrimental to the economy.

Look at banking regulations put into place in the last few years to "protect" us from EVIL CAPITALISTS because the banking crisis was "a failure of free enterprise, yet again" and we need the government to fix it.

Airliners are heavily regulated because it's safety and required for a strong national infrastructure.

Car manufacturers are now outright owned by the federal government.

Utilities have been run by the government for decades.

Telecoms have consolidated down to a handful of companies and all are beholded to government regulation of FCC spectrums.

Energy companies fall under the Clean Air Act and Obama hates coal and will put a stop to that soon.

Consumer Discretionary are NOT heavily regulated and will likely never be heavily regulated, relative to other industries, however if consumers have no discretionary funds, because of a reduction in spending power due to inflation and regulatory costs of their necessary purchases, then this sector will fail.

I'm hard pressed to see a prosperous future in America, Europe, or any country that basically will be eventually become the Soviet Union.

What's the point of this post if there's no good alternative? Partially to bitch and complain. Partially to spread information. Partially to promote Variable Portfolios.

I feel that in a VP one can potentially hedge against the future by looking at the intermediate future and speculating on sectors that may be strong. For example, government will eventually take over all of healthcare by necessity. There will be no more private R&D in drugs. 99% of drugs will be generic due to cost cutting measures by the government. Thus, instead of investing in the Mercks and Pfizers, consider investing in the Mylans and Tevas and Dr. Reddy's that produce generic drugs. Their margins are small but their volumes will increase with greater government spending.

Look at Defense Contractors. It's plain to see that the US is bankrupt and has no manufacturing capability. Our dollars are being devalued by QE 1, 2, Infinity, and eventually the rest of the world will stop accepting our dollars for their commodities, which would be disastrous because we can't make anything domestically anymore. The solution will be more war. We went into Iraq to grab Saddam because he threatened to take Euros as payment for oil. One of the major reasons the USD is actually worth anything on the global market, in spite of it not really being worth anything, is because OPEC only takes USD, which artificially drives up the demand for dollars and thus the value.

Fortunately for the USD, the Euro is going to fail within 10 to 20 years and there really won't be any other currency. Perhaps Gold demand will soar, but perhaps not.

It's inevitable that the US will go back into war. The broken glass fallacy that war is good for the economy will cause politicians to drive us into war to get us out of a future recession. Invest your VP into defense contractors for the intermediate term.

Make your own judgements about the VP but I urge you to be forward looking. Don't bet on Apple or other short term things. Bet on things that may cause the PP to fail such as the situation described above.

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Why The PP Will Eventually Fail

Simonjester wrote:this all somehow reminds me of Wesley Mouch and the "Equalization of Opportunity Bill" and other laws passed in a certain novel..TripleB wrote:

The irony is reading my Liberal Friends' postings on social media sites. After Obama was re-elected, several large businesses made big cuts in employees and reduced hours to part-time to avoid paying healthcare benefits. My Liberal Friends posted about how horrible and atrocious these evil businesses are acting with no regard for their employees. They fail to see the obvious truth. And they will support future leaders that make more regulations to "fix" the problem of businesses going out of the way to avoid the Accountable Care Act.

Perhaps the government will require that all businesses are not allowed to hire employees for less than 40 hours per week if the employee is willing to work all 40 hours and does not yet have another full time job. And this will lead to businesses laying off more people and causing other "unforeseen" consequences that are detrimental to the economy.

It is and it isn't, but this trend is by no means new. Our entire history as a country is, IMHO, the history of a people constantly moving toward greater freedom in some areas, and pulling away from it out of fear in other areas. Our fear caused us to outlaw alcohol, but we later moved away from that, just as we're now overcoming our fear of marijuana and we previously overcame our fear of empowered women and young black men. Right now we're afraid of Mexicans, banks, and ruinous medical bills, but in time, we'll regain our nerve and undo the damage we don't yet realize we're causing.TripleB wrote: I've recently read Harry Browne's Why Government Doesn't Work and Harry Hazlitt's Economics In One Lesson and I see the course that government is taking and it's one towards stricter and stricter regulation.

All we can do as individuals is try to influence those around us. Preach hope, not fear. Fear is the tool of those who would enslave you; free men have hope. You may find that more people than you think share your feelings about the restrictive government regulations once you speak their language and find common ground. I've gotten liberals to see guns in another light by telling them stories about women defending themselves against rapists and abusive husbands, and conservatives have responded well to my positions on drug prohibition once I point out the horror of no-knock SWAT raids against innocent families.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

-

RuralEngineer

- Executive Member

- Posts: 686

- Joined: Wed Oct 24, 2012 10:26 pm

Re: Why The PP Will Eventually Fail

I think we've lost far greater freedoms than the right to smoke a joint. Also, I'm not sure about you, but ruinous medical bills are as real a fear as armed home invasion for me.

Re: Why The PP Will Eventually Fail

TripleB,

You might want to double check that you haven't gone so far into an ideological hole that the world has ceased to make sense to you. When I read this post I see more confusion than clarity. I mean this in the best possible way.

You might want to double check that you haven't gone so far into an ideological hole that the world has ceased to make sense to you. When I read this post I see more confusion than clarity. I mean this in the best possible way.

everything comes from somewhere and everything goes somewhere

Re: Why The PP Will Eventually Fail

Ruinous medical bills are a byproduct of government regulation, manipulation, and policy.RuralEngineer wrote: I think we've lost far greater freedoms than the right to smoke a joint. Also, I'm not sure about you, but ruinous medical bills are as real a fear as armed home invasion for me.

Medicare and Medicaid set their prices on the market. However they set the price below the cost of production for many services, thus hospitals are forced to raise rates on private payers.

This leads to private payers being unable to pay, which leads the hospitals to raise rates further on the people who do pay.

EMTALA requires hospitals to stabilize patients for free, regardless of their ability to pay. While this sounds all well and good, the cost of transferred over to the private payer who has to pay more for their service to subsidize the non-payer.

Various paperwork regulations and compliance add 10% to 20% of the cost of healthcare. ICD-10 is coming soon and that will be fun.

Artificial shortages of care occur due to:

1) Government causing an artificial demand due to tax breaks on employer sponsored care and free care to Medicare/Medicaid patients

2) Restrictions on licensures to medical professionals

3) Several other factors based on government initiatives

If there's a problem with healthcare costs being too, it's not a problem for the government to fix. It's a problem the government caused. More government fixing can only make it worse.

Re: Why The PP Will Eventually Fail

And what if you're wrong? Things rarely ever turn out the way we think they will. In fact, the future is almost never the way we imagine it will be.TripleB wrote:Bet on things that may cause the PP to fail such as the situation described above.

It's also worth pointing out that you haven't even begun to explain how the Permanent Portfolio "will eventually fail" (the Permanent Portfolio does not require "prosperous future" in order to perform). Your post is nothing more than a heavily biased political rant.

Last edited by Gumby on Tue Nov 13, 2012 11:01 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Why The PP Will Eventually Fail

Perhaps TripleB should change his handle to "InfiniteNihilist".

People get in foul moods and type crazy things sometimes.

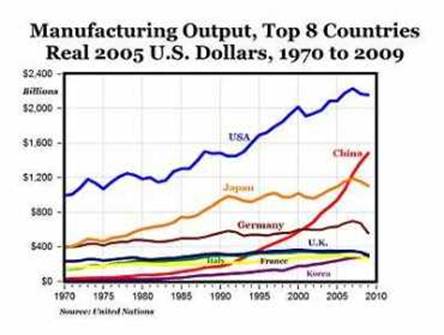

I'm pretty sure that TripleB knows that the U.S. is a manufacturing juggernaut, basically tied with China for highest manufacturing output in the world.

Things aren't as bad as his post makes them seem.

The PP may stop working at some point, or it may just keep grinding along for another 40 years. Who knows? I don't think it's worth worrying about.

People get in foul moods and type crazy things sometimes.

I'm pretty sure that TripleB knows that the U.S. is a manufacturing juggernaut, basically tied with China for highest manufacturing output in the world.

Things aren't as bad as his post makes them seem.

The PP may stop working at some point, or it may just keep grinding along for another 40 years. Who knows? I don't think it's worth worrying about.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- WildAboutHarry

- Executive Member

- Posts: 1090

- Joined: Wed May 04, 2011 9:35 am

Re: Why The PP Will Eventually Fail

American business is very adept at dealing with bureaucracy. If you consider the regulations that have been thrown at business since the 1960s, businesses have figured out how to 1) develop methods/procedures that address regulations at the same cost; or 2) figure out a way to pass those costs on to customers; or 3) change the regulations (or the implementation of the regulations), or some combination of those (and other) adaptations.TripleB wrote:Perhaps the government will require that all businesses are not allowed to hire employees for less than 40 hours per week if the employee is willing to work all 40 hours and does not yet have another full time job. And this will lead to businesses laying off more people and causing other "unforeseen" consequences that are detrimental to the economy.

Ultimately, the cost of all that regulation is borne by the consumer. If the consumer balks, regulations can be rescinded. A trivial example is the short supply of the "special" California gas formulation that resulted in a spike in gas prices earlier this year. Jerry Brown suspended the requirement to use that formulation because consumers squawked. Gas prices came down.

It is the settled policy of America, that as peace is better than war, war is better than tribute. The United States, while they wish for war with no nation, will buy peace with none" James Madison

Re: Why The PP Will Eventually Fail

Any time you hear anyone say "The U.S. doesn't make much of anything anymore", just know that what they are saying is 100% false.TripleB wrote: Look at Defense Contractors. It's plain to see that the US is bankrupt and has no manufacturing capability. Our dollars are being devalued by QE 1, 2, Infinity, and eventually the rest of the world will stop accepting our dollars for their commodities, which would be disastrous because we can't make anything domestically anymore.

Although China has since eclipsed the U.S. in total manufacturing, the U.S.'s manufacturing capacity is still enormous, and FAR larger than any other country in the world.

And even when you compare the U.S. to China, if you consider that China has four times as many people as the U.S., the fact that China has a slight edge on the U.S.'s manufacturing output is less impressive.

Note, too, that since 1970 the U.S.'s manufacturing output advantage over the rest of the world (ex. China) has widened. In other words, the U.S. is a more dominant manufacturing economy today compared to the rest of the world (ex. China) than at any time in the last 40 years.

If anything, it looks like it is Germany that has seen its manufacturing output stagnate in recent decades, which is ironic because everyone always talks about how great the stuff is that Germans build.

I'm really surprised that so many people have bought into this "the U.S. doesn't make anything anymore" narrative. I hear it everywhere and it makes no sense at all.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Why The PP Will Eventually Fail

I understand your concern that we might not see prosperity anytime soon. It's easy to see the current situation as dispiriting -- the U.S. rehired a balkanizing, statist epic fail of a President when we had a successful, pro-liberty executive like Gary Johnson ready to do the job. If you've been a libertarian for long enough, I assume that you are familiar with disappointment.

But people do what people do, and unfortunately sometimes these things affect us. Happily, the Permanent Portfolio is designed with the knowledge that governments tend to do very stupid and very damaging things. Remember that the same man who wrote the book (literally) on why government doesn't work is the man who designed the Permanent Portfolio. He understood at a very deep level the issues that are worrying you today.

We will still find ourselves, no matter what, in some combination of the four basic economic conditions. And if the PP has proven anything in the past few years, it's that it does not require a condition of prosperity in order to thrive. We can thank all of those "crazy" assets that make up the 75% non-stock portion of the portfolio for that!

People are much more familiar with where their iPhone comes from than where a backhoe comes from.

But people do what people do, and unfortunately sometimes these things affect us. Happily, the Permanent Portfolio is designed with the knowledge that governments tend to do very stupid and very damaging things. Remember that the same man who wrote the book (literally) on why government doesn't work is the man who designed the Permanent Portfolio. He understood at a very deep level the issues that are worrying you today.

We will still find ourselves, no matter what, in some combination of the four basic economic conditions. And if the PP has proven anything in the past few years, it's that it does not require a condition of prosperity in order to thrive. We can thank all of those "crazy" assets that make up the 75% non-stock portion of the portfolio for that!

I think this is due to the fact that the U.S. doesn't make a lot of the consumer goods like clothes, toys, neat electronic gizmos, etc. that the typical consumer is most familiar with. The things that people tend to see on a daily basis are much more likely to inform their view of reality.MediumTex wrote: I'm really surprised that so many people have bought into this "the U.S. doesn't make anything anymore" narrative. I hear it everywhere and it makes no sense at all.

People are much more familiar with where their iPhone comes from than where a backhoe comes from.

Re: Why The PP Will Eventually Fail

The question I always come back to is if the PP fails, what investment strategy will give you better risk adjusted returns?

If the PP fails, probably everything is failing

If the PP fails, probably everything is failing

Re: Why The PP Will Eventually Fail

The closest to a "fail" I think you will see with the PP is something like 4-6% returns when the stock market is providing 15%+.clacy wrote: The question I always come back to is if the PP fails, what investment strategy will give you better risk adjusted returns?

If the PP fails, probably everything is failing

This is the scenario that will probably shake the most people out of the PP.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

-

RuralEngineer

- Executive Member

- Posts: 686

- Joined: Wed Oct 24, 2012 10:26 pm

Re: Why The PP Will Eventually Fail

To be fair, there was a time when the idea behind American manufacturing was to make it here and sell it there. Many industries have been embracing a make it here / sell it here, make it there / sell it there philosophy for quite some time. The days of the West being the only location where quality manufacturing can take place are over. Now it often makes sense to manufacture product in the market where it will be sold in order to capitalize on reduced transportation and tariff costs. And then of course, there's China, always willing to extort concessions from foreign companies in return for the "privileged" of having their IP stolen. One of the common ploys is forced joint ventures or mandatory local sourcing.Lone Wolf wrote: People are much more familiar with where their iPhone comes from than where a backhoe comes from.

For example, Caterpillar now has large manufacturing facilities in India and China where they make product that can't meet NA or EU emissions regulations. The developing countries could give a crap about the emissions as long as the product is good value. Costs can be lowered by not shipping machinery weighing several tons by boat across the worlds largest ocean.

Re: Why The PP Will Eventually Fail

I don't mean that the US needs to keep manufacturing, or should even keep manufacturing.

My point is the government is pissing on the strength of the USD for many reasons:

1) Under pressure from domestic exporters who benefit from a weaker dollar (and provide lobbyist money to Congress)

2) Under pressure from mounting sovereign debt to allow inflation to ease the repayment through devalued dollars

3) Under free market pressure as an effect of printing too much money through QE 1, 2, sideways 8, to combat deflation

If the US can't make stuff anymore, then US citizens rely on a strong currency to import and buy things from international manufacturers. If the USD becomes devalued, then we can't import things anymore. And if we've lost domestic manufacturing capability, it won't be a trivial thing to re-assume domestic manufacturing.

When we outsource, we lose the tacit ability to make certain things and will have to go through learning curves again. Additionally, the machinery may be gone and need to be rebuilt.

Most importantly, the raw materials to manufacture things are a global commodity and will be very expensive relative to a weak USD.

Again, I think the PP is the best bet through this, but the problem will be that the US may turn into a 2nd or 3rd world country if things get bad economically. Then people will take to the streets much like Greece during austerity talks.

The difference between Greece and the US is there's a significant number of guns in private citizens hands here. Austerity policies may not go over very well here, which will drive us into a further depression.

I suppose you could use your PP to leave the country. Maybe Mexico will be peaceful and prosperous relative to the US at that point.

Then again, people have been talking Doom and Gloom for 40 years and it hasn't happened yet. Maybe it's just that I'm learning more about screwed up our government policies are and we really can kick the can down the road another 50 years until I'm dead.

My point is the government is pissing on the strength of the USD for many reasons:

1) Under pressure from domestic exporters who benefit from a weaker dollar (and provide lobbyist money to Congress)

2) Under pressure from mounting sovereign debt to allow inflation to ease the repayment through devalued dollars

3) Under free market pressure as an effect of printing too much money through QE 1, 2, sideways 8, to combat deflation

If the US can't make stuff anymore, then US citizens rely on a strong currency to import and buy things from international manufacturers. If the USD becomes devalued, then we can't import things anymore. And if we've lost domestic manufacturing capability, it won't be a trivial thing to re-assume domestic manufacturing.

When we outsource, we lose the tacit ability to make certain things and will have to go through learning curves again. Additionally, the machinery may be gone and need to be rebuilt.

Most importantly, the raw materials to manufacture things are a global commodity and will be very expensive relative to a weak USD.

Again, I think the PP is the best bet through this, but the problem will be that the US may turn into a 2nd or 3rd world country if things get bad economically. Then people will take to the streets much like Greece during austerity talks.

The difference between Greece and the US is there's a significant number of guns in private citizens hands here. Austerity policies may not go over very well here, which will drive us into a further depression.

I suppose you could use your PP to leave the country. Maybe Mexico will be peaceful and prosperous relative to the US at that point.

Then again, people have been talking Doom and Gloom for 40 years and it hasn't happened yet. Maybe it's just that I'm learning more about screwed up our government policies are and we really can kick the can down the road another 50 years until I'm dead.

- Pointedstick

- Executive Member

- Posts: 8866

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Why The PP Will Eventually Fail

Bingo. Notice that no matter how screwed-up things seem to be and get, it all somehow keeps working. People go to work, streets get cleaned, the lights stay on, and kids get educated. It's never as bad as looking purely at the political side would have you believe. And it's my belief that nearly every other area is downright awesome!TripleB wrote: Then again, people have been talking Doom and Gloom for 40 years and it hasn't happened yet. Maybe it's just that I'm learning more about screwed up our government policies are and we really can kick the can down the road another 50 years until I'm dead.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: Why The PP Will Eventually Fail

A weaker dollar isn't necessarily a bad thing. Seriously, it isn't. A 2012 US Dollar is worth $0.04 of an 1890 US Dollar. Did we become a third world country with this massive loss of our currency's value? No. Of course not. All that matters is that the standard of living improves. Our standard of living has increased dramatically since 1890. It makes no difference if your dinner costs 5¢ or $50, so long as you preserve your purchasing power in real terms (even Short Term Treasuries — otherwise known as our "public debt" — have done this for decades). When our exports become more appealing to foreign countries, that's a good thing. It keeps people employed so that they have money to create demand in the economy. When foreign imports become too expensive, from a weak dollar, domestic businesses can often thrive and hire more people.TripleB wrote: My point is the government is pissing on the strength of the USD for many reasons:

1) Under pressure from domestic exporters who benefit from a weaker dollar (and provide lobbyist money to Congress)

Yes, if you let your dollars earn negative real returns you'll be in trouble. And yes, if the dollar becomes undesirable to foreigners, we will likely be in trouble (i.e. the US is then forced to carry foreign-denominated debt). But, since every country is trying to devalue their currency, it seems unlikely that the US will devalue that much faster than the rest of the world. But, of course, you never know. So use the tools you have to preserve your wealth and quit worrying about it.

Inflation doesn't "ease" our ability to pay our debt. Inflation is a potential byproduct of paying our debt. Our Treasuries are entirely "risk free" no matter how strong or weak the dollar is. The US has no trouble paying its debt when its debt is denominated in the currency it issues.TripleB wrote:2) Under pressure from mounting sovereign debt to allow inflation to ease the repayment through devalued dollars

You're giving Quantitative Easing way too much credit. Japan has been using Quantitative Easing for more than a decade and their currency has only gotten stronger and stronger.TripleB wrote:3) Under free market pressure as an effect of printing too much money through QE 1, 2, sideways 8, to combat deflation

Quantitative Easing is mostly a non-event (it actually removes interest income from the private sector when interest-bearing assets are removed from the private sector).Wikipedia.org wrote:Quantitative easing was used unsuccessfully by the Bank of Japan (BOJ) to fight domestic deflation in the early 2000s

Source: http://en.wikipedia.org/wiki/Quantitati ... g#In_Japan

TripleB, I get the impression that you've been listening too many conservative pundits (Glenn Beck, Sean Hannity, etc.) who's sole purpose is to rile you up with flawed logic and scary tales of a dark and stormy future so that you'll buy their books and support their conservative agenda. Never mind that their over-simplified explanations of why we're all doomed don't hold water when you realize that are world is way more complex than they would have you believe.

Make no mistake, our country has big problems. An aging population will likely be a huge drag on our economy for the next few decades. But, worrying about a "weaker" dollar is a waste of everyone's time — particularly when you have a Permanent Portfolio.

Maybe the dollar will be weaker five years from now. Maybe it will be stronger. We just don't know. Whatever happens, the sun will rise and my dog will want to go for a walk.

Last edited by Gumby on Thu Nov 15, 2012 11:34 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Why The PP Will Eventually Fail

It may be time to read or re-read How I Found Freedom In An Unfree World.TripleB wrote: Then again, people have been talking Doom and Gloom for 40 years and it hasn't happened yet. Maybe it's just that I'm learning more about screwed up our government policies are and we really can kick the can down the road another 50 years until I'm dead.

Most of what is bothering you is in your head. The mental space you inhabit is completely up to you, and what the government in a country like the U.S. is doing doesn't really have to have much bearing on how you live your life if you don't want it to.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Why The PP Will Eventually Fail

I guess I am not sure why Mexico looks any more appealing than the US. Is it primarily the national debt that is driving your fear?

everything comes from somewhere and everything goes somewhere

-

flyingpylon

- Executive Member

- Posts: 1102

- Joined: Fri Jan 06, 2012 9:04 am

Re: Why The PP Will Eventually Fail

The part of this argument that I have trouble understanding is: doesn't this assume that your income is actually rising as fast or faster than the dollar is weakening? I'm not sure that is the case for everyone, and it seems like that would mean an erosion of purchasing power is taking place. I can understand the part about preserving wealth by earning positive real returns, but it's not always possible to have the same amount of control over income.Gumby wrote:But, worrying about a "weaker" dollar is a waste of everyone's time — particularly when you have a Permanent Portfolio.

Maybe the dollar will be weaker five years from now. Maybe it will be stronger. We just don't know. Whatever happens, the sun will rise and my dog will want to go for a walk.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Why The PP Will Eventually Fail

Manufacturing is coming back to the USA, because natural gas prices in Europe are 3x higher than here and in Asia they are 6x higher than here. Its simply cheaper to run factories here, especially chemical factories.

So stop worrying, be happy!

So stop worrying, be happy!

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Why The PP Will Eventually Fail

Typically, Short Term Treasuries and banks (via Short Term Treasuries and private credit instruments) have provided a relatively good preservation of wealth. Harry Browne discussed this a number of times. So, this idea that all our purchasing power disappears when the dollar weaken usually isn't true. People just like to whine about it. You do have to factor in taxes of course, but that's another matter.flyingpylon wrote:The part of this argument that I have trouble understanding is: doesn't this assume that your income is actually rising as fast or faster than the dollar is weakening? I'm not sure that is the case for everyone, and it seems like that would mean an erosion of purchasing power is taking place. I can understand the part about preserving wealth by earning positive real returns, but it's not always possible to have the same amount of control over income.Gumby wrote:But, worrying about a "weaker" dollar is a waste of everyone's time — particularly when you have a Permanent Portfolio.

Maybe the dollar will be weaker five years from now. Maybe it will be stronger. We just don't know. Whatever happens, the sun will rise and my dog will want to go for a walk.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Why The PP Will Eventually Fail

That's not true today, though. Interest rates are 0% but inflation is certainly >0%. So the "whiners" are of course correct when they worry that their irreplaceable savings are being eroded by our current policies.Gumby wrote: Typically, Short Term Treasuries and banks (via Short Term Treasuries and private credit instruments) have provided a relatively good preservation of wealth. Harry Browne discussed this a number of times. So, this idea that all our purchasing power disappears when the dollar weaken usually isn't true. People just like to whine about it. You do have to factor in taxes of course, but that's another matter.

We get around all of this fiat mismanagement by investing in gold, but the PP is the only way I know of to do this safely. Outside of the PP, I consider investing in commodities to be a pretty advanced play. All the little old ladies with their money in CDs get raided.

Re: Why The PP Will Eventually Fail

Agreed. Though, what we have now is an extreme situation. It's not indicative of the historical real return of Short Term Treasuries. Luckily Harry Browne gave us the Permanent Portfolio to combat this issue.Lone Wolf wrote:That's not true today, though. Interest rates are 0% but inflation is certainly >0%. So the "whiners" are of course correct when they worry that their irreplaceable savings are being eroded by our current policies.Gumby wrote: Typically, Short Term Treasuries and banks (via Short Term Treasuries and private credit instruments) have provided a relatively good preservation of wealth. Harry Browne discussed this a number of times. So, this idea that all our purchasing power disappears when the dollar weaken usually isn't true. People just like to whine about it. You do have to factor in taxes of course, but that's another matter.

Last edited by Gumby on Fri Nov 16, 2012 3:44 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Why The PP Will Eventually Fail

How many other oddities do there have to be before the PP loses its safety appeal? In the interest of full disclosure, I do not invest in the PP, but like to read about it since it is an elegant theory. But it is little things like zero interest rates, along with a lot of bigger things (like the potential end of the secular bond bull), which make me wonder how the PP can do well going forward. I respect Harry Browne, but he reserved the right to change his mind. I wonder what changes he might make to the PP today in light of the extraordinary extremes we are seeing in asset classes.Lone Wolf wrote:That's not true today, though. Interest rates are 0% but inflation is certainly >0%. So the "whiners" are of course correct when they worry that their irreplaceable savings are being eroded by our current policies.Gumby wrote: Typically, Short Term Treasuries and banks (via Short Term Treasuries and private credit instruments) have provided a relatively good preservation of wealth. Harry Browne discussed this a number of times. So, this idea that all our purchasing power disappears when the dollar weaken usually isn't true. People just like to whine about it. You do have to factor in taxes of course, but that's another matter.

Re: Why The PP Will Eventually Fail

Funny... I look at negative real interest rates and thank my lucky stars that I found the PP. How do you safely protect yourself against negative real interest rates?Gary wrote:How many other oddities do there have to be before the PP loses its safety appeal? In the interest of full disclosure, I do not invest in the PP, but like to read about it since it is an elegant theory. But it is little things like zero interest rates, along with a lot of bigger things (like the potential end of the secular bond bull), which make me wonder how the PP can do well going forward. I respect Harry Browne, but he reserved the right to change his mind. I wonder what changes he might make to the PP today in light of the extraordinary extremes we are seeing in asset classes.Lone Wolf wrote:That's not true today, though. Interest rates are 0% but inflation is certainly >0%. So the "whiners" are of course correct when they worry that their irreplaceable savings are being eroded by our current policies.Gumby wrote: Typically, Short Term Treasuries and banks (via Short Term Treasuries and private credit instruments) have provided a relatively good preservation of wealth. Harry Browne discussed this a number of times. So, this idea that all our purchasing power disappears when the dollar weaken usually isn't true. People just like to whine about it. You do have to factor in taxes of course, but that's another matter.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.