Search found 25 matches

- Sun Dec 04, 2016 5:17 pm

- Forum: Variable Portfolio Discussion

- Topic: Portfolio Moving Average

- Replies: 7

- Views: 5758

Re: Portfolio Moving Average

Looking at the results I'm not sure why one would do this (just looking at what was posted)? The PP is one of the more stable popular ports that exist. If one can't even handle what the PP dishes out for volatility perhaps go more cash or just don't do a PP. I have a plain vanilla PP which I don't ...

- Sat Dec 03, 2016 1:26 pm

- Forum: Variable Portfolio Discussion

- Topic: Portfolio Moving Average

- Replies: 7

- Views: 5758

Re: Portfolio Moving Average

SLK23, I commend you for doing the work and suggesting the approach, but I think trend-following the three volatile components has been shown to be a better approach. Why exit good performing assets just because others are doing badly and dragging the whole portfolio down? That's like group punishm...

- Fri Dec 02, 2016 12:45 pm

- Forum: Variable Portfolio Discussion

- Topic: Portfolio Moving Average

- Replies: 7

- Views: 5758

Re: Portfolio Moving Average

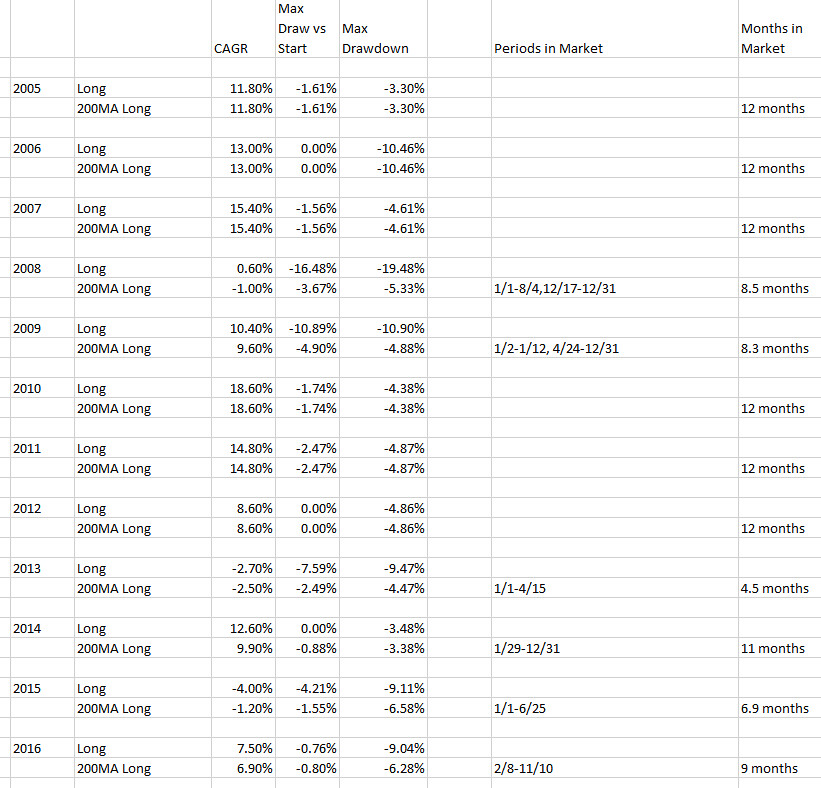

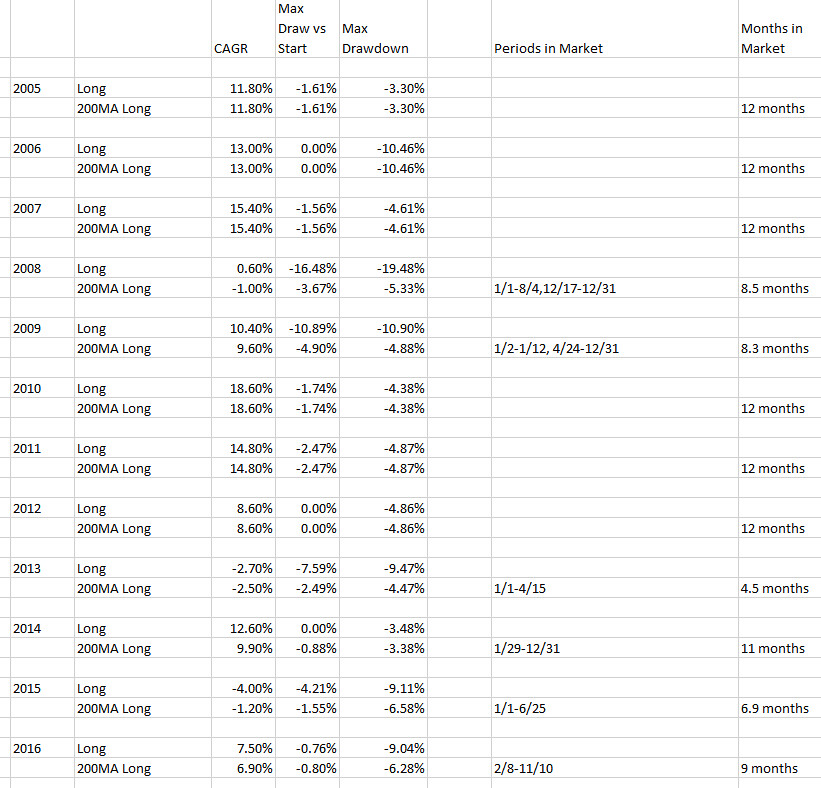

Comparing buy and hold ("Long") with the 200MA long/all cash system ("200MA Long"). Note the CAGR and Max Drawdown vs. Start figures:

- Fri Dec 02, 2016 10:40 am

- Forum: Variable Portfolio Discussion

- Topic: Portfolio Moving Average

- Replies: 7

- Views: 5758

Portfolio Moving Average

I know moving averages and timing have been discussed with regard to the individual components in a portfolio, but has anyone experimented with an entire portfolio's MA? For example, here's a portfolio composed of equal parts stocks (VTI), gold (GLD), and long term treasuries (TLT). It's indexed so ...

- Wed Jul 06, 2016 7:44 pm

- Forum: Variable Portfolio Discussion

- Topic: PP with 2x leverage (no 2x funds)

- Replies: 26

- Views: 16500

Re: PP with 2x leverage (no 2x funds)

Interesting idea to short the smaller contracts. However, aren't some of them fairly low volume with large bid/ask spreads? I've read that's the case for the smaller gold contracts, for example. I think I'd feel more comfortable staying with the very liquid full size contracts, filling in where need...

- Fri Jun 10, 2016 6:38 pm

- Forum: Variable Portfolio Discussion

- Topic: PP with 2x leverage (no 2x funds)

- Replies: 26

- Views: 16500

Re: PP with 2x leverage (no 2x funds)

How would one rebalance with futures? Is it possible to trade fractions of a contract? I assume not, which means trades are in approx. $100K blocks. Also, the 20%-30% max. DD stated earlier for the PP sounds high. 1980 had the largest DD that I'm aware of: 20% according to http://www.peaktotrough.co...

- Thu Jul 11, 2013 4:26 pm

- Forum: Permanent Portfolio Discussion

- Topic: Not Even Harry Browne Thought It Was Going To Be This Bad

- Replies: 399

- Views: 130689

Re: Not Even Harry Browne Thought It Was Going To Be This Bad

All of this macro economic analysis and debate is very interesting. But I think I've lost the thread; are you still discussing whether the Permanent Portfolio will continue to work? Naturally I hope it does still work because I don't feel qualified or courageous enough to place bets on my opinion ab...

- Thu Jun 20, 2013 6:22 pm

- Forum: Permanent Portfolio Discussion

- Topic: Oh how it hurts to see no gains

- Replies: 412

- Views: 162569

Re: Oh how it hurts to see no gains

Yes. I wasn't making a prediction. No, that would be contrary to the principles of the permanent portfolio. That's why I didn't rebalance months ago when it felt to me like stocks were about to top and gold would bounce. It's a good thing I heeded Harry's warnings about placing bets and didn't t...

- Thu Jun 20, 2013 4:53 pm

- Forum: Permanent Portfolio Discussion

- Topic: Oh how it hurts to see no gains

- Replies: 412

- Views: 162569

Re: Oh how it hurts to see no gains

I agree, but I thought that 6 months ago too. I guess it's like Alan Greenspan's warning about irrational exuberance; he was right but the turn didn't happen until 3 years later.MediumTex wrote: This stock rally just looks tired, gold looks cheap, and bond yields look high. That's JMHO, of course.

- Fri Jun 07, 2013 3:49 pm

- Forum: Other Discussions

- Topic: Low-cost smart phone plans

- Replies: 35

- Views: 17896

Re: Low-cost smart phone plans

I use what I consider a moderate amount of data (~1.5 GB/month). For a user like me it doesn't appear that any of the GSM alternate providers offer a significant savings over AT&T. Still, I'd like to dump AT&T for threatening to throttle my data access when I exceeded 2 GB one month with m...

- Wed May 22, 2013 6:05 pm

- Forum: Permanent Portfolio Discussion

- Topic: Oh how it hurts to see no gains

- Replies: 412

- Views: 162569

Re: Oh how it hurts to see no gains

Yeah, that makes sense. But I'd personally also be upset at missing out on the cash and gold parties. With the PP there's always a party! I think I understand the pros and cons of the PP and plan to stick with it for the long haul. But I have to admit it's been a pretty dull party for almost a yea...

- Wed May 22, 2013 11:49 am

- Forum: Permanent Portfolio Discussion

- Topic: Oh how it hurts to see no gains

- Replies: 412

- Views: 162569

Re: Oh how it hurts to see no gains

According to ETFreplay.com the VTI/GLD/TLT/SHY portfolio's YTD return is -0.4% (including dividends) as of 5/21.

http://etfreplay.com/combine.aspx

http://etfreplay.com/combine.aspx

- Wed Apr 10, 2013 10:07 am

- Forum: Gold

- Topic: Goldman Sachs: Short Gold!

- Replies: 9

- Views: 6172

Goldman Sachs: Short Gold!

Goldman slashed its short- and long-term gold forecasts, a move that comes about six weeks after the firm had already turned even more bearish on the metal. Goldman now sees gold ending the year at $1,450, a forecast that came down from $1,600 at the end of February and $1,810 prior to that. Goldma...

- Wed Dec 14, 2011 12:05 pm

- Forum: Permanent Portfolio Discussion

- Topic: Why is no one panicking?

- Replies: 32

- Views: 15384

Re: Why is no one panicking?

At the moment the chart of the PP (GLD, TLT, SHY, VTI) shows it near the long term trend line:D wrote: Isn't PP going down big time last few days?

http://etfreplay.com/combine.aspx

Odds are this is simply a pullback to the trend line and the trend will continue.

- Sat Dec 03, 2011 11:57 am

- Forum: Variable Portfolio Discussion

- Topic: 20% annual returns over 40 years...interested?

- Replies: 571

- Views: 337474

Re: 20% annual returns over 40 years...interested?

Clive: isn't a 33 day period too small of a sample to make conclusions from? The 2x PP (DGP, UBT, SSO) has done pretty well over almost two years: 77% compared to 38% from GLD, TLT, VTI (no rebalancing).

- Fri Sep 30, 2011 10:51 am

- Forum: Variable Portfolio Discussion

- Topic: BAC - Turkey or undervalued?

- Replies: 23

- Views: 11425

Re: BAC - Turkey or undervalued?

What is criminal to me is that banks have inserted themselves in between merchants and customers and charge 3% for every transaction, for what is basically a very basic data service that should only cost a maximum of 10 cents per transaction. Wouldn't it be nice if, rather than having to get some ...

- Mon Sep 26, 2011 1:55 pm

- Forum: Gold

- Topic: Weather the Storm...

- Replies: 40

- Views: 19562

Re: Weather the Storm...

Even if you look at gold in isolation it's still above its 200 day moving average and so far the trend is intact. Based on its past behavior it'll probably recover soon.

- Mon Jan 03, 2011 12:24 pm

- Forum: Permanent Portfolio Discussion

- Topic: In Investing, It’s When You Start And When You Finish

- Replies: 3

- Views: 3121

In Investing, It’s When You Start And When You Finish

An interesting analysis of stock market returns:

http://www.nytimes.com/interactive/2011 ... aphic.html

I'm posting this here because it shows how important reducing volatility is, which the Permanent Portfolio does quite well.

http://www.nytimes.com/interactive/2011 ... aphic.html

I'm posting this here because it shows how important reducing volatility is, which the Permanent Portfolio does quite well.

- Thu Jun 10, 2010 11:34 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio Allocator

- Replies: 7

- Views: 7257

Re: Permanent Portfolio Allocator

Thanks Clive. Looks good.Clive wrote: I've just quickly knocked up an Excel version that's somewhat similar

I think its ok but I've only quickly tested it so make sure you're happy that it works ok before using it for real.

- Wed Jun 02, 2010 12:02 pm

- Forum: Permanent Portfolio Discussion

- Topic: An Unknown Economic Climate?

- Replies: 9

- Views: 7644

Re: An Unknown Economic Climate?

I don't think Browne's idea was that the four assets would move in lockstep with their economic drivers. Rather, I would state the Permanent Portfolio theory as "for any economic climate, at least one asset should perform well enough to carry the portfolio." For example, under deflation ...

- Wed Jun 02, 2010 1:09 am

- Forum: Permanent Portfolio Discussion

- Topic: An Unknown Economic Climate?

- Replies: 9

- Views: 7644

Re: An Unknown Economic Climate?

* Then again everything can just kind of work out and stocks continue to post good gains on recovery. Which is why the portfolio holds all four assets all the time and doesn't attempt market timing. So basically you're saying we're in a confused environment which is why the performance of the four ...

- Tue Jun 01, 2010 4:49 pm

- Forum: Permanent Portfolio Discussion

- Topic: An Unknown Economic Climate?

- Replies: 9

- Views: 7644

Re: An Unknown Economic Climate?

From a recent blog post: https://web.archive.org/web/20160324133409/http://crawlingroad.com/blog/2010/05/31/an-unknown-economic-climate/ Someone wanted to know: Are we sure there are no more than four economic investing climates that can affect the Permanent Portfolio? [....] What say you? Is there...

- Wed May 26, 2010 8:39 pm

- Forum: Permanent Portfolio Discussion

- Topic: Rebalance how often?

- Replies: 10

- Views: 8932

Re: Rebalance how often?

It's usually OK to trade a little early if it makes you feel more comfortable (say rebalancing at 20%/30% instead of 15%/35%). However trading too late can be a very costly mistake if the overweight asset crashes. Forgive me if this has been previously discussed, but has anyone back tested 20%/30% ...

- Sat May 22, 2010 11:51 am

- Forum: Permanent Portfolio Discussion

- Topic: Rebalance how often?

- Replies: 10

- Views: 8932

Re: Rebalance how often?

Thanks for the replies. I had a few incorrect assumptions such as the idea that the portfolio would be rebalanced annually even if none of the allocations are hitting the 15/35 bands. I also assumed that the 15/35 bands would be hit several times a year. In Browne's Fail-Safe Investing book he sta...

- Fri May 21, 2010 1:30 am

- Forum: Permanent Portfolio Discussion

- Topic: Rebalance how often?

- Replies: 10

- Views: 8932

Rebalance how often?

What is recommended, rebalancing the portfolio as soon as one of the four categories is >35% or <15%, or rebalancing only annually? Has anyone done any back testing to compare the two approaches?

TIA.

TIA.