Yes indeed, thank you Craig (and Harry). I've implemented my PP variant (Juicy PP) years back and its keep my returns consistent. I sleep good at night with a hands-off passive portfolio that can endure any economic condition.

I also enjoyed your excellent book. Take care my friend.

Search found 180 matches

- Mon Mar 09, 2020 6:52 pm

- Forum: Permanent Portfolio Discussion

- Topic: Stay cool...

- Replies: 39

- Views: 19953

- Mon Jan 06, 2020 6:37 am

- Forum: Variable Portfolio Discussion

- Topic: PP Inspired Leveraged Portfolios

- Replies: 237

- Views: 534246

Re: PP Inspired Leveraged Portfolios

Var - correct. I prefer the simple hands-off approach. Same allocation (45% UPRO, 35% TMF, 20% UGLD), rebalance yearly. The less I tinker the better. Its a roller coaster ride, but I only keep a portion of my net worth in the Leveraged PP.

- Fri Jan 03, 2020 9:37 am

- Forum: Permanent Portfolio Discussion

- Topic: 2019 Permanent Portfolio Results

- Replies: 18

- Views: 8999

Re: 2019 Permanent Portfolio Results

Thanks dualstow! He's a standard tabby. Took him in as a stray kitten at 4 weeks old. He's been a real blessing in my life.

- Fri Jan 03, 2020 8:28 am

- Forum: Variable Portfolio Discussion

- Topic: PP Inspired Leveraged Portfolios

- Replies: 237

- Views: 534246

Re: PP Inspired Leveraged Portfolios

Hi all,

My 2019 leveraged PP results are in. I implemented this 5 years ago and have gotten a 14.93% CAGR. I rebalance yearly. Last year was spectacular, a whopping 67.71%! Here's a 5 year screenshot: http://www.tightwadweb.com/3x2019.jpg

Take care.

-Ozzy

My 2019 leveraged PP results are in. I implemented this 5 years ago and have gotten a 14.93% CAGR. I rebalance yearly. Last year was spectacular, a whopping 67.71%! Here's a 5 year screenshot: http://www.tightwadweb.com/3x2019.jpg

Take care.

-Ozzy

- Fri Jan 03, 2020 8:06 am

- Forum: Permanent Portfolio Discussion

- Topic: 2019 Permanent Portfolio Results

- Replies: 18

- Views: 8999

Re: 2019 Permanent Portfolio Results

Hi all,

My JuicyPP returned 21.43% for 2019! Best year of the decade! I updated my website with the 2019 numbers: http://www.tightwadweb.com/customportfolio.html

Keep America Great!

My JuicyPP returned 21.43% for 2019! Best year of the decade! I updated my website with the 2019 numbers: http://www.tightwadweb.com/customportfolio.html

Keep America Great!

- Wed Jan 02, 2019 2:08 pm

- Forum: Permanent Portfolio Discussion

- Topic: 2018 Results Post Here

- Replies: 26

- Views: 17726

Re: 2018 Results Post Here

For 2018 my JuicyPP returned -6.68%. It consists of:

Stocks: 55%

LT Bonds: 30%

Gold: 15%

Cash: 0%

http://www.tightwadweb.com/customportfolio.html

Stocks: 55%

LT Bonds: 30%

Gold: 15%

Cash: 0%

http://www.tightwadweb.com/customportfolio.html

- Fri Jul 20, 2018 10:04 pm

- Forum: Variable Portfolio Discussion

- Topic: PP Inspired Leveraged Portfolios

- Replies: 237

- Views: 534246

Re: PP Inspired Leveraged Portfolios

Hi all, adding my 2 cents. My leveraged PP is the following: 45% UPRO 35% TMF 20% UGLD I keep it simple and just rebalance annually. Its returned 22.23% CAGR over the past 5 years (2013-2017), here's a performance screenshot: http://www.tightwadweb.com/3x-2013-2017.jpg So far, the first 6 months of ...

- Fri Feb 02, 2018 7:34 pm

- Forum: Variable Portfolio Discussion

- Topic: PP Inspired Leveraged Portfolios

- Replies: 237

- Views: 534246

Re: PP Inspired Leveraged Portfolios

Here's a good article released today on combining leveraged and non-leveraged PP assets to increase overall performance. I've been implementing my own version of this for years and its been great:

https://seekingalpha.com/article/414276 ... erage#alt1

https://seekingalpha.com/article/414276 ... erage#alt1

- Sun Dec 31, 2017 7:32 pm

- Forum: Permanent Portfolio Discussion

- Topic: My 2017 Juicy PP returned 16.47%

- Replies: 3

- Views: 4220

My 2017 Juicy PP returned 16.47%

Happy New year all! Fantastic year as all PP assets were profitable. My Juicy PP returned 16.47%. It's 55% Stock, 30% LTT, 15% Gold, 0% Cash.

http://www.tightwadweb.com/customportfolio.html

-Ozzy

http://www.tightwadweb.com/customportfolio.html

-Ozzy

- Fri Jun 02, 2017 10:53 pm

- Forum: Permanent Portfolio Discussion

- Topic: PP at new high for the year...

- Replies: 52

- Views: 35600

Re: PP at new high for the year...

Yup, great post. Lovin' the returns so far this year!

- Fri Jan 06, 2017 10:19 pm

- Forum: Permanent Portfolio Discussion

- Topic: PP Performance for 2016

- Replies: 101

- Views: 65096

Re: PP Performance for 2016

Hi All,

For 2016 my "Juicy" Permanent Portfolio returned 9.69%. My sloppy website: http://www.tightwadweb.com/customportfolio.html

Make America Great Again!

For 2016 my "Juicy" Permanent Portfolio returned 9.69%. My sloppy website: http://www.tightwadweb.com/customportfolio.html

Make America Great Again!

- Thu Jul 28, 2016 8:09 am

- Forum: Variable Portfolio Discussion

- Topic: Golden Butterfly Portfolio

- Replies: 539

- Views: 365927

Re: Golden Butterfly Portfolio

However, I'm considering IJS (small cap value) in taxable, to reduce dividends. It's a commission-free fund at Fidelity. The expense ratio is a lot to stomach though. You may want to look at IJR (SmallCap Blend). Also commission-free at Fidelity. Broader diversification, low expense ratio (0.12%), ...

- Mon Jul 04, 2016 5:09 pm

- Forum: Permanent Portfolio Discussion

- Topic: ***Florida PP Meetups- @ ?***

- Replies: 2

- Views: 2661

Re: ***Florida PP Meetups- @ ?***

I'm in Tampa Bay FL.

- Thu Jun 30, 2016 10:44 pm

- Forum: Variable Portfolio Discussion

- Topic: 20% annual returns over 40 years...interested?

- Replies: 571

- Views: 337157

Re: 20% annual returns over 40 years...interested?

Wow is right my friend! Happy days are hear again...!

- Sat Jun 25, 2016 1:06 pm

- Forum: Permanent Portfolio Discussion

- Topic: Brexit

- Replies: 38

- Views: 19462

Re: Brexit

Amen. It's days like these when I thank my lucky stars I ran across Fail Safe Investing and this forum.[/quote]dualstow wrote:It bears repeating: Harry Browne was a smart man.

Ditto. Most solid portfolio out there.

- Thu Jun 09, 2016 8:36 pm

- Forum: Variable Portfolio Discussion

- Topic: PP with 2x leverage (no 2x funds)

- Replies: 26

- Views: 16486

Re: PP with 2x leverage (no 2x funds)

I also use the leveraged ETFs (as part of my Variable Portfolio) and find them to be the best choice for a leveraged PP. Yes there’s decay, but as KBG points out, it does seem to balance out. Plus it’s the cost of doing business. I don’t buy the ETFs on margin, so I never worry about margin calls.

- Wed Jan 27, 2016 11:13 am

- Forum: Bonds

- Topic: Long-Dated Bonds Make a Great Investment in These Volatile Markets

- Replies: 2

- Views: 3396

Re: Long-Dated Bonds Make a Great Investment in These Volatile Markets

Yup, I agree with the article too.

- Wed Jan 27, 2016 8:17 am

- Forum: Bonds

- Topic: Long-Dated Bonds Make a Great Investment in These Volatile Markets

- Replies: 2

- Views: 3396

- Fri Jan 08, 2016 1:59 pm

- Forum: Permanent Portfolio Discussion

- Topic: Average Investor Return for 2015 was -3.09%

- Replies: 9

- Views: 7340

Average Investor Return for 2015 was -3.09%

Cheer up PP'rs, 2015 was a rough year for all portfolios:

https://insights.openfolio.com/in-2015- ... .xwhe2nolw

https://insights.openfolio.com/in-2015- ... .xwhe2nolw

- Wed Sep 16, 2015 8:58 pm

- Forum: Permanent Portfolio Discussion

- Topic: Role of cash in the absence of tight money

- Replies: 7

- Views: 4452

Re: Role of cash in the absence of tight money

I Shrugged – I'm in your camp too. Aside from my emergency fund, I don't hold any cash in my portfolio. That said, I'm in the accumulation phase with steady employment.

- Sat Sep 12, 2015 2:10 pm

- Forum: Permanent Portfolio Discussion

- Topic: PSA: I now have a 3-year period with no gains

- Replies: 275

- Views: 107060

Re: PSA: I now have a 3-year period with no gains

what you have to wonder is if harry could see 40 years off in to the future would he have allocated differently . harry likely never imagined a world of zero interest rates , or bonds and stocks both being in what some call a bubble at the same time . or gold having so few opportunity's to do its ...

- Thu Sep 03, 2015 3:44 pm

- Forum: Other Discussions

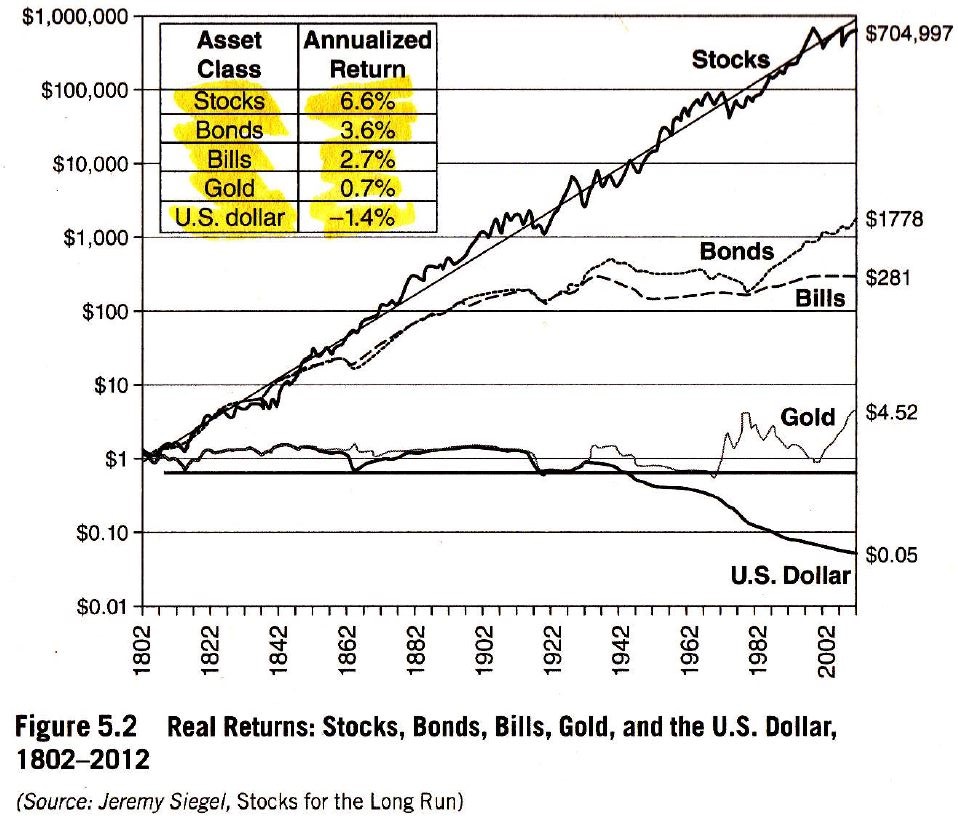

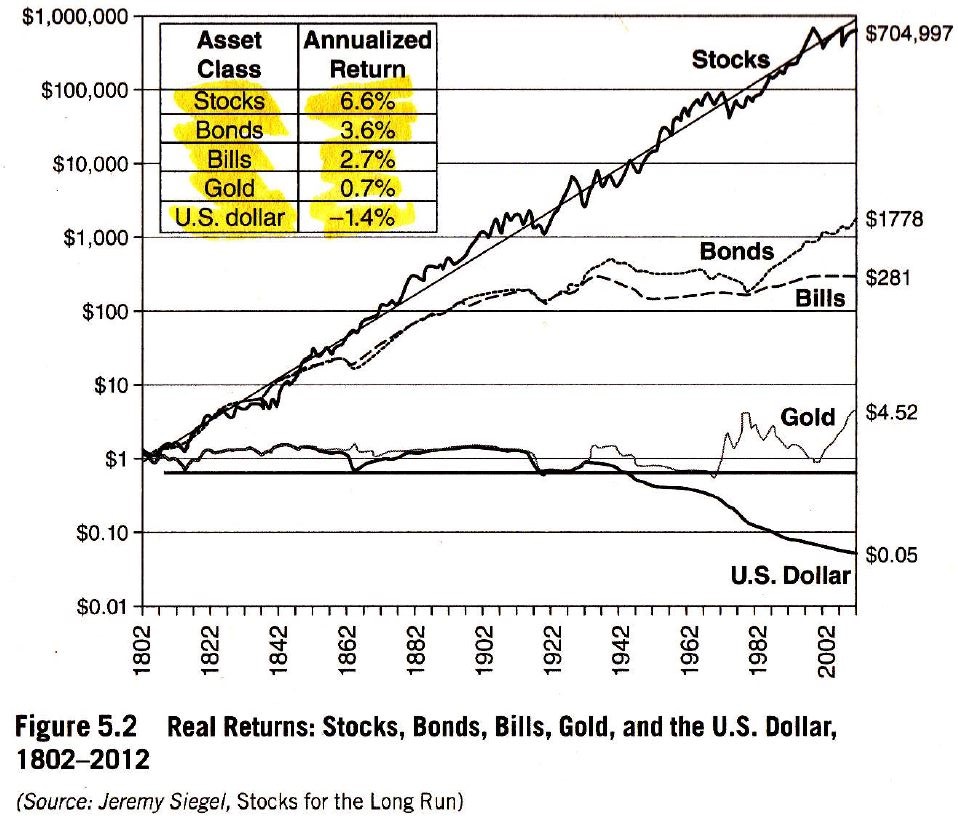

- Topic: 200 year performance of the PP assets (Real Returns)

- Replies: 11

- Views: 4734

Re: 200 year performance of the PP assets (Real Returns)

Thanks for the feedback guys. I'm sure the chart's purpose is to illustrate that in the VERY long run, stocks are the most profitable. But if you examine the stock graph closely, I see some very long stretches of bear markets, some lasting over 20 years. So, for stock-heavy investors, returns are d...

- Wed Sep 02, 2015 6:21 pm

- Forum: Other Discussions

- Topic: 200 year performance of the PP assets (Real Returns)

- Replies: 11

- Views: 4734

200 year performance of the PP assets (Real Returns)

Hi all,

I came accross this chart and thought I'd share it. Its shows the 200 year performance of the PP assets adjusted for inflation (Real Returns). To me, the scariest part is the declining dollar.

I came accross this chart and thought I'd share it. Its shows the 200 year performance of the PP assets adjusted for inflation (Real Returns). To me, the scariest part is the declining dollar.

- Wed Aug 26, 2015 5:50 pm

- Forum: Permanent Portfolio Discussion

- Topic: PSA: I now have a 3-year period with no gains

- Replies: 275

- Views: 107060

Re: PSA: I now have a 3-year period with no gains

I think investing in assets you like and minimizing assets you don't is more important than we've all thought, because the assets you hate are the ones that make you question your plan at the worst possible time, and the ones you love are the ones whose wild rides you're more easily able to tolerat...

- Tue Aug 18, 2015 1:44 pm

- Forum: Permanent Portfolio Discussion

- Topic: I keep seeing GLD being recommended over IAU

- Replies: 13

- Views: 6059

Re: I keep seeing GLD being recommended over IAU

I've been using IAU for years, its fine in my opinion.

Warning – get ready for a deluge of gold bugs telling you to only own physical.

Warning – get ready for a deluge of gold bugs telling you to only own physical.