Its just suggestive rather than actual. More so for the bottom right. And all very subjective. Btc use 32 mixed character passwords/keys and some states are indicating 7 minute quantum processing power time to crack such.

Search found 435 matches

- Fri Jan 14, 2022 4:07 am

- Forum: Other Discussions

- Topic: Password security

- Replies: 1

- Views: 561

Re: Password security

- Fri Jan 14, 2022 3:52 am

- Forum: Variable Portfolio Discussion

- Topic: Bitcoin question (How did FBI recover some pipeline ransom)

- Replies: 17

- Views: 4299

Re: Bitcoin question (How did FBI recover some pipeline ransom)

This is mis-information all BTC transactions are visible to anyone on the blockchain. I make this point every time somebody extols the privacy benefits of Bitcoin. Literally all your transactions are recorded permanently, publicly, and for all time. That's the opposite of "privacy" in eve...

- Tue Jan 11, 2022 2:46 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

I've noticed in the past that even adjusting to different start months for yearly data can throw out quite dissimilar worst case years outcomes. Whether the yearly granularity aligns with or avoids a volatility spike (volatility tends to cluster so a negative spike at one point tends to have a adjac...

- Tue Jan 11, 2022 2:30 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

Historically it helped to include some gold in a otherwise stock/bond blend. The difference between 50/50 stock/bond and 40/60 is broadly just noise, so adding in some gold might have 40/40/20 stock/bond/gold. For 40/60 adding in more volatile stock holdings (SCV/bonds) might further narrow the diff...

- Mon Jan 10, 2022 8:25 am

- Forum: Gold

- Topic: What explains the disconnect between gold and Fed balance sheets since about 2013?

- Replies: 11

- Views: 3095

Re: What explains the disconnect between gold and Fed balance sheets since about 2013?

Same might be said for stocks. 100% S&P500 for instance still has a element of single stock index risk, such as perhaps being excessively tilted into a single sector (techs pre dot com bubble bursting, banks pre 2008/9 financial crisis). The Golden Butterfly in part addresses that for the stock ...

- Mon Jan 10, 2022 8:18 am

- Forum: Permanent Portfolio Discussion

- Topic: 2022 PP predictions

- Replies: 44

- Views: 9656

Re: 2022 PP predictions

It looks like we’re 75 stocks/25 cash again today...more pain ahead. The same applies to the pp …when 3 or all 4 asset classes fall it is like having a very high equity level as far as down is down. There is no yin vs Yang going on. My models are no different….nothing is standing up But a less unco...

- Mon Jan 10, 2022 8:10 am

- Forum: Permanent Portfolio Discussion

- Topic: Virtual Gold (bonds)

- Replies: 3

- Views: 1145

Re: Virtual Gold (bonds)

No. It averages into the asset you opine has the lowest-prospect/seems-high. Gold in 1980 (Dow/Gold ratio was down at 1.0 levels), LTT's as of recent. In the example that started with 0% gold in 1980, so thirds each stock/STT/LTT, along with 25% virtual (pretend) gold - so a actual conventional PP b...

- Sun Jan 09, 2022 11:34 am

- Forum: Permanent Portfolio Discussion

- Topic: Virtual Gold (bonds)

- Replies: 3

- Views: 1145

Virtual Gold (bonds)

Many recently dislike long dated treasuries, due to low yields. rising inflation and interest rate risk. The same however might have been said about gold in the early 1980's when the Dow/Gold ratio was down at near 1.0 levels. Yet that subsequently provided a means to accumulate/cost-average gold. B...

- Sat Jan 08, 2022 8:56 pm

- Forum: Gold

- Topic: What explains the disconnect between gold and Fed balance sheets since about 2013?

- Replies: 11

- Views: 3095

Re: What explains the disconnect between gold and Fed balance sheets since about 2013?

We dont necessarily want everyone hoarding a deflationary currency under the bed. People risking their funds on companies is good for growth/innovation And the taxman, and brokers, market markers, fund managers ...etc. Print/spend money and that devalues all other notes in circulation, is a form of...

- Sat Jan 08, 2022 5:33 pm

- Forum: Bonds

- Topic: Staying the course with LTTs

- Replies: 86

- Views: 27773

Re: Staying the course with LTTs

Over the last couple of years this forum has seen lots of discussions about the current environment of historically low rates, unprecedented money printing and growing inflation and how it affects their attitude towards long-term Treasury bonds as part of PP. Some people stay the course and keep bu...

- Fri Jan 07, 2022 2:44 pm

- Forum: Other Discussions

- Topic: Executive Forum Member Check-In Thread

- Replies: 37

- Views: 8120

Re: Executive Forum Member Check-In Thread

Has anyone gotten this month's executive member gift basket? Mine usually arrives Tuesday or Wednesday on the first week of the month. It's late a few weeks, probably just COVID-related supply chain delays? Mine arrived!!! https://www.gyroscopicinvesting.com/forum/download/file.php?id=2234 Somethin...

- Fri Jan 07, 2022 11:11 am

- Forum: Permanent Portfolio Discussion

- Topic: 2022 PP predictions

- Replies: 44

- Views: 9656

Re: 2022 PP predictions

The PP is dead. The hope for the pp is that rising rates and covid kill growth and knock us towards recession stalling the rise Certainly plausible . But the only question is how much the pp will need to work its way back ..almost every day seems to put the pp further behind the inflation curve Whi...

- Fri Jan 07, 2022 11:06 am

- Forum: Variable Portfolio Discussion

- Topic: PP Inspired Leveraged Portfolios

- Replies: 237

- Views: 492381

Re: PP Inspired Leveraged Portfolios

I'm seeing 1.73x average leveraged PP, having provided 2x the reward since 1963 ... Dropping PP cash to invest in the other three assets = 1.33x leverage Dropping the asset at the start of each decade that has the lowest prospect to provide a 100%, 200% type reward, leaves just two assets, so 2x lev...

- Thu Jan 06, 2022 2:46 pm

- Forum: Variable Portfolio Discussion

- Topic: Some concerns about crypto (In General)

- Replies: 19

- Views: 3971

Re: Some concerns about crypto (In General)

The bitcoin algorithm is such that there is a miners squeeze over time, fewer (more powerful) miners. Attack vectors include squeezing out other miners, such that when there are relatively few one might trip out the others to then have authority over the reconciliation, along with massive rewards fo...

- Thu Jan 06, 2022 1:54 pm

- Forum: Permanent Portfolio Discussion

- Topic: 2022 PP predictions

- Replies: 44

- Views: 9656

Re: 2022 PP predictions

Start of 1972, Dow/Gold ratio 20, 20 year T yields 6%, S&P500 PE 18 Start of 1980 Dow/Gold 1.84, 20 year T 10.5%, PE 7.4 Gold from the start of 1972, held through to end of 1979 and after large gains rotated into LTT high yields and holding those since ... would have gained more than 100% TSM an...

- Thu Jan 06, 2022 10:05 am

- Forum: Permanent Portfolio Discussion

- Topic: 2022 PP predictions

- Replies: 44

- Views: 9656

Re: 2022 PP predictions

Stocks up +15%, banks doing well

Gold up +10%, as 'better value' elsewhere sees US$ down

LTT's down -5%

Cash +4%

PP +6%, matching inflation

Gold up +10%, as 'better value' elsewhere sees US$ down

LTT's down -5%

Cash +4%

PP +6%, matching inflation

- Wed Jan 05, 2022 11:47 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

I want to emphasize again to my fellow PPers on the forum that it's probably just nerves. Because of the windfall coming from my dad's estate, I made a sudden jump from 5 figure net worth to 7 figure net worth. Nonetheless, this is an allocation I was playing with in excel this morning. The duratio...

- Wed Jan 05, 2022 11:42 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

I noted in the other thread that I've recently received a windfall after my father's death. Something I must admit: I'm having a hard time committing 6 and 7 figure sums to the PP. It was one thing when all I was managing was 5 figures. In that case I'd be putting modest amounts of money in precari...

- Wed Jan 05, 2022 11:26 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

Would Harry Browne have invested in LTT's at all at today's rates (let alone betting 25% of the portfolio on them)? Of significant bearing is having one asset in 10 or 15 years time that has performed relatively well, maybe having provided a 200% type gain. Predicting which that might be, stocks, g...

- Wed Jan 05, 2022 11:05 am

- Forum: Permanent Portfolio Discussion

- Topic: The PP, marginal utility, and investment "faith"

- Replies: 135

- Views: 32366

Re: The PP, marginal utility, and investment "faith"

I noted in the other thread that I've recently received a windfall after my father's death. Something I must admit: I'm having a hard time committing 6 and 7 figure sums to the PP. It was one thing when all I was managing was 5 figures. In that case I'd be putting modest amounts of money in precari...

- Wed Jan 05, 2022 8:09 am

- Forum: Bonds

- Topic: Math for LTT purchase.

- Replies: 14

- Views: 3057

Re: Math for LTT purchase.

A T-Bill and 20 year T barbell might be expected to broadly compare to a central 10 year bullet (buy a 10.5 year, sell when down to 9.5 years remaining and buy another 10.5 year). As might a 10 year ladder compare ... holding 1, 2, 3, ... 10 year T's and after a year when one matures roll the procee...

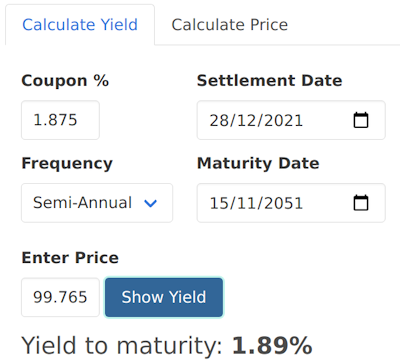

- Wed Jan 05, 2022 7:51 am

- Forum: Bonds

- Topic: Math for LTT purchase.

- Replies: 14

- Views: 3057

- Wed Jan 05, 2022 4:22 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio Failure?

- Replies: 34

- Views: 6931

Re: Permanent Portfolio Failure?

Personally I would never mix the home I lived in with any investing at all ….until the day comes that home is actually converted to cash it is strictly an expense ….especially with a stay at home spouse if long term care is needed for you which can leave her impoverished I believe more often its a ...

- Wed Jan 05, 2022 2:53 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio Failure?

- Replies: 34

- Views: 6931

Re: Permanent Portfolio Failure?

Nice! For various reasons home ownership is similar to a stock/gold blend, in part a housing market backed by significant amounts of debt (mortgages) will tend to be uplifted by the likes of negative real yields i.e. exhibit some element of gold like qualities (gold can perform well when real yield...

- Tue Jan 04, 2022 6:13 pm

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio Failure?

- Replies: 34

- Views: 6931