I've been happy with CSEMU for stocks and DBXG for bonds plus cash and physical gold.

I also added a large portion of variable portfolio to just VWCE/VWRA for global stocks.

Search found 19 matches

- Sun Mar 20, 2022 1:06 pm

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

- Sun Oct 18, 2020 2:28 am

- Forum: Permanent Portfolio Discussion

- Topic: European PP - short bonds

- Replies: 14

- Views: 7204

Re: European PP - short bonds

Thanks for the discussion, guys. And you are totally correct, you are looking for a safe haven for cash, even if the return is worse than the alternative. If this is the only reason, then there are other ways to do it, besides potentially splitting it between multiple local banks. You can sign up to...

- Sat Oct 17, 2020 4:14 am

- Forum: Permanent Portfolio Discussion

- Topic: European PP - short bonds

- Replies: 14

- Views: 7204

Re: European PP - short bonds

The shorter the duration the better, like the 0-1 year Gov't Bonds in the attachment. The 1-3 years ETF's are still OK, but typically more volatile. Senecaa's approach is the ultimate as the listed ETF's can have a fair slice of Italian Bonds. Edit: As for Government guarantees ->https://en.wikiped...

- Thu Oct 15, 2020 11:43 am

- Forum: Permanent Portfolio Discussion

- Topic: European PP - short bonds

- Replies: 14

- Views: 7204

Re: European PP - short bonds

@Hal, isn't this C13 what you mean? The FTSE MTS Eurozone Government Broad Investment Grade 1-3 Year index tracks eurozone’s largest and most widely traded outstanding sovereign debt securities. So if I understand Hal's and senecaaa's comments, I'd be investing into this because cash go down with a ...

- Thu Oct 15, 2020 2:07 am

- Forum: Permanent Portfolio Discussion

- Topic: European PP - short bonds

- Replies: 14

- Views: 7204

Re: European PP - short bonds

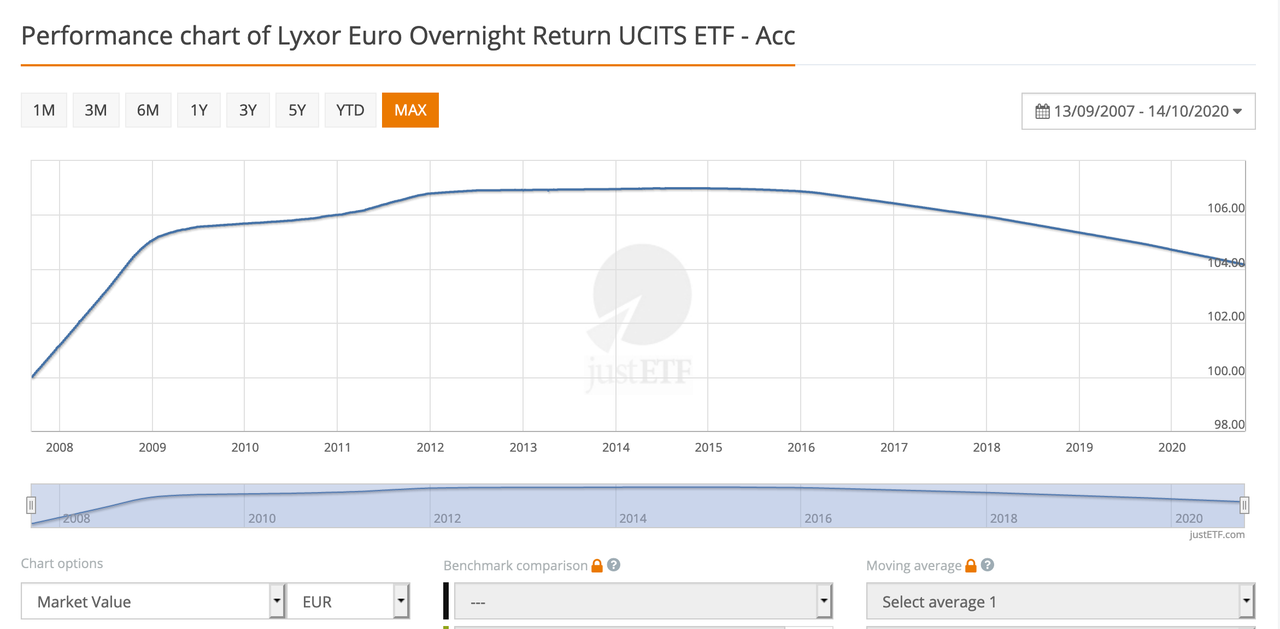

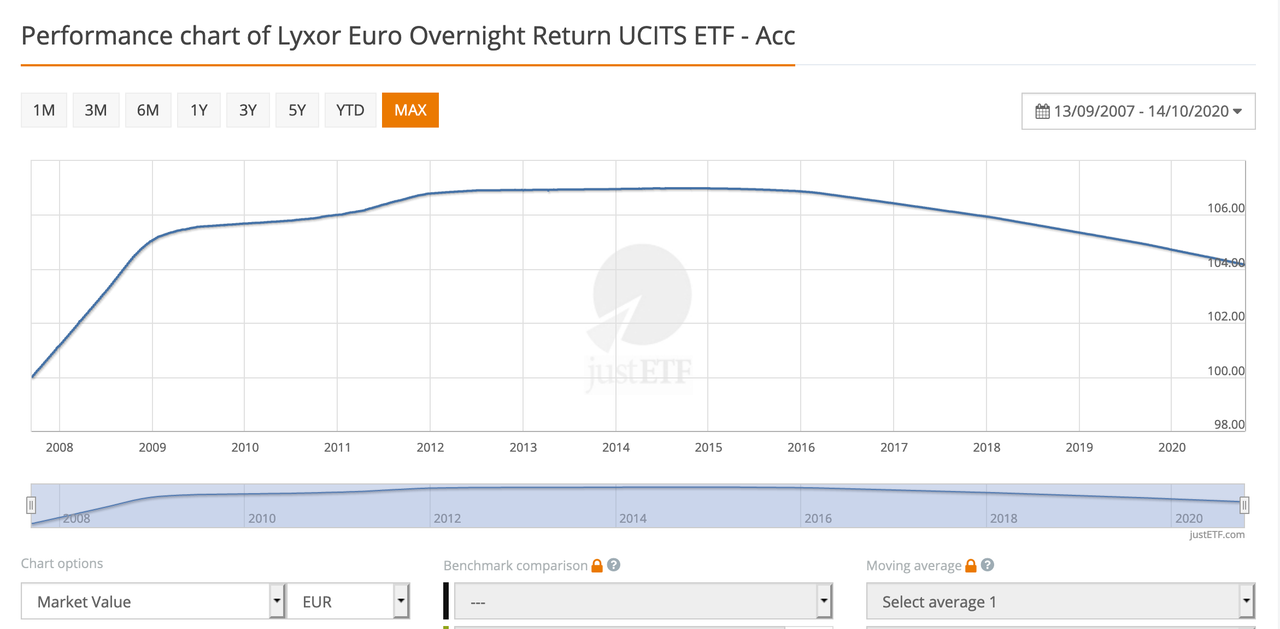

EU money market ETF:

JustETF

I don't think we should use a US treasury fund in EU because it's USD-based.

JustETF

I don't think we should use a US treasury fund in EU because it's USD-based.

- Wed Oct 14, 2020 12:30 pm

- Forum: Permanent Portfolio Discussion

- Topic: European PP - short bonds

- Replies: 14

- Views: 7204

European PP - short bonds

I'm having doubts again about the short-term bonds (again). In the past I've had C3M (0-6m gov bonds) but the losses were pretty bad, so I moved to plain cash. https://i.postimg.cc/3w1YjL0x/c3m.png A fellow EUPP in a thread mentioned C13 which looks a bit better, kind of. https://i.postimg.cc/zBPN6V...

- Sun Jan 26, 2020 10:18 am

- Forum: Permanent Portfolio Discussion

- Topic: [EU] Value of short-term bonds as "cash"

- Replies: 5

- Views: 3751

Re: [EU] Value of short-term bonds as "cash"

I'm currently trying to stick as much a possible to the recommended permanent portfolio, localized for EU. For the mid-term future, I'll be looking at either global PP (so global stocks+bonds, gold and cash EUR/USD) or a split between EU and US. I'm not at that stage yet though.

- Sun Jan 26, 2020 4:11 am

- Forum: Permanent Portfolio Discussion

- Topic: [EU] Value of short-term bonds as "cash"

- Replies: 5

- Views: 3751

Re: [EU] Value of short-term bonds as "cash"

Thanks! That solves it. I'll be moving to regular cash.

- Sat Jan 25, 2020 5:23 am

- Forum: Permanent Portfolio Discussion

- Topic: [EU] Value of short-term bonds as "cash"

- Replies: 5

- Views: 3751

[EU] Value of short-term bonds as "cash"

I've been really happy with PP for the last two years or so. My current allocation is: - physical gold - long-term bonds DBXG - stocks XD5E - and cash in the form of short-term bonds C3M My question is regarding the last ETF. C3M has been performing worse than cash . Is there a specific reason to ke...

- Fri Jun 07, 2019 5:24 am

- Forum: Permanent Portfolio Discussion

- Topic: Yearly balancing or 15/35?

- Replies: 13

- Views: 16560

Re: Yearly balancing or 15/35?

Got it, thanks. What about when investing more? Rebalance? Or add invested amount in 25%x4?

- Fri Jun 07, 2019 1:48 am

- Forum: Permanent Portfolio Discussion

- Topic: Yearly balancing or 15/35?

- Replies: 13

- Views: 16560

Yearly balancing or 15/35?

I'm coming around a year with my PP. Should I rebalance once a year or only when one asset hits 15/35?

Thanks

Thanks

- Mon Mar 05, 2018 11:58 am

- Forum: Gold

- Topic: Dealer fees on gold - bar cheaper than coin

- Replies: 5

- Views: 4953

Re: Dealer fees on gold - bar cheaper than coin

Ah, yes. That's closer.

36.05 EUR /g. So a premium over the bar but a lot cheaper.

Thanks, not sure how I missed that.

36.05 EUR /g. So a premium over the bar but a lot cheaper.

Thanks, not sure how I missed that.

- Mon Mar 05, 2018 6:01 am

- Forum: Gold

- Topic: Dealer fees on gold - bar cheaper than coin

- Replies: 5

- Views: 4953

Dealer fees on gold - bar cheaper than coin

So I'm looking at a well-known local gold dealer. Prices per gram (1 g). 34.6 EUR is the current gold price 39.4 EUR is the price I get for buying 20x Vienna Philharmonic coins (3.1103g) - that's 13.8% higher than gold price; their buy price is 36.68 EUR (diff: 7%) 35.61 EUR is the price I get for b...

- Sun Mar 04, 2018 2:04 pm

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

Same broker. Haven't looked into other options yet. Need to start investing, then when the portfolio grows so will the diversification for all elements.

- Sun Mar 04, 2018 6:03 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

In that highly unlikely event, I would lose ~14% of the portfolio (but I'm sure the EU part would grow that much more as a consequence). I don't see any of those two extremes happening. That said, if I would have to bet on likelihood, I'd say it's far higher for the EUR to get devalued against the U...

- Sun Mar 04, 2018 2:55 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

This is exactly done for the case if one day $1=3€.

As far as I saw, the long-term gains are a lot higher on USPP than on EUPP.

As far as I saw, the long-term gains are a lot higher on USPP than on EUPP.

- Sat Mar 03, 2018 3:14 pm

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

Great info, I'll read that in detail. Thanks!

- Sat Mar 03, 2018 2:02 pm

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

@frugal: I am comfortable with currency risk at 20% in USD, for the benefit of having exposure to US economy. @WhiteElephant: If that's concerning local taxes, we have a fixed capital gains tax on everything so that does not affect me. @stuper1: Thanks, good catch! I've changed that to iShares Treas...

- Sat Mar 03, 2018 7:06 am

- Forum: Permanent Portfolio Discussion

- Topic: Permanent Portfolio in Europe (follow-up)

- Replies: 66

- Views: 64965

Re: Permanent Portfolio in Europe (follow-up)

Hi everyone, here's my portfolio I'm looking to implement in the coming weeks. I'm in EU, so it's focused on Eurozone, however with 20% of assets in/related to US. I added symbols since I lost a ton of time looking for the right ones. Stocks - xTrackers MSCI EMU, EUR ( XD5E ) - 20% - Vanguard US Tot...