Search found 180 matches

- Mon Jul 04, 2016 5:09 pm

- Forum: Permanent Portfolio Discussion

- Topic: ***Florida PP Meetups- @ ?***

- Replies: 2

- Views: 2660

Re: ***Florida PP Meetups- @ ?***

I'm in Tampa Bay FL.

- Thu Jun 30, 2016 10:44 pm

- Forum: Variable Portfolio Discussion

- Topic: 20% annual returns over 40 years...interested?

- Replies: 571

- Views: 336319

Re: 20% annual returns over 40 years...interested?

Wow is right my friend! Happy days are hear again...!

- Sat Jun 25, 2016 1:06 pm

- Forum: Permanent Portfolio Discussion

- Topic: Brexit

- Replies: 38

- Views: 19453

Re: Brexit

Amen. It's days like these when I thank my lucky stars I ran across Fail Safe Investing and this forum.[/quote]dualstow wrote:It bears repeating: Harry Browne was a smart man.

Ditto. Most solid portfolio out there.

- Thu Jun 09, 2016 8:36 pm

- Forum: Variable Portfolio Discussion

- Topic: PP with 2x leverage (no 2x funds)

- Replies: 26

- Views: 16457

Re: PP with 2x leverage (no 2x funds)

I also use the leveraged ETFs (as part of my Variable Portfolio) and find them to be the best choice for a leveraged PP. Yes there’s decay, but as KBG points out, it does seem to balance out. Plus it’s the cost of doing business. I don’t buy the ETFs on margin, so I never worry about margin calls.

- Wed Jan 27, 2016 11:13 am

- Forum: Bonds

- Topic: Long-Dated Bonds Make a Great Investment in These Volatile Markets

- Replies: 2

- Views: 3394

Re: Long-Dated Bonds Make a Great Investment in These Volatile Markets

Yup, I agree with the article too.

- Wed Jan 27, 2016 8:17 am

- Forum: Bonds

- Topic: Long-Dated Bonds Make a Great Investment in These Volatile Markets

- Replies: 2

- Views: 3394

- Fri Jan 08, 2016 1:59 pm

- Forum: Permanent Portfolio Discussion

- Topic: Average Investor Return for 2015 was -3.09%

- Replies: 9

- Views: 7334

Average Investor Return for 2015 was -3.09%

Cheer up PP'rs, 2015 was a rough year for all portfolios:

https://insights.openfolio.com/in-2015- ... .xwhe2nolw

https://insights.openfolio.com/in-2015- ... .xwhe2nolw

- Wed Sep 16, 2015 8:58 pm

- Forum: Permanent Portfolio Discussion

- Topic: Role of cash in the absence of tight money

- Replies: 7

- Views: 4446

Re: Role of cash in the absence of tight money

I Shrugged – I'm in your camp too. Aside from my emergency fund, I don't hold any cash in my portfolio. That said, I'm in the accumulation phase with steady employment.

- Sat Sep 12, 2015 2:10 pm

- Forum: Permanent Portfolio Discussion

- Topic: PSA: I now have a 3-year period with no gains

- Replies: 275

- Views: 106753

Re: PSA: I now have a 3-year period with no gains

what you have to wonder is if harry could see 40 years off in to the future would he have allocated differently . harry likely never imagined a world of zero interest rates , or bonds and stocks both being in what some call a bubble at the same time . or gold having so few opportunity's to do its ...

- Thu Sep 03, 2015 3:44 pm

- Forum: Other Discussions

- Topic: 200 year performance of the PP assets (Real Returns)

- Replies: 11

- Views: 4728

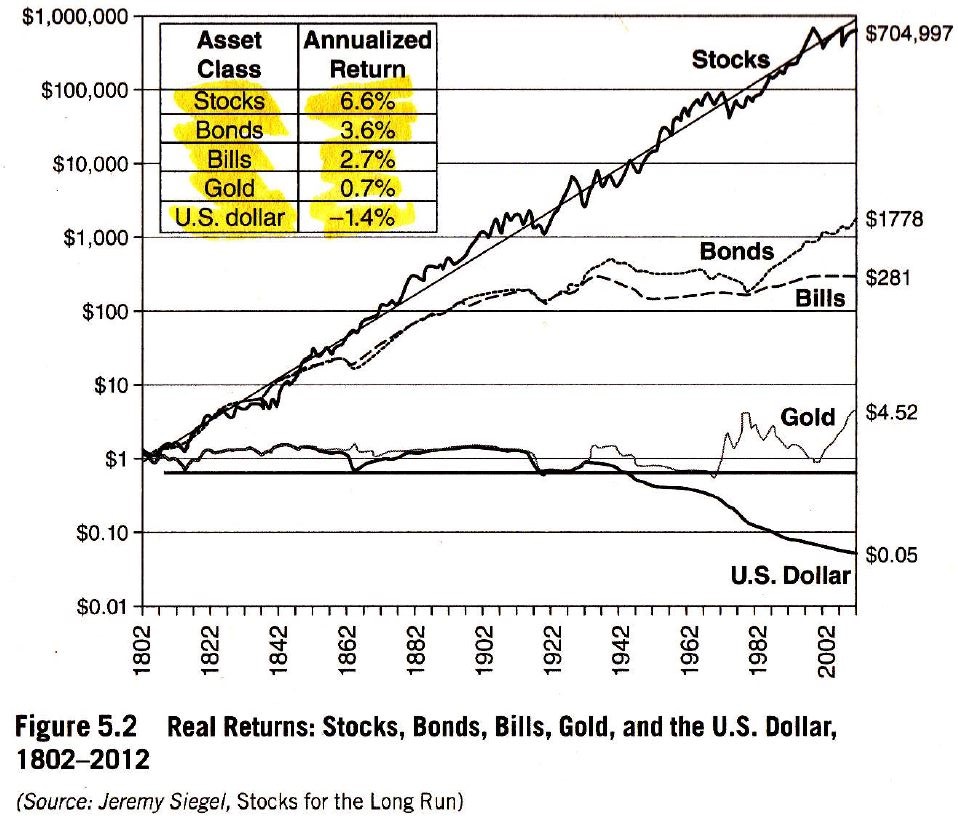

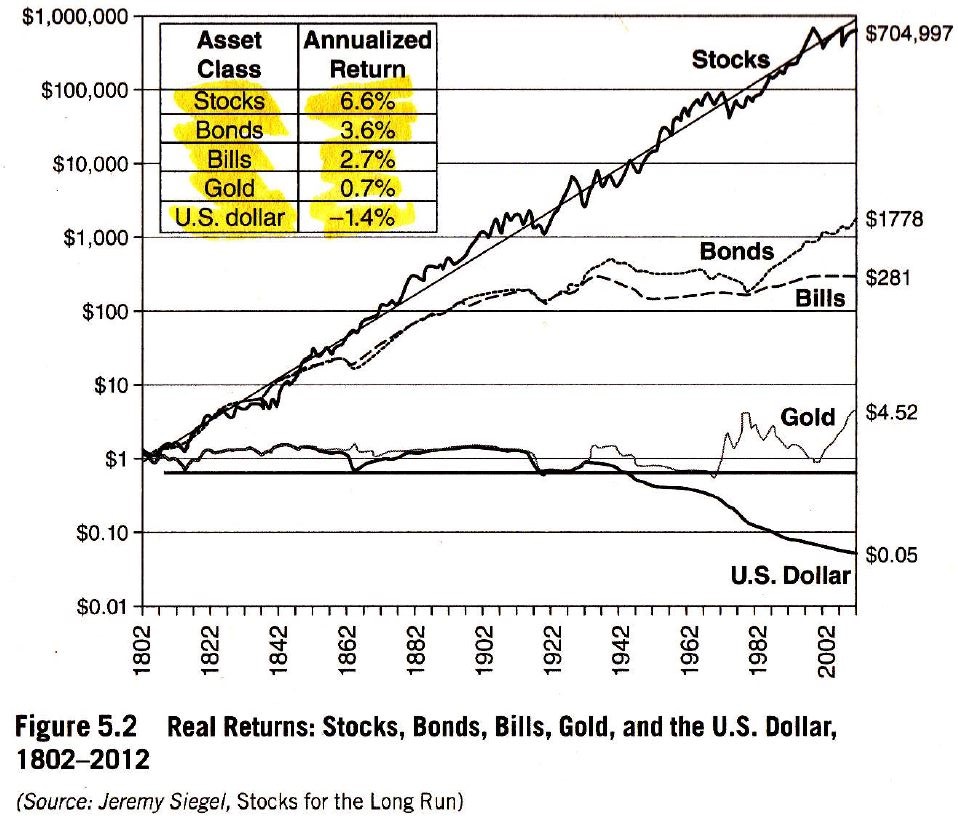

Re: 200 year performance of the PP assets (Real Returns)

Thanks for the feedback guys. I'm sure the chart's purpose is to illustrate that in the VERY long run, stocks are the most profitable. But if you examine the stock graph closely, I see some very long stretches of bear markets, some lasting over 20 years. So, for stock-heavy investors, returns are d...

- Wed Sep 02, 2015 6:21 pm

- Forum: Other Discussions

- Topic: 200 year performance of the PP assets (Real Returns)

- Replies: 11

- Views: 4728

200 year performance of the PP assets (Real Returns)

Hi all,

I came accross this chart and thought I'd share it. Its shows the 200 year performance of the PP assets adjusted for inflation (Real Returns). To me, the scariest part is the declining dollar.

I came accross this chart and thought I'd share it. Its shows the 200 year performance of the PP assets adjusted for inflation (Real Returns). To me, the scariest part is the declining dollar.

- Wed Aug 26, 2015 5:50 pm

- Forum: Permanent Portfolio Discussion

- Topic: PSA: I now have a 3-year period with no gains

- Replies: 275

- Views: 106753

Re: PSA: I now have a 3-year period with no gains

I think investing in assets you like and minimizing assets you don't is more important than we've all thought, because the assets you hate are the ones that make you question your plan at the worst possible time, and the ones you love are the ones whose wild rides you're more easily able to tolerat...

- Tue Aug 18, 2015 1:44 pm

- Forum: Permanent Portfolio Discussion

- Topic: I keep seeing GLD being recommended over IAU

- Replies: 13

- Views: 6047

Re: I keep seeing GLD being recommended over IAU

I've been using IAU for years, its fine in my opinion.

Warning – get ready for a deluge of gold bugs telling you to only own physical.

Warning – get ready for a deluge of gold bugs telling you to only own physical.

- Sun Aug 16, 2015 9:57 am

- Forum: Variable Portfolio Discussion

- Topic: What do you think of Doug Casey? Is he legit?

- Replies: 8

- Views: 7558

Re: What do you think of Doug Casey? Is he legit?

I like Doug Casey, but all these doom and gloom guys do is preach the same thing year after year. And even a broken clock is right twice a day. I would not take any investment advice from him, although I agree with most of his ideology. I bought his book Totally Incorrect and enjoyed it. Inciden...

- Wed Aug 12, 2015 1:10 pm

- Forum: Stocks

- Topic: Total Market Stocks vs. Diverse Mix

- Replies: 15

- Views: 10765

Re: Total Market Stocks vs. Diverse Mix

Sam, I totally agree with all your points. My own research shows much better performance and diversification with the inclusion of Small/Midcaps. But the expense ratio on RSP is a whopping 0.40%! Yikes! Why not use individual Small/Midcap ETFs instead? For example, replace RSP with IJR, IJH, VTI...

- Tue Aug 11, 2015 9:37 pm

- Forum: Other Discussions

- Topic: Ozzy's juicy portfolio

- Replies: 3

- Views: 2575

Re: Ozzy's juicy portfolio

Thanks Tyler.

- Tue Aug 11, 2015 7:55 pm

- Forum: Other Discussions

- Topic: Ozzy's juicy portfolio

- Replies: 3

- Views: 2575

Re: Ozzy's juicy portfolio

Hi rickb, Thanks for the feedback. I'm personally comfortable with my heavy dose of iShares. That said, I certainly have no problem with your suggestion of using similar funds. Depending on your broker, various funds are commission-free, so that needs to be considered too, especially if you're in...

- Tue Aug 11, 2015 4:16 pm

- Forum: Bonds

- Topic: TLT Suffers Record Outflows

- Replies: 30

- Views: 16389

Re: TLT Suffers Record Outflows

And now people are piling back into TLT. I guess it just goes to show its all noise. Just stick to one passive portfolio allocation and ignore all the hype. "Without the Federal Reserve pulling the trigger on an interest rate hike, overseas fixed-income investors have piled into more attracti...

- Fri Aug 07, 2015 1:39 pm

- Forum: Stocks

- Topic: Total Market Stocks vs. Diverse Mix

- Replies: 15

- Views: 10765

Re: Total Market Stocks vs. Diverse Mix

Mathjak- I totally agree that Small/Midcap increase long-term performance. Which is why I use them in my JuicyPP: http://www.tightwadweb.com/customportfolio.html Tyler, PointedStick- Here's the results of Small/Mid vs Large (S&P500). Chart below shows the difference from 1972-2014. I realize...

- Sat Jul 25, 2015 6:00 pm

- Forum: Permanent Portfolio Discussion

- Topic: The Desert Portfolio

- Replies: 52

- Views: 38634

Re: The Desert Portfolio

The Desert Portfolio looks pretty solid to me. I just ran it through PortfolioVisualizer.com and it shows a 9.06% CAGR:

- Mon Jul 13, 2015 7:51 pm

- Forum: Permanent Portfolio Discussion

- Topic: Why do you use the PP?

- Replies: 177

- Views: 74052

Re: Why do you use the PP?

I also use the PP because I believe in the theory behind it. After studying the PP for a couple years I realized its the only truly diversified portfolio. A 50/50 Boglehead portfolio just doesnt cover all the bases. Of course I have fiddled with the percentages and made mine more juicy, but I’m co...

- Fri Jul 10, 2015 1:56 pm

- Forum: Permanent Portfolio Discussion

- Topic: POLL: How Old Are You?

- Replies: 16

- Views: 8058

- Wed Jul 08, 2015 11:38 am

- Forum: Bonds

- Topic: Might rising rates hit LTTs more softly than we fear?

- Replies: 62

- Views: 28320

Re: Might rising rates hit LTTs more softly than we fear?

Thats a good article from Hedgewise. I also believe that LTTs wont be clobbered by rising rates over the long run. I think its a lot of worry over nothing. No doubt LTTs will decline temporarily, but stocks and gold will likely pick up the slack. They always have. Plus, if your LTTs are in a fun...

- Mon Jun 29, 2015 1:21 pm

- Forum: Permanent Portfolio Discussion

- Topic: SP500 + 10y Treasuries since 1900

- Replies: 13

- Views: 9790

- Mon Jun 29, 2015 8:36 am

- Forum: Permanent Portfolio Discussion

- Topic: SP500 + 10y Treasuries since 1900

- Replies: 13

- Views: 9790