Page 5 of 5

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 8:16 am

by ozzy

The traditional 60/40 portfolio has gone from bad to worse. Down -21.3% YTD. Worst performance since 1931. Ugh.

https://twitter.com/charliebilello/stat ... 78/photo/1

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 9:36 am

by mathjak107

Portfolio visualizer shows 60% spy 40% bnd down 20% in 2008

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 10:21 am

by jason

mathjak107 wrote: ↑Wed Oct 12, 2022 9:36 am

Portfolio visualizer shows 60% spy 40% bnd down 20% in 2008

That makes sense since BND includes a lot of non-Treasuries like corporate bonds and mortgage backed securities. The chart used only 10 year Treasuries as bonds.

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 10:24 am

by mathjak107

I think more representative is a total bond fund as far as what most use or even how a balanced fund would look

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 10:27 am

by jason

mathjak107 wrote: ↑Wed Oct 12, 2022 10:24 am

I think more representative is a total bond fund as far as what most use or even how a balanced fund would look

I agree. I think BND is more in line with what most people doing a 60/40 have.

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 1:15 pm

by GT

mathjak107 wrote: ↑Wed Oct 12, 2022 10:24 am

I think more representative is a total bond fund as far as what most use or even how a balanced fund would look

In 2008 I think a lot of 401K's had PIMCO Total Return as the bond fund.

Not sure if it makes much of a difference overall

SPY (60%) and PIMCO Total Return (40%) comes out to -20.15% for 2008

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 12, 2022 1:49 pm

by mathjak107

We had fidelity total bond in ours ..it really got hit ..

Fidelity had their core funds which were funds fore the fund managers to use .

The cores hadA lot of paper that turned toxic so even their most conservative bond funds got creamed

Re: PP YTD performance - was it the worst ever?

Posted: Thu Oct 13, 2022 2:56 am

by seajay

ozzy wrote: ↑Wed Oct 12, 2022 8:16 am

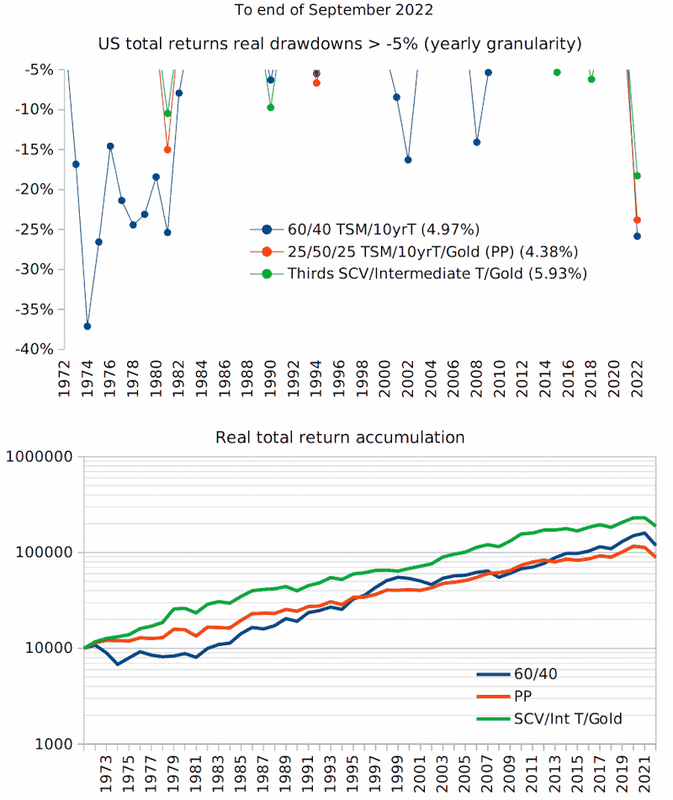

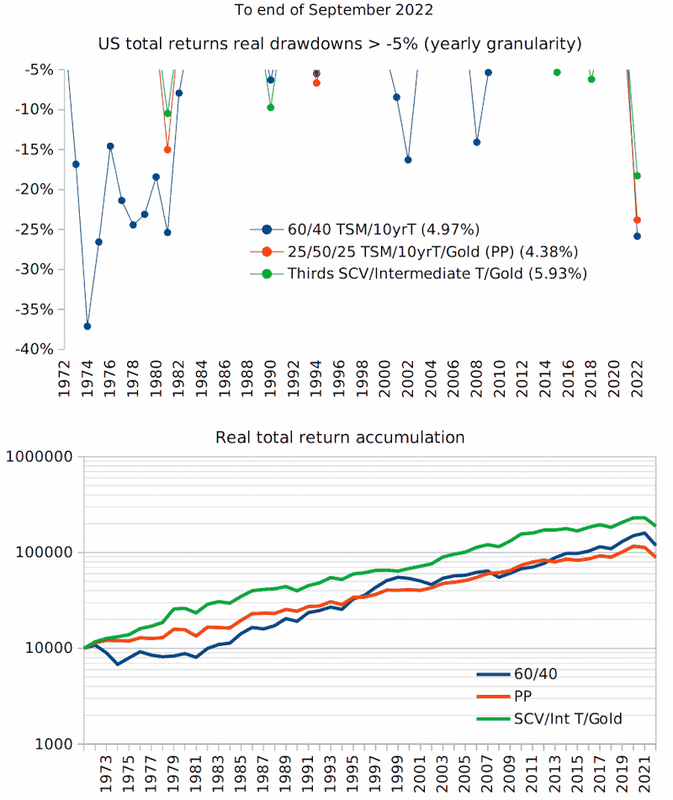

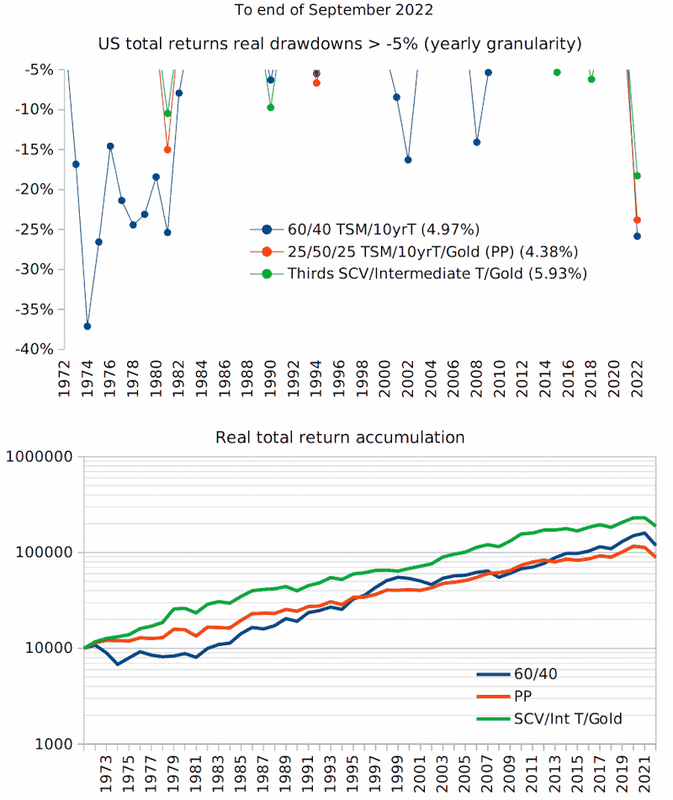

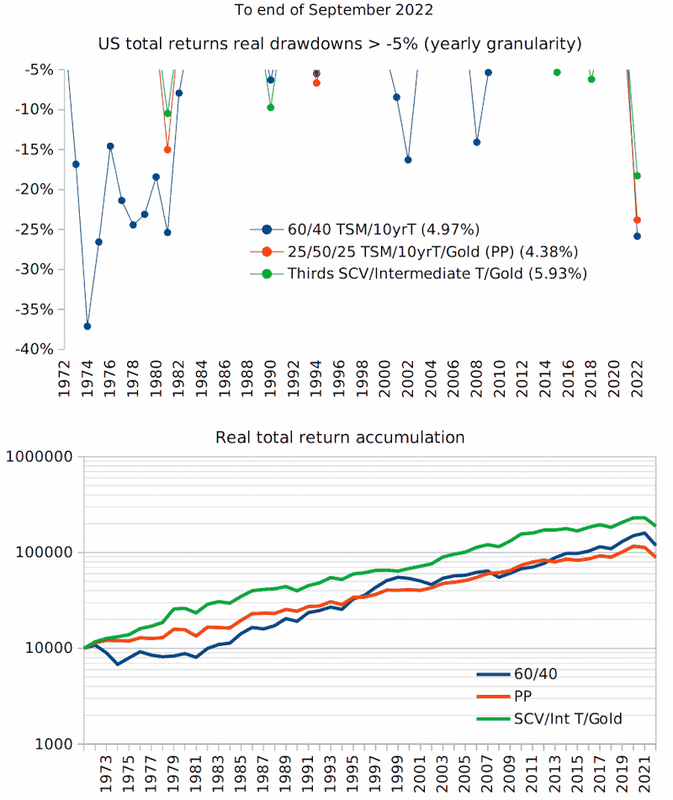

The traditional 60/40 portfolio has gone from bad to worse. Down -21.3% YTD. Worst performance since 1931. Ugh.

1974 was a deeper drawdown in real terms for 60/40 that current/recent

Re: PP YTD performance - was it the worst ever?

Posted: Thu Oct 13, 2022 10:12 am

by jason

seajay wrote: ↑Thu Oct 13, 2022 2:56 am

ozzy wrote: ↑Wed Oct 12, 2022 8:16 am

The traditional 60/40 portfolio has gone from bad to worse. Down -21.3% YTD. Worst performance since 1931. Ugh.

1974 was a deeper drawdown in real terms for 60/40 that current/recent

Maybe it would also be worth looking at a cashless PP - thirds of LTTs, stocks, and gold. That performs a lot better than the regular PP, historically (but not lately, obviously).

Re: PP YTD performance - was it the worst ever?

Posted: Wed Oct 19, 2022 5:36 pm

by seajay

jason wrote: ↑Thu Oct 13, 2022 10:12 am

seajay wrote: ↑Thu Oct 13, 2022 2:56 am

ozzy wrote: ↑Wed Oct 12, 2022 8:16 am

The traditional 60/40 portfolio has gone from bad to worse. Down -21.3% YTD. Worst performance since 1931. Ugh.

1974 was a deeper drawdown in real terms for 60/40 that current/recent

Maybe it would also be worth looking at a cashless PP - thirds of LTTs, stocks, and gold. That performs a lot better than the regular PP, historically (but not lately, obviously).

By decade, 1980 and

Dow/Gold was very low (stocks cheap/gold expensive) .. chuck out gold (thirds each stock/LTT/cash). Similar for 1990. 2000 and Dow/Gold was very high, stocks expensive/gold cheap, as were PE's etc indicating stocks were expensive (so thirds each LTT/cash/Gold). 2010 and Dow/Gold was again back down to lowish levels (thirds stock/cash/LTT). 2020 ... and LTT's low yields (thirds stock/cash/gold).

If you held a PP minus the 'expensive' asset for a decade as measured at the start of each decade

1980's/90's

2000's

2010's

2020's to recent

In total $10,000 grew to $454,403, compared to $182,019

for the PP (3.69% annualized real). Near-as 2.5 times more over a little under 43 years (so 2.15% annualized more, which would make a 3.69 + 2.15 = 5.84% annualized real).

If you didn't rebalance yearly, just the above rotations once/decade, left as is for the decade, then the final value was $547,402, 3x more than the PP (6.3% annualized real). 100% TSM yielded 7.49% annualized real from the start of 1980, but with much deeper down bad-years. 60/40 yearly rebalanced 5.39% annualized real (5.77% if not rebalanced). If again you didn't rebalance other than at the start of each decade and held Small Cap Value stock instead of TSM, then that ended with a $639,472 final value, 3.51 times more than the PP (6.66% annualized real).

If you scroll down to the Annual returns bars in each of the above links that also provides a indicator of bad years of which, until the current year, there were few and very small bad year declines. Current year to end of September -11% (thirds each stock/cash/gold).

If when drawing a income you withdraw in proportion of the current weightings at the time, then the same % rewards are achieved, just a lower final value amount due to the withdrawals.

Your cashless PP suggestion comes in better reward than the PP, but deeper bad years, and less rewarding ($253,826 final value) than the rotational approach.

Re: PP YTD performance - was it the worst ever?

Posted: Mon Dec 05, 2022 9:07 am

by Xan

A lot of lockstep this morning. :-(

Re: PP YTD performance - was it the worst ever?

Posted: Mon Dec 05, 2022 3:48 pm

by Kbg

Yep...I don't have my data in front of me but correlations have been on the rise for a while now.

Re: PP YTD performance - was it the worst ever?

Posted: Mon Dec 05, 2022 11:49 pm

by Mark Leavy

The fascinating thing about uncorrelated assets is that if they don't move in lockstep from time to time - then they are by definition correlated.

True randomness has to appear to show patterns or it is not random.

Just a fun musing. Nothing that applies directly to the nature of the Permanent Portfolio's primary asset classes.

Re: PP YTD performance - was it the worst ever?

Posted: Thu Dec 08, 2022 11:39 am

by Smith1776

YTD performance for the Canadian PP is -4.61%. Holding steady.

I like it.

Re: PP YTD performance - was it the worst ever?

Posted: Thu Dec 08, 2022 6:48 pm

by seajay

Kbg wrote: ↑Mon Dec 05, 2022 3:48 pm

Yep...I don't have my data in front of me but correlations have been on the rise for a while now.

Since 2013 (Yellen), and there's been a return to a semi-pegging, a multi-facet gold/dollar standard and as such gold has been flatish/range-bound. Not doing what otherwise might have been expected. As such the PP would seem to be performing more as-expected in other countries, whilst not so in the US.

Re: PP YTD performance - was it the worst ever?

Posted: Sat Dec 10, 2022 7:55 pm

by stpeter

seajay wrote: ↑Thu Dec 08, 2022 6:48 pm

Since 2013 (Yellen), and there's been a return to a semi-pegging, a multi-facet gold/dollar standard and as such gold has been flatish/range-bound. Not doing what otherwise might have been expected. As such the PP would seem to be performing more as-expected in other countries, whilst not so in the US.

The strong dollar hasn't helped the gold portion of the HBPP over the last few years, that's for sure. Do you think the "semi-pegging" starting in 2013 was a policy decision by the Fed?

Re: PP YTD performance - was it the worst ever?

Posted: Sun Dec 11, 2022 2:31 pm

by seajay

stpeter wrote: ↑Sat Dec 10, 2022 7:55 pm

seajay wrote: ↑Thu Dec 08, 2022 6:48 pm

Since 2013 (Yellen), and there's been a return to a semi-pegging, a multi-facet gold/dollar standard and as such gold has been flatish/range-bound. Not doing what otherwise might have been expected. As such the PP would seem to be performing more as-expected in other countries, whilst not so in the US.

The strong dollar hasn't helped the gold portion of the HBPP over the last few years, that's for sure. Do you think the "semi-pegging" starting in 2013 was a policy decision by the Fed?

https://www.congress.gov/bill/113th-con ... -bill/1576

Dollar Bill Act of 2013 - Directs the Board of Governors of the Federal Reserve System (Board) to: (1) designate a "Target Week"; (2) employ a random process to select a specific day, hour, minute, and second during such Target Week as "Target Moment" (which shall not be publicly disclosed); (3) make the value of the U.S. dollar at the Target Moment equal to the price of gold on the exchange operated by the Commodities Exchange, Inc. (COMEX) of the New York Mercantile Exchange, Inc.; and (4) maintain the value of the U.S. dollar within plus or minus 2% of such price ("Target Range") thereafter.

https://www.bullionvault.com/gold-news/ ... -041120181

Greenspan from 2017:

"When I was Chair of the Federal Reserve I used to testify before US Congressman Ron Paul, who was a very strong advocate of gold. We had some interesting discussions. I told him that US monetary policy tried to follow signals that a gold standard would have created. That is sound monetary policy even with a fiat currency.

On February 27, 2015, Yellen met with a group of twenty-one members of "the center right", which included American Principles in Action chairman Sean Fieler; APA monetary policy director Steve Lonegan, Ralph Benko, Prof. Brian Domitrovic, Judy Shelton, and then-Cato Institute president John Allison – all of them among the best of a rather small group of gold standard advocates (or, at the least, people friendly to the idea).

To summarize: when monetary policy more closely resembles a gold standard system (that is, the value of the Dollar is more stable vs. gold), good things happen; and when it does not, bad things happen.

If a policy, what does that mean for the PP? Well when on the gold standard, money/gold convertible at a fixed rate, it makes more sense to hold money, deposited into treasuries to earn interest - as that's like the state paying you for it to securely store your gold.

Re: PP YTD performance - was it the worst ever?

Posted: Mon Jan 09, 2023 4:54 pm

by johnnywitt

jason wrote: ↑Tue Sep 06, 2022 2:12 pm

I was just wondering if the performance of the PP year-to-date is the worst it has ever performed, or has it had a period(s) in the past where it actually performed worse? I've been doing the PP for 9 years and my returns are anemic. My CAGR is around 5%. Because I am retired and living off of my investments, I'm looking at the possibility of having to move into riskier investments or else having to slash my lifestyle/living expenses, which my wife probably will not want to tolerate. She'd rather take more risk than do that. Are many people here still optimistic about it bouncing back?

How would your Wife feel if we entered a 1929-1953 or a 1966-1982 event, or maybe a Japanese style meltdown. I wonder how she would

feel about that.