I agree ...the term is irrelevant when you are not tracking the same thing

POLL: How did you overcome the fear of tracking error?

Moderator: Global Moderator

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: POLL: How did you overcome the fear of tracking error?

I think it’s tracking error with respect to “the market”. I should have just put it in the SP500 like everyone else instead of this weird PP concept. I’m under-performing my peers...

Tracking error can also mean your S&P500 ETF is supposed to match the S&P500 after expenses but it under-performs or over-performs annually by 1%,2%...

The PP is not the S&P so your benchmark is different. Same as if someone held international stocks.

Tracking error can also mean your S&P500 ETF is supposed to match the S&P500 after expenses but it under-performs or over-performs annually by 1%,2%...

The PP is not the S&P so your benchmark is different. Same as if someone held international stocks.

Re: POLL: How did you overcome the fear of tracking error?

It's "tracking error regret" not "fear of tracking error." And if you look at Tyler's recent posts in the "commentary" section of Portfolio Charts about portfolios that have done best during recessions and market crises, as well as those that offer the smoothest ride and highest safe and perpetual withdrawal rates, all of them have substantial tracking error relative to the U.S. stock and bond market and classic portfolios like 60:40 or Three Fund as well as more complicated slice-and-dice, value-and-small tilted, internationally-diversified approaches as typified by the Merriman Ultimate.

In your original post about switching from the All Weather to the PP over on Bogleheads you said: "I'm a novice who is seeking a way to produce 7-8% annualized return safely with the least volatility and drawdown risk." That was my dream as well when I left the corporate world prematurely and I implemented a more complex version of this "conservative" MPT portfolio that has been through DFA's backtesting system and *couldn't* lose more than 8% during a market crisis:

https://portfoliocharts.com/portfolio/s ... portfolio/

Back in the real world, my even more diversified version of that portfolio with less than 40% equities was down 23% during late 2008. I'd have been much better off in Vanguard Wellesley, which lost only 12.5% that year and more than recovered in '09.

The PITA with the PP is not just tracking error but owning two assets (gold and LTT's) that mainstream investing sites like Bogleheads think are respectively stupid choices at any time (gold) and an insanely stupid choice at the present time (LTT's) along with a soupçon of plain vanilla stocks and a boatload of cash returning nothing.

In any case, I think you ought to cut your annual return expectations in half to 3-4% and then get clear about whether it's volatility or drawdowns that really bother you. The PP is volatile by design. You could go 100% Wellesley, or 60-70% ITT's and the rest TSM and most likely get the more realistic returns I mentioned without having to own any weird volatile assets but if your bigger concern is robustness during crises and you can live with the tracking error I still haven't found a better "bunker" than the PP.

In your original post about switching from the All Weather to the PP over on Bogleheads you said: "I'm a novice who is seeking a way to produce 7-8% annualized return safely with the least volatility and drawdown risk." That was my dream as well when I left the corporate world prematurely and I implemented a more complex version of this "conservative" MPT portfolio that has been through DFA's backtesting system and *couldn't* lose more than 8% during a market crisis:

https://portfoliocharts.com/portfolio/s ... portfolio/

Back in the real world, my even more diversified version of that portfolio with less than 40% equities was down 23% during late 2008. I'd have been much better off in Vanguard Wellesley, which lost only 12.5% that year and more than recovered in '09.

The PITA with the PP is not just tracking error but owning two assets (gold and LTT's) that mainstream investing sites like Bogleheads think are respectively stupid choices at any time (gold) and an insanely stupid choice at the present time (LTT's) along with a soupçon of plain vanilla stocks and a boatload of cash returning nothing.

In any case, I think you ought to cut your annual return expectations in half to 3-4% and then get clear about whether it's volatility or drawdowns that really bother you. The PP is volatile by design. You could go 100% Wellesley, or 60-70% ITT's and the rest TSM and most likely get the more realistic returns I mentioned without having to own any weird volatile assets but if your bigger concern is robustness during crises and you can live with the tracking error I still haven't found a better "bunker" than the PP.

Last edited by Kevin K. on Fri Aug 14, 2020 11:55 pm, edited 2 times in total.

-

Henryinroad

- Junior Member

- Posts: 17

- Joined: Thu Aug 06, 2020 10:46 pm

Re: POLL: How did you overcome the fear of tracking error?

Thanks for your encouragement. My risk appetite is similar to yours. Heartily agree with most of your points.Kevin K. wrote: ↑Fri Aug 14, 2020 7:58 pm It's "tracking error regret" not "fear of tracking error." And if you look at Tyler's recent posts in the "commentary" section of Portfolio Charts about portfolios that have done best during recessions and market crises, as well as those that offer the smoothest ride and highest safe and perpetual withdrawal rates, all of them have substantial tracking error relative to the U.S. stock and bond market and classic portfolios like 60:40 or Three Fund as well as more complicated slice-and-dice, value-and-small tilted, internationally-diversified approaches as typified by the Merriman Ultimate.

In your original post about switching from the All Weather to the PP over on Bogleheads you said: "I'm a novice who is seeking a way to produce 7-8% annualized return safely with the least volatility and drawdown risk." That was my dream as well when I left the corporate world prematurely and I implemented a more complex version of this "conservative" MPT portfolio that has been through DFA's backtesting system and *couldn't* lost more than 8% during a market crisis:

https://portfoliocharts.com/portfolio/s ... portfolio/

Back in the real world, my even more diversified version of that portfolio with less than 40% equities was down 23% during late 2008. I'd have been much better off in Vanguard Wellesley, which lost only 12.5% that year and more than recovered in '09.

The PITA with the PP is not just tracking error but owning two assets (gold and LTT's) that mainstream investing sites like Bogleheads think are respectively stupid choices at any time (gold) and an insanely stupid choice at the present time (LTT's) along with a soupçon of plain vanilla stocks and a boatload of cash returning nothing.

In any case, I think you ought to cut your annual return expectations in half to 3-4% and then get clear about whether it's volatility or drawdowns that really bother you. The PP is volatile by design. You could go 100% Wellesley, or 60-70% ITT's and the rest TSM and most likely get the more realistic returns I mentioned without having to own any weird volatile assets but if your bigger concern is robustness during crises and you can live with the tracking error I still haven't found a better "bunker" than the PP.

To rephrase my struggle: do u think GOLD + TIP + CASH would be better "bunkers" than TLT

My major concern is more related to the "death" of TLT. That the TLT would lose its stablization function.

The problem is, what happened in the past wont necessarily happen in future. The backtesting result you and I see on the computer screen does not take sth in account: negative interest rate

The model of PP is invented by Harry Browne, but he seemed also not able to foresee today's extremetly distorted environment, the level of interest rate, and the potential blow to nominal bond.

What's your opinion after reading this:

https://www.bridgewater.com/grappling-w ... everywhere

Much appreciated for any thought, thanks again

Re: POLL: How did you overcome the fear of tracking error?

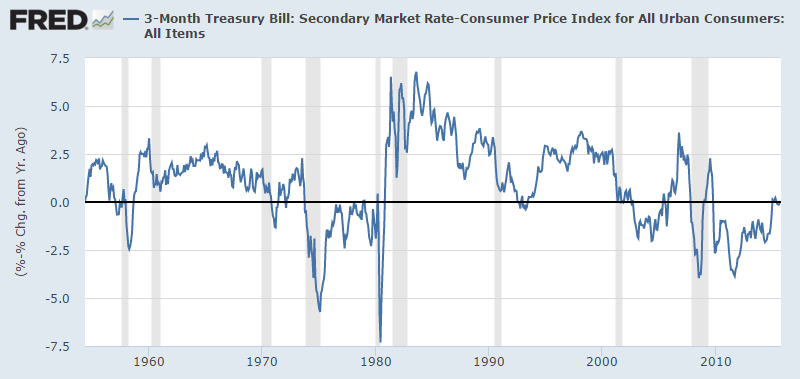

That's only partially true. If you look at real rates rather than nominal rates, the low rates today are not that unusual and negative real rates have been much deeper in the past than they are now.Henryinroad wrote: ↑Fri Aug 14, 2020 9:59 pm The problem is, what happened in the past wont necessarily happen in future. The backtesting result you and I see on the computer screen does not take sth in account: negative interest rate

In fact negative real rates are one of the situations where gold tends to shine. So I'd argue that the PP is better prepared for this situation than almost any traditional portfolio of stocks and bonds.

Along that line, one way to overcome the fear of a portfolio is to appreciate the strength of the team over the daily performance of any one player. A well-built portfolio expects the worst and thrives in adversity.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

the problem is most don't see negative real returns as a problem .. but nominal is a whole other issue .

negative nominal rates act as a tax on bank reserves . it encourages banks to make loans .

we dont have as tight a loan restrictions as japan or Europe . we tend to have much easier loan requirements as well as banks make riskier loans for ventures here .

so negative rates are not needed here and we likely will not see them .

]

negative nominal rates act as a tax on bank reserves . it encourages banks to make loans .

we dont have as tight a loan restrictions as japan or Europe . we tend to have much easier loan requirements as well as banks make riskier loans for ventures here .

so negative rates are not needed here and we likely will not see them .

]

Re: POLL: How did you overcome the fear of tracking error?

Well put!Kevin K. wrote: ↑Fri Aug 14, 2020 7:58 pm The PITA with the PP is not just tracking error but owning two assets (gold and LTT's) that mainstream investing sites like Bogleheads think are respectively stupid choices at any time (gold) and an insanely stupid choice at the present time (LTT's) along with a soupçon of plain vanilla stocks and a boatload of cash returning nothing.

Yes, the issue is not so much "tracking error" as owning an unconventional set of assets that you constantly feel have to be proven worthy. The PP is quite extreme that way, it's not just a small slice of gold added to an otherwise conventional portfolio. 75% of the PP assets are sneered at by conventional investors.

And if the PP has an extended period of underperformance compared to a standard portfolio (e.g. 80/20 or 60/40) then you feel like maybe those guys might be right and you are doing something wrong. You kind of have to get to a point where you really don't care, and keep reminding yourself that the tracking error disappears over long periods of time.

Re: POLL: How did you overcome the fear of tracking error?

It would be very interesting to see that same chart with a line plotted for inflation. That would isolate the two reasons for negative real rates and illustrate their relationship to each other over time.Tyler wrote: ↑Fri Aug 14, 2020 10:27 pmThat's only partially true. If you look at real rates rather than nominal rates, the low rates today are not that unusual and negative real rates have been much deeper in the past than they are now.Henryinroad wrote: ↑Fri Aug 14, 2020 9:59 pm The problem is, what happened in the past wont necessarily happen in future. The backtesting result you and I see on the computer screen does not take sth in account: negative interest rate

In fact negative real rates are one of the situations where gold tends to shine. So I'd argue that the PP is better prepared for this situation than almost any traditional portfolio of stocks and bonds.

Along that line, one way to overcome the fear of a portfolio is to appreciate the strength of the team over the daily performance of any one player. A well-built portfolio expects the worst and thrives in adversity.

Re: POLL: How did you overcome the fear of tracking error?

Fortunately I never even heard the term "tracking error" until after I had been using the PP for several years so I had no fear to overcome.

Just looked it up and I still don't get it.

Reminds me of my first wife who was always asking why we didn't have a lot of the things other people did even though I probably made a lot more money than they did. My answer was I don't know and I don't care. Their business is theirs and ours is ours.

Just looked it up and I still don't get it.

What benchmark are they using to track the "error" any way?What Is a Tracking Error?

Tracking error is the divergence between the price behavior of a position or a portfolio and the price behavior of a benchmark. This is often in the context of a hedge fund, mutual fund or exchange-traded fund (ETF) that did not work as effectively as intended, creating instead an unexpected profit or loss.

Reminds me of my first wife who was always asking why we didn't have a lot of the things other people did even though I probably made a lot more money than they did. My answer was I don't know and I don't care. Their business is theirs and ours is ours.

- I Shrugged

- Executive Member

- Posts: 2064

- Joined: Tue Dec 18, 2012 6:35 pm

Re: POLL: How did you overcome the fear of tracking error?

I would have a hard time buying in today. Because I'm a chicken.

But over time, I'm in the same camp as Smith and Mark. I no longer pay attention to tracking error. My PP has a beautiful track record to look back on, and it makes me feel good.

My answer would be to dollar cost average into it over a year or three.

But over time, I'm in the same camp as Smith and Mark. I no longer pay attention to tracking error. My PP has a beautiful track record to look back on, and it makes me feel good.

My answer would be to dollar cost average into it over a year or three.

Re: POLL: How did you overcome the fear of tracking error?

You have an interesting dilemma. The stock market is currently fake. TLT is bloated and could pop if we experience inflation. I would look at Tyler’s work at portfolio charts on start date sensitivity. Try to view the entire portfolio as one entity. IE If TLT collapses - gold and stocks would likely go up. Also Tyler (portfoliocharts.com) has an excellent post on bond convexity.I would recommend reading Craig Rowland’s book on the permanent portfolio. All that said VOO / VTI and TLT make me nervous as well. Love my gold.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

if tlt gets hit that bad i don't see how equities will do well nor gold ... high rates are kryptonite to the pp in my opinion.

we never have had a bear market in bonds in my investing life time .. for 40 years rates have only trended down except for a speed bump perhaps in a year , only to trend down further

we never have had a bear market in bonds in my investing life time .. for 40 years rates have only trended down except for a speed bump perhaps in a year , only to trend down further

-

Henryinroad

- Junior Member

- Posts: 17

- Joined: Thu Aug 06, 2020 10:46 pm

Re: POLL: How did you overcome the fear of tracking error?

Hi Tyler, want to say I just came across your web many members mentioned and have huge respect to your web that puts everything together, like, in explaining the convexity concept of bond. Its truly nice to have an objective point of view instead of one-sided argument in favor or against TLT.Tyler wrote: ↑Fri Aug 14, 2020 10:27 pmThat's only partially true. If you look at real rates rather than nominal rates, the low rates today are not that unusual and negative real rates have been much deeper in the past than they are now.Henryinroad wrote: ↑Fri Aug 14, 2020 9:59 pm The problem is, what happened in the past wont necessarily happen in future. The backtesting result you and I see on the computer screen does not take sth in account: negative interest rate

In fact negative real rates are one of the situations where gold tends to shine. So I'd argue that the PP is better prepared for this situation than almost any traditional portfolio of stocks and bonds.

Along that line, one way to overcome the fear of a portfolio is to appreciate the strength of the team over the daily performance of any one player. A well-built portfolio expects the worst and thrives in adversity.

Though I have one question:

1) For longer duration bonds, once the interest rate is getting lower and negative , their values can appreciate at a much greater pace, and act as a nice protection to the portfolio.

But one concern raised by some investors like Ray Dalio is more about how low the yield could go, here's the extract of the article from https://www.bridgewater.com/grappling-with-the-new-reality-of-zero-bond-yields-virtually-everywhere:

While one can’t say for sure how low yields could go, the obvious limitation is that at a certain level, cash hoarding becomes a more attractive alternative. Given the frictions between the central bank policy rate and the rates facing other borrowers and lenders (we would guess around -1%), policy rates would be unlikely to trigger a move to cash in most countries. Below that point, it becomes less clear. And at least for now, central bankers across the world have expressed growing hesitancy about further use of negative rates as a policy tool, in particular focusing on the potential adverse effects for the banking system, which could weaken the efficacy of such policies.

My confused thought:

If the yield still haven't reached -1% and -1% is the lowest bottom yield can go:

We could still expect to see an asymmetrical potential reward (biased towards the upside) in TLT, and its worth holding some to hedge against risk of further interest reduction.

However, if the yield already reached the -1% and -1% is the lowest bottom yield can go:

It bascially means all potential reward are fully exhausted, and TLT basically couldn't have any asymmetrical potential rewards?

What are your point of view with regard to the lowest limit of the yield?

2) Aside from GOLD, do you think TIPs are good diversifiers we could consider as inflation-hedge assets?

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

the cpi is really not reflective of anyone's lifestyle . it merely checks the temperature of the economy over the 1500 mini economies that we consist of .

it is a price index and not a cost of living index which takes in a whole lot more in factors .

nominal rates are much more meaningful since a 4% interest rate ina 5% cpi is not going to be reflective as negative for everyone .

for the last 5 years we had quite a bit drop in our lives even though the cpi didn't so we have not taken our first inflation raise yet in retirement 5 years later .

so the effect of nominal rates can be a lot different than real returns on our lives

it is a price index and not a cost of living index which takes in a whole lot more in factors .

nominal rates are much more meaningful since a 4% interest rate ina 5% cpi is not going to be reflective as negative for everyone .

for the last 5 years we had quite a bit drop in our lives even though the cpi didn't so we have not taken our first inflation raise yet in retirement 5 years later .

so the effect of nominal rates can be a lot different than real returns on our lives

Re: POLL: How did you overcome the fear of tracking error?

So then based on that logic, the calculation of a real return is highly personal?mathjak107 wrote: ↑Sun Aug 16, 2020 10:12 am the cpi is really not reflective of anyone's lifestyle . it merely checks the temperature of the economy over the 1500 mini economies that we consist of .

it is a price index and not a cost of living index which takes in a whole lot more in factors .

nominal rates are much more meaningful since a 4% interest rate ina 5% cpi is not going to be reflective as negative for everyone .

for the last 5 years we had quite a bit drop in our lives even though the cpi didn't so we have not taken our first inflation raise yet in retirement 5 years later .

so the effect of nominal rates can be a lot different than real returns on our lives

I can see what you're saying in terms of consumer spending. But I would say that there has been a meaningful amount of asset price inflation in terms of what your dollar can buy. I'm thinking about property, rent, travel, even cars whether leased or owned.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

a cost of living index is unique to us ...

a cost of living index takes in to consideration the price change , plus how many times we buy it . which is a huge factor . we all buy things different amounts of time .

plus we have to adjust for 'quality too. higher priced goods tend to see bigger price increases but last a lot longer .

i spent 1k in 1993 on a north face shell , ski pants and liner ... i am still wearing them decades later .

plus we all tend to sub out of class where as a price index can't .

if i cant get the ice cream i like on sale i will buy a jar of grape fruit instead .

so a cost of living index is different than just price changes on goods and services we dont use much of .

seniors tend to see a lot less inflation than those raising a family .

we tend to spend as seniors in a smile shape when you have discretionary spending . we spend more in the early go go years , less in the slow go years , until health care ramps up in the no go years . what we no longer buy and do , tends to offset price increases in what we continue to do and buy .

a cost of living index takes in to consideration the price change , plus how many times we buy it . which is a huge factor . we all buy things different amounts of time .

plus we have to adjust for 'quality too. higher priced goods tend to see bigger price increases but last a lot longer .

i spent 1k in 1993 on a north face shell , ski pants and liner ... i am still wearing them decades later .

plus we all tend to sub out of class where as a price index can't .

if i cant get the ice cream i like on sale i will buy a jar of grape fruit instead .

so a cost of living index is different than just price changes on goods and services we dont use much of .

seniors tend to see a lot less inflation than those raising a family .

we tend to spend as seniors in a smile shape when you have discretionary spending . we spend more in the early go go years , less in the slow go years , until health care ramps up in the no go years . what we no longer buy and do , tends to offset price increases in what we continue to do and buy .

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: POLL: How did you overcome the fear of tracking error?

We can all use the same returns calculations to see what asset did better at what time, but I think mathjak has made the point before that the returns we individually get are going to be different too. Like, when the big gold decline happened back in 2013, I wasn't personally affected too much because I just didn't own that much gold.glennds wrote: ↑Sun Aug 16, 2020 1:19 pm So then based on that logic, the calculation of a real return is highly personal?

I can see what you're saying in terms of consumer spending. But I would say that there has been a meaningful amount of asset price inflation in terms of what your dollar can buy. I'm thinking about property, rent, travel, even cars whether leased or owned.

I think CPIs are the same deal. Due to technological advances, more efficient commerce, and personally becoming more skillful/mindful in buying things over the years, I am getting some things for cheaper than I used to.

- I looked at the pricing at my old apartment complex in Texas, and it's gone up 128% in the 6 years since I lived there. I'm now living in a house with a garage and a yard for less expense than that apartment 6 years ago.

- My internet connection costs the same as it did back then but it's far faster now.

- Food costs have been pretty stable for me. I have price records of my protein powder that I'd gotten off Amazon for the past 10 years, and the price is basically unchanged (I got a years supply of the same stuff from Costco for 61% of what I'd been buying it for).

- I bought beds and mattresses for about 1/3 of what I spent about 8 years ago. Different materials and mattress type, I don't know if they even existed back then.

- Gasoline has been crazy-cheap, as we all know

- The quality of the used car market is ever-increasing, and the prices are still pretty low (although from what I've read, the Cash For Clunkers program was artificially propping up the cost of used cars for most of my adult life).

- I hadn't played any computer games more recent than 2005 or so, so I got a fairly cheap computer, and I've picked up a few older games on sale. Riding years behind the technology wave lets you save lots of money.

- I did the same thing with smartphones, using old iPhones for years while the technology advanced by leaps and bounds. My "budget phone" Moto G6 still feels absurdly amazing to me.

You there, Ephialtes. May you live forever.

Re: POLL: How did you overcome the fear of tracking error?

You've got that right. If I were single and frugal it would be a different story. But with two kids, helping them with first cars, college in the not too distant future, weddings, it sounds like inflation is a different matter for me than it is for you. I think time horizon is a factor too. Depending on how far away the future is and the unknowns.....mathjak107 wrote: ↑Sun Aug 16, 2020 2:05 pm a cost of living index is unique to us ...

seniors tend to see a lot less inflation than those raising a family .

Re: POLL: How did you overcome the fear of tracking error?

It’s tough - if I were to start right now. I am not sure I would buy in. One of my investment thesis is to buy things that are cheap. Right now nothing in the PP is cheap. It’s the opposite - very expensive.

- vnatale

- Executive Member

- Posts: 9472

- Joined: Fri Apr 12, 2019 8:56 pm

- Location: Massachusetts

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

Totally agree with buying older technology. Also, applies to books where you can buy them so cheaply when they are old and used.Kriegsspiel wrote: ↑Sun Aug 16, 2020 4:10 pm

[*]I hadn't played any computer games more recent than 2005 or so, so I got a fairly cheap computer, and I've picked up a few older games on sale. Riding years behind the technology wave lets you save lots of money.

[*]I did the same thing with smartphones, using old iPhones for years while the technology advanced by leaps and bounds. My "budget phone" Moto G6 still feels absurdly amazing to me.

[/list]

And, we use the same phone! I got mine to use with GoogleFi. What motivated you to buy that particular phone?

Vinny

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- vnatale

- Executive Member

- Posts: 9472

- Joined: Fri Apr 12, 2019 8:56 pm

- Location: Massachusetts

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

It definitely does pose a dilemma to your excellent investment thesis.

Vinny

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: POLL: How did you overcome the fear of tracking error?

I've probably only bought 2 or 3 books in the past 7 years or so. I've done most of my reading for $1.50 in late charges at the public library, as Will Hunting would say.

I was trying to find the cheapest Android phone with a good camera, decent battery life, a small amount of storage, and a middling to decent processor. It was pretty easy to disregard the phones with extraneous features I wasn't planning on taking advantage of, and the G6 had a better camera than the other ones I was looking at. The battery can last like 3 days with my normal use, I'm not even close to using up the 32GB of storage, and the processor exceeds my needs too. I could have bought a cheaper phone, but the G6 was much better for only a few dollars more.And, we use the same phone! I got mine to use with GoogleFi. What motivated you to buy that particular phone?

You there, Ephialtes. May you live forever.

Re: POLL: How did you overcome the fear of tracking error?

I think the idea that people will eventually look elsewhere if yields get too low is a legit observation. But I'd argue that's exactly what gold is for. So by holding both bonds and gold you prepare yourself for all outcomes. The best portfolios don't fold in adversity -- they thrive in it.Henryinroad wrote: ↑Sun Aug 16, 2020 7:50 am Though I have one question:

1) For longer duration bonds, once the interest rate is getting lower and negative , their values can appreciate at a much greater pace, and act as a nice protection to the portfolio.

But one concern raised by some investors like Ray Dalio is more about how low the yield could go...

What are your point of view with regard to the lowest limit of the yield?

2) Aside from GOLD, do you think TIPs are good diversifiers we could consider as inflation-hedge assets?

I think TIPS are good inflation hedges by definition, although I also think they're overrated because the tradeoff is accepting even lower yields than on nominal bonds. And personally, I think the most underrated inflation hedge is good old TBills.

- mathjak107

- Executive Member

- Posts: 4456

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: POLL: How did you overcome the fear of tracking error?

t-bills had negative real returns during the high inflation periods right up until inflation fell ... i would say in order to be a high inflation hedge you need positive real returns when called upon . big difference in being an inflation hedge vs a high or hyper inflation hedge .

Re: POLL: How did you overcome the fear of tracking error?

One of my favorite investment quotes is one you see from the folks at thinknewfound.com..."Risk can not be destroyed, only transformed."

On the whole TIPS thing...as Tyler noted, you swap some actual interest received for some inflation protection.

Just a quick data point...in the last 5 year auctions the median interest rates (July) were as follows:

-.96% 5yr TIPS (negative not a dash)

.28% 5yr Notes

1.0% July CPI

30 year .2% vs. 1.32%...and yes, no typos. These are the median auction rates for 30 years TIPS/Bonds.

4-52 week bills....08% to .14%

The above are as they say the facts. Not sure where the cutoff line is but the math says LTTs are not super attractive. To each his own, but I think it is hard to blame someone if they go short term only. Not advocating it, but I wouldn't try to dissuade someone from doing it either.

Back to the TIPS thing...none of these interests rates are hardly enough to matter. But let's assume everything just does nothing...at the end of the year your principal is going up 1% for a net nominal of .04% on the 30 year TIPS and 1.32% on the nominal bonds. Let's say we get a very modest 2% CPI then it's 1.04, 3% and it's 2.04 for TIPs. Probably at 3% everyone (TIPS/nominal B) is looking at duration related losses as bonds reprice...however, this simple math exercise should illustrate Bridgewater's basic argument. With TIPs flat interest rates and no CPI increases or deflation are the only losing scenarios comparatively speaking. Every other scenario you will do better with TIPS.

I'm not arguing for or against their advice, just explaining with some simple math why they are arguing what they are.