Safe Withdrawal Rates

Moderator: Global Moderator

Safe Withdrawal Rates

https://www.morningstar.com/podcasts/the-long-view

Recommended Podcast called "The Long View". This particular podcast is interesting because it's an interview with the person attributed to the four percent rule, Bill Bengen. The podcast in general is excellent.

He talks about using the Schiller CAPE plus an index to inflation as a formula for SWR. But unfortunately he does not go into much detail. But overall it's a good listen to see how someone with alot of experience still sees todays environment as difficult to navigate.

Recommended Podcast called "The Long View". This particular podcast is interesting because it's an interview with the person attributed to the four percent rule, Bill Bengen. The podcast in general is excellent.

He talks about using the Schiller CAPE plus an index to inflation as a formula for SWR. But unfortunately he does not go into much detail. But overall it's a good listen to see how someone with alot of experience still sees todays environment as difficult to navigate.

Re: Safe Withdrawal Rates

I am currently of the opinion that the 4% rule, or withdrawal strategies centred roughly around that neighbourhood, can still be salvaged with judicious use of factor exposure. An internally diversified portfolio with momentum, value, size, and profitability tilts may still be able to support that number for a retiree today.

A market cap weighted strategy though? Good luck with that one...

A market cap weighted strategy though? Good luck with that one...

Re: Safe Withdrawal Rates

I just retired (early) at the end of October. Are you saying I'm screwed? :/

I can't help but feel my timing is the worst ever, as so many things are in flux - inflation, house prices (or cost to build - we're building), market volatility...very hard to feel like I'm on solid footing, even though I made my decision based on a 3% withdrawal rate.

I'm still ~75% traditional PP and ~25% Wellesley. I'll just be keeping an eye on things and keeping my network in tact in case I need to come out of retirement for a bit to refill the coffers

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

We retired 6-1/2 years ago .

The day after we retired China devalued their currency and markets fell .

Well 6 1/2 years later despite spending 6 figures a year to live we are way way higher then the day we retired

The day after we retired China devalued their currency and markets fell .

Well 6 1/2 years later despite spending 6 figures a year to live we are way way higher then the day we retired

Re: Safe Withdrawal Rates

IMHO - You are probably well positioned for the four percent rule because Bill Bengen, and likely most other folks, are talking about stocks and bond based portfolio's. And Wellesley is so heavy in bonds that a crash (other than corporate bond default risks) wont hammer Wellesley.drumminj wrote: ↑Thu Dec 16, 2021 7:02 amI just retired (early) at the end of October. Are you saying I'm screwed? :/

I can't help but feel my timing is the worst ever, as so many things are in flux - inflation, house prices (or cost to build - we're building), market volatility...very hard to feel like I'm on solid footing, even though I made my decision based on a 3% withdrawal rate.

I'm still ~75% traditional PP and ~25% Wellesley. I'll just be keeping an eye on things and keeping my network in tact in case I need to come out of retirement for a bit to refill the coffers

Plus you are in the excellent position of still being able to generate an income if all hell breaks loose. So good job!

Re: Safe Withdrawal Rates

Stupid question, but how did you choose that (conservative IMHO) number - 3% - something that's tad less than the notorious 4% ? If I recall correctly 3% is even lower than the perpetual withdrawal rate of the classic HBPP. Is that your intention ?

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

To me 3% is a very inefficient use of ones hard earned savings .

If you are not a worst case poster child , which with a conventional portfolio there was a 5% chance of being, then a safe withdrawal rate would be in the 6 to 6-1/2% range .

I didn’t scrimp ,save and invest for a lifetime just to look at what we accumulated and leave it not enjoyed

If you are not a worst case poster child , which with a conventional portfolio there was a 5% chance of being, then a safe withdrawal rate would be in the 6 to 6-1/2% range .

I didn’t scrimp ,save and invest for a lifetime just to look at what we accumulated and leave it not enjoyed

Re: Safe Withdrawal Rates

Jumping in, and for most 65 year old retirees even a 25 year SWR period is optimistic, let alone 30 years. And for those that do get to 25 years (age 90) perhaps spending will be more a case of their home having been sold to fund all-inclusive care-home residency.

On those grounds 25 years of 4% SWR is safe, subject to consistent inflation pacing portfolio 'growth'. Most assets will broadly pace inflation or otherwise decline to being so cheap to no longer really be considered a asset. Diversifying across multiple 0% real expectancy assets is more inclined to dilute down overall portfolio volatility.

The PP is in effect diversifying across four assets that each might broadly be expected to 0% real and where if one lags 0% real over one time period others might beat 0% to compensate. Cash tends to be the least volatile at 0% real, but even that can see multi-years of lag, when gold might lead. When gold lags, stocks might lead and vice-versa. LTT's are somewhat like a time-shifted version of cash, out of phase with cash so-to-speak.

3% is more inclined to leave some for heirs, or cover longevity/higher-later-life-costs. Could be considered as drawing 4% SWR but then saving/(re)investing 25% of that for heirs/longevity. But to get to where 3% is enough does mean that you worked longer or were otherwise lucky in some way to reach a higher number than required for your purposes. If someone has $20K of pension income stream, expects to spend $40K, so requires $20K of investment income stream, then 4% SWR suggests a $500K portfolio value being required. At 3% that increases to $666K, a additional $166K amount to be saved up. However for some that were near the $500K figure the last year of accumulation/saving might have seen a +33% portfolio gain 'good year' outcome. Reducing to 3% SWR under such circumstance is more protective against that +33% year perhaps being a up-spike that might be backed-out-of/given-back the next year.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

We tend to not use 25 years especially if a couple because each can out live the other increasing life expectancy by a lot

But the other reason is we don’t spend like robots …some years can be way above budget with unexpected spending and emergencies…then there are cars , renovations and health issues to deal with .

My first year in retirement i got hit with a down year and 25k in unexpected dental.

So 30 years at 4% is so conservative that out of the 129 30 year cycles we had to date 90% of the time you ended 30 years later with more than you started ..2/3s of the time you ended with 2x what you started with a 60/40 so it creates a nice safety net

But the other reason is we don’t spend like robots …some years can be way above budget with unexpected spending and emergencies…then there are cars , renovations and health issues to deal with .

My first year in retirement i got hit with a down year and 25k in unexpected dental.

So 30 years at 4% is so conservative that out of the 129 30 year cycles we had to date 90% of the time you ended 30 years later with more than you started ..2/3s of the time you ended with 2x what you started with a 60/40 so it creates a nice safety net

Re: Safe Withdrawal Rates

Not a stupid question at all.

The short answer is: just to be conservative. We have no need/desire to leave a legacy, but we're also retiring early (mid 40s) so have more risk -- we need the money to last longer than 25yrs. I ran a few calculators, looked at all the possible outcomes/failure scenarios, and also made my own assessment of the current state of the world/possible returns. 3.5% seemed possible but risky, so I went with 3% (and round numbers).

I also know that while I tried to capture future monthly/annual expenses, I surely left something out (and healthcare is hard to estimate), so wanted to make sure my modeling had more of a buffer.

So, based on "feel" mostly (while trying to look at hard #s as best I could), I made the decision assuming a 3% withdrawal rate and 25% effective tax rate on those withdrawals.

To the other comments here, we can certainly adjust based on how things are going -- as I mentioned earlier, either going back to work to refill the coffers a bit, or being young enough to still travel more should we feel flush with cash and willing to deal with all the hassles

If anyone sees bad assumptions in the above, I'd love the feedback. Given I'm only a month or so in at this point, I'm freaking out a little TBH

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

To hold 4% over 30 years takes a 2% real return the first 15 years . But that could leave you with a buck the 31st year .

So the balance is important too since we have to cover unexpected spending too .

So it is easy to monitor along the way …certainly if five years in you are below that average a red flag should go up .

All the failures at 4% , 1907 ,1929, 1937, 1965 and 1966 failed because the first 15 ytears were real crappy.

If retirement periods are longer than 30 years Higher equity levels did very well …

So the balance is important too since we have to cover unexpected spending too .

So it is easy to monitor along the way …certainly if five years in you are below that average a red flag should go up .

All the failures at 4% , 1907 ,1929, 1937, 1965 and 1966 failed because the first 15 ytears were real crappy.

If retirement periods are longer than 30 years Higher equity levels did very well …

Re: Safe Withdrawal Rates

Are these for 100% stock portfolios or for 60/40 stock bond or for something else? The reason I ask is that while I know 1907, 1929, 1965, and 1966 failed at 4% for 30 years....IIRC starting in 1937 a 75/25, 70/30, 65/35, or 60/40 blend of US stocks and US intermediate-term Treasuries survived OK; you might not have had much left over after 30 years but it did survive the 30 year period.mathjak107 wrote: ↑Fri Dec 17, 2021 7:47 am To hold 4% over 30 years takes a 2% real return the first 15 years . But that could leave you with a buck the 31st year .

So the balance is important too since we have to cover unexpected spending too .

So it is easy to monitor along the way …certainly if five years in you are below that average a red flag should go up .

All the failures at 4% , 1907 ,1929, 1937, 1965 and 1966 failed because the first 15 ytears were real crappy.

If retirement periods are longer than 30 years Higher equity levels did very well …

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

50/50 to 60/40

Re: Safe Withdrawal Rates

OK, I just re-checked my spreadsheets I used to calculate this and not only did a 60/40 or 50/50 US stock/ITT portfolio survive 30 years at an inflation-adjusted 4% withdrawal, it survived 40 years (well, it would've survived even more than that....I stopped the test at 1976 because I assumed our erstwhile retiree--if he was 65 in 1937--would likely be dead anyway by then or pretty soon after it)!

This assumes a withdrawal of $4,000 from a $100,000 for the first year; after that, the withdrawal is adjusted for inflation each subsequent year. Withdrawals are assumed to be taken all on Jan 1st of each year.

I tested it using both US TSM and US S&P 500. Data for each was taken from a recent version of the Simba/Siamond backtest portfolio spreadsheet on Bogleheads which is not exactly known for being inaccurate.

Since two of the portfolio's early years (1938 and 1939) even had slight deflation (roughly one and a half percent each year) I even tried simply not cutting the withdrawal and instead using 1937's $4,000 withdrawal for those years. The portfolio still survived 30 and 40 years.

I wonder if the portfolio simulation that assumed 1937 failed at 4% used LTTs instead of ITTs....that likely would've done it; there was a 40-year bear market in long-term Treasuries from the early 1940s to mid-1981.

-

murphy_p_t

- Executive Member

- Posts: 1675

- Joined: Fri Jul 02, 2010 3:44 pm

Re: Safe Withdrawal Rates

ppnewbie wrote: ↑Wed Dec 15, 2021 3:19 pm https://www.morningstar.com/podcasts/the-long-view

Recommended Podcast called "The Long View". This particular podcast is interesting because it's an interview with the person attributed to the four percent rule, Bill Bengen. The podcast in general is excellent.

He talks about using the Schiller CAPE plus an index to inflation as a formula for SWR. But unfortunately he does not go into much detail. But overall it's a good listen to see how someone with alot of experience still sees todays environment as difficult to navigate.

He mentions in there that he's 20% equities.

Wow.

That gives me pause.

I like what he talks about shifting allocations depending on valuation.

I wonder how his past performance compares to the permanent portfolio.

Re: Safe Withdrawal Rates

Off topic but, mathjak107, how do you deal with the higher taxes of living in NYC? I'm retired and live there too.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

Our taxes are very very low on the state and local .

My wife’s pension isn’t taxed by New York , our social security isn’t taxed by the state , my one day of work I do goes right in the 401k and because we have a nys partnership plan for long term care we get a 1600 dollar tax credit on the premiums .

I do all my trading in my ira .

Last year we didn’t even make enough New York taxable income to even take the full 1600 …I had to carry it over .

Plus we have a huge carry over tax write off from my cost basis in the Real estate LLC we sold off .

I will have to start trading in the taxable account to eventually use all of it

My wife’s pension isn’t taxed by New York , our social security isn’t taxed by the state , my one day of work I do goes right in the 401k and because we have a nys partnership plan for long term care we get a 1600 dollar tax credit on the premiums .

I do all my trading in my ira .

Last year we didn’t even make enough New York taxable income to even take the full 1600 …I had to carry it over .

Plus we have a huge carry over tax write off from my cost basis in the Real estate LLC we sold off .

I will have to start trading in the taxable account to eventually use all of it

Re: Safe Withdrawal Rates

Thanks. I have fairly high capital gains distributions in my non-deferred accounts so I guess I'm kind of stuck giving NY state and city some money every year, unless I move.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

We have a 216k carry over to use from the sale of the LLC …all we have except for contra fund with about 100k in gains even after yearly capital gain distributions is bond funds .

So since I don’t want to sell contra there is little to offer in the taxable .

Be careful with the taxable account …if you are going to go on Medicare soon , they look back 2 years to set your premium …you can see some nasty surcharges added

Re: Safe Withdrawal Rates

Thanks for sharing. I arrange things pretty much on the conservative side too. I am in my very early 40s, and while substantially decreased the distance to FIRE in the last 6-7 years, still not able to say I am ready to cover all the expenses of a family of 4 (with established spending habits) from investing income...

Re: Safe Withdrawal Rates

?mathjak107 wrote: ↑Fri Dec 17, 2021 7:47 am To hold 4% over 30 years takes a 2% real return the first 15 years . But that could leave you with a buck the 31st year

I see a figure of 2% for the first 12 years, 0% thereafter, sustaining a 4% SWR.

Or 20% the first year, 0% thereafter.

Or 0% in all years except the 10th year that gained 33%

Or 0% in all years except a 50% gain in the 15th year

... Fundamentally low risk, and modest gains in earlier years, avoiding earlier years losses ... better serves 4% SWR.

A consistent 0% real of course supports 3.3% SWR (or 4% for 25 years).

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

Kitces found that in order to clear the worst case scenarios we had it is 2% the first 15 years in real return .

Because you are spending down , sequence risk ate up to much excess money the first 15 years ..

Even the best bull markets coming later on couldn’t save them in 1965/1966.

Don’t forget we are working with real outcomes that ended up being the worst to date

Because you are spending down , sequence risk ate up to much excess money the first 15 years ..

Even the best bull markets coming later on couldn’t save them in 1965/1966.

Don’t forget we are working with real outcomes that ended up being the worst to date

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Safe Withdrawal Rates

Here is the math behind the worst cases to date

what caused the failures were real returns being poor the first 15 years because of inflation

30 year

1907 stocks returned 7.77% -- bonds 4.250-- rebalanced portfolio 7.02- - inflation 1.64--

1929 stocks 8.19% - - bonds 1.74%-- rebalanced portfolio 6.28-- inflation 1.69--

1937 stocks 10.12 - - bonds 2.13 - rebalanced portfolio -- 7.24 inflation-- 2.82

1966 stocks 10.23 - -bonds 7.85 -- rebalanced portfolio 9.56- - inflation 5.38

for comparison the 140 year average's were: stocks 8.39--bonds 2.85%--rebalanced portfolio 6.17% inflation 2.23%

..

so what made those time frames the worst ? what made them the worst is the fact in every single retirement time frame the outcome of that 30 year period was determined not by what happened over the 30 years but the entire outcome was decided in the first 15 years.

..

so lets look at the first 15 years in those time frames determined to be the worst we ever had.

..

1907--- stocks minus 1.47%---- bonds minus .39%-- rebalanced minus .70% ---inflation 1.64%

.

1929---stocks 1.07%---bonds 1.79%---rebalanced 2.29%--inflation 1.69%

.

1937---stocks -- 3.45%---bonds minus 3.07%-- rebalanced 1.23%--inflation 2.82%

.

1966-stocks minus .13%--bonds 1.08%--rebalanced .64%-- inflation 5.38% it is those 15 year horrible time frames that the 4% safe withdrawal rate was born out of since you had to reduce from what could have been 6.50% as a swr down to just 4% to get through those worst of times.

what caused the failures were real returns being poor the first 15 years because of inflation

30 year

1907 stocks returned 7.77% -- bonds 4.250-- rebalanced portfolio 7.02- - inflation 1.64--

1929 stocks 8.19% - - bonds 1.74%-- rebalanced portfolio 6.28-- inflation 1.69--

1937 stocks 10.12 - - bonds 2.13 - rebalanced portfolio -- 7.24 inflation-- 2.82

1966 stocks 10.23 - -bonds 7.85 -- rebalanced portfolio 9.56- - inflation 5.38

for comparison the 140 year average's were: stocks 8.39--bonds 2.85%--rebalanced portfolio 6.17% inflation 2.23%

..

so what made those time frames the worst ? what made them the worst is the fact in every single retirement time frame the outcome of that 30 year period was determined not by what happened over the 30 years but the entire outcome was decided in the first 15 years.

..

so lets look at the first 15 years in those time frames determined to be the worst we ever had.

..

1907--- stocks minus 1.47%---- bonds minus .39%-- rebalanced minus .70% ---inflation 1.64%

.

1929---stocks 1.07%---bonds 1.79%---rebalanced 2.29%--inflation 1.69%

.

1937---stocks -- 3.45%---bonds minus 3.07%-- rebalanced 1.23%--inflation 2.82%

.

1966-stocks minus .13%--bonds 1.08%--rebalanced .64%-- inflation 5.38% it is those 15 year horrible time frames that the 4% safe withdrawal rate was born out of since you had to reduce from what could have been 6.50% as a swr down to just 4% to get through those worst of times.

Re: Safe Withdrawal Rates

mathjak107 wrote: ↑Fri Dec 17, 2021 2:20 pmI already found that out.

We have a 216k carry over to use from the sale of the LLC …all we have except for contra fund with about 100k in gains even after yearly capital gain distributions is bond funds .

So since I don’t want to sell contra there is little to offer in the taxable .

Be careful with the taxable account …if you are going to go on Medicare soon , they look back 2 years to set your premium …you can see some nasty surcharges added

Re: Safe Withdrawal Rates

Thanks mathjak107mathjak107 wrote: ↑Fri Dec 17, 2021 2:48 pm Here is the math behind the worst cases to date

what caused the failures were real returns being poor the first 15 years because of inflation

30 year

1907 stocks returned 7.77% -- bonds 4.250-- rebalanced portfolio 7.02- - inflation 1.64--

1929 stocks 8.19% - - bonds 1.74%-- rebalanced portfolio 6.28-- inflation 1.69--

1937 stocks 10.12 - - bonds 2.13 - rebalanced portfolio -- 7.24 inflation-- 2.82

1966 stocks 10.23 - -bonds 7.85 -- rebalanced portfolio 9.56- - inflation 5.38

for comparison the 140 year average's were: stocks 8.39--bonds 2.85%--rebalanced portfolio 6.17% inflation 2.23%

..

so what made those time frames the worst ? what made them the worst is the fact in every single retirement time frame the outcome of that 30 year period was determined not by what happened over the 30 years but the entire outcome was decided in the first 15 years.

..

so lets look at the first 15 years in those time frames determined to be the worst we ever had.

..

1907--- stocks minus 1.47%---- bonds minus .39%-- rebalanced minus .70% ---inflation 1.64%

.

1929---stocks 1.07%---bonds 1.79%---rebalanced 2.29%--inflation 1.69%

.

1937---stocks -- 3.45%---bonds minus 3.07%-- rebalanced 1.23%--inflation 2.82%

.

1966-stocks minus .13%--bonds 1.08%--rebalanced .64%-- inflation 5.38% it is those 15 year horrible time frames that the 4% safe withdrawal rate was born out of since you had to reduce from what could have been 6.50% as a swr down to just 4% to get through those worst of times.

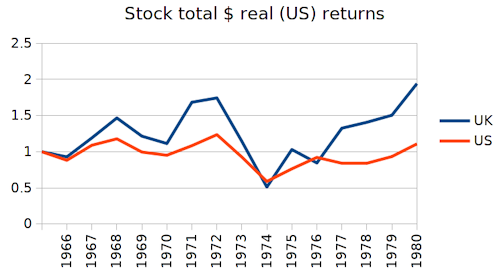

Looking at the valuations (PE, interest rates, inflation rates and other measures) for those start dates and there were no real clues as to what was to come. Looks more a case of each ran into wars (WW1, WW1, Vietnam) causing the hits. For the 1966 running into Vietnam war case looking at UK stock returns (London pretty much reflects global (hub for law/accounting/financials)) compared to US (in US/$ adjusted terms) for the 15 years and US was (approx) 0% whilst the UK stocks doubled.

For WW1 I note that shifting all into gold (or silver) for the war years didn't really save you either